There are a surprising number of people still promoting tax avoidance schemes. Of course, they say they’re not tax avoidance schemes, but the giveaway is that they are promising a much better tax result than you’d normally get. Often this makes people nervous. Two lines the promoters use to get round this are “we have an opinion from an independent KC” and “don’t worry, we’re fully insured”.

Here’s why this should make you more, not less, worried.

The problem with KC opinions

A KC avoidance scheme opinion in practice provides you, the client, with zero comfort. In fact it potentially makes your position worse.

1. The opinion is probably wrong

Most KCs are outstanding lawyers with an excellent reputation – they will give the correct legal answer, whether it’s convenient or not. But there are some who, even when faced with dubious tax avoidance schemes, give the answer the client wants. Jolyon Maugham described them as “The Boys Who Won’t Say ‘No’“.

And The Boys usually turn out to be wrong.

The taxpayer has lost almost every single tax avoidance case to come before the courts in the last 25 years. I’m aware of only two cases1the SHIPS 2 case, essentially because the legislation in question was such a mess that the Court of Appeal didn’t feel able to apply a purposive construction, and D’Arcy, where two anti-avoidance rules accidentally created a loophole. where the taxpayer won, and the response was to enact the general anti-abuse rule (GAAR) so that it wouldn’t happen again.

The Boys provided opinions for many of these, and all of them were wrong.

Mostly we don’t get to see the opinions, or even know which KC issued them, but in some cases we have the details:

- The K2 scheme (aka the “Jimmy Carr scheme”), was abandoned by its promoters when HMRC challenged it. But there was a an opinion from Robert Venables KC that it was fine.

- Here’s a scheme we wrote about, involving the astonishing step of incorporating thousands of UK companies with Filipino directors to escape HMRC scrutiny. The owner of the business ended up admitting fraud. But there was an opinion from Giles Goodfellow KC that it was fine.

- In one of the many film tax relief avoidance schemes, Andrew Thornhill KC said he “had no doubt” that the entity was trading. It wasn’t.

KC opinions in general are (in my experience) usually sensible and astonishingly right (i.e. they successfully predict the outcome when the point is later tested in court). So why are these opinions so wrong?

The charitable answer is that the KCs are advising on the basis of their instructions from the promoter, which usually puts forward the most favourable possible legal and factual position – very possibly making assumptions of fact which don’t apply to your individual case. And it is not uncommon for the structure that the “KC” approved to be markedly different from the structure the promoters end up implementing.

There are other obvious, but less charitable, answers…

2. You’re not the client

You’re not the KC’s client. The promoter is the KC’s client. So, even if the KC is completely wrong, you can’t sue him.

In that film relief case, even though the taxpayers relied on the KC’s advice, their claim for negligence failed.

3. The opinion makes it harder for you to sue the promoter

If everything goes wrong, the only person you can sue is the promoter.

You’ll sue them for negligence, which means you have to show that no reasonable adviser would have given the advice they gave. That is a harder task if they have a KC opinion, because they can then say they were following the advice of an eminent KC, which (they will argue) must have been a reasonable thing to do.

The KC opinion can make your position worse.

4. Normal people don’t need KC opinions

A KC opinion can be very useful if you’re in a dispute with HMRC, to get an independent view of your prospects of success. And people with complex affairs often have a legitimate reason to seek a KC’s advice (e.g. large companies, very wealthy people with assets all over the world).

But normal people shouldn’t be doing anything so complicated and uncertain that it requires a KC opinion (I’d certainly never put myself in that position).

The best approach to tax is to be boring, stick with the crowd, and do what everyone else is doing. That’s true for taxpayers of all kinds. When I was a practicing lawyer, I advised some of the largest and most sophisticated businesses in the world. If I’d told them I had a unique way to save tax, different and better than everyone else’s approach, they would have fired me on the spot.

The truth about insurance

This is a typical claim from the “Head of Estate Planning” at Less Tax for Landlords, an adviser/promoter we’ll be reporting on soon.2Video is © Less Tax for Landlords Ltd, and excerpted by us as fair dealing for the purposes of criticism and review.

“You also will be covered by our professional indemnity insurance. Our insurance is designed to return you to the place that you would have been had you never engaged with us. So it just ensures that although it won’t pay for example any tax that you would have paid if you didn’t do this, if any additional tax occurs because you engage with us it would cover that. It would cover any fines, any penalties and any further advice and also it would cover us to help you argue if HMRC ever had any issues and looked into this.”

And here’s someone on Property118’s website, who claims to have used the Property118 scheme on the basis of assurances that Cotswold Barristers were insured:

This all suggests that, if HMRC don’t agree with the tax treatment, you’re not out of pocket… you get immediately reimbursed by the friendly insurers.

Here’s what actually happens:

- Initially – nothing. You file the tax return, HMRC’s systems accept it, and you don’t hear anything back.

- Later, likely years later, HMRC tell you they disagree with your tax position, and claim back years of tax, plus interest and potentially penalties.

- You and your advisers have a lengthy exchange of correspondence with HMRC, trying to persuade them to back off.

- HMRC don’t back off – they require you to pay tax on the basis the scheme didn’t work.

- You disagree and file an appeal with the First Tier Tribunal.

- You lose that appeal, and possibly make and lose appeals in higher courts.

- At that point you have to pay up.3At least for income and corporation tax; for some other taxes (e.g. VAT) you have to pay up before you apply for the first appeal.

- You then sue the advisor for negligence.

- The adviser then notifies their insurer and the insurer steps in, but not on your side. The insurer will (in most cases) run the advisor’s defence. Remember, you’re not insured – the adviser is.

- (Unless the insurer finds a way to argue that the claim isn’t covered. Insurers are good at this. It is, for example, possible that selling a scheme on the strength of the insurance could itself invalidate it.

- You now have to win the negligence claim (or get a good settlement). This isn’t easy – many professional negligence claims fail. In short, you have to show (1) that the advice was so unreasonable, no reasonable advisor would have given it, (2) that it was reasonable for you to rely on their advice, (3) that you wouldn’t have entered into the arrangement if they’d given you correct advice, and (4) that you took reasonable steps to mitigate your loss.4My apologies to any tort lawyers reading this on a horrible over-simplification.

- Clients/victims of the various avoidance schemes of the last 20 years have generally had very little success getting recovery from their advisers.

- There will be lots of arguments about “quantum” – how much you are entitled to recover, and how much tax you would have paid anyway, if you hadn’t entered into the scheme. The best you can hope for is interest, penalties, and additional taxes the scheme created. You’ll never get back the tax you thought you’d saved with the scheme – this is gone for good.

- Once you win, the insurer then pays out. Even in this happy scenario, you’ve still been out of pocket for the (likely) years it took to pursue the negligence claim.

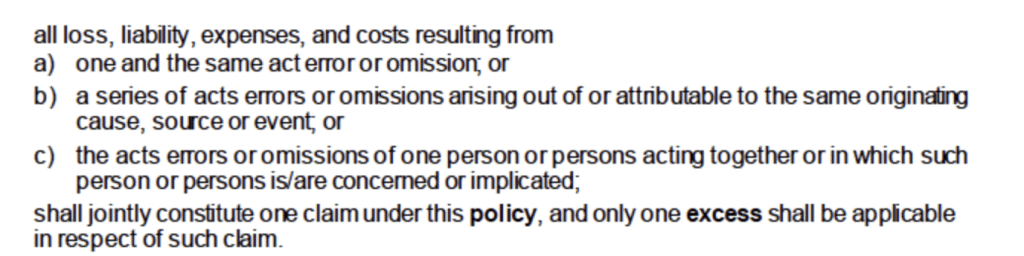

And it could be worse than this. Promoters often say they are covered for £2m (or more) “per claim”. But that is very different from “per client”. Imagine a promoter sells 500 basically identical schemes, and the same point goes wrong on all of them. The insurance may well contain wording like this:

In which case the insurer won’t be liable for 500 x £2m, but only a maximum of £2m total, across all 500 schemes. £4,000 each.

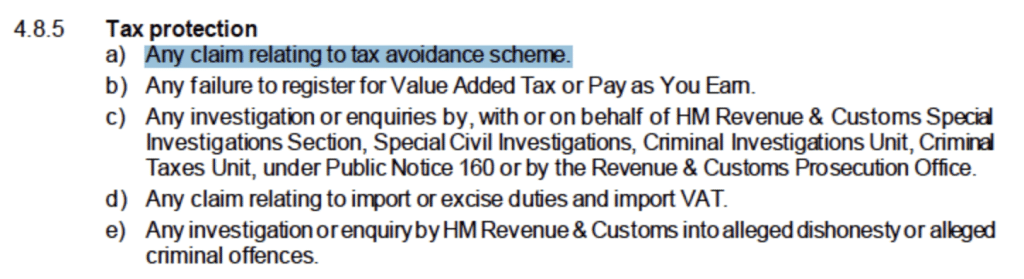

Finally, professional liability insurance often has this exclusion:

Which would could deny the claim entirely.

Even in a best case scenario, the only benefit of the insurance for a client is that it protects you against the adviser going bust or disappearing (if it’s “run-off” insurance, which it may not be). That’s not nothing… but it absolutely doesn’t make it easier for you to recover any tax you have to pay to HMRC.

When I was in practice, I never assured a client that they didn’t need to worry, because we had insurance. We certainly had insurance – a very serious policy with a very large amount of coverage. But my clients knew that the insurance is primarily there to protect the advisers, not the client. Insurance is not a guarantee that the adviser is correct.

My advice

You should expect your adviser to explain and stand behind their own advice. Promoters’ use of KC opinions and insurance is just a sales tactic. You want a competent technician, not a magician5We’d make an exception for one tax adviser we know who’s a member of the Magic Circle or a salesman. Remember, tax is supposed to be boring.

Image is © HMRC.

- 1

-

2Video is © Less Tax for Landlords Ltd, and excerpted by us as fair dealing for the purposes of criticism and review.

-

3At least for income and corporation tax; for some other taxes (e.g. VAT) you have to pay up before you apply for the first appeal.

-

4My apologies to any tort lawyers reading this on a horrible over-simplification

-

5We’d make an exception for one tax adviser we know who’s a member of the Magic Circle

12 responses to “Tax avoidance scheme myths: “we have a KC opinion” and “we’re fully insured””

Another great post, I often have to point out to prospective clients the differences between vanilla tax planning and the scheme dreams they are being sold elsewhere!

That was my experience. SDLT scheme recommended by mortgage broker. Adviser liquidated and set up new legal partnership. Insurer went into administration and insurance protection body said it was contra bonos mores to honour SDLT avoidance policies. Administrators said on the back of that, they would also refuse and policyholders could prove for their premiums only. Never even got a response out of them for that.

I have no sympathy for anyone losing out in these situations. If you are wealthy enough / earn enough to think about avoiding tax, just pay the tax and make your contribution to society. If you are a KC charging tax advisors for advice that in practice is just enriching yourself and the tax advisors, then maybe it’s time to think of more useful ways to spend your time.

Even (non-tax specialist) judges get this area wrong sometimes. See Mehjoo v Harben Barker [2013] EWHC 1500 (QB) in which it was ruled an accountant was negligent for failing to recommend a tax avoidance scheme to his client only one year before it was shut down by the government. Thankfully the Court of Appeal overturned Silber J’s barmy decision ([2014] EWCA Civ 358).

Hi Dan

Great article and thank you sincerely for saving me as I was about to sign up to a very similar *scheme* before I found your site ………….

after taking your advise regarding seeking a professional tax advisor which should have been obvious but overlooked as I and many others I presume were seeking along the lines of what we wanted to hear , anyways I have now found a CTA that seems good fingers crossed

my question is as your article points out regarding the insurance/liability , his company would work the same way and worthless if any claim was to arise irrespective of how good they word it and clarify it, would it not?

Many thanks

Dan

Another interesting piece of work.

From what I saw and learned, HMRC seemed to take the view that the more a scheme became popular with the consequent increase in likely loss of tax revenue the more likely they were to challenge it and/or introduce legislation to make it less viable – the Home Loan Scheme being a prime example.

There are many fine KCs out there, and I am lucky enough to work with some of them. I always remember the advice of Rumpole of the Bailey – barristers are like taxis, you tell them where you want to go.

Interesting piece Dan which is pretty much the same as we’ve been saying for a few years.

In contractor world there were a couple of additional factors which pushed people into schemes. The first was “an IR35 solution”. Contractors in 2001 onwards were terrified that they were in IR35 and would be accumulating tax liabilities that would bankrupt them later. They bought into the brainwash that they had to “beat” IR35 in order to continue working as contractors. That was not true then – and is not true now. The answer is that if a role is inside IR35, then it should command a premium price to offset the alleged (but often unproven) additional tax due. A scheme which guaranteed an outside IR35 status was high on the wish list.

Second was pure deception. Pre 2000, a contractor operating via a company would keep say 90% of their invoiced hours value by paying themselves dividends and not salary from their PSC. This ignored CT and compliance costs which might account for another 10% of invoice value. Post IR35 they were offered similar returns but without the cost/hassle of company compliance and were often told that “all taxes are taken care of”. In reality, the tax was 1% and the fees to promoters were 19%.

Hindsight is always 20/20.

I very much enjoy the posts.

I do wonder whether “The opinion is probably wrong” goes a bit far? I don’t know, but suspect the tax bar has collectively produced hundreds of KC opinions in the last few decades on tax schemes. As you say in the last 25 years only one challenge to a tax avoidance schemehas been defeated. I don’t know how many challenges have been succesful or the number of times a KC opinion has been succesfully proved wrong. However, I would have thought the number of times a KC opinion has been shown to be wrong is far lower than the total number of KC opinions. In short, HMRC don’t challenge a very large number of KC opinions and (in simple terms) they are probably correct.

I may well have misunderstood how this all works. Anyway, keep up the good work. It is very interesting, particularly for non-tax lawyers.

thanks – I’ll amend it to make clearer that I’m talking about a specific type of KC opinion – avoidance scheme opinions. I do believe “probably wrong” is a fair summary of these.

Hi Dan

Pedants rule….under bullet point 1, 3rd para “tax avoidance courts to come before the courts” should read “tax avoidance case…….”

oopsie! Thank you!