We wrote last week about a school fee tax avoidance scheme, promoted by Signature Tax (the tax boutique owned by the SNP’s new auditors). We’ve since been deluged with reports of other promoters pushing the same scheme. We’ve reported Signature and three other firms to their regulators. More below about who the promoters are, and how they can be stopped.

UPDATE: HMRC have now issued a “Spotlight” stating that HMRC also believe the schemes don’t work, and warning people off them

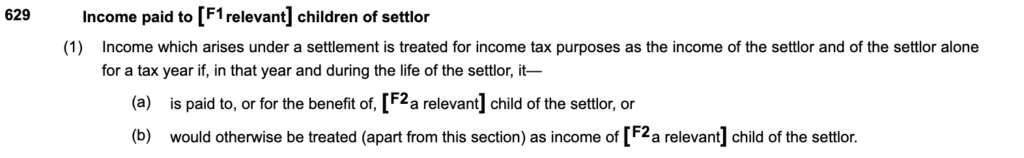

The rule they’re trying to avoid

An obvious wheeze is for wealthy parents to gift a valuable asset (say, shares) to their children. Then dividends on the shares are taxed at the children’s much lower tax rate – potentially saving ££££. Parents with three children at an expensive private school could save more than £60k of tax per year.

The wheeze is so obvious that there’s a rule stopping it. It’s worth stepping through the legislation, because I think it demonstrates to non-specialists just how straightforward the point is:

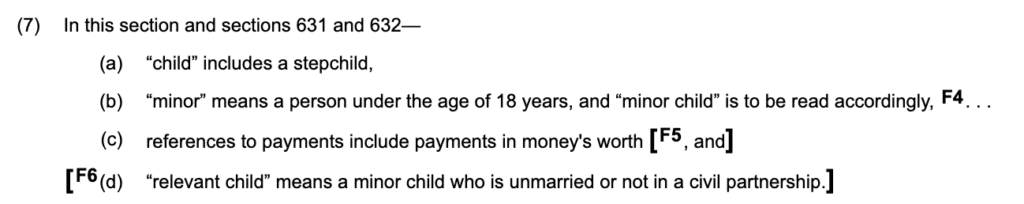

“relevant child” is defined to mean a child under 18:

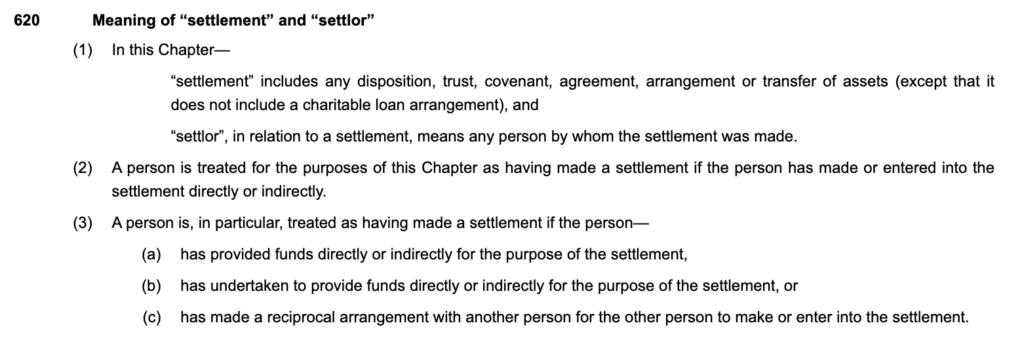

And “settlement” and settlor are defined extremely widely:

Looking at the legislation, here are some things that are fine:

- Grandparent or Aunt gives valuable shares to a child. The child pays tax on the dividends at a much lower rate, and there’s a big tax saving. Permitted by the rules and entirely proper.

- Rather than giving the shares to the child, Grandad/Auntie declares a trust. They may in fact need to do this, because minors can’t hold shares. Permitted by the rules and entirely proper, and if it’s a simple or “bare” trust then the tax result is the same as if the child owned the shares.

- The grandparents have their own company. They issue shares to the children (via a trust) to fund their education. Now you might think this shouldn’t be permitted, but it is – and realistically it’s the same as the previous two examples, just using the grandparents’ own company.

And here are some things that don’t work:

- Parents give valuable shares to their children. That’s a settlement within s620, and the parent is taxed on the income.

- Parents give valuable shares to Granny, and Granny gives the shares to the children. That’s an “indirect” settlement within s620(3)(a) and/or a “reciprocal arrangement” within s620(3)(c). The parent is still taxed on the income. And if those involved hide the connection between the gift to Granny, and her gift to the children, it’s not just failed tax planning – it’s criminal tax evasion.

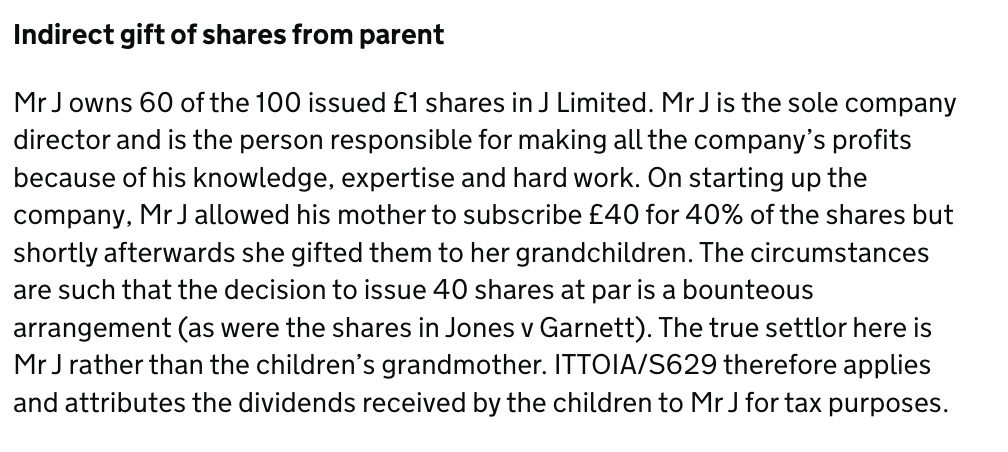

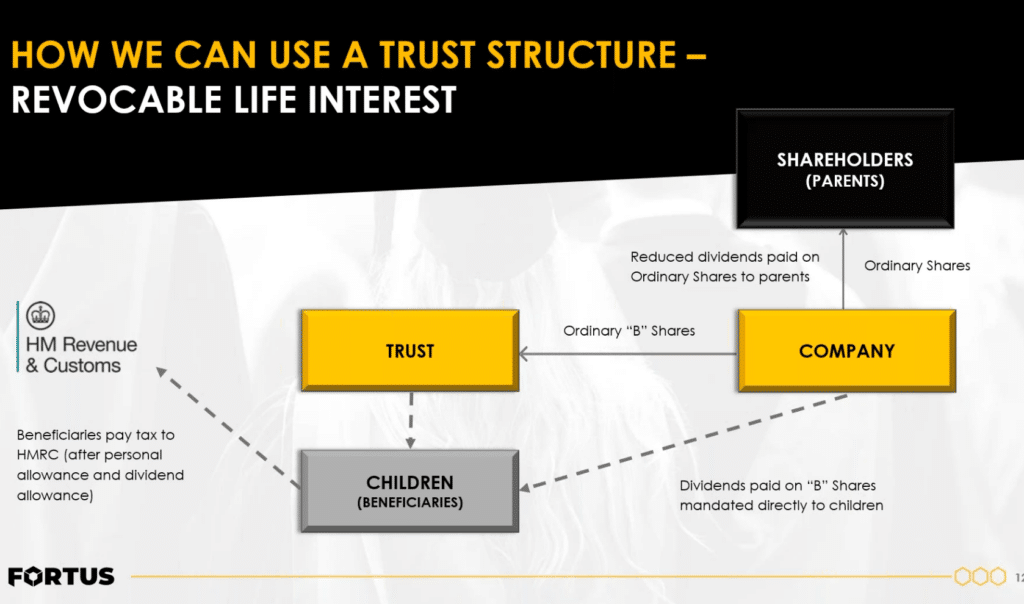

- Parents have their own company. It issues valuable shares to Granny/Uncle/whoever for free (or almost free), and Granny/whoever declares a trust in favour of the children. Well, that’s exactly the same as the previous example. It doesn’t work, and if it’s hidden from HMRC then we’re getting into criminal territory. But that’s the structure that some promoters are pushing.

I think most people (specialists or laypeople) reading the legislation above would see immediately that the scheme doesn’t work. There’s even HMRC guidance almost directly on point:

The Signature scheme

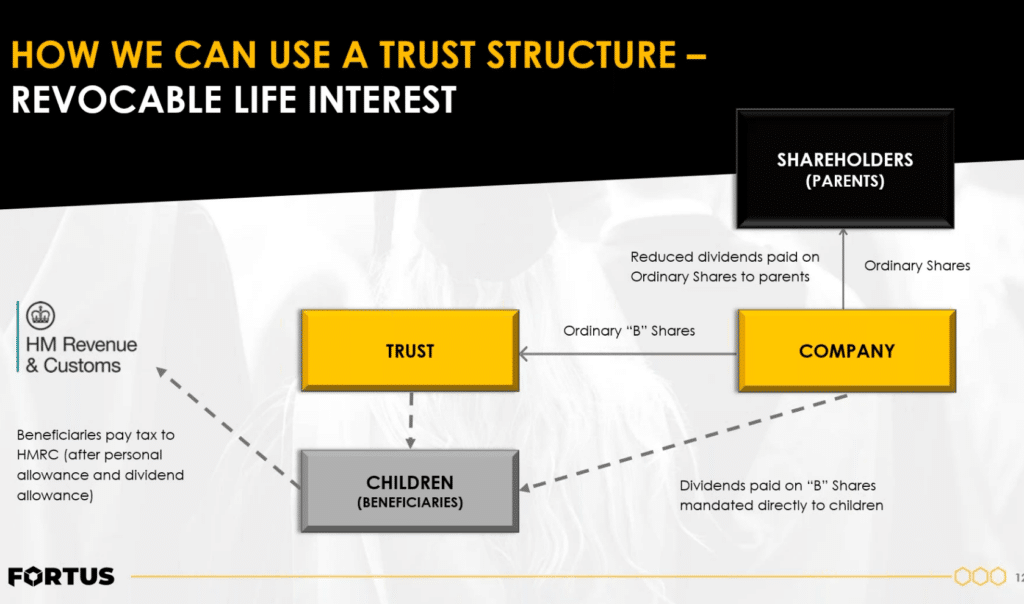

Here’s a presentation kindly provided by an outfit called Fortus, in a webinar on their website1(c) Fortus, but there is an obvious public interest and fair dealing justification in making a copy publicly available. It’s the same as the Signature scheme. It’s also almost exactly the same as the one that HMRC guidance, and common sense, says doesn’t work:2Actually the scheme in HMRC’s example is less terrible, because the company is new and so there is at least an argument the shares have no value when granted. The Fortus and Signature schemes involve pre-existing companies where the shares are clearly valuable. (I’m going to call this the “Signature scheme” just because I came across Signature first.)

So how on earth do Fortus/Signature think the scheme works? Here are a few possibilities:

- It’s completely kosher, because the grandparents/trust is paying full value for the B shares, and so there is no “indirect” settlement by the parents. The problem is that this isn’t plausible. If the grandparents had the necessary £££ to hand, they’d just be making a gift3or declare a trust directly to the children, and wouldn’t need to involve the parents or their company. It would also be a highly inefficient structure, because instead of the grandparents paying £100k/year, they’d be paying a lump sum equal to the present value of many years’ worth of £100k – approaching a seven-figure sum. I don’t think anyone would do that.

- They don’t bother. The nature of the B shares is never disclosed to HMRC, and they’re just chancing HMRC doesn’t spot what’s going on. Probably they’ll get away with it… but make no mistake, that’s criminal tax fraud.

- They claim the B shares are a genuine investment, with the grandparents/trust paying a few £k. They skate over the fact that the actual value is much higher than that. Again, this feels more like tax fraud.

- They run a series of crap valuation arguments, saying that the limited rights attached to the B shares mean their value is low. That is belied by the fact that they expect the B shares to pay enough dividends to cover school fees. However if everything is fully disclosed to HMRC, and the valuation argument presented, then even though if it’s wrong it’s unlikely to reach the level of criminality.

- The trust/grandparents provide full value for the shares, but it’s funded by the parents in the background. Clearly doesn’t work – and if hidden then again we’re in criminal tax fraud territory.

- There is no dishonesty here – the promoters are just clueless.

I asked Signature and Fortus to comment; neither have responded. I’m making a formal complaint about Signature to the Taxation Disciplinary Board4Because Signature promote themselves as a member of the Chartered Institute of Taxation, and to both Signature and Fortus to the Institute of Chartered Accountants in England and Wales (ICAEW).

What are other advisers up to?

Some advisers are promoting arrangements where grandparents gift property, or shares in a family business, to their grandchildren. We can think this is a good or bad thing from a policy perspective. but it’s clearly within the rules. See, for example, theprivateoffice.com, The Money Panel, and RDG Accounting, Henderson Logie and PD Tax Consultants. Each makes clear that it can’t be the parents gifting the property.

But there are other advisers who appear to be either ignorant of the rules, or trying to circumvent the legislation.

Accotax fail badly:

… as they appear to be entirely unaware that parents can’t get a tax benefit from gifting shares in their company to their child.

By contrast, TaxQube are aware of the issue, but say they have a “special structure” to fix it:

When I suggested that sounded like the Signature scheme, they responded by amending their website…

… and then making incoherent legal threats, but weirdly failing to explain what their “special structure” was. Absent an explanation, it’s reasonable to assume that their reference to a “special structure” was to the Signature scheme, or something like it.

Walji & Co propose something…

… that looks like the Signature scheme.

SFIA Wealth Management seems even worse than Signature…

… they’re either ignorant of the “indirect” rule or promoting tax evasion.

I understand from a source that SFIA charges £1,000 to taxpayers just to provide a report proposing their structure (which I assume is going to be similar to Fortus/Signature), then £7,000 for implementation. Apparently SFIA aren’t too keen on clients taking independent advice – I’d suggest it’s fairly obvious why.

I’ve referred Accotax and Walji & Co to the ICAEW, and will be referring Tax Qube to the ACCA, and SFIA Wealth Management to the FCA. I’ll refer more promoters as further reports come in.

The cost of the schemes

These schemes have two massive costs:

- First, to taxpayers who get caught up in them, and end up being challenged by HMRC, and paying the tax back, plus interest and very possibly penalties.

- Second, to all of us, as tax revenue is lost to the schemes that (inevitably) HMRC miss5Why do they miss schemes? In part because no bureaucracy is perfect. In part because some of the schemes involve non-disclosure to HMRC of key elements, and whilst that doesn’t help the technical analysis – and creates jeopardy of criminal tax evasion – it means that HMRC may not spot what’s going on.

So its in all of our interests that the schemes are stopped.

Stopping the schemes

I’m referring the advisers involved to HMRC, but this is just scratching the surface. Safe to assume that for every adviser foolish enough to explain their duff scheme on the internet, there are dozens who promote schemes in the shadows.

Ultimately only HMRC can stop this, by publicly calling out the schemes, saying they don’t work, and using its array of new powers to challenge the people who promote them.

Will they?

-

1(c) Fortus, but there is an obvious public interest and fair dealing justification in making a copy publicly available

-

2Actually the scheme in HMRC’s example is less terrible, because the company is new and so there is at least an argument the shares have no value when granted. The Fortus and Signature schemes involve pre-existing companies where the shares are clearly valuable

-

3or declare a trust

-

4Because Signature promote themselves as a member of the Chartered Institute of Taxation

-

5Why do they miss schemes? In part because no bureaucracy is perfect. In part because some of the schemes involve non-disclosure to HMRC of key elements, and whilst that doesn’t help the technical analysis – and creates jeopardy of criminal tax evasion – it means that HMRC may not spot what’s going on

21 responses to “Widespread promotion of school fee tax avoidance schemes”

Seems to rest on the initial share sale / transfer being non-commercial. Really difficult to prove, could be all sorts of reasons why grandparents or siblings choose to invest in a family business. Seems wishful thinking, wonder if it would pass a test case.

Personally I have no moral objection anyway. Children are entitled to the same tax allowances and brackets as anyone else and they’re exclusively benefitting. High earners already sponsor child support and nursery fees from the punitive tax traps of earning £100k+. Paying for private schooling out of earned income is practically impossible for the middle classes as it is and comes with serious lifestyle sacrifices. Meanwhile those with family assets can move them around to achieve the same tax breaks with no risk.

We need to shifting the tax burden to wealth not income.

no, it’s super-easy to prove. If the shares are worth £1m, and the subscription price is £1,000 then the structure fails. There is no difficulty here. See https://www.gov.uk/guidance/dividend-diversion-scheme-used-to-fund-education-fees-spotlight-62

Sorry to be dense but if a company has no net equity at the point the B shares are issued, how can it be proven they’re worth more based upon future potential earnings?

I get the NPV of future dividends argument but wouldn’t that only apply with hindsight? In the here and now who’s to know a company will generate X profits in the future. Even if it does that could be the direct result of the capital raise. Or there could be some other genuine commercial reasons for grandparents to invest in a parent’s business. At which point the other steps become legitimate and defensible?

Also, for what it’s worth, if these tax breaks are allowed on inherited wealth but not parental income wouldn’t that push private schooling even more into the preserve of aristocracy at the expense of meritocracy?

In these structures the company has net equity. The shares are valuable, because the idea is to pay school rights right now, not wait for years in the hope they become valuable

Why not just pay granny a salary and she pays school fees from that?

If it’s more than fair compensation for the work she undertakes then it fails for the same reason as the shares.

If the parent hold the shares on behalf of the children…who will get full entitlement at the age of 18, can the children receive the dividend and use their tax return?

A great public service Dan. Towards the end of my own time in practice i was increasingly uncomfortable that my firm (and therefore my income) was more and more reliant on helping rich people to pay less tax. I was also aware that other advisers, like many of those identified above, were less scrupulous than I was in giving honest advice to clients.

I had become adept at helping people understand the risks, downsides and challenges they could face if they pursued tax avoidance schemes – even those that appeared to be legal (which was primarily because they had the support of a QC’s opinion. There was a limit as to how much time I could spend reviewing these to identify the flaws and likely routes HMRC could pursue. And there were few people willing to pay a chunk of money to be told how NOT to reduce their taxes.

Many of the schemes and plans I saw 20+ years ago were (eventually) litigated and HMRC invariably won, all be it, many years later and long after anyone would have remembered my warnings and caveats.

I have long believed that HMRC needs to be seen to be taking more cases to court and winning, but this is costly and time intensive and cases can drag on for years. Sadly, it’s hard to see any of the (regulatory departments within the) professional bodies having the technical resources to pursue such matters. I imagine those accused of non-ethical promotions and advice would insist on waiting until the courts found their advice to be ill-founded. And I doubt the professional bodies would devote the resources to arguing otherwise.

HMRC published this a few days ago! Well done..

https://www.gov.uk/guidance/dividend-diversion-scheme-used-to-fund-education-fees-spotlight-62

The question now is, will HMRC take those responsible to task?

I wonder how widespread this is. Just looking at England as I have numbers easily at hand, there are about 9 million children at about 24,500 schools, which includes around 600,000 children at 2,400 private schools (that is, private education account for around 7% of children at around 10% of the schools, as they tend to be a bit smaller). And average private school fees of around £20,000 per year, or around £12 billion in total. If parents of only 1 in 12 pupils indulge in this sort of nonsense, that could be £1 billion or so of untaxed income each year.

(A slightly different issue, but the funding of state schools is around £7,500 per pupil. Now, 20% VAT on £20,000 of fees would be £4,000 per year, but the fees at somewhere like Winchester is about £45,000 per year for a boarder, and 20% VAT would be £9,000. So, continuing to exempt private school fees from VAT gives a state subsidy for each pupil at Winchester which is greater than the amount paid per pupil at state schools. This goes in the same bucket as the lower effective tax rates for many taxpayers with the greatest incomes, as they realise capital gains or receive dividends rather than earned income.)

Andrew, I take your points but making suggestion that “if only 1 in 12” seems farfetched and I would tend to believe it is fraction of that (at least I hope so!). However, if that was the case I would definitely encourage all the means to tackle it.

What I am more concerned is your cherry-picking when it comes to the funding. To be clear, I am biased, as I have 3 kids in private schools (all below your stated average), all paid from taxed income – no schemes. The cost of private education hurts but it was our conscious decision to go this path. Many people have fancy houses, fancy cars but we chose to spend our money differently, investing in kids education. The cost of putting kids through the private school system is enormous and represents by far the largest expense of our household.

If the VAT would be introduced, we would not be able to cope with that. We would have to pull our kids from private education and they would go to state schools. What do you think it would do to the funding of public schools? Where would additional 3x £7,500 for state schools come from? Bear in mind, my taxes already go towards state schools, I am not getting any tax benefits from educating privately. So there wouldn’t be more tax to fund those.

Portion of our fees fund places of talented kids that can’t afford the school fees. My current 3x £15,000 would not be spend on teachers’ salaries in private school but likely invested into stocks, buying a property, … unlikely a VATable event in any case because my consumption wouldn’t go up.

If anything governments (however is in charge) should focus on improving the education system not making it worse by punishing those who are keen to fund their kids education.

The school fees VAT argument is extremely misleading. Yes of course you can tax the fees and collect output tax and I suppose that might generate some savings if massive numbers don’t move to state education and the Government does not need to spend loads on extra schools etc…

But for every output you collect, there is potential input (tax) – and so private schools would be entitled to 100% VAT recovery as opposed to a much lower number now, under 10% in most cases. Lots of them are in very expensive accommodation and the VAT man will need to pay the VAT back on those costs, even if that VAT exceeds the output tax. Which it may well do as lots of these improvement projects in Grade 1 and 2 listed properties or new buildings cost fortunes.

At present, private schools ARE taxed with a VAT bill, the same as every other exempt entity. The irrecoverable VAT is every bit as much revenue for the Government as collecting output tax from the seller, it’s all money.

Politicians generally are not clever enough to understand this and almost always forget to discount their projected savings from taxing something they think should be taxed by the input tax that newly taxed sectors will be able to claim. Or they are aware but it is better to be ‘politically ignorant’ as generally newspapers/the general public are likely to believe too that adding on 20% or taking out 20% from a £45k school fee is all a complete gain to the Government, because no-one understands VAT…well not many.

Sorry but that’s nonsense. VAT recovery will be low because most inputs for a school are not VATable – wages being the biggest cost by far.

Nonsense? Bit rude. Where did I say how much the recovery would be? I was just saying that, whatever the VAT bill is, the school would claim 100%. Of course no VAT to claim on wages, food…

Now if for marketed schemes the advisers became personally and vicariously liable to pay the taxpayer’s excess tax, penalties and interest, unless they can show they had taken all reasonable steps to be sure the advice was correct, that might be a deterrent.

PI cover ought still to be available for competent advisers.

I assume the old s99 TMA defence of ‘ I am too stupid and/or ignorant’ to know this planning fails still applies in some form.

HMRC rarely prosecute. I always assumed this was because it is so resource intensive with an uncertain outcome.

Perhaps if the professional bodies took a more proactive approach to policing their members that would help too. It will be interesting to see the action taken after your referrals.

Thanks, James. My feeling is that we need some prosecutions pour encourager les autres…

Great work Dan,

Also compliments on the clarity of your explanation as to how they fail.

Hopefully HMRC will drop a specialist tax force to analyse company share transactions with the hallmarks highlighted by you. Of course if the users decide to conceal the true background facts then it should be easier for HMRC to get the criminal standard for prosecution. I don’t suppose they are increasing the chances of being caught by using dividend waivers.

One of the challenges as you say is identifying the promoters concerned who are a bit more discreet than those you’ve identified above. Do you think HMRC could obtain a Sch36 para 5 notice requiring the largest 50 (say) schools to provide data – eg where school fees are being paid by a trust in the name of the student, and would that be another way to screen for such arrangements?

That does indeed strike me as the best route for HMRC to follow.

As a profession, we have been too tolerant of promoters of tax avoidance schemes for too long. We know full well a scheme that sounds too good to be true won’t work and any counsel’s opinion behind it isn’t worth the paper it’s written on. But we watch on while wealthy users looking to dodge tax fall into the trap.

This is a great public service – the number of examples of people doing blatantly dodgy things to avoid tax is depressing. And HMRC’s lack of interest / lack of resources to crackdown just provides fuel to the enablers.

(Full disclosure: I’d quite like to reduce my own tax bill, but I really don’t fancy a whopping great fine for breaking the law to do so!)