Fintech company B2BTradeCard has run a successful loyalty card business for eight years – sponsoring a local motorsport team, donating to a local air ambulance, and now a member of the Payments Association. But behind the scenes, they’re enabling a tax avoidance scheme which could cost the UK £46m each year, and might even enable criminal fraud. Here’s how.

UPDATE: 7 September 2023. B2BTradeCard appear to have shut down. The website is no longer public, and the employees’ LinkedIn profiles all show them leaving the company in July or August 2023. It could be that HMRC started an investigation, or it could be that those behind the company knew its days were numbered. Either way, we’d advise anyone who used the B2BTradeCard scheme to seek advice from a regulated tax professional (i.e. an CIOT/ATT qualified accountant or a solicitor).

The puzzle

You can’t tell what’s going on from the website or promotional video. Just looks like a peer-to-peer advertising platform and loyalty card scheme.

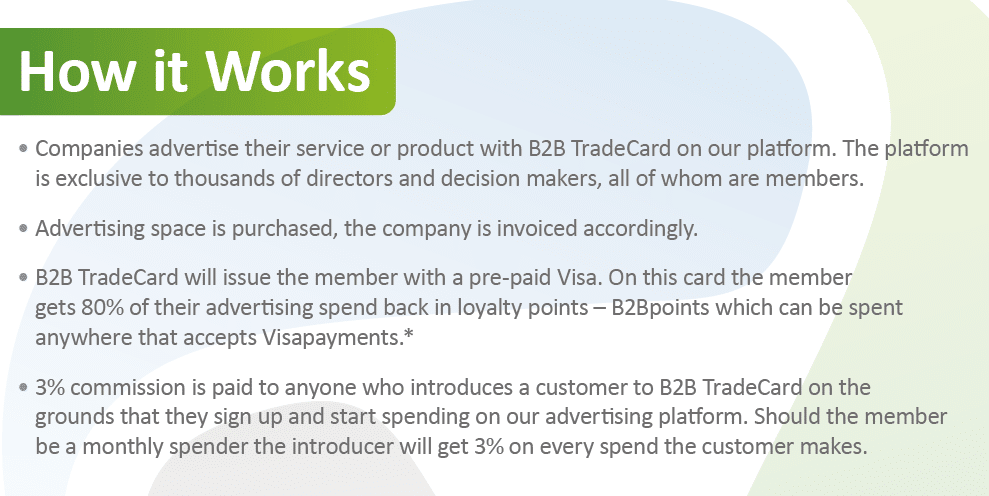

The first clue that something odd is going on comes from the promotional material they send to potential clients.

An 80% cashback. Huh?

Why would anyone spend £10,000 to advertise on an obscure website to get an £8,000 cashback? What’s going on?

And why do the LinkedIn profiles of the CEO and even junior staff boast about corporation tax savings? What’s that got to do with a loyalty card?

After we approached B2BTradeCard for comment, the reference to corporation tax disappeared from the headline in the profiles.. but “corporation tax” is listed as a key benefit of the product.

It’s puzzling.

The answer

There’s a small clue on an accounting firm’s website that this might be something about tax:

Another of B2B’s “business partners” gives the game away:1And here’s a third “business partner”, SCA Business Consultancy, saying much the same thing. And I have confirmation from multiple independent sources that this is also B2BTradeCard’s pitch to potential clients, although they’re careful not to put it in writing.

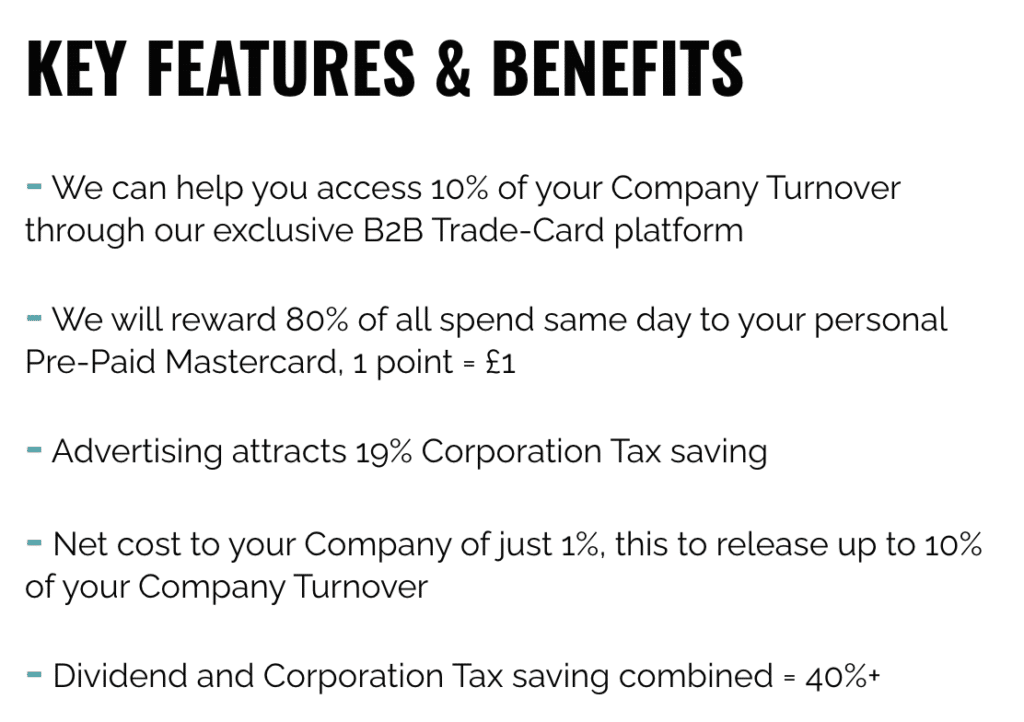

So, whilst I’m sure much of what B2BTradeCard and their clients do is a standard loyalty card product2Particularly the points you get for spending with other B2BTradeCard members – doesn’t immediately look like avoidance to me, it appears to also enable a tax avoidance scheme that looks like this:

- An SME pays B2BTradeCard £10,000 for “advertising” (on a website that only their 3,500 members will see).

- B2BTradeCard then gives the SME a pre-paid Visa card loaded with £8,000, which the SME hands to its director

- The director can use the card in much the same way as any other payment card (the only exception is that they can’t make a cash withdrawal).

- But the director isn’t taxed on the £8,000, and the company gets a £10,000 corporation tax deduction (because advertising is a deductible expense).3Although “advertising” is not a deductible expense. More on that below

- So the SME is paying £10,000 to get £8,000 to its director tax-free. That’s compared to the £4,400 of tax that would normally be due if a company used £8,000 of profits to pay a dividend to a director/shareholder.4 There would be £2,000 of corporation tax paid by the company on its profits, and then £2,400 of income tax paid by the director/shareholder on their dividends- a total of £4,400. You get a similar result if the cash was being paid to an employee, or a director who isn’t a shareholder. Out of the £8,000, £970 would go on employer national insurance, then the employee would pay £3,300 of income tax (at the highest marginal rate) – for a total of £4,270. Which is where the “40%+” claim in the promotional material comes from.

- They say you can do this with up to 10% of your annual turnover – the rationale being that it’s common to spend 10% of your turnover on advertising. That looks very much like an attempt to hide what’s really going on.

What an amazing deal. Avoid £4,400 of tax for a £2,000 fee (i.e. the £10,000 of “advertising” less the £8,000 loaded onto the Visa card).

What could possibly go wrong?

What goes wrong

For many decades, employers have tried to find ways to pay their staff without tax. Fine wine, gold bars, platinum sponge, “loans” that never have to be repaid, trust interests, combinations of loans, trusts and gold. HMRC were able to challenge most of these schemes at the time, and subsequent legislation means that now it’s almost impossible that a company can give value to a director or employee and escape tax.

The upshot of those decades is that HMRC have plenty of ways to tax the £8,000:

- Most obviously, directors and other employees are taxed on all earnings they receive. There is an old House of Lords case where Christmas vouchers were taxed as “earnings”, and a much more recent Supreme Court case where cash that was redirected through a third party was taxed as earnings.5The facts here seem worse than in Rangers, because at least they had the argument that a loan had a different character to earnings. Here they don’t even have that The general view of our team is that this is probably all HMRC need to tax the £8,000.6It looks like the promoters are trying to escape the “earnings” definition by making it impossible to directly convert the £ on the Visa card into cash. They can then argue it isn’t “money or money’s worth” and so not earnings. However, that seems wrong given that the £8,000 on a Visa card is so close in practice to £8,000 cash. Even if right, it doesn’t help you one jot with the BIK and disguised remuneration points. So all their carefully crafted restriction does is reveal that they were trying quite hard to achieve a tax avoidance result, and HMRC would be optimistic of finding lots of discoverable documentation demonstrating that.

- Alternatively, the card is a “benefit in kind”. If your employer buys you a TV, it’s a taxable benefit. Why should it be any different if your employer loads up cash on a Visa card, which you can use to buy a TV?7There are also special provisions for “credit-tokens” and “non-cash vouchers” which might apply if the usual earnings and BIK treatment does not apply.

- After the most recent wave of attempts to avoid employment tax, the “disguised remuneration” rules were introduced. If you somehow escape being taxed as an earnings or benefit, but receive what is in substance a reward, via a third party, then you get taxed. These rules are intentionally extremely broad. We spoke to several remuneration tax specialists, and none saw any way in which B2BTradeCard could escape these rules.8i.e. because the payment of the asset (the prepaid Visa card) is a “relevant step” within the DR rules under s554C(1)(b)

- And even if the scheme somehow escaped all of that, there is still the General Anti-Abuse Rule (GAAR), which would likely apply in a case such as this.9Or, in the words of one eminent KC who kindly reviewed a draft of this paper: “Lol what about the GAAR”

So here’s what will actually happen once HMRC starts sniffing around a company that’s bought into B2BTradeCard:

- The company will be required to apply PAYE and account for employer’s national insurance, employee national insurance and income tax on the director’s earnings10With slightly different results, and potentially very different compliance, if it’s not earnings but a benefit, a token/voucher, or the disguised remuneration rules apply

- Or, if the disguised remuneration rules apply, HMRC can collect the tax directly from the employee.

- The company may still get a corporation tax deduction for the £8,000 (as, after all, it was remunerating an employee)11But HMRC may argue that it was all non-deductible – ending up indirectly with an employee is enough for the employee to get taxed, but perhaps not enough for a corporation tax deduction. And, if it is deductible, there’s possibly a deferral until the point the cash on the card is spent. This point could become quite complicated. but only gets a deduction for the £2,000 to the extent it was fair value for the advertising. Given the dubious value of that advertising, and the fact it’s easily viewed as a non-deductible payment for a tax avoidance scheme, possibly very little of the £2,000 is deductible.

- So a plausible result for the company is that they’ve paid £2,000 in non-deductible fees (which costs £2,70012Because £2,700 of profits, after 25% corporation tax, leaves £2,000), plus £4,200 of tax. Plus interest and very likely penalties. A much worse result than if they’d just paid their director in the usual way.13We didn’t discuss the scheme with accounting (as opposed to tax) professionals before publication. Since then, one of our correspondents, L, has made the excellent point that there may be a question as to whether accounts showing £10k of advertising expenditure in these circumstances can be FRS102/CA2006 compliant as they seem not to give a ‘true and fair view’.

HMRC has already listed a similar scheme in one of its Spotlights – these list avoidance schemes that in HMRC’s view don’t work, and that HMRC will challenge. It’s surely only a matter of time until B2BTradeCard’s scheme is listed too.

Interestingly, Amex ran a similar scheme on a much larger scale in the US. It did not end well.14Entertaining commentary on this from the brilliant Matt Levine here, including what happens when a product’s main benefit is pushed by sales personnel, but never put in writing.

Worse than tax avoidance?

In practice, it’s easy to see how B2BTradeCard’s scheme could end up being worse than tax avoidance.

The way the product works means that it’s almost invisible – the only entry in the company’s accounts for my example above would be a £10,000 payment for advertising.

That opens up two concerning possibilities:

- Directors could buy into the scheme having been told that it doesn’t work technically,15And we’ve spoken to a large number of advisers who did indeed tell their clients that B2BTradeCard didn’t work but expecting HMRC not to spot it. That would be criminal tax evasion. If any B2BTradeCard employee or agent (including the likes of Business Solutions) knowingly facilitated that evasion, then that employee/agent could also be criminally liable, and B2BTradeCard could itself be criminally liable as a corporate under the rules in the Criminal Finances Act 2017.

- Directors or employees could buy “advertising” with B2BTradeCard without having told shareholders/other employees what’s going on. Everyone else just sees £10,000 spent on advertising, and has no idea that Bob from Marketing has in fact stolen £8,000 from the company. In those circumstances you can be pretty sure Bob won’t have disclosed the arrangement to HMRC either.

We are absolutely not saying that B2BTradeCard intend either of these results, or are aware of them, but their scheme clearly facilitates the possibility.

That all makes it very hard for HMRC to spot the scheme – although now they are forewarned16And not just by us – one adviser sent extensive information on the scheme to HMRC a couple of years ago they should be able to obtain an order against B2BTradeCard requiring disclosure of all clients and transactions.

How much is this costing us in lost tax?

All Business Solutions, one of B2BTradeCard’s “partners”, says:

If that’s right, that means £2,500 x 12 months x 3,500 members x 44% tax avoided = £46m of tax avoided per year. And it seems B2BTradeCard has been going for at least eight years.

The total loss could be much more than this given that there seem to be other similar schemes around – we are investigating.

How do B2BTradeCard justify the scheme?

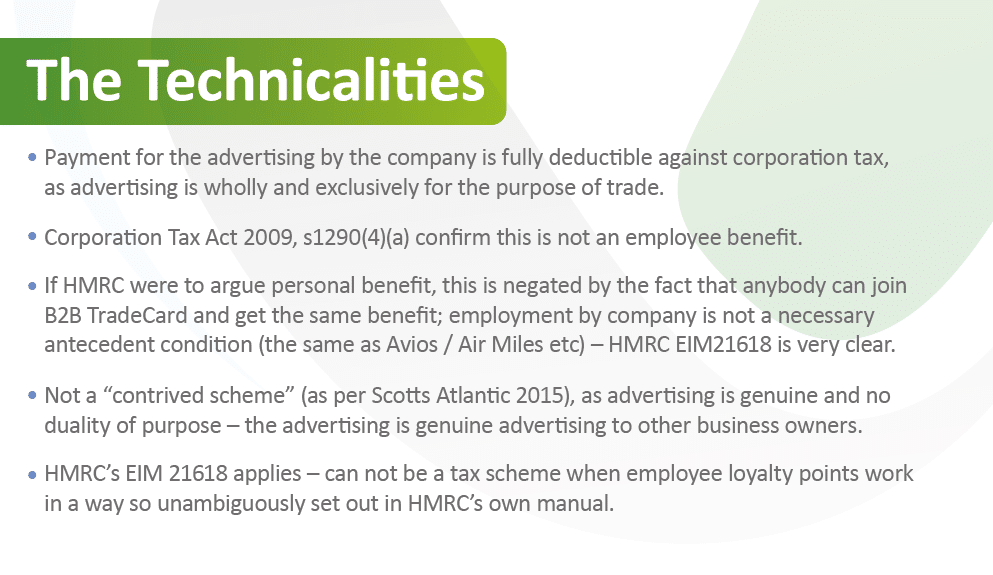

One possibility is that B2BTradeCard are running a straightforward loyalty card scheme, and it just happens to be abused by some third party accountants. That feels unlikely given the CEO’s touting of the corporation tax benefit. It’s more unlikely still when we see what they send to potential clients:

This is fairly clear that B2BTradeCard really do sell their product as giving a corporation tax deduction to the company, and tax-free income to the director/cardholder.

It’s also fairly clearly nonsense:

- They focus on whether the money loaded onto the Visa card is a taxable benefit. But that’s a sideshow – It’s probably just straightforwardly taxable as earnings. If neither earnings nor a benefit, it will be taxed under the disguised remuneration rules. Either way, they lose.

- Then they throw in some irrelevant technical references, perhaps to confuse non-specialists. Section 1290 is a specific corporation tax anti-avoidance rule, which has nothing to do with whether a payment is a taxable benefit.17They’re also wrong – it’s an exclusion “for anything given as consideration for goods or services provided in the course of a trade or profession”. But the £8,000 that goes straight back to the director is realistically not consideration for goods or services.

- The reference to HMRC guidance in EIM21618 is also irrelevant. This is a concession where HMRC say that Airmiles, credit card points and other very incidental benefits aren’t taxed.18The technical basis for the concession is a little dubious; probably this is just a sensible piece of pragmatism But those benefits are typically worth around 1% of the purchase price, and can only be used in a very limited way. Here the benefit is 80% of the purchase price, and is almost as good as cash.19And the “B2Bpoints” are acquired because the employer has paid some money, not because the employee has bought something. In any case, you can’t rely on HMRC concessions if you’re trying to avoid tax.

- Given how far removed B2BTradeCard is from the usual loyalty schemes, the idea that it “can not [sic] be a tax scheme when employee loyalty points work in a way so unambiguously set out in HMRC’s own manual” is not defensible.20The use of “unambiguously” seems to be designed to fit into the “clear and unambiguous representation” case law on when you can rely on HMRC guidance, but B2BTradeCard is well outside EIM21618, and the guidance contains no clear or unambiguous representation – the last sentence in EIM21618 reads “It is important to remember that the exact tax treatment will depend on the facts of a particular case”. And, again, you can’t rely on HMRC guidance if you’re trying to avoid tax.

- The reference to the Scotts Atlantic case is another irrelevance. The case concerns deductibility for employers and is irrelevant to the tax treatment of employees.21See paragraph 147 of the FTT judgment, quoted at paragraph 61 of the UTT judgment

- The idea this is not a “contrived scheme” is very doubtful given the astonishing 80% payback, the way the scheme is promoted behind the scenes, and those features of the scheme which seem designed to give a particular tax result. The “advertising” may be genuine, but plainly 80% of what is paid for the “advertising” is not payment for advertising.

B2BTradeCard’s response to our investigation

We wrote to B2BTradeCard putting to them our understanding of how the 80% cash rebate worked, and that we thought it was clearly taxable. They responded as follows:

They have not denied that their product works as we have described. Their assertion that a leading firm has confirmed the tax position is in our view not credible for all the reasons set out above (although it is possible that a firm advised on the product’s use as a simple loyalty card, not appreciating its use as a tax avoidance scheme). “Confidentiality” is a pretty feeble reason to refuse to provide any comment at all. And the materials we quote are not out of date – the key “technicalities” document was created in June 2022.

The reference to “industry peers” is interesting – who else is doing this?

What should happen next?

Here are some suggestions:

- HMRC should publish a “Spotlight” making clear that the scheme doesn’t work, and that anyone participating should expect to be investigated.

- HMRC should open an investigation into B2BTradeCard and other companies offering similar products.

- In due course, HMRC should investigate the end-users of the product: SMEs and directors.

- B2BTradeCard’s debit card provider is Nium Fintech Limited. I’m confident Nium have no idea what’s going on. But they should have done – the financial services industry is well aware of the potential that pre-paid cards have for tax evasion and money laundering. Something has gone badly wrong with their due diligence procedures. We are writing to them.

- The Payments Association also presumably has no idea what B2BTradeCard is up to – but it might want to rethink the due diligence it undertakes before accepting a new member. We are also writing to them.

And if you are aware of any other schemes similar to B2BTradeCard, please do get in touch.

Finally, after this report went to press we became aware of an article on the same subject published in The Tax Journal at almost exactly the same time. It reaches the same conclusions as us. The author is Thomas Wallace, a former HMRC investigations specialist now in private practice. We’ll link to it when available.

Thanks to the remuneration tax guru who worked with us on this (he knows who he is), the KC who read the original draft, and the KC who provided the technical GAAR analysis. Thanks most of all to T for bringing the scheme to our attention, and M, B and R for providing further information. And finally thanks to all the advisers on Twitter and LinkedIn who responded to our initial bemused queries about B2BTradeCard, and the many others who wrote to us directly.

-

1And here’s a third “business partner”, SCA Business Consultancy, saying much the same thing. And I have confirmation from multiple independent sources that this is also B2BTradeCard’s pitch to potential clients, although they’re careful not to put it in writing.

-

2Particularly the points you get for spending with other B2BTradeCard members – doesn’t immediately look like avoidance to me

-

3Although “advertising” is not a deductible expense. More on that below

-

4There would be £2,000 of corporation tax paid by the company on its profits, and then £2,400 of income tax paid by the director/shareholder on their dividends- a total of £4,400. You get a similar result if the cash was being paid to an employee, or a director who isn’t a shareholder. Out of the £8,000, £970 would go on employer national insurance, then the employee would pay £3,300 of income tax (at the highest marginal rate) – for a total of £4,270

-

5The facts here seem worse than in Rangers, because at least they had the argument that a loan had a different character to earnings. Here they don’t even have that

-

6It looks like the promoters are trying to escape the “earnings” definition by making it impossible to directly convert the £ on the Visa card into cash. They can then argue it isn’t “money or money’s worth” and so not earnings. However, that seems wrong given that the £8,000 on a Visa card is so close in practice to £8,000 cash. Even if right, it doesn’t help you one jot with the BIK and disguised remuneration points. So all their carefully crafted restriction does is reveal that they were trying quite hard to achieve a tax avoidance result, and HMRC would be optimistic of finding lots of discoverable documentation demonstrating that.

-

7There are also special provisions for “credit-tokens” and “non-cash vouchers” which might apply if the usual earnings and BIK treatment does not apply.

-

8i.e. because the payment of the asset (the prepaid Visa card) is a “relevant step” within the DR rules under s554C(1)(b)

-

9Or, in the words of one eminent KC who kindly reviewed a draft of this paper: “Lol what about the GAAR”

-

10With slightly different results, and potentially very different compliance, if it’s not earnings but a benefit, a token/voucher, or the disguised remuneration rules apply

-

11But HMRC may argue that it was all non-deductible – ending up indirectly with an employee is enough for the employee to get taxed, but perhaps not enough for a corporation tax deduction. And, if it is deductible, there’s possibly a deferral until the point the cash on the card is spent. This point could become quite complicated.

-

12Because £2,700 of profits, after 25% corporation tax, leaves £2,000

-

13We didn’t discuss the scheme with accounting (as opposed to tax) professionals before publication. Since then, one of our correspondents, L, has made the excellent point that there may be a question as to whether accounts showing £10k of advertising expenditure in these circumstances can be FRS102/CA2006 compliant as they seem not to give a ‘true and fair view’.

-

14Entertaining commentary on this from the brilliant Matt Levine here, including what happens when a product’s main benefit is pushed by sales personnel, but never put in writing.

-

15And we’ve spoken to a large number of advisers who did indeed tell their clients that B2BTradeCard didn’t work

-

16And not just by us – one adviser sent extensive information on the scheme to HMRC a couple of years ago

-

17They’re also wrong – it’s an exclusion “for anything given as consideration for goods or services provided in the course of a trade or profession”. But the £8,000 that goes straight back to the director is realistically not consideration for goods or services.

-

18The technical basis for the concession is a little dubious; probably this is just a sensible piece of pragmatism

-

19And the “B2Bpoints” are acquired because the employer has paid some money, not because the employee has bought something. In any case, you can’t rely on HMRC concessions if you’re trying to avoid tax.

-

20The use of “unambiguously” seems to be designed to fit into the “clear and unambiguous representation” case law on when you can rely on HMRC guidance, but B2BTradeCard is well outside EIM21618, and the guidance contains no clear or unambiguous representation – the last sentence in EIM21618 reads “It is important to remember that the exact tax treatment will depend on the facts of a particular case”. And, again, you can’t rely on HMRC guidance if you’re trying to avoid tax.

-

21See paragraph 147 of the FTT judgment, quoted at paragraph 61 of the UTT judgment

5 responses to “The fintech company secretly enabling a £46m tax avoidance scheme”

I don’t know exactly how it is in the UK, but here in Germany, there are so many ways to give tax-free income completely legally. Pension or childcare subsidies, canteen/food allowances, mobile IT equipment and contracts, public transport reimbursements, vouchers for goods, etc. But of course, these are only small amounts for all employees and not larger ones for directors and owners. That’s why most companies don’t do this or do it only on a small scale.

Brilliant and concise summary of a complex subject. I hadn’t appreciated QC’s would become KC’s so that was an update for me. Everything else seems spot on, if it sounds too good to be true, HMRC have you!!!

Excellent analysis as always, Dan. I suspect that a lot of people this morning are suddenly realising how stupid they have been to believe that it would work out ok.

In this case I doubt there is, or they would have said so. But the response I’ve had from the tax community makes me very confident that this is only going on at the fringes, and mostly in unregulated boutiques/promoters rather than regulated accounting or law firms.

Is the tax profession too tolerant of schemes which are too good to be true but still being flogged to the greedy and/or unsuspecting? Easy to call those involved cowboys but often there’s an eminent KC’s “opinion” behind it.