Less Tax for Landlords is a high profile firm. They sponsor the National Landlord Investment Show and are promoted by the National Residential Landlords Association. They won the Property Reporter award for “Best Accounting & Tax Services 2023“. They’ve sold hundreds of landlords a “hybrid partnership” structure which is supposed to avoid income tax, capital gains tax, stamp duty land tax and inheritance tax. It’s flown under HMRC’s radar, and so avoided about £50m in tax to date. But in reality the scheme doesn’t work, and triggers significant additional taxes. HMRC have just confirmed this. Worse, the scheme will in many cases default the landlord’s mortgage.

Our recent report on Property118 described their trust/company scheme as the worst avoidance scheme we’ve seen. The aim was to enable landlords to move their business to a company, and claim relief on their mortgage interest, without any of the commercial or tax downsides that would normally follow from that. The scheme fails, and likely triggers significant additional tax but, more seriously, in our view (and that of UK Finance) it likely defaults the client’s mortgage.

A plausible explanation was that Property118 is a firm of salespeople with no legal or tax expertise. They are reliant for legal and tax advice on “Cotswold Barristers” – a genuine barristers’ chambers, but a rather peculiar one, with no specialist tax barristers. So it’s not surprising that their attempts to engineer a clever tax avoidance scheme ran awry.

Less Tax for Landlords is different. On the face of it, they have a large, qualified and experienced team. However their explanations for their structure are nonsensical, and their structures will leave taxpayers in a complex mess – a potentially even worse outcome than Property118’s.

Here’s the view of Ray McCann, a retired senior HMRC inspector and past President of the Chartered Institute of Taxation:

“The Less Tax for Landlords structure is nonsense. It lures clients into what they may think are clever interpretations of the law – but actually LT4L are just plain wrong”

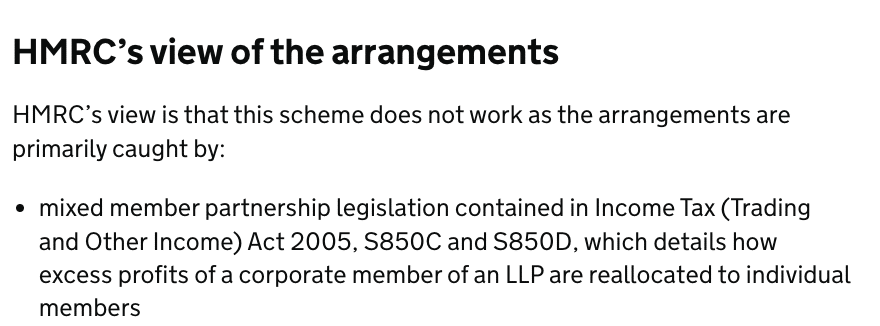

And here’s HMRC’s view:

Who are Less Tax for Landlords?

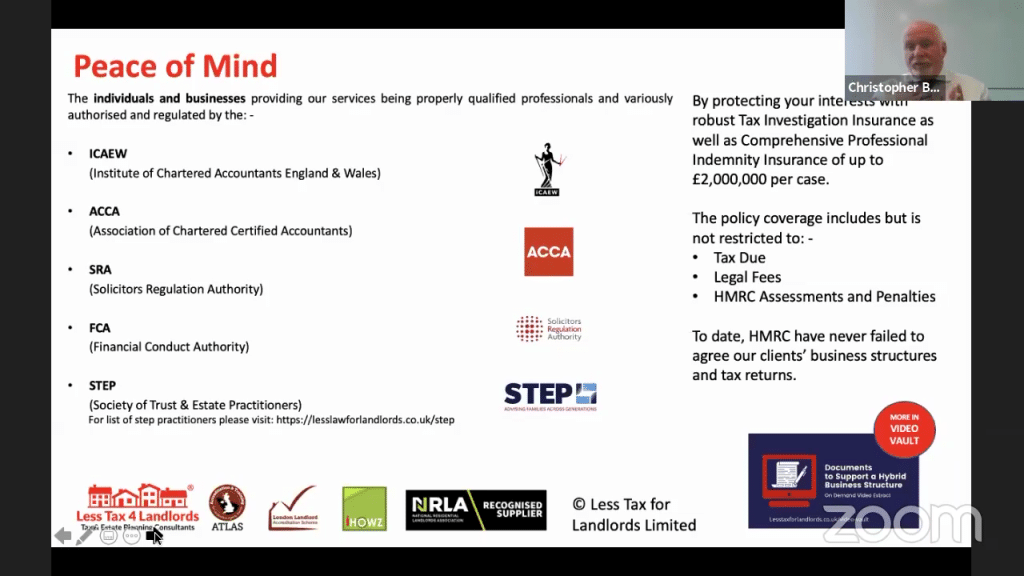

They’re part of the One Consultancy Group, which includes an accounting firm (OCG Accountants), a mortgage broker (OCG Mortgages), an FCA regulated financial services firm (Phare Financial Services) and an SRA regulated law firm (OCG Legal).1Less Tax for Landlords Ltd appears to be just used for marketing; all the work is undertaken by employees of other group members. In the interest of clarity, this report will refer throughout to LT4L. They say their tax services are provided by qualified professionals – solicitors, ICAEW and ACCA accountants, and STEP (trust and estate) practitioners:

Less Tax for Landlords (LT4L) have an established industry profile. They sponsor the National Landlord Investment Show and are promoted by the National Residential Landlords Association:

They won the Property Reporter award for “Best Accounting & Tax Services 2023”:

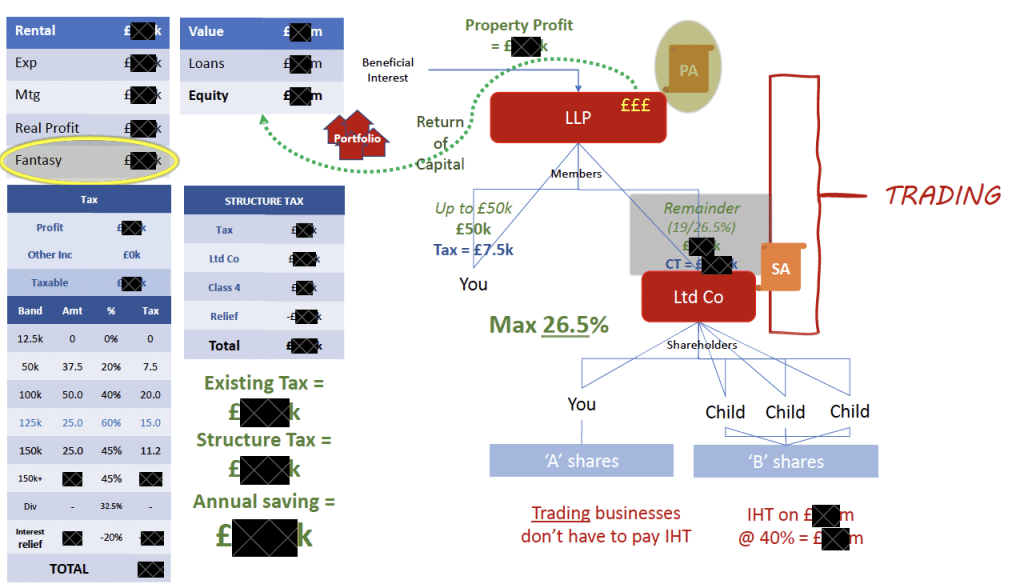

And here’s the typical LT4L scheme.2The descriptions of LT4L’s structure and approach in this report are based on statements made by LT4L on their websites, videos and web forums, as well as reports with advisers who’ve spoken to LT4L’s representatives, and reports from and documents provided by potential and actual LT4L clients. Our understanding is not complete and, in particular, we do not understand the rationale for the debt that LT4L often puts in place between the LLP and its members – the nature of an LLP is such that this is unlikely to create a tax benefit, and could trigger additional tax (particularly SDLT under the very awkward debt repayment rule in Schedule 15 para 17A Finance Act 2003). This is from a document sent to a potential client this year:3We’ve seen numerous almost identical examples going back several years. The only edits we’ve made to this are to mask the figures to protect our source.

This is a very complicated-looking structure for a medium-sized property rental business.

It is supposed to work like this:

- The landlords (say a married couple) establish a limited liability partnership (LLP).

- The landlords become members of the LLP.

- The landlords declare a trust over their properties in favour of the LLP.

- The landlords establish a company which becomes a member of the LLP (or, in some cases, the company becomes a member earlier, at the same time as the landlords).

- The landlords hold A shares in the company, giving them voting rights. Their children acquire B shares in the company, which carry rights to all the increases in value in the company (“growth shares”).4This is fairly standard planning, provided the “growth” shares only become valuable once a growth “hurdle” is reached, say a 20% increase in the value of the business, measured from the date the shares were issued. That makes it much harder for HMRC to claim the growth shares have value on day one (which could have adverse inheritance tax and CGT consequences). However, in the case of LT4L and Property 118, there is no hurdle, and the structure may well be vulnerable to challenge.

- The LLP diverts most of its profit to the company.

The claimed benefits are much more impressive than Property118’s:

- No need to tell the mortgage lender.

- After two years, the structure is entirely exempt from inheritance tax thanks to business property relief (BPR).

- The diversion of LLP profits to the company means rental income is taxed at the corporate rate of 19-25%.5The rate is 19% for profits under £50,000, with a “catch-up rate” of 26.5% on profits up to £250,000, so that the overall effective rate smoothly transitions into the full rate of 25%.

- The trust means the landlords’ obligation to make mortgage payments “shifts to the LLP”, meaning the company as LLP member obtains full tax relief for mortgage interest. The “section 24” restriction on landlords claiming tax relief is avoided.

- No CGT or SDLT on establishment, without needing to qualify for any special reliefs.

- The properties are “rebased” for capital gains tax. In other words, when they’re sold, only the capital gain after incorporation of the LLP is taxed. Pre-incorporation gains disappear.

- Instead of taking profits out of the LLP, you can take capital out instead, and you won’t be taxed.

- There’s no need to disclose the structure to HMRC.

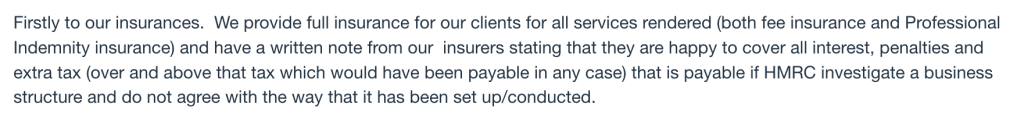

- If the structure triggers unexpected tax, LT4L’s clients are protected by an unusual insurance arrangement:

In reality, every aspect of the structure fails:

- Declaring a trust over the rental properties without the mortgage lender’s consent (or even telling them) will in most cases default the mortgage. The structure was described to us by an experienced broker as “almost unmortgageable”.

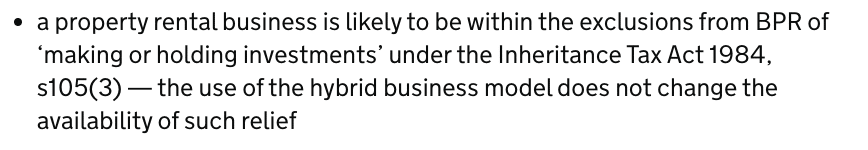

- Rental property businesses don’t qualify for inheritance tax business property relief. The LLP structure doesn’t change that.

- The mortgage obligation doesn’t “shift to the LLP”. It remains with the landlords – who now lose their 20% credit.

- The “mixed partnership” rules mean you can’t get a tax benefit by allocating profits to a corporate partner in an LLP.

- The allocation of profits to the corporate partner means there will be up-front capital gains tax. There’s no CGT rebasing.

- SDLT will be due at the point that income profits are allocated to the corporate member. LT4L’s unusual structuring potentially results in a higher SDLT liability than would result from a simple incorporation.

- The structure can incur additional SDLT every time the profit allocation changes. LT4L’s clients could have unknowingly racked up years of SDLT liabilities.

- The structure is disclosable under DOTAS, the rules requiring tax avoidance schemes to be disclosed to HMRC.

- Members are taxed on profits as they are made; when and how they are taken out is irrelevant. This is a basic principle of LLP taxation.

- There is no special “written note” from LT4L’s insurers. They just have the usual professional indemnity insurance. To get any benefit from that you have to: lose a dispute with HMRC, sue LT4L (with the insurers arguing LT4L’s case, not yours), and win. This is not easy, even if (as we believe) LT4L’s advice is plain wrong.

Advisers and potential clients have been challenging LT4L on these issues for years, and – when they have received an answer – it suggests LT4L are making a series of serious legal and tax mistakes. The response we received from LT4L also suggested LT4L are advising in areas where they fundamentally misunderstand the law.

It’s therefore our opinion that the structure has no realistic prospect of success. It will leave LT4L’s clients in a very difficult position with their mortgage lender and HMRC.

Given LT4L’s high profile, we set out all these issues in detail below. We will publish any further response we receive from LT4L.

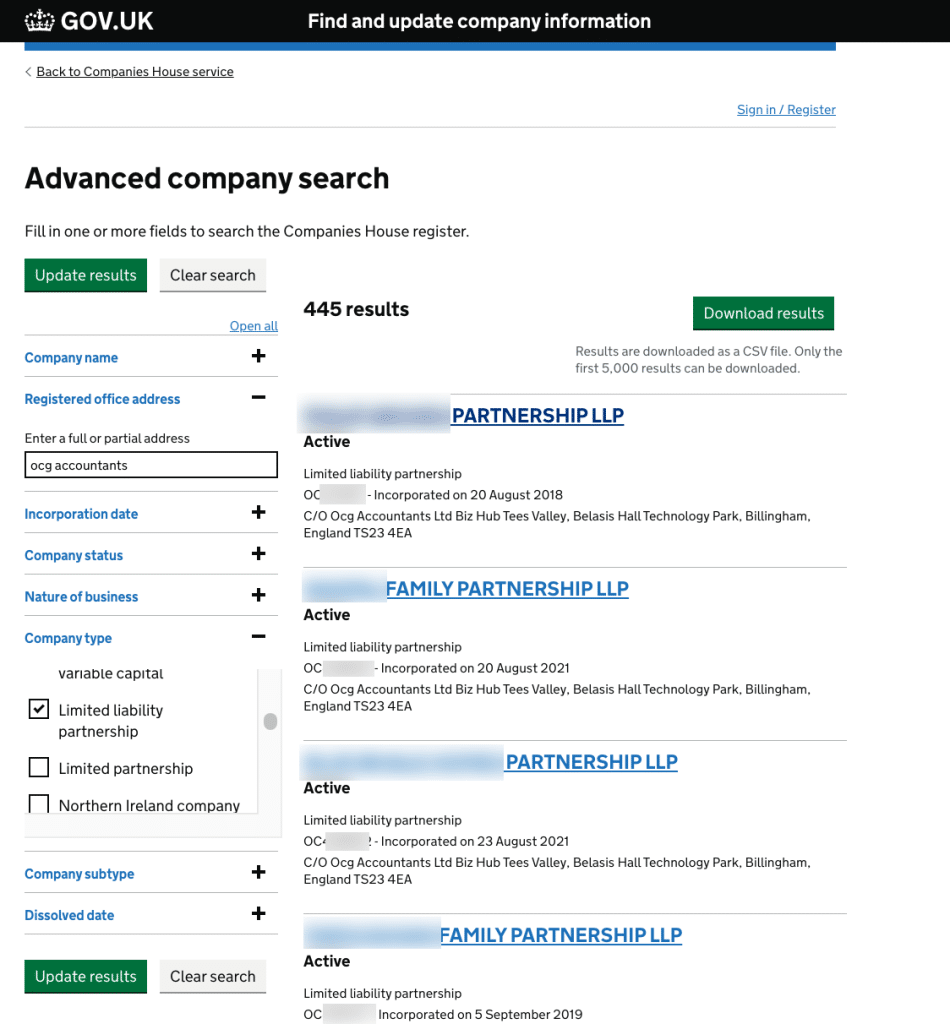

What is the scale of this?

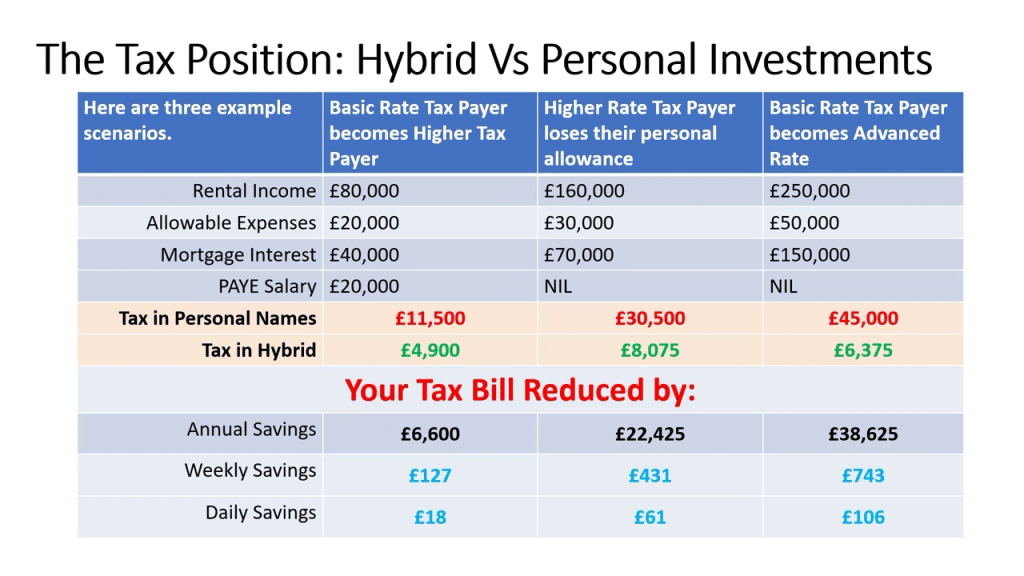

Here’s Less Tax for Landlord’s illustration of a typical tax saving:

That accords with the figures we’ve seen in advice they’ve provided to clients – typical tax savings or (to be more accurate) tax avoided of £40-50k/year.

Less Tax for Landlords have registered 440 LLPs since 2016:6It is possible that some are “normal” LLPs which don’t use the “hybrid” structure described in this report, but we randomly sampled 20 LLPs and each of their accounts were consistent with the hybrid structure. We excluded the earliest five LLPs, as they appear to be unrelated.

That suggests that, over the life of these LLPs, about £50m of income tax has been avoided.7The methodology was simply to take each LLP, multiply £40k by the number of years it had been in existence, then total those figures.8There will also be a much larger figure of SDLT and CGT avoided on the establishment of the structure. The word “avoided” here is not quite correct, because the structure does not achieve the intended result. “Attempted avoidance” is perhaps more accurate.

The mortgage default

Our report on Property118 set out in detail why declaring a trust over rental properties, without the consent of the mortgage lender (or even telling them) in our view likely defaults the landlord’s mortgage.

More importantly than our view is the view of UK Finance, the representative body for mortgage lenders:

“If someone wishes to transfer ownership of a buy to let property they should contact their lender to discuss whether this is permitted under the terms of any mortgage on the property. Transferring ownership of a property into a trust without informing your lender and seeking their consent would most likely be a breach of a mortgage’s terms and conditions.”

We believe UK Finance are right on this. But even if we didn’t agree, we’d suggest that it’s not a good idea to enter into a structure which your lender believes most likely breaches the terms of your mortgage.

We put this point to LT4L. They said:

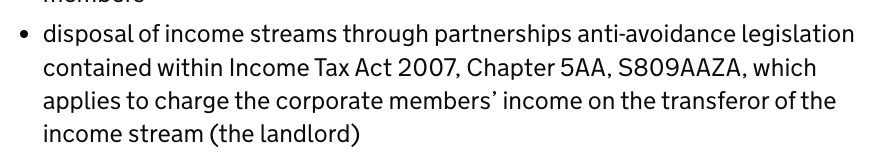

“Whilst having a similar impact [to Property118], we do not use a declaration of trust, just a simple letter of trust. The relationship between the individual member and the LLP is registered with HMRC via the Trust Registration Service.”

A “letter of trust” is a “declaration of trust”. Registration with HMRC is irrelevant to the legal analysis. This answer suggests LT4L do not understand the nature of a trust.

They go on:

“The letter of trust operates to ensure that the contractual rights of the lender are preserved and not prejudiced such that the trust operates in a manner that the rights of the beneficiaries are subordinate to those of the lender.”

This is irrelevant. The question is whether the trust breaches a requirement in the mortgage T&Cs to obtain lender consent. In most cases it will.

“In our experience full disclosure to lenders is always the best policy and our mortgage team constantly discuss with lenders the ever-changing landscape in the mortgage market. Through these discussions we are well aware of which lenders are happy to accept the structure and those that don’t.

We would never advise a client not to tell their mortgage company. If any client is unsure whether the use of this structure may affect their mortgage conditions they can, and do, ask us, and we will provide professional advice on that matter.”

Property118 and LT4L have a slightly different emphasis here. Property118 announce with confidence (but wrongly) that there is no need to tell the lender, or obtain its consent. LT4L seem more cautious around the point – they say above that they “never advise a client not to tell their mortgage company”, but the lender wasn’t informed in any of the specific LT4L LLPs we’ve investigated. LT4L’s founder has also made some very bold (and incorrect) statements on the subject.

This shouldn’t be a surprise, because the entire purpose of the trust structure is to circumvent the need to obtain lender consent. It serves no other purpose. The transaction would be more straightforward if the landlord just sold the properties to the LLP.

LT4L say their in-house mortgage broker can obtain mortgages for the LLP structure, but they will be specialised products. The unusual combination of a trust and an LLP was described to us by an experienced broker as “almost unmortgageable”.

Inheritance tax

Less Tax for Landlords say that a standard company holding rental property is subject to inheritance tax, but their “mixed partnership” structure is not.

The claims

Here’s LT4L’s founder, Tony Gimple (now retired):

“[B]ecause the HMRC recognizes that there is a trading relationship between you all, and that you’ve got a written business plan and that you’re managing it and that your sole purpose is not to avoid tax but to maximize your wealth to tax efficiently as possible, the whole thing becomes inheritance tax free.”

A trading relationship between the participants, a business plan, not having a tax avoidance purpose – all these things are irrelevant to whether inheritance tax applies.

This is from a June 2021 webinar:9You can find the full versions of some of these videos on YouTube; most are freely available on the LT4L website once you’ve registered (but that means we can’t link to them). All the videos are © Less Tax for Landlords, and republished by us for the purposes of fair dealing/criticism.

“The LLP structure that we set up is not investing in property. It does not own the property. The property is owned by the individuals. The LLP has taken advantage of that ownership and it is available… after two years, that LLP turns into a trading business according to HMRC, not according to us, according to HMRC. And at that point, after two years, the equity of those properties inside that LLP are then outside of the estate for inheritance tax after two years. “

The LLP does have beneficial ownership of the property. The LLP does not “turn into a trading business”. HMRC has certainly not said that.

From that same webinar:

“It is outside of your estate for inheritance tax, as long as you tick various boxes”

There are no “boxes” you can tick, literally or figuratively. As we discuss further below, whether an inheritance tax exemption applies is a question of substance.

And:

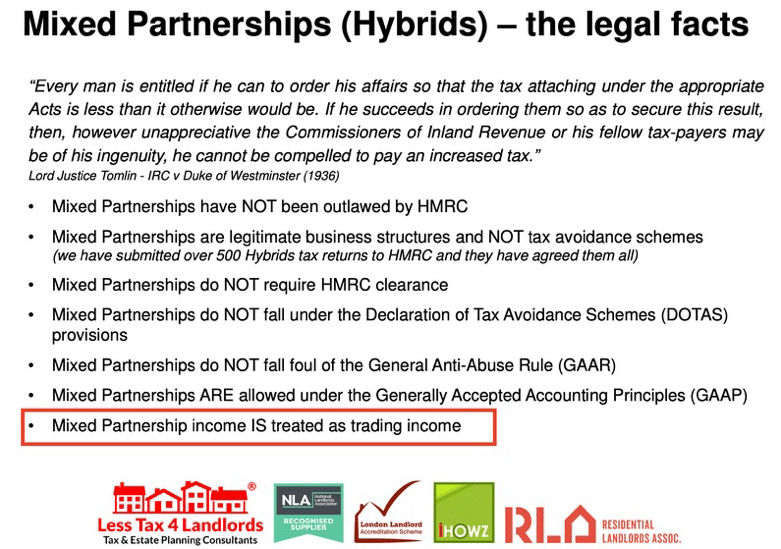

Mixed partnership income is not “treated as trading income” (and it would be irrelevant if it was).10Also: The Duke of Westminster case hasn’t been good law for decades. GAAP doesn’t “allow” (or indeed “not allow”) particular business structures. The “D” in DOTAS is not “Declaration”.

And on their website, right now:

The reality

HMRC say this doesn’t work.

HMRC are, of course, right.

There is an exemption from inheritance tax for certain business property – business property relief (BPR).

Under section 105(3) of the Inheritance Tax Act 1984, a business won’t benefit from BPR if it consists wholly or mainly of one or more of the following: dealing in securities, stocks or shares, land or buildings, or making or holding investments. When an individual holds real estate through an LLP, they are treated as if they held the real estate directly.11That’s a considerable simplification: LLPs and partnerships can make the BPR position worse in several respects, but they cannot convert a non-BPR business into a BPR business.

Almost all property rental businesses consist of holding “investments” (the real estate), and so fail to qualify for BPR. Taxpayers have failed to qualify for BPR even for an actively managed business of letting holiday cottages; in the words of the recent Grace Joyce Graham judgment, it is only “the exceptional letting business which falls on the non-investment side of the line”. In the Graham case, the deceased “lavished” personal care on guests, including making them home-made food, providing them with fresh crab and fish, arranging linen and towels, making cream teas, and organising weddings and other events. The Tribunal thought this was an “exceptional” case but that, even then, it only “just” qualified for BPR.

It’s a question of substance, not legal structuring. So, unless the original rental business was itself “exceptional”, the LLP structure won’t benefit from BPR. There is no inheritance tax benefit to the structure.

This is all well known to tax advisers in this area.

Here’s a summary of the position from the Chartered Institute of Taxation:

![13.2 Reliefs

There are no special reliefs from inheritance tax for let property.

Business property relief (BPR) can apply to the value of assets used wholly or mainly for the purposes of a business.

However, property letting is not regarded as a business for these purposes. Property held wholly or mainly as an

investment will not qualify for BPR (s 105(3) IHTA 1984).

Although a furnished holiday lettings (FHL) business is a deemed trade, it is unlikely to qualify for BPR. To qualify

for BPR the FHL business needs to provide a level of services over and above that which would be expected from a

landlord. This was explored in Pawson (dec) v HMRC [2012] UKFTT 51 (TC) where the executors of the estate won

the argument for BPR to be given at the First-tier Tribunal, but this was overturned at the Upper Tribunal, and leave

to appeal was refused.

The level and type of services needed to make holiday accommodation into a business qualifying for BPR may be

achieved in the case of a caravan park or seasonal short lets where catering, entertainment and other services are

also provided. However, HMRC are very uneasy about granting such relief and will refer any case concerning FHL

property to their technical team (litigation).

Where the accommodation is merely furnished and no other services are provided to the tenants, HMRC conclude

in their inheritance manual: “In most cases the level of services provided will not be sufficient to weigh the balance

away from ‘investment’” (IHTM 25276).](/wp-content/uploads/2023/09/Screenshot-2023-09-30-at-23.13.10-1024x733.png)

Over the years, numerous advisers have challenged LT4L on this point – we’ve seen emails and transcripts of calls where LT4L simply refuse to answer questions on the subject (and there’s a public example of this here).

We have spoken to numerous inheritance tax specialists – KCs, academics, accountants and solicitors – and they are mystified by LT4L’s claims. One eminent KC described LT4L’s approach as “mad and hopeless”.

Less Tax for Landlords’ response

We do not work with all landlords, at least not in relation to a Mixed Partnership structure, and for those we do work with, we look to help them commercialise their operation and introduce more trading activity into their business model.

The BPR test as you know is about being ‘wholly or mainly’ involved in trading activity.

You can’t “introduce more trading activity” into a rental property business and qualify for business property relief. The scale and sophistication of the business is irrelevant. Only the “exceptional” property rental business will qualify for BPR 12Or businesses which use the property as part of a business, e.g. a hotel or, in a recent case, a livery business.).

Regarding [their claim that “mixed partnership income is trading income”], we assume that your quote was taken from a slide last used in 2019? It is not a correct statement hence it hasn’t been used for a number of years.

What is true to say though is that we have had correspondence with HMRC where they have agreed that the partnership income received from the LLP is treated as trading income and as such, the clients pay the appropriate Class 2 and Class 4 National Insurance contributions.

Despite the denial in that first paragraph, it seems from the second (and the material referenced above) that LT4L do believe their structure somehow creates trading income (it doesn’t), and that trading income means BPR would apply (it wouldn’t).

It is possible that HMRC might have accepted a position of “trading” for income tax purposes – that would be technically wrong, but HMRC would have no reason to scrutinise the position too heavily. It does not follow that HMRC has accepted BPR status and in any case, the classification of the profit share in the hands of the partner of the LLP for the purposes of his or her national insurance contributions does not automatically extend to other taxes, and has no relevance for the purposes of determining whether BPR will apply for the purposes of inheritance tax. As a result, any clearance received on the income tax position cannot be relied upon for BPR purposes. All the advisers we spoke to believed HMRC would resist such a claim.

LT4L have claimed that they have had clients who died and whose estates successfully claimed BPR. Unless those clients were actually managing a hotel (or similar BPR-qualified business), we do not see how that was possible. Either HMRC made a serious mistake or – more likely – LT4L failed to disclose the reality of the business to HMRC. In such a case, HMRC would have at least six years to investigate, and potentially twenty years.

Mixed partnership rules

A key element in the LT4L structure is that the rental properties are sold to the LLP by the landlord, who becomes a member of the LLP. The landlord also sets up a company, which becomes a member of the LLP. Then, despite the fact the landlord contributed all the value to the LLP, profits are disproportionately allocated to the company. Which is the LT4L “special sauce” – the company supposedly gets to fully deduct the mortgage interest from its profits.

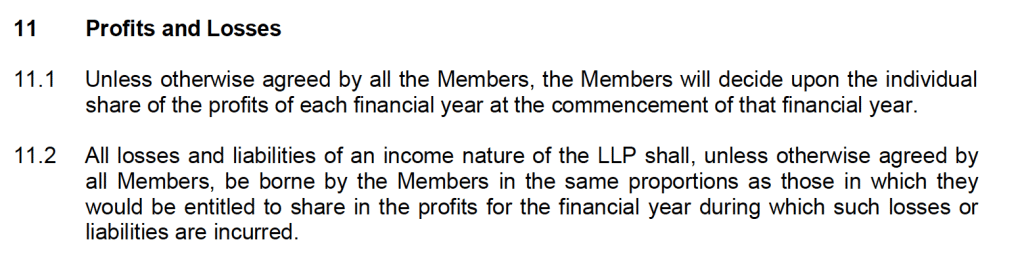

The standard LT4L LLP agreement is explicit that profit can be allocated between the members however they like:

And:

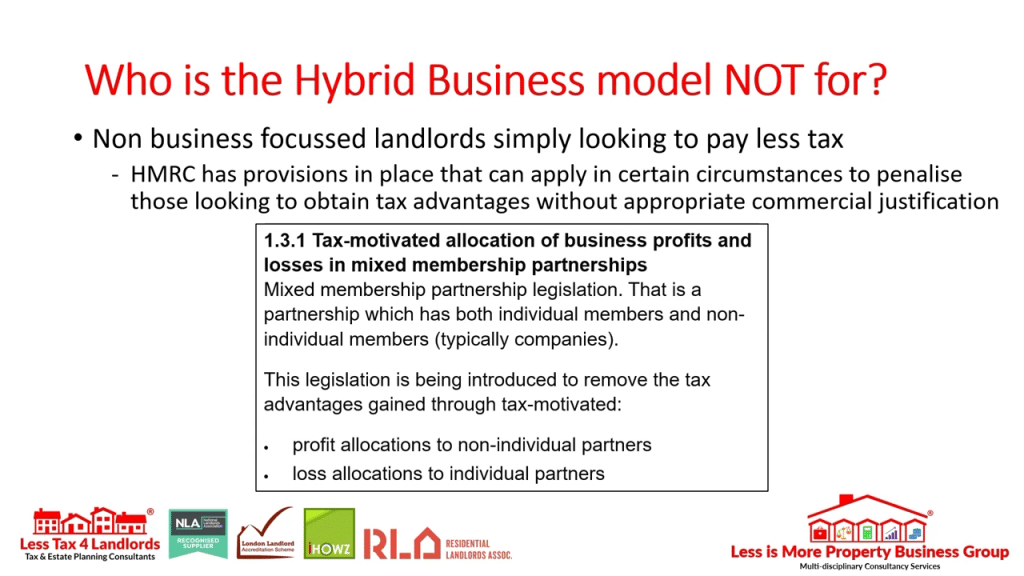

Most people would describe this as tax avoidance – profits are being artificially allocated to one member of an LLP solely for tax reasons. And rules were introduced in 2014 to counter this – the “mixed partnership rules”.

These rules (broadly speaking) stop partnerships and LLPs allocating income to different partners in a way that obtains a tax advantage. The effect of the rules is (essentially) to undo any allocation to an LLP member that exceeds a commercial return on the capital or services the member provided. That is a big problem for the LT4L structure, because the corporate LLP member is receiving a large profit share, creating a tax advantage, when it provided no capital and provided no services.

LT4L clearly sense there’s an issue here, because they created a video to specifically address the point:

” In all our cases we ensure that all our LLPs have proper business planning and they have reasons for doing what they do. In simple terms, if these are followed then the mixed partnership rules which were built to stop tax avoidance will not apply to the partnerships because they are used for business purposes. HMRC quite rightly are attempting to stop tax avoidance. “

That’s their consistent line:

“As I said all the way through my presentation, there are rules that HMRC have put in place to stop people using the structure for tax avoidance reasons. So everything that you do has got to be business generated and has got to be in line with the business objectives where the business is going. If that’s the case, then what’s being referred to here are what’s called the mixed partnership rules that came out in 2014 and those rules relate to people where the main reason for dealing with the structure is tax avoidance. Clearly, it’s not the case with our clients because of because of the business structures that we put in place and therefore, we are outside of those rules.”

The same approach is set out in a “technical FAQ” that LT4L circulated in 2022:

And in this recent presentation:

So, in short, the LT4L answer is that there’s no need to worry about the 2014 legislation, unless there is a “tax motivation”. This is hopelessly wrong as a matter of tax law.13The FAQ has other errors too. This is not a “power” of HMRC – it’s a rule that applies as part of the usual self-assessment rules. PwC is not a mixed partnership (and indeed professional partnerships rarely are mixed partnerships). The FAQ also cites the Duke of Westminster case, which hasn’t been good law for forty years. It’s also a bit silly, when it’s clear their profit allocation to the corporate member of the LLP is entirely tax motivated.

The rules don’t contain a motive or purpose test.14In a case like this, where the individual partner has the “power to enjoy” the profits of the corporate partner, because he is connected to it. The key question is (broadly) whether the profits are being allocated to the corporate partner because of the individual’s control of the company. It is fairly clear that is what is happening.

In the LT4L structure, the corporate member provides no capital and no services – it follows that all the profits allocated to it will be reversed by the mixed-partnership rules. The overall commerciality (or not) of the structure isn’t relevant.

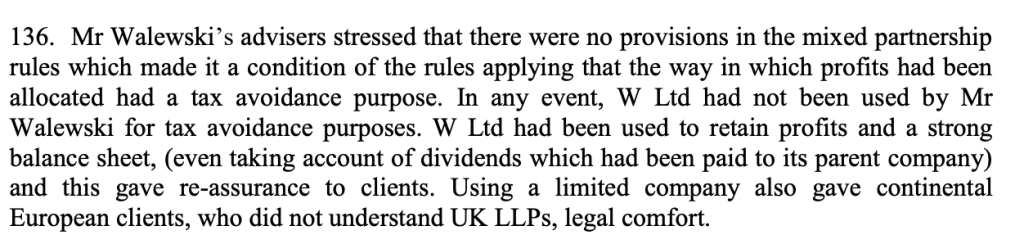

There has been one decided case on the mixed partnership rules, Walewksi. LT4L say they’ve read the judgment “very carefully“, and have a video specifically on the case:

“the court found that the structure was set up purely for tax evasion or tax avoidance”

This is false, and suggests LT4L didn’t in fact read the case. The taxpayer’s own advisers said the application of the rules wasn’t dependent on a tax avoidance purpose:15There is a good summary of the case here.

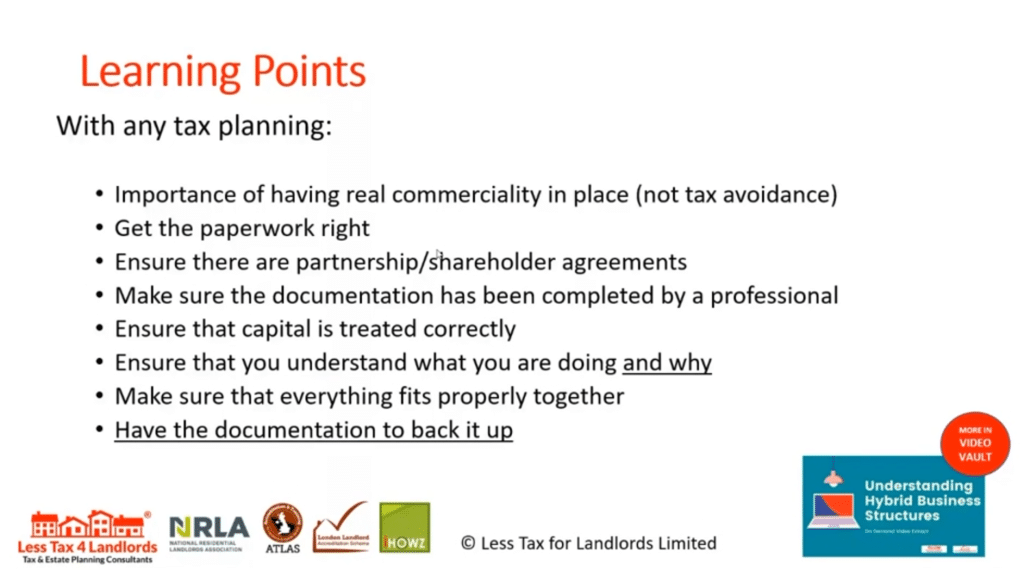

LT4L appear to believe that it was the lack of documentation which sunk Mr Walewski’s structure:

This is not correct – the problem was that the allocation of profit to the company didn’t reflect capital or services it had provided. LT4L’s structure has exactly the same problem. Documentation won’t solve this, and you can’t manufacture “real commerciality”.16The video is full of other errors. In particular, LT4L don’t understand that “power to enjoy” is a defined term which was somewhat difficult to apply to Mr Walewski’s trust, but is very easy to apply to the connected company in their structure.

We have spoken to numerous advisers who have made these points to LT4L and received no response. There is a typical exchange here.

None of the positions above are controversial or difficult; they reflect the general view of tax advisers on the mixed partnership rules. We are aware of one instance, soon after the rules came into force in 2014, where an experienced adviser sought a clearance from HMRC on facts somewhat similar to LT4L’s, in the hope that HMRC would not apply the rules literally. HMRC’s response was that they would, and the mixed partnership rules applied.

And HMRC now has a public statement saying the same thing:

LT4L’s response

We asked LT4L why their material referred to the purpose or justification of a structure, when that wasn’t relevant to the mixed partnership rules. We mentioned one example where they had said the rules only apply “where you are doing a hybrid structure purely for tax motivated reasons”. This was their reply:

“This should not be the words being used and we would look to review any literature to ensure that it is stated correctly.

GAAR [the UK’s general anti-abuse rule] states that tax arrangements are abusive if they are arrangements, the entering into, or carrying out of which, cannot reasonably be regarded as a reasonable course of action in relation to the relevant tax provisions taking into account all of the circumstances.

In HMRC’s policy paper published 28/3/2014 it clearly states that the legislation is being introduced to remove the tax advantages gained by tax motivated profit allocations.

There are always commercial reasons motivating the incorporation into this structure, and the structure provides the Client with options to consider including, but not limited to, commercial opportunities, flexibility, and business continuity.”

This is all rather alarming:

- LT4L use the same formulation in dozens of documents that we’ve seen, all of their videos, and a document titled “technical FAQ”. This isn’t a one-off mistake. The most charitable view is that LT4L have completely misunderstood the rules.

- The reference to the GAAR is irrelevant, and it’s hard to understand why a tax professional would mention the GAAR in this context.17On a similar note, LT4L often say their schemes are “allowed under the Generally Accepted Accounting Principles (GAAP)”.

- In this response and in the FAQ, LT4L refer to a March 2014 policy paper that discussed the mixed partnership rules, then in draft. The legislation was enacted on 17 July 2014, and the final version of the rules was not limited to “tax motivated profit allocations”. Why are LT4L advising clients on the basis of an out-of-date policy paper, and not by reference to the actual legislation?

- The fact there are “commercial reasons” as well as a tax motive doesn’t escape most anti-avoidance rules. But, for this particular rule, the existence (or not) of a tax motive is irrelevant. The question is whether the return to the corporate member is commercially justified given the capital and services it has provided.

Transfer of income stream rules

We would add in passing that the transfer of income stream rules may also apply. LT4L have said the rules won’t apply to a commercial structure, but only to “purely tax-motivated transactions”. We don’t believe that is an accurate way to describe “main purpose” tests, and in any case not all of the rules are subject to a main purpose test.18See e.g. section 809AZA ITA 2007 via section 809AZF. The rules are complicated and, given the LT4L structure has already failed so comprehensively, we won’t go into them in detail, but HMRC agree there is a problem:

Tax treatment of the mortgage payments

You can declare a trust over assets. You can’t declare a trust over obligations. This creates a problem when promoters try to circumvent section 24 by using a trust to “move” interest payments from a landlord to a company. We discussed these issues in detail for the Property118 structure.

In the LT4L structure, the landlord remains the borrower under the mortgage. Property118 argued (incorrectly) the landlord was the company’s agent.

We have evidence of LT4L saying to another adviser that, under the Letter of Trust, the payment obligation “shifts to the LLP”, hence the members of the LLP can claim a deduction “through” the LLP. This is not possible as a legal matter. Furthermore, there is nothing in LT4L’s standard trust document even purporting to achieve the kind of agency or indemnity result that Property118 claim to achieve:19We believe this is LT4L’s standard form letter of trust; we have received different versions from different LT4L clients, and all are materially identical.

Accordingly, at present we see no basis for the LLP members to claim a deduction (even an arguable one). The mortgage obligation remains with the landlords – but as they no longer hold a beneficial interest in property, they lose their 20% credit.

We would also query several elements of the letter:

- Why does it say the landlord received the property “free from any and all obligations” when it’s mortgaged?

- Why does it say the landlord will transfer legal title to the LLP when required, when the mortgage prevents him doing that?

- Why does it say the landlord won’t present himself to any third party as the beneficial owner, when he will present himself to the mortgage lender, insurance company, tenants, letting agent etc as the beneficial owner?

All of this adds to the sense that this is an uncommercial and artificial structure.

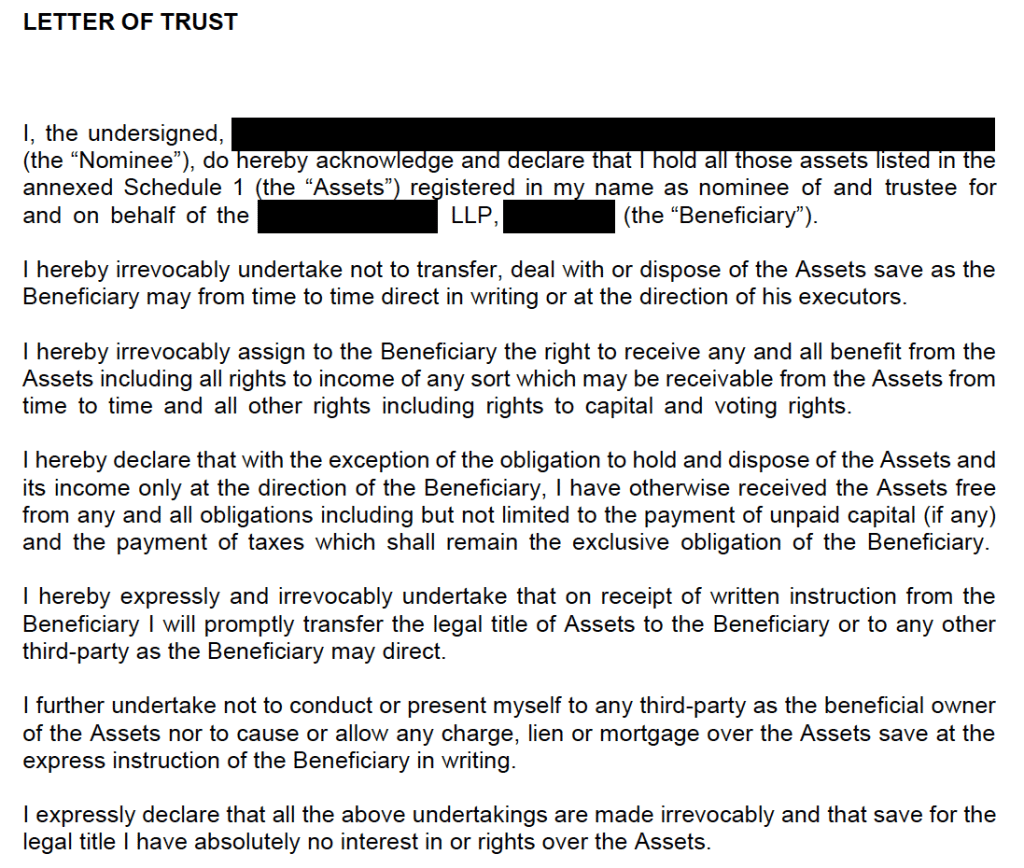

Capital gains tax

The claim from LT4L is that, when the landlord sells the rental properties into the LLP, he’s the only member of the LLP and so there’s no change in ownership and no CGT. Better still, your rental properties are “rebased” so, when the LLP later sells the properties, you’re only taxed on the gain after the LLP is incorporated:

“Capital gains tax is mitigated or at least seriously reduced on entry to the LLP. Your market value is re-based. Technically it’s done every year but we just focus on the market value on the date of incorporation. So it’s the date when all the legal work takes place and your LLP is up and running and the LLP is now taking responsibility for the accountancy side of the of the business. So when you make that move into the LLP there’s no capital gains or stamp duty to pay at that point. There is no change of title, legal title, so the properties state in your own name.”

These two claims are contradictory. If there’s no change in beneficial ownership, and the sale to the LLP is a capital gains tax “nothing”, then how can there be a re-basing?20We have seen correspondence and attendance notes from discussions between advisers and LT4L which suggests that LT4L may be confusing the FRS 102 treatment with the tax treatment. This video is consistent with that..

Here’s Tony Gimple, again:

“Here’s the kicker: mixed partnership Income is treated as trading income. It’s why HMRC say if at some point you ever want to incorporate, go into a partnership first. Because it’s trading income and only trading businesses get Section 162 incorporation relief.”

These are non-sequiturs. There is nothing special about mixed partnership income which treats it as trading income. You qualify for incorporation relief if you are a “business” – there is no need to be trading. There is no transfer by the LLP, and so no application of incorporation relief. We’re not aware of anyone from HMRC saying anything like “if you ever want to incorporate, go into a partnership first”.

And here is the same claim on their website:

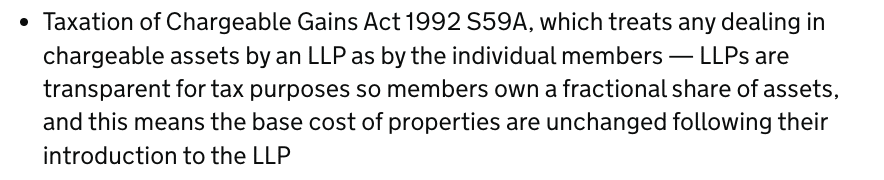

None of this is true. Here’s what actually happens:

- When they allocate partnership income to the corporate partner, that may be a change in the partners’ fractional interests in the LLP’s assets, and that may be a capital gains tax disposal event – the landlord is disposing of part of his interest in the rental properties, and the company is acquiring it. That could trigger immediate CGT for the landlord.21The counter-argument is that only a change to a capital entitlement has this effect; HMRC may take the contrary view, presumably on the basis that if you are reallocating income then you are changing the value of the capital entitlement.

- There is no rebasing. The individual landlord remains the owner of the properties (save to the extent there’s been an allocation to the corporate partner). When rental properties are sold, it’s just a straightforward CGT disposal by the individual landlord, so she is taxed on all the gain since her original purchase (and the company is taxed on its (probably much smaller) gain since it acquired its fractional interest).

HMRC agree:

This is a much worse result than if the landlord simply sold her business to the company in the usual way, because then (subject to qualifying as a “business”) incorporation relief could apply – there would be no up-front CGT and the assets would be rebased.

Stamp duty land tax

LT4L say there is no SDLT on the establishment of their structure, because there is no change in ownership – the landlords still own the property “through” the LLP.

That is, however, not how the rules work.

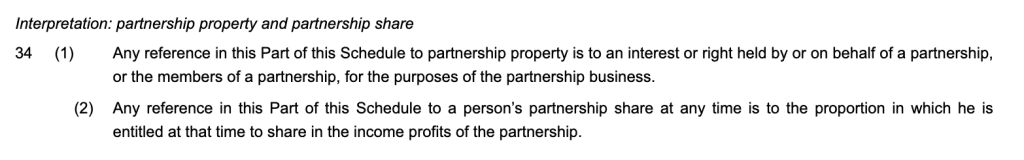

The LLP’s beneficial interest in the property means it is a “property investment partnership” for SDLT purposes. That results in a charge to SDLT on a change in income profit sharing entitlement under Finance Act 2003 Schedule 15 paragraph 1422This is because (1) a change in profit-sharing ratios is the “transfer of an interest”, (2) this is then a “type B” transfer, (3) the LLP’s beneficial interest in real estate is “relevant partnership property” unless the exclusions in para (5A), apply, (4) most of the exclusions are irrelevant, (5) exclusion (f) doesn’t apply because there was a para 10/sum of lower proportions calculation when the property was transferred to the LLP. – even if there is no change in the entitlement to capital:

One might expect the result to be the SDLT the structure is avoiding – i.e. SDLT on the share of profit to which the company is now entitled. However in fact the charge could be much higher than this, especially for high value portfolios holding low value properties, because of the loss of multiple dwellings relief.

This is a surprising result, so it’s helpful to step through an example.

A UK resident married couple have a portfolio of 30 let residential properties worth £6m. They wish to put the properties into an LLP with an 80% share of the income profit going to their limited company.

If they did this directly, the LLP would pay SDLT on chargeable consideration of £4.8m (80% of £6m) which would be:

- £229,500 if they took the default of applying non-residential rates,23An option under FA03/s116(7); the top marginal rate of SDLT is then 5%.

- but potentially reduced to £144,000 by claiming multiple dwellings relief.24Worked out on the average chargeable consideration per dwelling of £160,000 (80% of £200,000), so coming in at 3%.

LT4L think their structure avoids the £144,000. Their strategy involves the following steps:

- The properties are first introduced by the couple to the LLP.

- After the property is introduced, the company is added as a member of the LLP.

- The members subsequently agree that the company is to have an income profits share of 80%.

Under the SDLT provisions for property investment partnerships, there is chargeable consideration of £4.8m25 Calculated as 80% of the market value, £6m – but if the market value of the properties is different by the time of the change in the income profit shares, one takes the market value at that time. at the point the income profit share is adjusted. HMRC take the view that MDR is not available for this form of charge, so the SDLT would on the face of it be charged at £229,500 (using non-residential rates). This is significant increase on the £144,000 charge if a more direct approach had been taken.

But it could be much worse. HMRC might go further, and argue that residential rates apply (without MDR still being available). On chargeable consideration of £4.8m this would mean SDLT of £487,250 – more than double the expected charge.26This is calculated at residential property rates without the 3% surcharge.

And even worse: LT4L’s LLP agreement and promotional videos suggest you can flexibly change profit-sharing ratios. Each time you do that, there could be a new SDLT charge under paragraph 14.27In principle there wouldn’t be if the reallocation is sufficiently small to fall below the £150k de minimis. So, for example, a portfolio was worth £3m then a change in profit share of up to 5% should escape SDLT. However that is subject to the “linked transaction” rule and so, example, a strategy of having six successive changes of 5% to achieve a 30% change in income share, would be viewed together and therefore exceed the de minimis. LT4L’s clients could have unknowingly racked up years of SDLT liabilities.

This is a terrible result28Potentially there are other bad consequences. In particular, we do not currently understand the rationale for debt that LT4L often puts in place between the LLP and its members. This might, depending on the details, trigger additional SDLT under the very awkward debt repayment rule in Schedule 15 para 17A Finance Act 2003. for the landlords – and HMRC could challenge their position at any time in the next 20 years29Because of the failure to file a land transaction return upon the change in LLP profit sharing ratios., and then collect the tax, interest, and a tax-geared penalty.

It would be better for the landlords if HMRC simply applied the SDLT anti-avoidance rule in section 75A Finance Act 2003 – that would just undo the SDLT benefit of LT4L’s two-stage approach, and charge the £144,000 that the structure tries to avoid. However, if we are correct that paragraph 14 applies as above, then section 75A cannot apply.

HMRC’s Spotlight doesn’t mention the SDLT issues yet, but we expect HMRC will have no difficulty identifying the points.

Failure to disclose to HMRC

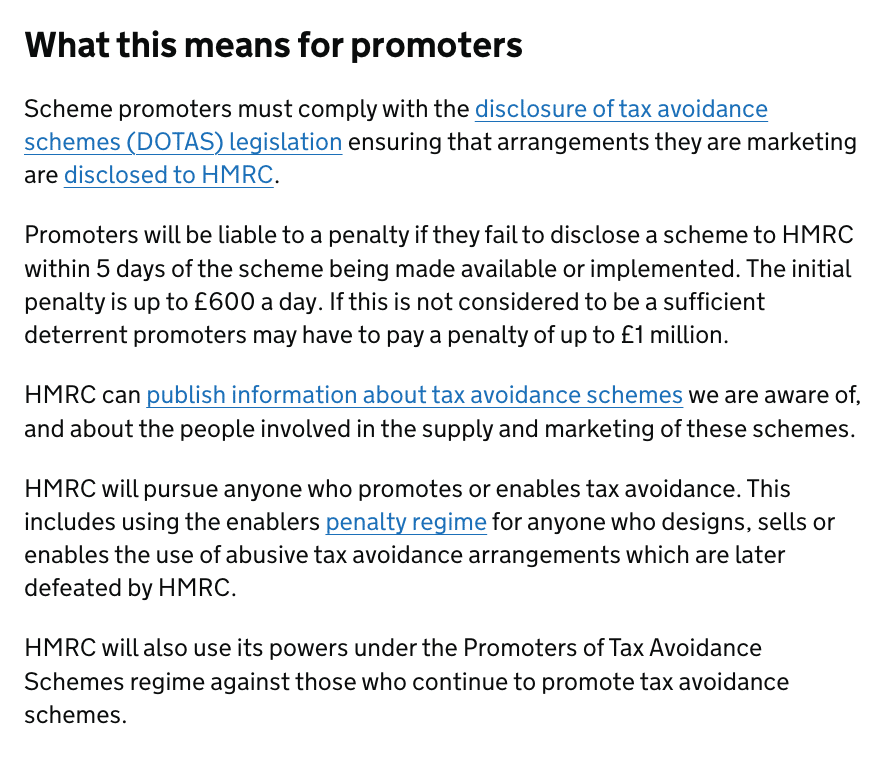

Most tax avoidance schemes are required to be disclosed to HMRC under the “DOTAS” rules. The idea is that a promoter who comes up with a scheme has to disclose it to HMRC. HMRC will then give them a “scheme reference number”, which they have to give to clients, and those clients have to put on their tax return. It’s the tax equivalent of putting a “kick me” sign on your back, because the expected HMRC response is to challenge the scheme and pursue the taxpayers for the tax.

For this reason, promoters of tax avoidance schemes typically don’t disclose, even though they should. This is often on the basis of tenuous legal and factual arguments, to which the courts have given short shrift30See e.g. the Hyrax case, where the tribunal described as “incredible” the claim by one witness that she wasn’t aware that the transaction involved tax avoidance..

LT4L provided us with both a tenuous factual argument and a tenuous legal one.

Their tenuous factual argument was to deny that one of the main benefits of their structure is the tax advantage. This is surprising given that the only reason to use an LLP rather than a company is the supposed tax benefits. It is also surprising given the name of their company. They responded that their name was merely a marketing term, and the “Less Tax for Landlords” company doesn’t undertake work itself. This isn’t terribly persuasive.

Their tenuous legal argument was that LT4L can’t be a “promoter” within DOTAS, because they “are not in any extent responsible for the design of a ‘scheme'”. This is, however, not what the legislation says. The legal test isn’t whether there is a “scheme” but whether there’s an “arrangement”, and any series of transactions is an arrangement. So the LT4L structures are an “arrangement”, and LT4L are responsible for the design.

Once we’ve established there’s a tax main benefit, and that LT4L are a promoter, the only question is whether one of the DOTAS “hallmarks” is present. There are several candidates:

- The most likely to apply is the financial product hallmark given that the structure involves contrived and abnormal arrangements regarding a loan.31The “arrangement” in question is the declaration of trust over a mortgage loan in favour of an LLP and subsequent reallocation of profits to the corporate partner. The mortgage loan is one of the specified “financial products”. One of the main benefits of including the loan in the trust/LLP is to obtain a tax advantage. Finally, the arrangements involve contrived and abnormal steps without which the tax advantage could not be obtained (the trust and the reallocation are both contrived and abnormal).

- The confidentiality hallmark. As far as we are aware, LT4L have never explained the technical analysis underpinning their structure, and on several occasions they have explicitly declined to do so because it is their “IP”.

- The “premium fee” hallmark may also apply given the high fees LT4L charge (£18,000 or more).32The hallmark applies where (broadly speaking) a promoter can be reasonably expected to receive a fee that exceeds the time value of their work. Less Tax for Landlords say their fee reflects the work undertaken, but we doubt that – they charge £18,000 or more for what is a standardised structure (LT4L clients have sent us documentation, and it’s almost identical between the different clients).

- The standardised tax product hallmark.33LT4L’s documentation certainly seems standardised, but it is possible there is sufficient customisation that the hallmark doesn’t apply.

In addition: if (as seems likely) one of the main benefits of the structure is gaining an SDLT advantage compared to a vanilla incorporation, then the SDLT disclosure regime may34We say “may” because one defence would be to argue that the scheme is excluded from disclosure because it was made available (presumably by someone else) before 1 April 2010. We don’t know if that’s the case. On the one hand, it’s an obvious “trick” which may have been used. On the other hand, it has equally obvious problems. apply (for which there are no hallmarks).

HMRC’s Spotlight also suggests DOTAS applies:

If the structure should have been disclosed under DOTAS, then LT4L’s failure to do so means they may be liable for penalties of up to £1m.

LT4L fail to understand the basic principles of partnership taxation

An LLP is essentially taxed as a partnership. The essence of partnership taxation is that members are taxed on their share of the partnership’s profits. Whether it’s actually paid out to them is irrelevant, as is the way it’s paid out. Members are taxed when the LLP makes the profit.

We’ve received reports from advisers who have recently heard LT4L say the opposite: that members are only taxed on profits distributed to them. LT4L then engineer a structure where profits aren’t returned (but capital returned instead) and claim it saves tax. This is “not even wrong“.

We would find these reports hard to believe, but Tony Gimple, LT4L’s founder, is on record saying that an LLP member is only taxed on distributed profits.

“Partnerships don’t pay tax on income only on distributed profits. But you have this million pounds sitting on the balance sheet. So instead of taking your 100,000 pounds a year in income, HMRC allows you to treat that as a return of capital. As a direct result of that, it is not subject to income tax. You may choose to take some income in order to pay tax.”

And that wasn’t a one-off:

“LLP’s don’t pay tax – it is the recipient of a distributed profit who pays the tax”

It is incredible that a firm is selling a structure based around an LLP, when its founder doesn’t understand the basics of partnership taxation.

We are concerned that LT4Ls may have taken “tax free” capital out of their LLPs, not realising that they were fully taxable on the underlying profits.

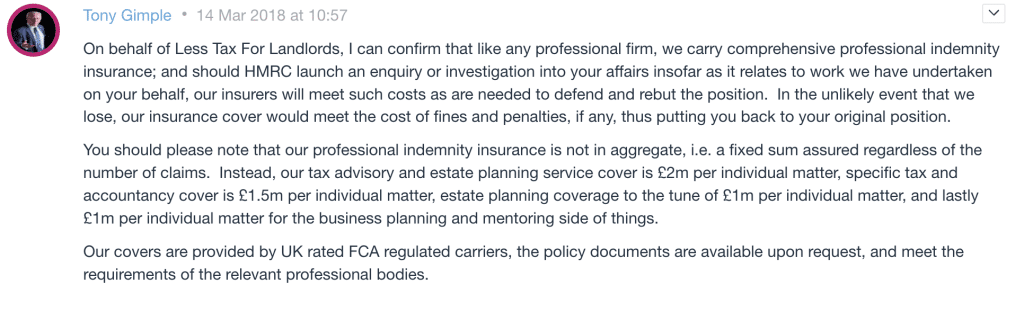

Insurance

Tony Gimple, LT4L’s founder, made this claim about their insurance35Before he retired from the business.:

This is not at all how insurance of this kind works. If a client follows LT4L’s advice and HMRC do not agree with the tax treatment, then LT4L’s insurers will not simply pay over the tax. The client would have to commence a court claim for negligence against LT4L. The insurers would then (assuming the claim is covered) likely require LT4L to defend the claim (and usually take over the conduct of the defence). Only if the client prevails, and is awarded damages (or achieves a settlement) would the insurers pay. That is, needless to say, not straightforward – professional negligence claims are usually difficult, and proving that the advice was unreasonable is only one part of the claimant’s burden.

We’ve seen a copy of LT4L’s professional indemnity insurance, and it is completely standard. There is no written note from the insurers saying they are happy to cover everything. Professional indemnity insurance gives you comfort that, if you do pursue and win a claim against your advisers, someone will be there to pay up. It does nothing more than that.

We asked LT4L about Tony Gimple’s statement. They said they recognised it could be construed as misleading, but the purpose “was to deal with ‘noise’ that was being generated on social media at that time”. It is unclear why dealing with “noise” justifies an untrue claim.

It is also not a one-off. Gimple said something similar before:

It is fair to note that Gimple retired from LT4L in 2020. But his claims continue to be repeated – here’s LTFL’s Head of Estate Planning:

“You also will be covered by our personal indemnity insurance. Our insurance is designed to return you to the place that you would have been had you never engaged with us. So it just ensures that although it won’t pay for example any tax that you would have paid if you didn’t do this. If any additional tax occurs because you engage with us it would cover that. It would cover any fines, any penalties and any further advice and also it would cover us to help you argue if HMRC ever had any issues and looked into this. It would help cover our costs and our fees for us to legally argue and do the work on your behalf.”

The same false claim – that the insurance would pay out if “any additional tax occurs because you engage” with LT4L.

And again:

“And then our insurance, we all have professional indemnity insurance, obviously. We’ve got two types, one PI cover, two million pounds a case. This is if we lose at court with HMRC. We also have what we call fees cover, and that covers any of the extra tax due, it covers any legal fees and it also covers any HMRC things like interest and penalties and everything like that.”

All these claims are misleading. The insurers do not simply pay out if a client “loses at court with HMRC”. They’re missing the vital detail that you’d have to sue LT4L for negligence, and win.

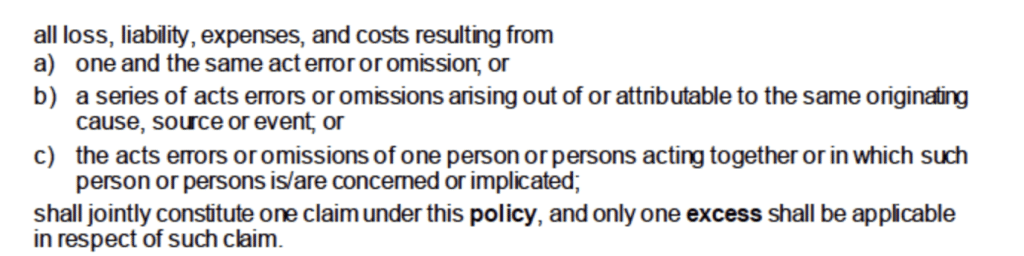

The claim that their insurance covers £2m per individual matter is also questionable. It will cover £2m per “claim”, and insurers will usually take the position that, if there are multiple liabilities to different clients, all resting on fundamentally the same point, then this is one “claim”. Often the policy wording expressly says this – here’s a standard form from LT4L’s own insurer:

It is certainly unlikely that if, say, all 440 LLPs sued LT4L for the same failings, the insurer would agree to cover £880m.

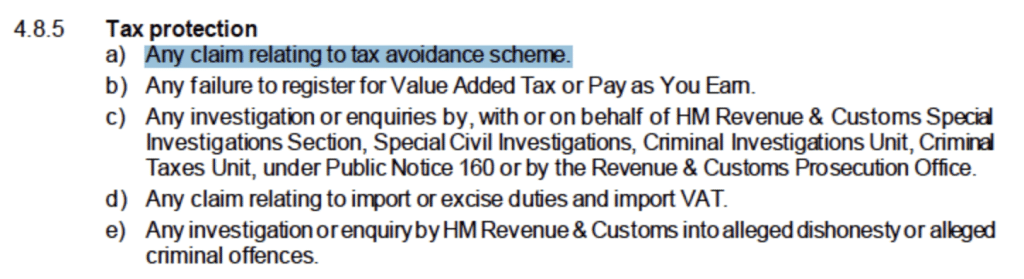

And LT4L’s insurer’s standard form also contains this exclusion:

Which would could deny the claim entirely if the insurer can show the claim “relates to a tax avoidance scheme”. The term isn’t defined, but given everything we’ve written above, there must be a significant risk the exclusion applies.

And finally there are a variety of reasons why the insurer could

We asked LT4L why they were making misleading claims about the nature of their insurance. The response was that they are “communicating practically and focusing on outcomes”. We don’t believe that’s fair, because the actual outcome (client has to sue LT4L, this is difficult, and insurers run LT4L’s defence) is entirely missing from their presentations.

We also asked LT4L if their insurance had the claims and exclusion wording we’ve cited above. They didn’t respond.

We would add for completeness that LT4L say they have fee insurance which covers taking a dispute with HMRC to the First Tier Tribunal. But LT4L don’t add the obvious point: if the client loses at the FTT and wishes to appeal, the client would have to pay their own fees.

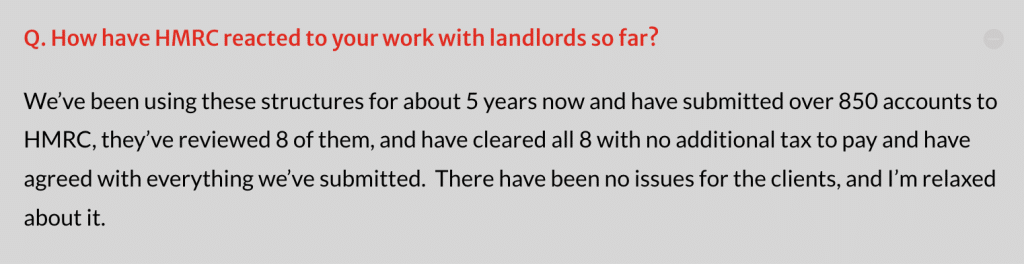

But LT4L say their clients have never been challenged by HMRC?

The claim here is typical:

We don’t know if this claim is true. But it’s hard to believe given the strength of the language in HMRC’s new Spotlight.

But it is possible for schemes to “fly under the radar” if the true nature of the scheme is never properly disclosed to HMRC, and we expect that is what’s happened here.36LT4L’s founder has suggested that clients can obtain comfort from the fact that LT4L are based in the same building as an HMRC department. That reminds us of something.

If that’s right, then HMRC would have at least six years to investigate an LT4L structure, and potentially twenty years (given the failure to disclose under DOTAS).

What if you’ve implemented this structure?

HMRC suggest contacting HMRC. They really have to say that, but we would instead suggest you first seek advice from an independent tax professional, in particular a tax lawyer or an accountant who is a member of a regulated tax body (e.g. ACCA, ATT, CIOT, ICAEW, ICAS or STEP). Given the potential for a mortgage default, we would also suggest you urgently seek advice from a solicitor experienced with trusts and mortgages/real estate finance (e.g. a member of STEP).

We would strongly advise against approaching Less Tax for Landlords given their apparent lack of understanding of the rules, and the obvious potential for a conflict of interest.

We’d also be interested in hearing from you, but unfortunately we cannot provide advice. In some cases we will be able to discuss the technical points discussed in this article with advisers.

Next steps

We hope HMRC will now investigate LT4L for what appears to be a serious failure to comply with DOTAS, and open enquiries and/or discovery assessments into its structures (which are easily to identify via Companies House).

We will be writing to the ICAEW, FCA, STEP and the SRA asking them to investigate those involved for promoting tax avoidance schemes that realistically have no prospect of success.

We will also be asking to the FCA raising a wider point about regulated firms’ involvement in aggressive and technically hopeless tax avoidance.

A large number of experienced tax advisers contributed to this report. Thanks to D and J for their inheritance tax analysis, B for the LLP and mixed partnership analysis, P and R for preparing the first draft, G, M and E for their detailed review of the structure, S and Sean Randall (Chair of the Stamp Taxes Practitioners Group and one of the leading advisers on SDLT) for their specialist SDLT input (and S also for exhaustively reviewing for errors), E for challenging potential weaknesses and errors, Pete Miller (who literally wrote the book on many of the taxes discussed in this report) and Ray McCann (former senior HMRC inspector and past President of the Chartered Institute of Taxation).

Thanks also to all the people who provided us with information and documentation on Less Tax Landlord’s structure. Very little in this report is new – advisers have been making these points for years.

-

1Less Tax for Landlords Ltd appears to be just used for marketing; all the work is undertaken by employees of other group members. In the interest of clarity, this report will refer throughout to LT4L.

-

2The descriptions of LT4L’s structure and approach in this report are based on statements made by LT4L on their websites, videos and web forums, as well as reports with advisers who’ve spoken to LT4L’s representatives, and reports from and documents provided by potential and actual LT4L clients. Our understanding is not complete and, in particular, we do not understand the rationale for the debt that LT4L often puts in place between the LLP and its members – the nature of an LLP is such that this is unlikely to create a tax benefit, and could trigger additional tax (particularly SDLT under the very awkward debt repayment rule in Schedule 15 para 17A Finance Act 2003).

-

3We’ve seen numerous almost identical examples going back several years. The only edits we’ve made to this are to mask the figures to protect our source.

-

4This is fairly standard planning, provided the “growth” shares only become valuable once a growth “hurdle” is reached, say a 20% increase in the value of the business, measured from the date the shares were issued. That makes it much harder for HMRC to claim the growth shares have value on day one (which could have adverse inheritance tax and CGT consequences). However, in the case of LT4L and Property 118, there is no hurdle, and the structure may well be vulnerable to challenge.

-

5The rate is 19% for profits under £50,000, with a “catch-up rate” of 26.5% on profits up to £250,000, so that the overall effective rate smoothly transitions into the full rate of 25%.

-

6It is possible that some are “normal” LLPs which don’t use the “hybrid” structure described in this report, but we randomly sampled 20 LLPs and each of their accounts were consistent with the hybrid structure. We excluded the earliest five LLPs, as they appear to be unrelated.

-

7The methodology was simply to take each LLP, multiply £40k by the number of years it had been in existence, then total those figures.

-

8There will also be a much larger figure of SDLT and CGT avoided on the establishment of the structure. The word “avoided” here is not quite correct, because the structure does not achieve the intended result. “Attempted avoidance” is perhaps more accurate.

-

9You can find the full versions of some of these videos on YouTube; most are freely available on the LT4L website once you’ve registered (but that means we can’t link to them). All the videos are © Less Tax for Landlords, and republished by us for the purposes of fair dealing/criticism.

-

10Also: The Duke of Westminster case hasn’t been good law for decades. GAAP doesn’t “allow” (or indeed “not allow”) particular business structures. The “D” in DOTAS is not “Declaration”.

-

11That’s a considerable simplification: LLPs and partnerships can make the BPR position worse in several respects, but they cannot convert a non-BPR business into a BPR business.

-

12Or businesses which use the property as part of a business, e.g. a hotel or, in a recent case, a livery business.

-

13The FAQ has other errors too. This is not a “power” of HMRC – it’s a rule that applies as part of the usual self-assessment rules. PwC is not a mixed partnership (and indeed professional partnerships rarely are mixed partnerships). The FAQ also cites the Duke of Westminster case, which hasn’t been good law for forty years.

-

14In a case like this, where the individual partner has the “power to enjoy” the profits of the corporate partner, because he is connected to it. The key question is (broadly) whether the profits are being allocated to the corporate partner because of the individual’s control of the company. It is fairly clear that is what is happening.

- 15

-

16The video is full of other errors. In particular, LT4L don’t understand that “power to enjoy” is a defined term which was somewhat difficult to apply to Mr Walewski’s trust, but is very easy to apply to the connected company in their structure.

-

17On a similar note, LT4L often say their schemes are “allowed under the Generally Accepted Accounting Principles (GAAP)”.

-

18See e.g. section 809AZA ITA 2007 via section 809AZF.

-

19We believe this is LT4L’s standard form letter of trust; we have received different versions from different LT4L clients, and all are materially identical.

-

20We have seen correspondence and attendance notes from discussions between advisers and LT4L which suggests that LT4L may be confusing the FRS 102 treatment with the tax treatment. This video is consistent with that.

-

21The counter-argument is that only a change to a capital entitlement has this effect; HMRC may take the contrary view, presumably on the basis that if you are reallocating income then you are changing the value of the capital entitlement.

-

22This is because (1) a change in profit-sharing ratios is the “transfer of an interest”, (2) this is then a “type B” transfer, (3) the LLP’s beneficial interest in real estate is “relevant partnership property” unless the exclusions in para (5A), apply, (4) most of the exclusions are irrelevant, (5) exclusion (f) doesn’t apply because there was a para 10/sum of lower proportions calculation when the property was transferred to the LLP.

-

23An option under FA03/s116(7); the top marginal rate of SDLT is then 5%.

-

24Worked out on the average chargeable consideration per dwelling of £160,000 (80% of £200,000), so coming in at 3%.

-

25Calculated as 80% of the market value, £6m – but if the market value of the properties is different by the time of the change in the income profit shares, one takes the market value at that time.

-

26This is calculated at residential property rates without the 3% surcharge.

-

27In principle there wouldn’t be if the reallocation is sufficiently small to fall below the £150k de minimis. So, for example, a portfolio was worth £3m then a change in profit share of up to 5% should escape SDLT. However that is subject to the “linked transaction” rule and so, example, a strategy of having six successive changes of 5% to achieve a 30% change in income share, would be viewed together and therefore exceed the de minimis.

-

28Potentially there are other bad consequences. In particular, we do not currently understand the rationale for debt that LT4L often puts in place between the LLP and its members. This might, depending on the details, trigger additional SDLT under the very awkward debt repayment rule in Schedule 15 para 17A Finance Act 2003.

-

29Because of the failure to file a land transaction return upon the change in LLP profit sharing ratios.

-

30See e.g. the Hyrax case, where the tribunal described as “incredible” the claim by one witness that she wasn’t aware that the transaction involved tax avoidance.

-

31The “arrangement” in question is the declaration of trust over a mortgage loan in favour of an LLP and subsequent reallocation of profits to the corporate partner. The mortgage loan is one of the specified “financial products”. One of the main benefits of including the loan in the trust/LLP is to obtain a tax advantage. Finally, the arrangements involve contrived and abnormal steps without which the tax advantage could not be obtained (the trust and the reallocation are both contrived and abnormal).

-

32The hallmark applies where (broadly speaking) a promoter can be reasonably expected to receive a fee that exceeds the time value of their work. Less Tax for Landlords say their fee reflects the work undertaken, but we doubt that – they charge £18,000 or more for what is a standardised structure (LT4L clients have sent us documentation, and it’s almost identical between the different clients).

-

33LT4L’s documentation certainly seems standardised, but it is possible there is sufficient customisation that the hallmark doesn’t apply.

-

34We say “may” because one defence would be to argue that the scheme is excluded from disclosure because it was made available (presumably by someone else) before 1 April 2010. We don’t know if that’s the case. On the one hand, it’s an obvious “trick” which may have been used. On the other hand, it has equally obvious problems.

-

35Before he retired from the business.

-

36LT4L’s founder has suggested that clients can obtain comfort from the fact that LT4L are based in the same building as an HMRC department. That reminds us of something.

18 responses to “Less Tax for Landlords: the £50m landlord tax avoidance scheme that HMRC say doesn’t work, and can trigger a mortgage default.”

Excellent article! Less tax for landlords is an interesting decision to say the least.

I see on the CIOT website https://www.tax.org.uk/hmrc-one-to-many-letters-concerning-spotlight-63-llp-property-tax-planning a posting of 10 November that HMRC are sending letters to a small number of agents and their clients who used the planning highlighted in Spotlight 63.

The model letter and fact sheet are linked there. HMRC do not mention the SDLT issues covered in this investigation, but surely it is just a matter of time.

Is there a way that you can invite all landlords with LT4L to add there contact details on this site so they can at least talk with one another to see what individual’s may be losing and what they can do to take action against LT4L. Collectively

through legal means to try to regain there losses. Clients are being told to wait for 10 days for information but are still taking monthly direct debit payments from clients of £450 – £650 a month x by 450 landlords. That equates to £292,500 a month and £3,510,000 a year.

unfortunately the website isn’t really set up to do that, and we (as a very small organisation) don’t have the capability to manage it. There are lawyers with experience in litigating against tax avoidance scheme promoters, and I would suggest contacting them. Hopefully they will find a way to act for multiple users on a no-win-no-fee basis.

Is there any connection between the “One Group” and “One-E”, a now-defunct promoter of aggressive EFRBS schemes back in the day? I went to one of their presentations and the technical guy (an engaging young man) told me that he always advised his clients to submit their tax returns in Welsh, because it’s technically allowed and made life difficult for HMRC.

Needless to say this was something of a red flag.

that is a wonderful story, but I’ve no reason to think they are connected

With regards to insurers covering the cost of tax, interest and penalties:

Tax Liability Insurance does exist, but the contract is directly between the taxpayer and the insurer.

Pretty clearly given the analysis here, no insurer would offer it for these Landlord schemes, but various companies do provide it for IR35 issues – E.g. https://www.kingsbridge.co.uk/products/legal-ir35-protect-cover/

And it seems to be widespread in the M&A area: E.g. https://www.aon.com/apac/transaction-liability/tax-insurance.jsp

The crucial point is that the insurers will only accept the risk if they see the relevant client documentation in advance of a transaction (and may insist on changes to draft documentation which they review, before offering to insure)

All very different from Professional Indemnity Insurance.

Well done Dan for doing a brilliant job of exposing the fraudulent ‘scheme’. I did my best 4 years ago on the Property Tribes forum to warn potential customers.

Tony Gimple would never answer my repeated question as to how an investment business could be treated as a trading business.

The Duke of Westminster quote is so annoying…..

That should be taught to all investors and self-employed people in this country as being the Number 1 red flag indicator of a crackpot tax avoidance scheme promoter – it’s frankly astonishing how many of them use it!

Great journalism , tax knowledge, and easy read, same for the 118 article, well done to all concerned.

I had a consultation with both and for some reason (and only with my average intelligence) just could not quite understand how it all possibly could work.

So I thought if you don’t understand something so complicated don’t bother .

Thankfully, your articles have been an enlightening simple common sense endorsement for me, (of course notwithstanding all the life long technical tax analysis experience you’ve used to make it easy to read).

My interest in it was not from the morgage angle, but both schemes also seemed to enthusiastically provide IHT, CGT benefits for those who’s portfolio like mine were not indebted.

So it seemed as if most people could benefit from the schemes, clearly not.

One thought it did raise though, having spoken to a friend of mine, who has a large Indebted portfolio, told me most lenders would not want to enforce such a default, certainly if the mortgage accounts were being paid and up to date, ie there’s no real reason to, and the expense of proceedings etc?

How say ye ?

Yours Faithfully Mr Farn

Fantastic detailed article! Have/Will you review Gresham Street Partners scheme? They seem to solvently roll from one LLP to another, mitigating previous CGT, income tax, IHT, all the above etc etc

What I never understand with this type of case is how the promoters of schemes come away with a lot of fee income but no accountability for what appear to be a combination of false and misleading statements. Can they really simply say “we relied on this opinion” and that makes them essentially untouchable, even if they’re also giving incorrect comfort about eg the insurance in place? Are they really just benefitting from a gap in the law which de facto protects them when the schemes are found to be ineffective?

The involvement of the NRLA is disappointing. I was a member for a year and they gave me some useful legal advice, on the second occasion. I had to challenge the advice on the first. They are very commercially oriented in a way that the NLA, which merged into it, was not to the same degree. Perhaps that’s why NLA went away. Thinking about this brought me back to discussions about IHT and SDLT. It seems that as time goes on, IHT avoidance becomes a more pressing concern for older Landlords. Then there are the desperate for whom s24 provided their margin. There appears to be quite a shakeout because of this or where the market allows, an increase in residential rents. IF IHT were to go then this construct would be less attractive to the credulous. The chancellor seems to think there are fewer votes on SDLT then IHT and you can see the psychology of that, but its the worse of the two. The middle classes are now revolting about IHT now that they are increasingly liable for it. For me, GAAR hangs over this somewhat. To Landlords I would explain this in terms of Tenancy v. Licence. You can call it what you want but a court will ask “how does it walk?” and “how does it quack?”. The same applies here with actual statute.

Top work. Let’s see what happens. Small landlords in my experience do not paying for advice and can’t always afford it so even if the wheels publicly fall off this scheme I’m certain it will survive in some form.

The link in the text string “We discussed these issues in detail for the Property118 structure” is dead.

Hi Dan

Great ! Thank you !

Waiting eagerly on the article you said you will write in the comments of P118 exposure.

Do the esteemed “Cotswold Barristers” have anything to say on the matter or is tax outside of their instructions?

Wow! That’s a very comprehensive note. Some of the comments made by LT4L are stunning. I’m very impressed with what you have written and how you’ve developed your reputation so that people give you so much evidence. Proper job.

Oh, by the way. You might want to check to see if HMRC have got any spyware on your PC!

We’ve been noting LT4L’s activities for a few weeks – HMRC have a Twitter account… they don’t need spyware!