We reported earlier this year that, when the Post Office finally paid compensation to some of the victims of the Post Office scandal, it left many postmasters with large unforseen tax liabilities. The Post Office agreed to fix this by making “top-up” payments to postmasters to cover the tax. But it’s been so slow at doing this that 1,100 postmasters won’t receive a top-up payment in time for the 31 January 2024 tax filing deadline. They’ll have to work out the filings and pay the tax themselves – an average of £10k – with no help from the Post Office. Many won’t even know they owe tax, and will go into default with HMRC.

Between 2000 and 2013, the Post Office falsely accused thousands of managers of theft. Some went to prison. Many had their assets seized and their reputations shredded. Marriages and livelihoods were destroyed, and at least 59 have now died, never receiving an apology or recompense. These prosecutions were on the basis of financial discrepancies reported by a computer accounting system called Horizon. The Post Office knew from the start that there were serious problems with the Horizon system, but covered it up, and proceeded with aggressive prosecutions based on unreliable data. It’s beyond shocking, and there should be criminal prosecutions of those responsible.

Now, finally – ten years after the Post Office almost certainly knew that it had wronged these people, it is paying compensation. However, the way the compensation is being paid to 2,000 postmasters under the “horizon settlement scheme” (HSS) has left them with tax problems.

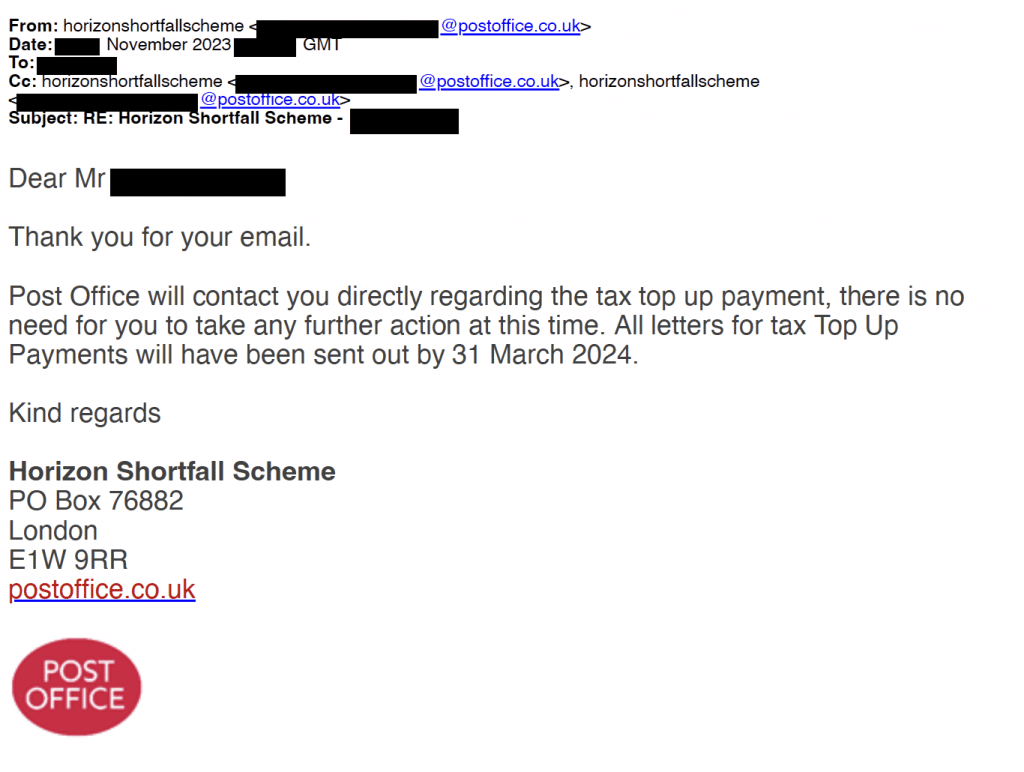

The Post Office promised to solve the tax issues back in June. So one postmaster, who knew he had tax to pay by 31 January 2024, was very surprised to receive this email:

The Post Office landed him with a large unnecessary tax bill, and won’t help him financially or with the accounting before the 31 January deadline.

The problem with tax on compensation payments

Postmasters have received compensation under various schemes for loss of earnings.

Imagine a postmaster who, as a result of the scandal, lost their £30k annual earnings over ten years. How should compensation deal with this?

The competent way

Some postmasters received compensation under the GLO scheme, run by the Government. The Government calculated the payments competently, by reference to the postmasters’ after-tax income. So, in the above example, the postmasters’ after-tax annual salary would have been about £25k, so ten years’ compensation would be £250k. The Government anticipated creating a special tax exemption so that the payments themselves would not be taxed, and that happened.

There would be interest payable, a large amount in some cases (potentially six figures). The tax exemption covers the interest too.

That was a sensible way to deal with tax.

The incompetent way

Other postmasters received compensation under the HSS scheme. This was run by the Post Office incompetently. They took no account of tax, and so calculated compensation for loss of earnings on a before-tax basis, so ten years’ compensation would be £300k. They didn’t think about the fact the compensation payment would be massively taxed (because £300k all at once falls into high tax brackets), leaving the postmasters with (1) an unexpected bill, and (2) only about £170k net. So an HSS postmaster would (on these example figures) be £70k worse off than a GLO postmaster.

The worst thing is that it’s hard to fix. If the Government stepped in and enacted an exemption then the postmasters would be receiving an unfairly large amount compared to their GLO brethren.

And no exemption was created for tax payable on interest. The Post Office deducted 20% tax from the interest payments (technically correct) but then failed to provide a clear warning that in most cases there would be significant further tax. This would be easy to fix with an exemption: I’m not clear why that wasn’t done.

The fix

After we identified the issue, the Post Office agreed to make “top-up” payments to postmasters, to compensate them for the additional tax they suffer from receiving the compensation in one go. In the above example, that would be £70k. The Government enacted an exemption so the top-up payment would not itself be taxed.

I believe the top-up payments were intended to also cover the tax on the interest payments, but that unfortunately isn’t clear.

Affected postmasters would receive a letter explaining the tax calculation, and offering £300 to cover an accountant’s fee for preparing the tax return (I’m not confident this is sufficient).

What has gone wrong

This should not have been a difficult task. The Post Office knew what the HSS compensation payments were, and what years they covered. So calculating the amount of the top-up payment should have been a spreadsheet exercise. I’ve spoken to accountants familiar with this kind of exercise (from other compensation schemes), and they think a small team could have calculated the appropriate top-ups in a few weeks.1A few would have been trickier, for example where the postmaster operated their business through a partnership or company; but reasonable simplifying assumptions could have been made.

However the Post Office has been unable to do this after six months.

As of 4 April 2023, 1,924 HSS settlement payments had been made, totalling £62m.2The source for this is this FOIA request

However the Post Office tells me that only 831 tax top-up payment letters, with individual calculations, have been sent. They’re issuing 130 per week and expect all the letters to have gone out by end March 2024.

The self assessment deadline is 31 January 2024. We’re almost at the point where it’s realistically too late to engage an accountant to sort this before the deadline. So over 1,100 postmasters will hit the deadline with a tax liability they probably don’t expect and don’t understand, and may not be able to afford. Some will be distressed by this. Others won’t realise they have any tax to pay, and will fall into default with HMRC.

How many?

Total top-up payments were expected to be £26m across all 2,681 HSS compensation payments.3Some of those are post April 2023, and some of them will probably never be made That implies £10.6m over the 1,100 outstanding top-up payments, or just under £10k each.4Likely there will be a lot of variation, with some very large tax bills and some very small

There are multiple failings here:

- Failure to consider the postmasters’ tax position at all when the HSS scheme was created. These are not subtle points. A trainee accountant would have spotted them.

- Failure to respond quickly after we identified the issue, and (I believe) giving incorrect information to the Department for Business and Trade, who relayed it to the Sir Wyn Williams inquiry.

- Failure to competently manage the top-up payments, so that 1,100 postmasters miss the self assessment deadline

- Failure to properly communicate this to affected postmasters. The email above doesn’t explain the consequences of the delay – that the postmaster will have to pay and file tax by 31 January 2024 without any help. Naturally it doesn’t apologise.

It’s important to be clear that the fault lies with the Post Office. It was solely the Post Office running this scheme, not DBT or HMRC.

But the more important point is to ask: what can be done now?

Whilst HMRC isn’t to blame for this mess, HMRC is now the only body that can fix it. They should issue a statement that HMRC will not charge penalties on affected postmasters, and will accept late payment of tax until top-up payments have been received.

We also need clarity on whether postmasters receiving HSS compensation payments will receive “top-up payments” to cover tax on the interest they received. Fairness requires that they do.

Post Office photo by ©JThomas and licenced for reuse under cc-by-sa/2.0

-

1A few would have been trickier, for example where the postmaster operated their business through a partnership or company; but reasonable simplifying assumptions could have been made.

-

2The source for this is this FOIA request

-

3Some of those are post April 2023, and some of them will probably never be made

-

4Likely there will be a lot of variation, with some very large tax bills and some very small

3 responses to “More Post Office scandal: its incompetence leaves 1,100 postmasters with a £10k tax bill”

If a postmaster (wrongly) paid to make up for Horizon’s claimed deficit, did the postmaster get the money back?

This has been one of the most disgusting scandals ever. Then to compound this through, what one must consider as, further deliberate criminal negligence, is appalling . In fact the whole sorry saga is blatantly criminal from start to finish. Where’s the NCA. Please refer this item to GB News which is where I first heard of you. Then to watch the news today about the two filling their coffers, at the taxpayers expense, during the PPE purchase scandal. And don’t get me started on those poor people who contracted HIV from the infected blood scandal. God Almighty! we really are ruled and abused by the entitled and corporations and incompetent MP’s./civil servants. Keep up the excellent work.

Having spent a while working in the Post Office during the tail end of this period, I can’t say I’m at all surprised.

I was also pretty shocked when I arrived to see they had an in-house criminal lawyer – but it was explained as being necessary and I never enquired further. He was a nice normal guy. Just the banality of bureaucracy and the challenges of change.