We previously reported that Douglas Barrowman’s companies had unlawfully hidden their ownership of PPE Medpro and the companies holding Barrowman’s Belgravia house. We can now identify 25 additional companies where Barrowman’s group has unlawfully failed to disclose the ownership, abetted by what appears to be a rogue company verification agent.

(Update: the total is actually now 27, thanks to a tip received shortly after we first published)

The law

There are two separate regimes under which companies are required to report their true owner.

- UK companies have to keep a register of their “persons with significant control” (PSCs) and report their PSC to Companies House.

- Foreign companies owning UK real estate have to identify their “beneficial owners” and submit a return to Companies House so that the company can be listed on the “register of overseas entities” (ROE).

The details of the rules are a little different, but the principle is the same. Companies have to identify their actual human owners – they’re only permitted to identify companies as their PSCs/beneficial owners if those companies report their owners (preventing multiple duplicated filings).1There are certain other cases where a PSC/beneficial owner can be a company which are not relevant here – there is helpful guidance in paragraph 2.2 here for PSCs, and paragraph 4.1 here for beneficial owners. So, for example, if I own UK company A which owns UK company B, then company B will declare that company A is the PSC, and company A will declare that I am the PSC.

The evidence suggests that Barrowman’s group of companies completely ignores these rules. We can discard the possibility that they don’t understand them: Barrowman himself is a sophisticated businessman with years of experience in business, funds and corporate finance, and he runs a group of companies that provide technical tax and legal services to private offices. Understanding rules like these should be part of their core expertise.

1. The Belgravia townhouse

The FT reported in December 2022 that a company in Barrowman’s group, Chester Ventures, paid £9.25m for a townhouse in Belgravia.2Not the house he and Michelle Mone lived in; another property said to have been acquired for development.

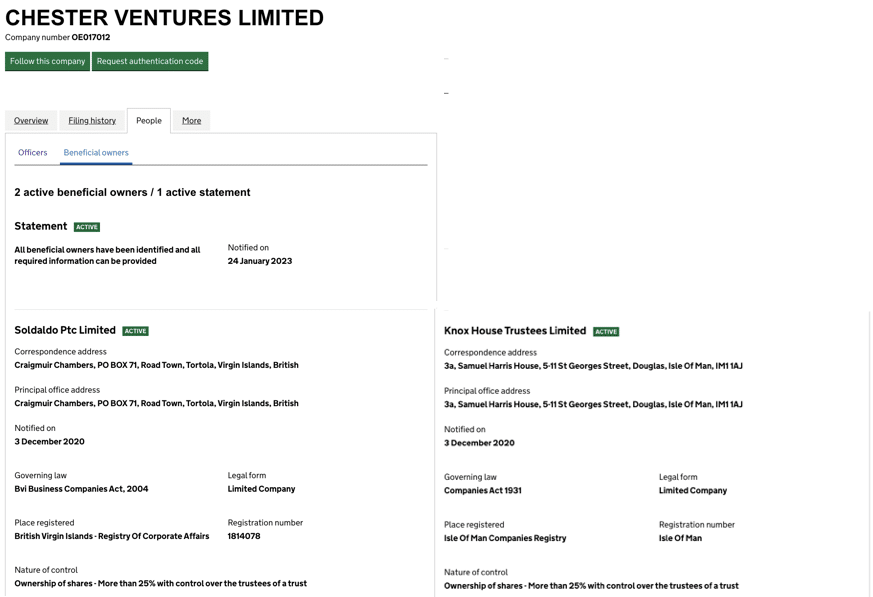

Under the Economic Crime (Transparency and Enforcement) Act 2022, foreign companies owning real estate have to register who their beneficial owners are. Here is the registration for Chester Ventures Limited as at last week:

This was wrong in several respects:

- Soldaldo PTC Limited, company number 1814078 appears to be a typo for Soldaldo (PTC) Limited, company number 1814077. A sloppy error by Barrowman’s companies (and this is supposed to be their expertise).3On the basis of this search, we can probably discount the possibility that there are two companies with almost-identical names and sequential registration numbers.

- As we previously reported, Soldaldo (PTC) Limited unlawfully fails to report its beneficial owner.

- The other registered beneficial owner is Knox House Trustees Limited, an Isle of Man company.4Not to be confused with a separate UK company, Knox House Trustees (UK) Limited As it is regulated in the Isle of Man it (unlike most overseas companies) can be a registrable beneficial owner. However we expect that in reality Barrowman exercises significant influence over Chester Ventures (by some formal or informal arrangement with Knox House Trustees (UK) Limited) and therefore he should personally be listed as a beneficial owner.

The “verification agent” responsible for checking the registration for Chester Ventures was FCLS – the same agent that missed evident errors in the reporting for Barrowman’s house. This suggests that FCLS don’t in fact verify anything, even in an automated way – even a simple check would have revealed that Soldaldo PTC Limited doesn’t exist.

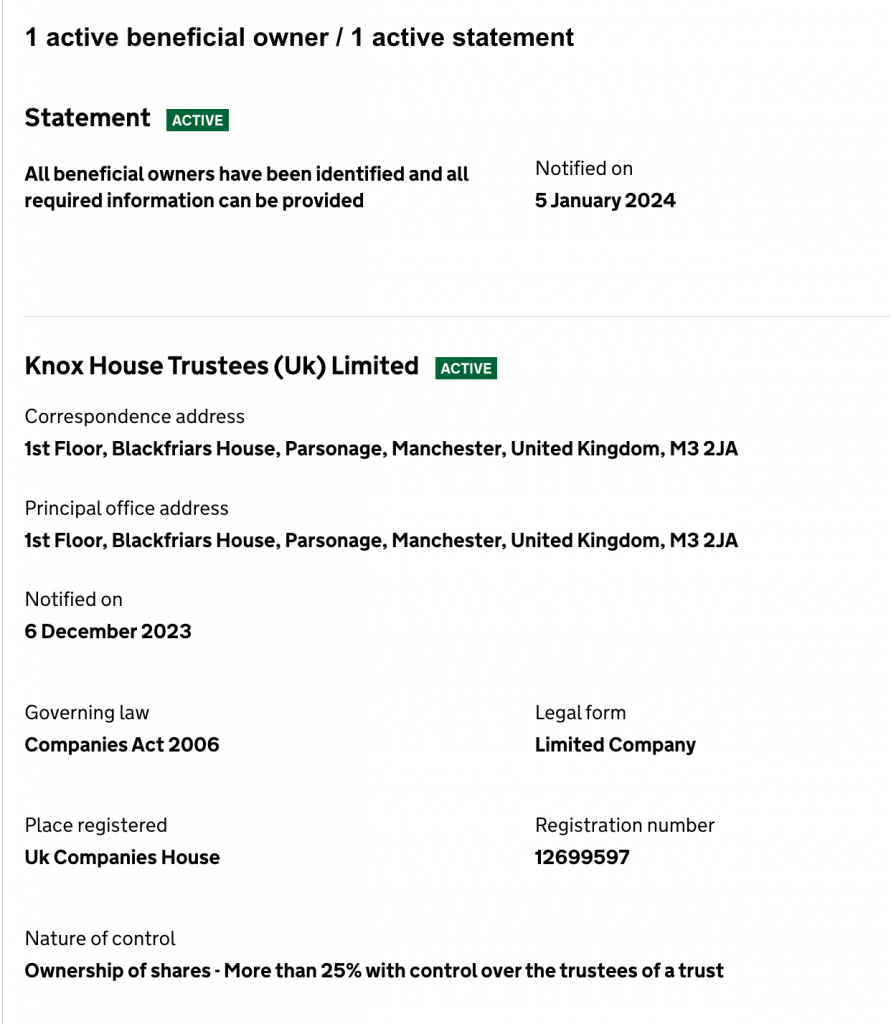

This was amended last week, with Knox House Trustees (UK) Limited shown as the only PSC:

The registered PSC of Knox House Trustees (UK) Limited is Arthur Lancaster. Lancaster is an accountant who is closely connected to Douglas Barrowman and the Knox Group – he was recently described by a tax tribunal as “seriously misleading”, “evasive” and “lacking in candor”.

Lancaster is also listed as the PSC for PPE Medpro – which Barrowman has now admitted is really controlled by him. It looks like they’re pulling the same trick here – Lancaster is a “front man”.

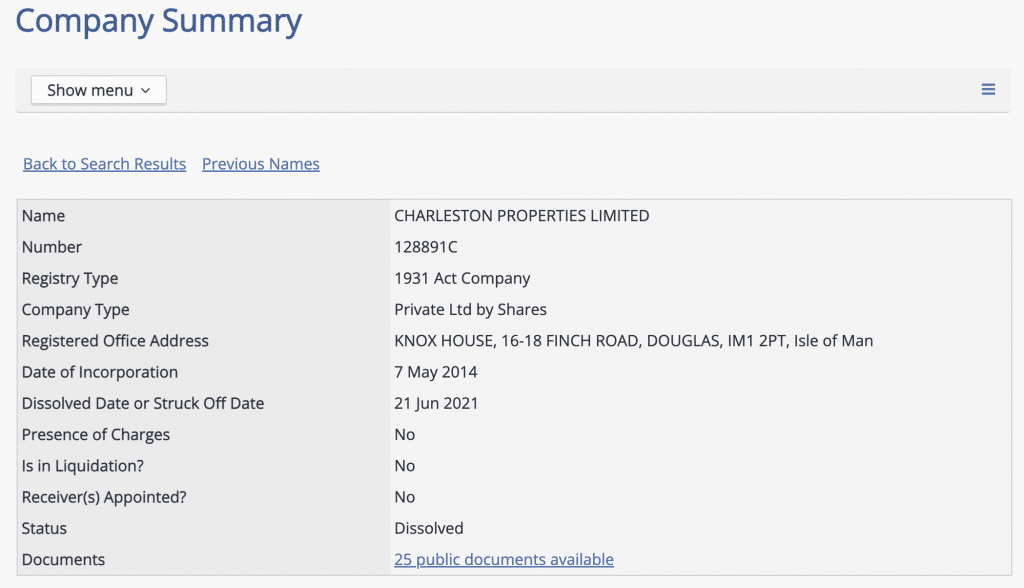

2. The dissolved company

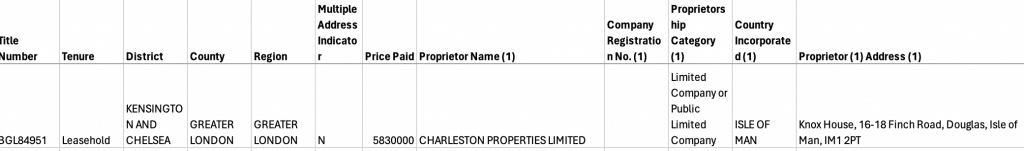

Barrowman’s group is connected to an apartment in Chelsea, held by an Isle of Man company called Charleston Properties Limited.5It also holds two other smaller properties in the same building. Query if these properties are really owned by Barrowman or on behalf of a third party client, although the fact it has only one registered proprietor suggests it isn’t held on trust (i.e. because overreaching requires two trustees and therefore a single trustee cannot in practice deal in the land).

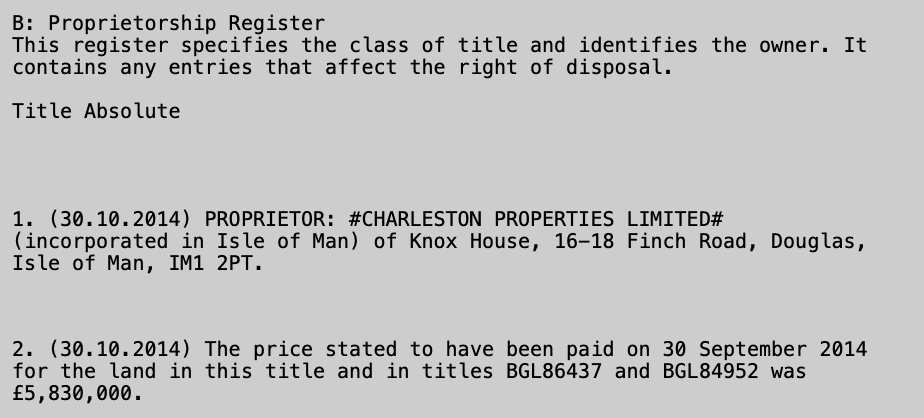

The land registry shows Charleston bought it in 2014 for £5.8m:

However the Isle of Man registry shows that Charleston Properties Limited was dissolved in June 2021:6If Charleston held as trustee then the terms of the trust should facilitate its replacement; if Charleston was not a trustee then the apartment may now be bona vacantia, i.e. go to the Crown.

Perhaps for this reason, the company isn’t registered at Companies House at all.7There is another unrelated UK company called Charleston Properties Limited, now dissolved

3. Eleven more offshore companies with false ROE registrations

We were able to identify eleven further companies connected with Barrowman which hold UK real estate 8This is revealed by the connection to Knox or other known Barrowman entities. Likely there are more which we have missed. They are required to be on the “register of overseas entities”, and declare their beneficial owner. However in each of these cases the declared beneficial owner appears to be false.

- Cove Estates Ltd is an Isle of Man company which holds five titles in Cornwall. Its beneficial owner is declared to be Knox House Trustees Limited, but again there is no entry for Barrowman or which person is influencing the trustees, and therefore exercises significant influence over Cove Estates Ltd:9This again could be held for a third party client, although if it is held on trust it is a little odd that there is only one trustee

- F is an Isle of Man company which holds two titles in Hertfordshire. Its declared owners are one company with a properly declared ownership chain held by a third party, and Knox House Trustees, which doesn’t. We’re keeping this anonymous because it’s likely a bona fide business which has made the mistake of hiring Knox.

- Bagshaw Limited is an Isle of Man company owning property in Glasgow10It therefore isn’t included on the English land registry’s register of foreign entities; the Scottish equivalent is not publicly searchable.. Its declared beneficial owners are again the typo version of Soldaldo (PTC) Limited, and the incorrectly registered Knox House Trustees Limited.

- Praeban Limited is another Isle of Man company owning property in Glasgow, and with declared beneficial owners the typo version of Soldaldo (PTC) Limited, and the incorrectly registered Knox House Trustees Limited.

- Breck Limited is the same: an Isle of Man company owning property in Glasgow, and with declared beneficial owners the typo version of Soldaldo (PTC) Limited, and the incorrectly registered Knox House Trustees Limited.

- APVCo 19 Ltd is another Isle of Man company owning property in Scotland.11We deduce this from its absence on the England & Wales register This time the beneficial owner is listed as Sallagh Limited, an IoM company(visible on the Isle of Man register). An unregulated Isle of Man company cannot be listed as a beneficial owner. This couldn’t be clearer in the guidance. 12See paragraph 4 of the guidance or para 1 Schedule 2 to the Act.

- R is another Isle of Man company owning UK property, with the beneficial owner listed as Knox House Trustees Limited – an Isle of Man company cannot be listed as the beneficial owner. Again it appears to be a bona fide business which hired Knox.

- APV Co (25) Limited is another Isle of Man company owning property in Scotland. This time the beneficial owner is Perree (PTC) Limited, which itself registers no beneficial owner.

- APV Co (39) Limited: another Isle of Man company owning property in Scotland, with Perree (PTC) Limited as beneficial owner.

- APV Co (38) Limited: again an Isle of Man company owning property in Scotland, with Perree (PTC) Limited as beneficial owner.

- ZJR Limited is another Isle of Man company owning property in Scotland. Its beneficiary is Knox House Trustees Limited, which should not be listed as the beneficial owner.

Some of these may be beneficially owned by Knox’s clients, and not Barrowman himself – but in all these cases there has been a failure to comply with the laws requiring beneficial ownership disclosure. In each case the verification agent was FCLS (save R, where FCLS didn’t act).

4. Twelve more UK companies with false PSC registrations

There are a series of UK companies which are connected to Barrowman which have declared what appears to be a false “persons with significant control” to Companies House:

- AML Tax (UK) Limited is a UK company which is involved in abusive tax avoidance schemes, and was fined £150,000 last year for unlawfully failing to comply with an information notice from HMRC. It has registered its PSC as Braaid Limited, a BVI company.13The Panama Papers list Braaid as the road where Barrowman’s house is located. The rules don’t permit a BVI company to be a PSC. This is a very material failing, given dubious nature of AML Tax (UK) Limited’s activities (for which its directors were severely criticised by a tax tribunal), and the tax and potentially other liabilities which we expect it will have accrued.

- Denmedical UK Limited is another UK company involved in the same types of avoidance scheme. Its registered PSC was originally Barrowman himself, then this was changed to Anthony Page. Page who worked for Knox/Barrowman until he was sacked in disputed circumstances. It seems unlikely the ultimate owner of a group company is an employee – this is consistent with Page being a “PSC of convenience”, with Barrowman really exercising influence/control over the company.

- Carnegie Knox Limited participated in the same avoidance schemes. It declared no PSC until 2021 and now declares Timothy Eve (Knox Deputy Chairman). Weirdly there is an Isle of Man company with the same name – “weird” because most corporate groups would never have two companies with the same name (even similar names create the potential for dangerous/expensive mistakes).

- Q Tax Services Limited, previously Grosvenor Tax Limited, marketed the AML Tax scheme to contractors. Its PSC is listed as Knox Limited, an Isle of Man company. An Isle of Man company cannot be a PSC.

- Carnegie Knox (Scotland) Limited had no PSC until 19 January 2021, then registered Douglas Barrowman as the PSC for precisely one day, and then registered Timothy Eve. Could it be that, by accident, this company was briefly compliant with the law?

- Knox House Trustees (UK) Limited is a UK company. Douglas Alan Barrowman was listed as PSC for Knox House Trustees (UK) Ltd from 26 June 2020 to 10 February 2023, but since then it has declared Arthur Lancaster as the PSC. However, Lancaster is an employee of Barrowman. It seems most unlikely he is the true beneficial owner of a company in Barrowman’s group; Barrowman surely has “significant influence” and is therefore the PSC. Lancaster is also listed as the PSC for PPE Medpro – which Barrowman has now admitted is really controlled by him. It looks like they’re pulling the same trick here – Lancaster is a “front man”.

- PPE Medical Protection Limited is another UK company which declares Lancaster as the PSC. The previous PSC was Anthony Page. That is consistent with Page and then Lancaster being a “PSC of convenience”, with someone else (presumably Barrowman) really exercising influence/control over the company.

- Neo Space (Aberdeen) Limited is a UK company providing flexible office space. According to reports when it was founded, it is owned and funded by Barrowman and Mone, as a “collaborative business project” between them. So it’s a surprise that its listed PSC is Scott Paton, its managing director. The previous PSC was Anthony Page; again that’s consistent with Page and then Paton being a “PSC of convenience”, with someone else (presumably Mone and/or Barrowman) really exercising influence/control over the company.

- Neo Space (Douglas) Limited is the same deal. A UK company with Paton supposedly the PSC. Until December 2023, Page and Voirrey Claire Coole (another Barrowman employee) were listed as PSCs.

- Knox Capital Solutions (UK) Limited is a UK company which lists Knox Capital Solutions Ltd, an Isle of Man company, as its PSC. An Isle of Man company cannot be a PSC – the individuals behind it should be registered.

- Marclaud Limited was dissolved in 2017. It listed as its PSC Knox House Trust Limited, an Isle of Man company. That is, again, not permitted.

- Klaba Limited has Anthony Page (former Barrowman employee) and Timothy Eve as directors. It is in the process of being liquidated. It lists as its PSC Omnia Group Limited, an Isle of Man company. Again, not permitted.

Also two more, courtesy of G (who alerted us shortly after we first published). it would be confusing to change the title of the article, but the total companies stands at 27 not 25

- Neo Space (Riverside) Limited – this has David Powell listed as the PSC, who is linked to Barrowman – see his LinkedIn profile. Powell is located in the Isle of Man and has worked at Carnegie Knox since October 2014. Carnegie Knox’s website lists the company’s address as Neo House, Riverside Drive, Aberdeen, AB11 7LH.

- Monthly Advance Loans Limited – a Wonga-style loans business. Barrowman was a director, but resigned 7 September 2023. Registered PSC is MAL (Holdings) Limited, an Isle of Man company registered to the usual Knox address. So another unlawful PSC registration. The company is regulated by the FCA – will they care?

Criminal liability for Barrowman and his companies

There are potentially criminal consequences for Barrowman, his companies and his staff.14And potentially Michelle Mone, if she is a PSC of the two Neo Space companies, although it is plausible that in her case this was an innocent error.

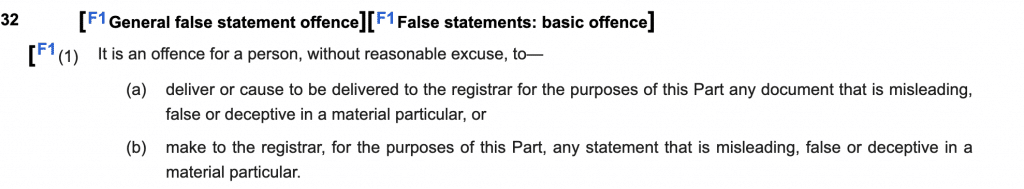

- Section 32 of the Economic Crime (Transparency and Enforcement) Act 2022 creates an offence for false registration of beneficial ownership of UK real estate held by foreign companies. It’s an offence for anyone, without reasonable excuse, to deliver (or cause to be delivered) a false or deceptive filing (even accidentally). On conviction they can be liable for an unlimited fine. The offence is “aggravated” if the person knew the filing it was false or deceptive – there is then also the possibility of up to two years’ imprisonment.

- There are a variety of offences under the Companies Act 2006 for false registration of PSCs of UK companies. That includes specific offences for breaches of the PSC rules, plus a general Companies Act offence of knowingly or recklessly delivering a false statement or document to Companies House, and another offence for a beneficial owner who knowingly fails to supply information. On conviction there’s an unlimited fine and up to two years’ imprisonment.

It seems clear that the section 32 offence has been committed – the filings were false, and it is hard to see how there could be a “reasonable excuse”. It is plausible that the offences were aggravated.

It also seems reasonably clear that Companies Act offences have been committed. The failures were, at a minimum, “reckless”.

The obvious question is whether any prosecution will take place.

Criminal liability for the agent, FCLS

Regulations made under the Act require that an agent (regulated under money laundering rules) must verify beneficial ownership and submit details to Companies House within 14 days of registration, using this form. They’re not just a post-box – they have a positive duty to verify, and can be liable if they get it wrong. The Law Society has published detailed guidance for lawyers acting as verification agents, and the risk of liability lead the Law Society to caution against lawyers agreeing to do so.

The section 32 offence of making a false or deceptive filing applies to verification agents as well as the companies/directors involved.

FCLS are responsible for a series of false/deceptive filings. The obviousness of the falsity means that we are doubtful there could have been a “reasonable excuse”. It therefore seems likely they are criminally liable.

The register of overseas entities relies upon verification agents. The entire enterprise falls apart if there are rogue agents, making not even the most straightforward of checks. That appears to be what FCLS is doing. A prosecution would be in the public interest.

A more immediate concern is to stop FCLS. Companies House has the power to serve a notice revoking a company’s registration as a verification agent. It should use it as soon as possible.

Why are the laws being ignored?

Because they are not enforced, and Barrowman and his team likely perceive the risk of material fines/penalties, let alone prosecution, as non-existent. Barrowman and others will continue to behave like this until there are high profile prosecutions.

A law that is never enforced may as well not exist.

Thanks to V and P for their research on this, and to M for Companies Act and ROE advice. Thanks to G for spotting two more Barrowman connections shortly after we first published.

-

1There are certain other cases where a PSC/beneficial owner can be a company which are not relevant here – there is helpful guidance in paragraph 2.2 here for PSCs, and paragraph 4.1 here for beneficial owners.

-

2Not the house he and Michelle Mone lived in; another property said to have been acquired for development.

-

3On the basis of this search, we can probably discount the possibility that there are two companies with almost-identical names and sequential registration numbers.

-

4Not to be confused with a separate UK company, Knox House Trustees (UK) Limited

-

5It also holds two other smaller properties in the same building. Query if these properties are really owned by Barrowman or on behalf of a third party client, although the fact it has only one registered proprietor suggests it isn’t held on trust (i.e. because overreaching requires two trustees and therefore a single trustee cannot in practice deal in the land).

-

6If Charleston held as trustee then the terms of the trust should facilitate its replacement; if Charleston was not a trustee then the apartment may now be bona vacantia, i.e. go to the Crown.

-

7There is another unrelated UK company called Charleston Properties Limited, now dissolved

-

8This is revealed by the connection to Knox or other known Barrowman entities. Likely there are more which we have missed

-

9This again could be held for a third party client, although if it is held on trust it is a little odd that there is only one trustee

-

10It therefore isn’t included on the English land registry’s register of foreign entities; the Scottish equivalent is not publicly searchable.

-

11We deduce this from its absence on the England & Wales register

-

12See paragraph 4 of the guidance or para 1 Schedule 2 to the Act.

-

13The Panama Papers list Braaid as the road where Barrowman’s house is located.

-

14And potentially Michelle Mone, if she is a PSC of the two Neo Space companies, although it is plausible that in her case this was an innocent error.

9 responses to “Douglas Barrowman: 25 more companies with unlawfully hidden ownership”

Dan Dan Dan why is taking so long for SOMEONEin authority to chase these totally disgusting people down, sure you heard it before but do 33 in a 30 zone and all hell breaks out, you have pages and pages of questions that need to be answered!!!!

For gods sake someone get these people to court.

Feel sorry for Michele as she never benefits from all this activity!!!! Mmmmmm???????

Hi, Neat post. There is a problem along with your site in web explorer, might check

this? IE still is the marketplace leader and a big component of folks will omit your fantastic

writing due to this problem.

Would it be inappropriate to suggest a private prosecution if the CPS fail to act…

Someone needs to pay for it, and counsel fees on a privately instructed basis (as opposed to legal aid rates) are prohibitive. That’s why private prosecutions tend to be, in my limited experience, between Russian oligarchs, who can afford it.

Good work. Thank you.

It is noteworthy that there are scenarios in which a non-UK entity can be recorded as a registrable beneficial owner on the Register of Overseas Entities. Section 14 of The Register of Overseas Entities (Delivery, Protection and Trust Services) Regulations 2022 specifies that a non-UK entity which provide trust services in a jurisdiction where the provision of trust services is regulated are viewed as “subject to its own disclosure requirements” so it can qualify as a registrable beneficial owner under paragraph 3 of Schedule 2 to the Economic Crime (Transparency and Enforcement) Act 2022.

I also think that care needs to be taken in describing the scope of the role of a verification agent under the Act. Notably The Register of Overseas Entities (Verification and Provision of Information) Regulations 2022 do not require an agent to verify the statement made under section 4(2) of the Act so, for example, an agent does not need to determine whether it is appropriate for managing officers to be declared instead of beneficial owners. In addition the verification is limited to confirming the information provided to the agent so an agent is not required to investigate whether there should be other beneficial owners declared (that duty falls on the company and it’s directors under section 12).

thanks, yes you are absolutely right – hopefully the text now reflects this. However where the non-UK entity is acting on the instructions of an individual (“significant influence), that individual should be registered as a beneficial owner of the non-UK company holding the property.

Thanks Dan and agreed on the point of significant influence over either the trustee or over the company holding the property.

However, by my reading of the regulations an entity does not need to be regulated itself to be viewed as “subject to its own disclosure requirements”. The requirements are solely that the entity acts a trustee and is established in a jurisdiction where the provision of trust services is regulated. In the Isle of Man the provision of trust services is regulated but private trust companies are exempt from regulation due to not providing trustee service by way of business. Intentionally of through poor drafting the regulations would still appear to permit all Isle of Man companies which act as trustees to be viewed as registrable beneficial owners.

This actually impacts Knox House Trustees Limited as it does not appear to be directly regulated in the Isle of Man but Knox House Trust Limited is and there is an exemption from regulation for trust services for corporate trustees which are subsidiaries of licensed entities (which I assume is the case here).

It is worth noting that the above is made somewhat moot moving forward by section 161 of the Economic Crime and Corporate Transparency Act 2023 which will make all corporate trustees registrable beneficial owners and revokes the regulation referenced above.

Have the Government reduced funding towards regulatory checks and enforcement? Not sure if the lack of focus (and press coverage) seem so low compared to desperate folk crossing the channel in small boats.