The UK’s high marginal tax rates on people earning £50k are a disincentive to work. They’re made worse by the way a large chunk of the tax is collected – the “high income child benefit charge” (HICBC).

The HICBC creates a “tax trap” for employees who usually wouldn’t file a tax return. If they earn £50k, and they or their partner claims child benefit, they have an immediate requirement to file and pay the HICBC. It’s easy to get that wrong. In the last four years 19,000 did, and were hit with a penalty of up to 30%.

Tax systems shouldn’t have marginal rates of over 70%, and shouldn’t have “traps” that can catch the unwary. The HICBC should be abolished.

The Financial Times covered this story over the weekend, and there was more on marginal rates in Saturday’s Times.

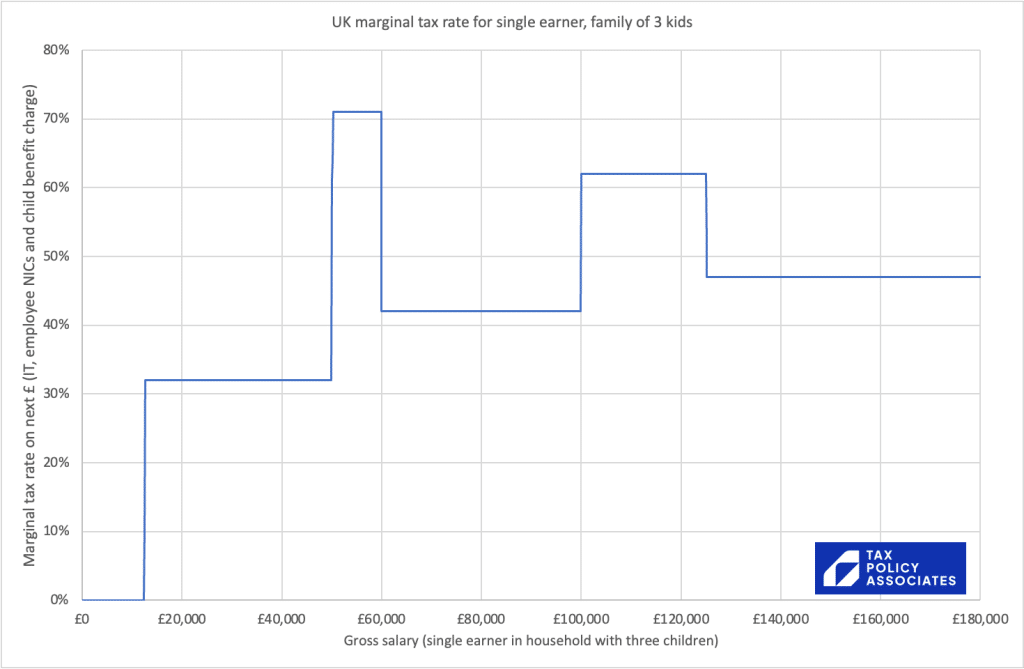

The chart above shows the marginal rate of income tax paid by a UK taxpayer with three children under 18. That’s a 71% marginal tax rate between £50k and £60k.1It’s not even the most extreme example – student loan repayments can take the rate to 77%.

The high marginal rate results from George Osborne’s 2013 decision to withdraw child benefit from people earning a “high income” – £50,000. If the £50k threshold had been upgraded with inflation it would be £67,000 now – but it wasn’t. Around one in three households now include someone earning £50,000 – it’s not a “high income”.

How the HICBC works

Whatever we think of the politics of withdrawing child benefit from “high earners”, the way that it was done was a mess.

UK tax generally applies to individuals.2That didn’t used to be the case – until 1988, the income of a married woman was taxed as if it belonged to her husband, on his tax return. Married women had no financial privacy. I’m taxed on my income; my wife is taxed on hers. The benefits system on the other hand, looks at overall household income and capital. The decision was taken to withdraw child benefit based on a mixture of both – if the highest earner in a household hit £50,000 then child benefit would start to be clawed back, and if it hit £60,000 then all child benefit would be withdrawn.3There are a number of cases where it’s more complicated than this. For example: where the high earning parent doesn’t know if the other parent claims child benefit, or where child benefit is claimed by someone outside the household but who provides the household with financial support. I’m going to ignore these issues for now, but they’re important for the people affected.

The challenge was that, whilst HMRC knows how much I earn, it doesn’t have a way to see how much the highest earning person in my household earns. So child benefit couldn’t “automatically” be clawed back.

The highly bureaucratic answer to this challenge was to outsource all the work to taxpayers. Osborne created a new tax – the HICBC – and required people to self-assess it in their tax return. It’s a bad answer because most people earning £50,000 are employees, and don’t file a tax return. So people would have to realise they had to start filing a tax return just because they claimed “too much” child benefit, and notify HMRC.

It was very foreseeable this would cause problems, and many said so at the time. There’s an excellent briefing on the HICBC from the wonderful House of Commons Library.

The HICBC choices

If your household has children under 18 and someone earning £50k, then you have three choices:

- Don’t claim child benefit.

- Register for child benefit but opt not to receive it.

- Register for child benefit, receive it, and then pay some/all of it back through a special tax, the High Income Child Benefit Charge.

These are difficult choices with not-at-all-obvious outcomes:

- The first choice – not claiming child benefit – seems the easiest thing to do, but is actually a mistake, because it means a non-working parent can lose their national insurance entitlement.4It also means the child won’t automatically receive a national insurance number when they turn 16 It’s a mistake I made – and as a result my wife lost some pension entitlement. The Government pledged to fix this back in April, but nothing’s happened since.5Thanks to Miro in the comments for reminding me of this.

- The second is the “correct” answer if the highest earner in a household makes £60k+ but not so great an answer if they earn £50-60k, because they’re then giving up all their child benefit unnecessarily.

- The third is a pretty bad answer, but if the highest earner makes between £50k and £60k then it’s the only way to receive some child benefit. If you’re already on self assessment and filing online, then paying the HICBC is fairly easy – you just tick a box and type in the amount of child benefit claimed. But if, like most employed people, you’re not on self assessment, then you’ll have to register for self assessment. If you don’t, you’re breaking the law.

These choices all get more complicated if income unexpectedly changes during a year, or a couple separate, or a couple move in together.

And lots of people get it wrong. Sometimes in the Dan’s-wife-loses-some-of-her-pension way. And sometimes in failing to realise you now have to register for self assessment and file/pay the HICBC.

How many people get it wrong?

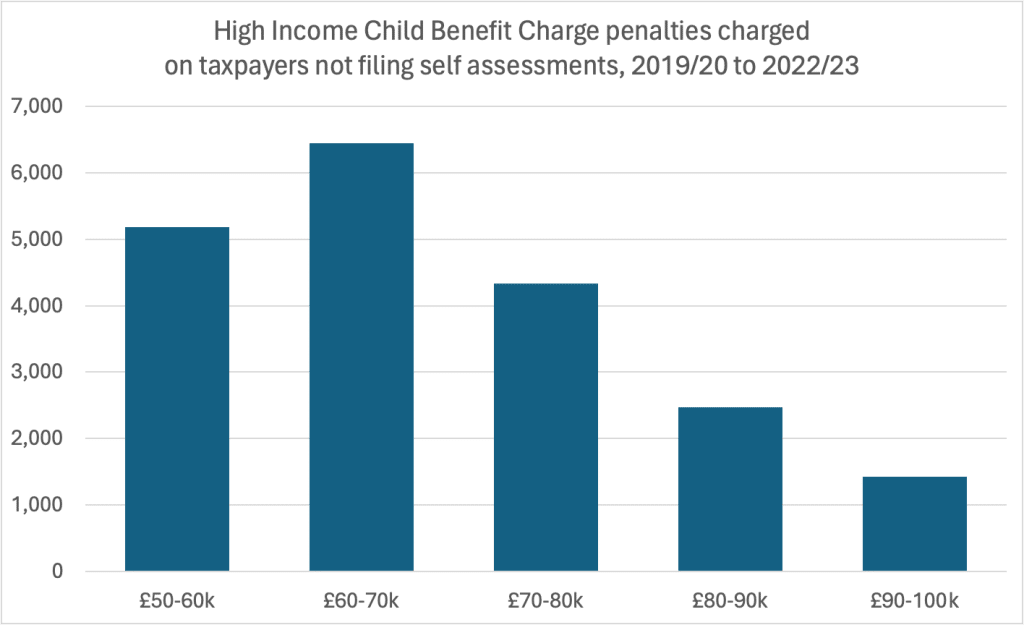

Almost 20,000 people who weren’t on self assessment were hit with penalties from 2019/2020 to 2022/23 for not realising6My assumption is that it was almost always an accident, because I think it would be obvious to most people who understood the system that they would be caught they should be paying the HICBC:7The source for this is an FOIA request we filed with HMRC – the full FOIA response is here.

We don’t have data on the amount of the penalties, but likely it was several hundred pounds.8That’s on the basis that a penalty will usually be 10-30% of the tax due, and child benefit is £1,250 each year (for a first child).

This is after an HMRC review of HICBC penalties in 2018 – before then, there were about twice as many penalties issued.9There is some data on this here, but it is all older than the data above, and doesn’t show the penalties charged to people not on self assessment

HMRC has sent millions of letters to people warning them about the HICBC, but not everyone affected has received one. HMRC has pursued people for penalties even when they weren’t adequately informed; tax tribunals have been reasonably sympathetic to taxpayers.10We can add “wasting the time of tax tribunals” to the charge sheet against the HICBC. One recent appeal was over a £182.40 penalty.

What should happen?

Marginal rates of over 60% should be regarded as unacceptable. I’d abolish the HICBC on this ground alone.

But the way the HICBC was implemented is an illustration of how a tax system shouldn’t work. A wholly disproportionate level of complication for people on not-very-high incomes doing something as ordinary as having children, where the total amount of tax at stake is so small (likely around £1bn).

The Government has promised to improve things by enabling HICBC to be collected through PAYE, removing the need to file a self assessment form. But taxpayers would still have to notify HMRC this, and still have to make surprisingly difficult choice as to how to proceed.

I’d hope abolishing the HICBC would appeal to both a Conservative Party that regards high marginal rates as an anathema, and a Labour Party that’s always supported the principle of universal child benefit. The amount of money at stake is small, and if the government wished to recoup the cost from people earning £50k, that could be easily done in a less damaging way (for example by upgrading the higher rate income tax threshold slightly more slowly than it otherwise would).

-

1It’s not even the most extreme example – student loan repayments can take the rate to 77%.

-

2That didn’t used to be the case – until 1988, the income of a married woman was taxed as if it belonged to her husband, on his tax return. Married women had no financial privacy.

-

3There are a number of cases where it’s more complicated than this. For example: where the high earning parent doesn’t know if the other parent claims child benefit, or where child benefit is claimed by someone outside the household but who provides the household with financial support. I’m going to ignore these issues for now, but they’re important for the people affected.

-

4It also means the child won’t automatically receive a national insurance number when they turn 16

-

5Thanks to Miro in the comments for reminding me of this.

-

6My assumption is that it was almost always an accident, because I think it would be obvious to most people who understood the system that they would be caught

-

7The source for this is an FOIA request we filed with HMRC – the full FOIA response is here.

-

8That’s on the basis that a penalty will usually be 10-30% of the tax due, and child benefit is £1,250 each year (for a first child).

-

9There is some data on this here, but it is all older than the data above, and doesn’t show the penalties charged to people not on self assessment

-

10We can add “wasting the time of tax tribunals” to the charge sheet against the HICBC. One recent appeal was over a £182.40 penalty.

57 responses to “What’s worse than a 71% marginal tax rate? Penalising 19,000 people who don’t understand it.”

The definition of “household” is also worth looking into, which is basically along the lines of “two people who share a fridge”. That caught my friend off guard when he started staying over at his girlfriend’s regularly, who lives with her three year-old daughter from her previous marriage. This also seem to bite at the £100k threshold for nursery fees, though clearly that would be an issue for far fewer people. He seemed to be directly liable, rather than the mother or biological father. The indirect intention of the system when coupled with the gender pay gap seems to be to locate the closest man with a high income, when presumably it is partly meant to be supporting women’s independence. With that level of tax contribution to the system, one might be expecting a further discount rather than a penalty for supporting a single mother, but that is in the nature of the paradoxical progressive tax system, which has crept in over the decades, after the middle classes were stitched up with the idea of universal contributions for universal benefits.

Hi there. Thanks for the excellent article. I found this page while actually searching for some information regarding this HICBC which I am struggling to find, so I hope maybe someone here might know the answer.

I was under the threshold, but last year suddenly we had a bonus from the company and a long awaited backdated payrise to counter the inflation, and then I had a few one-off awards for performance and innovation, and suddenly I am caught off-guard and ended up above the threshold. The HICBC ends up clawing back my performance award completely and some more, which I find very unfair. I am really frustrated., and I am trying to find out if these one off payments should be included in the adjusted net income, or not, since they do not reflect my true usual income. Is there a way to appeal for this unfairness?

worth a quick call with an accountant, but I fear this is an inevitable result of the way the system works. That said, while you will have a high effective rate (perhaps up to 80%) it won’t be over 100%, and so the performance award shouldn’t make you worse off than you were before…. just not much better.

I am in this same situation. In one year a bonus took me over £60k, and I’m now been asked to pay all child benefit back when my normal salary is more than half this! Is there any hope of appeal or anything to avoid the payment?

If you’re still in the tax year you can take action to reduce your income such as moving cash into your pension, or asking your company to split the bonus over two tax years.

Great article. I do hope there is a taskforce or at least some groups that are compaigning to get thix tax changed or abolihed. I was hit with a fine back in 2019, after unwittingly hitting the “high income” threshold and my wife claiming child allowance whilst being a stay at home mom.

I find myself now putting anything >50k in to pension, and hoping for one day getting a pay rise which takes me above the 65k level to make it worth our while actually taking the cash. Not ideal with 3 kids age between 8 and 1. The money in our bank would be more useful right now.

Meanwhile there are couples out there, both working, earning 49k each, and getting the full benefit of child allowance and not paying a penny back.

I hate this tax, and the frozen thresholds, with a vengeance!!!

I have a lot of sympathy for your position and agree this tax should be abolished but your comparison with the dual £49k income family doesn’t add up.

If they employ someone to do all the work your, stay at home mum, wife does (childcare, cooking, cleaning, taxi-ing etc etc) they would pay for that out of their post tax salary. That employee then also pays tax on their earnings. This set up effectively sees them taxed twice on the labour your wife provides you tax free.

It would be ridiculous and wrong to tax stay at home parents but it’s also wrong to suggest the tax system advantages dual income households when the opposite is true.

IF you were to employ someone.

My taxable income is 60k and have four children as a single parent. This means I get no child benefit.

I cannot afford to pay someone to help us around the house.

So I do agree it is unfair that a two parent family can have two taxable incomes £49998 and still get child benefit.

Not sure I follow your logic here. I am comparing myself to a working couple that I knew earned 45+49k. They pay for after school club, and grandparents have the chilren in holidays. They don’t pay for a nanny and I can’t imagine many other working couples in this salary range do, at least, I’ve never heard of it.

And yet with this 94k of household income they get to keep all of their child allowance.

Our household with far less income, have to pay it back.

That’s definitely an advantage to the dual income couple.

Hi, 2 weeks back I received a letter stating that I may have to repay some child benefit that my partner claims, I’m employed so PAYE, I’ve done the online self assessment but I’m so lost on what I should of put, all this net adjusted income is so confusing, like what needs to be added up and deducted?

How long roughly till I hear back from HMRC as it’s just dragging

I’m assuming this isn’t including the tax-free childcare and the free childcare hours benefit that’s lost if you earn over £100k (assuming these still exist, which I think they do). Assuming 2 kids of the right age and a high childcare cost area it’s worth c £25k net

£100k gross and get c£67k + £25k = £92k net

£101k gross and get c£67.4k net a £24.5k drop

So you’d need a 50%+ pay rise to break even.

So mental it can’t still be the case…..can it?

I’d be really interested in someone publishing some figures on this. My calculations, which I’m very happy to admit could be wrong, don’t show the impact to be quite as bad but still significant.

– Just looking at 3-4 year olds: everyone appears to get 15 hours of ‘free’ childcare, regardless of income. And you can then get an additional 15 hours if you (and your partner if applicable) earn <£100k.

– So the additional you gain/lose benefit is 15 hours and that's probably worth ~£3.5-4k a year per child.

– Based on the example above, £100k – £33k tax + £8k childcare (for 2 child family) = £75k net

– Above the threshold = £101k – £33.6k tax + £0k childcare = £67.4k net

– This is a £7.6k drop meaning you'd need to be earning ~£116.5k to break even.

Not sure what that equates to in terms of marginal tax rate, but think it's likely well above the 60% unacceptable threshold Dan references in his article

Yes I believe it’s the case. And like Matt’s post above it is lost if one earner in the household goes over. So 2x earners at 100k and you get it. One at 101 and another at 40 and you don’t. I think you can actually go to 140 and use full pension allowance to take you back down. So 2×140 and you get it. But one at 141 and another on 40 and you don’t!

I was hoping this would be abolished today, or at least the thresholds risen to the rate they should have been if Osborne and Cameron had sensibly (yeah, right) set it to rise with inflation. Doesn’t look like it’s going to happen. I don’t even earn a salary over £50k, but for the last two tax years and the next one, I have an will, owing to the fact that I received a payment, received in three installments, for the additional work I carried out in getting the company I work for acquired for over seven figures.

So I’ll only temporarily be earning enough to trigger the HICBC, so it’s pretty galling that what should be a bit of a boost is being siphoned off through a stealth tax. I have three children and for my first two payments I had a student loan. So the money I earned above £50k in the previous two tax years would have essentially been taxed at about 80%. I had little choice but to sign up to Cycle to Work and dump thousands into my pension.

What a lovely start to the day, a massive dose of Schadenfreude. Thank you for this, Dan. I shall be insufferably smug for ages now, having actually spotted this one when the annoying tax came in, and worked out that I could keep our child benefit if I reduced my taxable income with pension contributions. Not all who spotted it were in a position to do this, so I was very fortunate to be able to do so. Best wishes, please keep up the good work. RA

Hi Dan

This is an excellent article. We went for option 1, because it seemed easier, although we didn’t know about the potential NI problem. Fortunately, our earnings are sufficient that NI will always be paid by both husband and wife.

Here’s another trap you may be unaware of though. My wife is doing a part time OU degree over six years (actually turning into eight thanks to home schooling during Covid) For the first four we funded the fees directly, but in year five, due to Covid impact on income she decided to go for a student loan.

We’ve subsequently discovered the student loan is repayable after the course end OR four years, whichever is sooner. For us, this meant the loan was repayable 6 months before it was taken out, yet the application process did not filter my wife out as not qualifying, which surely would not be too difficult. This all resulted in an additional unexpected £5k bill earlier this year, which included interest, but very fortunately (considering your article), no penalties.

OMG that is nuts…

This also impacts on claims for Specified Adult Childcare Credits – a mechanism for allowing a grandparent or other child carer not yet old enough for their state pension to transfer NI credits awarded to the parent to the grandparent/carer if the parent doesn’t need them for their own pension. If the parent chooses option 1 (don’t bother completing a CB claim because of the HICBC) the parent won’t be given the NI credits and the grandparent/carer will get a shock when HMRC refuse the claim for SACC and the grandparent/carer loses pension for want of a CB claim form being submitted. Add in the way HMRC administers SACC and the massive delays in processing claims (it takes more than 52 weeks currently) and its minefield for claimants.

If the claim form for SACC made it plain that unless the parent had submitted a CB claim form a claim for SACC would be rejected that would be helpful. That would encourage the grandparent to get the parent to submit the claim form for CB even if the “don’t pay” check box was selected.

I hate the practical problems that tax policy like this creates. The loss of personal allowances is similar for those earning over £100K because it creates a 60% tax rate for those earning between £100,000 and £125,140. We have plenty of doctors and others in the public sector who now only work 3.5 or 4 days a week so that they stay just below £100K. At a time when there is a shortage of doctors we have Govt policy which encourages them to work less. This is another policy that should be scrapped but if that is too hot a political potato to handle then the band should be massively expanded to say £100K to £200K. We don’t need tax disincentives to work.

As a >£60k earner that does file tax returns and a tax professional, I can also say that although ended up in the ‘right’ place with the option 2 position, it was absolutely more by luck than judgment. Mainly this was because my daughter was born a year or so before the HICBC was introduced so we did register and claim CB and then had to opt out of the payments. Even so, it was by the skin of my teeth (ie by refiling my tax return the day before the 12 month refiling deadline) that I avoided penalties and interest as communication of the change to affected taxpayers was pretty poor such that the issue (and how to deal with it) really only became obvious when preparing the following year’s return.

do these graphs include NI

yes, the marginal rate calculations includes all taxes paid by the employee, so employee NICs as well as income tax. But not employer NICs, apprenticeship levy etc, as whilst they are mostly economically borne by employees in the long run, in the short term they are not, and so they don’t impact employee incentives.

My wife and I got stung by this. She claimed the benefit as guidance from HMRC was that this was necessary to preserve her NICs contributions. The money went into her account. We didn’t realise that, due to my salary, that created an obligation to repay all of it – until a letter from HMRC dropped onto the doormat. We/I then had to repay the lot, with interest. I felt like a tax cheat. Why invite someone to claim child benefit only to claw it back from their partner?

The HICBC is a classic example of the bureaucratic cat’s cradle that the UK tax system has become, a system so perverse that even in what should be a simple matter tax professionals, even our Dan, are ensnared.

Although the NINO problem and the partner’s potential loss of NI credits are addressed in the HMRC HICBC document online it’s significant that if tax experts can be caught, what hope is there for the ordinary taxpayer.

Because I now regard the UK tax system as Churchill’s “riddle, wrapped in a mystery, inside an enigma” even though my tax affairs are simple, I always file a return. It’s simply too dangerous not to.

Great Blog, keep up the good work Dan, I can’t wait for your piece on pre-owned assets.

So, I work in education, my salary has gone over 50k with the teacher pay review increase awarded by the government. What do I need to do?

We have two children and claim child benefit, my wife works but earns half my salary. I do pay into a pension via work, are these contributions deductable?

This just seems another bizarre tax system

“The government will provide details in due course on how it will enable employed customers to pay through their tax code, without the need to register for Self Assessment.” Ministerial statement you linked to.

Perhaps Jim Harra needs to be reminded that he signed, as one of the Commissioners for Her Majesty’s Revenue and Customs, the Income Tax (Pay As You Earn) (Amendment) Regulations 2013 (S.I. 2014/521), regulation 3 of which, coming into force on 6 April 2013, not 2023, inserted regulation 14B into the Income Tax (Pay As You Earn) Regulations 2003 (S.I. 2003/2682). Regulation 14B provides that:

“HMRC may determine a code, if and to the extent that the payee does not object, to

secure that—

(a) income tax payable for a tax year by the payee by virtue of section 681B of ITEPA (high income child benefit charge) is deducted from PAYE income of the payee paid during that year, and

(b) repayments are made in a tax year in respect of any amounts overpaid on account of income tax under that section for that tax year.”

The Explanatory Memorandum at para 4.9 confirms that regulation 14B was to “enable” (HMRC’s words then as now) collection of HICBC from employees through coding. This regulation and its purpose is mentioned in HMRC’s PAYE Manual, especially at page 13150.

Thus the tools to enable coding have been there for 10 years. Coding out income and items such as HICBC is an alternative to requiring an employee with smallish amounts to notify liability and being required to make a tax return. That is achieved in the case of income by section 7(3)(a), (4) and (5) Taxes Management Act 1970. But having enacted this tool designed to keep employed taxpayers who do not meet the criteria HMRC impose on themselves which determine who should be served with a notice to file, HMRC did not also, as they should have done, cause (through Parliament) section 7 TMA to be amended to extend subsections (3), (4) and (5) so that there was no liability to notify HICBC if it was coded out or intended to be. That was yet another policy failure.

It is the converse of a further failure, the saga that culminated in the Court of Appeal decision in HMRC v Wilkes where it was held, dismissing HMRC’s appeal from the Upper Tribunal, that HMRC had no power in law to make an assessment to recover HICBC that had not been notified nor included in a return. I immodestly take some of the credit for being the first to point this out in an FTT decision. I also pointed out that it was not the first time that HMRC had faced the problem caused by section 29(1) TMA, as it applied to some of the standalone pension charges on things such as unauthorised member payments. In the pension cases HMRC introduced regulations which modified section 29 to allow assessments to be made, but in the intervening 8 years between those regulations and FA 2012 the corporate knowledge obviously got lost.

Then there is the failure of HMRC to use the Child Benefit computer systems and the SA computer systems to produce lists of those who were liable to HICBC but were not with self-assessment and to warn them of potential liability specifically, not through “one to many” letters. I suspect that originally the policy officials assumed that those not within SA would be taxed on HICBC through their code – my main evidence for that is the Explanatory Memorandum to the 2013 Regulations which says:

“7.14 The new income tax charge will apply to those taxpayers who are in receipt of Child Benefit and on a higher income. For taxpayers with income between £50,000 and £60,000, the amount of the charge will be a proportion of the Child Benefit received. For taxpayers with income above £60,000, the amount of the charge will equal the amount of Child Benefit received. The charge will be collected through self assessment (SA) but can be coded where there is a PAYE income.”

There is of course the further fact that regulation 14B depended on appropriate vires being present, and these were introduced by paragraph 7 of Schedule 1 to Finance Act 2012 (part of the legislation enacting the HICBC).

I am in total agreement with what you say. It’s the worst tax policy decision of this century.

A further consequence of having to file a self-assessment return is in relation to student loans.

If someone has more than one job and is not required to file a self-assessment return, the repayment threshold is calculated individually for each employment, much like national insurance.

Once self-assessment comes into play, the threshold is calculated annually across all employments, potentially leading to significantly higher SL repayments.

The immediate tax wallop and penalty is bad enough. But the almost invisible effect of a decision not to register (your option 1) on the long term is pernicious. This failure to recognise NI consequences could be disastrous for the low earning parent- and could take 30 to 40 years to know about it. Are there other ‘access’ rights for parents or child, I wonder?

An indication of the lowest level of penalty likely to be applied: https://www.accountingweb.co.uk/tax/personal-tax/hmrc-fails-in-pursuit-over-ps18240-hicbc-penalty?utm_medium=email&utm_campaign=AWUKTAX201123&utm_content=AWUKTAX201123+CID_9671988e83c669039af4b9f1f7aa2a78&utm_source=internal_cm&utm_term=Read%20more

Presumably if you’re on – say – £55k the best option is to dump the excess £5k in a SIPP.

Do you have to file SA in these circumstances?

Dumping £5k (or even just £4k – given that deduction at source applies) in a SIPP (in the year) makes you not liable to HICBC, and so not liable to notify liability (all other things being equal), which HMRC wrongly equate with being liable to “register” for self-assessment.

Dumping into a SIPP 80% of your income over £50,000 is easier said than done, For example, I imagine that most parents earning £55,000 would struggle to invest an extra £4000 into their pension (SIPP or AVC, for as Dan said, many are employees and many of those will still be in employer pension schemes)

Yes you do if you want the higher rate tax relief for the SIPP contributions.

Great article as usual, Dan. Please can you indulge me and explain as simply as possible why “option 2” (register then opt out) is the best and how it impacts NI/pension? I wasn’t aware of this – simply thought as we didn’t qualify there was no point. Thanks

As my own mistake will testify, I am absolutely not a pension expert, but it seems a parent who is not working is deemed to be making national insurance contributions if they are claiming child benefit (including where they have claimed but opted out of receiving payments). Please please don’t take my word on this!

Correct! A state pension year credit is given in respect of a child under 12, as long as HMRC knows about you and your children even if you can’t take the child benefit because you earn too much.

Having made the same mistake as Dan in not claiming child benefit, I was pleased to see a Treasury announcement in April that this would be fixed retrospectively. I’m hoping for details in the Autumn Statement. It seems to be moving incredibly slowly for a known and acknowledged problem.

https://www.gov.uk/government/news/savers-set-to-benefit-from-simpler-tax-system

thanks – I’ve been watching this and haven’t seen anything…

Wow. I had no idea about this. Hope so – as I suspect we have fallen into this trap too. I looked at the gov website and just assumed we weren’t supposed to claim child benefit if the HICBC just offset it. My wife left the workforce after our second so probably has a pension gap now. It also meant we couldn’t get the 30 hours childcare. Plus I’m in the just over 100k marginal tax hell. Thanks for shining a light on it.

a poor article. it doesn’t explain how the nic/record is lost or how the high tax rate arises.

What is it you don’t understand?

If a stay at home Mum does not claim CB because their partner earns over £60K, they get no NI credits because they have no earnings on which to pay NI and HMRC does not give credit for those years because their trigger to do so is a claim for Child Benefit.

The article refers to people who don’t realise that those earning over £50K lose CB on a sliding scale up to earnings of £60K at which point they lose all entitlement to keep it. In these cases they have to repay the CB, which for a family with 3 children equates to 71% tax on the earnings between £50K and £60K.

When you throw in the fact that a working couple with children can both earn £49,999 and keep every penny of CB but the family next door where the husband earns £60K and the wife stays at home, get no CB, it shows how stupid and unfair the HICB charge is.

As a financial adviser I have rarely met a person paid through PAYE caught by this who is aware of it, as unless they have other income to declare and file a tax return, or receive a HMRC letter how would they? Could the numbers caught be the tip of an iceberg? It’s likely now that savings rates have increased and many more have taxable savings interest to declare that more cases will surface.

I wouldnt assume a Starmer government will abolish HICBC – Centrists absolutely live for means-testing.

The HICBC is a mean spirited bit of tax legislation that obviously ought to go. As for all the talk of tax cuts in the Autumn Statement, it would make a lot more sense for any slack in the system to be applied to eliminate the HICBC and some of the other nonsense that has been brought under the ‘Austerity’, brand. Knowingly cheap and nasty

There must be many families (mine included) that have selected option 1, and just not registered for child benefit. Your comment (note 4) about the child then not automatically receiving an NINO at age 16 is something I wasn’t aware of, and is an example of the extra unnecessary confusion and administration being passed to families, this time when the child turns 16. These children likely have parents who automatically received their NINO at 16, and would suspect no different for their own children.

I didn’t know that either. Was a mistake – the fact two tax professionals make it suggests there is something badly wrong with the system.

and the chart is wrong as it doesn’t show the point employee nic drops from 12% to 2% at around £50k.

I can assure you it does – all the calculations can be seen here: https://github.com/DanNeidle/UK-marginal-tax-rates/blob/main/marginal%20rate%20calculator%20-%20september%202023.xlsx

It’s an example of poor policy making and implementation. To spot the pension credit trap from not claiming Child Benefit you had to be an expert in that area and in reality very few are. It’s also an example of how tax policy affecting many people on lower earnings can be much more complex than the overly generous tax reliefs enjoyed by the very wealthy.

We’ve done the same. Registered for child 1 (as we qualified at the time), but didn’t bother for child 2. I keep meaning to find out how to register her, but it keeps falling to the bottom of the to-do list. Not worried too much from a pensions perspective (as I’ve worked all the way through), but probably should bear it in mind for the future (esp as I signed across NI credits to my in-laws when they did childcare a few years back).

Excellent article. The multiple marginal tax traps created by Osborne and his mates urgently need to be replaced by a simpler system which incentivises work and doesn’t punish the innocent and unwary. Hopefully the next govt will have this as a top priority.

Keep Dreaming

Up until 1988 the wife’s income was includedin the husband

Think this says how disfunctional people’s minds are

Yes it’s dystopian for a wife to be forced to attribute her earnings to her husband for tax purposes.

However, were there to be an option for couples in a marriage or civil partnership to file a household tax return, there are plenty of households for which that would be of great benefit.

It worked well for us when I was able to claim tax relief at the higher rate on my wife’s pension contributions – her earnings were below the tax threshold.

It used to be quite beneficial, a kind of wedding present from the Government to the happy couple!

But where both spouses worked it was described as “a tax on marriage”.

Because there was only one personal allowance.