6pm update: St James’s Place sent me a statement saying “We are currently investigating this matter, including the nature of the planning outlined and how the marketing material was published on the website. While we work with clients to consider the tax efficiencies of their financial plans, SJP does not endorse the use of tax avoidance schemes.”

No response from Apollo, although their website has been “down for maintenance” since this afternoon.

Back in May, we reported on a widely promoted tax avoidance scheme for funding private school fees. The basic idea was to create a trust in favour of your children and put valuable assets in it (e.g. shares in a family company). The return on those shares would then be taxed at the children’s lower tax rate and benefit from the children’s tax allowances – potentially saving tens of thousands of pounds.

These schemes don’t work. There’s a specific tax rule that says that, if a parent puts assets, directly or indirectly, in the name of their children, then the assets are taxed as if still owned by the parents. HMRC subsequently confirmed this in a “Spotlight” update.

The firms we wrote about were all fairly minor players, which is what we’d expect.

The schemes were, as you’d expect, promoted by small firms – surely no serious adviser would touch such nonsense. It turns out that the country’s largest private client firm, Apollo Private Wealth, absolutely is promoting this nonsense.

Apollo Private Wealth may be the country’s largest private wealth firm,1Apollo Private Wealth has no connection with Apollo Global Management, the asset management giant and is a “senior partner practice” of St James’s Place, the FTSE listed wealth management business. These are significant businesses, with large numbers of high net worth clients.

The scheme

This LinkedIn post looks like it’s promoting something boring and sensible like an ISA.

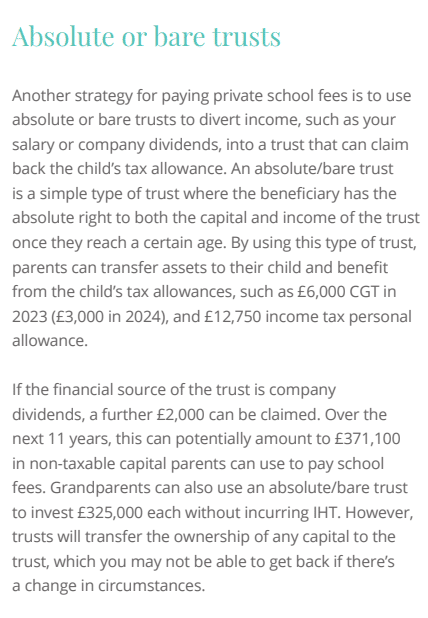

The link goes through to a pretty brochure (archived here) which does indeed mention ISAs, but also includes this proposal:

The meaning is clear: that parents can use a trust to “divert” their own assets/income to their children, and benefit from the children’s lower rate and higher allowances.

Which doesn’t work.2The “grandparent” variation they mention would work, if the assets start out truly owned by the grandparents and not the parents. But then you don’t need a trust – the grandparents could just pay the school fees directly..

Why these schemes don’t work

Tax law can be complicated, with unclear and highly contestable boundaries between good tax planning, failed tax planning, and tax avoidance.

In this case, it’s easy.

Here’s section 629 of the Income Tax (Trading and Other Income) Act 2005:

![629Income paid to [F1relevant] children of settlor

(1)Income which arises under a settlement is treated for income tax purposes as the income of the settlor and of the settlor alone for a tax year if, in that year and during the life of the settlor, it—

(a)is paid to, or for the benefit of, [F2a relevant] child of the settlor, or

(b)would otherwise be treated (apart from this section) as income of [F2a relevant] child of the settlor.](/wp-content/uploads/2023/09/Screenshot-2023-09-07-at-20.39.08-1024x162.png)

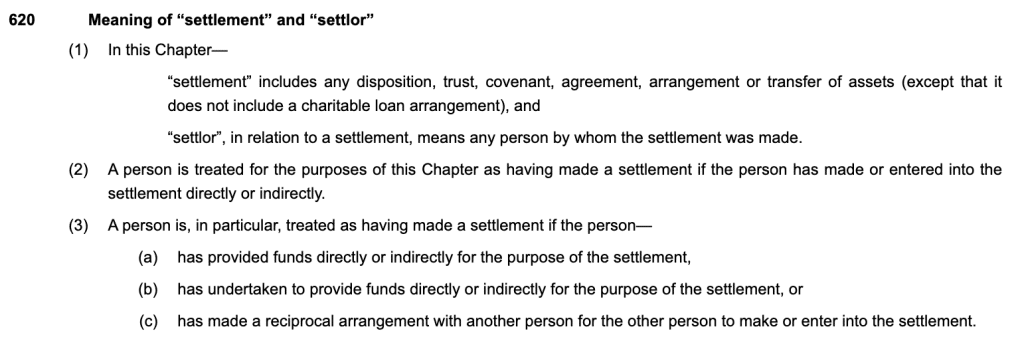

The terms “settlement” and “settlor” are defined exceedingly broadly:

Applying these rules to the Apollo proposal: the trust is a “settlement”, the parents are “settlors”, and income is paid under the settlement for the benefit of the settlor’s children. Section 629 then applies and the parent, not the child, is taxed on the income. Whatever layers and complexity are added won’t make a difference, given the breadth of the legislation.

Any client entering into the arrangement Apollo suggests would, once HMRC become aware, have to repay the tax, plus interest, plus (very likely) penalties for carelessness. Any tax adviser should know this – there’s no grey area or uncertainty here.

The questions for Apollo

It’s pretty worrying that a large advisory firm is promoting something that just can’t work, and after HMRC issued a Spotlight on the same subject. More worrying if they’ve actually advised anyone to do this. The obvious question is: if they get something this simple wrong, and are happy to put something this rubbish in a glossy brochure, what on earth are they recommending to clients behind closed doors?

I referred the small firms promoting the school fees schemes to their regulators, the Institute of Chartered Accountants in England & Wales and the Chartered Institute of Taxation. Apollo don’t appear to be regulated by anyone.

I’ve asked Apollo and St James’s Place for comment.

Many thanks to Sam Brodsky for bringing this to our attention.

-

1Apollo Private Wealth has no connection with Apollo Global Management, the asset management giant

-

2The “grandparent” variation they mention would work, if the assets start out truly owned by the grandparents and not the parents. But then you don’t need a trust – the grandparents could just pay the school fees directly.

4 responses to “Why is the UK’s largest private wealth adviser promoting a scheme that avoids tax on private school fees?”

https://register.fca.org.uk/s/firm?id=001b000003lAXuPAAW

Apollo are regulated by the FCA.

There are detailed rules about financial promotions where it could be said that this promotion does not meet the required standard. FCA rules are quite different from tax law and the firm could have transgressed on the new Consumer Duty rules with regard to client outcomes.

The approach of these firms is to dangle a carrot to gullible middle class clients to encourage them to hand over fees for schemes that don’t work. “School fees” is simply a buzz phrase to invoke a deep down anger that costs are going up with inflation and then “save tax” is intended to put a big grin on the client’s face.

The Apollo Wealth [ GONDAL NAUMAN ] companies are UK registered and what might possibly be very worrying for those people who are of a gullible nature is that recently “ Apollo Private Wealth buys fellow SJP firm Debra Wait WM

Deal takes HNW specialist Apollo’s AUM to £300m”

As Victor Meldrew would have said about Apollo’s advice – ‘I don’t believe it’

Hopefully SJP will now look at how they carry out carry due diligence on their Appointed Representatives, especially when some Appointed Representatives appear to be ‘piggy backing’ on SJP’s professional credentials.

Hello Dan,

Surely if Apollo are trading and physically present in the UK, even if they’re actually registered somewhere else like Panama of Grand Cayman (which wouldn’t surprise me one jot), they MUST be subject to the oversight of one or other of the financial services regulators?

Regards,

Steve B.