Since our original report, we’ve received numerous reports of clients’ and advisers’ experiences with Property118. This short report explains one new element – the artificial creation of a “director loan” which can be used by landlords to take profits from their business free from income tax.

It’s an artificial tax avoidance scheme which doesn’t work, and any landlord using it will incur large tax liabilities and penalties. The scheme should have been disclosed to HMRC under the “DOTAS” rules, but wasn’t – Property118 potentially face penalties of up to £1m.

UPDATE 13 October 2023: since we wrote this report we’ve discovered more about the precise details of this scheme, which means that the description and analysis below is both inaccurate and too kind. We’ll keep this here, but our updated full description of the scheme is here.

The sales pitch

Here’s the sales pitch from Property118:

We’ve redacted the figure to protect our source, but it’s a large six figure sum.

Here’s their explanation:

This just one example from the many we’ve received – it’s a standardised structure. Property118 even set out the details themselves here.

What’s going on?

When a company makes a profit, it pays corporation tax. If it then pays the profit to its shareholders as a dividend, they pay tax on that. But if it can use the profit to repay a loan from the shareholders then they don’t pay tax on the loan repayment.

Standard (and legitimate) tax planning on incorporation takes advantage of that. In the standard approach, the landlord sells property to the newly incorporated company in return for (1) shares, (2) assumption of mortgage debt, and (3) a “loan note”1Why a loan note and not a loan? Because, conceptually, the company is then giving something (the loan note) as part of the purchase price for the properties. In part because the tax treatment for the company is more certain, as a loan note is clearly a “loan relationship” for tax purposes, and simply leaving money on account may not be (or similar) issued by the company to the landlord. Future profits can be used to repay the loan note.

That is uncontroversial, but has the disadvantage that the sale of the property to the company will be subject to capital gains tax.

Property118 think they’ve found a way to avoid the capital gains tax and extract profits by a tax-free loan repayment.

Here’s an example. Let’s take a landlord who owns properties worth £1m and has a mortgage of £500k.

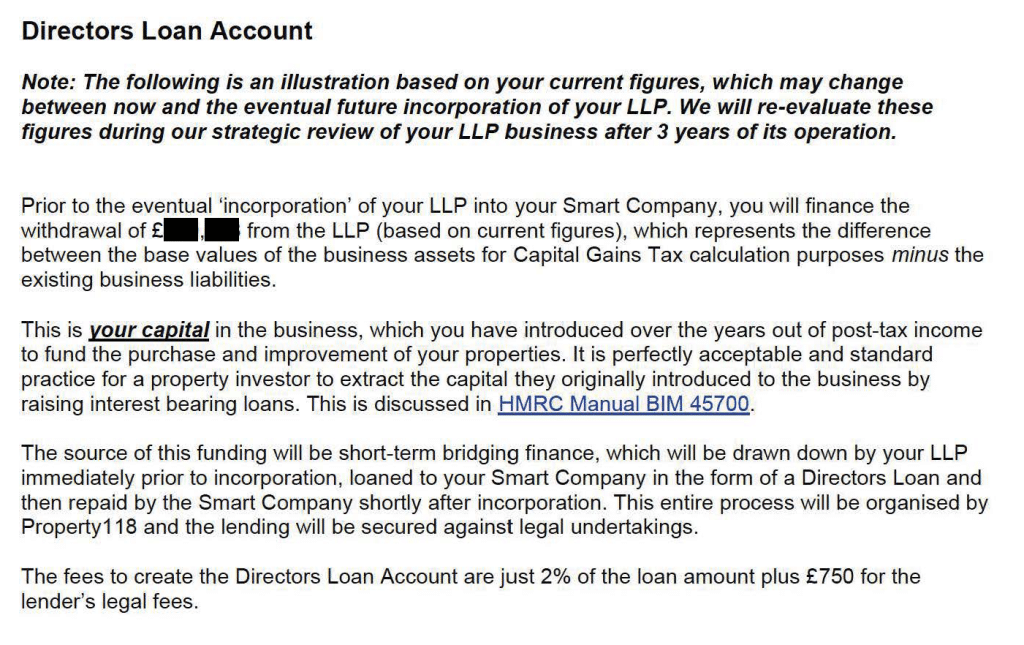

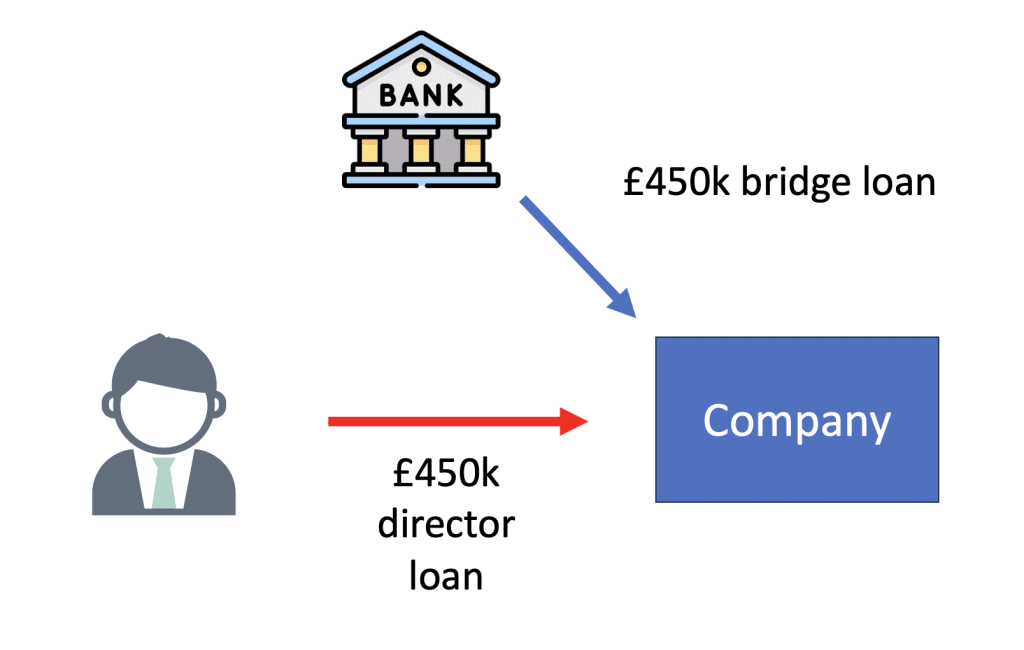

Step 1: Landlord takes out a two week bridge loan of £450k. The money never actually goes to the landlord – it’s held in a solicitor’s client account. The solicitor undertakes to the lender that the money will never leave that account (so the arrangement is risk-free for the lender):

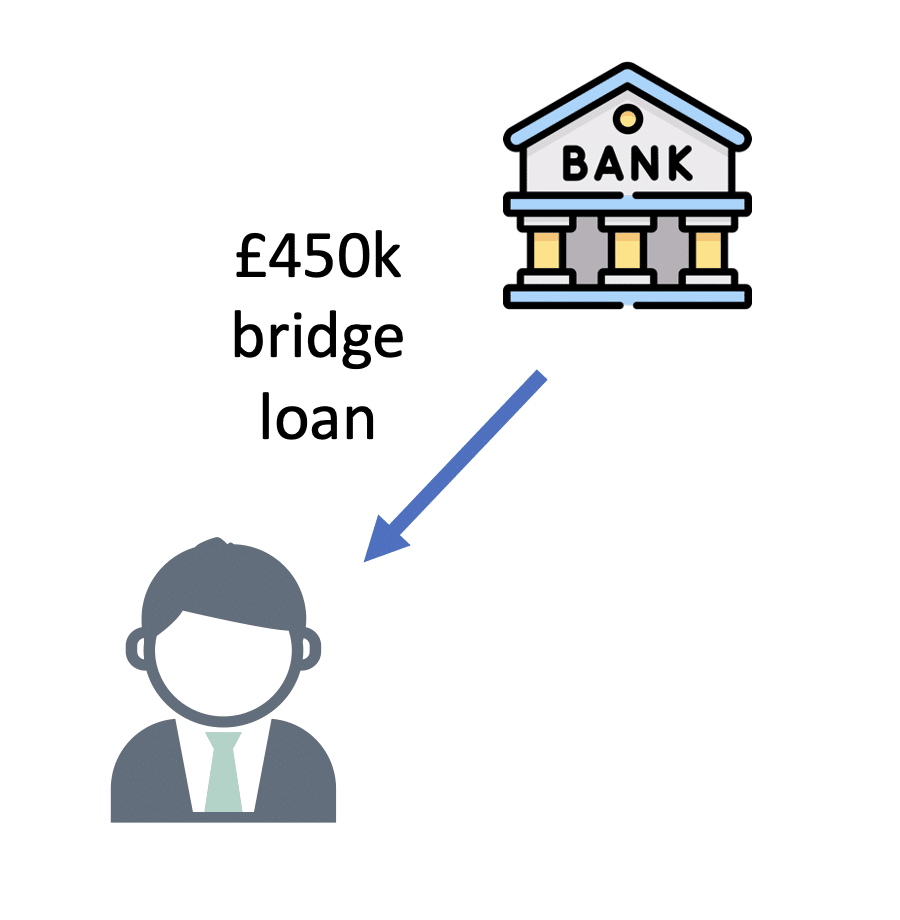

Step 2: Landlord incorporates a new company. The company buys the rental properties, and in return issues £50k of shares to the landlord, and agrees to assume responsibility for the £500k mortgage and the £450k bridge loan (under a “novation”). Note that the £450k advanced under the bridge loan stays with the landlord (in the solicitor’s client account):2As explained in our original report, the transfer of the property is actually effected using a trust rather than a normal legal transfer, to avoid having to obtain the consent of the lender. The mortgage loan isn’t novated, but the company agrees to indemnify the landlord for the payments under the mortgage. The trust causes a number of serious legal and tax complications, not least triggering a mortgage default. However, to keep this example clear, we’ll ignore the trust in this report.

Step 3: Two weeks later, the landlord makes a £450k “director loan” to his company, using the £450k advanced under the bridge loan in step 1 (but the £450k again stays in the solicitor client account – these are just accounting entries):

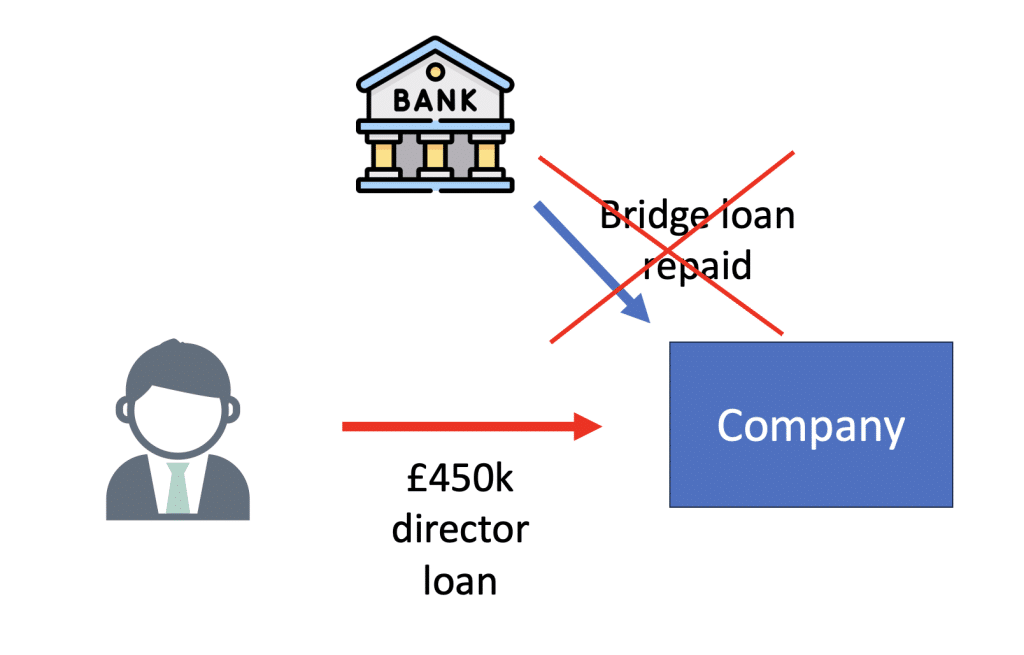

Step 4: The company immediately uses the £450k to “repay” the bridge loan. “Repay” is in quotes, because the bridge loan money never left the solicitor’s client account:

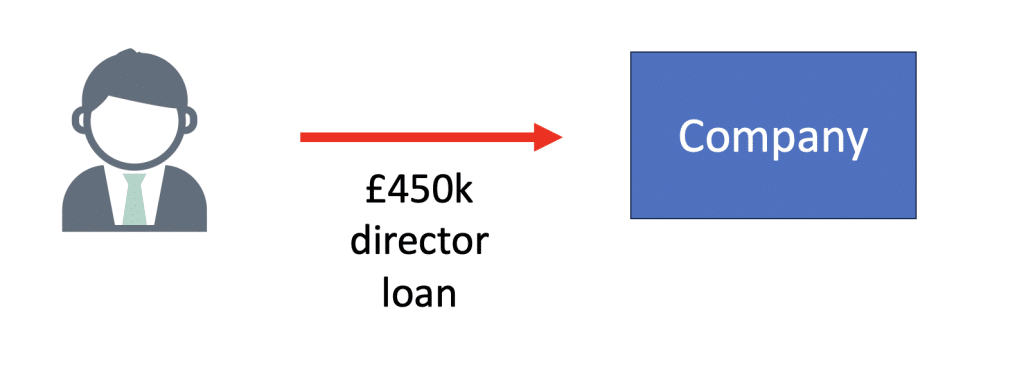

The outcome of all this:

A £450k “director loan” has been magicked into existence, despite the landlord never having had the £450k, and certainly never having lent any real money to the company. £450k just sat in a solicitor’s client account for two weeks. The only money that really moved was £9,000 – the fees Property118 and the bridge lender received for arranging the structure.

The intended consequences

There are two intended consequences:

- The company now magically owes £450k to the landlord under the “director loan”, despite the landlord never having £450k and the company never receiving £450k. The next £450k of profit made by the company can be paid to the landlord as a repayment of the “loan” – and the landlord won’t be taxed on it. That’s saved/avoided up to £177k of tax.3The highest marginal rate of tax on dividends is 39.35%

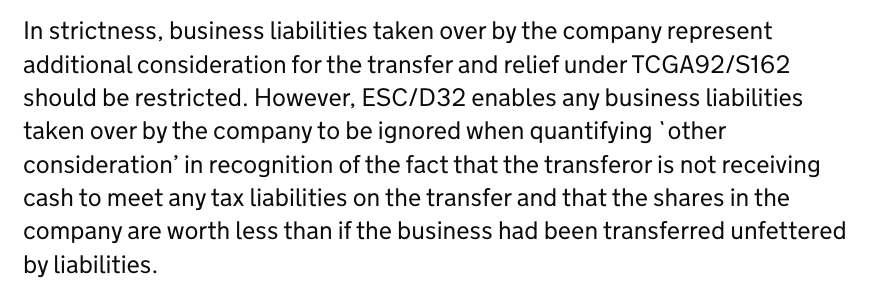

- Incorporation relief applies so there is no capital gains tax because, thanks to the HMRC concession that allows a company can assume liabilities of the business.

The actual consequence – a large CGT hit

When a landlord incorporates their property rental business, an important and legitimate part of the tax planning is ensuring “incorporation relief” applies to prevent an immediate capital gains tax hit on moving the properties into the company.

That requires (amongst other conditions) that the property is sold in consideration for shares in the company, and only for shares.

By concession, HMRC also permit the company to take over business liabilities of the landlord:

In the Property118 scheme, the bridge loan is taken over by the company; but the problem is that it’s not a “business liability” of the landlord. It barely exists at all, and certainly isn’t used for the landlord’s business.

Oh, and HMRC expressly say that this concession can’t be used for tax avoidance:

So incorporation relief isn’t available.

Another consequence – the “director loan” isn’t a loan

This is an artificial tax avoidance structure. The bridge loan is taken immediately prior to incorporation for no purpose other than tax avoidance. Money is then moved in a predetermined circle for no purpose other than tax avoidance, and achieves no result other than tax avoidance. The bridge loan doesn’t even exist for a whole day. Structures of this kind have been repeatedly struck down by the courts over the last 25 years.4We are only aware of one such scheme that wasn’t defeated – SHIPS 2, essentially because the legislation in question was such a mess that the Court of Appeal didn’t feel able to apply a purposive construction. The consequence of that decision was the creation of the GAAR, which doubtless would have kiboshed SHIPS 2 had it existed at the time

So the question is: despite that artificiality, can the director loan be used to facilitate tax-free profit-extraction in the same way as the “loan note” in the standard version of the structure?

There are several ways this could be viewed:5Our original draft suggested the second scenario was more likely; on reflection we think that would be a harsh result. The CGT element of the structure still fails, but the taxpayer may avoid a double tax disaster

- Realistically, the bridge loan did nothing and can be disregarded – but the director loan can still be viewed as part of the consideration for the sale of the property. In other words, if we step back and ignore the silly intermediate steps, the landlord sold the property to the company for consideration comprising: shares, the assumption of the mortgage debt, and another £450k which remains outstanding as a director loan. In this scenario it’s clear CGT incorporation relief fails. But future profits can be paid out on the director loan without suffering income tax. The structure failed to achieve its CGT aim, but did achieve the basic planning aim of the standard structure… in a much more complicated way and at much greater expense for the landlord.

- The bridge loan didn’t exist and neither did the director loan. So future profits can’t be paid out on it, and the structure fails completely. This seems a harsh result. Can HMRC really say the director loan exists enough to kill CGT incorporation relief, but not enough to shield future profits from income tax on dividends? HMRC has a history of running such harsh “double tax” arguments when attacking tax avoidance schemes, but not always successfully.

Failure to disclose to HMRC

Most tax avoidance schemes are required to be disclosed to HMRC under the “DOTAS” rules. The idea is that a promoter who comes up with a scheme has to disclose it to HMRC. HMRC will then give them a “scheme reference number”, which they have to give to clients, and those clients have to put on their tax return. It’s the tax equivalent of putting a “kick me” sign on your back, because the inevitable HMRC response will be to challenge the scheme and pursue the taxpayers for the tax.

For this reason, promoters of tax avoidance schemes typically don’t disclose, even though they should. This is often on the basis of tenuous legal and factual arguments, to which the courts have given short shrift6See e.g. the Hyrax case, where the tribunal described as “incredible” the evidence of one witness that she wasn’t aware the transaction was involved tax avoidance.

We understand that this structure has not been disclosed under DOTAS. In our view, it clearly should have been. The structure has the main purpose of avoiding tax – indeed that’s its sole purpose. Property118 charge a 1% “arrangement fee” for the director loan structure, which is the kind of “premium fee” that triggers disclosure 7Although other possible hallmarks are: the standardised tax product hallmark, the employment income hallmark (if there’s a “relevant step”), and/or the financial products hallmark The failure to disclose means Property118 are liable for penalties of up to £1m.

How do Property118 defend the structure?

In the advice note above, they refer to HMRC guidance in their Business Income Manual. Advisers questioning the structure have received the same explanation. However, that guidance relates to when a company can claim an interest deduction for a loan taken by the company to fund a withdrawal of capital by its shareholders. It has nothing to do with creating a “director loan” out of nothing, and nothing to do with circular tax avoidance transactions.

Property118 have also assured advisers that HMRC have accepted the structure in numerous cases. We are highly doubtful that the true nature of the structure was ever explained to HMRC. Any clearance, or enquiry closure, obtained on the basis of incomplete disclosure is worthless.

These two responses are typical of Property118 and other avoidance scheme promoters. Little or no reference is ever made to the law, and certainly never to tax avoidance caselaw. Instead, HMRC guidance is quoted out of context, and clients are assured that nothing has ever gone wrong in the past.

For what it’s worth, we don’t believe Property118 know what they’re doing is improper (or they presumably wouldn’t publish full details of the scheme). Our explanation is incompetence rather than fraud – nobody at Property118, or Cotswold Barristers, has any tax expertise.

What should happen next?

Property118 are entirely unregulated. The only body who can take action against them is HMRC – which should investigate Property118 for failing to disclose schemes that were disclosable under DOTAS. It may well have been unaware of the scheme before now – the nature of the scheme is such that it may have been completely undisclosed on landlords’ tax returns.

We will be referring Cotswold Barristers to the Bar Standards Board for their role promoting the structure.

The bank providing the bridge loan surely knows what’s going on (anti-money laundering rules require it to). Its involvement may breach the Code of Practice on Taxation for Banks, which generally prohibits banks from facilitating tax avoidance schemes.

No ICAEW-regulated accountant or CIOT/ATT tax adviser should participate in the structure – it breaches the Professional Conduct in Relation to Taxation (PCRT) rules.

No law firm should be facilitating this structure. The Solicitors Regulation Authority prohibits firms from using their client accounts as bank accounts or as pure escrow accounts. The SRA has recently taken enforcement action against firms doing this. Solicitors are also bound by the PCRT rules.

What if you’ve implemented this structure?

We would strongly suggest you seek advice from an independent tax professional, in particular a tax lawyer or an accountant who is a member of a regulated tax body (e.g. ACCA, ATT, CIOT, ICAEW, ICAS or STEP). Given the potential for a mortgage default, we would also suggest you urgently seek advice from a solicitor experienced with trusts and mortgages/real estate finance (e.g. a member of STEP).

We would advise against approaching Property118 given the obvious potential for a conflict of interest.

Thanks to accountants and tax advisers across the country for telling us about their experiences with Property118, as well as the clients who contacted us directly. Particular thanks to Q and to A.

Landlord image by rawpixel.com on Freepik. Bank image by Freepik – Flaticon

-

1Why a loan note and not a loan? Because, conceptually, the company is then giving something (the loan note) as part of the purchase price for the properties. In part because the tax treatment for the company is more certain, as a loan note is clearly a “loan relationship” for tax purposes, and simply leaving money on account may not be

-

2As explained in our original report, the transfer of the property is actually effected using a trust rather than a normal legal transfer, to avoid having to obtain the consent of the lender. The mortgage loan isn’t novated, but the company agrees to indemnify the landlord for the payments under the mortgage. The trust causes a number of serious legal and tax complications, not least triggering a mortgage default. However, to keep this example clear, we’ll ignore the trust in this report.

-

3The highest marginal rate of tax on dividends is 39.35%

-

4We are only aware of one such scheme that wasn’t defeated – SHIPS 2, essentially because the legislation in question was such a mess that the Court of Appeal didn’t feel able to apply a purposive construction. The consequence of that decision was the creation of the GAAR, which doubtless would have kiboshed SHIPS 2 had it existed at the time

-

5Our original draft suggested the second scenario was more likely; on reflection we think that would be a harsh result. The CGT element of the structure still fails, but the taxpayer may avoid a double tax disaster

-

6See e.g. the Hyrax case, where the tribunal described as “incredible” the evidence of one witness that she wasn’t aware the transaction was involved tax avoidance

-

7Although other possible hallmarks are: the standardised tax product hallmark, the employment income hallmark (if there’s a “relevant step”), and/or the financial products hallmark

20 responses to “The “amazing opportunity” from Property118 to avoid tax, and its amazingly bad consequences”

Isn’t another problem with the professional indemnity insurance claim is that that is presumably qua activities as barristers. However, Cotswold Barristers doesn’t seem to operate as a conventional chambers at all. Query whether Bar insurance would cover what is effectively a financial advisory / services practice, which may not even include any individual legal advice, rather than just putting their names as lawyers to Property118’s scheme.

Hi Dan – I don’t agree with all your analysis here.

I agree that incorporation relief will fail, for the reasons you give.

I don’t agree that the loan repayment should then be recharacterised as a dividend. The substance of the transaction is that a £1m property asset is being sold to a company for consideration including the assumption of a £450k liability (and CGT should be chargeable on that £450k, which will be consideration for the property sale). The assumption of the £450k liability has a genuine commerial effect – the company now owes the money. The director then puts real money into the company so it can repay that liability so I don’t think it’s fair to describe the director loan as having been ‘magicked’ into existence.

The substance of this is that it is a transfer of an asset to a company for a debt left outstanding, with a bit of dust kicked up involving a third party bank to pretend that incorporation relief applies (it doesn’t). If you transfer an asset to a company for a debt left outstanding, and assuming the transactions in securities rules don’t apply (it’s not immediately obvious that they do) I think it’s fine for repayments of the debt to be tax free, and not recharacterised as dividends. However, you are not supposed to get incorporation relief in the circumstances, and you won’t get it here – the ‘bridging loan’ is just a scam attempt to fall within HMRC guidance/ concession on the assumption of “liabilities of the business” not precluding incorporation relief.

I’m not sure we disagree. It’s the attempt to get the loan and also incorporation relief which I think can’t be done.

I agree with this but some parts of the report may be overstated IMVHO.

It refers to “technical hopelessness” (in relation to loan repayments being taxed as dividends rather than tax free) and the loan being “magicked” into existence. In substance a real asset (the property) has gone into the company to create a debt left outstanding – it’s a little harsh to describe the debt as coming into existence by magic. I don’t think it’s 100% clear that repayments of that debt would be taxed as dividends. Although, of course, you shouldn’t be able to create a debt from the sale of an asset and simultaneously “roll” the gain on the asset using incorporation relief. Not an SDLT expert but I wonder whether HMRC would also go for SDLT on top of the CGT in the circumstances.

we are publishing more on this scheme tomorrow, with details that may change your mind…

Nope, I’ve read the update and still not persuaded.

Put it another way. Suppose Avocado isn’t repaid instantly. The £450k is lent by the taxpayer to their company and the company spends it on buying another property.

The £450k is repaid by the company to the taxpayer over time (from rent on the two properties), and the taxpayer repays Avocado over time. Would you then treat the repayments made by the company to the taxpayer as dividends?

The difference here is timing and the fact that the delightful gentleman in your video doesn’t want to take any actual lending risk.

However, if you are saying that on a realistic view of the facts there is no real loan from Avocado at all (as no real lending risk) then query whether you should accept that incorporation relief actually does apply – as, viewed realistically, there is no real loan from Avocado/ debt for the taxpayer’s company to assume.

Going for the double charge of CGT plus the dividend charge would feel a bit like “cakeism” from HMRC.

If there is a real loan from Avocado, a real assumption of liability by the company (which has the real effect of generating a CGT charge), and a real advance from the taxpayer to the company, then arguably the debt repayments to the taxpayer should also be respected (although if ESC D32 applies to this then I am a cat).

If none of it is real then query whether you just have the transfer of a property for a share issue, and no assumption of liability to count as CGT consideration. I’m not sure HMRC could selectively treat some parts of it as real but others not, to generate both a dividend and a CGT charge – which seems quite onerous.

I see your point. I’ll amend the notes to reflect it.

I do think HMRC like pursuing “cakeism” in avoidance cases, but the courts don’t always agree. The recent Executors of Leslie Vivienne Elborne case is an interesting example, not a million miles away from our facts (ie HMRC arguing something isn’t real when it comes to an exemption, but is real when it comes to a charge)

now updated – please let me know what you think

Thank you – I agree with the new section and am rather flattered by your inclusion of it!

I’m not sure what would happen if this went to court – I was only saying that, bad as the scheme is, it may be overstating the position to say it’s *definitely* going to pick up a double hit (and the revised version addresses this). Presumably HMRC are looking at this (or will do so) and it will be interesting to see how, and how hard, they go after it.

FAOD, nor am I saying that it definitely *won’t* pick up a double hit. As well as the “not a real loan” line I can see that disguised remuneration has been mentioned below. @ Tigs I don’t think HMRC would need to show that this is “in connection with the individual’s role as an employee or director” – there is also the “close companies gateway” (554AA ITEPA is an alternative to 554A ITEPA IIRC). If this applies (and someone would need to read through the rules with a cold towel) it’s possible that the scheme could pick up CGT, income tax and NICs on top. There is also the transactions in securities legislation to consider, as mentioned below.

Just to add, quite enjoying following this one!

I read Mark Alexander’s response in which he claims that whatever KCs and law firms you’re working with are Property 118’s “competitors”, and comparable to old school London cabbies with Property 118 as the Uber equivalent/ “bold new disruptor”. Which makes me wonder if he’s delusional and out of his depth rather than dishonest (although the DOTAS disclosure omitting to mention the Avocado loan suggests the latter…)

* white space disclosure.

I once had the misfortune to briefly work for a place that is reminding me very much of 118. I can follow only some of this tax law, but I must say I’m loving the drama.

Isn’t a much more basic problem with incorporation relief that in many (most?) cases the landlord is not likely to be considered trading (i.e. a private landlord rather than a sole trader) so incorporation relief wouldn’t be available anyway?

Or have I misunderstood ow incorporation relief works? (Just a lay reader here, no specialist tax knowledge.)

This is excellent work, Mr Neidle, and a further chapter to an already depressing book. I have seen bridging finance adopted as a means of allowing the ‘existing’ business liabilities to be transferred to the company within the terms of ESC D32; however, I would caution any individual who hopes to attract incorporation relief under TCGA 1992, s 162 on the transfer of their property business to a limited company that they must not regard the incorporation of the business as an opportunity to release cash to them, personally, as the business liabilities must be ‘taken over’, not increased!

I wouldn’t take much comfort from the Westmoreland investments. Subsequent judgements have re-emphasised the importance of Ramsay (Tower MCashback) and a cynical circle is highly unlikely to be shrugged off. It should also be remembered that the case was pre-GAAR!

Apologies. For the avoidance of doubt my original point was a reply to Tigs.

Hello Dan,

There is a House of Lords case, Westmoreland Investments Limited, where money was lent and moved in a circle very quickly purely to get a tax deduction. The House of Lords said that was fine.

From an employment disguised remuneration perspective, the lending money to the individual by the bank (or not-a-bank lender) would be a relevant step if (i) it was not on “normal commercial terms”, or (ii) you or I couldn’t borrow from the lender on exactly the same terms (and I mean exactly the same terms (s554F)), or (iii) there is a connection (direct or indirect) between the loan and a tax avoidance arrangement. So if you are through the disguised remuneration gateway for employees, PAYE / NIC is due on the full amount of the loan when the loan is made, with no refunc of the tax when the loan is repaid two weeks later.

The key question then is whether you are through the gateway. In particular, is it “reasonable to suppose that, in essence … [the loan is] a means of providing, or is otherwise concerned (wholly or partly) with the provision of, rewards or recognition or loans in connection with” the individual’s role as an employee or director. As you’ve described it, it doesn’t seem that it is as it seems to relate to capital and ownership rather than employment. So I would say the employee DR rules (and the employment income hallmark for DOTAS) would not apply as you’ve described them.

But I can change the facts. If they said “and you can effectively take money out by the company repaying the loan and so not taking a salary and not paying PAYE” then it sounds like it is in the employment gateway and so PAYE/NIC would be due unless you could clearly show (i) normal commercial terms, (ii) the public at large could get such a loan on exactly the same terms, and (iii) there was no connection with tax avoidance. And I don’t think “normal commercial terms” would cover situations were you borrow money but you can’t spend it as the cash has to stay in the current account.

I agree the disguised remuneration legislation doesn’t really seem to be in point. My own thought was transactions in securities – not something I work with terribly often but it certainly seems like “the application of assets of a close company in discharge of liabilities” (s.685(2)(b) ITA 2007).

thanks! Ray McCann also mentioned that… must at least be a possibility, but a simple “this ain’t a loan” approach seems to me something a court/FTT would readily accept. That said, it may be that killing CGT incorporation relief is all HMRC would seek to do here… imposing income tax as well feels punitive (although technically I don’t think it would be challenging)

I think the likely outcome is that HMRC would disregard the involvement of the ‘lender’ (given that it is an artifice that attempts to add substance to support a double entry in the company accounts) and simply treat the director’s loan account (DLA) as ‘other consideration’, thus nullifying a claim for Incorporation Relief under TCGA 1992, s 162; partial relief may be available (“wholly or partly in exchange for shares issued by the company to the person transferring the business”); a just-and-reasonable apportionment would result in a CGT liability at 28% of the value credited to the DLA.

This seems like the least bad outcome for the client; although it is likely that HMRC would charge a penalty of at least 10%. A more significant issue for affected individuals is that the abuse of ESC E32 introduced by the bridge facility makes it even less likely that HMRC would apply the concession to ANY of the borrowings. In other words, it’s like, the promoter is advising clients to exploit what they perceive to be a loophole in an extra-statutory CONCESSION! It is not even like they are exploiting a loophole in the legislation.

It’s like, why does the promoter believe that HMRC would apply ESC D32 to disregard the liability when the SOLE purpose of the bridge facility is to avoid capital gains tax!? It is more likely that HMRC will refuse to apply ESC D32 AT ALL, thus bringing the whole of the liabilities into charge.