Our report yesterday revealed the scheme: it used 10,000 UK companies, supposedly owned by 10,000 Philippine individuals, to claim at least £50m in tax incentives. A central player admits the scheme was fraudulent. Today we identify the KC who gave the scheme the green light, publish his opinion, and explain why we regard it as improper.

The KCs issuing these opinions do so knowing they face no downside, and no accountability – that has to change.

The opinion

The scheme was enabled and facilitated by an opinion from Giles Goodfellow KC, a well-known tax KC. We are publishing the opinion in full, with our commentary, here.

Our view is that the opinion was clearly wrong as a technical matter – no court would realistically have thought it succeeded in claiming the intended tax benefits. More seriously, the opinion ignored “red flags” that suggested those involved were not merely engaged in tax avoidance, but that criminal tax evasion/fraud was a likely outcome.

If you haven’t read Part 1 of our report, please do – but to recap: one business was split into 10,000 “mini umbrella companies” (MUCs), with 10,000 Filipino individuals recruited using social media to act as “directors” and “shareholders”. Those behind the scheme then claimed the 10,000 companies were independent, and each one claimed small business incentives – amounting to at least £50m in total. But, behind the scenes, the Filipino individuals were just clicking buttons on a web portal – they weren’t independent at all. The whole thing was a fraud.

We have no reason to believe Mr Goodfellow knew the implementation of the transaction would be fraudulent (and possibly was already fraudulent at the time of the implementation). But why didn’t he spot the obvious red flags? Why did his analysis fail to take into account any relevant caselaw? How did he conclude that the scheme worked, when almost every tax avoidance scheme the courts saw in the last twenty years had failed? And when this was perhaps more egregious than any scheme that had come before a court?

We are calling for the Bar Standards Board to investigate.

Why we believe the opinion was improper

We provide a detailed analysis in our commentary to the opinion. But, in short, our view is that:

- Mr Goodfellow did not raise a red flag at the proposal to create large numbers of UK companies with Philippine individuals as directors. Indeed Mr Goodfellow expressly notes that an effect of the structure is that HMRC would have difficulty recovering tax from the Philippine individuals (para 40.3). It is a reasonable inference that this is the sole purpose of appointing them in the first place – indeed we cannot see any other purpose. But that is an improper purpose. Why did Mr Goodfellow not say so?

- Mr Goodfellow may not have known quite how many MUCs would be created – at least 10,000. But he should have appreciated that the economics of the scheme required there to be a large number (i.e. given the small tax benefit from each one).

- Nor did Mr Goodfellow raise a red flag on being asked whether, if the structure failed technically, HMRC would be able to recover tax from participants in the structure (para 40) and prosecute them for tax evasion (para 41). Such questions are in our view highly unusual and suspicious. Why did Mr Goodfellow not identify this?

- Mr Goodfellow did not think there was anything improper in hiring Philippine individuals as directors solely on the basis they spoke English and had a mobile phone and email, and then leaving them with liability to HMRC if the structure did not work. He was surely aware that the individuals would not receive any legal or tax advice. Why did Mr Goodfellow not query this?

- The opinion proceeded on the basis of the unrealistic assumption that the Philippine directors of the companies would make independent decisions, so that they were not “controlled” by those behind the scheme. The terms of the arrangement should be “explained” to the Philippine shareholders/directors and “approved” by them (para 20). How did Mr Goodfellow think this could be done thousands of times, without turning the directors into mere glove puppets? For the structure to work commercially, the directors had to be coordinated on some automated basis, so that they did not depart from the plan. The assumption was, therefore, impossible in practice (and the reality can be seen here). But the entire opinion depended on it. How did Mr Goodfellow think it could work?

- The opinion also assumes that each Philippine individual would subscribe for shares in their companies from his or her own resources, and provide it with “sufficient working capital”. That was unrealistic, in terms of the likelihood of such individuals having sufficient resources, the attractiveness of the “offer” being made to them, and the practical difficulty of receiving payments from thousands of individual Filipinos. In reality, that didn’t happen – the directors were hired on the basis that “we will never ask you for a single centavo”. The funds came from a participant in the structure. That meant that the structure immediately failed, even on its own terms. Mr Goodfellow should have appreciated that was the inevitable outcome.

- Mr Goodfellow concludes that the “main purposes” and “main objects” of the arrangement do not include the avoidance of tax. He says that each participant in the structure only has an eye to its own commercial profits. This is unreal. Realistically, stepping back and looking at the artificial nature of the structure, its sole purpose is to avoid tax. Why did Mr Goodfellow not refer to a single case? Why did he think it appropriate to adopt an approach which implies the “main purpose/object” tests can never apply to special purpose vehicles?

- The opinion does not refer to a single case or other authority. It ignores common law anti-avoidance principles (which the courts have used to strike down almost every avoidance scheme in the last twenty years). It ignores the Halifax VAT anti-abuse principle. This would be puzzling for an opinion on an ordinary commercial structure. It is astonishing for an opinion on an aggressive tax avoidance structure. Why did Mr Goodfellow do this?

- The opinion doesn’t mention the general anti-abuse rule – the GAAR – enacted in 2013, and extended in 2014 to apply to national insurance. In our view, it would have nullified the transaction, even if the specific anti-avoidance rules did not. This is another startling omission. Why did Mr Goodfellow not mention the GAAR.

The job of a lawyer writing an opinion is to predict how a future court would behave: to put themself in the place of a judge, and ask what the judge would do. And that lawyer will be keenly aware of the dismal recent history of tax avoidance schemes when they come before tribunals and courts.

Mr Goodfellow never does this. He approaches each element of his analysis in isolation, never stepping back and considering the complete picture. That picture is an unedifying one: thousands of UK companies, with Philippine directors, each claiming to be independent when realistically they are not. In the words of a senior lawyer who reviewed the opinion, it’s like someone trying to describe a murder scene without mentioning the dead body, the kitchen knife, or the blood all over the floor.

The opinion has now been reviewed by a dozen senior tax professionals – KCs, tax accountants, retired HMRC officials and solicitors. The view is unanimous: no court would have found that the structure worked, and a competent and independent barrister should have known that. Furthermore, the “red flags” raised by several key elements of the structure should have been challenged by Mr Goodfellow, and/or he should have refused to act.

Why did Mr Goodfellow advise in the way that he did?

Why Mr Goodfellow’s opinion was important

KC opinions can give a very significant advantage to promoters and others engaging in aggressive tax avoidance. In practice, a KC opinion can make it impossible for HMRC to pursue a criminal prosecution against those involved

People entering into complicated commercial transactions will sometimes seek the opinion of a KC. They are typically doing so either because the KC is particularly expert in the area of law, or because the KC is as a practical matter more familiar than the solicitors with how courts assess questions of fact and law.

Tax avoidance scheme participants typically obtain KC opinions for three completely different reasons.

- First, as a marketing tool – to persuade other people (potentially retail “investors”) to enter into the scheme.

- Second, as a defence against HMRC penalties – if taxpayers took advice from a KC then it will be hard for HMRC to show that they were negligent/careless so that penalties apply. This was relevant here.

- Third, as a defence against prosecution for tax evasion/fraud. These offences require dishonesty and, even if the scheme fails, the existence of a KC opinion surely means the taxpayers were proceeding in good faith?

The first reason doesn’t seem to have been the case here – there was nobody to market to. The second and third reasons absolutely were the case.

And note the timing of the opinion: the MUCs started up in 2015, but the opinion was dated 2016, when HMRC started to wind some of the companies up. That is strange, because the opinion is written in the future tense. Why was this?

One potential answer is that the parties sought the opinion to provide a shield against prosecution. Perhaps HMRC had started to attack the structure, the promoters were getting worried about personal and criminal liability, and that’s why Mr Goodfellow was approached? Was Mr Goodfellow told of this background? Or was he lied to?

The consequence of Mr Goodfellow’s opinion

The structure continued until HMRC eventually wound it up. The cost to the taxpayer was at least £50m, and potentially much more.

It is possible (but we do not know) that the opinion prevented penalties being assessed on some of those responsible for the structure, and prosecutions being brought against them. That certainly appears to have been a significant motivation for commissioning the opinion.

At least one individual has faced serious legal consequences for his part in the scheme – David Smith, the director of Contrella:

Smith admits the scheme was a fraud, but cites the KC opinion as the reason for believing the structure to be legal at the time:

That is Mr Goodfellow’s responsibility.

Smith also gives another explanation – that they departed from the KC’s advice:

It’s interesting that the description of the structure as “highly aggressive and high risk tax avoidance scheme” is absent from Mr Goodfellow’s opinion. Was this a different opinion? Or was this a discussion that did not make it into the written opinion document?

We do not know the nature of the “decisions on how the model was run” that departed from the KC’s advice, or who was responsible. It is unclear if Mr Smith was prosecuted, and we are not aware of any other prosecutions. The big unanswered question is: were these “departures” in fact elements that we identify above, where it was, realistically, inevitable that the KC’s assumptions were incorrect, and his advice would not be followed?

Why there was no incentive for Mr Goodfellow to give a correct opinion

Lawyers normally have a strong incentive to give correct advice: if they do not, and their client loses out, they will face significant liability – potentially personal and professional ruin. Tax lawyers face particular risk here, given that they are often opining on very difficult points, with large amounts of clients’ money at stake. In our experience, they almost always do so responsibly – solicitors and barristers/KCs. Not because they are saints, but because of the powerful incentives.

But in this instance, what incentive did Mr Goodfellow have to provide correct advice?

The companies exposed to the failure or success of the tax planning were the MUCs, with their Philippine directors. But the MUCs, and the directors, were not advised by anyone. Mr Goodfellow was only advising Contrella, and he is careful to say at the start that the opinion is only for the benefit of Contrella and its directors.

Mr Goodfellow had a powerful incentive to say “yes” – otherwise he would presumably receive no further instructions from the promoter. He had an ongoing relationship with Aspire, having acted for its principal, Alan Nolan at an appeal tribunal in 2012 (where Nolan was found to have “sought to avoid telling the truth”). We understand that this relationship continues.

On the other hand, Mr Goodfellow had very little incentive to say “no”. His client would take a large benefit from the structure even if HMRC successfully challenged it – the MUCs would just be allowed to sink to the bottom of the proverbial harbour. And that is exactly what happened. Even when the director of Contrella admits a fraud, Mr Goodfellow can credibly say that it is because his advice was not followed.

The many recent mass-marketed tax avoidance schemes have evidenced a similar problem. The KC was the client of the designer of the scheme, not the ultimate taxpayers. Even when the scheme goes wrong, and the KC’s advice was on its face reckless, the taxpayers have no recourse. The Court of Appeal had no answer to this in the recent McClean v Thornhill case (excellent article about the case here).

We are sure Mr Goodfellow is a decent man, and that he did not set out to provide a wrong opinion. But all of us are driven, consciously and unconsciously, by our incentives. Did those incentives compromise Mr Goodfellow’s independence and competence? Why did he issue an opinion that (in our view) was wrong.

The key problem: if (as we believe) Mr Goodfellow issued an opinion that was wrong, and that caused loss to HMRC and others, that should have consequences for him. But it does not.

Jolyon Maugham wrote about the incentive problem almost ten years ago – nothing has changed.

How to end the incentive problem

One answer is regulation. But it’s unclear that would make a difference: after all, KCs are already regulated.

A better answer, simultaneously easier to implement and more ambitious, is to create a statutory standard on tax practitioners:- accountants, barristers, solicitors… everybody.

That standard would look something like the old IRS Circular 230 from the US:

A tax practitioner must base all written advice on reasonable factual and legal assumptions, and consider all relevant facts that the practitioner knows or should reasonably know.

In circumstances where the GAAR would apply (i.e. a structure so unreasonable that no reasonable person would have thought it a reasonable course of action), any practitioner who advised on the “unreasonable” elements of the structure, and departed from the statutory standard, would be jointly liable for the lost tax to HMRC and/or the ultimate taxpayer.

So that the statutory standard can be applied, the taxpayers and HMRC would need to be able to see the advice in question – currently, legal privilege means they often cannot. So the existing iniquity exception to legal privilege should be expanded to tax avoidance schemes that are subject to the GAAR.

This is based on Maugham’s original proposal, but with additional protection to ensure that only the most egregious schemes are subject to the rule – otherwise, fear of liability could drive good advisers out of the profession. But the important element is that, in those most egregious schemes, KCs and other advisers can no longer evade responsibility to HMRC and to taxpayers.

It’s time to change the incentives.

Why we are publishing the opinion

We would never normally name a barrister just because we disagreed with their advice. This is an exceptional case. We are publishing the opinion, and naming Mr Goodfellow, because we believe the scheme was outrageous, ended up costing HMRC at least £50m, and a central figure in the scheme has admitted fraud. We believe the opinion was improper, and that the fact such opinions are given raises an important matter of public interest.

We are strong supporters of the Tax Bar, the vast majority of whom prize their independence and are technically rigorous. However, there is a very small minority, of perhaps half a dozen individuals, who habitually issue opinions that facilitate tax avoidance schemes that realistically have no prospect of success. But those opinions enable the schemes to proceed, at society’s cost.

We see no prospect of changing the law unless the reality of these opinions becomes clear to policymakers – and the nature of the opinions is such that they are usually invisible. Now one, at least, is publicly available – and we think other tax practitioners will be as shocked by it as we were.

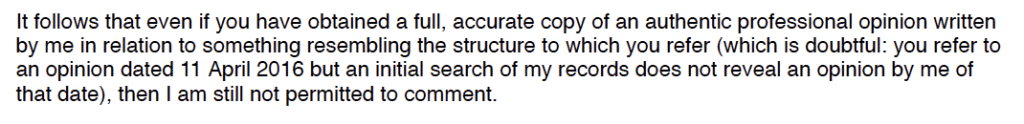

Mr Goodfellow’s response

Mr Goodfellow initially responded by suggesting he couldn’t comment because of his professional duty of confidentiality. He also cast doubt on whether the opinion existed, saying:

That was a surprising answer. Most lawyers would remember so unusual a structure, particularly if it had then been the subject of press coverage and the lawyer’s actual client had admitted it was a fraud.

Given the possibility that the opinion was a hoax, we subsequently sent Mr Goodfellow a copy of the opinion, together with detailed explanation of our criticisms. Mr Goodfellow has not confirmed that the document is indeed his, but neither has he denied it (and we expect that a barrister presented with a hoax opinion in his name would immediately say that it is a hoax).

Mr Goodfellow’s more significant response is that it is unfair for us to criticise him, because client confidentiality prevents him from responding. We are unconvinced that client confidentiality prevents any response at all: a technical response to a technical point does not breach client confidentiality. There is also the real possibility that Mr Goodfellow’s opinion was commissioned in the course of a fraud – the people instructing Mr Goodfellow had already put the structure in place, and knew for a fact that Mr Goodfellows assumptions were false. If that is right, the opinion may not be confidential at all.

However, even if Mr Goodfellow is indeed unable to comment, we cannot accept that this renders him immune from any public criticism. It does put a particular onus on us to act fairly, and we believe we have done so. The material in this report, and our previous summary of the structure, reflects careful consideration over several months, and input from a large team of legal and tax experts.

We will immediately correct any error that is brought to our attention.

Thanks to Simon Goodley at the Guardian for the original reporting on this, and Richard Smith, Gillian Schonrock and Graham Barrow for their amazing investigative work (again noting that they draw no legal conclusions; the legal conclusions are the sole responsibility of Tax Policy Associates Ltd).

Thanks to R, P, T, C, M and B for their help with our tax analysis, to K for assistance with the confidential information and privilege elements, to Michael Gomulka for a useful discussion of the barristers’ Code of Conduct, and to A for finding the reference to umbrella schemes in recent tax tribunal data. Thanks to JK for her insight on umbrella companies

25 responses to “The outrageous £50m tax scheme that was KC-approved. Part 2: The Opinion.”

“Mr Goodfellow did not think there was anything improper in hiring Philippine individuals as directors solely on the basis they spoke English and had a mobile phone and email, and then leaving them with liability to HMRC if the structure did not work. He was surely aware that the individuals would not receive any legal or tax advice. Why did Mr Goodfellow not query this?”

£

“We have no reason to believe Mr Goodfellow knew the implementation of the transaction would be fraudulent (and possibly was already fraudulent at the time of the implementation). But why didn’t he spot the obvious red flags? ”

£

The ‘boys who can’t say no’ problem referred here is certainly an issue, but the recent register of overseas entities process is a pertinent reminder of what happens when the penalties for professionals getting it wrong become too great. In that case there was a threat of criminal sanctions for getting your certificate wrong, leading to the overwhelming majority of accountants and lawyers choosing not to offer the certifying service and in turn leaving supply of professionals overwhelmed by demand of would be users. Your recommendation of making tax advisors jointly liable for tax losses brought about by their clients risks a similar outcome. Either that, or creating an environment where opinions are given with such caveat as to be useless. Sanctions must have adequate safeguards and must impact only those persons at whom they are targeted.

thanks – I agree there’s a difficult balance to be struck, which is why I’m suggesting liability only applies when a transaction is subject to the GAAR, which seems an appropriately high threshold.

But I’m certainly open to other suggestions

And how appropriate that this illustrious man (Chairman of the Board of Governors of Harrow’s John Lyon School, no less), should continue to be supported and financed in his career by us the taxpayers through the good offices of HMRC if Chambers Review can be believed -“He acts for both the Revenue and taxpayers” (as an aside, I suspect they include non-taxpayers in that latter phrase). And how admirable that HMRC, who are presumably in a better position than most to be well aware of his activities and the fact that he was named in Parliament (see above) as one of those “guys who prostitute themselves to these schemes” should not hold that against him.

Does the UK (England) have a “crime/fraud” exception, as appears to exist in the US, for legal privilege?

If so, is the difficulty that HMRC would need a threshold basis to argue that exists or is the difficulty that it has to know the legal advice exists?

Hi Dan,

One thing that I’ve noticed in the response to this investigation is the question of what responsibility a KC has in this context.

Are they a hired gun, who has a job of threading a needle, however improbably, in order to respond to their clients instructions and without wavering from any narrow tramlines they are given?

Or do they have a responsibility (of professionalism/ethics/integrity/morality?) to highlight where there is a genuine risk of law breaking or impropriety – or the risk that a future judge might see it as such.

On the former reading, Mr. Goodfellow has done nothing wrong. But if so, what does that say about our society and its priorities – and the esteem in which such professional qualifications are held.

Hi Dan,

One thing that I’ve noticed in the response to this investigation is the question of what responsibility a KC has in this context.

Are they a hired gun, who has a job of threading a needle, however improbably, in order to respond to their clients instructions and without wavering from any narrow tramlines they are given?

Or do they have a responsibility (of professionalism/ethics/integrity/morality?) to highlight where there is a genuine risk of law breaking or impropriety – or the risk that a future judge might see it as such.

On the former reading, Mr. Goodfellow has done nothing wrong. But if so, what does that say about our society and its priorities?

it’s a great question. Exactly where you draw the line is a hard question, but surely nobody would say there is no line at all? For me, that line is crossed when a structure involves elements that cannot be explained other than as an attempt to prevent HMRC discovery or enforcing against the structure..

Good work Dan. One things that I’m missing from this is how they make sure that things happen properly if one of the directors goes on holiday, disappears, etc. I could see a few ways of dealing with this:

1. The overseas director signs an undated letter of resignation and an undated stock transfer form somewhere.

2. The overseas director gives someone a power of attorney to do whatever they like (such as resign and transfer their shares).

3. An alternate director is appointed just in case. Looking in the articles, there are words to do this.

I can’t see any of this mentioned in the opinion but may be it was never done or not mentioned in the instructions. If they did anything like this though I’d assume it would flavour the tax analysis.

It’s a very good point. I’ve seen this kind of thing stymie (legitimate) structures before. “OMG we have an urgent decision to make, but our offshore director is unavailable.” No clue in the info I had how they dealt with this.

You may not have been able to post this on your report, but this article from the Guardian is telling

https://www.theguardian.com/business/2013/feb/19/margaret-hodge-tax-avoidance-treasury-loss

At the hearing she named QCs …. ….. ….. and Giles Goodfellow as “the guys who prostitute themselves to these schemes”

It is sometimes astonishing how the aggressive avoidance industry seems to survive however many times it loses in court, and however high the penalties are.

I met a prospective client last week, who was recently introduced by his IFA (a very large national brand) to a small firm of chartered accountants in Kent. These accountants offered to sell him an aggressive tax avoidance scheme which appears almost identical to the Odey case, which was defeated in court in 2021. The accountant’s fee would have been a five figure sum, with a third of it paid in advance on signing the engagement letter. If the scheme worked (it does not) then the individual would be able to take tax-free dividends from his company in future. Granted the scheme does not involve 10,000 directors, but it is tax “advice” of the sort I had hoped we as advisors had put behind us.

Adam, if the firm are a member firm of ICAEW I urge you to report them to the ICAEW professional conduct department as they absolutely should not be doing this. We need to call out this behaviour and by reporting them to their professional body we can be part of the solution. As said elsewhere on this thread, fellow members have an obligation to report, but I would encourage anyone who sees this sort of activity to make a report in the public interest.

Excellent analysis, Dan, and well done for exposing the sort of QC/KC’s opinions that are still out there. I had hoped that they were a thing of the past (and this one does look to be seven years’ old) but we obviously do need to remain vigilant.

In terms of your solution, you don’t mention the existing Enabler Penalties (Schedule 16 FA (2) 2017) which can charge a penalty on the Enabler in GAAR-type situations. The definition of Enabler might need tightening a bit to encompass Barristers giving opinions, but otherwise we already have something along the lines you mention. Admittedly the penalties are only equal to the enabler’s fee (not the tax), but I do fear that if you have a tax-based penalty for enablers then you will make life almost impossible for the 99% reputable tax advisers out there – not because they get anywhere near GAAR, but because their internal risk teams will deem the risk of giving tax advice just too great. And that would have serious repercussions (not least for a government 90% of whose tax is collected for them by tax agents). In terms of incentive effect, having the prospect of your whole fee confiscated (or perhaps it could be double your fee) ought to be enough incentive effect. So I think it’s the definition of Enabler that might need tweaking. Otherwise we already have something on the statute book.

The other thing you don’t mention is PCRT – a voluntary standard for CIOT, ICAEW, STEP and other members which already contains similar language to your circular 230 (see https://www.tax.org.uk/professional-conduct-in-relation-to-taxation-pcrt – helpsheet B). The issue with this is that being a member of a professional body and subjecting yourself to these standards is currently voluntary, so it is difficult for the bodies to police this better without members just choosing to leave them. Statutory regulation of the profession requiring tax advisers to join a PCRT body might be an answer(?)

I do sense that a lot of the issue here is with the Bar (and to a lesser extent with the SRA) who don’t subscribe to the same standards – rather than one which applies to all tax advisers, many of whom are already members of PCRT bodies.

Might have known the KC would be one of the Dame Margaret Hodge Four.

Too subtle for me – can you add a clue?

Separately, I see that the very first area of expertise he lists is “pursuing and defending claims for substantial damages arising out of allegedly defective direct or indirect tax advice given ”

IF he was misled and is now acting against an ex-client, then I could understand why he could not comment.

https://www.theguardian.com/business/2013/feb/19/margaret-hodge-tax-avoidance-treasury-loss

I am pretty confident that is not the case.

Thank you.

Important that professionals of conscience speak out when questionable practice is encountered.

At the ICAEW there is an obligation to report misconduct by other members.

https://www.icaew.com/regulation/complaints-process/your-duty-to-report-misconduct

Do the Bar Council and the Law Society have equivalent obligations?

They do, but I believe solicitors don’t have an obligation to report barristers (or vice versa)

The significance of the word “obligation” seems to be missed by most people.

You are showing that any member of the public has a right to report people (assuming not vexatiously) without being in the same professional body.

But for those in the same professional body it’s not a right, but a requirement.

So every barrister who has read this opinion (E.g. because you showed it to them) and concluded it is deeply wrong, is in breach of their professional ethics code if they have not reported Mr Goodfellow to the Bar Council?

And thus subject to disciplinary action themselves?

A short note “I agree with the analysis of Dan Neidle dated YYYY.MM.DD and his complaint to you about Mr X” would be sufficient.

I’m not attacking those barristers, or encouraging witch-hunts – I’m pointing out how the professional bodies should work, and claim that they do work.

The way to eliminate improper professional activity is to get this obligation taken seriously – very little happens without other people knowing about it.

Many of us in the profession have come across dubious counsel’s opinions. But we also know if we say anything, we’ll have an Oxbridge-educated man with a posh voice threatening to sue us.

Well done Dan. A fair and well reasoned explanation that entirely, IMHO, justifies the ‘naming and shaming’ (effectively) of what appears to have transpired here. And, in so doing:

1 – Highlighting the challenges that HMRC has to overcome when pursuing such schemes and their promoters;

2 – Suggesting a way forward to change things;

3 – Giving the Bar Council and/or the Tax Bar something to think about; and

4 – Justifying (all be it long after the event) my stance when I was in practice and I was presented with opinions from QCs (now KCs) that I could not endorse to my clients. I’m sure that plenty of decent accountants and tax advisers do the same to this day and can now explain, even better, to clients why such opinions are not automatically bullet proof!