This is now largely of historic interest; after I published this analysis, Zahawi’s people started putting out a different story – that Balshore received the shares because Zahawi “had no experience of running a business at the time and so relied heavily on the support and guidance of his father, who was an experienced entrepreneur”. That always seemed unlikely, and has been debunked by The Times.

Rather than complicate my already long report on the Zahawi/YouGov arrangements, I’m putting this onto a separate page. It consolidates my Twitter thread posted earlier this morning.

Nadhim Zahawi founded YouGov, but took no shares in it. A Gibraltar company, Balshore Investments, did instead. Zahawi says this wasn’t tax avoidance, but was his father injecting capital into the business. Is there any evidence for that?

I’ll go through the trail of evidence of YouGov’s capital, from its founding in 2000 to the IPO in 2005.

Executive Summary

There are only three possibilities:

1. I am missing something.

2. Balshore did provide capital, but this was omitted from all of YouGov’s accounts and filings, and not even picked up during the IPO.

3. Zahawi is lying, and this was tax avoidance.

The evidence

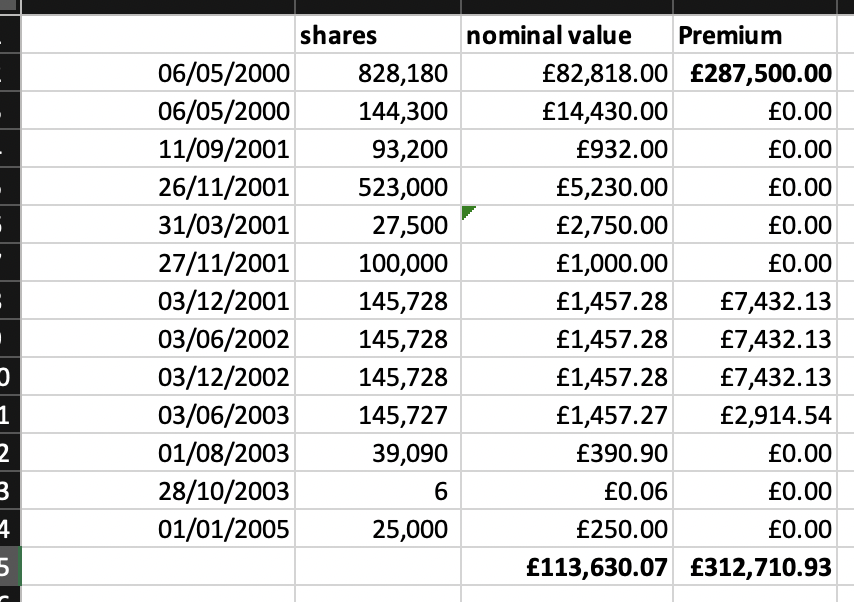

When a company issues shares, it has to complete Companies House form 88(2). I’ve consolidated all of YouGov’s pre-IPO forms here. Going through them one-by-one:

YouGov’s first share issuance, May 2000

The original share issuance looks like this (first two pages of the PDF):

- Neil Copp provided £287,500 of capital & got 15% of the shares.

- Stephan Shakespeare provided no capital and got 42.5%. He was one of the two principal founders – so that’s unsurprising. The shares were a reward for his work.

- Zahawi, the other founder, got nothing. That is surprising and unusual

- Balshore, on the other hand, got the same deal as Shakespeare. 42.5% of the shares for no payment. There is no suggestion Balshore provided any services (and that would have been disclosed as a related party transaction).

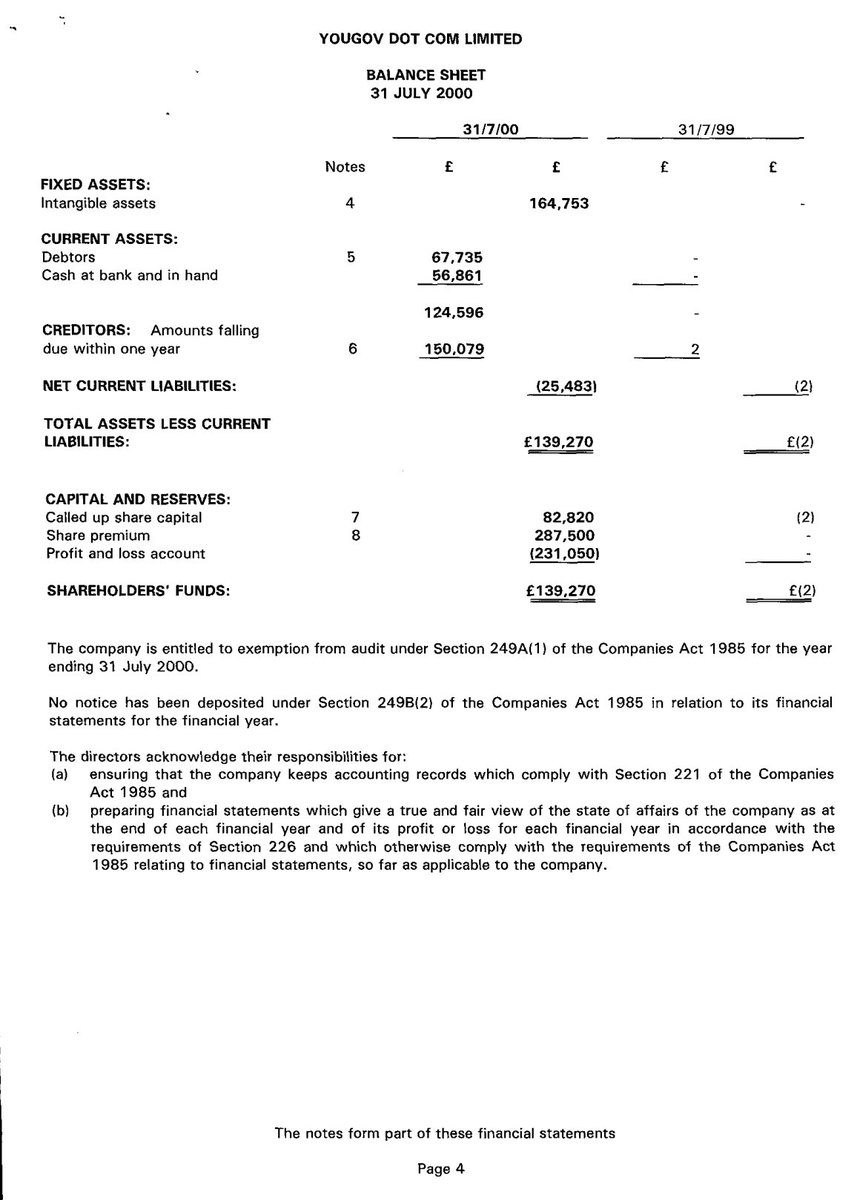

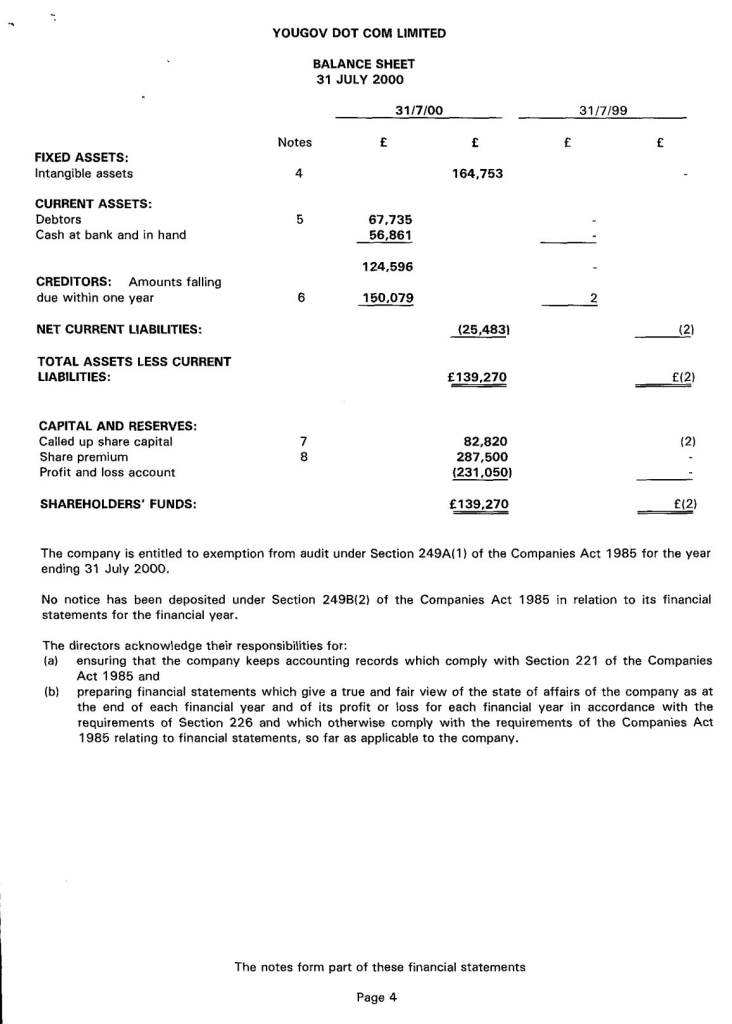

But perhaps the form is wrong and Balshore did provide capital. Let’s look at the accounts – here’s the balance sheet from two months after that share issuance:

No sign of any equity capital other than Copp’s.

Startups often make mistakes, and Companies House filings and accounts can be wrong. This is generally picked up as a company matures… particularly if it’s planning an IPO (which is the path YouGov was on).

YouGov did just that… in 2002, YouGov filed a Companies House form showing Shakespeare and Balshore each acquired more shares back in 2000. But for “nominal” value – only £7k each. It is likely (but we cannot be sure) that the £7k was paid in 2002, not 2000, and that the document was backdated. It is also possible the £7k was really paid in 2000, and they just forgot to file the form until 2002… but that would mean all the accounts between 2000 and 2002 were wrong, which feels unlikely (and would ordinarily have been corrected subsequently when the mistake was recognised).

This wasn’t a capital injection – just (typical) cheap shares for founders.

Balshore wasn’t a founder. Why did it get this?

Other pre-IPO share issuances

There were a load more share issuances in the next few years – starting on page 5 of the PDF.

- The wonderful Peter Kellner got involved, so got shares for free. As did Roland Berger & Partners (consulting firm).

- A series of small freebie shares were dished out to employees and consultants (including @JamesDuddridge). Again, perfectly normal for a startup.

- Chime Communications then acquired 27,500 shares for the (bargain) nominal price of 10p each. There’s a good reason for that – we’ll come to it later.

- 27 November 2001. More consultants got to acquire cheap shares.

- Then Peter Kellner gets to buy more shares at the cheap but eccentric price of 6.1p each. Then the same a few months later, and again, and again. He’s paying a bit, but it’s not what you’d call capital.

- We’re up to page 24 of the PDF, and it’s August 2003: another consultant pays nominal 1p each for some shares.

- There are now a lot of shareholders. At this point, founders often want to preserve their ability to take dividends without giving dividends to everyone. That happens on page 26 of the PDF: Shakespeare, Zahawi, Kellner each get two special shares (with Shakespeare’s giving one of his to his wife).1Thanks to K for the correction here – I’d wrongly said they were special voting shares

- Start of 2005 – another consultant gets shares for 1p each:

And that takes us up to the April 2005 IPO.

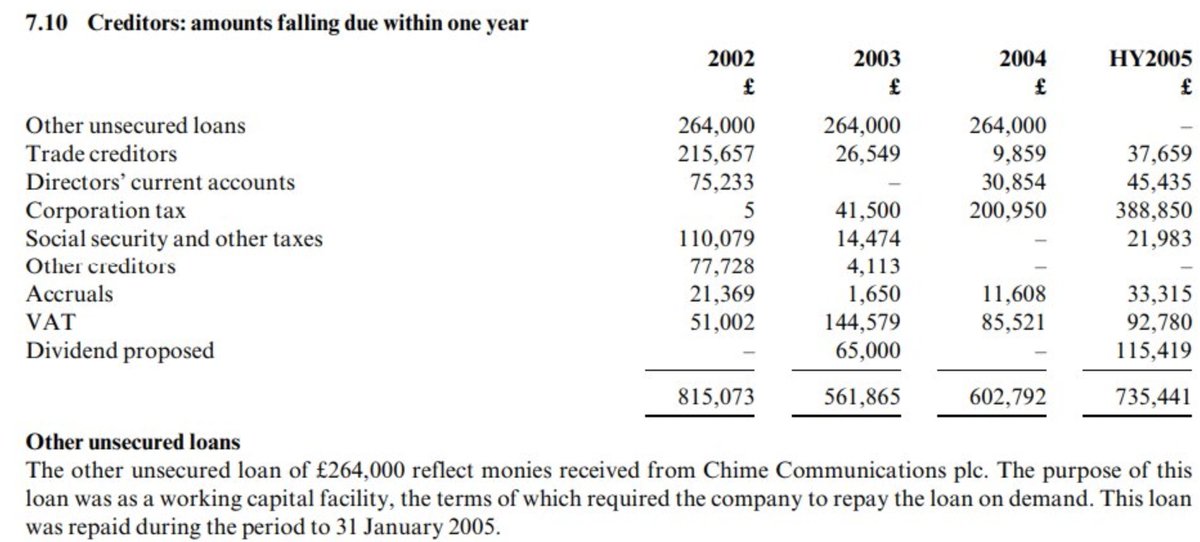

At this point I count £113,630 of share capital, £312,711 of share premium.

None of that was from Balshore.

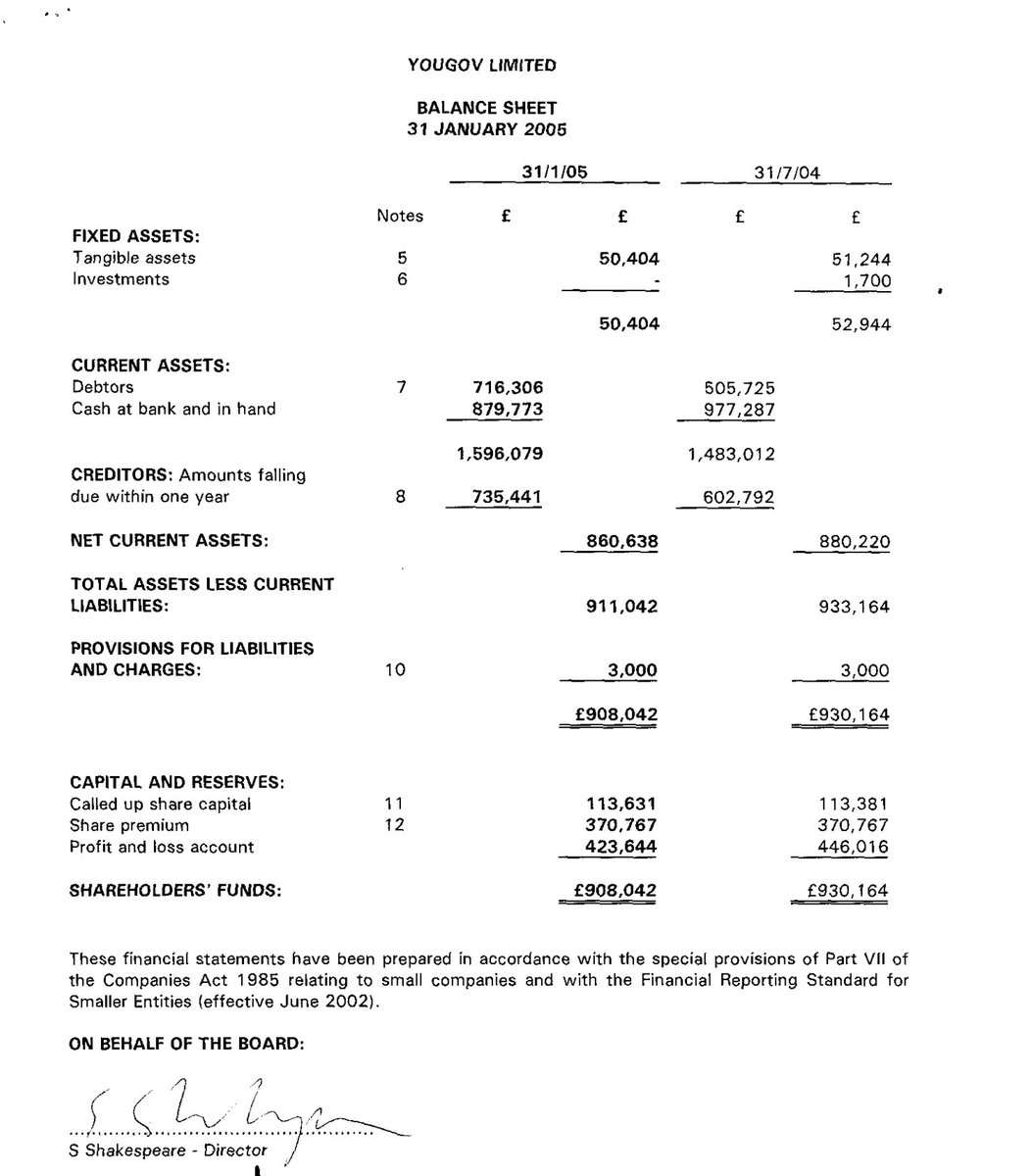

That is broadly consistent with the Jan 2005 balance sheet – except it shows £370,767 of share premium:

I can’t see where the additional £58k comes from, but it’s hardly a significant amount of capital, and it wasn’t Balshore (as they haven’t received any shares since 2000).

Debt finance

There are broadly two ways to finance a company: equity (shares) and debt (loans, bonds, etc). Could Balshore have provided debt finance and that’s how it got the shares for free?

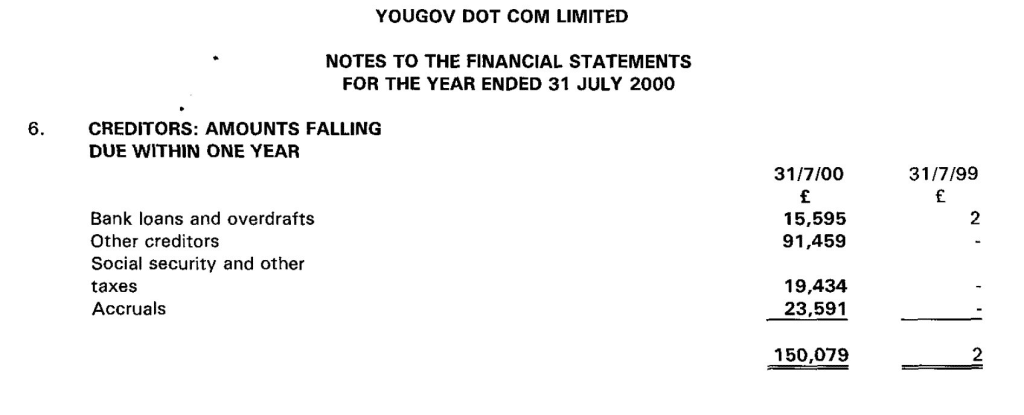

Back in 2000, the year Balshore got its shares, there were £91,459 of “other creditors”. Could that be debt finance from Balshore?

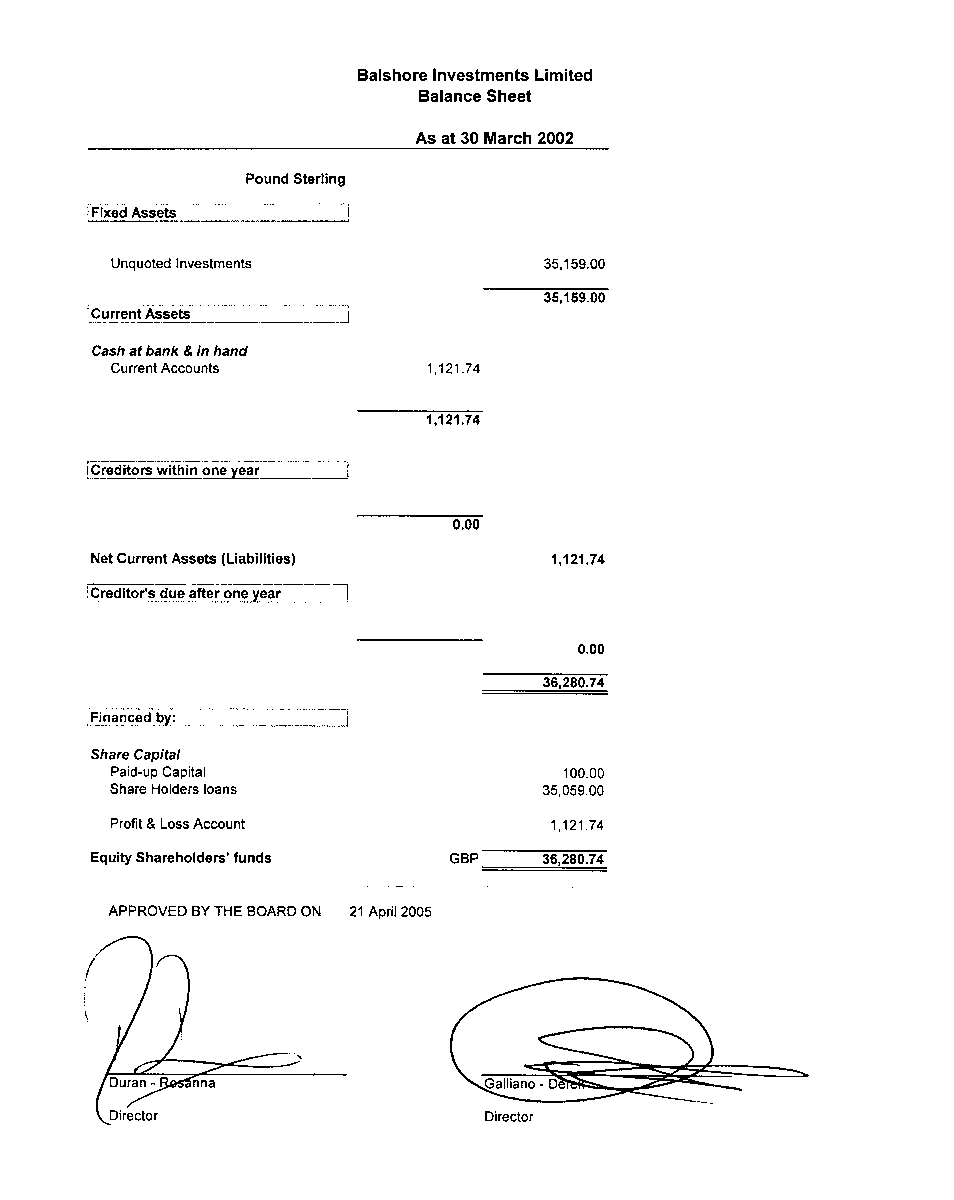

Doesn’t look like it. The £91k is still there in the next few years, but there’s no corresponding entry in Balshore’s accounts – just £35k (which I assume is an estimate of the value of its YouGov stake, but could be something else).

It’s possible Balshore’s accounts are wrong, and the £91k was a loan from Balshore.

But it’s not credible for Neil Copp to pay £287,500 cash for a 15% stake, but Balshore to *lend* £91k and get a 45% stake. Commercially people just don’t behave like that (and it probably would have been contrary to company law).

There was some reasonably significant debt funding, but from Chime Communications and not Balshore. Which explains why (way upthread) Chime got cheap shares.

The conclusion

Zahawi is saying that Balshore got a 45% stake in YouGov because it provided capital to YouGov.

There is zero evidence of any capital from Balshore (except, just about possibly, a £91k loan – but that wouldn’t justify a 45% stake).

I see only three possibilities:

- I am missing something. What?

- Balshore did provide capital, but this was omitted from all of YouGov’s accounts and filings, and not even picked up during the IPO (when financial statements are carefully checked).

- Zahawi is lying, and this was tax avoidance.

I don’t accuse someone of lying frivolously. But Zahawi is making a definitive claim and, right now, there is just no evidence for it. If the answer is indeed that I’ve made a mistake, or the YouGov and Balshore filings are all mistakes, Zahawi should prove it by pointing us towards some actual evidence. Not just making assertions in background briefings to journalists.

For anyone wanting to go hunting:

- here are all the pre-IPO 88(2) forms in one place

- the 2000 YouGov accounts

- The last pre-IPO YouGov balance sheet

And this was my previous analysis, for which this post really serves as an appendix.

6 responses to “Did Nadhim Zahawi’s family trust provide any capital for its 45% founder stake in YouGov?”

Page 170 of the Balshore documents you have uploaded is most interesting to me.

That is the “accounts” – a laughably brief single page balance sheet – showing the position at the 31 March 2018 year end, compared to March 2017.

In 2017, there were fixed asset investments of £21.5m, current asset debtors of £3.7m, and current asset investments of £1.4m. Total net assets of £26.5m (there is some rounding here). And a P&L reserve of the same.

(Those reserves had been building up over time since about 2004. By 2007 there was about £21m of assets, but about £18m of creditors, then the assets and the debt decline in tandem up to about 2010, and then it is all gravy)

In 2018 there was just current asset investments of £0.5m, which appears to be a shareholder loan, although the shareholder is a nominee. And a slight P&L deficit. The shares stay the same.

So what happened between 1 April 2017 and 31 March 2018? Looks like a realisation event, and then a distribution.

And then on page 144, the directors change from (what looks like) three Gibraltar professionals to a sole director, Mahmood Yusuf on 18 September 2014. He gives UK address, but within weeks that changes to Dubai. And Hareth Galil al Zahawi is added on 1 April 2015. He gives an address in Lebanon.

If one wanted to pull on threads, one might ask how the company maintained its Gibraltar residence from September to November 2015, with a sole director apparently based in the UK. Perhaps no management decisions were taken in that period…

Many thanks! Hard to get much from these accounts, but does seem clear everything was sold in 2017/18. Still within the enquiry window…

Zahawi may no longer be a candidate for Conservative party leader, but he is still an MP and the Chancellor of the Exchequer, and it seems to me he still has questions to answer about the Gibraltar company/trust, and the funding of his property company.

Similarly, I hope you’ll be asking questions about offshore tax planning involving Sajid Javid. While he is also no longer a leadership candidate, and not currently a minister, I expect he may return to executive office within months, and he is still an MP, and there are also questions for him to answer.

I agree. We can’t have a Chancellor of the Exchequer who very plausibly entered into an aggressive tax avoidance structure, and dissembles when asked about it.

Indeed, and yet it seems we have had three in s row

Zahawi is a minister as Chancellor of the Exchequer. A key cabinet post. The boss, should it happen, if whomever examines his case