UPDATED 1pm on 13 October with comment from HSBC UK

Here’s “property guru” and Youtuber Ranjan Bhattacharya promoting the Property118 tax avoidance scheme:

Part of the Property118 scheme involves the landlord borrowing under a “bridge loan” for a few hours, with the money moving swiftly between three different bank accounts all controlled by the lender. The claim is that this magically avoids £100k+ of tax for the landlord.

But what kind of lender would facilitate such a scheme?

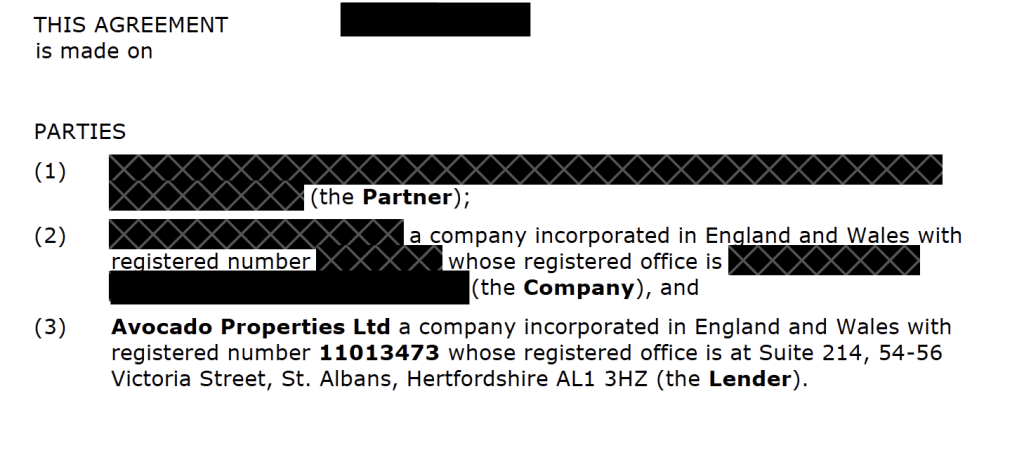

Who owns Avocado Properties Ltd?

Rajan Bhattacharya.

If what Property118 says is true, Avocado has made hundreds of such loans, charging a 1% fee each time. So Mr Bhattacharya has been paid more than £500k for facilitating the scheme.

His failure to disclose that in his promotional videos is startling – a breach of Advertising Standards Association guidance and YouTube’s own rules. But that’s the least of it.

When HMRC challenge the arrangement, which we expect they will, the landlords involved will potentially have to pay hundreds of thousands of pounds in tax, interest and penalties.

And Property118 and Mr Bhattacharya’s companies could be liable for fines of up to £1m for failing to disclose the scheme to HMRC.

The short summary above doesn’t do justice to how brazen the scheme is – full details are below.

Why hasn’t HMRC challenged the scheme yet?

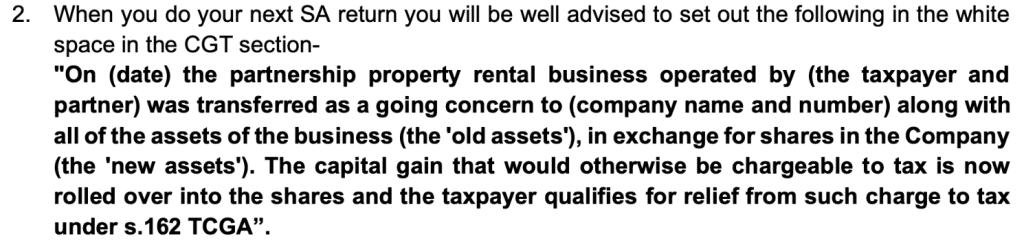

Because Property118 tell their clients not to mention the bridge loan when they file their self assessment return:1We have seen the exact same wording for multiple clients. The fact they don’t even complete the company name illustrates quite how standardised Property118’s advice is.

Actually the business is sold for shares PLUS the assumption of the bridge loan (and other liabilities). Property118 surely know this, because their own documents say it. We expect they also know that the assumption of liabilities is highly relevant to incorporation relief, particularly when tax avoidance is involved. But they provide clients with disclosure that ensures HMRC don’t find out.2That wording also means HMRC doesn’t find out about the trust, or the assumption of the mortgage liabilities.

The scheme

When a company makes a profit, it pays corporation tax. If it then pays the profit to its shareholders as a dividend, they pay tax on that. But if it can use the profit to repay a loan from the shareholders then they don’t pay tax on the loan repayment.

Standard (and legitimate) tax planning on incorporation takes advantage of that. In the standard approach, the landlord sells property to the newly incorporated company in return for (1) shares, (2) assumption of mortgage debt, and (3) a “loan note”3Why a loan note and not a loan? Because, conceptually, the company is then giving something (the loan note) as part of the purchase price for the properties. In part because the tax treatment for the company is more certain, as a loan note is clearly a “loan relationship” for tax purposes, and simply leaving money on account may not be (or similar) issued by the company to the landlord. Future profits can be used to repay the loan note.

That is uncontroversial, but has the disadvantage that the sale of the property to the company will be subject to capital gains tax.

Property118 think they’ve found a way to avoid the capital gains tax and extract profits by a tax-free loan repayment.4This is an update of our earlier piece here – we have since learned more about the scheme mechanics, thanks to a detailed review of the scheme documentation and bank account statements. We have also been able to confirm the identity of the parties.

An example: let’s take a landlord who owns properties worth £1m, has a mortgage of £500k, and wishes to transfer the properties to a newly incorporated company.5The actual figures we’ve seen are typically twice as large as this, but we’ll use the same figures as in our original explanation, in the interests of clarity.

Step 1 – The loan

Avocado Properties Limited lends £450k to the landlord. So, on paper, the arrangement looks like this:

In reality, the money actually goes from Avocado Properties Limited to an HSBC bank account held by Fab Lets (London) LLP, a company owned by Mr Bhattacharya, held on escrow for the landlord. The landlord never gets the £450k.

Here’s what Property118 tell their clients about Avocado Properties Limited:

I am pleased to confirm I have now submitted your bridging finance application to our preferred lender and that:

-

-

- Your application matches their lending criteria perfectly

- Their processes and documentation have been compliance checked by Cotswold Barristers

- We have a 100% success record with this lender

- We have completed hundreds of loans with this lender

-

And here’s what they say about Fab Lets (London) LLP:

This is another of Ranjan’s companies and was originally purposed as a property management business, so it has the correct structures to securely create and manage clients’ accounts in a fully compliant, insured and ring-fenced manner.

The reality:

- Avocado Properties Limited is not a regulated lender, despite apparently making hundreds of loans to individuals.6It can be a criminal offence for an unregulated company to carry out “unauthorised business” such as making a loan to an individual. Not all lending is required to be regulated; however in this case, the exemption for loans made “wholly or predominantly for the purposes of a business” may not apply, because the loan is not for the business, it’s for the personal tax benefit of the landlord. The exemption for loans to high net worth individuals might have applied if the loan included an appropriate declaration, but it does not. The absence of a declaration suggests that Property118 may not have taken appropriate legal advice. However, we take no position on the substantive question of whether the lending was unlawful .

- Fab Lets (London) LLP is not regulated to act as an escrow agent, despite apparently having a significant escrow business.7Escrow agents are generally required to be regulated under the Payment Services Regulation 2017, breach of which may be a criminal offence. We take no position on whether Fab Lets (London) LLP is in breach.

- As far as we are aware, Fab Lets (London) LLP has no insurance that would cover this arrangement.8Fab Lets is a member of the Property Ombudsman. That doesn’t make it insured to operate escrow accounts. There is no evidence of any “ring-fencing”. Why did Property118 claim otherwise?

- There may also be a breach of HSBC’s account terms.

There are obvious questions as to the regulatory propriety of these arrangements, but that is not our expertise. We will leave such matters to regulatory lawyers and the FCA. The remainder of this report will focus on tax.9There are additional VAT questions for Mr Bhattacharya’s companies: does the exempt lending activity impact VAT recovery by Avocado? Should VAT be charged on the escrow services? We have insufficient facts to comment.

HSBC has now seen this report. A spokesperson for HSBC UK told us:

“HSBC has zero tolerance for the facilitation of tax avoidance schemes using HSBC products and services.”

Our assumption is/was that HSBC had no knowledge or involvement in the scheme.

Step 2 – Novation

Immediately after the bridge loan, the landlord’s new company buys the rental properties. In return, the company issues £50k of shares to the landlord, and agrees to assume responsibility for the £500k mortgage and the £450k bridge loan (under a “novation”).

In theory, it’s this:

In practice, nothing happens, and no money moves.

Step 3 – Director loan

The landlord now makes a £450k “director loan” to his company, using the £450k advanced under the bridge loan in step 1:

In practice, Fab Lets (London) LLP transfers the cash from the first HSBC bank account (supposedly held on escrow for the landlord), and moves it into a second HSBC bank account (but now supposedly held on escrow for the company).

Back in the real world, the landlord isn’t lending £450k, because the landlord never really had £450k.

Step 4 – Repayment

Immediately afterwards – this is all happening on the same day – the company uses the £450k to “repay” the bridge loan. In theory:

In practice, Fab Lets (London) LLP returns the £450k to Avocado Properties Ltd. The money never left Mr Bhattacharya’s control.

The intended consequences

There are four intended consequences:

- The company now magically owes £450k to the landlord under the “director loan”, despite the landlord never having £450k and the company never receiving £450k. The next £450k of profit made by the company can be paid to the landlord as a repayment of the “loan” – and the landlord won’t be taxed on it. That’s saved/avoided up to £177k of tax.10The highest marginal rate of tax on dividends is 39.35%

- Incorporation relief applies so there is no capital gains tax because, thanks to the HMRC concession that allows a company can assume liabilities of the business.

- Rajan Bhattacharya has made £5,25011A 1% fee plus £750 “contribution towards administrative costs” for moving £450k between three bank accounts in the course of one day. If Property118 have really “completed hundreds of loans with this lender” then Mr Bhattacharya has made well over £500k in total.12That seems a very conservative estimate. The loan in this example is small by Property118’s standards. “Hundreds” would usually mean at least 200. So we could easily be talking over £1m

- Property118 has made a £4,500 “arrangement fee”.

The actual consequence – a large CGT hit

When a landlord incorporates their property rental business, an important and legitimate part of the tax planning is ensuring “incorporation relief” applies to prevent an immediate capital gains tax hit on moving the properties into the company.

That requires (amongst other conditions) that the property is sold in consideration for shares in the company, and only for shares.

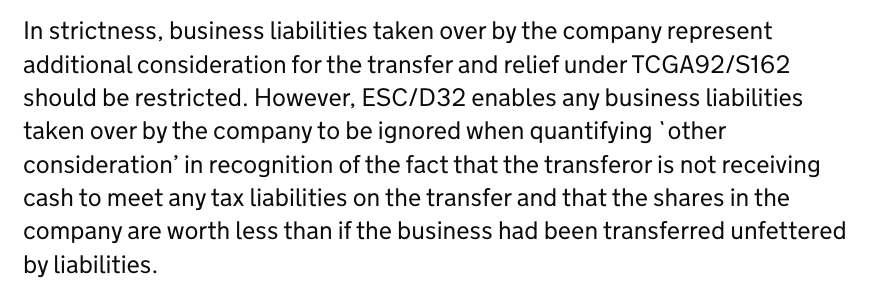

By concession, HMRC also permit the company to take over business liabilities of the landlord:

In the Property118 scheme, the bridge loan is taken over by the company; but the problem is that it’s not a “business liability” of the landlord. It barely exists at all, and certainly isn’t used for the landlord’s business.

Oh, and HMRC expressly say that this concession can’t be used for tax avoidance:

So incorporation relief is DOA. Not “it’s doubtful the relief applies” or “some would question whether the relief applies”. We see no reasonable basis for believing incorporation relief applies to the assumption of debt in such circumstances. That means a large up-front capital gains tax hit for the landlord, probably around £130k on the numbers in the example above.1395% (the proportion of non-share consideration) x 28% (the CGT rate) x £500k (assuming the property has doubled in value). The landlord could argue that incorporation relief should still apply for the assumed mortgage, but not for the bridge loan, roughly halving the CGT cost – however HMRC are entitled to disapply all of ESC D32.

If the bridge loan had been properly disclosed to HMRC we expect that HMRC would have raised this point. However, Property118 tell their clients not to mention it:

We asked Property118 why they do this. They didn’t respond, so we have to speculate. Our view is that no reasonable adviser would advise a client to mis-describe a transaction to HMRC. Best case, it’s carelessness, for which penalties apply. Worst case, it’s deliberate and concealed, and we are into serious penalties. We still believe Property118 are incompetent rather than dishonest… but if we are wrong, and this is dishonesty, then we get into criminal tax fraud territory.

Another consequence – the “director loan” isn’t a loan

This is an artificial tax avoidance structure. The bridge loan is taken immediately prior to incorporation for no purpose other than tax avoidance. Money is then moved in a predetermined circle for no purpose other than tax avoidance, and achieves no result other than tax avoidance. The bridge loan doesn’t even exist for a whole day. Structures of this kind have been repeatedly struck down by the courts over the last 25 years.14We are only aware of one such scheme that wasn’t defeated – SHIPS 2, essentially because the legislation in question was such a mess that the Court of Appeal didn’t feel able to apply a purposive construction. The consequence of that decision was the creation of the GAAR, which doubtless would have kiboshed SHIPS 2 had it existed at the time

So the question is: despite that artificiality, can the director loan be used to facilitate tax-free profit-extraction in the same way as the “loan note” in the standard version of the structure?

There are several ways this could be viewed:15Our original draft suggested the second scenario was more likely; on reflection we think that would be a harsh result. The CGT element of the structure still fails, but the taxpayer may avoid a double tax disaster

- Realistically, the bridge loan did nothing and can be disregarded – but the director loan can still be viewed as part of the consideration for the sale of the property. In other words, if we step back and ignore the silly intermediate steps, the landlord sold the property to the company for consideration comprising: shares, the assumption of the mortgage debt, and another £450k which remains outstanding as a director loan. In this scenario it’s clear CGT incorporation relief fails. But future profits can be paid out on the director loan without suffering income tax. The structure failed to achieve its CGT aim, but did achieve the basic planning aim of the standard structure… in a much more complicated way and at much greater expense for the landlord.

- The bridge loan didn’t exist and neither did the director loan. So future profits can’t be paid out on it, and the structure fails completely. This seems a harsh result. Can HMRC really say the director loan exists enough to kill CGT incorporation relief, but not enough to shield future profits from income tax on dividends? HMRC has a history of running such harsh “double tax” arguments when attacking tax avoidance schemes, but not always successfully.

The consequence of failing to disclose to HMRC

Most tax avoidance schemes are required to be disclosed to HMRC under the “DOTAS” rules. The idea is that a promoter who comes up with a scheme has to disclose it to HMRC. HMRC will then give them a “scheme reference number”, which they have to give to clients, and those clients have to put on their tax return. The expected HMRC response is to challenge the scheme and pursue the taxpayers for the tax.

For this reason, promoters of tax avoidance schemes typically don’t disclose, even though they should. This is often on the basis of tenuous legal and factual arguments, to which the courts have given short shrift16See e.g. the Hyrax case, where the tribunal described as “incredible” the evidence of one witness that she wasn’t aware the transaction was involved tax avoidance. One recent example was Less Tax for Landlords, who were adamant their structure was “not a scheme” and so not disclosable. HMRC disagreed.

It is, therefore, unsurprising that the Property118 structure has not been disclosed under DOTAS. In our view, it clearly should have been. The structure has the main purpose of avoiding tax – indeed that’s its sole purpose. The high fees charged by Property118 and Mr Bhattacharya are the kind of “premium fee” that triggers disclosure17The terminology is that the premium fee is a “hallmark”. Other plausible hallmarks are the “standardised tax product” hallmark (given how standardised the documents and advice appear to be), the “financial products” hallmark (given the off-market nature of the arrangements), and the “confidentiality hallmark” (given the fact the arrangement appears to be hidden from HMRC).

The failure to disclose means Property118 may be liable for penalties of up to £1m. It also means that HMRC could have up to 20 years to challenge the landlord’s tax position.

Mr Bhattacharya’s companies may also be liable as “promoters”, as their role administering the transaction may make them a “relevant business”. HMRC say:

How do Property118 defend the structure?

We asked Mr Bhattacharya and Property118 for comment; neither responded.

In the advice note Property118 sends to clients, they refer to HMRC guidance in the “Business Income Manual”. Advisers questioning the structure have received the same explanation. But that guidance is irrelevant – it relates to when a company can claim an interest deduction for a loan taken by the company to fund a withdrawal of capital by its shareholders. It has nothing to do with creating a “director loan” out of nothing, and nothing to do with circular tax avoidance transactions.

Property118 have also assured advisers that HMRC have accepted the structure in numerous cases. We are highly doubtful that the true nature of the structure was ever explained to HMRC (and, as noted above, Property118 appear to advise against providing an explanation). Any clearance, or enquiry closure, obtained on the basis of incomplete disclosure is worthless.

These two responses are typical of Property118 and other avoidance scheme promoters. Little or no reference is ever made to the law, and certainly never to tax avoidance caselaw. Instead, HMRC guidance is quoted out of context, and clients are assured that nothing has ever gone wrong in the past, whilst success is (apparently) assured by never revealing the full details to HMRC.

When and if Property118 and Mr Bhattacharya do respond, we will gladly correct any factual or legal errors they identify.

What if you’ve implemented this structure?

We would strongly suggest you seek advice from an independent tax professional, in particular a tax lawyer or an accountant who is a member of a regulated tax body (e.g. ACCA, ATT, CIOT, ICAEW, ICAS or STEP).

If it appears you will suffer a financial loss from the scheme, you may wish to also approach a lawyer with a record of bringing claims against tax avoidance scheme promoters.18It feels inappropriate for us to recommend anybody, but a simple Google search will find examples fairly quickly

We would advise against approaching Property118 given the obvious conflict of interest.

Thanks to accountants and tax advisers across the country for telling us about their experiences with Property118, as well as the clients who contacted us directly. Thanks again to all the many advisers who’ve worked with us on these issues.

Landlord image by rawpixel.com on Freepik. Bank image by Freepik – Flaticon

-

1We have seen the exact same wording for multiple clients. The fact they don’t even complete the company name illustrates quite how standardised Property118’s advice is.

-

2That wording also means HMRC doesn’t find out about the trust, or the assumption of the mortgage liabilities.

-

3Why a loan note and not a loan? Because, conceptually, the company is then giving something (the loan note) as part of the purchase price for the properties. In part because the tax treatment for the company is more certain, as a loan note is clearly a “loan relationship” for tax purposes, and simply leaving money on account may not be

-

4This is an update of our earlier piece here – we have since learned more about the scheme mechanics, thanks to a detailed review of the scheme documentation and bank account statements. We have also been able to confirm the identity of the parties.

-

5The actual figures we’ve seen are typically twice as large as this, but we’ll use the same figures as in our original explanation, in the interests of clarity.

-

6It can be a criminal offence for an unregulated company to carry out “unauthorised business” such as making a loan to an individual. Not all lending is required to be regulated; however in this case, the exemption for loans made “wholly or predominantly for the purposes of a business” may not apply, because the loan is not for the business, it’s for the personal tax benefit of the landlord. The exemption for loans to high net worth individuals might have applied if the loan included an appropriate declaration, but it does not. The absence of a declaration suggests that Property118 may not have taken appropriate legal advice. However, we take no position on the substantive question of whether the lending was unlawful .

-

7Escrow agents are generally required to be regulated under the Payment Services Regulation 2017, breach of which may be a criminal offence. We take no position on whether Fab Lets (London) LLP is in breach.

-

8Fab Lets is a member of the Property Ombudsman. That doesn’t make it insured to operate escrow accounts.

-

9There are additional VAT questions for Mr Bhattacharya’s companies: does the exempt lending activity impact VAT recovery by Avocado? Should VAT be charged on the escrow services? We have insufficient facts to comment.

-

10The highest marginal rate of tax on dividends is 39.35%

-

11A 1% fee plus £750 “contribution towards administrative costs”

-

12That seems a very conservative estimate. The loan in this example is small by Property118’s standards. “Hundreds” would usually mean at least 200. So we could easily be talking over £1m

-

1395% (the proportion of non-share consideration) x 28% (the CGT rate) x £500k (assuming the property has doubled in value). The landlord could argue that incorporation relief should still apply for the assumed mortgage, but not for the bridge loan, roughly halving the CGT cost – however HMRC are entitled to disapply all of ESC D32.

-

14We are only aware of one such scheme that wasn’t defeated – SHIPS 2, essentially because the legislation in question was such a mess that the Court of Appeal didn’t feel able to apply a purposive construction. The consequence of that decision was the creation of the GAAR, which doubtless would have kiboshed SHIPS 2 had it existed at the time

-

15Our original draft suggested the second scenario was more likely; on reflection we think that would be a harsh result. The CGT element of the structure still fails, but the taxpayer may avoid a double tax disaster

-

16See e.g. the Hyrax case, where the tribunal described as “incredible” the evidence of one witness that she wasn’t aware the transaction was involved tax avoidance

-

17The terminology is that the premium fee is a “hallmark”. Other plausible hallmarks are the “standardised tax product” hallmark (given how standardised the documents and advice appear to be), the “financial products” hallmark (given the off-market nature of the arrangements), and the “confidentiality hallmark” (given the fact the arrangement appears to be hidden from HMRC).

-

18It feels inappropriate for us to recommend anybody, but a simple Google search will find examples fairly quickly

22 responses to “A TV property pundit and YouTuber promotes Property118’s tax avoidance scheme. What he doesn’t say: he’s been paid over £500k for facilitating it”

Can I ask what this situation would be if there were no mortgages? If the portfolio was unencumbered and just the equity in the portfolio was being withdrawn.

The following is taken from https://www.gov.uk/hmrc-internal-manuals/business-income-manual/bim45700

“………Although the bank loan is secured on the factory and is shown as a trading liability in the accounts, part of the money has been used to fund drawings in excess of his capital and the profits. The fact that part of the drawings were used to buy a property in Spain does not determine the tax treatment……..

In this example the loan is a liability of the business. The bridge loan clearly isn’t. So it knackers incorporation relief.

Another question on this…

Mark Alexander’s latest article seems to imply that they only use the “bridge financing” as a means of providing liquidity to repay capital accounts. Is this true? He’s written the following:

“This support aims to replace the positive capital account balances of business owners, which are tied up in assets that have already been subjected to taxation, with liquid funds accessible from the business owners’ capital accounts.”

The articles on this website didn’t mention any capital account repayments – I thought the “bridge loan” was simply an attempt to engineer a “business liability” which, it was then claimed, would fall within ESC D32.

I think he’s using “capital account” to mean the landlord’s equity in the properties. Your understanding is correct – it’s an attempt to engineer a “business liability” when it obviously isn’t one.

I’m not defending them but if he’s misdescribing what they’re doing I’d say so. If he’s telling the truth I think the articles need a bit more analysis to cover the capital account point.

For example, suppose a landlord bought a buy to let property for £600k with £100k of his own capital and £500k of debt. It’s now worth £1 million. He has £100k credited to his capital account.

Property 118 get in touch and sell the incorporation structure including bridge loan. How much will the bridge loan be?

If the answer is £450k (as per the explanation on the website) then this is a scam with zero hope of getting within ESC D32. This is what I thought they were doing.

If the answer is £100k (i.e. doing no more than providing liquidity to repay the capital account) it’s not quite as bad as this although HMRC may well deny ESC D32 anyway – for example, on the basis that this is personal borrowing.

I agree with that. It is £100k but it’s a purely personal liability and ESC D32 should be denied. The bridge loan is just theatre. An expensive and concealed way of simply selling the properties for shares plus loan note.

Possibly one could seek clearance from HMRC that ESC D32 still applies (although I doubt it). But filing a self assessment which doesn’t mention the loan at all is improper.

I’d personally update the article to set out exactly what their argument is here and why it’s thought not to work. I think at the moment they do have grounds to say you’re not representing their analysis accurately – presumably it’s something along the following lines:

– HMRC accept in BIM45700 that interest on borrowing incurred to repay capital accounts is deductible

– This presumably means that HMRC accept that any such borrowing is incurred wholly and exclusively for the purposes of the lettings business

– The borrowing can therefore be treated as a business liability within ESC D32

It still looks contrived and vulnerable to an argument that this is personal borrowing but at the same time BIM45700 doesn’t look totally irrelevant to me. The TPA article omitting to mention that the bridge loan is only used to repay capital accounts (if this is true) arguably makes it look worse than it is (and the TPA articles should be “whiter than white”!)

Will be very interesting to see what HMRC produce on this. Googling just now tells me that there are cases at the moment where they’re seeking to deny interest deductions even in circumstances within BIM45700 – and this looks rather worse. If we do get another Spotlight then presumably Mark will blame you & associates for pushing HMRC into going after his perfectly innocent structure!

Definitely strive to be whiter than white, so I will amend to reflect this. You are putting the argument rather more coherently than P118 do (they just jump from the manual and don’t seem to realise it’s not directly relevant). But I don’t buy it: the examples show business loans that facilitate a withdrawal of capital. This isn’t a business loan at all.

I still agree that this is likely to result in CGT. The overall result is very “cakeist” in the sense of generating a debt left outstanding without a corresponding CGT disposal. Taken together with the artificiality of the bridging arrangements, it looks ripe for a Spotlight.

Even if this is wrong then on any view their clients should have been clearly warned that it may trigger CGT – which seems not to have happened. On the legislation this is unequivocally chargeable to CGT – they have designed an artificial structure around an ESC and a passage in the manuals which isn’t directly on point, and which HMRC don’t seem to be very consistent in their application of. This may go to any future claim against them.

Ironically, one argument they may have for no CGT is that their own bridge loan arrangements should be disregarded on a realistic view of the facts – but subsequent profit extractions would then be taxed as dividends.

Another point on this one – sorry for the stream of consciousness…

If HMRC refuse to apply ESC D32 then what is their plan? They have no argument at all on the legislation so would the plan be to seek judicial review?

If so, are they setting themselves a different and higher bar from simply “HMRC have interpreted this wrongly” – would they need to show something like “HMRC decision is so unreasonable that no reasonable authority could have made” (I’m by no means an expert here).

In layman’s terms, and without looking at the exact test that would be applied, would anyone really want to ask a court for judicial review to hold HMRC’s feet to the fire on a structure like this?

Well, quite! Although until now HMRC will have been entirely unaware of the bridge loan, so everything went through on the nod.

I can see these discussions have been heating up!

I thought a bit more about the capital account argument – see below if of any interest.

I *think* they are arguing that the owner is just taking back out their capital account funded by post-tax money – i.e. as they are just “getting their money back” it should be tax free. I don’t think the argument works in this context.

On my example above (property bought for £600k – £100k of own funds credited to capital account, and £500k of debt) then the £100k will form part of the tax base cost of the property. This will then “roll” into the company shares if incorporation relief applies. On a sale of the company the owner will “get their money back” tax free because the base cost will be deducted in computing the gain.

What they are arguing for amounts to the owner “getting their money back” tax free twice – first, through the debt left outstanding they have generated and secondly through the base cost in the company shares on sale or liquidation.

Really what the structure amounts to is “cakeism” – the scheme of the legislation is that they either trigger a disposal and generate a debt left outstanding, or they roll the gain into the shares. They aren’t supposed to roll the gain and simultaneously generate a debt left outstanding.

So, applying ESC D32, there is a serious risk that this is avoidance on the Willoughby definition – i.e. contrary to the intention of Parliament. If HMRC do not agree to apply ESC D32 then the end point as I understand it is judicial review. I can’t recall ever dealing with a case where judicial review has been sought to force HMRC to allow a tax planning/ avoidance scheme. If there are any public law specialists on the TPA team maybe they could comment on how likely this is to be obtained.

I think the “business liability” argument does have some kind of support in BIM45700 but it’s unclear at best that HMRC would agree to apply BIM45700 here (and HMRC seem to be arguing that borrowing to repay capital accounts is not a business liability in more innocent contexts than this). Again, if HMRC say this isn’t a business liability, query what your chances are of getting judicial review with a structure like this.

“We asked Property118 why they do this. They didn’t respond, so we have to *speculate*”

Suggestion if I may: My experience (toerag duty Sol.) always makes me wary of s word. In fact you don’t speculate, you reason. But you don’t know what you don’t know. The specific reasons and scope Cotswold Chambers Opinion or any other Opinion they have disclosed are unknown. Are the advisors and Mr B. being unreasonable? (the u word, bless it). It could all be a jolly big uber fidelis mistake. The foregoing is just my opinion. The null hypothesis. It’s made in good faith and may be a complete load of….

Sterling job. I think Mr Bhattacharya deserves praise for the production quality of his video in comparison to the others. produced by the scheme’s promoters. One commenter from two years ago states “please cut the horse****…

this is a commercial”. I am not going to speculate as to why someone might say that.

I had a feeling Ranjan would be involved somewhere along the lines. Now we know who is funding the bridge just need to expose the solicitor holding then money then all these bunch of ***** can explain themselves to HMRC. And when it does got belly up put the so call indemnity insurance to test. Mark A is deluded if he thinks this is not tax avoidance,

[edited by Dan for legal reasons]

Dan, with regards to ‘If it appears you will suffer a financial loss from the scheme, you may wish to also approach a lawyer with a record of bringing claims against tax avoidance scheme promoters.’ what is your view on the chances that a class action could be brought against P118, Cotswold Barristers or indeed Mr Bhattacharya’s outfits? It sounds like there are a lot of people out there who have been duped by these characters and will be heavily out of pocket when HMRC start to act…

Ranjan’s face is all over their poor-quality cartoon YouTube posts, I’m not surprised he’s mixed up in the racket, i would guess by now Jane there’s a claims company seeking out the depth of this to see if it is worth it , there’s been plenty of speculation and comments from mark alexander boasting about his big cars and houses, how much millions of transactions his property 118 scheme has done, i shouldn’t think it will be too long before we see a post from one claims company or another offering to get your money back no win no fee as usual .!

I’ve been following this case closely out of professional interest.

If I were HMRC i’d be sharpening the claws… Ultimately there are a host of acts under which this scheme is likely to fall foul and HMRC will have their pick of legislation under which to prosecute. This sounds like a cut and shut case for CCO but it will likely be easier to secure a conviction under a more established and tested anti avoidance measure. At best, its negligent advice, realistically deliberate and concealed.

The only semblance of qualification at P118 is a chap called Alex Nurian who holds an ACCA practicing certificate. Anyone who has completed this qualification knows through their studies that they cannot market a scheme such as this, they’ve covered DOTAS and GAAR, unless of course they didn’t sit the Advanced tax module. If Mr Nurian reads this i hope he finds the following link helpful…

https://www.accaglobal.com/gb/en/technical-activities/technical-resources-search/2019/february/professional-conduct-in-relation-to-taxation-pcrt.html#:~:text=Professional%20Conduct%20in%20Relation%20to%20Taxation%20(PCRT)%20sets%20out%20the,members%20who%20undertake%20R%26D%20work.

Edit: I think there may be a typo in the above article, just under the first diagram Fab Lets LLP is referred to as a company where I think it should be referred to as a partnership, although this has no practical baring on the analysis.

Edit 2: I look forward to hearing if the ACCA have any comments on the above given their unfortunate affiliation to P118

General Communication Point:

“An example: let’s take a landlord who owns properties worth £1m, has a mortgage of £500k…”

Of course it’s better to keep numbers round, but using half of the first number invites misunderstandings about “which half?”

In this case if it needs to be easy to split the 500k into 90% and 10%, make the gross value 900k.

thanks, that’s a good point – will bear in mind for next time

Thanks again Dan.

The accounts of Fab Lets (London) LLP for the year ended 30 November 2021 are a bit strange. They are signed by Rajan Bhattacharya on 30 November 2022 as “designated member” but Companies House doesn’t show him as a designated member, or indeed a member at all. The three current members seem to be Mango Properties Limited, YPE Limited and Avocado Properties Limited and Rajan Bhattacharya is shown as a director and a PSC of all three.

Rajan Bhattacharya seems to have retired from Fab Lets (London) LLP on 6 February 2014 (just before the mixed partnership rules came in on 6 April 2014 but s850D ITTOIA may make that a moot point if he personally performs services for the LLP). Out of interest, the LLP’s website also says “Ranjan is also a senior partner in Fab Lets, a North London based lettings and property management company” and runs “interactive” sessions.

thanks – to be fair, small companies make these kinds of mistakes all the time. It’s not necessarily suspicious.

Property118, Cotswold Barristers and eminent KCs are the three wise monkeys. Property118 say HMRC hasn’t won yet so it’s fine, Cotswold Barristers don’t advise on tax and the KC wasn’t instructed to cover anti-avoidance measures.