Thanks again to WeThink (formerly Omnisis), we have some new polling on the Autumn Statement.

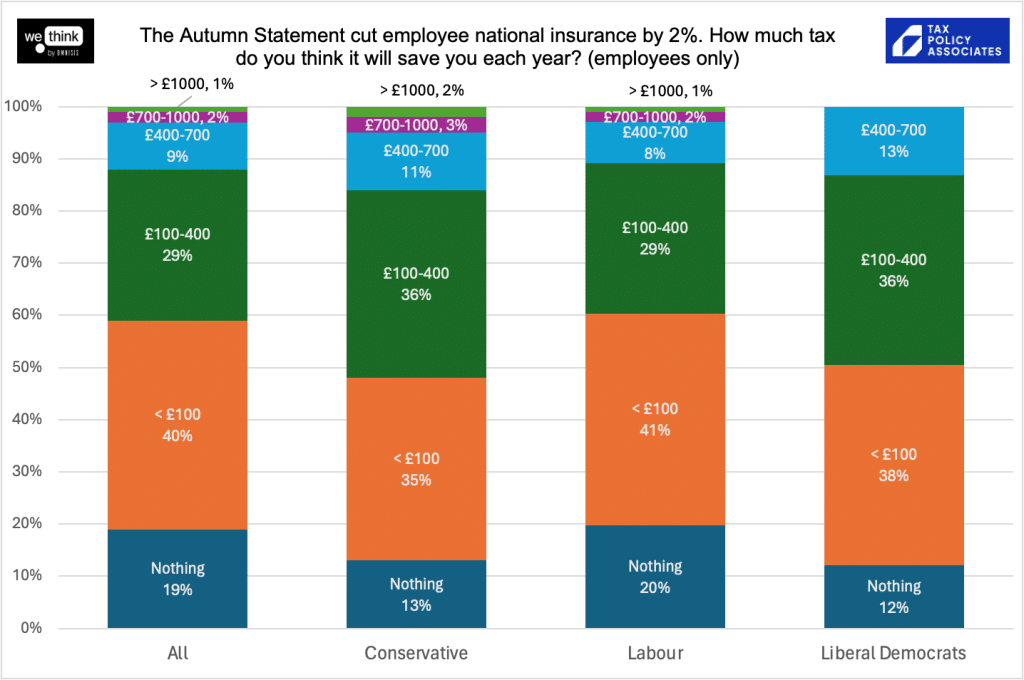

We first asked people about the direct impact of the 2% employee national insurance tax cut in the Autumn Statement (we limited the question to employees, as the self-employment NIC position is slightly different):

The tax cut is actually worth £450 each year to the average full-time employee; so many people are under-estimating it. Possibly this reflects people not realising how the 2% cut applies (understandable, given it isn’t just a simple 2% of income). Possibly it just reflects a general level of cynicism in politics.

We then asked about the perception of the overall change in tax position over the last 18 months:

The percentage believing they’re paying more tax is surprising low. The national insurance cut is much smaller than the approximately £50bn raised from “fiscal drag” – holding tax thresholds steady in nominal terms as inflation erodes their real value.

As Paul Johnson has said:

It’s interesting that fiscal drag is not “cutting through” as an issue, given that it is both a real effect, and the subject of frequent press commentary.

The full polling data is here. Thanks once more to WeThink for their generosity in running these polling questions completely pro bono.

Photo by Elliott Stallion on Unsplash

6 responses to “Are voters noticing fiscal drag? New polling evidence following the Autumn Statement”

People in general are simply not very numerate at this level. They notice if a beer or a tank of petrol goes up but spotting the rather more subtle effects of fiscal drag passes them by. Which is why the Lords of the Treasury like it.

It’s a tricky political message for the opposition parties. If they shout from the rooftops that freezing PA’s and rate bands = paying more tax, then the obvious question is “if I vote for you, will you reverse it?”.

The answer is that they will not reverse it because otherwise they have an immediate £50bn hole in the economy and even the increased spending power of taxpayers will take time to heal that.

So it pays them to sotto voce and the increased tax revenues are already spent in their manifestos.

I suspect fiscal drag is a little difficult for people to spot in their own affairs, as they are comparing their actual situation to a hypothetical. When someone gets a pay rise, even if just an inflationary rise, they expect to pay more tax. Perhaps we should expect them to notice a difference in tax rates and thresholds just once or twice per year – in April, when there may be a new tax code for the new tax year, and whenever a pay rise hits the payslip. The change to NICs in January may be a little more obvious, but it is relatively small.

A more noticeable comparison for most people will be their standard of living, and whether their after tax earnings (taking account of cost of living) allows them to live like they did before.

Depending on their circumstances, there may be some respondents to the survey who would be right to say that after the Autumn Statement their taxes will be similar to 18 months ago, and some may be right to say their taxes will be lower (back then, even before the recent 2% cut, the health and social care levy added another 1.25% to NICs). Only about half the UK population pay income tax – around 33 million out of 67 million – and not all of them will pay NICs. Those who do, plenty of people will still be in the same tax band.

It may also be that as an individual if your pay has not changed you aren’t paying more tax, but if it has increased then you put the increase in your tax paid just down to the effect of being paid more. I doubt many people work out what their tax position would have been if thresholds had been indexed, even if they are aware of fiscal drag.

Thanks Dan

No surprise really – you and the people who read this blog (etc.) eat & breath politics but I suspect most voters do not. Maybe politics is becoming niche activity?

Dan,

That’ll be because they’re too busy just managing and haven’t got time for people they’ve written off as liars and who they no longer trust.