The Scottish National Party just appointed AMS Accounting as their auditors. AMS have a tax boutique, Signature, as part of their corporate group, providing “education and school fees planning”. This “planning” turns out to be a tax avoidance scheme for parents paying school fees.

Signature‘s marketing suggests a “huge annual saving”, and we reckon a family with three children could avoid £60k of tax per year. However, we’ve analysed the scheme, and believe it to be technically hopeless – HMRC will inevitably challenge it, and likely win, leaving Signature’s clients in a disastrous tax position. Worse still, Signature appears to have unlawfully failed to disclose the scheme to HMRC, which could trigger a £1m penalty

This short report summarises the Signature scheme, how it’s supposed to work, why it fails, and the wider implications. The Guardian is covering the story here.

FURTHER UPDATE: HMRC have published a “Spotlight” confirming that they believe these schemes don’t work. Hopefully that’s the end of them.

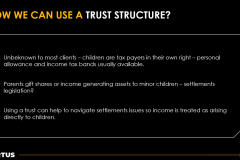

UPDATE: I’m hearing that the scheme is being widely promoted. One such promoter, Fortus, took down the relevant page off their website earlier today, but left a copy of their webinar, which we have archived here1(c) Fortus, but there is an obvious public interest and fair dealing justification in making a copy publicly available, with some nice slides demonstrating what looks like exactly the same structure:

How the scheme works

The basic scenario is this:

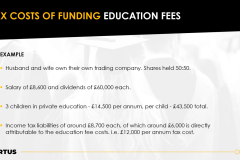

- I’m a successful businessman, running my business through a company and receiving most of my income through dividends on ordinary shares, on which I’m taxed at 39.35%.

- I send my three children to an expensive independent school. This costs about £100k a year for the three kids2I’m frugal – if the kids were boarding the cost could hit £150k. But, naturally, I pay it out of my post-tax income – so I have to extract £164k of dividends to be able to afford the school fees. Frankly I’d rather save that £64k and pay the fees out of my pre-tax income.

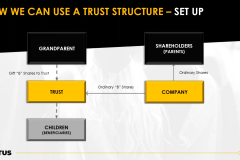

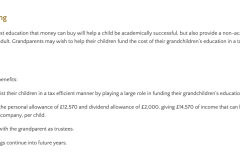

- So I get my brother (or grandparent) to subscribe for some shares in the company – not ordinary shares, but rather strange “B” shares. He pays say £1,000. The B shares don’t get a normal dividend in the way my ordinary shares do. And the B shares only have one voting right – to vote a special dividend on the B shares, capped at £106,000 per year.

- The brother then immediately declares a trust over the B shares in favour of my three children.

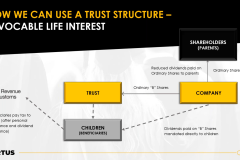

- When school fees fall due, my kind brother votes for a B share dividend. The trust gets £106k.

- As the beneficiaries of the trust, my kids have to pay tax on the B share dividends. How much? Assuming they have no other income, they each have a £12,570 personal allowance, a £1,000 dividend allowance, and pay basic rate dividend tax at 8.75% on the rest. So each of the three kids pays just under £2k in tax, and the trust uses the remaining £100k to pay the school fees.

- And as if by magic, the school fees no longer cost me £164k in ordinary share dividends, but just £106k in B share dividends. Almost £60k of tax avoided, by magically shifting income from me (who pays a high tax rate) to my kids (who don’t).

The Signature Group3Looking at Signature’s Companies House filings, the precise relationship between AMS and Signature appears to have changed over time. AMS describe Signature as part of their group, but legally Signature appears to be some form of joint venture between AMS and Signature’s founder, Ebrahim Sidat. Sidat holds 75 “A” shares and AMS holds 25 “B” shares. Possibly there was a mistake drafting the memorandum and articles, because the A and B shares are defined at the start of the document, but the terms are never used subsequently. So the precise nature of the joint venture is not clear. promoted the scheme here, until the Guardian contacted them on Friday – that page has now mysteriously lost most of its content.4See also the PDF brochure here (still up, but archived here just in case). This reveals some more features of the scheme but hides others. Some of the summary above is taken from these pages, and some is from a reliable source who is familiar with the scheme. Notably, Signature’s website gives the impression that the brother/grandparent is making a real investment into the company – but (for reasons below) that investment will in reality always be a token sum (£1,000 in my example), and out of all proportion to the school fees that will be paid.

How the scheme fails

Connoisseurs of tax planning will spot that, conceptually, the structure is similar to the Zahawi scheme. A person (the parent/Zahawi) is claiming that valuable shares were acquired by someone else (the brother/Zahawi’s father) who pays no/low tax, when in reality it’s the parent/Zahawi who still benefits from the shares, and the brother/father paid little/nothing for them.

It’s not a coincidence. There are really only a handful of different ways to avoid tax, and this one is “pretend that someone else holds something valuable you don’t want to be taxed on, but then still actually own it”.

Like the Zahawi scheme, it doesn’t work – and for the same fundamental reason: there’s a lie at its heart – the shares are acquired for much less than their true value. The B shares are worth a lot of money – broadly the present value of all the future school fees (which could approach a seven-figure sum). But my brother is acquiring them for £1,000.5I gather that in practice the B shares may be split between B1 shares, carrying the dividend right, and B2 shares, carrying the right to vote the dividend. I’m unsure why anyone thinks this makes a difference – perhaps an argument that the B1 shares have no value because they can’t control the dividend, and the B2 shares have no value because they have no economics? The best way to describe such an argument is “courageous”.

When things are done for horribly wrong valuations then, as a rule, the tax will go horribly wrong.

But hang on – am I being unfair? How am I so confident that the uncle isn’t really paying full value for the B shares? Because, if he could really afford to pay all the school fees, then he’d just pay the school fees (or, if he’s that way inclined, create a trust to pay the school fees). The whole palaver with the B shares is required because he can’t. It would be madness for my brother to actually pay the £1m (or whatever) for the B shares up-front, and I don’t think anyone would do that.6One rubbish solution, which I wouldn’t put past promoters, would be for the uncle to pay the £1m, funded by me making a secret transfer behind the scenes. That clearly wouldn’t work and, if not disclosed to HMRC, is edging over the line into criminal tax fraud.

The undervalue is both essential to the structure and what dooms the structure.

How exactly would HMRC attack the arrangement? Let me count some of the ways7This is not a complete list – it’s informed by discussions with three experienced tax advisers with differing backgrounds, and is in rough order of attractiveness for HMRC, but there will almost certainly be other arguments HMRC could run, perhaps many others:

- Apply the specific anti-avoidance rules created for this kind of scenario. The “settlor interested trust” rules8Could be sections 624 or 629 ITTOIA apply if someone establishes a trust for which they (the “settlor”), their spouse, or their minor children benefit. The effect is that the trust income is taxable in the hands of the settlor (so back to 39.35% tax). The Signature structure attempts to circumvent this by saying that the trust was established by the brother and not the parent, and that the parent has no control over the trust property.9Possibly they also try to argue that, because the trust is a “bare trust”, it isn’t a settlement and these rules can’t apply. But the definition of “settlement” for this purpose is much wider than for normal income tax purposes, and will apply to a bare trust. Alternatively, the bare trust may be there to prevent an up-front inheritance tax liability. And the trust may end up not being bare – see below. The answer to that is: come off it. The true “settlor” is the parent, because in permitting the issuance of the B shares, he is causing a large amount of value to move from his company to his children – i.e. because his ordinary shares are worth less than they were. And the legislation expressly covers scenarios where settlements are made indirectly.

- Use common sense (or “common law anti-avoidance doctrines“, if you prefer). Realistically the overall effect of the arrangement is that I, the parent, am paying the school fees. Nothing has changed. There is no tax benefit.

- If (as is likely) the parent masterminding the scheme is a director of the company issuing the B shares, then the “securities with artificially enhanced value” rules may apply (see the “alphabet soup” example here – and the fact the uncle isn’t himself an employee won’t stop the rules applying).

- The “value shifting” rules may apply, given that value is being artificially shifted from the parent’s company to the uncle/children.

- The “transactions in securities” rules might possibly apply.10The analysis is quite difficult and a bit of a stretch, but if HMRC were going to throw in the kitchen sink then this probably belongs somewhere at the bottom of the sink.

- There may also be legal/implementation problems with the structure, depending on how precisely it is carried out. Who is legally paying the school fees here? Does the uncle sign the contract with the school in his capacity as trustee, so that the fees become an expense of the trust? If so, that means 100% of the trust’s assets are applied for expenses, and none going to the beneficiaries – and that may call into question its nature as a bare trust. Or, alternatively, is the trustee paying the fees on behalf of the children? But I rather doubt they sign the contract with the school. Many tax avoidance schemes fall apart on this kind of point, with no need to even consider the underlying tax issues.

- If implementation is really shoddy, the arrangement might be regarded as a “sham”. The definition of the term is much narrower than a non-tax specialist might expect, but the worst tax avoidance schemes do sometimes fall within it.

- HMRC may not bother actually arguing any of these points before a Tribunal, and instead apply the General Anti-Abuse Rule. The GAAR only applies to the most heinous structures – ones which “cannot reasonably be regarded as a reasonable course of action”. There is a good chance this structure falls into that category – in which case all the technicalities are irrelevant, and the structure just fails. Given the potential 60% penalty when a structure is GAAR’d, a wise taxpayer would probably fold the second HMRC start muttering about approaching the GAAR Advisory Panel.

- And a potential bonus for HMRC: if they can successfully argue the trust is a settlement for inheritance tax purposes, and not a bare trust, then they get to collect up-front IHT equal to 20% of the value of the property put into trust (after the nil rate band) – in addition to denying the original tax benefit. That could be a significant sum. If you play stupid games with the tax system, you can’t complain if you end up with a stupidly unfair result.

- And the kicker – the scheme ultimately falls apart because the uncle is paying tuppence for shares that are very valuable. If tax returns are submitted on the basis that the shares are really worth tuppence, then we could be approaching tax fraud territory.

In short, the scheme is technically hopeless. I don’t think any reasonable adviser would disagree with that conclusion – the acquisition of the B shares at an undervalue is a fatal flaw. The biggest challenge for HMRC would be working out which of the 57 potential lines of attack they would run.

That would leave the parents in a fairly awful tax position, facing an HMRC investigation, and almost certainly having to repay the tax, plus possibly additional random taxes, plus interest and likely penalties.

And if any school was foolish enough to facilitate the structure, they could well be an enabling participant, potentially liable for a penalty equal to 100% of the fees received from the structure.

To be clear, we’re not talking about technical flaws in the scheme – it’s improper. Signature and AMS should be ashamed.

Signature’s defence

The Guardian approached AMS for comment, setting out what we thought their scheme was, and telling them that Tax Policy Associates thought it didn’t work. AMS responded with this:

Signature Group is an award-winning mid-market advisory firm. The tax division (Signature Tax) has been recognised as providing excellent service in the sector and boasts an exceptional team of chartered tax advisers, lawyers and chartered accountants.

Signature Tax has a strict tax compliance and risk policy which refrains from any form of aggressive tax planning that could be deemed ‘disclosable’ to HMRC or construed as a ‘tax avoidance scheme’. The tax division has been trading successfully for over a decade and has built a fantastic reputation in the market.

We continue to build on our reputation and presence in the mid-market and continue to deliver exceptional growth year-on-year. Our most recent acquisitions include one of the largest teams of HMRC Dispute and Investigations specialists in the UK, which continually helps us to build on our existing fantastic relationship with HMRC.

At about the same time they put out this statement, they updated their website to remove the obvious “avoidancy” elements from the scheme. Here’s the before and after, and my markup showing the changes:11Gone are the references to the parent’s net income, the “huge annual saving”, to uncles/aunts, to the parent’s company and, most importantly, to “limited rights” in the shares ensuring “no dilution” for the parent (the key dodgy share value point). So Signature are helpfully drawing our attention to the features of their scheme they regard as most problematic.

I take two things from all this. First, they’re not denying that we have the details of the scheme correct, they’re just running away from it. Second, they’ve accidentally admitted they’ve broken the law, and potentially face a £1m penalty.

The accidental admission

Most tax avoidance schemes are required to be disclosed to HMRC under the “DOTAS” rules. The idea is that a promoter who comes up with a scheme has to disclose it to HMRC. HMRC will then give them a “scheme reference number”, which they have to give to clients, and those clients have to put on their tax return. It’s the tax equivalent of putting a “kick me” sign on your back, because the inevitable HMRC response will be to challenge the scheme and pursue the taxpayers for the tax.

In this case, my opinion, and that of other leading barristers, solicitors and tax accountants I’ve spoken to, is that the scheme is clearly disclosable. It gives the parent a tax advantage; that’s the main benefit of the scheme (indeed the only benefit); and it has the “hallmark” of using a “financial product” (the shares) which have unusual terms that only exist because of the tax advantage.12The “standardised tax product” hallmark may also apply, but one is enough.

However, AMS’s statement above amounts to a confession that they did not disclose.

So, from the information I have, and from their own statement, it’s my opinion that Signature have probably broken the law and unlawfully failed to disclose the scheme to HMRC. That can result in a penalty of up to £1m, and that’s a power which HMRC have started to use.

The role of tax KCs

At some point I expect Signature will say they’ve a KC opinion that the structure works, and that it wasn’t disclosable. If so, I’d bet that (1) they approached several KCs before finding one silly enough to provide an opinion, and (2) the opinion is based on factual assumptions that are evidently false (such as the brother acquiring his shares for market value), and/or (3) the opinion is based on a fringe view of the definition of “tax avoidance” that no court has ever accepted.

I’ll be writing more about dodgy KC opinions soon. It’s almost ten years since an obscure barrister called Jolyon Maugham wrote perceptively about this problem – sadly nothing has changed. Something needs to be done – and I’ve a few suggestions.

What should HMRC be doing?

Three things:

- Put out a Spotlight notice confirming that the scheme is a non-starter, which probably ends all prospect of marketing it.

- Send Signature a formal notice giving them 30 days to demonstrate that the scheme isn’t notifiable under DOTAS.

- Take a closer look at Signature. Chances are, this isn’t the only tax avoidance scheme they’re promoting. Tax avoidance is a bit like adultery – very few people only do it once.

What should taxpayers do?

Don’t do “tax mitigation” schemes other than those promoted by Government, e.g. ISAs and pensions (which aren’t tax avoidance at all).

Unless, perhaps, you have an adviser you deeply trust, who is giving advice specific to you, and they tell you the arrangement doesn’t just work under the letter of the law, but will be accepted as kosher by HMRC (and not tax avoidance) and so won’t be challenged. Failing that, be ready to accept the consequences when/if it all goes wrong.

How should advisers respond to these schemes?

I speak to many accountants who are frustrated that their clients are lured into schemes by promoters. Often they’re able to dissuade their clients from entering into the schemes. Sometimes they’re not. If you’re an adviser and you come across a dubious scheme, please do send it to me – naturally in complete confidence.

Mass-marketed tax avoidance is dead, and the people still flogging the schemes are knaves or fools. The tax profession has a duty to weed these people out.

Many thanks to W for bringing this to my attention, to M and M for their invaluable trust and ERS input, and to Pippa Crerar at the Guardian.

-

1(c) Fortus, but there is an obvious public interest and fair dealing justification in making a copy publicly available

-

2I’m frugal – if the kids were boarding the cost could hit £150k

-

3Looking at Signature’s Companies House filings, the precise relationship between AMS and Signature appears to have changed over time. AMS describe Signature as part of their group, but legally Signature appears to be some form of joint venture between AMS and Signature’s founder, Ebrahim Sidat. Sidat holds 75 “A” shares and AMS holds 25 “B” shares. Possibly there was a mistake drafting the memorandum and articles, because the A and B shares are defined at the start of the document, but the terms are never used subsequently. So the precise nature of the joint venture is not clear.

- 4

-

5I gather that in practice the B shares may be split between B1 shares, carrying the dividend right, and B2 shares, carrying the right to vote the dividend. I’m unsure why anyone thinks this makes a difference – perhaps an argument that the B1 shares have no value because they can’t control the dividend, and the B2 shares have no value because they have no economics? The best way to describe such an argument is “courageous”.

-

6One rubbish solution, which I wouldn’t put past promoters, would be for the uncle to pay the £1m, funded by me making a secret transfer behind the scenes. That clearly wouldn’t work and, if not disclosed to HMRC, is edging over the line into criminal tax fraud.

-

7This is not a complete list – it’s informed by discussions with three experienced tax advisers with differing backgrounds, and is in rough order of attractiveness for HMRC, but there will almost certainly be other arguments HMRC could run, perhaps many others

- 8

-

9Possibly they also try to argue that, because the trust is a “bare trust”, it isn’t a settlement and these rules can’t apply. But the definition of “settlement” for this purpose is much wider than for normal income tax purposes, and will apply to a bare trust. Alternatively, the bare trust may be there to prevent an up-front inheritance tax liability. And the trust may end up not being bare – see below.

-

10The analysis is quite difficult and a bit of a stretch, but if HMRC were going to throw in the kitchen sink then this probably belongs somewhere at the bottom of the sink.

-

11Gone are the references to the parent’s net income, the “huge annual saving”, to uncles/aunts, to the parent’s company and, most importantly, to “limited rights” in the shares ensuring “no dilution” for the parent (the key dodgy share value point). So Signature are helpfully drawing our attention to the features of their scheme they regard as most problematic.

-

12The “standardised tax product” hallmark may also apply, but one is enough.

21 responses to “The SNP’s new auditors are flogging a dodgy tax avoidance scheme, and may face a £1m HMRC penalty”

What about Uni costs rather than School (under 18 year olds)? i.e. awarding a 19 year old son dividends, that they use to fund their expenses. Rather than the parent paying directly. I’d assume that is less contentious given they are an adult…?

https://www.taxation.co.uk/articles/readers-forum-tax-concerns-on-trust-payments-for-school-fees

https://www.accountingweb.co.uk/tax/personal-tax/use-shares-to-support-a-student

Why not simply pay them a tax-deductible salary (there is no age or quantity limit for company secretaries, so you could perhaps consider that)?

If they’re doing a proper day’s work to earn their salary that’s fine – but also pointless. If they’re not really working for the salary then it’s a settlement and you get the bad income tax consequences. It’s also not tax-deductible for the company, as the salaries are not paid wholly and exclusively for the purposes of the trade.

Dan, if you’re right then surely that’s a much bigger and more controversial tax story that you should cover, as 1,000s of UK Ltds pay their (UBO) family like this.

The settlement point I’m making relates only to children (although there is a similar potential point in other cases, e.g. Jones v Garnett/Arctic Systems). The deductibility point would apply to any company paying a “salary” to someone who wasn’t actually working for the money. Or am I missing something?

A child can of course work for the company. Being a company secretary is a potentially onerous position even if no actual work is done. But that’s all beside the point per my above comment, as if you’re right about that being a problem then this alternative common planning is far more a significant thing to be discussing than the Signature thing (who appear to be keeping this simple alternative planning a secret from their clients in order to sell them an OTT expensive scheme that is also much higher risk as you say – that seems to be the real scandal here).

The scheme has made AMS a fortune. They also sell an offshore scheme which could make the news soon.

Thanks – but are you sure? If you have evidence, please drop me a line

What is your view on grandparents settling shares in their trading company into Trust for the purpose of school fees? Presumably with BPR for IHT and the option to holdover CGT this can be effective but they will still have issues with the school contract not being with either the Trustees or the children?

Seems okay to me – clearly permitted by the rules. But the contract would need to be with the grandparents not the parents, or it surely fails.

Presumably, this would be a discretionary trust with the tax saving arising from an income tax reclaim by the child (or am I missing something)?

Of course, share valuation (or misvaluation?) has played a part in tax avoidance for decades, so nothing new. But even today, advisers seem to hang their hat on valuation being an “art form”. I’m afraid to say, some schemes appear designed in the hope an HMRC officer will agree without fully understanding what they’re agreeing to.

Settlements legislation and arrangements should stick the tax bill firmly on the parent. Let’s hope they don’t knowingly enter a form of words explaining what they’ve done that does not fully lay out all the true steps and reasons.

Unfortunately of course the KC in giving the opinion on the efficacy of the arrangements will have no responsibility to the parent user.

Wonder how AMS are going to deal with benefits in kind on motor homes?

Great work Dan – as usual – should imagine HMRC should be risk assessing arrangement pedlars before too long.

You might also have mentioned that Signature Tax Limited seems to have its own share capital of just £100. Not much to sue against if and when the scheme proves not to work. (Admittedly it has retained profits at the end of 2021 – but will be interesting to see if those are still there in the next accounts).

https://s3.eu-west-2.amazonaws.com/document-api-images-live.ch.gov.uk/docs/vaE_32XqXC0TDEXFg9PVyizL7Mr3mCpzFRqVEohGd9Q/application-pdf?X-Amz-Algorithm=AWS4-HMAC-SHA256&X-Amz-Credential=ASIAWRGBDBV3NZSRGNWO%2F20230506%2Feu-west-2%2Fs3%2Faws4_request&X-Amz-Date=20230506T171713Z&X-Amz-Expires=60&X-Amz-Security-Token=IQoJb3JpZ2luX2VjEBYaCWV1LXdlc3QtMiJGMEQCIBcHkXNcmx2N1G2HJsYaD%2BioiHvNs4yqGs7U51XPJMWGAiB%2FtdJkCPQBAreJzORQLJrgQ6rAUnwIlVsIB00cZeyzHCq7BQgvEAQaDDQ0OTIyOTAzMjgyMiIMyXoNVBI6QGoXVCa2KpgFN6XL5B1ExYGOv3mHdhKb%2BR4Jksa50z%2FVrcIdFCIzopD2NrN%2Fz%2BKmoeaNmebHclZndE5n6TtHP5KV0T6UfDoNl%2BEwNrj5PTSlMxT0Ba%2FaMVFVwaotkjKBijE3HzaHA3W6h%2FoWaK%2BOUsMNcd5D5o88HdKESltE%2BqpT51%2FnN%2BQj46ZisGPJJMBSZPbkXjNUFUgOfH%2FagzcP4%2B9YMlggmIIxL%2FUxRG%2FnWZwVDTlONULEGBnl2LGaEB3Ir8s04MYFGk2PiQtfQqfKQwyAcvv%2BYELmSLa4C6FaBIeofqgWf%2BdhwoJGGi%2Ftnj2mdS5pybDByf%2BMo9XgbNd%2FWz3oWNKCP7wZsZMzscNniYqXztq%2BNqVaUDNOk1l4XbGOs75WnDjUGH0TQJg46p4bzFcEDc3N7m6xvVotHnesiyFy8n%2B8F3CZHtAkXH7qvydW9miujeZIM8fdUkkRBUBzEZ4gkJoRFkpyhDQBbGDRBqhROghwdtQ4%2Bu3TZ%2BppkKww55QqRpL1F52OIixaluzafUu8j29%2BZUZw2uQrh70ZZerbPHJk2JIlek23ETcMp86QFffDUNZEdCla%2FLgC2BxJlmFNw%2BZaiFmuzKOAhVCC5efZjZ4TTndciGWZ68ZOSikdNluV3sP7kaILysV28wA%2BH33y%2FHZD67ggfcQHRQS0gnDInQPJyT6k5LLc9oo1%2B%2FrB0INsNY5ty%2BXv3ClhPNJKRtzIgWpQyNrEylcZYermzfMPUEm6hW%2Bfp%2FDPdqGPNmzqJp8OXX7H7RzKTHxj5g89coLk03BwXNwa4swyE79kkaIYn0XHA5GKQYTRXqrrV1TYLAPjVIPwq2c0E4UfnSoN02kRONm2L%2Fd0cMQEo%2BQcLEQ9wWAyh81w9dJO9hs2cC9dnTCOvNmiBjqyAd8a%2FyaFlcrZsHVgDdKchcfikeCyClL6OFlqmTQILHuxUSALxlLa7buNzhq451SItynaCfBR9tV9%2F%2Fg1ngvDdc1qMMu0fbnhCTqY6IomoFZ%2BG0b3lPjuqfNVKYRxs5aXuhbAS1Mb%2B10DJFLc0dYd0mppwKr%2FuGmzhkk03m%2F%2Fb8Ii5K4xMLgM9%2FfDTKXsky3tna3V%2FXlaeYPpMAGQaMOW%2B86ZwjBNO3YT4CUipKQKIHeZVMg%3D&X-Amz-SignedHeaders=host&response-content-disposition=inline%3Bfilename%3D%2208281817_aa_2022-09-20.pdf%22&X-Amz-Signature=203f7b0626b11ad79156df694eb5392f188e8e091a07c4f67b571ebf93ac58ba

I think that’s pretty usual for small private companies

Very interesting. Let’s assume it’s a family business, director wants to send his children to school or university (I appreciate there may be a key distinction). HMRC will accept legitimate expenses for staff training (including as I’ve seen £100k for an MBA and even less relevant degrees). Could there not simply be a more direct route? The ministry of defence pays for officers children’s school fees…

I suspect there would be an indirect settlement if the company was 100% owned by parents. Query the % at which that changes!

Training expenses are allowable to the extent that they are wholly and exclusively for the purposes of a trade and/or are not capital. So for example a hair salon would be allowed to claim expenses incurred on it’s staff

See HMRC manual https://www.gov.uk/hmrc-internal-manuals/business-income-manual/bim47080

One minor comment: in your para on DOTAS, you refer to the scheme’s purpose as being tax avoidance. The DOTAS rules are of course triggered by an arrangement’s main benefit being tax avoidance, rather than its purpose. Which is even more clearly the case here!

Crikey, amateur hour! Will fix asap.

In fact DOTAS is triggered by an arrangement’s main benefit being a tax ADVANTAGE, doesn’t even require AVOIDANCE (i.e. doing something contrary to the intention of Parliament).