Thanks to WeThink (formerly Omnisis), we’ve conducted some opinion polling on inheritance tax. The polling confirms that inheritance tax really is deeply unpopular, and this isn’t driven by ignorance of how it works. But our polling also suggests that most of the unpopularity is driven by the details, and not the principle, of inheritance tax.

Previous opinion poll research shows that inheritance tax is deeply unpopular – we see this in both straightforward opinion polls and more extensive work combining polling with focus groups.

I’ve been curious how much of this polling is led by people not understanding the current over-complicated inheritance tax threshold, which means that inheritance tax in practice usually only applies to a married couple’s assets over £1m. I’ve also been curious whether we’re seeing a principled opposition to inheritance tax in any form, or opposition to inheritance tax as it currently works.

WeThink (formerly Omnisis) very kindly offered to conduct a poll for us without charge. We devised a series of simple questions about inheritance tax that attempted to probe peoples’ views in a reasonably neutral way.

The fairness of the tax

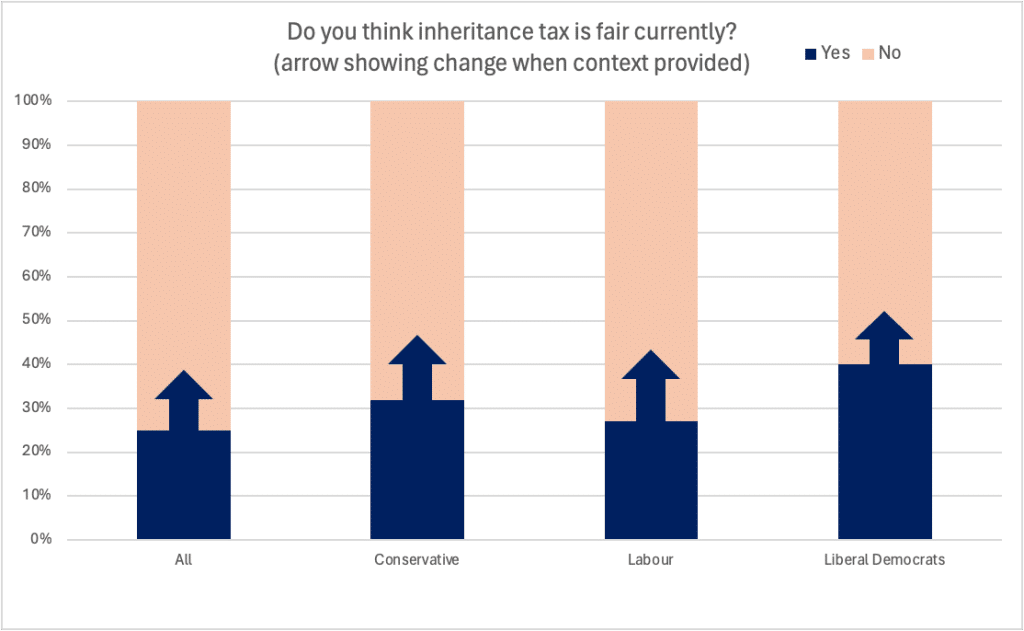

WeThink split the panel into two statistically identical groups.

The first set was asked – without any context – a simple question: “Do you think IHT is fair currently?”. The answer was pretty overwhelming:

Surprisingly, Labour voters are even more likely than Conservative voters to believe inheritance tax is unfair.1I’m not including the breakdowns for the other political parties because the numbers are too small for statistical significance; even the Lib Dem figures should be treated with caution. You can see all the details here. Possibly that’s because some of them believe the tax is too low.2There’s some support for that in the polling detail; about 10% of Labour voters support a rate of inheritance tax of 60% or more; no Conservative voters do. However the statistical validity of individual answers is very low, so I don’t think it’s safe to draw conclusions from this.

The numbers are broadly consistent with YouGov’s long-running polling on the same question.3Note that YouGov gives a “not sure” option and we did not. The question of whether “forced choice” is the best approach has a long history… I have no expertise in this, and was happy to be guided by the experts at WeThink.

The second set were given some context:

“For most married couples, inheritance tax is only charged where their net assets exceed £1m. The rate is 40%. Do you think IHT is fair currently?“4It’s a very simplified presentation but compressing an explanation of inheritance tax into a sentence is not easy. One obvious criticism is that the question could give the impression that all the assets are taxable the second they hit £1m, and this is a fairly common folk belief about tax thresholds. That was perhaps a mistake on my part.

That lets us test the hypothesis that people oppose IHT because they wrongly think it will apply to them.

We did indeed see an increase in the percentage believing inheritance tax to be fair, but not a terribly significant increase:

We still see a large majority against the tax; only Lib Dem voters thought inheritance tax fair, even when provided with that context.

I’d conclude from this that we should discard the idea that inheritance tax’s unpopularity is caused by a lack of understanding of the system.

Options for change

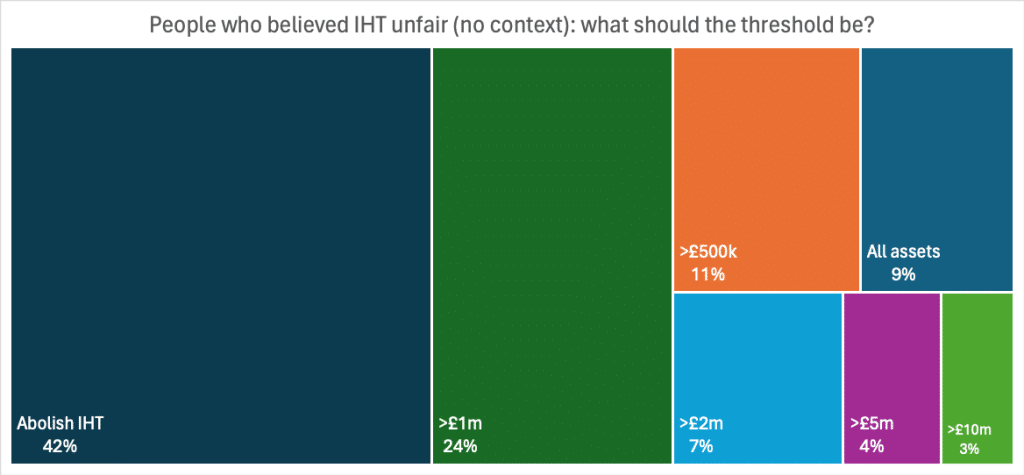

Where a respondent said IHT was unfair, we went on to ask what they thought the inheritance tax threshold should be, giving options ranging from no threshold to a £10m threshold. We also included an option for abolition. The intention was to test whether opposition to inheritance tax reflects an absolute principle, or a dislike of the way inheritance tax currently works.

A slim majority – 56% – of the “no context” group preferred changing the threshold to abolition.

An even more slim majority – 53% – of the “context” group preferred changing the threshold to abolition:5Presumably because people who think inheritance tax is unfair after being presented with the context have already considered and dismissed a £1m threshold

We can draw two conclusions from this. First, some of those saying inheritance tax is unfair believe it unfairly under-taxes estates. Second, at least on this evidence, it’s plausible that if the threshold was set to £2m then only a minority of people would believe inheritance tax to unfairly over-tax.

Finally, for those who said IHT was unfair, but were open to keeping it at a different threshold, we then tested different rates, ranging from 20% to 80%. There was overwhelming support (almost 80%) for reducing the rate to 20%. That was unexpected, and in retrospect we should have given more options below 20%.

Conclusions

Inheritance tax is deeply unpopular – not a surprise.

Some of that unpopularity is caused by a misapprehension as to the level of wealth at which the tax applies. But most of it isn’t – there’s a large majority who believe the tax is unfair even when told that it only applies (broadly speaking) to wealth over £1m.

A much more significant factor appears to be unhappiness with the threshold and/or the rate. It’s plausible that a majority would believe inheritance tax to be fair if the threshold was increased and/or rate reduced. I wouldn’t put it more strongly than that given the limitations of this exercise.

My view remains that we should cut/cap the over-generous reliefs from inheritance tax, and use the revenues to cut the rate. We didn’t ask that in the polling, because I’m unconvinced the complexity of these issues, and the inevitable trade-offs, can be condensed into a one sentence question without pushing an agenda (one way or another). I would prefer that to raising the threshold, because the high (by international standards) 40% rate drives avoidance. A low rate and wide base is the standard boring tax policy response to most problems – and it’s the right one here.

We’ve published the detailed polling numbers here.

Many thanks to Brian Cooper and Mike Gray at WeThink/Omnisis for their generosity.

-

1I’m not including the breakdowns for the other political parties because the numbers are too small for statistical significance; even the Lib Dem figures should be treated with caution. You can see all the details here.

-

2There’s some support for that in the polling detail; about 10% of Labour voters support a rate of inheritance tax of 60% or more; no Conservative voters do. However the statistical validity of individual answers is very low, so I don’t think it’s safe to draw conclusions from this.

-

3Note that YouGov gives a “not sure” option and we did not. The question of whether “forced choice” is the best approach has a long history… I have no expertise in this, and was happy to be guided by the experts at WeThink.

-

4It’s a very simplified presentation but compressing an explanation of inheritance tax into a sentence is not easy. One obvious criticism is that the question could give the impression that all the assets are taxable the second they hit £1m, and this is a fairly common folk belief about tax thresholds. That was perhaps a mistake on my part.

-

5Presumably because people who think inheritance tax is unfair after being presented with the context have already considered and dismissed a £1m threshold

9 responses to “Is inheritance tax really unpopular? We’ve exclusive new polling evidence”

Late to this, but thanks for the blog and for sharing the data. I think the really striking finding is around the rate – as you mention, very strong support for 20%. However, that was the only option below the current rate, so more options (15%, 30%) do need more testing. Even as someone who thinks inheritance tax is, in principle, a very good idea, I can understand that 40% feels steep, no doubt exacerbated by confusion over what it applies to (i.e. not the whole, and not your house – the latter being crucial, as that’s the only asset that most people imagine could be worth that much). People are also very familiar with income tax bands, and I wonder whether bands for inheritance tax might also make it much more palatable. Overall, reasonable initial data to support your conclusion.

Also meant to add, the restructuring of the tax so it actually did what it says on the tin – tax inheritances – rather than what it currently does – tax estates – I think would also significant help. Taxing the deceased feels somehow a final insult to dead pappa / mamma. Taxing the lucky descendant, on what is by that stage of life often a bit of a luxury windfall, feels inherently more fair, and also allows for variable taxation depending on their financial position. It would also indirectly encourage people to spread their wealth around more in their will, rather than leave it all to immediate descendants.

Is it possible to get any information on the way IHT avoidance impacts the perceptions of fairness? Clearly, it is possible to assess how much tax estates should pay in principle but then we also know that many estates (eg. various dukedoms) have managed to hand down massive amounts of wealth over many generations as a result of being able to indulge in complex avoidance strategies.

I’m not sure how to do this fairly in a poll (which is another way of saying we weren’t smart enough to come up with a way!). Demos recently ran focus groups looking at exactly this; I’m sceptical of that approach, because it’s so easy to tilt the playing field in your own direction.

I suggest that “Inheritance tax is a tax paid only by the moderately wealthy” is pretty well recited among the moderately wealthy – i.e. the rich don’t pay it as Phil Brown says.

Perhaps even more true is “Inheritance tax is paid only by people who trust their relatives less than the taxman”.

i.e. some proportion of the middle-aged people who regard inheritance tax as unfair do so because they suffered from it, but their peers didn’t because their parents passed on the assets more than 7 years before death.

Then there will be those with siblings who regard it as unfair that their peers who were only children received the same per head without tax.

And the very justified complaint from those whose parents did not own homes that the family home is excluded (that Cameron/Osborne distortion should be one of the first to go)

Solution is to tax receipts rather than estates.

Use CGT, and one could wipe out thousands of pages of tax law about IHT !

i.e. you considered fairness being possibly because too low as well as too high, but the fairness aspect may also be materially impacted by (largely accurate) perceptions of distortions.

Add in grandparents paying for grandchildren’s school fees (only feasible for the pretty wealthy) and for grandchildren’s deposits on first house etc.

Um footnote 6 is blank.

Are there any clues as to reasons why IHT is so hated? Even when only 4% of estates pay it. So presumably it is is irrelevant for most people in the survey.

Interesting to see the support for a 20% rate rather than 40%. I wonder if that could turn into a majority of support for the tax. The quid pro quo is presumably the abolition or capping of reliefs such as BPR or APR, plus taxing inherited pensions, and abolishing the residential nil rate band. Does that give you enough powder to halve the rate without losing revenue?

Perhaps worth linking the recent work published by the IFS.

Eg. https://ifs.org.uk/publications/reforming-inheritance-tax

Did you test that they understood the 40% question? Many would think that once the assets are over a million the whole sum is subject to 40% tax. Ask a focus group to calculate, individually, the tax liable on £1.1million.

I would agree. If you were to take the average individual living in the UK and tell them that when they eventually pass away (based on current rules), they would not pay any IHT, whether they would still hold the same view against IHT.