Douglas Barrowman and Michelle Mone appear to own a house in Belgravia through two BVI companies and a trust. They should all show Barrowman and/or Mone as the beneficial owner. They don’t. That’s a breach of company law – and potentially a criminal offence.

UPDATE 22 December 2023: The Times has reported that Barrowman sold the Belgravia house earlier this year for £19m. That doesn’t explain or excuse the failure to correctly report the ownership of the company holding it. The sale doesn’t show up in the land registry. Possibly the sale was recent, the filings were delayed, or the land registry has been slow – it’s also possible that this was not a straightforward sale, but some kind of aggressive arrangement to avoid tax. Barrowman has form for this.

Last year, the Times and then The Daily Mirror reported that Douglas Barrowman and Michelle Mone own (and sometimes live in) a £20m house in Belgravia which is owned by two British Virgin Islands companies called Perree (PTC) Limited and Soldaldo (PTC) Limited.

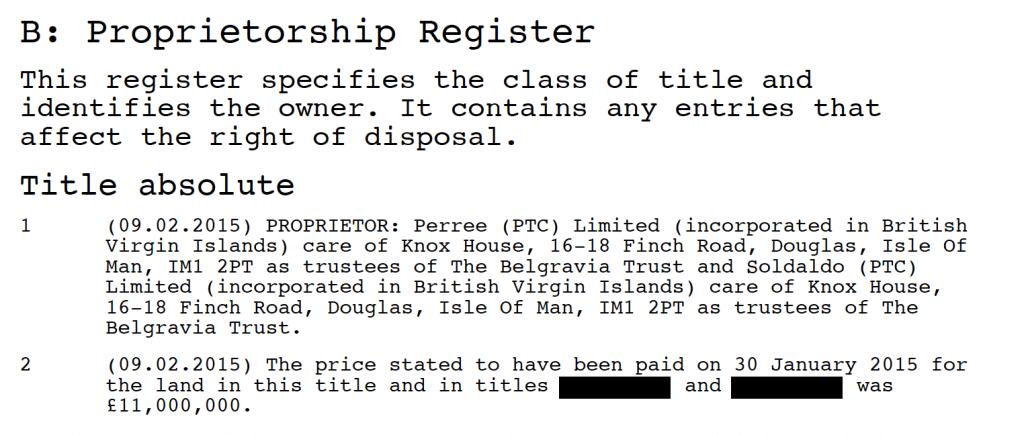

Here’s the Land Registry entry for their house:

The UK was perhaps the first country in the world requiring foreign companies owning real estate to register their beneficial ownership.1This follows a recommendation of the Financial Action Tax Force. You can access the complete list of foreign companies owning UK real estate here – you have to register, and agree to a licence, but it’s free and straightforward. The deadline for registration of existing ownerships was 31 January 2023. Naturally Barrowman/Mone didn’t do this.

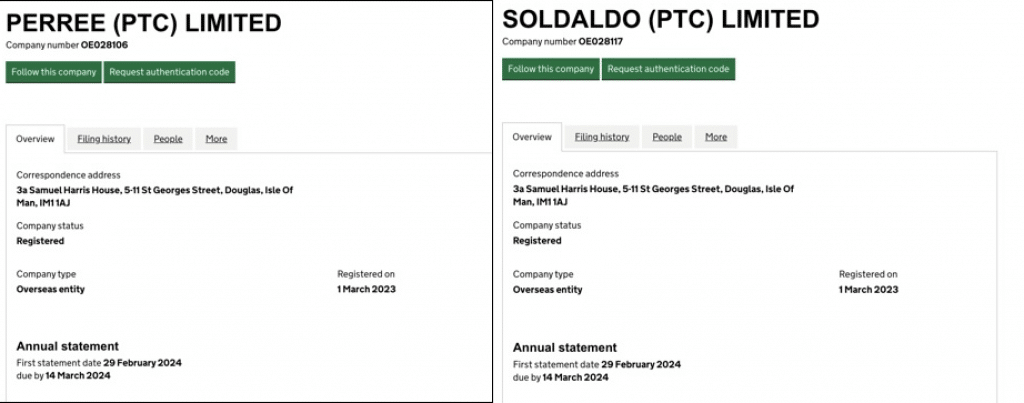

The rules have some “teeth” – a foreign company that fails to register can’t buy or sell the real estate. Hence, perhaps because Mone/Barrowman are now selling the house, they registered Perree (PTC) Limited with Companies House on 1 March 2023, and Soldaldo (PTC) Limited on the same date:

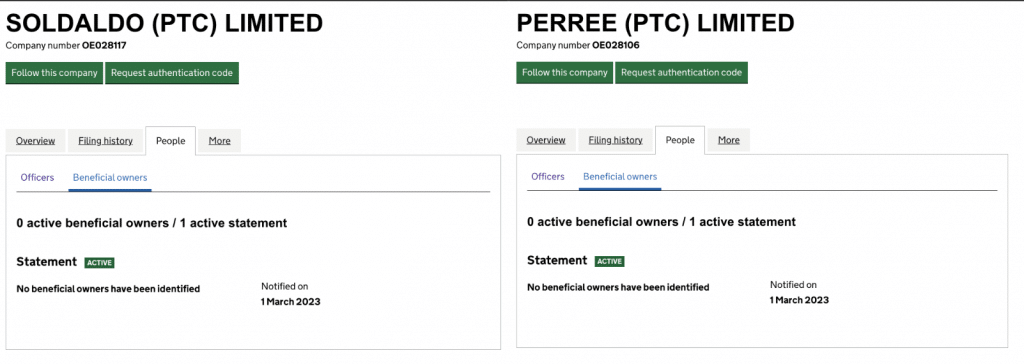

The main purpose of the rules is requiring foreign companies to identify their beneficial owner. Here are the entries for the two companies:

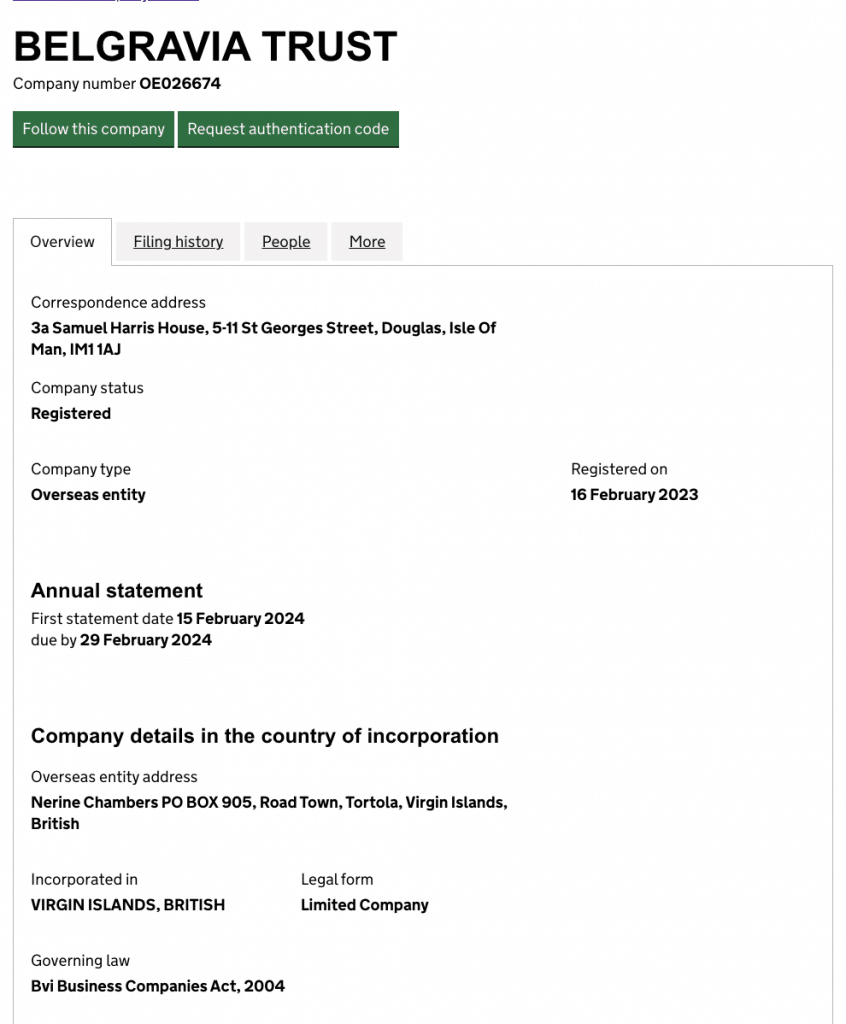

The Companies are said to hold the property as trustees of the Belgravia Trust. The trust is also on the register of overseas entities, bizarrely stated to be a “limited company” (which is almost certainly impossible):2Trusts aren’t required to be registered. Either the Belgravia Trust has a truly bizarre nature/structure, or this is a mistake of some kind.

The Belgravia Trust lists as its beneficial owners its trustees, Soldado (PTC) Limited and Perree (PTC) Limited. Which isn’t right, because beneficial owners for this purpose have to be individuals (with an exception for companies subject to their own disclosure requirements, which BVI companies definitely are not).

Who is the actual beneficial owner?

Section 12 of the Economic Crime (Transparency and Enforcement) Act 2022 requires that a company take reasonable steps to identify its beneficial owners.

The definition of “beneficial owner” is in Schedule 2 of the Economic Crime (Transparency and Enforcement) Act 2022. It includes straightforward cases, e.g. anyone holding more than 25% of the shares in a company, but also this general rule:

We don’t know who ultimately controls the Belgravia Trust, Perree (PTC) Limited and Soldaldo (PTC) Limited, but here’s what we do know about the three entities:

- They own a house used (according to the Mirror) personally by Michelle Mone and Douglas Barrowman

- They each give as their service address the headquarters of Barrowman’s Knox Group in the Isle of Man.

- They each list as their “managing officers” Anthony Edward Page and Claire Voirrey Coole. Page was the managing director of the Knox Group; he subsequently had some kind of falling-out with Barrowman. Coole is a director of PPE Medpro and another Barrowman company. 3Note that the company is only disclosing its managing officers because it decided it had no beneficial owners. This is the “fallback” under the rules. What should have happened was Barrowman disclosed as beneficial owner and no managing officers disclosed.

So it seems likely, from the known facts, that Barrowman exercises “significant influence or control” over the trust and the companies. If so, then Barrowman should be listed as the beneficial owner.4Shares in the two companies are likely “orphaned” – held through private purpose trusts (with an “enforcer“) or foundations so that they have no actual individual as their beneficial owner. However Barrowman would almost certainly only agree to such a structure if he could control it as a practical matter, albeit perhaps not as a strict legal matter. That kind of “nod and wink” control can sometimes fool tax rules, but it doesn’t fool the beneficial ownership rules here. In such a case, Barrowman would have “significant influence” over the companies. All the more so when, as here, his own employees are the directors.

It is possible in principle that the directors tried and failed to identify the beneficial owner – it was a complete mystery they were unable to resolve, despite taking appropriate steps.5e.g. issuing “information notices” to their shareholder. That seems very unlikely given that the Knox Group are in the business of company formation. Page and Coole didn’t become directors by accident.

The consequences

Section 4 of the Act requires the beneficial ownership information to be included in the application for registration. Plainly that didn’t happen.

Under section 32, it’s an offence for anyone, without reasonable excuse, to deliver (or cause to be delivered) a false or deceptive filing under the Act – on conviction they can be liable for an unlimited fine. The offence is “aggravated” if a person knows it was false or deceptive – there is then also the possibility of up to two years’ imprisonment.

In this case, if Barrowman was the beneficial owner, the registration documents were false/deceptive in not listing him. Surely the directors knew they were false.

That suggests that Page and Coole may have committed the aggravated offence. If Barrowman was aware, he may also be liable.6Either on the basis he “caused” the false filing to be delivered, given the apparent group-wide policy of hiding his ownership, or alternatively on the basis he is a shadow director.

If this was a small widget company then we could be forgiving about a technical breach of the law. People make mistakes, and those unfamiliar with the law can easily misunderstand what it means. But the Knox Group is in the business of providing corporate and fiduciary services – setting up and managing companies. Knowing how these rules work is literally their job.

Why do Barrowman and his companies ignore the law?

In the BBC interview with Barrowman and Mone, Laura Kuenssberg asked specifically why Barrowman wasn’t visible on PPE Medpro’s Companies House filings (our original report on PPE Medpro is here). Barrowman first suggested this was a complicated technical question. Then he admitted being the ultimate beneficial owner;7This may be a rare case where someone admits to a criminal offence in a TV interview. finally he seemed to blame his staff. Most of this was cut from the TV edit, but the BBC made the full audio available here – the relevant section starts at 41:53.

Perhaps the real explanation comes a bit later – “I don’t want anyone in the press to know of any business activity or anything I get engaged in”.

He goes on to suggest that concealing the true ownership of companies is very standard:

“What happens in family offices is that the senior people in our family office tend to hold all the appointments for any businesses or companies I own, which is very common across family office structures around the world.”

Unfortunately for Mr Barrowman, there is no exemption from transparency laws for people wanting privacy. And Barrowman’s suggestion that most private offices operate this way is false. Sure, the ultimate owner is often not a director or direct shareholder of a company – but they are always listed as the beneficial owner – that’s what the law requires.

Two examples demonstrate how this works in practice:

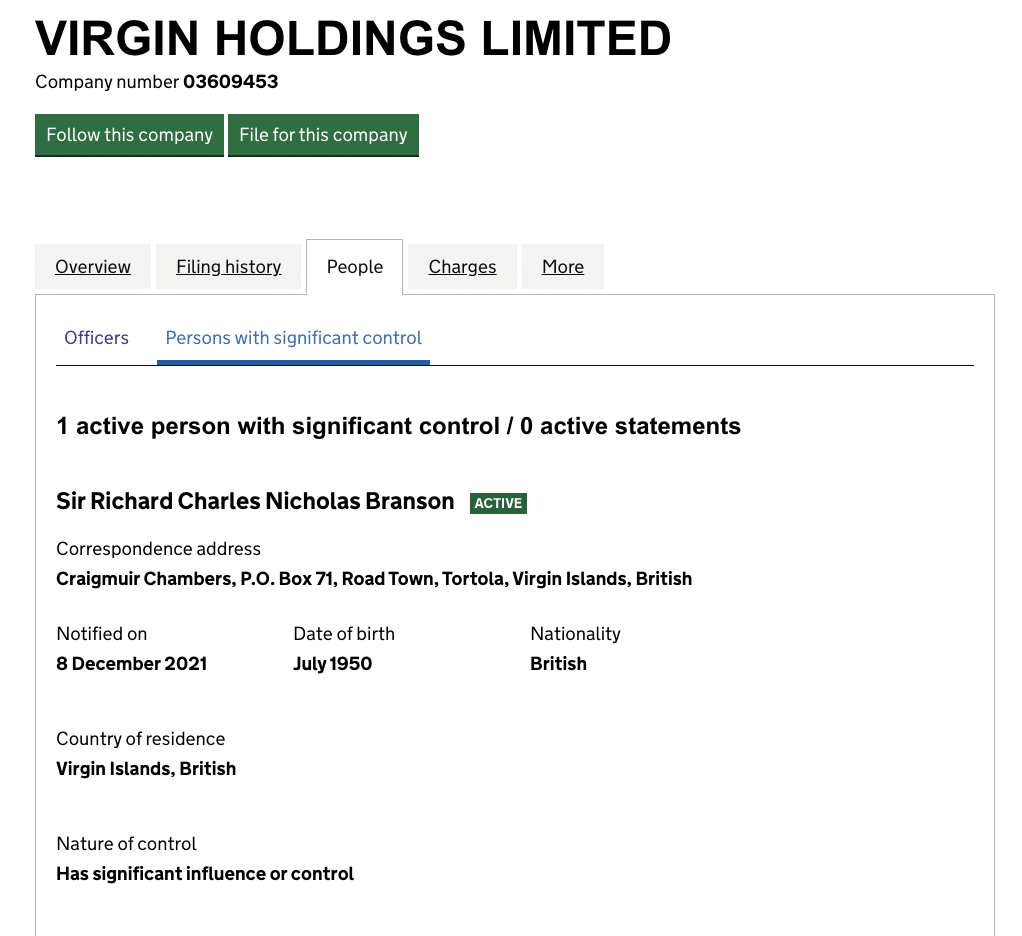

Richard Branson has a private office. He’s not a director or shareholder of Virgin Holdings Limited. I’m sure the ownership arrangements are highly complex (and Mr Branson has never been shy about his desire to minimise tax). But, quite properly, Mr Branson is listed as the beneficial owner.

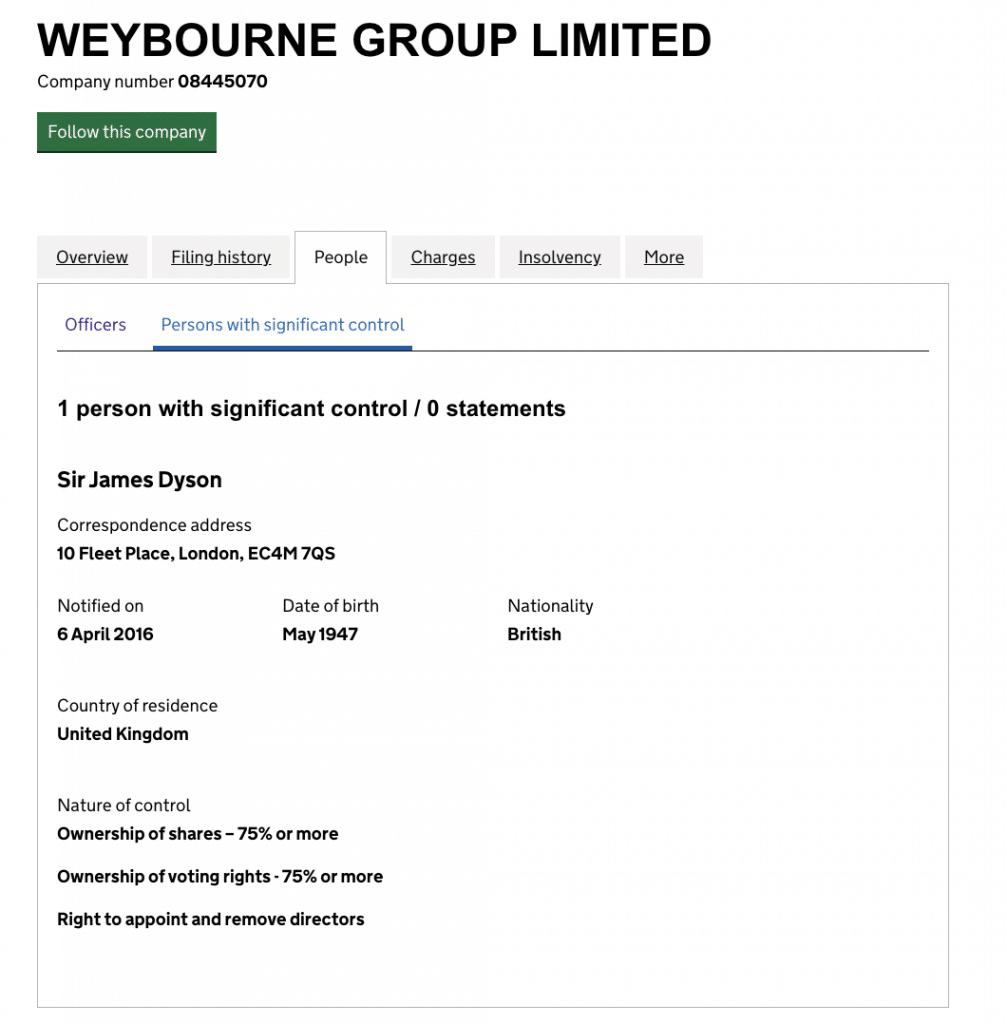

James Dyson has a family office. He’s no longer a director of Weybourne Group Limited, which holds his UK businesses. Again, I’m sure his ownership arrangements are highly complex – Mr Dyson is much wealthier than Mr Barrowman, with interests around the world. Yet Weybourne, quite properly, lists Mr Dyson as the beneficial owner:

The only reason Douglas Barrowman’s company filings are different from Messrs Dyson and Branson is that Mr Barrowman chooses to ignore the law. He has form for this.

What about the agent?

The Act doesn’t just trust companies to file correct beneficial ownership information. Regulations made under the Act require that an agent (regulated under money laundering rules) must verify beneficial ownership and submit details to Companies House within 14 days of registration, using this form.

In this case, that clearly went wrong.

You can see the agent details for Perree (PTC) Limited in the company’s filings – it was FCLS Group Limited. The same for Soldaldo (PTC) Limited and the Belgravia Trust. This isn’t a case where Mr Barrowman’s people misled the agent into thinking some accountant was the true beneficial owner. The registration lists no beneficial owner at all. And surely nobody misled FCLS into thinking a trust was a company – that’s a complete non-sequitur.

What was FCLS Group Limited thinking? Or have they created an automated process that doesn’t involve any thinking?

Next steps

I’ve written to the Knox Group and FCLS seeking comment, and will update this article with anything I receive.

The question is whether Mr Barrowman and his team will face any criminal sanctions for what appears to be their widespread practice of treating inconvenient laws as optional.

Thanks to K and P for an invaluable discussion, and to W for hugely helpful technical input after we published our initial report. And thanks to M for the tip.

Photo – obviously not of Barrowman/Mone’s actual house – by Amanda Slater, licensed under Attribution-ShareAlike (CC BY-SA 2.0)

-

1This follows a recommendation of the Financial Action Tax Force. You can access the complete list of foreign companies owning UK real estate here – you have to register, and agree to a licence, but it’s free and straightforward.

-

2Trusts aren’t required to be registered. Either the Belgravia Trust has a truly bizarre nature/structure, or this is a mistake of some kind.

-

3Note that the company is only disclosing its managing officers because it decided it had no beneficial owners. This is the “fallback” under the rules. What should have happened was Barrowman disclosed as beneficial owner and no managing officers disclosed.

-

4Shares in the two companies are likely “orphaned” – held through private purpose trusts (with an “enforcer“) or foundations so that they have no actual individual as their beneficial owner. However Barrowman would almost certainly only agree to such a structure if he could control it as a practical matter, albeit perhaps not as a strict legal matter. That kind of “nod and wink” control can sometimes fool tax rules, but it doesn’t fool the beneficial ownership rules here. In such a case, Barrowman would have “significant influence” over the companies. All the more so when, as here, his own employees are the directors.

-

5e.g. issuing “information notices” to their shareholder.

-

6Either on the basis he “caused” the false filing to be delivered, given the apparent group-wide policy of hiding his ownership, or alternatively on the basis he is a shadow director.

-

7This may be a rare case where someone admits to a criminal offence in a TV interview.

30 responses to “Douglas Barrowman unlawfully hid the ownership of another company”

Whilst I have doubts about whether they are relevant to these particular private trust companies the fact pattern does highlight deficiencies in the disclosure requirements of the Register of Overseas Entities where properties are held in trusts rather by companies owned by trusts.

The Register focuses on legal rather than beneficial ownership of property and for properties held in trust the legal owner will frequently be a corporate trustee set up as part of an orphan structure or owned by a trust and corporate service provider. The corporate trustee will be required to register and to provide details of any trusts in its own ownership structure but not of any trusts holding UK property for which it acts as trustee. In addition the requirements in relation to significant control relate to that corporate trustee rather than control of any individual trust for which it is the trustee or control of any particular property. As the corporate trustee could be acting for many trusts it is unlikely the settlor or beneficiaries of any one trust would be viewed as having sufficiently dominant influence or control of the trustee entity for the significant control condition to require their disclosure.

I note that in this respect the UK government has taken a different approach to the Scottish government which introduced the Register of Persons Holding a Controlled Interest in Land requiring the registration of those who control the decisions made in relation to individual parcels of land rather than just those who control the legal owners of land.

I wonder if ICAS – which is the professional body of Chartered Accountants to which I believe Mr Barrowman belongs – are investigating him from a ‘fitness to practice’ perspective?

Ignoring company law and beneficial ownership regulations in the manner which Mr Barrowman does is surely a breach of the obligation – which is basically integral to any professional organisation in my experience – to act both in accordance with both the letter and spirit of any legislation.

it’s a great question. If they are not it is very disappointing.

The issue of the agent is an interesting one. My experience of FCLS is that they are a company secretarial agent who are used by accountants to prepare Co Sec forms and statutory filings on behalf of those firms. The accountant just tells them what transaction they require paperwork for and they just produce it from a bank of templates. FCLS do not, in my experience, contract with the end client. I wonder whether they have not appreciated what “agent” means on this form or the responsibilities which come with it. I could have this completely wrong of course, but this is only based on how I’ve seen them work previously.

If so, that is amazingly negligent of them.

I think the requirement to declare the beneficial owner(s) is impossible to enforce because you are trying to find someone who isn’t there. Tricky that, and that is why it is done. In the PPE Medpro case, the beneficial owner(s) has declared this on TV and can therefore be investigated and appropriate action can be taken against non-compliance along with applicable penalties. We can assume there will be a pattern here with other business dealings and worth the investigation. Company directors do have a fiduciary responsibility, so taking them to task would be worth it, pour encourager les autres…..

Dan, you’ve not made mention of the private side of the register where the details of the trust, the trustees, the beneficiaries and protector are all disclosed.

Do you think they are?

Aren’t you conflating persons with significant control disclosures with beneficial ownership? A discretionary trust with many beneficiaries would have its trustees as the controlling parties but none of the beneficiaries because it is the trustees who are the legal owners and in control.

If the companies own the properties as corporate trustees, the beneficiaries could be anybody, most likely Mone settling a trust for Barrowman and issue in one trust and Barrowman for Mone and issue in the other, to deal with any issues regarding settlor interested trusts. None of the beneficiaries or settlers would be in control unless there are deeming provisions in the disclosure legislation or they have roles as “trust protectors” and similar with veto / trustee dismissal powers which are caught.

in reality in all such structures the settlor has influence over how the trust behaves. Otherwise they wouldn’t create it. That’s enough for beneficial ownership under these rules (and also under the separate PSC rules).

I s it’s a fundamental point of English law that the beneficial owner of a trust is not its trustees. The person with “control over the trustees of a trust” is – obviously – not the trustees.

Not under AML law. See Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017.

Meaning of beneficial owner: trusts, similar arrangements and others

6.—(1) In these Regulations, “beneficial owner”, in relation to a trust, means each of the following—

(a)the settlor;

(b)the trustees;

(c)the beneficiaries;

(d)where the individuals (or some of the individuals) benefiting from the trust have not been determined, the class of persons in whose main interest the trust is set up, or operates;

(e)any individual who has control over the trust.

thanks – I’ve heard a few different views on this, so will amend the text!

An illuminating article, I only hope justice is done, whatever that is. One question, the commencement of the ’22 Act is subject to the usual provisos of introduction by Statutory Instrument and Treasury Rules. Are all of the sections you quote in force and if in force, do they have retrospective effect or, alternatively, are the registration obligations subject to an interim period which would allow registration now?

yes, they all came into force Jan 2023

Thanks, I didn’t doubt you for a minute!!

Perhaps he has been advised that the register being public infringes his human rights?

It’s a pity that HMRC was unable to be quite so penetrative in resolving corporate interests when they took tow cases against AML to Tribunal (result = stiff fines).

Many of my clients delight in seeing the present difficulties of Mr Barrowman and see it as payback for the decades of misery he has caused them.

That’s of little financial comfort when HMRC come asking for money that we think he and AML should have paid, but we and they are in a situation in which even small wins have to be cherished.

His marriage to Ms Mone seems to have embroiled him in yet more murky behaviours and he may now be regretting many aspects of that union?

May have been a marriage of convenience. But basically hes married to a UK DOMICILED AND TAX RESIDENT SPOUSE irrespective as to wherever she visited in the world. In fact she was so classified from her entering the HOUSE OF LORDS in October 2015. Being resident in IOM won’t help her and could cause issues with DB.

Also wonder where they got the millions to buy the BELGRAVIA PROPERTY via BIV companies and a trust.

Interesting times and many open questions from a couple of liars

What only £11,000,000?

Great work, following with interest and will look into Bridge the gap.

Well done and people like you give me hope for the future, albeit I am profoundly worried that the weight of the mass/establishment against you, ie. shoning a light on the shenaigans of the powerful/wealthy will in time also crush you as it does and have done to everyone before you.

thanks, but nothing to worry about. I’m pretty establishment myself. I think most people are decent, whether rich or poor, and almost all the messages I’ve ever received have been supportive.

Thanks for all the work you are doing Dan. Keep shining a light in these dark places. I look forward to further revelations.

Congratulations on your recent investigative journalism gong Dan.

You follow it with some sterling work on Barrowman and Mone. I cannot wait to see the outcome of this.

Two highly unpopular people, dripping in privelege with their noses in the trough of greed.

Some comeuppance will hopefully follow and not just a slap on the wrist.

I wonder if the company has been making ATED returns and has paid the ATED charges. Can’t think of any reason why it should not have been liable.

Hi Robert,

I was thinking the same about the Annual Tax on Enveloped Dwellings. It comes down to whether “non-qualifying individuals” occupy the property. That is addressed at paras 33 and 34 of the technical guidance here: https://www.gov.uk/government/publications/annual-tax-on-enveloped-dwellings-technical-guidance. The example given at 34.3 is of an individual who controls the company and 34.5 deals with settlors of trusts owning the property.

Bill Stevensonand control of the BVI companies could result in HMRC askingcabout some difficilt questions asvto how they got thec£11m to buy the property an the tax residence of the companies and potential BIKs for their personal use ( or availability for personal use) of this valuable property. Remember that any Hol Peer is deemed UK Tax Resident and UK tax domiciled wherever they are in the WORLD

The property appears to be owned in a trustee capacity, which is not within the scope of ATED, even if the property is occupied by a non-qualifying individual. See s95(2)(a) FA 2013.

There would likely be an exposure to inheritance tax of some sort, the most likely scenario being a 6% charge every ten years (and possibly also upon the death of the settlor, if they have retained an interest in the trust).

EXCELLENT WORK WELL DONE!!!!! Thank you for all you are doing – please expand your team. How can people support your work?

we don’t accept donations but Bridge The Gap do – please consider donating. https://bridge-the-gap.org.uk/