There are plenty of reasons to be suspicious of PPE Medpro. The way it obtained a contract to supply PPE to the Government during the pandemic. The oddity of there being both a UK company and Isle of Man company with the same name (something most businesses would try to avoid). The alleged uselessness of the PPE it supplied. The steps taken to hide that it was owned by Douglas Barrowman. That Baroness Mone (his wife) both introduced PPE Medpro to the Government and shares in its profits. The documentary it funded to defend the couple.

So the news that PPE Medpro is involved in a peculiar loan arrangement is not surprising.

Companies that borrow money often grant security to the lender. Sometimes a mortgage – in much the same way that an individual would borrow from a bank; other times, the security isn’t over land, but is over assets. The benefit for the lender is that, if the borrower becomes insolvent, a secured lender is paid out in priority to ordinary unsecured creditors. The charge can be “fixed” or “floating” (“fixed” is practically more difficult in many cases, but has a higher priority in insolvency).

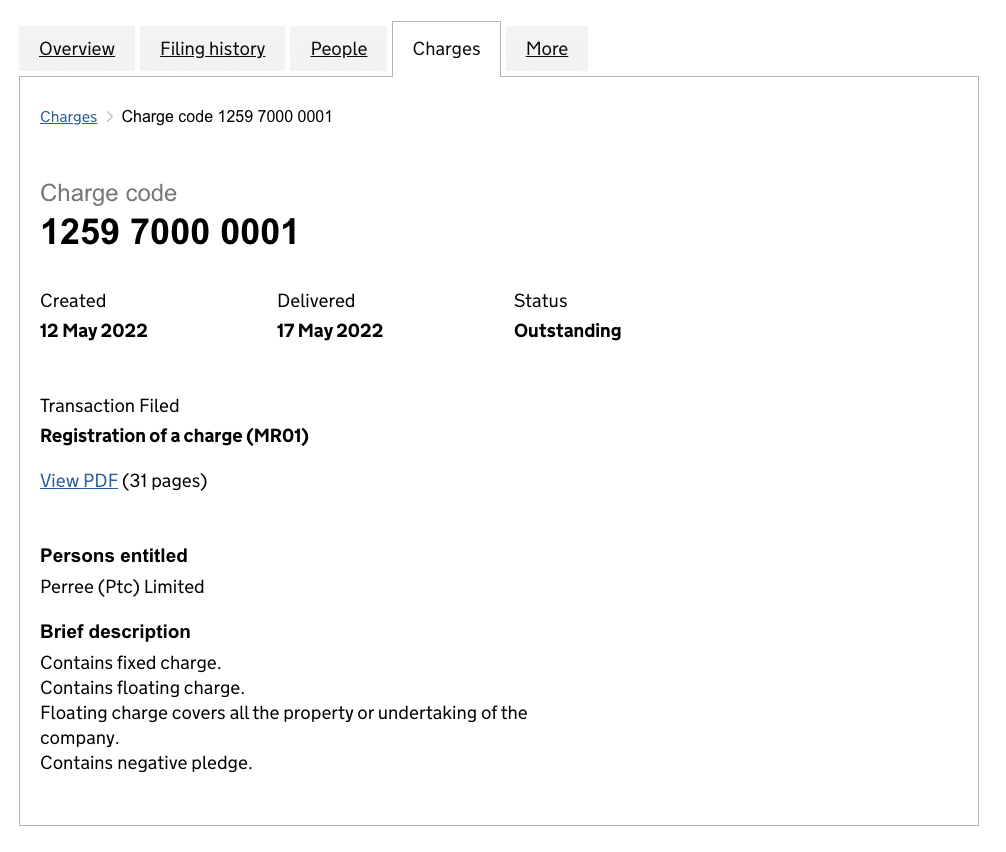

You can see the security granted by a company on its Companies House charge register. Here’s the charge register for PPE Medpro Limited:

You can click through that to the debenture (the document creating the charge). In case this is withdrawn/amended, I’ve saved a copy here. The debenture secures obligations under a loan facility from a BVI company called Perree (PTC) Limited – the company involved in the shadowy ownership arrangements of his Belgravia house.

There are several interesting things about this:

1. The BVI loan

Obvious questions arise:

- Why did PPE Medpro take a loan in 2022? There have been no reports of it undertaking additional business (except for funding the documentary).

- How much was the loan?

- Why was the loan secured? It’s an unusual step for an intra-group loan.

We currently have no way to answer these questions (the balance sheet date for the most recent accounts pre-dates the facility).

It’s not normally a great idea for UK companies to borrow from tax haven companies, because interest they pay on the loan is subject to a 20% withholding tax. Probably one of three things happened:

- This is an interest free loan

- Some structure was put in place to avoid the withholding tax – e.g. discounted notes. This isn’t something many tax advisers would recommend these days.

- They forgot or ignored the legal requirement to withhold tax.

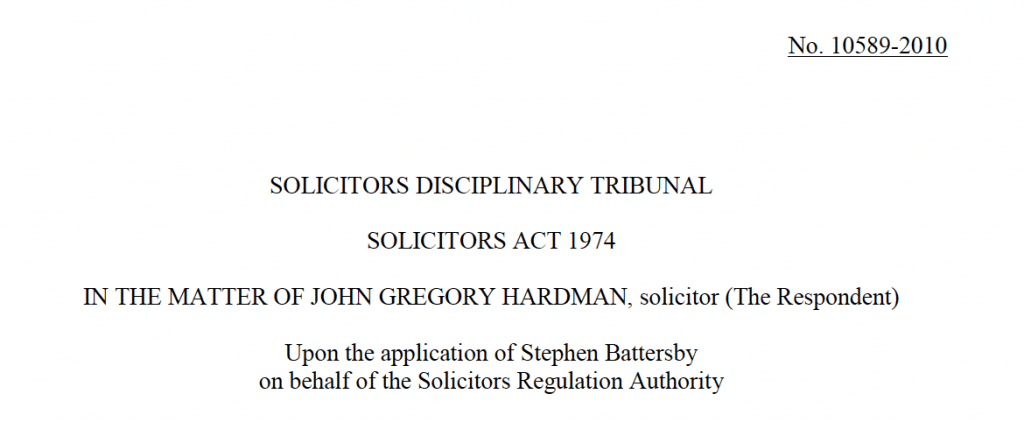

2. The struck-off solicitor

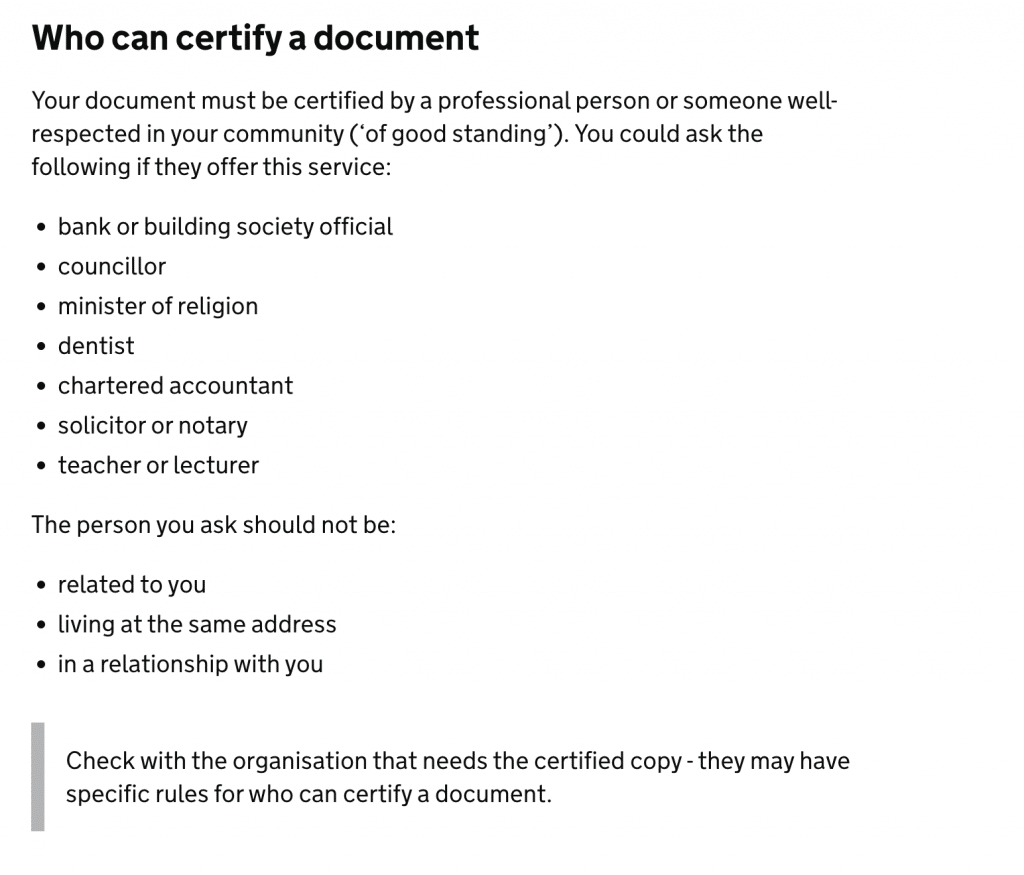

When a charge is filed with Companies House, it has to be accompanied by a copy of the charging document (here, the debenture). To provide some assurance this is a copy of the actual document, it has to be “certified”.

Here’s what the UK government website says about certified copies:1This accords with my understanding, but I’m embarrassed to say I don’t know the legal authority for this. Very possibly there isn’t one – but I’d be most grateful for any thoughts.

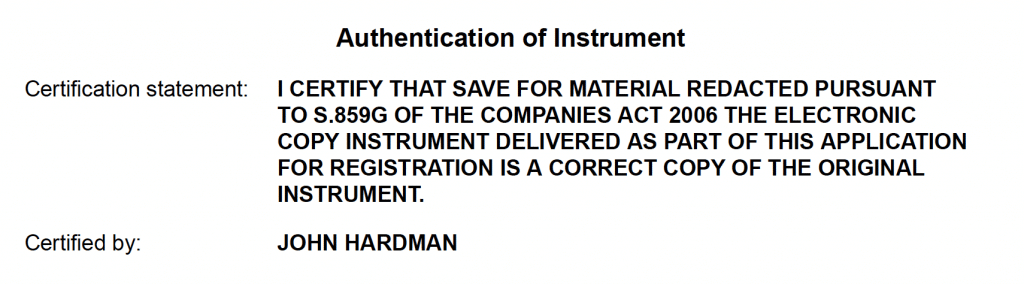

Here’s who certified the PPE Medpro charge:

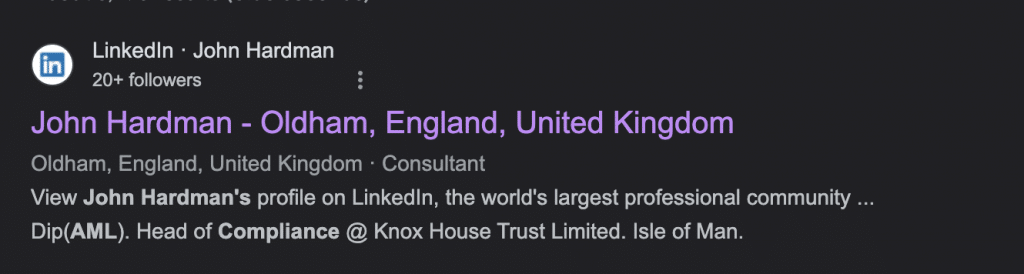

John Hardman is effectively Barrowman’s in-house lawyer.2Not to be confused with the tax adviser John Hardman, formerly at Pinsent Masons, who has no connection to these matters. Of course there are likely many other unrelated John Hardmans.. However, you can see only traces of this on the public internet, including Companies House connections with Barrowman and an old LinkedIn profile:3Hardman recently removed all content from his LinkedIn profile

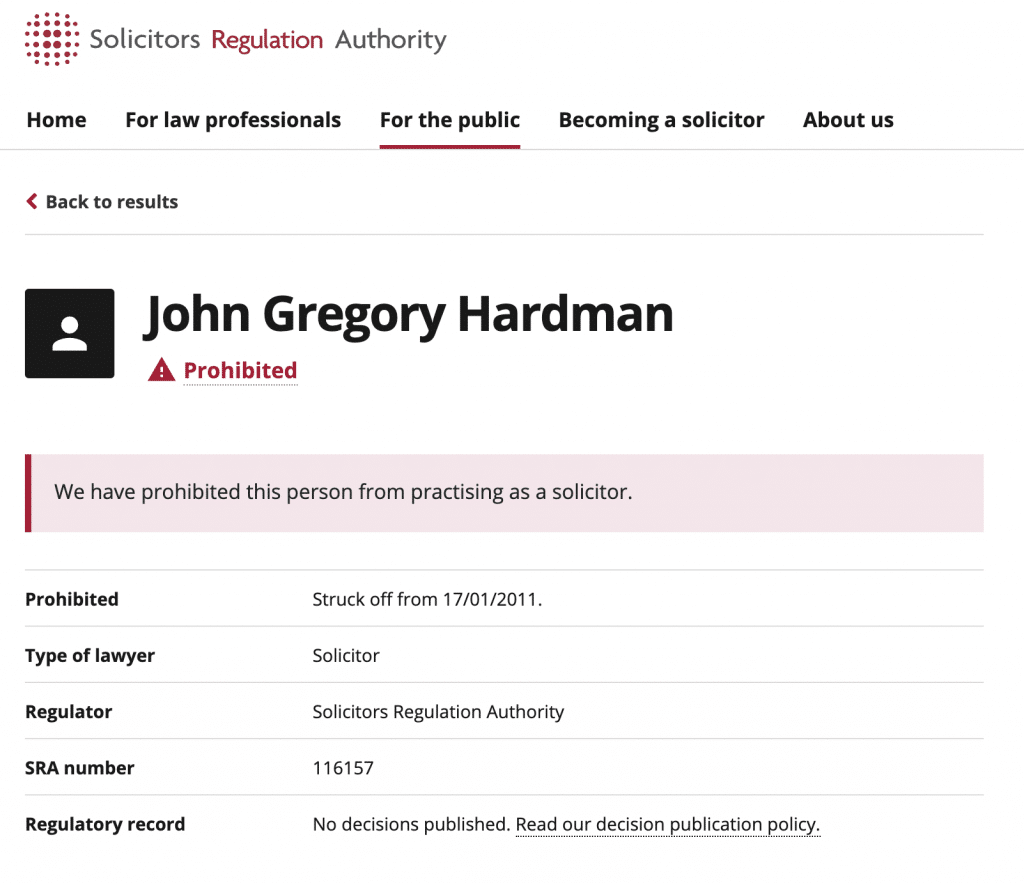

Hardman is an interesting choice for a legal adviser, because he is a former solicitor who was struck off for dishonesty:

You can’t see the details online, but I’ve obtained them – he was struck off for stealing client money to support his failing business (he then went bankrupt).

Three more obvious questions:

- Why does Douglas Barrowman employ as his in-house lawyer someone who was struck off for dishonesty?

- Why do the Isle of Man authorities think such a person is acceptable to work in a regulated business?

- Is Hardman’s certification of the debenture is valid, given he has no professional status? If not, does this invalidate the charge, or just remove the normal presumption the certified copy is a true copy? If the charge were invalid then it would not have priority over other creditors of PPE Medpro such as (to pick random examples) the Government or HMRC.

Many thanks to Y for background research on this.

-

1This accords with my understanding, but I’m embarrassed to say I don’t know the legal authority for this. Very possibly there isn’t one – but I’d be most grateful for any thoughts.

-

2Not to be confused with the tax adviser John Hardman, formerly at Pinsent Masons, who has no connection to these matters. Of course there are likely many other unrelated John Hardmans.

-

3Hardman recently removed all content from his LinkedIn profile

15 responses to “Douglas Barrowman, PPE Medpro, the BVI loan and the struck-off solicitor”

Now that March 2023 accounts have been filed (on last day of 9 months period allowed), it seems possible that the BVI facility was to pay the tax shown in the March 2022 accounts. Perhaps there was no W/T because interest was “short” interest.

Do we know how MedPro got it’s original capital ? It struck me the X letter stressed the point they took on all the risk… But how a new co get capital ?

Also, what happens if MedPro goes bankrupt… I can’t imagine there’such in the way of assets …

Dan

The use of companies with the same name in different jurisdictions was the very essence of the “Dollar Premium” scam run by Judah Binstock and Lewis Altman that cost the Bank of England hundreds and hundreds of millions in today’s money.

Nothing changes

I wonder if the Fiona Pilling who witnessed the director’s signature on the debenture is the office manager of the same name at Trident Trust IOM, which has had its own well publicised regulatory issues?

I expect this John Hardman is not actually working within the IoM registered corporate services provider (Knox House Trust). The only named individual listed on their website as working at that company is Voirrey Coole, Managing Director, who seems to have grown up in IoM and still works there – though there are 9 others are so listed on LinkedIn. Coole has been a director of PPE Medpro companies as you have previously noted and remains a director of a company allegedly controlled by ex Knox employee Anthony Page.

Why are dentists on the list but not doctors?

good question – is it because doctors are often partners, but dentists are employees?

I wonder if they are omitted simply to avoid sending people to a GP as the perceived easy option – same as the situation with passport applications etc.

That is an interesting observation.

My impression is that dentists being employees of largish organisations is something that has only happened in the last ?20 years as private equity money has flooded in (income being pretty independent of government policy as much has moved from being a matter of health to a matter of beauty)

And before that, was true in a different way: dental practices were owned by one dentist, with junior dentists as employees until they set up on their own, while doctors would join a partnership, at an earlier age.

Perhaps some accountant with long experience of the sector could correct/confirm that impression.

But I’m struggling to see the relevance of that to who can certify!

…an adviser must have a qualification recognised and approved by the Financial Conduct Authority (FCA)….

Whether a struck off lawyer is permitted to hold such qualification is another thing. I downloaded a copy or the doc thanks, will point more people this way.

On point three, I don’t see any reason that Mr Hardman not being a solicitor means that the registration is void – my reading of s. 8599(3) of the Companies Act 2006 is that the Registrar may – but is not required to – refuse the registration if it is not accompanied by a certified copy. However, if it has now been accepted I’m not sure there is a basis for the Registrar/third parties to now revoke that registration.

The registration of the charge not being valid would, of course, not affect whether or not the debt was payable (subject to the usual insolvency rules).

I’m also not actually aware of any authority stating who may and may not certify something. It’s really a matter for the recipient.

Looking at the two sets of accounts, it doesn’t appear that this company has made a £65 million profit. So what entity did? If it is an offshore entity, do the profit fragmentation rules apply?

HMRC’s manuals summarise them them applying if (https://www.gov.uk/hmrc-internal-manuals/international-manual/intm610020):

– A UK resident party has arrangements with an overseas party as a result of which value deriving from the profits of a UK business is transferred out of the UK.

– The amount of value transferred out is greater than it would have been had the arrangements been made between independent parties acting at an arm’s length.

– It is reasonable to conclude that some or all of the value transferred relates to something done by, or any property, right, or purported right of, an individual who is related to the UK resident party.

– The related individual is able to enjoy the benefit of the value transferred, or has procured the arrangements with a view to avoiding the enjoyment conditions.

The ability to enjoy the profits is particularly widely defined and might well include enjoying, among other things, the use of a yacht.

thanks, Tigs. It’s very unclear what happened – presumably most of the money went elsewhere, but on what basis, and to whom, we just don’t know.

Would it be reasonable to assume that HMRC are investigating the corporation tax affairs of PPE Medpro? If not, how does one go about making the suggestion that they do? Barrowman admitted that they made £60m profit and as the contract was with the English company then there should be tax liability showing in the accounts on the balance sheet.

Taxpayer confidentiality means HMRC can’t say anything, but I’d be astonished if they’re not investigating. However PPE Medpro appears to have seen little of that £60m profit… it’s unclear what happened, or how the money ended up in this trust?