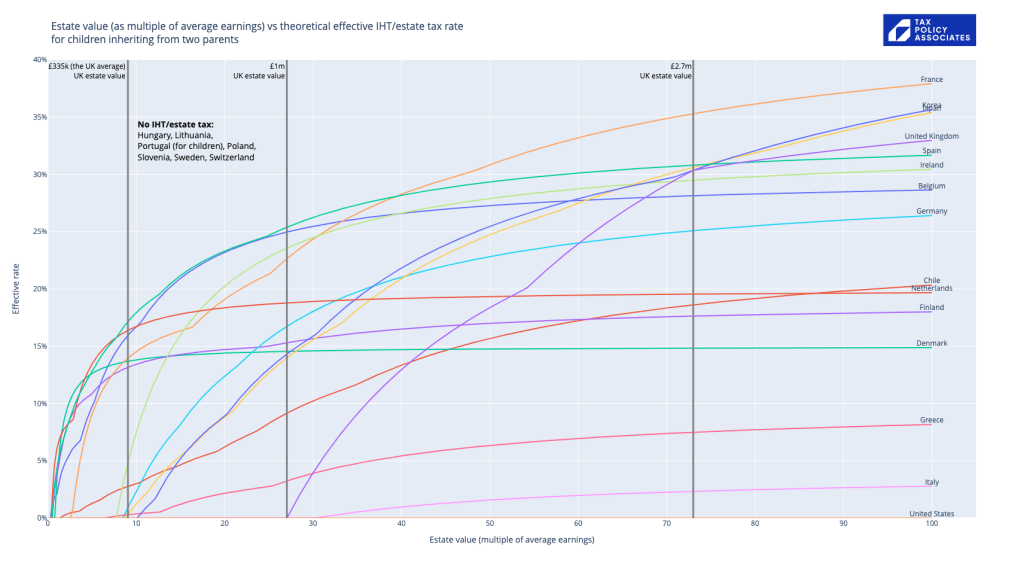

The OECD tax database has data on inheritance tax systems across the world, and we can use that to plot theoretical estate/inheritance tax effective rates in each country. In other words, for estates going from 1x average earnings to 100x average earnings,1Would be better to use wealth centiles in each country, but I can’t find consistent data across the OECD. If anyone can, please drop me a line). how much tax does the estate pay, as a % of estate value?

In many countries, the tax result differs markedly depending on who inherits, so I’ll focus on children inheriting from two married parents (generally the scenario with the lowest tax).

That gives us this:2Important caveats: this uses OECD data which covers the broad sweep of estate/inheritance taxes but inevitably misses some of the detail. I manually added in the UK residence nil-rate bands… I didn’t go through other countries and investigate/add in all of their quirks. So this may somewhat flatter the UK compared to other countries. The chart also only covers the scenarios where children inherit from a married couple. Other scenarios are hard to model given that many countries have forced heirship rules, where the children more-or-less always inherit.

Obvious conclusions:

- The point at which inheritance tax first applies is much later in the UK than in most other countries. An average UK estate of £335k isn’t taxed – equivalents in many other countries are.

- By the time we get to estate values of 27 x average earnings (£1m in the UK), every country on the chart is charging tax, except the UK and the US (plus of course the countries that don’t have an inheritance tax at all).3The US is an interesting case. The rate is the same as the UK’s – 40% – but the per-person exemption has always been much higher. $5.5m in the 2010s and $12.9m today, rising with inflation each year until it resets back to $5.5m in 2025 (unless extended). Like the UK, there are many ways to avoid US estate tax – arguably it’s even easier (the use of trusts is extremely common).

- On the other hand, the UK rate is higher than most, and so starts catching up fast. When we reach estates worth 80 x average incomes (£3m in the UK), the UK has one of the highest theoretical effective rates of inheritance tax in the world.

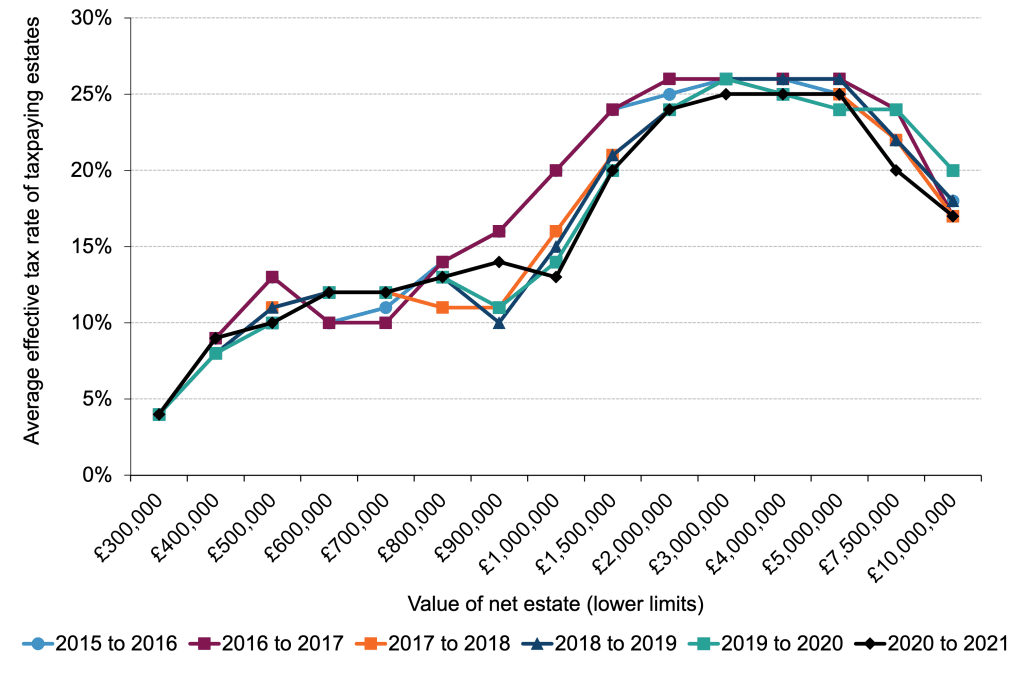

That’s the theory. Here’s the reality, from HMRC’s latest inheritance tax commentary:4Note that the HMRC chart s for individual estates, and my chart above for the overall impact on a married couple couple. You therefore can’t directly compare one against the other – i.e. because the spouse exemption means that 30-40% of all deaths result in no inheritance tax, so even if the 40% rate applied perfectly, the HMRC chart would show an effective rate in the 20%s.

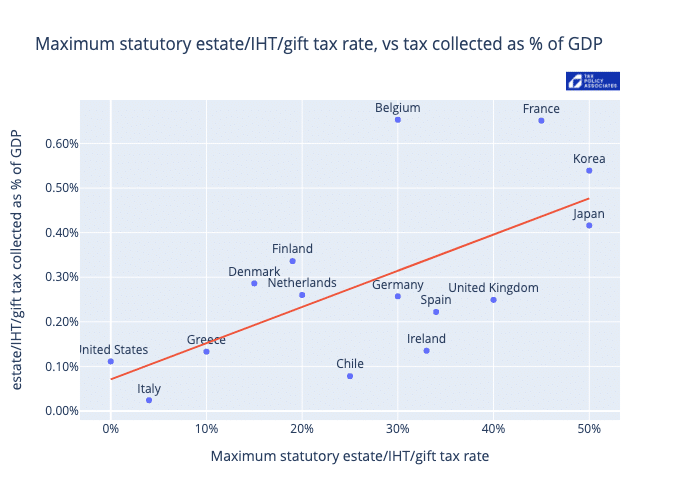

There is a very noteable drop-off in the effective rate for large estates (£9m+). Perhaps for this reason, the UK’s high rate of inheritance tax is not reflected in its tax revenues:

Denmark, The Netherlands and Germany all collect about the same amount of tax as us, but with markedly lower rates.

Why? The most important explanations are likely to be:

- The complicated-but-generous £1m UK inheritance tax allowance for children inheriting the family home from a married couple.

- The very generous exemptions for agricultural property and business property, which the latest figures show cost around £1.4bn. The original intention was to avoid forced-sales of small businesses and farms. However, the exemptions are widely used as pure tax planning/avoidance, with particular use of woodlands and AIM shares.

- The even more generous complete exemption from IHT for foreign property of non-doms, which is supposed to lapse after 15 years, but thanks to standard planning can be made permanent. The cost of this is unknown, because we (and HMRC) know nothing about the foreign assets of non-doms.

So a tax that’s very progressive in theory, turns out to be only progressive for the upper middle class – who are rich enough to get taxed, but not rich enough to avoid it.5Primarily because a disproportionate amount of their wealth is in their house, which means taking advantage of the various reliefs/exemptions is impracticable. The middle class pay nothing (unlike much of the Continent). The seriously wealthy pay (relatively speaking) considerably less than the upper middle class.

Where does that leave us? A tax with an unfortunate combination of a high rate (which makes it unpopular and motivates avoidance) and poorly targeted/overly-generous exemptions (which enable avoidance).

There are lots of proposals for reform, but a dramatic change to such a sensitive tax will always be politically difficult.

My proposal is simple. Let’s be more Netherlands. Aim to collect the same amount of tax, and from the same people. Keep the £1m threshold, but simplify it. Make the exemptions less generous, and use the proceeds to greatly reduce the rate – perhaps even to as low as 20%. A fairer and more effective inheritance tax system.

The underlying data is all thanks to the OECD; the code is available here.

-

1Would be better to use wealth centiles in each country, but I can’t find consistent data across the OECD. If anyone can, please drop me a line).

-

2Important caveats: this uses OECD data which covers the broad sweep of estate/inheritance taxes but inevitably misses some of the detail. I manually added in the UK residence nil-rate bands… I didn’t go through other countries and investigate/add in all of their quirks. So this may somewhat flatter the UK compared to other countries. The chart also only covers the scenarios where children inherit from a married couple. Other scenarios are hard to model given that many countries have forced heirship rules, where the children more-or-less always inherit.

-

3The US is an interesting case. The rate is the same as the UK’s – 40% – but the per-person exemption has always been much higher. $5.5m in the 2010s and $12.9m today, rising with inflation each year until it resets back to $5.5m in 2025 (unless extended). Like the UK, there are many ways to avoid US estate tax – arguably it’s even easier (the use of trusts is extremely common).

-

4Note that the HMRC chart s for individual estates, and my chart above for the overall impact on a married couple couple. You therefore can’t directly compare one against the other – i.e. because the spouse exemption means that 30-40% of all deaths result in no inheritance tax, so even if the 40% rate applied perfectly, the HMRC chart would show an effective rate in the 20%s

-

5Primarily because a disproportionate amount of their wealth is in their house, which means taking advantage of the various reliefs/exemptions is impracticable

7 responses to “How does UK inheritance tax compare with other countries?”

No-one likes complexity. Anyone running a business or a farm (or a scout group) who doesn’t plan their succession will leave a mess for their successors. No reason to create tax loopholes. As for the tax-free amount, well, a nice nod to wanting to pass something on is not Osborne’s rich-boy £1m, but instead the average value of a UK home – coincidentally where we are now, about £300k). After that, why not default to the (newly equalised under your recommendations…?) CGT and basic-rate income tax rates? It means that higher-rate tax-payers would have surprise equality with their poor siblings for once, but then, didn’t Mum love them just as much?! The same for legacies to foreign nationals, cats’ homes, trusts and everyone else. You die, you leave a house-worth for free, the rest is taxed. Let’s set all those brainy tax lawyers free to do something useful!

Do any of these comparisons factor in potentially exempt transfers? I’ve always thought the unlimited tax free lifetime giving to be incredibly generous. Do we need a return to Capital Transfer Tax?

How about reducing rates by 50% and putting a ceiling on PETs? And at the same time abolish non-dom status aside from the first few years. Make it work the same way as overseas workday relief?

As I understand it gifts are not tax free, and the law regarding the taxation of gifts are surprisingly complex though ian can confirm this

A gift to an individual is free from inheritance tax provided you live for seven years. If it’s a CGT asset then you will have CGT to pay when you make a gift – it’s deemed to be a disposal at market value. Otherwise a gift isn’t taxable in the UK.

Dan

I totally agree

Before I retired I worked for a UK international firm of accounts specialising on IHT mitigation and family trust planning.

The Labour party proposals on UK resident non-doms don’t mention IHT. Perhaps this is because of a lack of reliable information on the assets potentially chargeable. Applying the reservation of benefit rules to ‘excluded property’ trusts would be a simple first step.

The problem is that HNW and UHNW are also comparing the IHT/Estate tax burden to the US.

For UK UHNW whether Non-Doms or Doms, let’s assume for a moment that it goes up to a clean £1M that the Times says is being considered by the Tories and that the Tories win and put this in place. Furthermore let’s assume for a moment that a spouse has a second £1M. That would mean that a couple would have a £2M exemption before paying 40% on everything over that. As for their vague future promises that they would abolish the IHT…don’t hold your breath.

Now compare that pig in a poke of £2M (approximately $2,447,800 USD) to the current EXISTING 2023 single individual exemption (i.e. unified credit) from US Gift and Estate tax of $12,920,000 USD. Add in the existing spousal exemption and now the first $25,840,000 USD is exempt from the US version of IHT. And just to put the final nail in the coffin, the exemption amount is annually indexed for inflation and will probably increase in 2024 by an amount exceeding the Tories’ proposed new exemption!

While the Tories proposal looks better than Labour’s promise to drop the exemption amount to £125,000, there should be little wonder that UHNW UK taxpayers are actively looking at acquiring a domicile of choice elsewhere…such as the US? or Canada which has NO estate tax (https://lesperanceassociates.com/wp-content/uploads/2020/03/Meghan-and-Harry-Tax-Issues-and-Canada-A-White-Paper.pdf)