Interest withholding tax is easily avoided by sophisticated businesses, but a hassle for everyone else. Time for it to go.

I’m keen to identify taxes that don’t serve a purpose, don’t raise much money (or can be easily replaced) and add nothing except complication and economic distortion. The first two were stamp duty and the bank levy. The third is withholding tax.1I’d love to hear more ideas on pointless taxes that should be abolished. The only rule is that, given the current state of the public finances, the tax must either raise zero revenue, or be easily replaced by a simple expansion of an existing tax. So “let’s abolish VAT!” is a non-starter, I’m afraid.

We’re all familiar with withholding taxes. The basic idea is: the government doesn’t trust us. In particular, it doesn’t trust us to pay tax on our earnings. So our employer is required to withhold tax on our salary, at more or less the right rate.2Actually almost everybody wins from this. Employees don’t have to worry about tax. Government doesn’t have to worry about employees not paying tax. Government gets paid the tax much earlier than it would under self assessment. Everybody except the poor old employer, who has to operate the system.

There’s another type of taxpayer the government trusts even less than employees, and that’s foreigners. If a foreign person receives interest paid by a UK person, then, in theory, the foreign person is subject to UK income tax at 20%.3The “in theory” hides a lot of complexity which is fascinating, but I won’t go into now. Realistically they’d often not pay it. So the UK charges a 20% withholding tax on interest paid to foreigners. 4The basic rule is in section 879 of the Income Tax Act 2007. Strictly it’s a “requirement to deduct income tax at 20%” but most people call it “withholding tax”.

How withholding tax works in practice is a hot mess. Most big-firm tax practitioners are used to dealing with it (it’s standard fare for junior tax lawyers/accountants), which means we sometimes under-appreciate how cumbersome it is for everyone else. The length and wonkishness of this article is itself an argument for abolition.

How things work now

There are many exemptions from interest withholding tax. The most important ones are:

- Payments on loans with a term of less than a year5Not strictly an exemption, but it may as well be

- Payments which aren’t interest at all, but are “discount”. For example: I could lend you £100 for five years and charge you 5% interest per year, with the interest rolling-up and repayable in five year’s time. Or I could buy a bond from you for £100, repayable in five years at its face value of £128. These transactions are economically identical, but the first is subject to interest withholding tax and the second isn’t.6Again not strictly an exemption, but it may as well be

- Payments to UK banks, and UK branches of foreign banks

- Payments to UK building societies

- Payments to UK companies/branches, pension funds, etc

- Payments to lenders in countries that have signed a double tax treaty with the UK which exempts interest from tax

- Payments to lenders under a “private placement“, provided they in any country with a treaty with the UK that has a “non-discrimination” article, even if it doesn’t exempt interest from tax. That basically means “not a tax haven”.

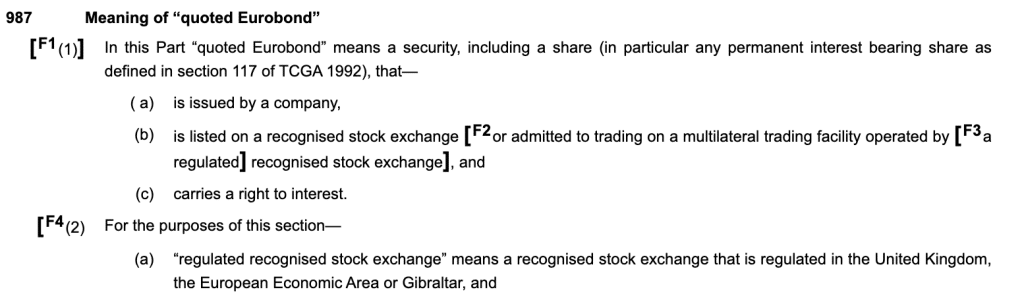

- Payments on a “quoted Eurobond“, meaning a listed security

So when does withholding tax apply in practice? Between very sophisticated parties: never. Between less sophisticated parties: sometimes, when the lender is in a tax haven. But it can still cause a disproportionate amount of hassle.

Some examples:

Scenario 1 – Marks & Spencer plc issuing bonds to investors

Many larger companies choose to raise funds on the capital markets, by issuing bonds, instead of borrowing from banks. It’s often cheaper (i.e. lower rate of interest) and can come with fewer restrictions. The bonds are usually listed on a stock exchange, to ensure liquidity.

But the way modern capital markets work, at least in Europe, means that Marks and Spencer has literally zero idea who the ultimate holders of its bonds are.

Bonds are held in a “clearing system”. That makes it very easy for people to trade bonds electronically. So M&S issues bonds to the “common depositary” for the clearing system. Financial institutions are members of the clearing system, and the clearing systems records will show which financial institution holds which percentage of the bonds. But these financial institutions will mostly not hold the bonds for themselves – they hold them for their clients. Often these clients will be another institution (think someone like Hargreaves Lansdowne) who will themselves hold on behalf of the ultimate investors.

So there’s a chain of payment. M&S pays the clearing system. The clearing system pays its members. Its members pay their clients. Their clients pay the ultimate investors. There’s full tax reporting at each link in the chain, so the complexity of the chain doesn’t create tax avoidance/evasion possibilities. But it does make it impossible for M&S to withhold tax – it doesn’t know who and where the ultimate recipients are, and so can’t apply the correct rate.

Fortunately, as I mentioned above, the UK has a nice simple withholding tax exemption for payments on a “quoted Eurobond”:

And if M&S’s bond is listed on the London Stock Exchange, it will be a “quoted Eurobond“:

The outcome is that Marks & Spencer plc doesn’t have to worry about withholding tax. That’s sensible.

Scenario 2 – Doctor Evil

You’re an evil supervillain, living in a volcano in a tax haven. You have an evil UK subsidiary, and you’d love to receive interest from it – but there’s a 20% withholding tax.

Fortunately, there is an easy solution. Create a listed bond, almost exactly like Marks & Spencer’s.

“Almost” doing quite a lot of work, because your bond differs from M&S’s bond in two important respects:

- You, Doctor Evil, are always going to be the only bondholder. You don’t care about liquidity. The listing is solely for tax reasons.

- M&S had to do all kinds of tiresome disclosure to satisfy London Stock Exchange rules and get a listing. Supervillains aren’t very keen on disclosure. Fortunately, you can just list on the Channel Islands Stock Exchange. It will cost about £20,000 all in, and pretty much no information will ever be public. Your villainous UK subsidiary will never even have to tell HMRC what you’ve done.

Clearly tax avoidance, but the quoted Eurobond exemption doesn’t care. HMRC have no prospect of challenging the arrangement.

The outcome is that Doctor Evil doesn’t have to worry about withholding tax. That’s deeply silly.

Scenario 3 – UK widget-maker borrowing from a large US bank

You’re a UK widget-maker looking to expand with a cheap loan from a US bank.

Problem is, you have to withhold tax at 20%. Fortunately, there’s a treaty between the US and the UK, which says that actually the rate is zero. And the UK has treaties with most countries (with the important exception of tax havens), which do the same thing.

If you’re borrowing from Citibank then you’re in luck – Citi has a “treaty passport”7Full disclosure: I played a small role in the creation of the treaty passport scheme, many years ago, acting for the Loan Market Association. Believe it or not, it’s a huge improvement on how things had been before. which means that HMRC have preapproved it. So all you, the borrower, have to do is complete HMRC online form DTTP2 and then wait for HMRC to issue with a “direction” to pay the interest without withholding – which should take a couple of weeks, but in recent years has been taking months. This is all under the Double Taxation Relief (Taxes On Income) (General) Regulations 1970, perhaps the oldest piece of direct tax legislation still in force.

In the meantime, you have to withhold tax. Citi will make you eat the cost of that – another 20% on your interest payments. Then, when the “direction” arrives, Citi can apply to HMRC for a refund of the tax withheld, and pay it back to you. Pure hassle for you, Citi, and HMRC – as millions of pounds go around in a circle for no reason.

Or, if you’re brave, you can pay without withholding, betting that the “direction” will come through – but then you’ll be on the hook to HMRC if something’s wrong and HMRC decide not to issue a direction.

In theory, you could issue Citi a bond, but if you’re a small company you would probably regard that as a bit racey. And even if you’re a large company, you’ll probably find Citi’s bank loan team want a loan, not a bond.

The outcome is pointless bureaucracy and delay. HMRC knows exactly who Citi is, and shouldn’t be putting obstacles in the way of people borrowing from Citi. There is no tax at risk here. We trust companies to self-assess their corporation tax. Why have an old-fashioned 1970s system for withholding tax?

Scenario 4 – UK widget-maker borrowing from a small US bank

You’re a UK widget-maker looking to expand with a really cheap loan from an obscure US bank.

Problem is, Kentland Federal Savings and Loan doesn’t have a treaty passport. So it has to complete HMRC form US-Company (an actual paper form). Then complete US tax form 8802 and mail both forms to the IRS in Philadelphia (not email; actual mail mail). Then after a random amount of time (supposedly 45 days, but six months is not uncommon) the IRS will send the HMRC form with a US residency certificate to HMRC in the UK. Or – as seems to happen about 10% of the time – lose the form.

Then HMRC takes a random amount of time to consider the form and issue a “direction” to you to pay without withholding tax.8You could persuade the Kentland Federal Savings and Loan to apply for a treaty passport – but that still necessitates the US form 8802 process.

All this means months and months, and sometimes over a year, before HMRC authorise you to pay without withholding tax. In the meantime, you’re paying the withholding tax, and eventually all that money will (hopefully) come round in a circle back to you.

Again, you could pay the interest before the “direction” without withholding tax, and chance your luck. But it’s a risk.

The outcome is that an entirely commercial arrangement runs into a maze of pointless bureaucracy, for no reason at all.

Scenario 5 – Private fund making a loan

You’re a private fund, looking to make a loan:

- Perhaps you’re a private equity fund, and you’re using the loan to juice up one of your own portfolio companies’ tax position, by getting additional interest tax relief. These days that’s hard.

- More likely debt is just a more efficient way to extract profit from your businesses than equity (don’t need to declare dividends, don’t need accountants to confirm sufficient distributable profits).

- Or perhaps you’re not a private equity fund at all, but a debt fund making a loan to a third party?

You’re a partnership, which means that for tax purposes you don’t exist9This is a simplification, but a pretty good one. Your investors are taxed as if they made the fund investments themselves – and all of your investors are probably in countries with 0% treaties with the UK. So in theory you can just make treaty claims for those investors, and any investors that are in “wrong” countries suffer the withholding tax. Simple!

Nope.

Getting treaty forms off all your different investors will be a right faff. Particularly if your investors are themselves funds with multiple investors. And then what happens when investors in your fund change (or investors in the fund investing in your fund)?

So absolutely standard practice is that the fund doesn’t lend itself. It sets up a subsidiary special-purpose company, often in Luxembourg, and therefore in the jargon, “Luxco“. Luxembourg has a tax treaty with the UK, which reduces interest withholding tax to zero.

Luxco then obtains a treaty passport, which is a slow and annoying process (but the Luxemboug tax authorities are way faster than the IRS). But once it has the treaty passport, it can lend relatively straightforwardly. When making the application, Luxco should provide HMRC with full details of its ownership structure and, in particular, promise that all of the fund investors are in “good” tax treaty jurisdictions.

Hang on! Luxembourg SPVs? Tax-motivated transactions? Some would say “tax avoidance”!

I don’t agree.

If we ignore the detail, the tax result is in substance the “correct” one: investors in good countries are receiving UK interest without withholding tax.

And if we want to be tedious lawyers and obsess over the detail, the tax result is also correct, because Luxco benefits from a tax treaty.

This is tax hassle avoidance, not tax avoidance.

But it’s also clearly daft. All the investors are in “good” jurisdictions. There’s no tax risk here for the UK. So why are we forcing the fund to waste time and money setting up a pointless Luxembourg subsidiary?

Scenario 6 – fund can’t use Luxco

The facts are the same as in scenario 5. But everything is moving quickly, and you just have no time to make a treaty claim. Or, for obscure technical reason, you cannot use a Luxco (investors in some countries may not be permitted to invest in a fund that sets up this kind of subsidiary).

So you take a page out of Doctor Evil’s book, and lend to the borrower using a kinda-fake listed bond. Now it’s not really tax avoidance (because all your investors are in a “good jurisdiction”). It’s not as evil as Doctor Evil, because the bond is (probably) being issued between genuine third parties. But it’s a weird outcome.

Scenarios 7 through to 100

There are lots of other ways that sophisticated people can “work round”, “mitigate” or “avoid” withholding tax:

- Use that exclusion for short term loans.

- Take advantage of the surprisingly generous exemption for “private placements”

- Lend from a tax haven, then at the last minute before interest is paid, flip the loan to someone in a nicer country with a tax treaty. Serious avoidance territory, but I believe some people do this.

- You can have a UK bank make the loan, but then have a back-to-back arrangement between that bank and a tax haven lender, such as a hedge fund. This happens a lot. Is it tax avoidance? Depends on whether the ultimate owners of the hedge fund are in a tax haven, or in nice tax treaty countries.

The short version

For sophisticated businesses, and sophisticated tax avoiders, withholding tax is optional.

For less sophisticated businesses, and sometimes even larger ones, withholding tax is a hassle.

How much money does withholding tax raise?

We don’t know.

HMRC does not have statistics on withholding tax that take into account the significant amount of withholding tax that ends up being refunded.

HMRC told me, in an FOIA response, that £230m in interest withholding tax was withheld in 2021-22. But much of this will be cases where there were delays obtaining authorisation to pay without withholding, and so the lender will in due course obtain a refund of the tax. HMRC does not keep track of those refunds. So we don’t know the true figure for the net amount withholding tax raises, after withholdings and refunds. My expectation, and that of most other advisers, is that it will be very small.

What do other countries do?

The UK is an outlier these days in both having interest withholding tax, and having such a cumbersome procedure to access tax treaty exemptions.

Most of Europe now has no interest withholding tax at all (save on payments to some tax havens). That includes France, Germany, Austria, Denmark, The Netherlands, Sweden and others (some of which are typically regarded as high tax jurisdictions).

Other countries still have interest withholding tax in theory, but exemptions and/or wide tax treaty networks, with straightforward procedures so that it rarely becomes a business impediment. That includes for example United States, Ireland, Denmark, Norway, Spain, Australia.

If these countries manage without a complex interest withholding tax regime, why can’t the UK?

The best solution

My preferred solution is to abolish all withholding tax for payments between companies.

If that’s all we did, it could facilitate erosion of the UK tax base by payments to tax havens by people who aren’t sophisticated enough to use one of the many existing ways to “get around” withholding tax. So we probably do need some kind of backstop. My suggestion would be to create a new prohibition on corporation tax interest relief, where interest is paid (directly or indirectly10i.e. we’re looking at the ultimate recipient, not entities in the middle of a structure) to a related party in a tax haven.11This would need to be legislated with care. For example, in many structures (both commercial and avoidance-driven), a loan to a tax haven is derecognised for accounting purposes, so in fact there is no tax relief to deny. Debits and credits would have to be re-recognised in a tax haven/related party case, and the debits then disallowed.

My instinct is that these two changes would be broadly revenue-neutral, or even raise a small amount of additional tax (i.e. because some existing structures which facilitate deductibility with no withholding tax would now lose deductibility). Given the lack of statistics around the real cost and benefit of the current withholding tax framework, considerable analysis would be required before abolition.

And the quoted Eurobond exemption would now serve no purpose, and would be scrapped.

The less good solution

We probably can’t abolish withholding tax on payments by individuals, because that could lead to a material revenue loss.12For two reasons. First, individuals can’t use the listed bond exemption, and so it’s currently not so easy for an individual to escape withholding tax… thus abolition could represent an absolute tax loss. Second, individuals don’t usually get a tax deduction for their interest payments, so we can’t use deductibility as a backstop So, whatever we do with corporate interest withholding tax, we in practice likely need to find another solution for interest payments by individuals.

And, if you think total abolition of withholding tax on payments to companies is a step too far, we need a less good solution for companies too.

In both cases, I think there’s an obvious answer: abolish withholding tax on everything except the payments we really care about – payments to tax havens.

So no withholding tax, and only a very simple procedure, for withholding tax paid abroad, provided that the ultimate beneficial owner of the interest is not in a “bad jurisdiction” – i.e. a tax haven or other country where the UK doesn’t have a tax treaty with an interest provision.

This needs to be done very carefully, to prevent large-scale evasion and avoidance whilst still ensuring it’s workable for normal businesses. Here’s one way it could work:

- To take advantage of the new rule, a lender completes a simple online form, confirming – for the benefit of the borrower and HMRC – that its ultimate beneficial owners are not in a bad jurisdiction.

- The lender could be a financial institution or a “fiscally transparent” fund. Doesn’t matter. The rule looks to the ultimate beneficial owners.

- The borrower can then immediately pay without withholding.

- Alternatively, the lender could confirm that say 5% of its beneficial owners are in a bad jurisdiction, and then withholding applies at 5% times 20%.

- The form has scary wording ensuring that people take it seriously – for example when you sign a US withholding tax form, you sign a statement that you are certifying under “penalty of perjury“.

- If it turns out the lender statement was wrong, then withholding tax becomes retrospectively due, plus 100% penalties. HMRC can collect the tax (but not the penalties) from the borrower, or the tax and penalties from the lender, the “bad” ultimate beneficial owner, or anyone between them in the ownership chain.

- If HMRC collects from the borrower, then the borrower has a statutory indemnity right against those same people (which it is entitled to deduct from future interest payments13that’s not a radical change – it’s already there in the 1970/488 SI).

- Any contractual provision which in substance makes the resultant tax the cost of the borrower (e.g. counter-indemnity or gross-up) is void.

To prevent tax haven lenders doing an end-run round these rules by using listed bonds, we’d need to tighten up the quoted Eurobond exemption:

- We could, for example, create an exclusion where it is the parties’ expectation that the bonds will at all times be predominantly held by a related person.

- And at the same time create a simple reporting regime for payments on quoted Eurobonds – HMRC currently doesn’t track these at all.

Again, my instinct is that this change would be revenue-neutral, or perhaps even slightly revenue positive. But HMRC would need to undertake a proper analysis.

The bottom line

The UK’s existing corporate interest withholding tax is easily circumvented by bad actors. It’s an unnecessary complication for large businesses. It can be an impediment to smaller businesses.

And we can probably abolish it, or greatly liberalise it, at zero cost.

Thanks to all the bank, private equity and corporate borrower people who spoke to me about this.

Obvious caveat: nothing in this article, or indeed anything on the Tax Policy Associates website, is legal or tax advice.

Image by Stable Diffusion – “a man with a tangled ball of string as a head”

-

1I’d love to hear more ideas on pointless taxes that should be abolished. The only rule is that, given the current state of the public finances, the tax must either raise zero revenue, or be easily replaced by a simple expansion of an existing tax. So “let’s abolish VAT!” is a non-starter, I’m afraid.

-

2Actually almost everybody wins from this. Employees don’t have to worry about tax. Government doesn’t have to worry about employees not paying tax. Government gets paid the tax much earlier than it would under self assessment. Everybody except the poor old employer, who has to operate the system

-

3The “in theory” hides a lot of complexity which is fascinating, but I won’t go into now

-

4The basic rule is in section 879 of the Income Tax Act 2007. Strictly it’s a “requirement to deduct income tax at 20%” but most people call it “withholding tax”.

-

5Not strictly an exemption, but it may as well be

-

6Again not strictly an exemption, but it may as well be

-

7Full disclosure: I played a small role in the creation of the treaty passport scheme, many years ago, acting for the Loan Market Association. Believe it or not, it’s a huge improvement on how things had been before.

-

8You could persuade the Kentland Federal Savings and Loan to apply for a treaty passport – but that still necessitates the US form 8802 process.

-

9This is a simplification, but a pretty good one

-

10i.e. we’re looking at the ultimate recipient, not entities in the middle of a structure

-

11This would need to be legislated with care. For example, in many structures (both commercial and avoidance-driven), a loan to a tax haven is derecognised for accounting purposes, so in fact there is no tax relief to deny. Debits and credits would have to be re-recognised in a tax haven/related party case, and the debits then disallowed.

-

12For two reasons. First, individuals can’t use the listed bond exemption, and so it’s currently not so easy for an individual to escape withholding tax… thus abolition could represent an absolute tax loss. Second, individuals don’t usually get a tax deduction for their interest payments, so we can’t use deductibility as a backstop

-

13that’s not a radical change – it’s already there in the 1970/488 SI

14 responses to “Pointless taxes that should be abolished #3: withholding tax”

Totally agree on the general ridiculousness! The quoted eurobond is an odd one too – it feels like a hammer to crack a nut, perhaps a different exemption should apply to genuine third party debt, or where there are a lot of investors? Often I actually saw WHT when the hassle/fees of claiming the relief outweighs the tax cost.

From my experience (including a review of 30 countries’ WHT systems for a cashpool restructuring project), the UK WHT direction system is reasonably bad, but not terribly unusual, at least the UK don’t need notarised AND apostilled certificates of tax residency of the recipient before a direction is made. Also, there are a fair number of cases where WHT does apply, as there are a lot of treaties with WHT on interest – a smaller number in Europe but many outside Europe. Plus there are the countries without treaties. But even in this case it is effectively only paid because the quoted eurobond solution isn’t cost effective.

However, the fact you can self assess a lower treaty rate for royalties, but not interest, makes no sense at all.

“This is all under the Double Taxation Relief (Taxes On Income) (General) Regulations 1970, perhaps the oldest piece of direct tax legislation still in force.”

Hmm! Now there’s a challenge. Apart from TMA 1970 which got Royal Assent on 12/3/1970, 11 days before SI 1970/488 was made (they both came into force on 6/4/70), there’s SI 1967/924, the Capital Gains Tax Regulations. But my candidate in which I have a special stake is s 39 FA 1950 (Treatment for taxation purposes of enemy debts, etc., written off during the war.), a profits tax provision. I had this provision amended in para 1 of the Schedule to SI 2004/2310 and it was subsequently amended by CTA 2009 and FA 2012, my having it rescued from repeal by the Law Commission.

Happy to say I never looked at that one! Why did you rescue it?

I’m with you on abolishing the Quoted Eurobond exemption, which is clearly something that is subject to manipulation. Abolishing withholding tax for companies in toto makes no sense. I’d be interested to see your data that this would be cost free. Also, it would create a whole new industry of incorporation for individuals. The UK is absolutely not “an outlier these days in both having interest withholding tax, and having such a cumbersome procedure to access tax treaty exemptions.” Try filing for WHT exemptions in the US, for example.

Abolish the quoted Eurobond exemption? Sorry but that’s nuts. Killing the ability of UK companies to access the bond market makes zero sense.

Data is above. If the gross yield is £200m then the net yield will be a few £10m at most.

“Filing for WHT exemptions in the US”? Just give the paying agent a W8-BEN. Simples. No waiting for procedures to be completed

HMRC did consult on removing the Eurobond exemption back in 2010 (the response to the consultation was in 2012 I think). They also, rightly, concluded that it would be nuts to withdraw it.

I remember discussing at the time that it seemed that HMRC hadn’t realised before launching the consultation how basically the entire London bond market relied on it – they seemed to think it was a little-used exemption and so no-one would mind if it was removed to simply the tax rules…

It wasn’t removal, it was excluding bonds that weren’t liquid. The problem is that there are many completely genuine bonds, which either intentionally aren’t liquid, or turn out not to be liquid. The consultation was looking at the problem the wrong way round. The mischief isn’t in a liquid bonds: it’s in bonds being issued between related parties, which are just loans, dressed up for tax avoidance reasons. The complexity is that some of that “tax avoidance” is actually “hassle avoidance” of the type I outline above. So I think the real answer is withholding tax reform, which renders the exemption of limited relevance

A very well respected tax adviser, who is now retired, once shared with me his theory that HMRC keeps interest WHT not to collect it, but to give them something to bargain with in tax treaty negotiations. If we had no interest WHT (the theory goes) then the UK would find it harder to get 0% WHT in treaties on foreign interest paid to UK taxpayers, hence the UK would lose revenue by giving more DTR. I am not aware that this theory was based on anything more than educated guesswork, but could it be the case?

I’ve heard that theory! Feels a bit of a rubbish reason to saddle UK plc with all that bureaucracy…

There is no WHT on dividends from the UK.

It’s easier to characterise what is economically interest as dividends rather than the other way rounds.

So is of the scenarios 7-100 issuing preference shares with effectively a finite life?

The Double Tax Treaty Passport scheme feels a lot like the US QI or even FATCA PFFI status except from the standpoint of the borrower paying interest in the US to a foreign creditor once a foreign financial intermediary is designated as a QI/FATCA PFFI there is no action required to be taken in term of applying withholding tax. Given the UK has already endorsed TRACE is a standardized multi-country version of the US QI program perhaps the UK should be moving more in that direction.

Thanks for this very comprehensive explainer Dan. I broadly agree with you. Any tax or tax admin that only hits less sophisticated tax payers always raises a red flag to me. The system shouldn’t work like that.

I used to work on lots of tax restructuring or transaction projects with loan notes listed in the Channel Islands for exactly the reason you point out – to avoid tax withholding on the interest. I often wondered why that listing “counted” – to me, if there was no liquidity and no other buyers of those notes/debt/bonds, then it didn’t feel like a real listing.

The biggy that always niggles away at the back of my mind in terms of abolishing taxes is NIC. Especially now the bands are aligned in the most part, employees’ NIC should become part of income tax. Have different rates for savings and other non-employment/non-trading income tax, but absorb employees’ NIC into the main income tax rates and bands.

I really appreciate this Dan. It’s refreshing to have a light cast on this stuff in a way that is technical and unpolitical.

Yes, but ….

PAYE addresses a different problem: several million more tax returns. And see your articles about people being given penalties that exceed their tax liability.

I’m not clear why it is OK to pay gross to a LuxCo but not to a (say) Cayman company. Both are set up for tax neutrality purposes. What matters is beneficial ownership and FATCA / CRS and AML are pretty helpful on that to an extent. If you have abolished WHT, why target “tax havens”? Or do you have a very narrow definition of jurisdictions which do not exchange information?

For funds, particularly open-ended funds, being able to certify ownership at any point is a real pain. In particular, if a fund of funds has an interest in the fund, there is very limited ability to look through.