The Post Office has claimed a £934m tax deduction for its compensation payments to the victims of the Post Office scandal. That’s outrageous – and also unlawful. The consequence is that the Post Office has underpaid its corporation tax by over £100m over the last five years, and may no longer be solvent.

We understand that HMRC are actively pursuing this point – and it’s just one of five major Horizon scandal matters where the Post Office has, we believe, materially underpaid its tax. The Post Office failed to declare these issues in its accounts until this year, when it included an obscure reference which failed to adequately disclose the point.

The FT is covering our report here.

How do we know there’s a liability?

The Post Office’s report and accounts for 2022/23 suggest there is a serious potential tax problem that could result in it becoming insolvent:

And again on page 70:

and on page 82:

We’d expect so serious a contingent liability to be disclosed in the notes to the accounts – it is mentioned, but with nothing specific:

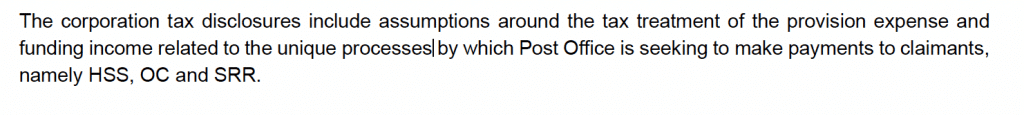

The only hint as to what the issue could be is in the small print on page 101:

So we know this relates to historic periods, that nothing was disclosed until this year (none of these disclosures were included in previous accounts), and that it is something to do with the provisions/expenses and funding income relating to the Post Office’s compensation payments to victims of the scandal.

We can also take from this that the Post Office is under investigation by HMRC (either an HMRC enquiry and/or a discovery assessment).1The term “investigation” is often used, but technically that is not a term of art – any query from HMRC as to the accuracy of a recent corporation tax return is technically an “enquiry”; a discovery assessment is the process for re-opening previous years that would otherwise be past the point of correction. Both have legal consequences.

What is the liability?

Our team of eminent tax and accounting experts has reviewed the Post Office’s accounts for the last ten years in detail and one issue stands out: it has treated the compensation it pays to postmasters as tax deductible. That is not correct.

A source at the Post Office has confirmed to us that HMRC is investigating this and asserting that the Post Office owes tax – in our view they are right to do so.

Background

Most payments made by a trading company are deductible for tax purposes. However, a deduction is only permitted for a payment made “wholly and exclusively” for the purposes of the trade. At this point we cannot say with certainty why the Post Office falsely accused 4,000+ postmasters of theft, but we can be sure it was not for any bona fide purpose of its trade. The Post Office’s actions were, as the Court of Appeal put it, an affront to the conscience of the court – unlawful and very plausibly criminal.

It follows that all expenses connected with the Post Office’s persecution of the postmasters are non-deductible – including (but not limited to) compensation and provisions for compensation. There are many cases on this point, but none with facts as extreme as the Post Office scandal2The leading case is probably still Strong & Co of Romsey Ltd v Woodifield. A customer sleeping at an inn was hurt when a chimney collapsed on him, because the company had breached its duty to maintain the property. The company had to pay costs and damages, and the House of Lords ruled this was non-deductible. Here, whatever the precise reasons for the Post Office’s actions, to say it “breached its duty” would be a significant under-statement. Other relevant cases include Cattermole v Borax Chemicals Ltd [1949] (payments to settle potential fines in the US were non-deductlble) and Fairrie v Hall [1947] (libel damages are ordinarily not deductible, although newspapers are different). – the position is, in the view of our team, reasonably clear.

We understand from our source that the Post Office is contesting HMRC’s position that the compensation payments are non-deductible. We believe the Post Office’s prospects of success are low.

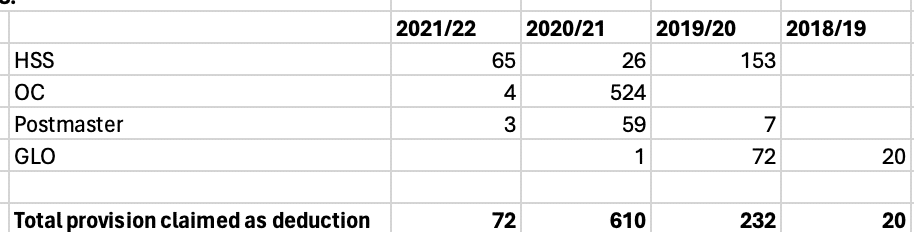

The total deductions wrongly claimed by the Post Office

We can find the data on the deductions taken for compensation payments by looking the notes in the account for the last five years.3See page 97 of the 2022/23 accounts, page 98 of the 2021/22 accounts, page 73 of the 2019/20 accounts. The totals are shown below. All figures are £m.4We’re following the accounts convention that positive numbers here are losses booked in the accounts for the compensation provisions, and negative numbers are reversals of the provisions.

In other words, a total of £934m has been claimed – improperly.

There was a partial reversal of the provisions in the most recent year (2022/23), however that will not change the corporation tax liability for previous years.

The impact of reversing those provisions

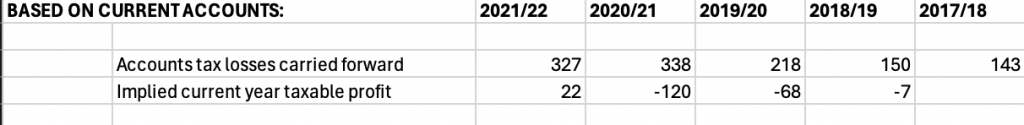

Like most companies, the Post Office does not disclose its actual corporation tax liability for each year. However we can infer this by looking at the figures in its accounts for tax losses brought forward each year. The change in tax losses broadly reflects its taxable profit for each year (i.e. because a further tax loss increases brought-forward losses, and a taxable profit reduces them).

On that basis, we estimate the Post Office’s taxable profit for each year as follows (£m):

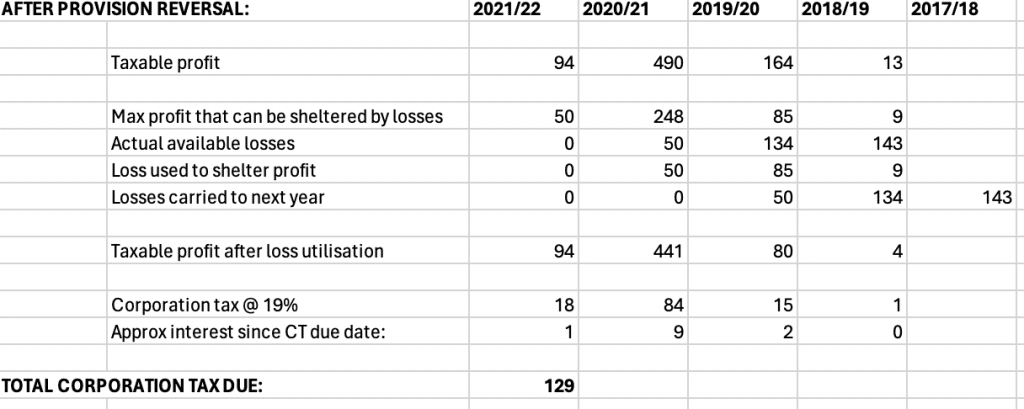

The next step is to adjust this inferred taxable profit to reflect the reversal of the tax deduction. That profit will then be reduced by the Post Office’s considerable carried-forward losses; but a change of law in 2017 means that no more than half of a current year profit can be sheltered by brought-forward losses.5After an allowance of £5m which can be entirely sheltered by losses. Note that as the Post Office’s losses end up being exhausted by the reversal of the provision, the loss restriction rule ends up having little effect (other than to decelerate loss utilisation and therefore slightly increase the interest charge). Interestingly, and probably not by coincidence, the Post Office’s accounts disclose the loss utilisation point this year, never having mentioned it in the past (despite having large losses).

So we can model the impact on the Post Office as follows:

This figure needs to be treated with caution, and as an approximation.6In particular, it doesn’t take account of loss surrenders (although that likely means the same amount of tax would be collectable, but from other entities). The full calculations are available here.

However it seems likely that the Post Office has a corporation tax liability of over £100m.

There is also the question of penalties: the non-deductibility of compensation for unlawful acts is a well-known point, and the Post Office certainly knew that its actions had been unlawful. It was careless. Hence we would expect HMRC to consider penalties of up to 30%, with the precise figure depending on the facts, and in particular whether this was a “prompted” disclosure by the Post Office (i.e. whether the Post Office approached HMRC with this issue or whether, alternatively, HMRC identified it).

The Post Office’s response

We asked the Post Office for comment on a potential undisclosed £100m tax liability. They said:

“The disclosed information on taxation in Post Office’s Annual Report and Accounts for 2022/23, published on 20 December 2022, is appropriate and accurate. Discussions with HMRC and the Department of Business continue.”

(Presumably this is a typo, and they meant to say “20 December 2023”)

We read this as confirmation that our findings are accurate, and that the Post Office is under HMRC investigation. We also note that the Post Office is asserting that the disclosure in this year’s accounts is appropriate (we disagree) but not defending the accuracy of its previous years’ accounts.

The other tax liabilities

The Post Office likely has other significant underpaid corporation tax resulting from the scandal, in addition to the £100m we estimate above. We can identify four particular issues:

First, the “shortfalls” it recovered from postmasters, which supposedly represented the return of money they had stolen, but actually represented a windfall for the Post Office. This income should have been included in the Post Offices taxable profits7The demand for payments of shortfalls was unlawful, and potentially a criminal offence, but unlawful/illegal income is taxable if (very broadly) it forms part of a systemic activity – there is helpful HMRC guidance here. So, for example, a drug dealer’s profits were taxable. We are confident the Post Office’s “shortfall” receipts were taxable too.; was it?8Nick Wallis has written about what happened to the shortfall money here.

Second, the Post Office will have non-deductible costs dating back to the inception of the scandal, including the costs of falsely prosecuting postmasters between 2000 and 2015 (which we would say were unlawful/illegal actions carried outside the course of the trade and therefore are not deductible).

Third, the Post Office has claimed a deduction for all of its legal fees and other costs of fighting the postmasters’ claims, and of dealing with the Inquiry. We do not know the full amount, but we expect it is several hundred million pounds (given that the postmasters’ costs for the civil claim alone were £150m). Some of this may be deductible; other amounts (particularly for pursuing unjustifiable positions) may in our view not be. We await the Inquiry’s conclusions on the appropriateness of the Post Office’s actions in this regard.

Finally, and most significantly, the Post Office has been receiving funding from Government in a form which may be taxable. If a shareholder pays cash to a company to subscribe for shares, the cash isn’t taxable for the company. If a shareholder makes a cash loan to a company, the loan advance isn’t taxable. But if the shareholder just gives money to a company, to supplement its trading receipts and enable it to carry on in business, then that will be a taxable trading receipt. HMRC guidance on this is clear – and so businesses typically never obtain funding in the form of simple gifts. But, for unknown reasons, that’s what happened here (again suggesting a basic lack of competence at the Post Office).

Possibly the Post Office can argue that the funding from Government is a special case which doesn’t give rise to a profit;9By analogy with BBC v Johns – however the facts here are different. but our understanding from the accounts disclosure and a source at the Post Office is that HMRC believes the amounts are taxable. This was confirmed by the Post Office yesterday – the FT asked the Post Office if it had written to HM Treasury to complain about HMRC and they responded:

“We have regular conversations with Government who are our sole shareholder. Our correspondence in respect of this issue was about ensuring that the tax treatment of compensation was treated in the same way as other government funding that we receive.”

This suggests the Post Office is very confused.10We believe the statement means to say “the tax treatment of funding for compensation” The tax treatment of gifts will not be “treated in the same way” as funding by way of share capital or loans, because a gift is not the same as a share subscription or loan. It is, furthermore, not appropriate for the Post Office to write to the Government to lobby for HMRC to treat it differently from other companies – the Post Office is supposed to be managed at arm’s length.

Ordinarily HMRC cannot recover tax from more than (broadly speaking) six years ago, but it can go back 20 years where an action was deliberate. That may be the case here.11The point is not straightforward. The Post Office’s actions were clearly deliberate, but we expect they paid no heed to tax at all. Was the loss to tax “brought about deliberately“? It may be difficult in practice to quantify the amounts in question, particularly given what appears to be poor record-keeping on the part of the Post Office. That would (rightly) not stop HMRC pursuing the point against a normal commercial taxpayer – HMRC would require that the Post Office provide the best figures available for the potentially taxable and non-deductible items we identify.

We would hope HMRC will pursue all these points, and that it will disregard any attempt at political interference from the Post Office.

The interest is likely to be a significant amount and, again, penalties may be chargeable (particularly if the misappropriated “shortfalls” were not taxed as income).

Does it matter?

Taxes go to HMRC, a non-ministerial Government department. The Post Office is wholly owned by the Government. Does it matter how much tax the Post Office pays?

We would say it does:

- The Post Office should follow the law, just like every other company.

- The Post Office has boasted about finally making a trading profit. Our findings show that it has in fact made a very substantial loss.

- Bonuses have been paid to the executive team based on an apparent level of profitability which does not exist.

- The existence of a £100m+ hole in the accounts suggests that the Post Office has an alarming lack of the usual financial controls one would expect from a business of this size.

- It is inappropriate that the point was not disclosed at all in previous years’ accounts, and was disclosed only very elliptically in the most recent accounts.

- Has the Post Office informed the Government, as its shareholder, as to the true state of its accounts and tax position?

- It is possible that this liability means that the Post Office is in fact insolvent.

This all raises the question of whether, in accordance with the Post Office’s published policies, bonuses paid to its executive team should be reduced or returned:12See page 39 of the 2022/23 accounts

It also raises the question: if the management team can miss a £100m black hole, what else are they missing?

Thanks to K1 for asking the question which led to this analysis, Heather Self (one of the UK’s most respected corporate tax advisers) of Blick Rothenberg, together with K2, D, and X for generously providing their expertise on non-deductibility of compensation payments, and to C for his invaluable tax accounting input. And many thanks to Emma Agyemang at the FT for her help developing this report.

-

1The term “investigation” is often used, but technically that is not a term of art – any query from HMRC as to the accuracy of a recent corporation tax return is technically an “enquiry”; a discovery assessment is the process for re-opening previous years that would otherwise be past the point of correction. Both have legal consequences.

-

2The leading case is probably still Strong & Co of Romsey Ltd v Woodifield. A customer sleeping at an inn was hurt when a chimney collapsed on him, because the company had breached its duty to maintain the property. The company had to pay costs and damages, and the House of Lords ruled this was non-deductible. Here, whatever the precise reasons for the Post Office’s actions, to say it “breached its duty” would be a significant under-statement. Other relevant cases include Cattermole v Borax Chemicals Ltd [1949] (payments to settle potential fines in the US were non-deductlble) and Fairrie v Hall [1947] (libel damages are ordinarily not deductible, although newspapers are different).

-

3See page 97 of the 2022/23 accounts, page 98 of the 2021/22 accounts, page 73 of the 2019/20 accounts

-

4We’re following the accounts convention that positive numbers here are losses booked in the accounts for the compensation provisions, and negative numbers are reversals of the provisions.

-

5After an allowance of £5m which can be entirely sheltered by losses. Note that as the Post Office’s losses end up being exhausted by the reversal of the provision, the loss restriction rule ends up having little effect (other than to decelerate loss utilisation and therefore slightly increase the interest charge).

-

6In particular, it doesn’t take account of loss surrenders (although that likely means the same amount of tax would be collectable, but from other entities).

-

7The demand for payments of shortfalls was unlawful, and potentially a criminal offence, but unlawful/illegal income is taxable if (very broadly) it forms part of a systemic activity – there is helpful HMRC guidance here. So, for example, a drug dealer’s profits were taxable. We are confident the Post Office’s “shortfall” receipts were taxable too.

- 8

-

9By analogy with BBC v Johns – however the facts here are different.

-

10We believe the statement means to say “the tax treatment of funding for compensation”

-

11The point is not straightforward. The Post Office’s actions were clearly deliberate, but we expect they paid no heed to tax at all. Was the loss to tax “brought about deliberately“?

-

12See page 39 of the 2022/23 accounts

25 responses to “The Post Office unlawfully claimed £934m tax relief for its compensation payments, and now faces an unexpected £100m tax bill.”

One of the things that always gets lost is that the Post Office is a cost centre, not a profit centre. It has outsourced the income generation to self employed SPMs. It is totally disingenuous to talk about Execs and profit as they make a profit by restricting what they pay SPMs.

The rates of remuneration are pathetic. 0.125% plus 23p for banking so a single deposit of £1000 would earn a SPM about £1.50.

3p for 2nd class stamp 9p or so for a 1st, home shopping returns 35p.

Whilst there are 20 plus Execs earning over £200k pa.

When Vennels culled the network and SPM became self employed they have been totally abused. The rates of pay make it impossible to earn minimum wage as a SPM but as they are self employed no one cares.

The PO has been advising SPMs for several years that it can’t pay more in commission as it has to hold back funds to pay compensation.

So existing postmasters are paying towards compensation for the wronged postmasters carried out by POL.

I think that the amounts quoted as tax losses are the tax effected amounts cf tax losses (note 8 (d) of the annual report refers to assets not gross losses).

If you are right, Dan ( I see that the PO disputes what you say), isn’t this another audit failure by one of the Big Four?

Duncan, you’ll probably want to show your reasoning in coming to that conclusion, given that the salient extracts are quite literally taken from the audit report.

Dan says that the PO has taken an unsustainable position regarding tax relief on compensation (Heather Self agrees – see link). Despite what you say, PWC make no mention of material dodgy tax claims in any of their audit reports. Either the auditors didn’t consider the allowability of the compensation or they didn’t exercise the required degree of professional scepticism. This is on the basis that Dan is right.

https://www.taxjournal.com/articles/tax-clouds-on-the-horizon-for-the-post-office-

It baffles me that ,no matter the scheme, they only serve themselves. It really is all about the execs. Lessons learned and huge bonuses paid. As always Dan is right on the money. It is very interesting the way Dan breaks each item down to such detail. Fantastic. Well done Dan!

Lee

If the public decide we still need post offices (particularly as banks leave the high street) we will end up paying the costs, but it would be good if decisions could be made based on the correct figures, and not on the basis that the PO is a private company – but only sort of.

I’m not too bothered if the left pocket has to pay the right pocket. But would be good if Fujitsu can be made to gross up any compensation payable to POL for 25% corporation tax.

In a system apparently so flawed as Horizon, why should we assume that every error, even the undetected ones, fell out in favour of The Post Office? If they did, it would be damniing indeed. But if not, would this not reduce the tax relief overclaim?

This is the very funny thing – that there were good reasons to believe that there were very few errors which went in favour of postmasters (“overs”, they called them). There are dark speculations amongst IT people about how that could be

There were frequently ‘overs’ too. As a Chartered Accountant, I found it impossible to reconcile my parents’ Post Office’s balance from one week to the next as the reporting simply didn’t exist at a branch level in a format which enabled you to do so. If there was a material ‘over’ you ignored it, safe in the knowledge it would have disappeared in a week’s time.

The organisational culture that completely lacked interest in tracking and correcting faults in Horizon suggests that there might be bigger problems with the accuracy of the post office accounts, beyond the sub-post office balances.

Well well well. What goes around come back to bite them. How totally apt.

The wheels of justice are starting to grind extremely finely.

Would it be appropriate for HMRC to claw back unpaid tax from executives who have benefitted from bonuses and pension top ups whilst they were stewards of this egregious, inefficient and corrupt organisation.

Further is it likely that those at the top of The Post Office will be charged with criminal proceedings for tax evasion, fraud, conspiracy to defraud, theft and perjury?

I sincefely hope so.

Along with many others I will take great pleasure in watching these egregious bullies having the full force of the law laid upon them and sincerely hope that they receive lengthy prison sentences.

I also hope that all of these subpostmasters and postmistresses receive full compensation for the pain and suffering they have endured at the hands of these criminals, my understanding is that the fund available to them in compensation is in excess of £1 billion.

Well said !

I really do hope they charge all these executives who lied and cheated the postal workers and who defrauded the HMRC

You’ve got a typo in the section “ The Post Office’s response”.

The Post Office’s Annual Report and Accounts for 2022/23 were published on 20 December 2023, and not in 2022.

thank you – good spot! The typo was the Post Office’s, but I’ll note the point!

Jaw-dropping levels of incompetence.

Is your summary accurate?

Referring to s 133A of the CTA:

https://www.legislation.gov.uk/ukpga/2009/4/chapter/9/crossheading/banking-companies

Compensation payments were (prior to 2015) CT-deductible in general.

However for ‘banking companies’ (which I believe the Post Office is in this context), ‘relevant compensation’ payable to ‘a customer’ is thereby no longer tax-deductible.

‘Relevant compensation’ excludes that which is due to

(a)an administrative error,

(b)the failure of a computer or electronic system, or

(c)loss or damage which is wholly or mainly attributable to an unconnected third party.

I.e. such compensation would remain tax deductible.

But that may not be relevant since this legislation was passed to address the harm of banks ripping off customers (with PFI and the like) and then claiming back compensation payments.

The question of whether ‘sub-postmasters’ are customers might be trivially answered with ‘no’, except under 133J it is not so simple.

A ‘customer’ is someone who:

* has used or may have contemplated using a financial service provided by company A OR

* has relevant rights or interests in relation to a financial service provided by company A.

Where ‘financial service’ means a service provided

* in carrying on regulated activities,

* in communicating, or approving the communication by others of, invitations or inducements to engage in investment activity, or

* in providing relevant ancillary services (if company A is an investment firm or credit institution).

The putative ‘customer’ has a “relevant right or interest” if they have a right or interest—

(a) which is derived from, or is otherwise attributable to, the use of the service by another person, or

(b) which may be adversely affected by the use of the service by persons acting on P’s behalf or in a fiduciary capacity in relation to P.

As I understand it the subpostmasters are/were paid for the various banking transactions they performed, both for new account openings, and per transaction, so in that regard they have a ‘right’ (to a payment) derived from the use of the service by the user.

Therefore I would say:

* compensation is in general CT-deductible

* but not for banking companies

* of which PO is one

* and the compensation is not in respect of the failure of a computer or electronic system

* nor is it in respect of an administrative error

* therefore it is non-tax deductible by reason of CTA 2009 s 133A.

Of course it is open to the Post Office to claim that it relates to such a failure, in that clearly their computer system was useless, but it seems to me that ‘failure’ is intended to address compensation *caused* by such a failure (e.g., the server room caught fire, and the bank had to pay compensation). In this case the failed computer system did not lead to the compensation being paid. What led to the compensation being paid was the decision of PO staff to ignore the evidence that their system failed continuously and to persecute their SPMs.

Hi, that’s not right. The 2015 legislation was introduced to deal with a specific class of bank compensation (PPI), as there wasn’t caselaw dealing with compensation for missold financial products. It has no other effects, and isn’t relevant here. The legislation sits on top of the previous common law rules discussed in this report; it doesn’t replace them.

I’m aware that the banking legislation was introduced to specifically prohibit banks deducting CT for compensation paid in respect of mis-sold financial products, what I was saying is that :

1) in your post you state that it is not CT-deductible if it is paid in respect of an unlawful act

2) therefore it would need to be shown that the PO prosecutions were unlawful

3) whereas if the compensation relates to a ‘banking product’ as per above, it is not necessary to show that it is unlawful

Obviously the intent of the legislation was in relation specifically to ‘mis-selling’, which this is not, but it seems to me you could read the statute to cover the Horizon situation, as an alternative to showing that the prosecutions were unlawful.

Hi Dan, when they refer to ‘unrecognised tax assets’ that would typically be the losses carried forward multiplied by the tax rate. So 17/18 would not be £143m of tax losses but more like £700m.

This would affect your model significantly as you model underestimates taxable losses by some margin.

Good work Dan. But I did notice a typo in the date in:

“The disclosed information on taxation in Post Office’s Annual Report and Accounts for 2022/23, published on 20 December 2022, is appropriate and accurate. Discussions with HMRC and the Department of Business continue.”

Not sure whether that was your work experience person or the Post Office’s.

it seems typical of the level of education and ability of Post Office staff we have seen.

‘Department of Business’?

How could we take their claims about tax law seriously when they can’t even distinguish ‘of’ and ‘for’, let alone notice that it ‘Business and Trade’, not ‘Business’.

Another reason why it matters…The Post Office is, true to form, probably about to spend a large amount of money on professional fees on this. Firstly in a futile attempt to fight it. And secondly in repairing the damage (which will be much more costly to repair because of step 1).