From 2018 to 2022, HMRC charged 420,000 penalties on people with incomes too low to owe any tax. They shouldn’t have needed to file a tax return, but for some reason they were – and because they didn’t file on time, they received a penalty of at least £100. In most cases, that’s more than half their weekly income.

Astonishingly, 40% of all late filing penalties charged by HMRC over these four years fall into this category.

We believe the law and HMRC practice should change. Nobody filing late should be required to pay a penalty that exceeds the tax they owe.

The Guardian’s coverage is here. The Times’ coverage is here

UPDATED 27 June 2023 with our thoughts on HMRC’s response

The data

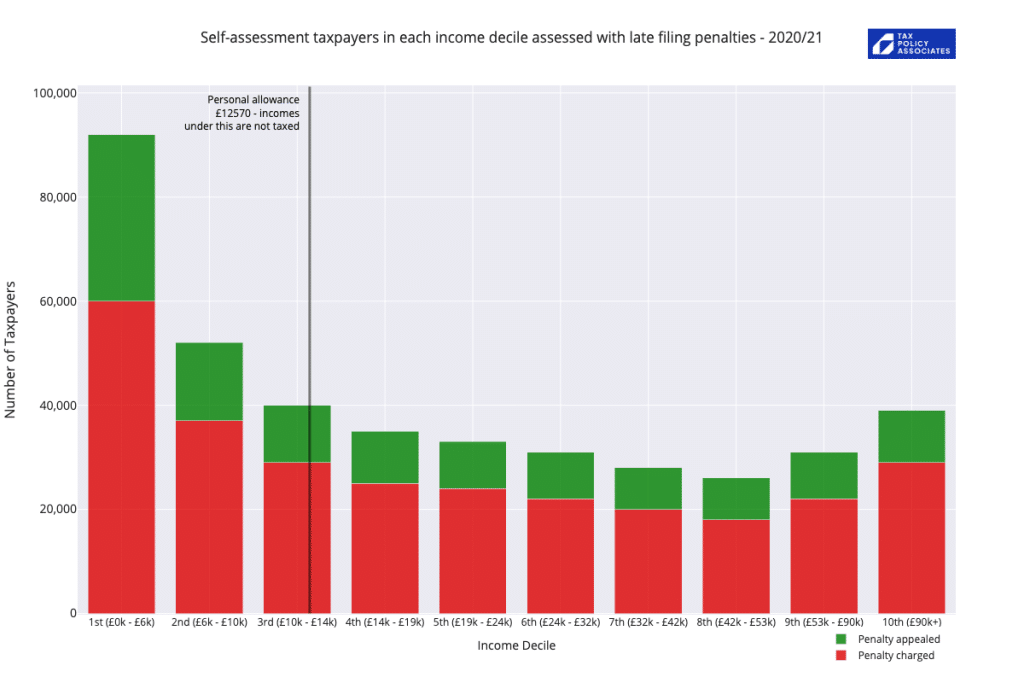

Our new data1This is an update of our report from last year, with two more years of data and further statistical analysis shows the percentage of taxpayers in each income decile who were charged a £100 fixed late filing penalty in 2020/21, the most recent year for which full data is available:

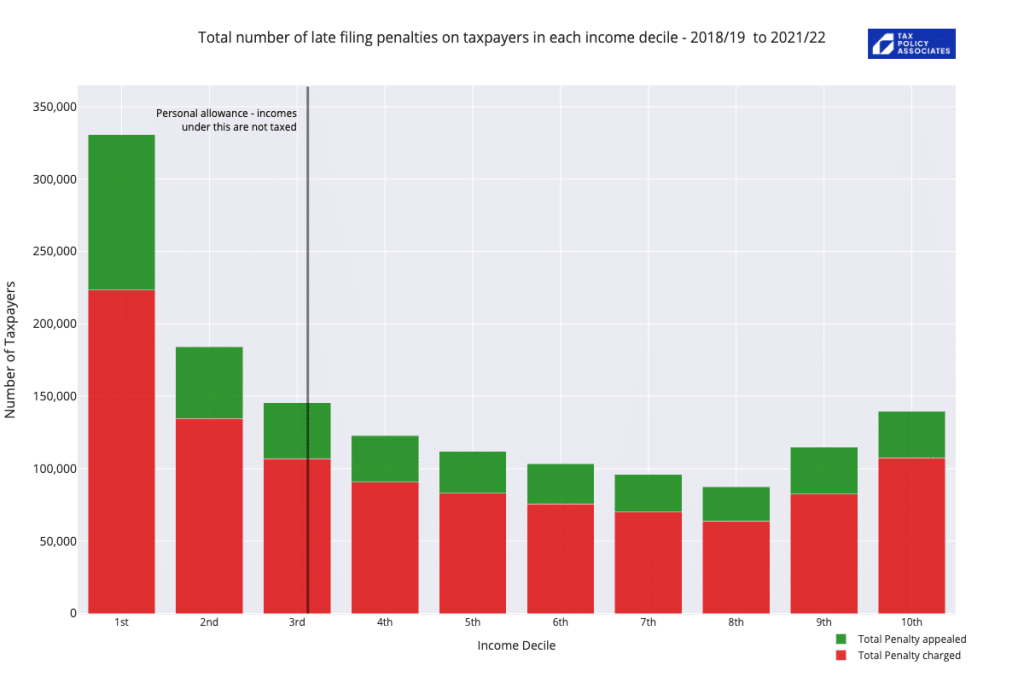

The green bars show where penalties were assessed but successfully appealed. The red bars show where the penalty was charged. The black vertical line shows the £12,570 personal allowance, below which nobody should have any tax liability.

We view every penalty issued to the left of that line as a policy failure. There were 184,000 in 2020/21.

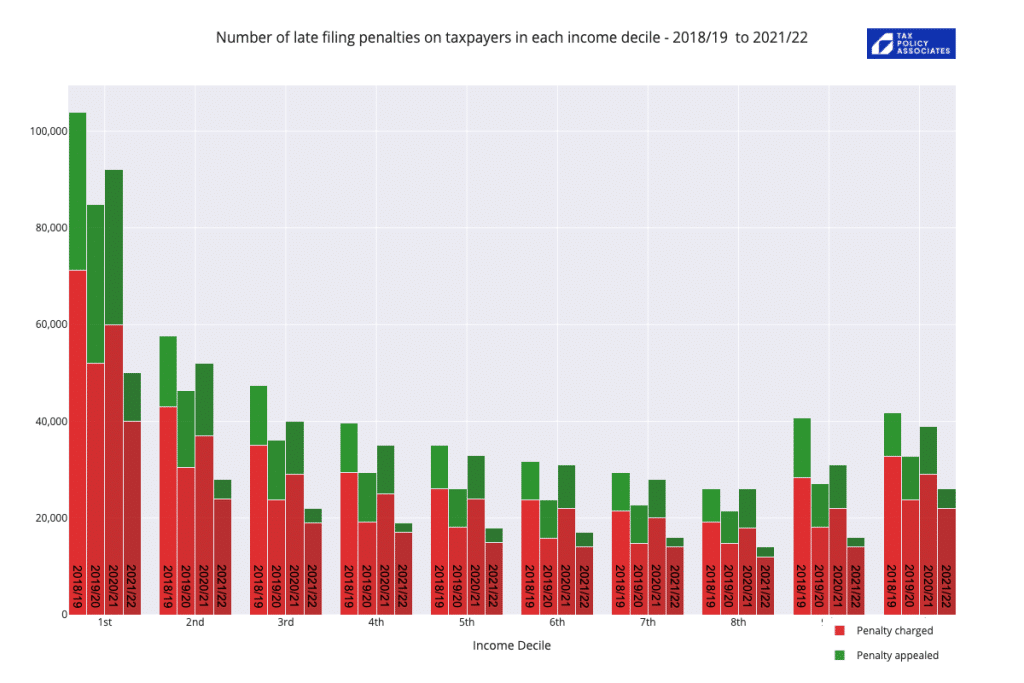

The trend is the same for the other years we have data: 2018/19 through 2021/22 (although note that taxpayers are still filing for 2021/22 and so this data is incomplete.2Because whilst HMRC knows the number of penalties issued for late filing, it doesn’t have tax returns for many of these taxpayers and so can’t assess their incomes. There will also be more appeals over time. We can therefore expect the final figures for 2021/22 to be closer to those for earlier years, with all the numbers around 40% higher.):

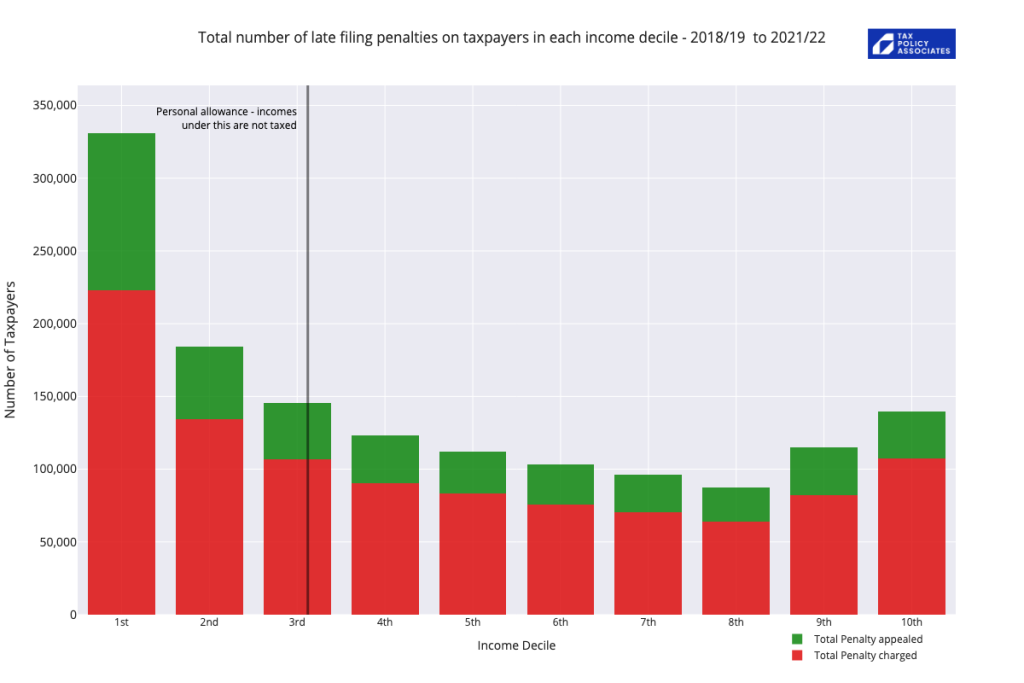

Looking at the totals, across the four years, for each decile:

… we see a total of 660,000 penalties issued to taxpayers in the lowest three deciles, and we estimate that 600,000 of those penalties were issued to people who owed no tax (because their income was lower than the personal allowance; £12,570 for the most recent two years, and slightly lower for the two before that).

Important to note that this is 600,000 penalties, not 600,000 people – there will be people who received multiple penalties (which is in our view an even larger policy failure, given that HMRC by this point know that the individuals involved earned too little to pay tax).

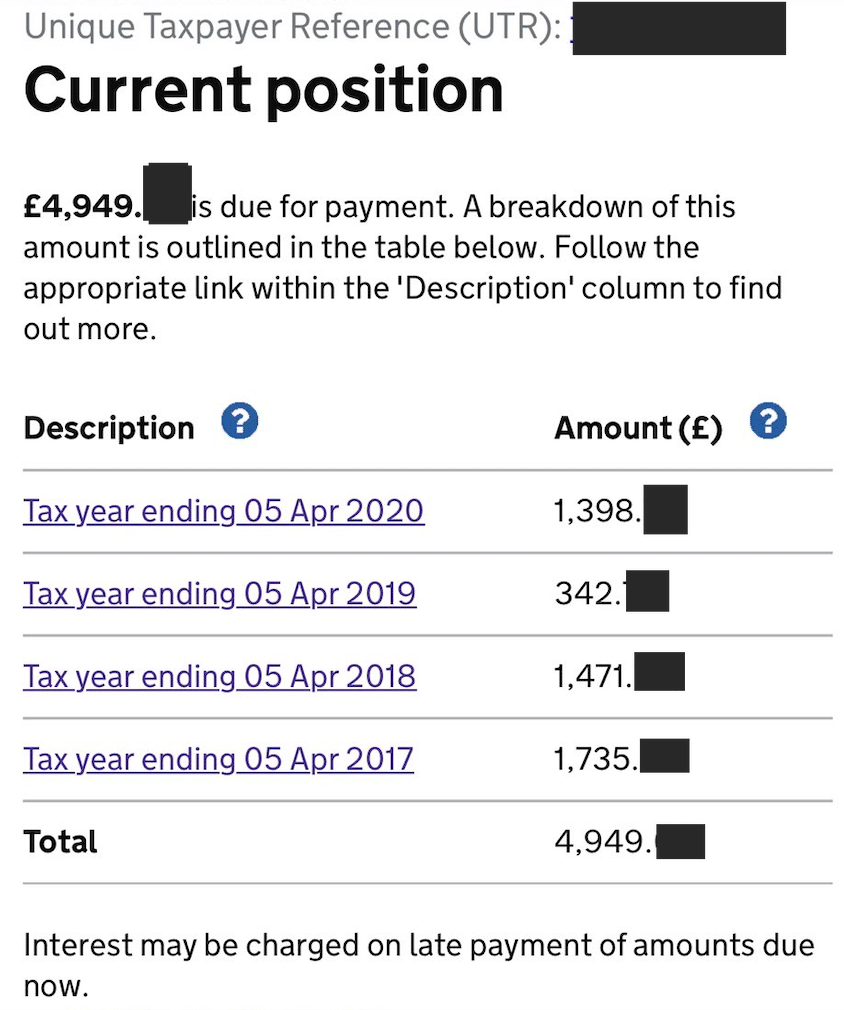

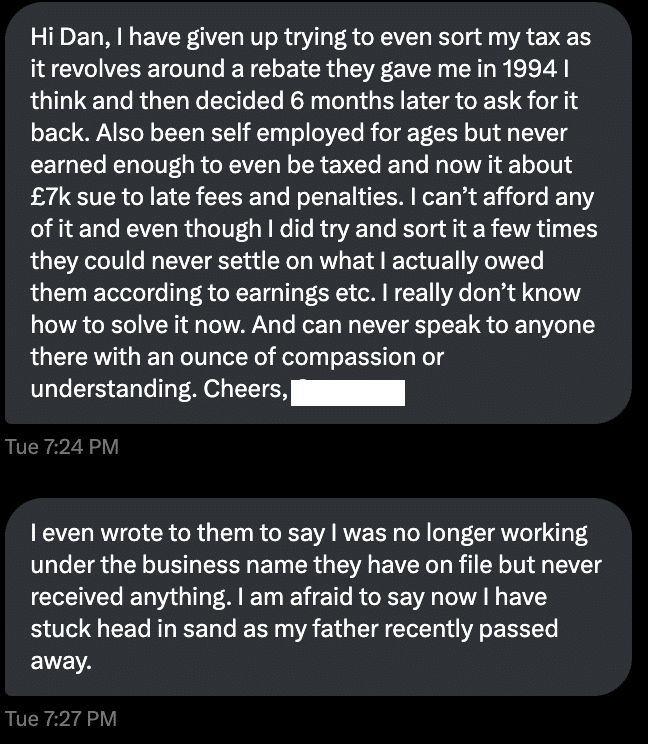

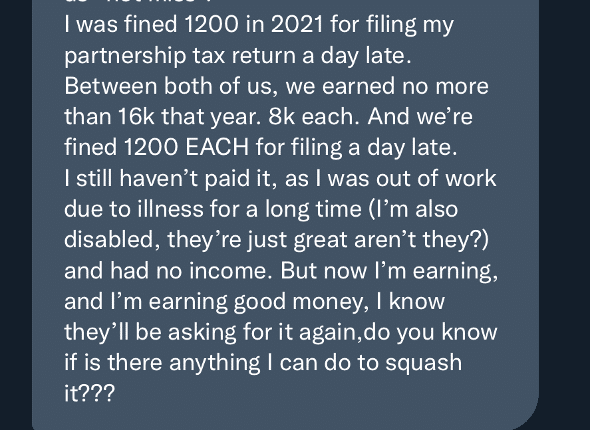

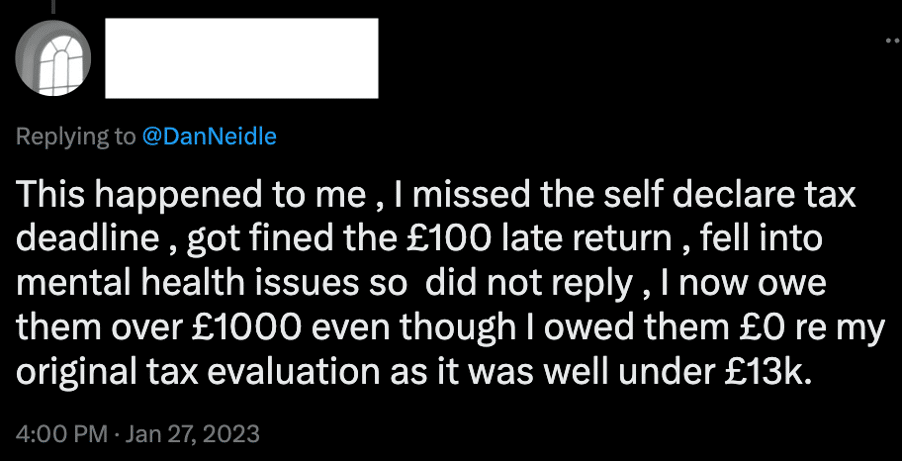

Several years of penalties can add up to thousands of pounds – here’s a typical example that was sent to us (digits obscured to preserve privacy):

People are falling into debt, and in one case we’re away of, actually becoming homeless, as a result of HMRC penalties.

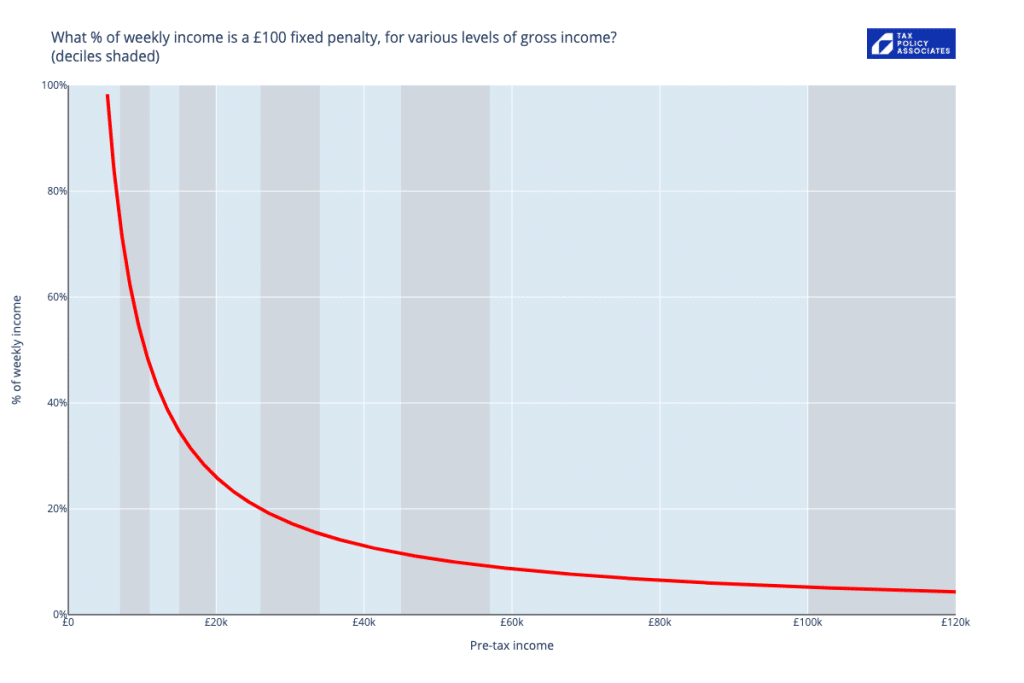

Even just the lowest penalty of £100 is a large proportion of the weekly income of someone on a low income (indeed over 100% of the weekly income for someone in the lowest income decile):

A respected retired tax tribunal judge has described the current UK penalties regime as the most punitive in the world for people on low incomes.3See Richard Thomas’ comments here

Background

Self assessment

Most people in the UK aren’t required to submit a tax return. Where your only income is employment income and a modest amount of bank interest, then in most cases a tax return isn’t required.

For this reason, out of the 32 million individual taxpayers4See the projection for 2022 here: https://www.gov.uk/government/statistics/income-tax-liabilities-statistics-tax-year-2018-to-2019-to-tax-year-2021-to-2022/summary-statistics in the UK, only about a third (11 million people) are required to submit a self assessment income tax return.5See HMRC figures at https://www.gov.uk/government/news/fascinating-facts-about-self assessment

Tax returns must be filed online by 31 January, or three months earlier (31 October) for people submitting paper forms.6In response to the Covid pandemic, the filing deadline for 2020/21 was extended by one month.

Penalties

If HMRC has required a taxpayer to submit a tax return, but he or she misses the deadline (even by one day), then a £100 automatic late filing penalty is applied.

After three months past the deadline, the penalty can start increasing by £10 each day, for a maximum of 90 days (£900) After six months, a flat £300 additional penalty can be applied, and after twelve months another £300. By that point, total penalties can be £1,600.7i.e., £100 + 90 x £10 + £300 + £300. Technically the £900 daily penalties are discretionary, but in practice they appear to be applied automatically. Unfortunately, we have no data on the distribution of different penalty amounts.

Until 2011, a late filing penalty would be cancelled if, once a tax return was filed, there was no tax to pay. However the law was changed, and now the penalty will remain even if it turns out the “taxpayer” has no taxable income, and no tax liability. At the time, the Low Incomes Tax Reform Group warned of the hardship this could create, but their advice was not followed.8See paragraph 4.4.1 of their response to the 2008 HMRC consultation paper on penalties

Advisers working with low income taxpayers now see this kind of situation all the time, and filing appeals for late payment penalties often makes up a significant amount of their work.

Appeals

Anyone receiving a late payment penalty who has a “reasonable excuse” for not paying can make an administrative appeal to HMRC, either using a form or an online service.9See https://www.gov.uk/government/publications/self assessment-appeal-against-penalties-for-late-filing-and-late-payment-sa370. Strictly the appeal should be made within 30 days of a penalty being notified, but in practice we believe HMRC rarely holds taxpayers to this deadline. If HMRC agree, then the penalty will be “cancelled”. If HMRC don’t agree, then a judicial appeal can be made to the First Tier Tribunal, but only a small proportion of late filing penalties reach this point10The absolute numbers are still quite large; one FTT judge recalls personally hearing over 300 late filing appeals, and they make up a high proportion of overall FTT appeals. See Richard Thomas’ comments here.. All the “appeals” discussed in this report are administrative form-based appeals.

The human cost

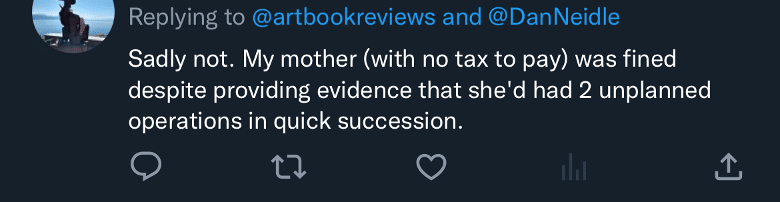

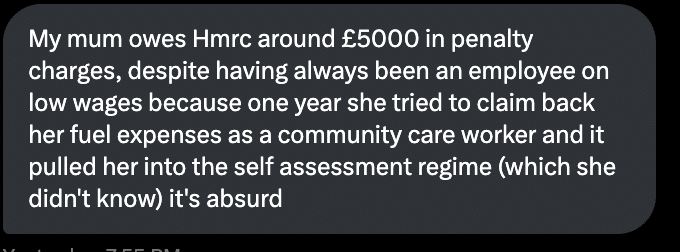

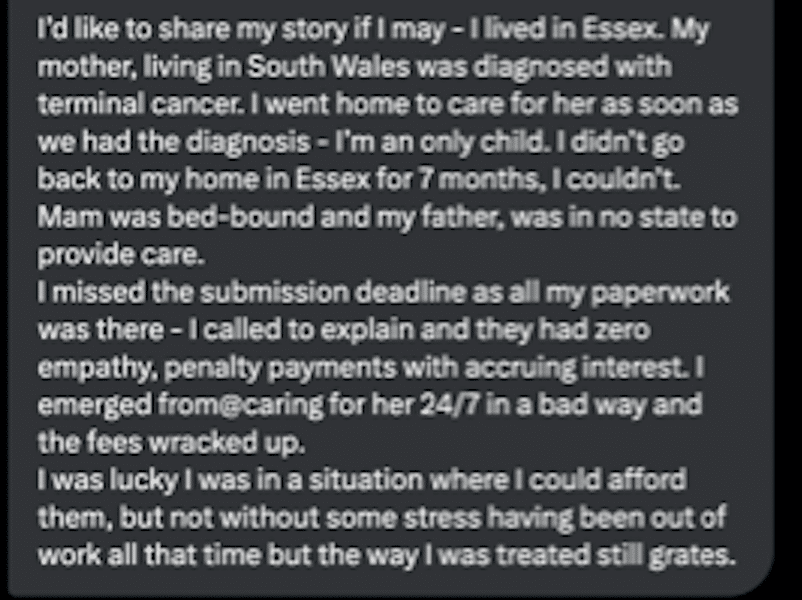

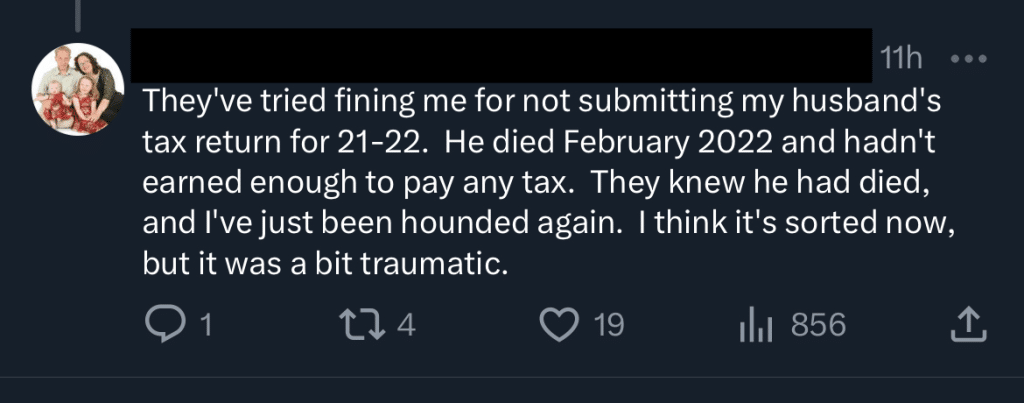

Since publishing our initial report, we’ve been inundated with stories from people on low incomes affected by penalties when they had no tax to pay.

These are vulnerable people, at a low point in their lives – and the same difficulties which meant they missed the filing deadline mean they often won’t lodge an appeal, and may take months before they pay the penalties (racking up additional penalties in the meantime). A successful appeal is not a success – it means that someone with limited time and resources has had to navigate what is to many a complex and difficult administrative system.

Here are just some of the responses we received:

HMRC’s response

In the Times article, HMRC say:

This refers to a revamp of all the self assessment penalty rules which will apply to all taxpayers from 6 April 2025.11Possibly later – although this isn’t clear – see Rebecca Cave’s comments below

From that date, a one-off failure to file will not incur a penalty; rather it will result in a taxpayer incurring a “point”, and only after two points (for an annual filer) or four points (for a quarterly filer) will a penalty be issued.12See HMRC policy paper: https://www.gov.uk/government/publications/interest-harmonisation-and-penalties-for-late-submission-and-late-payment-of-tax/interest-harmonisation-and-penalties-for-late-payment-and-late-submission We don’t know how long a delay will run up two points.

At the same time, the fixed penalty amount will increase to £200.

This might reduce the number of penalties imposed on low-earning taxpayers (for example where someone currently misses the filing deadline by a few days or weeks), but it could equally well worsen the position given the higher amount. We don’t know when the £200 penalty will kick in, and we don’t have data on how late low income self assessments typically are. It’s our hope that the issues highlighted in this report are considered when the details of the new regime are finalised.

Conclusions

We believe that the Government, HM Treasury and HMRC are acting in good faith, and until our report last year were unaware of the disproportionate impact that penalties have on the low-paid.

In light of the data revealed by this report, we have three recommendations:

1. Change in law

Late filing penalties should be automatically cancelled (and, if paid, refunded) if HMRC later determines that a taxpayer has no taxable income. Most likely that would be after a subsequent submission of a self assessment form; but no further application or appeal should be required.

Similarly, there should be an automatic abatement of penalties (by, say, 50%) if HMRC determines that a taxpayer has a taxable income but it is low (for example less than £15,000).

Whilst it is possible that some cancellations could be achieved under HMRC’s existing “care and management” powers, we expect that creating a general cancellation and abatement rule falls outside those powers, and therefore may require a change of law.

Alternatively, we could simply return to the pre-2011 position, with penalties automatically capped at the amount of a taxpayer’s tax liability.

In the meantime, HMRC should use its powers to cancel penalties on the low-paid as extensively as it can.

2. Monitoring

HMRC should start monitoring late submission penalties across income deciles, (using other sources of data, i.e. not limited to those provided to us) to provide a more complete picture of the impact on the low paid, including the level of penalties paid (i.e. not just the data on £100 penalties presented in this report).

Armed with that data, HMRC should aim to reduce the disparities identified in this report, and report annually on its progress.

3. Rework processes

The data reveals that there is a significant population of self assessment “taxpayers” who are being required to complete an income tax self assessment, are charged a late submission penalty, but turn out to have no tax to pay.

It is unclear why that is happening at so large a scale.

HMRC should analyse this population with a view to determining:

- how many of these are taxpayers who in retrospect should not have been required to submit a self assessment return at all,

- whether that could have been determined in advance, on the basis of the information HMRC possessed at the time,

- if it could be determined in advance, what additional processes should be put in place by HMRC to prevent such taxpayers being required to submit a self assessment in the future, and

- if there are small changes which could impact this population’s tax compliance, for example changing envelope labelling.

Methodology

Source of data

HMRC provided data to Tax Policy Associates following two Freedom of Information Act requests. The full methodology is set out below, with links to the original FOIA answers and our calculation spreadsheets.

All the raw data is available here and here. The data is visible in a more usable form in our GitHub repository, which also contains the Python scripts that drew the charts in this report.

The fact the lowest three deciles pay little tax is confirmed by the data on penalties issued for late payment (as opposed to late filing). The first three deciles pay almost no late payment penalties13Although some of the late payment penalties applied to those on low income will have been held over from a previous, higher earning, year. Hence the proportion in the lowest three deciles with tax to pay will be lower than suggested by this chart; in principle it should be zero for the lowest two deciles.. This obviously isn’t because they are more punctual at paying than they are at filing; it’s because they almost always have no tax to pay.

The lowest three income deciles are mostly below the personal allowance, currently £12,570, but the third decile is partly under and partly over that amount. We therefore estimated the number of penalties charge to people in the third decile but earning under the personal allowance using a simple pro-rata calculation.

Limitations

The most important limitation is that, whilst we had asked for income level to be computed by reference to previous self assessments filed by taxpayers, HMRC’s systems were unable to do this (at least within the limited budget available for responding to FOIA requests).

The data is therefore based upon the income level revealed when a taxpayer did eventually submit his or her return. That means, if a taxpayer did not submit a return at all for the relevant year, they do not appear in this data. In fact, the majority of taxpayers fall in this category, and that proportion will be even greater for the most recent year, 2021/22, where taxpayers are still filing and HMRC still processing returns.

We expect that the “never filing” taxpayers will disproportionately be low/no income taxpayers rather than higher income taxpayers, as they are more likely to lack the time/resources to file, and HMRC is less likely to pursue them. If that is right then the data we report is underestimating the impact of penalties on low-income taxpayers. However, this is speculation; further data is required.

Note that the income deciles are different from the usual national income deciles, as self assessment taxpayers have different (and, on average, lower) incomes than the population as a whole.

Many thanks to HMRC for their detailed and open response to our FOIA requests on penalties and income levels.

Thanks to all those who responded with their personal experiences of penalties, and to the tax professionals who provided technical input and insight (many of whom spend hours volunteering to help people in this position), particularly Andrew and Richard Thomas, the respected retired Tax Tribunal judge.

Finally, thanks to Rupert Neate at the Guardian.

-

1This is an update of our report from last year, with two more years of data and further statistical analysis

-

2Because whilst HMRC knows the number of penalties issued for late filing, it doesn’t have tax returns for many of these taxpayers and so can’t assess their incomes. There will also be more appeals over time. We can therefore expect the final figures for 2021/22 to be closer to those for earlier years, with all the numbers around 40% higher.

-

3See Richard Thomas’ comments here

- 4

-

5See HMRC figures at https://www.gov.uk/government/news/fascinating-facts-about-self assessment

-

6In response to the Covid pandemic, the filing deadline for 2020/21 was extended by one month.

-

7i.e., £100 + 90 x £10 + £300 + £300. Technically the £900 daily penalties are discretionary, but in practice they appear to be applied automatically.

-

8See paragraph 4.4.1 of their response to the 2008 HMRC consultation paper on penalties

-

9See https://www.gov.uk/government/publications/self assessment-appeal-against-penalties-for-late-filing-and-late-payment-sa370. Strictly the appeal should be made within 30 days of a penalty being notified, but in practice we believe HMRC rarely holds taxpayers to this deadline.

-

10The absolute numbers are still quite large; one FTT judge recalls personally hearing over 300 late filing appeals, and they make up a high proportion of overall FTT appeals. See Richard Thomas’ comments here.

-

11Possibly later – although this isn’t clear – see Rebecca Cave’s comments below

- 12

-

13Although some of the late payment penalties applied to those on low income will have been held over from a previous, higher earning, year. Hence the proportion in the lowest three deciles with tax to pay will be lower than suggested by this chart; in principle it should be zero for the lowest two deciles.

10 responses to “Penalising the poor: 420,000 HMRC penalties charged to people who earned too little to pay tax. That’s 40% of all HMRC late filing penalties.”

I suggest that cost-cutting at HMRC, fewer staff, not as well trained, and so not reading what one sends them, is a significant factor.

E.g. In April (so days after the tax-year-end) I submitted a nil return for a new English LLP with a cover letter which said “and both partners are tax resident in XXXX, not the UK.” Result – both partners received a Notification to File a Self-Assessment return.

I’m clued up enough to ask immediately for them to withdraw those notices, but lots of people are not.

I wonder whether they have also picked up the Home Office mindset of creating a hostile atmosphere.

Hi Dan, what a wonderfull and informational piece. It’s interesting to see how deep this issue gets.

I must say, I have been self employed since 2012, but haven’t earned no income on that since 2018, as I also work a 9-5 job…

They did wrote to me back in 2018, saying that from then on I was not required to file tax, and would not penalise me , as they could see I wasn’t making money as self employed.

Some people park on yellow lines for five minutes and get a £70 parking ticket. We have many months to file a SA report after the tax year ends and so many people can’t be bothered to do any life admin – witness the number of people who leave monies in zero interest accounts, fail to write a will or do any planning whatsoever for retirement. They probably are not on the electoral register and didn’t tell the DVLA when they moved five years ago.

Having said that HMRC cuts to staffing make contact difficult – and I do agree that there should be a rebate of part (half?) of the penalty if they late file a SA report and no tax is payable.

You say the system for late filing penalties is going to change in 2025, but that is unlikely as the new penalty system is tied to the introduction of MTD ITSA, which has now been put back to 6 April 2026 for taxpayers with turnover of £50,000 or more. Those with turnover of £30,000 + are due to enter the MTD ITSA regime from 6 April 2027. There is no date yet when those wiht turnover of £10,000 or more wil enter MTD ITSA

HMRC should be pressed to say exactly when the late filing penalty system wil change for those on low incomes.

Thanks, Rebecca, I am clearly out of date and should correct this.

I would suggest that it speaks buckets that you have flagged this issue that seems so egregious to basic justice and yet certain other organisations, that have been around for a long time and purport to stand for “the taxpayer” have never raised it.

Perhaps these other organisations, so renown for their appearances on the BBC, are perhaps less concerned with tax justice and more concerned with their rich and powerful backers avoiding it.

to be fair, this isn’t the kind of tax policy issue that most such groups work on. It’s slightly slipped between the gap of existing think tanks/NGOs/etc, and I don’t think it’s fair to blame anyone for that.

I am suffering for late filing – as I was overpaid child benefit which aí paid back in full it was decided I had to self assess- I am an NHS employee and have paid via PAYE for 42 years. I owe no tax or child benefits. I thought it was an error- why would I self assess I pay by paye. I am besides myself with anxiety about this. I have paid over £1400 ponds now and it continues.

It is so unfair and bullying . Exploitative and intimidating.

Congratulations on another outstanding piece of work, alongside your report on the Post Office compensation scandal. Changing the real world experience of those who don’t have access to power or a political voice is a really vital cause.

Excellent work. Interested to see if you get any type of formal response from HMRC.