We recently wrote about two landlord tax avoidance outfits: Less Tax for Landlords and Property118. They together advised thousands of landlords, and avoided £100m+ of tax; we believe both firms, and their clients, are now the subject of HMRC investigations.1HMRC’s obligation of taxpayer confidentiality means that it will never say that a person is under investigation. HMRC can undertake an enquiry and collect large amounts of tax and penalties, and this won’t become public. Usually it is only if the taxpayer appeals, and the matter reaches a tribunal, that the name of the taxpayer becomes publicly known. However in some cases, as here, we can infer from surrounding circumstances that an HMRC investigation is likely to be underway.

Property118

Property118 sell a scheme that involves landlords declaring a trust over their rental properties (likely in breach of their mortgage) in favour of a newly incorporated company.

The background

We published a series of reports outlining:

- their basic structure,

- the highly artificial “bridge loan” element of the structure, which involves undisclosed payments of £500k+ to a prominent YouTuber who promotes Property118,

- the ways in which their documents and advice appear to be defective, and

- the false claims made about the insurance carried by their in-house barrister.

We believe the Property118 structure not only fails to achieve the intended tax savings, but likely triggers significant additional tax for its clients.

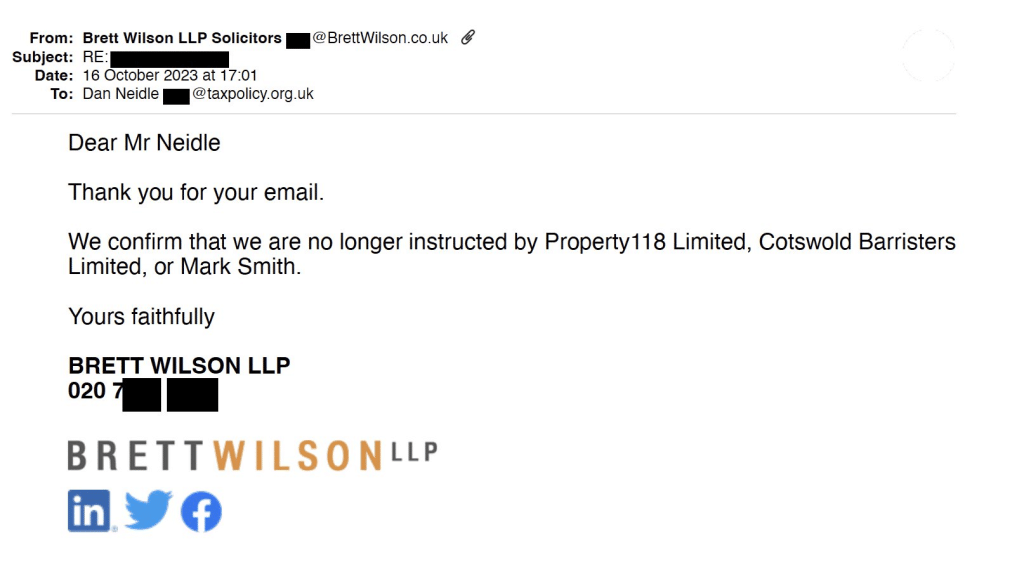

Property118’s initial response was to instruct law firm Brett Wilson LLP to threaten us with defamation proceedings. This was backed by an opinion Property118 had obtained from a KC which they claimed upheld their structure. When we read their summary of the opinion, it became clear the opinion failed to even discuss the key problems with the structure. We pointed that out; then this happened:

Property118 then switched to insults and weird conspiracy theories (illustrated with a spooky AI-generated image of me).

The HMRC investigation?

In the last few weeks, Property118 have been completely silent, with no response to our recent serious allegations that their documents and advice appear to be defective (or indeed to any specific point that we have made).

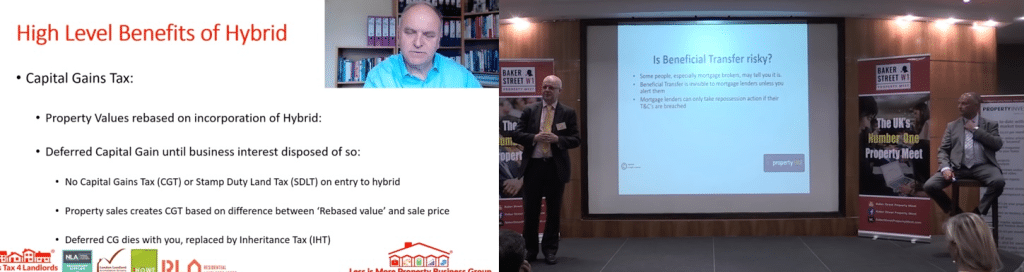

Around this time, they deleted an article defending their approach to capital gains tax “incorporation relief” (archived version here). Incorporation relief is used by Property118 to enable their clients to move their rental properties into a company without paying capital gains tax.

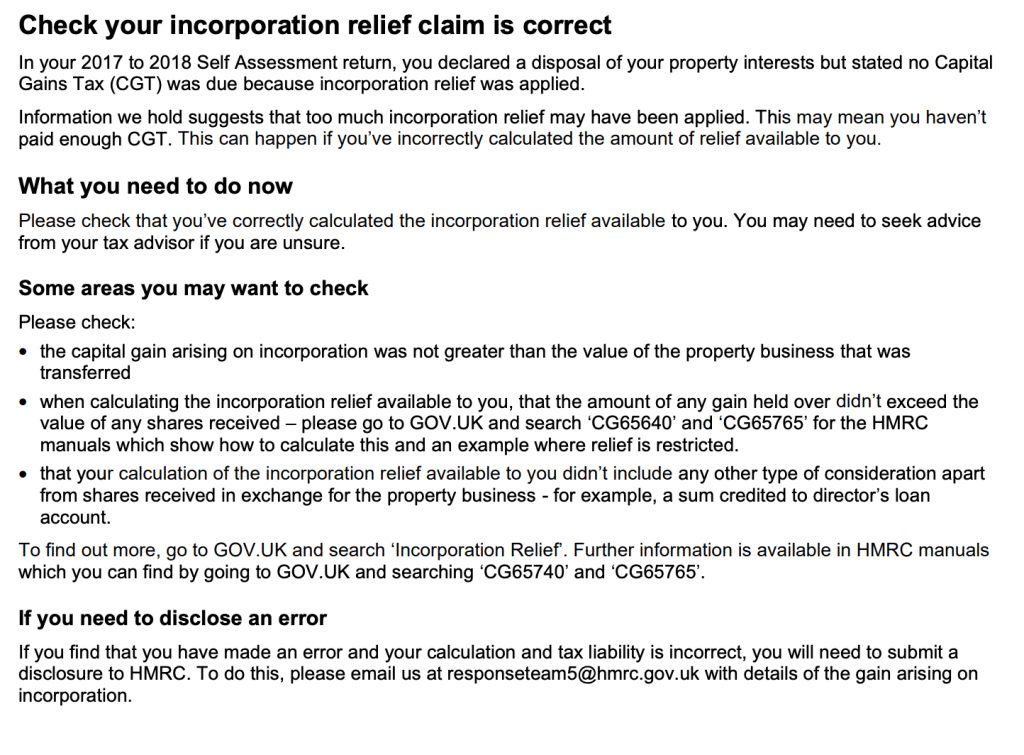

It seems likely this change in approach follows a 16 November announcement from HMRC that they have started to investigate incorporation relief claims from as far back as 2017/18. They’re initially writing to taxpayers and inviting them to make a voluntary disclosure:

It’s the third bullet here which kills the Property118 scheme. Property118 create a director loan (through a very peculiar arrangement), and this means that some capital gains tax will always be due, as CGT will be charged on the proportion of the sale consideration that isn’t shares.2It’s very clear in this HMRC example. From the client files we’ve reviewed, it seems Property118 did not appreciate this, and told their clients there would be no capital gains tax at all.3Our analysis goes further, and says that there are several good reasons to doubt incorporation relief applies at all. We expect HMRC will take these points, in the fullness of time, but for now is applying the much easier calculation point, given that it’s just arithmetic.

HMRC isn’t usually able to open an investigation (a “discovery assessment”) more than four years after the event. But they can go back six years when a taxpayer (or their agent) has been “careless”. If we are right that Property118 did miss this fundamental point, then that would probably constitute “carelessness”, and that may explain why HMRC believe they can go back to 2017/18.

We therefore believe, on the basis of the HMRC letter coinciding with the silence from Property 118, that they are under HMRC investigation, or expect to be shortly. If that’s right, this will probably be the start of a long process of HMRC picking apart Property118’s structure. They’ll start with 2017/18 and then roll forward to later years (probably rather slowly, but making sure they don’t miss the six year deadline).4If Property118 tell us they’re not aware of any active investigation we will of course update this article; but Property118 would then have to explain why they believe the 16 November HMRC letter doesn’t impact their director loan structure.

I expect this letter will be going to many people who claimed incorporation relief in 2017/18, even if not a client of Property118, and even if not a user of a “scheme” of any kind. Anyone receiving it should obtain tax advice, although if this was a “normal” incorporation then they shouldn’t need specialist tax investigation advice in the first instance.

What clients should do

Property118 failed to alert its clients that their structure carried any risk5Normal legal and tax advisers always tell you about the risk of a structure going wrong, even when it’s a simple and straightforward arrangement. In 2017, the Court of Appeal found an adviser negligent for failing to warn of the risk of a structure, even when the advice was not itself negligent., prepared documentation that had serious errors, made false claims that their in-house barrister’s insurance meant clients were “shielded from financial risk”, and got the fundamentals of incorporation relief badly wrong.

Affected clients should sack Property118 and appoint an appropriately qualified independent accountant or lawyer.

Less Tax for Landlords

Less Tax for Landlords sold a scheme that involved landlords declaring a trust over their rental properties in favour of a newly incorporated limited liability partnership.

The background

We published a report on 4 October 2023 saying that, in our view, the structure failed to achieve its objectives and likely triggered additional tax. Like Property118, it also likely triggered a breach of their clients’ mortgages; Less Tax for Landlords’ response to this was bizarre.

More than that, the structure was inexplicable. Property118 made mistakes, but we could see how they made those mistakes. Less Tax for Landlords took positions with, it seems, no justification at all. It is possible that the structure was fraudulent. We will be writing more about this soon.

On the same day we published our report, HMRC took the unusual step of issuing a “Spotlight” saying that the scheme doesn’t work.

The HMRC investigation?

The week after the Spotlight, HMRC started writing to affected taxpayers and agents advising them to fully disclose their position by 31 January 2024 and withdraw from the scheme.

Less Tax for Landlords are not admitting wrongdoing and are continuing to represent their clients. It’s an impossible conflict of interest.6Most of the people who run Less Tax for Landlords are unregulated, and the concept of a “conflict of interest” is likely unproblematic for them. It’s probably in their clients’ interests to say that they were mis-sold a scheme which had no technical basis – they may then be able to avoid penalties, or even argue that the scheme should be disregarded. Less Tax for Landlords are obviously not going to run that argument. They’ve a clear incentive to claim that HMRC are wrong and their scheme works, and to keep the ball rolling for years.

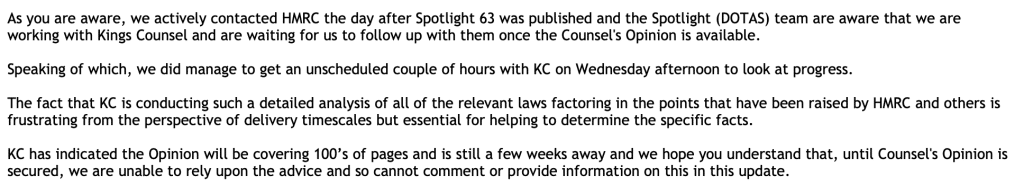

So it’s no surprise that they’ve written to their clients saying they’ve approached a KC for an opinion:

We are very sceptical that this is a genuine attempt to establish the correct position. That position is very obvious, and wouldn’t require “hundreds of pages” of analysis. Most likely the KC is being asked to construct a series of desperate arguments to bolster a scheme which never had any prospect of success. Other promoters of failed schemes have spent years in hopeless litigation, funded by the same clients they mis-sold their schemes to. If that’s what Less Tax for Landlords are planning, it’s a disgrace.

What clients should do

Less Tax for Landlords failed to alert its clients that its structure carried any risk, and got a series of tax points utterly wrong in a way that nobody has been able to explain. They should be helping their clients exit the structure as painlessly as possible; instead they are scrabbling around, trying to defend their hopeless position.

Affected clients should sack Less Tax for Landlords and appoint an appropriately qualified independent accountant or lawyer. The looming 31 January 2024 deadline means this is now urgent.

Which adviser should landlords trust?

I made some suggestions here as to how to pick an adviser for a straightforward incorporation, and avoid the cowboys – the same holds true for any normal business transaction. Unfortunately in this case it’s a bit more specialised; there are advisers who’d be brilliant at a normal incorporation, and advisers who’d be brilliant at unpicking a disastrous structure; often they are not the same people.

I can’t recommend any particular adviser – it feels like a potential conflict of interest – but here are some suggestions:

- HMRC suggest that affected taxpayers contact them directly. They have to say this, but it’s not a good idea. I would strongly advise speaking to a tax adviser first.

- You may improve your position if (after taking advice) you approach HMRC yourself, rather than waiting for HMRC to contact you. In particular, it can reduce penalties.

- The adviser should be familiar with technical tax and also HMRC investigations. Not necessarily a litigator (the matter is unlikely to end up in court), but certainly someone who’s familiar with representing clients through the investigation process.

- Your adviser will have to become familiar with the details of the Property118/LT4L scheme – it will be easier, cheaper and faster if they’ve already been through this with another client.

- It therefore makes sense to find a law firm or accounting firm that’s already advising other Property118/LT4L clients and, ideally, that has already achieved success in helping clients extricate themselves from the structures.

- If you are financially/legally sophisticated you could consider directly instructing a barrister from a tax set but, again, it should be someone familiar with the issues.

- Either way, only instruct advisers who are regulated (principally that means CIOT or ICAEW accountants, or solicitors or barristers).

- If your phone call is answered by a salesman, put down the phone. You should be speaking to an actual qualified adviser.

- If anyone tries to sell you a complicated structure then you should be very suspicious. People who bought into avoidance schemes in the past have then been sold schemes that supposedly escape HMRC attacks on the original schemes. Those new schemes, inevitably, also failed.

- If your properties are in Scotland your advisers will need to consider the different nature of Scottish land law. I would use a Scottish firm, or at least a firm very familiar with Scottish real estate tax.7Note that where you are, and where your company is, isn’t relevant – just the location of the properties. It is unclear Property118/LT4L ever considered Scots law issues.

- And if your properties are in Scotland or Wales then your advisers will need to consider the equivalents of stamp duty land tax – LBTT and LTT. Again, it makes sense to instruct either a Scottish/Welsh adviser, or someone very familiar with Scottish/Welsh land tax.

- As with any professional, you should ask for references (in this case clients may be unwilling to give references, but it’s still worth asking).

Tax investigations are slow, with HMRC often taking many months to reply to correspondence. Affected landlords could well be in a difficult and uncertain position for several years.

Can landlords sue Property118/Less Tax for Landlords?

On the face of it, the hopeless nature of the LT4L scheme, and the defective documents in the Property118 scheme, suggest landlords have a potential claim for negligence against the two firms.

There are already several reputable firms pursuing this.

Some important notes of caution:

- There are many “claim handling” firms who are adept at self-promotion and chasing ambulances but have little or no legal expertise. I’d strongly recommend only instructing a firm with experience suing tax avoidance scheme promoters and, again, one where you are speaking to an actual adviser and not a salesperson.

- Many (perhaps most) legal claims against promoters of tax avoidance schemes have failed because they were made too late. So it is important you don’t wait until everything is resolved with HMRC – it’s likely a good idea to assert a claim now (or at least very soon).

- It’s ideal if a firm is willing to act on a “no win no fee” basis. If that’s not possible, please do make sure their fees are affordable, or you risk throwing good money after bad.

- The best case is that you could recover wasted fees and any additional taxes/costs the landlord incurred. You are unlikely to be able to obtain compensation for the tax benefit you were promised.

-

1HMRC’s obligation of taxpayer confidentiality means that it will never say that a person is under investigation. HMRC can undertake an enquiry and collect large amounts of tax and penalties, and this won’t become public. Usually it is only if the taxpayer appeals, and the matter reaches a tribunal, that the name of the taxpayer becomes publicly known. However in some cases, as here, we can infer from surrounding circumstances that an HMRC investigation is likely to be underway.

-

2It’s very clear in this HMRC example.

-

3Our analysis goes further, and says that there are several good reasons to doubt incorporation relief applies at all. We expect HMRC will take these points, in the fullness of time, but for now is applying the much easier calculation point, given that it’s just arithmetic.

-

4If Property118 tell us they’re not aware of any active investigation we will of course update this article; but Property118 would then have to explain why they believe the 16 November HMRC letter doesn’t impact their director loan structure.

-

5Normal legal and tax advisers always tell you about the risk of a structure going wrong, even when it’s a simple and straightforward arrangement. In 2017, the Court of Appeal found an adviser negligent for failing to warn of the risk of a structure, even when the advice was not itself negligent.

-

6Most of the people who run Less Tax for Landlords are unregulated, and the concept of a “conflict of interest” is likely unproblematic for them.

-

7Note that where you are, and where your company is, isn’t relevant – just the location of the properties. It is unclear Property118/LT4L ever considered Scots law issues.

18 responses to “HMRC is likely investigating the two big landlord tax avoidance firms. What should their clients do?”

Still trying to drum up business…

https://www.property118.com/what-is-a-family-investment-company/

And it comes as no surprise, comments are switched off. I wonder what else one could ask chat GPT?

I don ‘t know why everyone is thanking Dan —- what for!. It is absurd that this suposedly retired Dan keeps attacking landlords who have every right to incorporate without payinf CGT and sometimes SDLT- check Ramsey’s court case. Dan should tell the truth about the illegal, unjust and corrupt Section 24 brought by George Osbourn in 2015. Why only landlords are disallowed to claim interest relief?. Shame on you, shame on the consevatives who will lose 2.5 Millions voters….. you are causing exit of landlords, as a result rents gone up, homelessness up…. SOON OR LATER THE COURTS WILL FORCE REMOVAL OF S24 BECAUSE IT IS UNFAIR/UNJUST/DISCRIMINATORY…..

Mark allow me to explain it to you. Yes,, if you qualify you can incorporate your rental portfolio and benefit from certain reliefs. However, two firms have been advising people that they qualify when they do not. That means they have been claiming mortgage interest, CGT roll over and possibly stamp duty which they are unlikely to be entitled to. They will have claims for serious money.

Dan has highlighted all of that is why people are thanking him. Section 24 and the fairness of it are irrelevant but it is certainly legal which is why landlords went looking for help. It is very unfortunate that those promoting these “solutions” have been accountants and barristers who ought to have known better. I really don’t know how the ordinary person is meant to know how to judge which advisor can give sound advice.

This is all wrong:

1. no court can remove s24, even if it was unfair and discriminatory. Parliament is sovereign and can pass what laws it likes

2. I haven’t attacked a single landlord. I’m attacking people ripping off landlords by selling schemes that don’t work, and taking a fortune in fees from landlords.

3. Landlords certainly can incorporate without paying CGT if they have a significant enough business, and do it carefully. Unlikely they’ll escape SDLT. And they’ll need to remortgage.

4. It’s completely wrong that “only landlords are disallowed interest relief”. Nobody gets interest relief for an investment business. Except landlords, who get 20%. It’s the opposite of discriminination.

Mark, the courts ruled that s.24 was lawful years ago.

https://www.theguardian.com/money/2016/oct/06/landlords-lose-legal-challenge-buy-to-let-tax-changes-cherie-booth

yes, it was a hopeless challenge – no UK court challenge to primary tax legislation has ever succeeded (other than re. EU law, not relevant). I’m not sure what the lawyers running the case thought they were doing…

Nice work Dan.

Do you think that it is any coincidence that there was an application to strike off “Less Law For Landlords Limited” on 12 October 2023?

Good work Dan! Also notice that two directors of COTSWOLD BARRISTERS LTD (08751593) resigned not to long after you sent your first email to publish back in July. In hindsight that might of been wise of them to get out early!

Dan

In mentioning delay- can you give a brief overview of the Limitation issues-is that what you mean.?

Victims cannot wait until HMRC take a view or resolve. From your excellent articles the deed in 118 and the MPRs allow a preliminary letter of claim perhaps certainly in the not to distant future. As for LT4LL then that is just a shambles per se. Nevertheless breach of contract and negligence limitations are different as you know.

Thanks again for the hard work on this

thanks – I will add that point

HMRC have chosen their moment to improve some people’s holiday season. That is a tight disclosure deadline. P118/LT4LL statement is negligent I think. It completely fails to signal the potential precariousness of their clients position, even in a manner that is not admissive, i.e. “You should consider engaging qualified tax advice if you are concerned. Do not ignore any communication from HMRC”. Then they will have to ‘fess up to their lenders and I suspect many more will be terrified of that prospect.

Haven’t read all of this yet, but I’m guessing the affected clients are not recommended to go and have a chat with Alexander or Gimple over a pint.

Another great article, thank you Dan.

Great work Dan.

Is that extract of the HMRC incorporation relief letter a copy of one sent to a Property118 client ?

it’s the “one-to-many” letter which HMRC told the CIOT they’re sending out to some taxpayers. I expect it went to P118 clients, but we don’t know for sure.

Dan, thank you so much for all your efforts to analyse and uncover these schemes. And I say this as someone who stood to significantly benefit (albeit potentially temporarily in the end!) from the Property118 scheme. Also thank you for your guidance as to how to resolve the mess that these charlatans have created for so many people, many of whom thought, like me, that their advice was sound and that this was a legitimate way to go for legacy planning. Your integrity and ethics shone through as soon as I started to read what you were saying (the technical analysis of the tax approach) versus what Property118 were responding with (the SLAPP, personal attacks, accusations of “gish galloping” are just a few that spring to mind…), and on their site, the obvious deletion of any negative comments to their position.

If your analysis of the sums of money made by Property118 are correct, given that their advice was largely templated, to me it would seem to be an opportunity for a class action against them for a legal firm with an interest in this area. Or am I missing something?

The above is sensible and valuable information and I’d like to add just a couple of thoughts.

First, if HMRC are investigating then do not expect any quick reaction beyond the templated “please tell us about…” letter in the article. In our experience, there can a long delay, certainly more than six months, perhaps a year, before the structure is analysed by whatever passes in HMRC for a technical division these days. Clients tend to forget that they are under enquiry and when the reminders arrive, can be a little surprised. Better to be proactive and push HMRC before they arrive at their “max tax” analysis.

Second, in an ideal world an adviser with both property and tax enquiry experitse should be engaged. I suggest that these are quite rare. Given that HMRC enquiry teams usually arrive indoctrinated with a particular (and peculiar) view of the transaction, if I had to choose, I’d go for a tax enquiry specialist adviser. (Of course I have to say that because that’s what I am).

Going to be an interesting few years here.

thanks – these are v good points. I’ll add something in the article about delays, because it’s something advisers often take for granted, but is very surprising to most laypeople.