In the last few months we may have given the impression that someone earning £50k, with three children under 18, faced a marginal tax rate of 68%. We may have suggested that this was a disincentive to work, contributed to a shortage of key workers and even held back economic growth. We may have used words like “indefensible” and “disgrace”.

We now realise that our analysis failed to take into account the uprating of child benefit, and in fact the marginal rate in this scenario will be 71%, not 68%. A graduate in this position repaying a student loan can face a marginal rate of 80%.

We also wrongly suggested that someone earning £50k and with six children under 18 faced a marginal rate of 90%. The correct marginal rate is 96%.

We can only apologise for what is an unacceptable error, and would like to make clear for the record that a marginal rate of 71%, 80% or 96% is absolutely fine, and the effect on the individuals involved and the economy as a whole is completely unimportant.

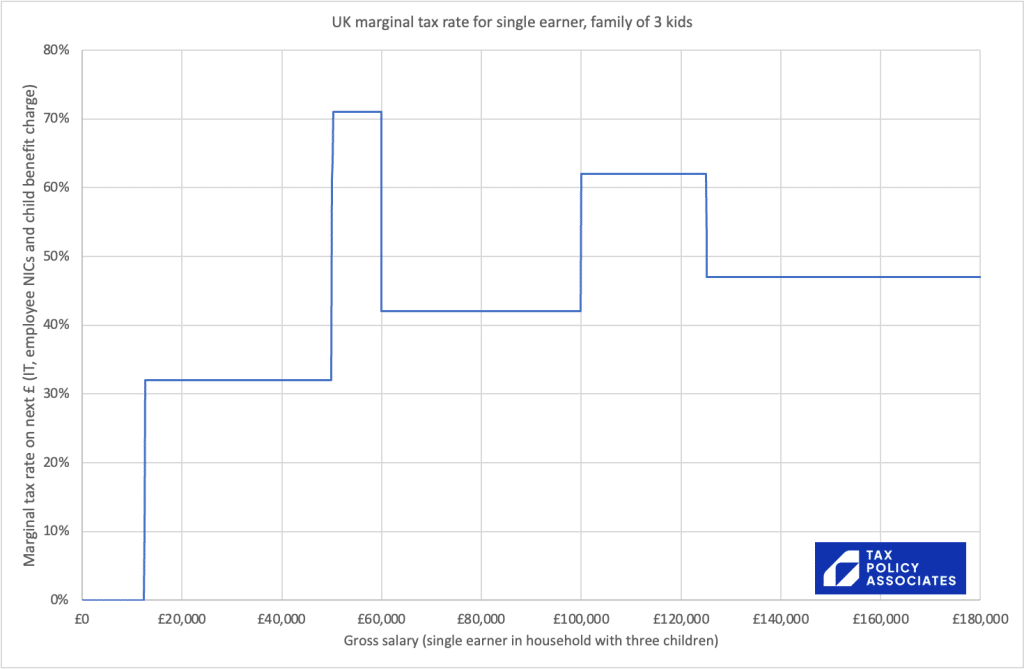

The corrected chart showing the child benefit withdrawal/CBHIC effect:

And including student loan repayments:

The spreadsheet model is available here. Note these figures are for the UK excluding Scotland. The Scottish rates are higher.

11 responses to “Marginal rates – an apology”

You also need to factor in the loss of 30 hours free childcare and tax free childcare at 100,000.

This ends up at a 100% marginal tax rate!

I think I made it rather higher than that – see https://heacham.neidles.com/2023/09/24/70percent/

The interaction between the tax and benefits systems is never a particularly happy one (assessment on the individual for the tax year, versus assessment on the household for the week or month, for example). I wonder what the alternative would be. Perhaps just abolishing the HICBC. Given the number of cases popping up at the tax tribunals that may be the right thing to do.

It seems that about 350,000 people pay the HICBC and that brings in about £400 million. And there are approaching 700,000 of the 7 million families registered for child benefit who don’t claim (and another bunch of eligible people who don’t claim at all – take up is around 90%).

So abolishing the HICBC – and assuming everyone entitled then claimed – could cost around £1 to 2 billion. Equivalent to about a quarter to half a penny on the basic rate. Small beer. Except for those currently caught by the charge.

The theoretical possibility is bad enough, but I wonder how many families have six children and are actually caught by this earnings trap? ONS statistics suggest there are about 170,000 families with seven or more people (not necessarily five or six children: they could be multigenerational). So that is an approximate upper bound. From the income tax ventures, £50k puts a person in the top 10% of earners (90th centile). So perhaps a few thousand families.

Do we need some sort of shield to protect people from excessive marginal tax rates?

Oh, this is what I get for commenting on your most recent post without reading the previous one first. It looks like we agree.

Going by the latest ONS data at https://www.gov.uk/government/statistics/percentile-points-from-1-to-99-for-total-income-before-and-after-tax, £50k income before tax is exactly the 85th percentile. Assuming that:

a) having children does not alter their incomes from the averages,

b) the chances of any of the parents being in any income percentile are independent,

we get 1-0.85*0.85 = 27.75% families impacted by CBHIC.

Multiplying that by the 170k families, and assuming that 2/3 of them reach 7+ members due to factors other than >= 6 children, gives us

1/3 * 27.75% * 170,000 = ~15,000 families

The difference in families impacted is not big, but it’s fascinating how frozen tax bands impact back of the envelope math – from 90th percentile to the 85th! And the ONS data is from 2021, so it’s probably ~83rd percentile now.

Thanks for doing the math! Seems very likely that post-2021 inflation takes that to over 30%…

I subconsciously made one assumption that might be overstating this % – I assumed all families had both parents

15% of families had a single parent in 2019 according to https://www.ons.gov.uk/peoplepopulationandcommunity/birthsdeathsandmarriages/families/bulletins/familiesandhouseholds/2019#london-had-the-highest-proportion-of-lone-parent-families-in-the-uk-in-2019

So multiplying the % dual parent households impacted by the proportion of dual parent households, and adding the proportion of single income households impacted multiplied by the proportion of single income households gives us

27.75% * 0.85 + 15% * 0.15 = 25.8375% households impacted

Those are all back of the envelope calculations though – the variables are not really independent and trying to go deeper than ~1 in 4 families are impacted requires more data.

I currently say “about a third” in the article. Even after inflation, that’s perhaps over-stated? “Somewhere between a quarter and a third” perhaps?

You are right – 50k was the 85th centile in 2020/21 not 90th. I misread the spreadsheet and took the row and not the percentile point.

And we are most interested in those between 85th and 90th centiles (about 50k to about 60k) with the ridiculously high marginal tax rates.

So perhaps a quarter of families affected by the HICBC including perhaps 5 to 10% suffering the worse marginal rates.

On 6+ children, table 5 of the ONS families and households dataset give the number of 7+ person households as 171,000 with a +/- 33,000 confidence interval. And the child benefit data says about 300,000 families claim for four or more children. So we are in the right ballpark. Probably somewhat fewer than 100,000 families with 6+ minor children.

Earnings in two-parent families are not independent of course and I suspect there may be some bunching below £50k each and then below £100k each to avoid these tax and benefit problems.

I wonder if HMRC has the data to truly understand how widespread a problem this is.

Thanks for highlighting this important topic. It would be great to see this analysis as well for total cost to the employer (i.e. including employer’s NI). It seems to me that the distinction between employers and employees NI is there mainly to conceal from the public how much tax their employment attracts. As a business your budget envelope – or bonus pot – to pay someone is £x amount, and that needs to include the full cost inclusive of employer NI… also it increases the delta between payroll taxes and CGT/carried interest.