If I was a Tory Chancellor, I wouldn’t abolish inheritance tax. I’d fix the ridiculous marginal rates that mean there are hundreds of thousands of 30-somethings paying more than 70% tax on every additional £ they earn.

This is complicated, unfair and a disincentive to work; it could also plausibly be holding back growth. Any government serious about fixing the tax system should start here.

UPDATE 20 November 2023 to take account of the uprating of child benefit. And more here on the ghastly mechanics of the High Income Child Benefit Charge. Also please note that the figures in this article are for the UK excluding Scotland – the Scottish rates are higher.

Here’s a speech from the last time a Conservative Chancellor cut taxes:

But 45% isn’t the highest rate. Not even close. There are millions of people paying more than 60%. And hundreds of thousands paying much more – some even over 100%.

The marginal rate

If you want to know your take-home pay, then it’s your effective rate of tax that’s important – total tax you pay, divided by gross wage (more on that here). Earn £50k, you take home about £38k after tax, so your effective tax rate is 24%.

The marginal rate of tax is different and more subtle – it’s the percentage of tax you’ll pay on the next £ you earn. Irrelevant to where you are now, but highly relevant to your future, because it affects your incentive to work more hours/earn more money.1Everything interesting happens at the margin. For more on why that is, and some international context, there’s a fascinating paper by the Tax Foundation here.

The marginal rate of tax in the UK for high earners in theory caps out at 47% (45% income tax and 2% national insurance2Note that I’m not including employer’s national insurance here. Employer’s national insurance is absolutely a tax on labour in the long term, because it reduces pay packets in the long term. But it’s not usually included in a calculation of a marginal tax rate, because it’s not economically passed to you in the short term, and so it won’t rationally affect your decision whether or not to work more hours. There’s a good explanation of this point here.) once you get to £125,140k. I’m not terribly convinced this disincentivises anyone to work (and I spent many years working in an environment surrounded by colleagues and clients paying tax at this rate). But people earning much less than £125k can have a considerably higher rate, principally due to four effects:

- Child benefit is £1,248 per year for the first child and £827 for the rest. It starts to be phased out by a special tax – the “high income child benefit charge” – if your salary hits £50k, and you get no child benefit at all once the gross salary of the highest earner in the household hits 60k.

- The personal allowance – the amount we earn before income tax kicks in – starts to be phased out if your salary hits £100k, and is gone completely by £125k.

- Student loan repayments

- Government childcare schemes

These phased withdrawals create very high marginal rates.

The 70%+ rates

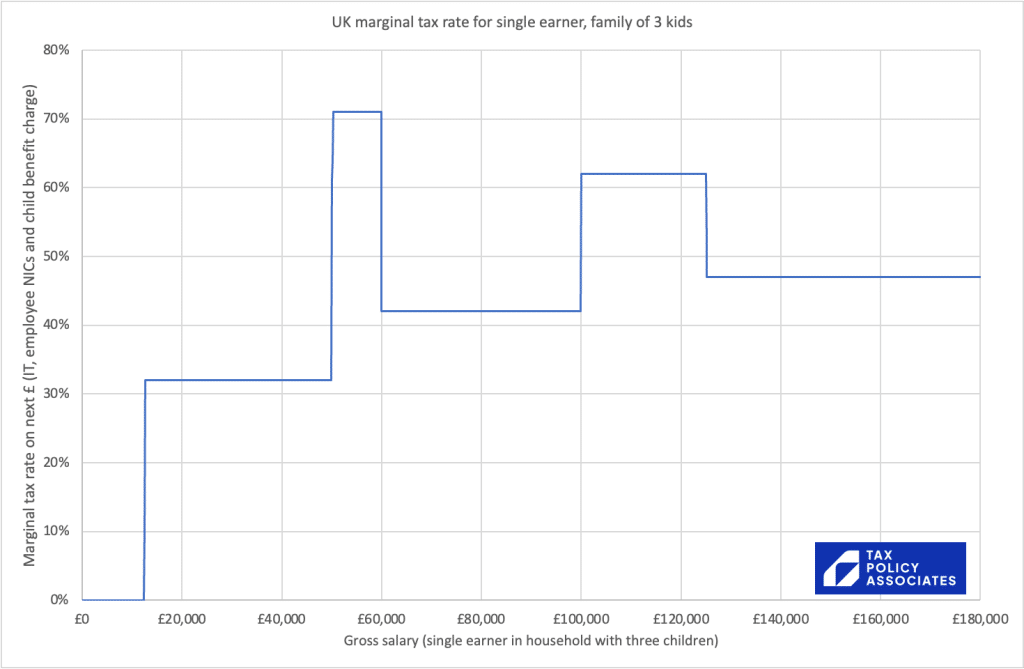

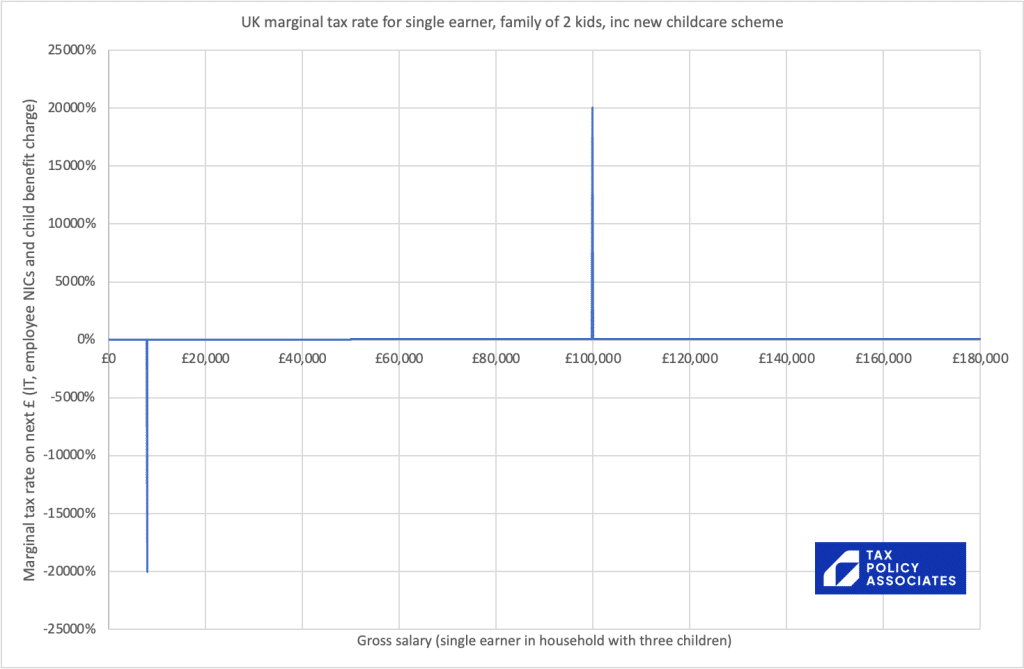

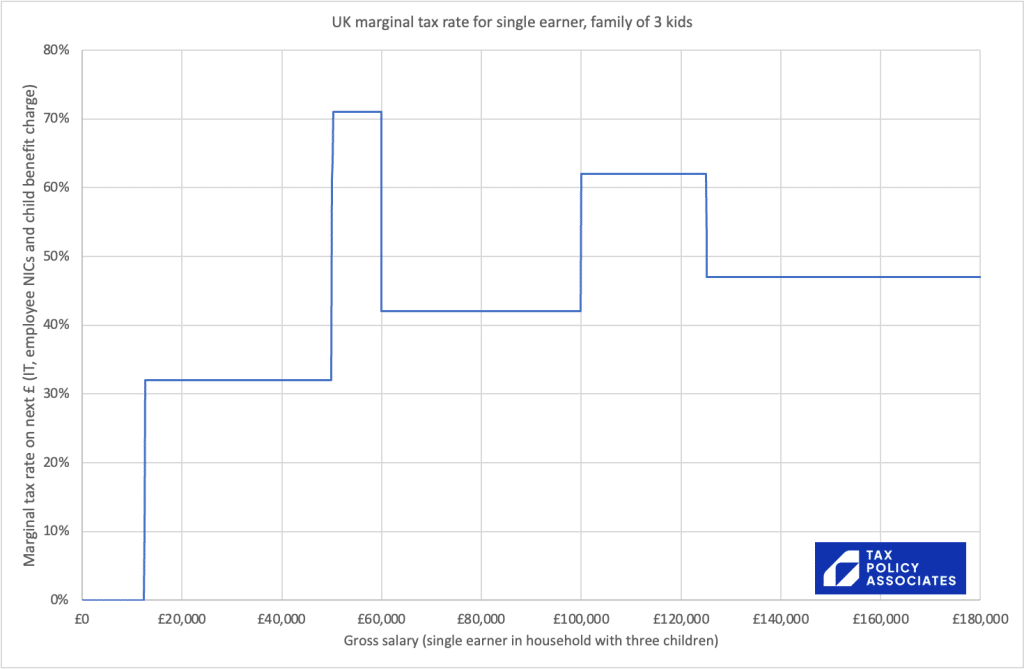

For a family with three kids, the marginal tax rate for a given salary looks like this:3The Scottish rates are higher – the charts and figures here are for the rest of the UK

That bump between £50k and £60k is a 71% marginal tax rate, meaning that, for every additional £1,000 you earn gross, you take home £290.

Looking at it another way: imagine you’re working a reasonably modest 1,500 hours a year and earning £50k gross, so about £38k take-home. That’s £33/hour before tax, £25/hour after tax.

How would you like to work another 200 hours a year for the same hourly rate? Sounds good. But after-tax you’ll actually be earning £9.57/hour. You may well not think that’s worth your while. And, given that £9.57 is less than the minimum wage, if you need childcare cover then that could easily cost you more than the additional pay.

The bump between £100k and £125k is the withdrawal of the personal allowance, and results in a 62% rate between £100k and £125k. Not quite as dramatic as the 71%, but still well over the psychologically important 50% mark – and that rate lasts for a significant £25k.

An example of how this can play out: you work 1,500 hours a year and earn £99k, gross, about £63k take-home. That’s £66/hour before tax, £42/hour after tax. If you work another 400 hours to hit £125k gross, after-tax you’re earning £26/hour.

Let’s go higher

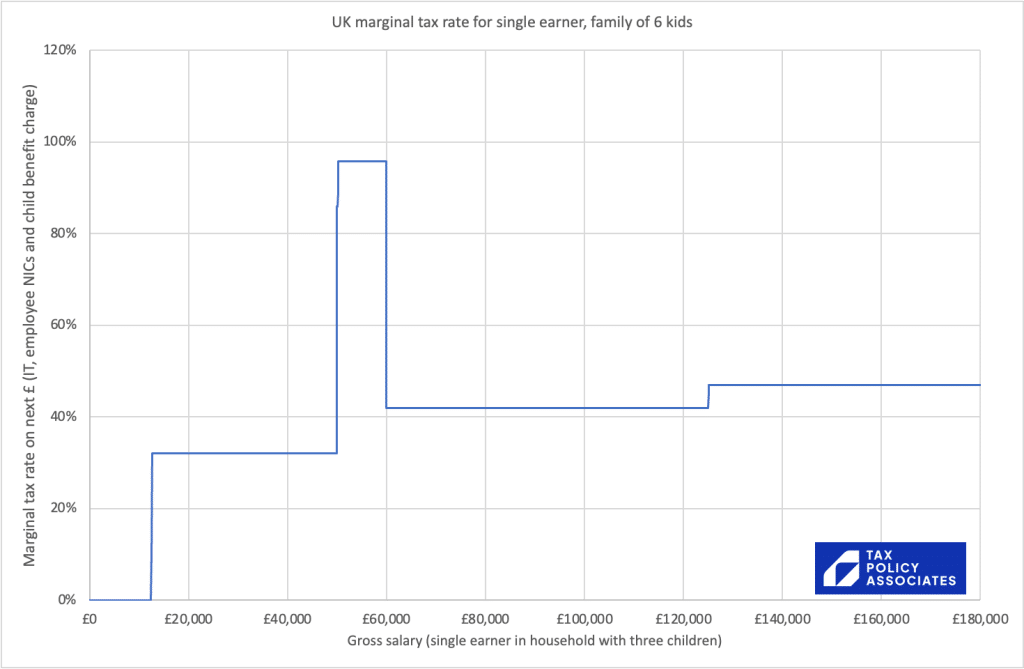

Because it’s linked to child benefits, those high marginal rates just get bigger the more children you have. I have a friend with six children. Congratulations, Steve, because you can win a marginal tax rate of 96%.

Why stop there? With eight children you get a top marginal rate of 112% – so if you earn £50k gross, your after-tax pay is £38k. If you earn £60k gross, your after-tax pay is £37k. That’s insane. Hopefully, nobody is actually in that position, but a sensible tax system doesn’t create such results, even in theory.

What about student loans?

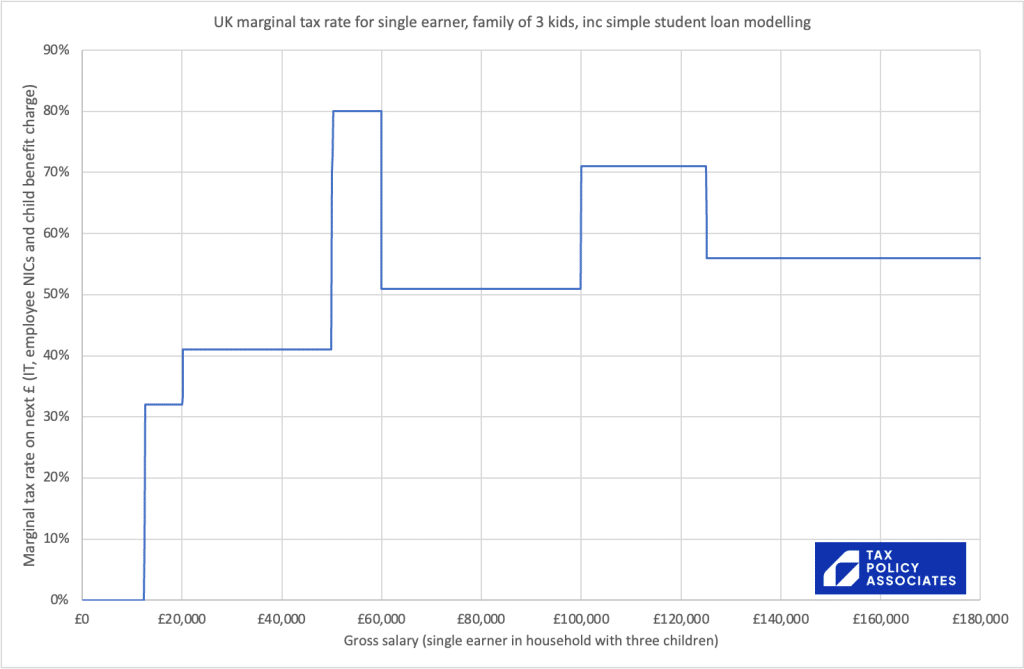

Student loans are really just a complicated hidden graduate tax.

For someone starting university before 2012, you pay 9% of your salary over £20,184, until the loan is repaid. Of course, the effect on individuals – even those on the same income – will vary widely, depending on how much loan they borrowed, how long they’ve been earning, and how their salary ramped up over time.

We can model it with some simplifying assumptions. Let’s say everyone on the chart is 30 years old, graduated nine years ago, and their salary ramped up in a straight line from £20k to where it is now. The marginal rates then look like this:

I’d be cautious about citing these precise figures, given how dependent they are on the assumptions.4i.e. because in some cases someone earning £50k will have already repaid their student loan But, unsurprising, the broad effect is just to raise all the marginal rates by 9%. Graduates with children can therefore easily suffer from marginal rates of 80%. You can have a play with the spreadsheet to look a the various scenarios.

It gets worse

The Government keeps creating generous childcare schemes that are removed suddenly when your wage hits £100,000. That creates a marginal rate that can only be described as “insane”.

This year, the Government created a new childcare support scheme for parents with children under 3. This could be worth £10,000 per child for parents living in London. And it vanishes completely once one parent’s earnings hit £100k. Here’s what that does to the marginal tax rate:5The chart is for a single earner, but if they have a partner, the partner would also need to be earning at least £8,668 (the national minimum wage for 16 hours a week)

The 20,000% spike at £100,000 is absolutely not a joke – someone earning £99,999.99 with two children under three in London will lose an immediate £20k if they earn a penny more.6The 20,000% figure is a consequence of the spreadsheet incrementing the gross salary by £100 in each step. Arguably the true marginal rate is £20,000 divided by 1p, or 200,000,000% – but the concept of marginal rates doesn’t really make much sense when we have discontinuities like this

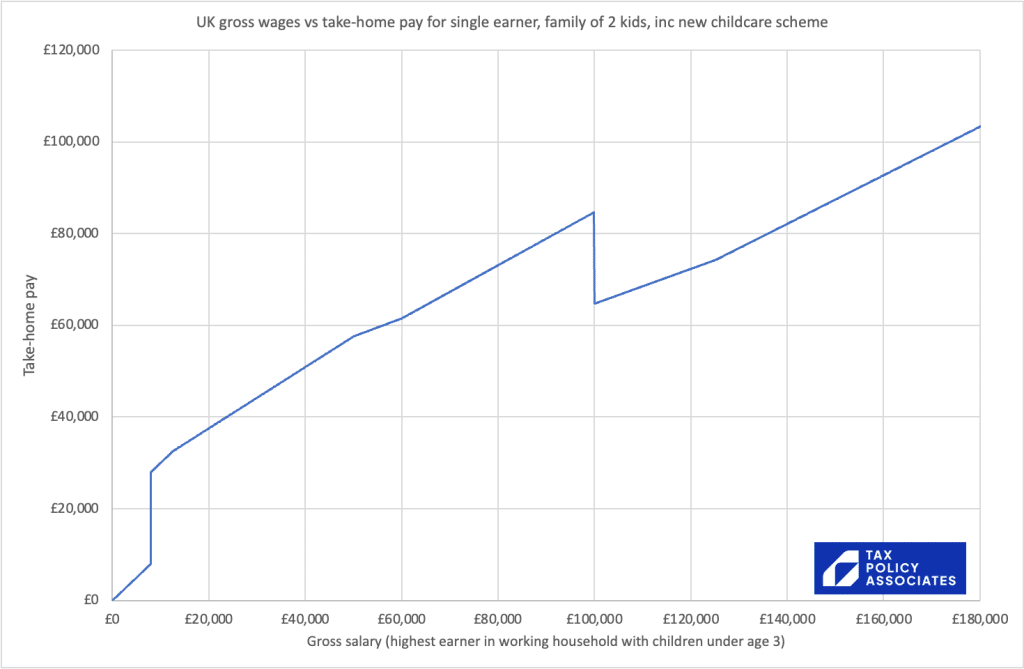

The practical effect is clearer if we plot gross vs net income:

After-tax income drops calamitously at £100k, and doesn’t recover to where it was until the gross salary hits £145k.

This is ignoring the pre-existing tax-free childcare scheme, which also vanishes at £100k. The amounts are less (usually under c£7k/child) so the curve would look less dramatic. However, as the scheme applies to children under 11, taxpayers feel these effects for many more years.

Why does nobody care?

If a political party went into an election, promising a tax system like the one described in the article, there would be uproar. But instead, we’ve drifted into this disaster over many years, and the topic is absent from almost all political debate. The Conservative Party mostly doesn’t talk about these high marginal rates, perhaps because they’re too embarrassed to admit it’s mostly a system they created. Labour doesn’t talk about it, perhaps because they’re too embarrassed to appear to care about anyone earning £50k (and Brown/Darling were responsible for the personal allowance taper)7I’d forgotten that detail – thanks to Robert Palache for reminding me.

And if your reaction to this is “I don’t care about people earning £50k or £100k a year”, then you should.

- It’s more people than you’d think. After the recent surge of inflation, something like 23% of taxpayers earn £50,000 and 6% earn £100,000. 8Taxpayer income percentiles are here, but only go to the 20/21 tax year; we then have to uprate these figures by the approx 18% inflation since.

- But that’s a snapshot, and also not quite the right measure. A better question is: what proportion of households will at some point have someone in a position to accept a promotion, or work more hours, and break the £50k or £100k barrier? I’m not aware of any figures on this, but I expect the answer is a large percentage, perhaps even a majority.

- There’s an obvious impact on all of us if plumbers, doctors, IT contractors etc are turning away work/hours to avoid hitting £50k/£100k.

- And a wider economic impact. When we have a workforce capacity crisis, we shouldn’t be creating an incentive for people to turn away work. I’m not an economist, but it seems plausible these effects act as a brake on growth.

And we should also care about fairness, at all levels of income. A marginal rate of 80% is a problem we should fix, whether it hits people earning £10k or people earning £1m.

The child benefit withdrawal is particularly complicated and unfair, and catches lots of people out.9See also this excellent OTS report here

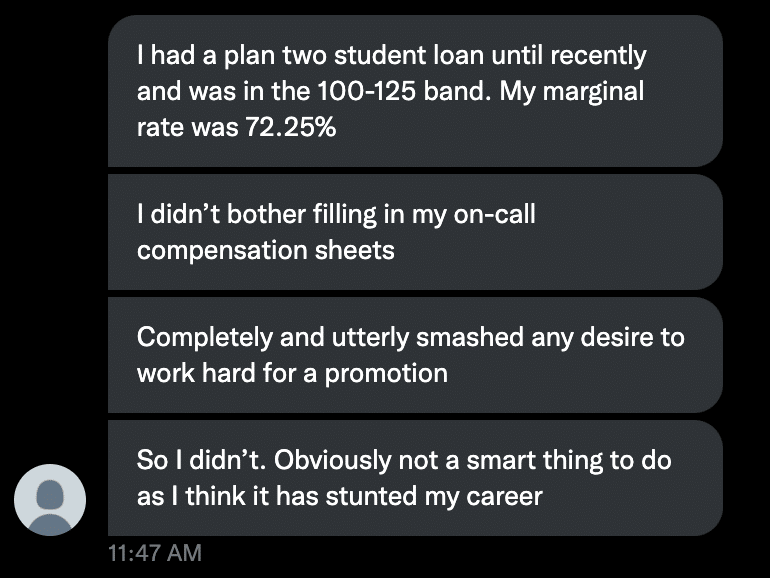

The human side looks like this, one of many similar messages sent to me:

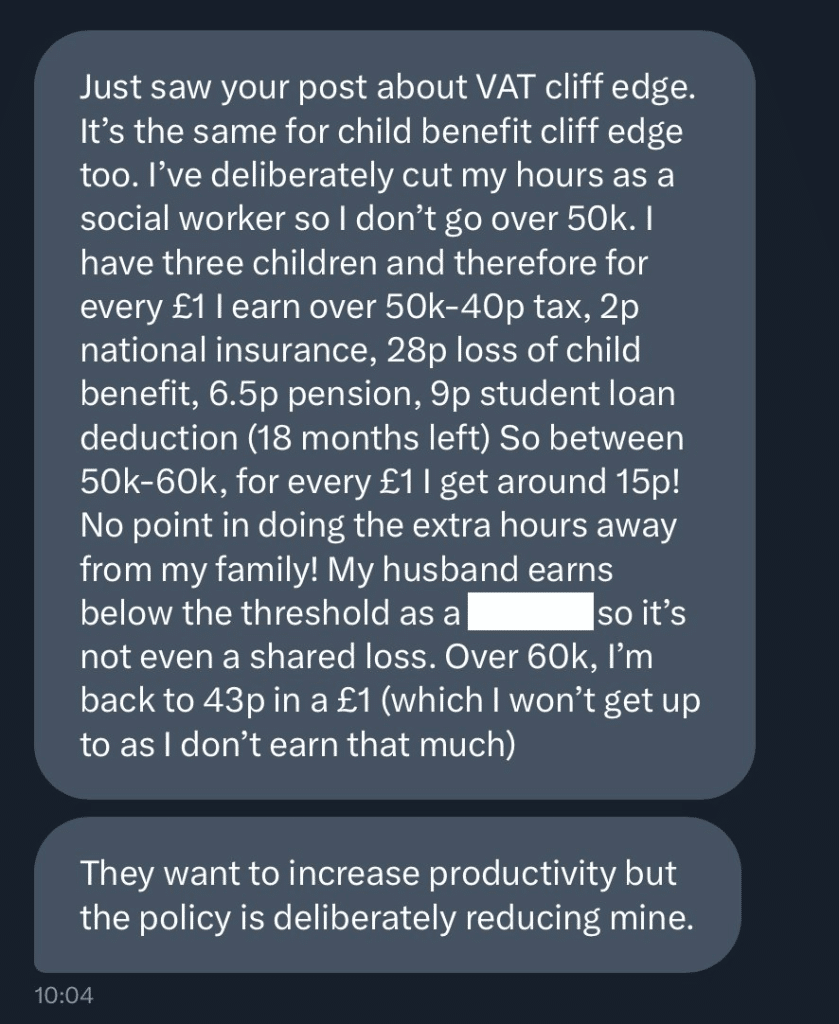

And:

If we’re looking for ways to fix the tax system, then this should be right at the top of the target list. Regardless of where we sit on the political spectrum.

The solution

One solution is simply to scrap the personal allowance and child benefit tapers (and the marriage allowance to boot). That would, however, be fairly expensive, on the face of it, costing somewhere around £6bn to repeal both.10Nikhil Woodruff has properly modelled this, and reckons £6.6bn. We can sense-check very approximately as follows: 500,000 taxpayers earn £120k, value of personal allowance is £5k, so approx cost £2.5bn. Child benefit taper envelope: the child benefit taper was expected to bring in £2.5bn of revenue when introduced in 2013. Since then, child benefit has gone up about 10%, and nominal earnings about 30%. Implying costs of around £2.5bn today. The marriage allowance should be small beer by comparison with either figure. Scrapping the childcare hard-stop at £100k, and the student loan repayment rules, would be more expensive still. That said, the widespread awareness of these issues amongst the people affected, and use of salary sacrifice, additional pension contributions, etc, makes me wonder if the actual (dynamic) cost might be materially less.11Some people respond to this by saying: it’s easy; they can just make a pension contribution to keep their income below £50k/£100k. For the self-employed, or anyone with irregular earnings, that’s not so easy to manage in practice. And people (reasonably) often want to spend their earnings as they like, and not make a huge pension contribution.

Realistically the most likely source of funding is playing around with rate thresholds, for example reducing the point at which the additional rate kicks in. There are certainly other alternatives; but the important thing is that we really, really, shouldn’t have a tax system that can have a 71% marginal rate, let alone a 20,000% marginal rate.

Oh, and the other lesson: please please, politicians and HM Treasury, don’t introduce any more tapers into the tax system. Thank you.

The caveats

All the calculations are in this spreadsheet. The key assumptions/caveats are:

- Income tax/NI as for tax year 2023/24

- One earner in a household, who is over 21 and not an apprentice, not a veteran, and under the state pension age

- Ignores benefits aside from child benefit (although benefits are notorious for creating very high marginal rates – not, however, an area where I and our team have expertise)

- Doesn’t include tapering of pensions annual allowance (starting at £240k)

- Doesn’t include effects of the pension annual allowance.

Do please send me any corrections, additions or comments.

-

1Everything interesting happens at the margin. For more on why that is, and some international context, there’s a fascinating paper by the Tax Foundation here

-

2Note that I’m not including employer’s national insurance here. Employer’s national insurance is absolutely a tax on labour in the long term, because it reduces pay packets in the long term. But it’s not usually included in a calculation of a marginal tax rate, because it’s not economically passed to you in the short term, and so it won’t rationally affect your decision whether or not to work more hours. There’s a good explanation of this point here.

-

3The Scottish rates are higher – the charts and figures here are for the rest of the UK

-

4i.e. because in some cases someone earning £50k will have already repaid their student loan

-

5The chart is for a single earner, but if they have a partner, the partner would also need to be earning at least £8,668 (the national minimum wage for 16 hours a week)

-

6The 20,000% figure is a consequence of the spreadsheet incrementing the gross salary by £100 in each step. Arguably the true marginal rate is £20,000 divided by 1p, or 200,000,000% – but the concept of marginal rates doesn’t really make much sense when we have discontinuities like this

-

7I’d forgotten that detail – thanks to Robert Palache for reminding me

-

8Taxpayer income percentiles are here, but only go to the 20/21 tax year; we then have to uprate these figures by the approx 18% inflation since.

-

9See also this excellent OTS report here

-

10Nikhil Woodruff has properly modelled this, and reckons £6.6bn. We can sense-check very approximately as follows: 500,000 taxpayers earn £120k, value of personal allowance is £5k, so approx cost £2.5bn. Child benefit taper envelope: the child benefit taper was expected to bring in £2.5bn of revenue when introduced in 2013. Since then, child benefit has gone up about 10%, and nominal earnings about 30%. Implying costs of around £2.5bn today. The marriage allowance should be small beer by comparison with either figure.

-

11Some people respond to this by saying: it’s easy; they can just make a pension contribution to keep their income below £50k/£100k. For the self-employed, or anyone with irregular earnings, that’s not so easy to manage in practice. And people (reasonably) often want to spend their earnings as they like, and not make a huge pension contribution

42 responses to “Why cutting 70%+ marginal rates should be a Government priority”

The revised headline figure is still below the real outcome. I appreciate the original article focusses on the discontinuities introduced by tapering and benefit thresholds. However, the headline figure of taxation for families is also heavily driven by purchase tax. It is probable that a family with three children and £49K of income would spend all their income on essentials many of which are subject to purchase and fuel tax of some form. So the headline is surely 10-20% higher than portrayed here.

okay, but this is talking about the marginal tax rate on income, which is important because it affects the incentive to work. In other words, your willingness to work an additional hour will likely depend upon how much you receive after-tax for that hour. Living costs, indirect taxes etc don’t have that effect.

According to https://www.gov.uk/national-insurance-rates-letters the category A NI rate (applicable to most employees) is 12%, not 13.25% as in the spreadsheet.

that’s a really bad mistake – don’t know how it wasn’t picked up. Thank you! Fortunately doesn’t materially change the shape of the charts

Dan, great article, but please be advised that the UK includes Scotland where some of us are enjoying an extra 2% on our higher rates of income tax!

Apologies – I really should be more precise. I’ve also completely failed to deliver the promised update which includes the Scottish rates…

Really well laid out and detailed.

Another side effect is that partners of higher earners are less likely to return to the workforce (many in core roles such as nursing, teaching etc) due to the loss of childcare support.

Is there anywhere in the world that manages to provide subsidised childcare with a phased out entitlement, but does it well? It seems like one of those spaces where the politics of “free childcare for wealthy lawyers” is political poison, despite the obvious benefits of encouraging caregivers to return to work if they are willing and able.

Child Benefit is the one that affects the most people at a relatively middling income level. Myself and Mrs both just under the 50k mark. Me – I’m an IT contractor, I could pay myself more but choose not to specifically because of this boundary. Mrs earns approx 70k as a top line salary but is part time thus her actual gross is just under 50k. It is just not worth either Mrs doing extra hours, or myself paying myself more (which I’d otherwise be keen to do), as the child benefit heinous marginal rate would kick in and take most of it away.

the 100-123k is also unpleasant – have experienced this when in a 100k perm role, most of bonus vanishing in tax…but people in this range have options such as dump the bonus into pension instead and should be very comfortable anyway so honestly this is less of a priority for the system / govt.

I’m a 30-something with a marginal rate of tax which can be over 100% dependent on my bonus, for the reasons you outline in your article. It is why so many people in my pay band at my company has an EV – we are effectively being paid to drive one. It’s also why I am more than happy to take unpaid leave.

This analysis assume that when you are in the higher bands of income, you are on the 2% rate of NI. I retired took my work pension at 60, I also have some property income. I decided to go back to work part time, my NI is is at 12%, I agreed to work an extra day, this pushed me into the band where I start losing my personal allowance, even though my job pays less 50K p.a.. This gives me a marginal rate of 72%. Hardly worth doing the extra day.

That’s just craziness…

Tempting to run a competition – find the highest marginal tax rate that someone on a modest income could pay…

A family with 3 children, one of whom is disabled, in receipt of housing benefits. One earner in household with student loan earning £967 per week (at the higher rate threshold). Still entitled to Universal Credit and other benefits totalling £341.62 per week. Given a £100 per week payrise, benefits reduce by £31.50 to £310.12, income tax and NI £42.00, Student loan £9.00, HICBC of £29.02 per week. Total reduction for earning the additional £100 per week is £31.50 + £42.00 + £9.00 + £29.02 = £111.52 so £11.52 worse off per week than without the £100 per week payrise. Bonkers that a £5200 per annum payrise leaves you nearly £600 per year worse off.

Benefit figures taken from http://www.entitledto.co.uk assuming housing costs of £120 per week.

thanks – yes, am aware there are very serious marginal rate problems in the benefits system, but I don’t write about them because I and our regular team have no expertise in these issues…

Important article, thank you.

Not sure if this is the right place to suggest a possible correction, but I have concerns about the assumption in the article that the family will only one earner, firstly as this is relatively rare and secondly as the Tax-Free Childcare scheme is not available at all to families with only one earner, both parents have to be earning or on maternity/paternity leave. I know this as my husband and I use the scheme and you have to confirm once every three months that you are both working. I would expect the new offer to be exactly the same in that regard.

thanks – yes, I really should mention that… I’ll check it

“There’s an obvious impact on all of us if plumbers, doctors, IT contractors etc are turning away work/hours to avoid hitting £50k/£100k”

Speaking as somebody fortunate/unlucky enough to be in this position (two kids, single earner) I never turned down hours, but for a couple of years every penny above that threshold went into a SIPP to keep my ‘adjusted net income’ below that figure*. The crazy part was knowing dual earner households with far higher incomes that weren’t captured by it – at a minimum, any benefit paid to households that is means tested should be tested against household income, not single earner.

*nervously awaiting Dan telling me that shouldn’t have worked.

that worked!

Observation from an oldie:

The Tory chancellors in the 1980s did an excellent job of removing such distortions (as well as the one from CGT) and in 1997 the system was at the most sensible it has been for at least sixty years (one can disagree whether at the right level).

Gordon Brown introduced complication after complication (and tore up the CGT solution) being by nature a meddler; Darling wasn’t going to show up his predecessor who was his boss; but George Osborne not simplifying things was a major disappointment, and rather a mystery given his intellectual background and who were his supporters.

Politically the smart move would be to announce “no marginal tax rates over 50%” and do:

1) at higher levels as you say, reduce general thresholds

2) at the benefit-to-earned income boundary, taper out the benefits rather than having cliffs

Choose the numbers correctly and it can be revenue-neutral.

And that’s without considering the “Employer National Insurance” – so even the simple 45% + 2% is actually (45+2+13.8 ) / (100+13.8) = 53.4% rather than 47%, with similar effects all the way along.

That 53.4% being over the psychologically important 50% is not smart.

That aspect tends to get hidden because negotiations are about nominal salary rather than actual cost, but if management looks at actual costs, then it does come into play.

Yes, an excellent analysis, however…

Even bigger losers are those on benefits, who lose the benefit at a ridiculously steep taper.

Universal Credit is not quire as bad as Child Tax credit, but to keep it simple I’ll use the child tax credit taper.

Above £16k (that may have changed) child tax credit was reduced by 50p for every £1 gross(!!). So a graduate on £22K with a couple of young children would pay a marginal tax rate of 12% NI, 20% PAYE, 9% Student Loan and 50% benefit reduction => 91%, keeping an extra 9p for every pound earned. If they also had a post graduate loan (taxed at 6%) they get to keep 3p.

The ONLY genuine progressive tax system is one based on cash entitlements. All allowances should be converted to cash entitlements, in the same was as was done for child benefit decades ago.

Move the 45% band down to £100,000 and phase-out the phase-outs. And make the Personal Allowance a Tax Credit at 20% so that it is worth most to the lower paid. There are plenty of fixes that will leave it more transparent and less unfair. As long as the overlap between all of them is considered at the same time, then you can create many more winners than losers.

I’m not sure the spreadsheet is working for tax free childcare.

It seems to include within take-home pay, up-to £10k per child.

If you use the maximum, then the government-contribution-to-childcare is actually 20% of £10k=£2k per child.

And i haven’t unpicked why the amount in this column would increase as wages increase. If you’re eligible and you pay for childcare, the government covers 20% upto maximum contribution of £2k/child. The input should be how much you spend on childcare, and then when your salary is within the band, the add-on is 20% of that, subject to £2k maximum.

(If you have an email to share i can send you a corrected spreadsheet)

thanks – I’ll take a look. Although it’s intended to be modelling the new childcare offering announced in the Budget, worth up to £20k for a couple with two small children living in London

thanks. that makes more sense in the £10k : you do lose the entitlement to 30 hours funded childcare when you pass £100k. Valuing this at £10k might be a bit of a stretch – it think providers receive about £8k, but a politician could make that claim….

still haven’t worked out why it graduates upward with salary though….if you (& your partner) earn within the window then you get full entitlement. (should the marginal tax rate at that point not be massively negative?)

my apologies – there was a bug there – a carry-over from a previous version, which modelled tax-free childcare. Now corrected in article and on the github

Worth looking at the impact for taxpayers paying income tax at Scottish rates – they have a horrible marginal rate (if you include National Insurance Contributions) starting at £43,663 : 42% tax + NIC at 12% for employees. NIC reduces to 2% at £50,270 (just as HICBC starts).

As a self employed individual of a certain age, the marginal rates of tax certainly do influence whether I am likely to accept additional work or not. I also have a daughter who is seeing a mortgage fix end shortly. Her husband is on low pay, and she has scope to take on another part time job or more hours, but at almost £50,000 income with 3 small children this won’t help.

Excellent analysis. However we vote the government’s do little to correct these stupidities. I think they rely on the inertia of the employee. In my case I found myself in the late 1970’s working for the taxman until about Thursday midday each week. I moved, with my family, to Switzerland and happily paid 22-24% overall tax for >20 years. All that tax I was paying could have gone into UK coffers if I had stayed in the UK if they had not been so stupid to have engineered such a high marginal rate. Now, back in the UK I find my GP (mid 50’s) has retired bec the marginal tax rate and pension ceiling means there is no point in continuing.

We complain about marginal rates but the government of the day still does zero to correct/simplify things.

Absolutely… the loss in tax revenue from someone going part time (from £120k to £95k) is a much bigger cost to the country than the extra tax/savings these measures propose to make. These are smart people, they won’t work the extra 20% if they take home less money at the end of the day… ask yourself why you can’t get a GP appointment – they are all going part time to avoid these ridiculous schemes.

Clearly someone in a regular job earning around 27k to 30k may consider the above pie in the sky. But people who are self-employed do think about marginal rates. And they are taxed on their profits (unless they are trading through a company) – not what they notionally “draw” from their business – so a plumber or builder may be making profits of 50k or 60k even though they only “draw” some of that because they need to keep the rest as working capital or to put towards buying new equipment. I have had many conversations over the years about the VAT threshold and avoiding that kicking in. There is also the issue of bonuses in some lines of work where the base salary is low – would you be incentivised by a bonus where more than half goes in tax? And finally the child benefit charge only applies if one of the household earns more than 50k – so if one earns just over 50k and the other 16k it kicks in – whereas if each parent earned 33k it would not.

It’s a massive mess but that’s what happens when politicians promise not to increase tax rates but want to squeeze more revenue out of the income tax system. They instead resort to fiddling about with withdrawing allowances and so forth to disguise what’s really a tax increase.

Good analysis, thanks for writing. There’s another issue perhaps worth mentioning (albeit one which I know is fervently disbelieved by the Left), and that is the number of people leaving the UK to avoid tax. I moved from a US law firm in London to work offshore, and I now save £80k/year in income tax alone. I’m surrounded by similarly-minded people who also fled London, and who have no intention of ever returning (some may return upon retirement, assuming that no wealth tax is introduced). Ever more of my remaining UK former colleagues are now considering a similar move.

For information only, here was the analysis I originally wrote several years ago building up to my decision to leave: https://london2050.wixsite.com/miscellaneous-musing/post/uk-prognosis

I mention this merely as context in case anyone believes that “people will leave the UK” is an empty threat. It’s not. I was at a Magic Circle firm (not CC) years ago when Corbyn looked like he had a fighting chance of getting into power, and our UHNWI had fantastic billings for much of that year as people restructured their assets and their lives to minimise the potential impact on their families. Whether a potential exodus is on a sufficient scale to matter, I defer to others. If it is a risk however, it’s one which may happen fast. As Rudi Dornbusch* said, “In economics, things take longer to happen than you think they will, and then they happen faster than you thought they could.”

(* 1942-2002, internationally renowned macroeconomist who made fundamental contributions to economic science and to international economic policy.)

The marginal rates issue is a significant issue. We have all told our children that if they work hard and get good jobs or start great businesses they will be fine. Unfortunately the way that tax works (and the way the housing market works) that is no longer true. It feels as though we are breaking a covenant with the younger generation. Let’s fix it.

I certainly agree with the main argument. Make universal benefits universal, and set your top rate of tax accordingly at whatever level your politics determine, rather than faffing about taking stuff away over certain thresholds – its much simpler and fairer. OTOH, I think the context in which you have worked is rather colouring your view in terms of human incentives. Median annual salary in the UK is about £27k, so no, I don’t think it probable that most people have at some point have opportunities to earn over £50k let alone £100k. Also in the sectors I know best (charities, academia), part-time work falls well under these thresholds, and additional hours at full time is just more work, the hours don’t come with any more pay. I have never in my life (30+ years professional work, including managing teams) come across anyone refusing promotion on the basis of marginal tax impacts. Yes, childcare costs, or benefit withdrawal, but not taxes – that’s a conversation for circles other than the ones in which most people move.

Funnily enough regarding high marginal rates of tax, I was doing a bit of research on surtax the other day, and found an interesting extract from Hansard from 1968-69. An opposition MP (the splendidly named Sir Gerald Nabarro) was pointing out the fairly pitiful amount of additional take home pay for a high ranking position in one of the nationalised industries the occupant of which was getting a pay rise of £7,500. The tax including surtax came to about 96%.

So we’ve been here before. Logically these punitive tax rates should have caused an enormous and continual brain drain and whilst there were some notable examples, if didn’t seem to make “that” much difference overall. It’s the same with the standard comical threats of a few high profile people to “quit the UK” if Labour are elected. Somehow the vast majority of them remain where they are. So I’m never entirely convinced that the marginal traps in the UK system, even the personal allowance taper actually matters that much.

For example – big families – how many of them ever received child benefit in the first place? The income thresholds are fairly small and people working in Finance/Accounting/Law could be well over £60k before they start a family in the first place – so they never experience CB (although they should register to ensure their wives get NIC credits).

Similarly a great many of those impacted by the loss of the PA are not those whose salaries will “stand still”. The impact is a temporary blip as they power past £125k.

You can of course prove anything with statistics, but I dont really accept that these academic numbers actually matter to a great many people, beyond a bit of shoulder shrugging. I’d rather much more was done to those genuinely at the bottom with the benefits taper.

A perfect analysis of an absurdity in our current tax system. Interesting to see what political response this provokes !

Absolutely correct on this Dan. It should be priority #1 and frankly would have been a much better idea than much of the last round of dross the chancellor trotted out.

#2 should be the same naff tapering of annual allowance for pension contributions. This should have been prioritised over the recent more controversial removal of Lifetime Allowance.

What really gets me “fired up” is that these two foolish complications to the tax code only provide bad incentives.

If you believe in capping the annual allowance (I do so long as at a reasonable level) then pick a number, preferably back with some empirical research.

If you favour creating a lifetime allowance (I do not) the.n pick a number. As above make it reasonable and importantly index it so that the purchasing power of that amount can be maintained.

I look forward to supporting and promoting your thoughts on this one Dan.

Many thanks for spotting that two of the charts were from the old version of the article, and had the wrong 45p threshold. Now fixed!

If I’m not mistaken the 45% tax rate now kicks in at £125,140, tying in with the point that the personal allowance is phased out. Otherwise excellent analysis as always – also agree that the net cost of removing the PA phase out is likely to be lower than the headline figure as most people earning in that region will just bump up their pension contributions

I’m sure I must be missing something, but I thought the 47% additional rate (ie. 45% plus 2% NI) now started at c.£125k (as of April 23)?

But the above states “The marginal rate of tax in the UK for high earners in theory caps out at 47% (45% income tax and 2% national insurance) once you get to £150k.”

Excellent analysis though and totally agree that the current position is absurd.

Excellent analysis, well done. I hope that you have sent it to Rachel Reeves.