I wrote in February about some serious tax problems with the way the Post Office was compensating the victims of the Post Office scandal. At the Post Office inquiry last Thursday, the Department for Business and Trade said that the problems have been resolved. I am concerned that is not correct.

UPDATE: as of 19 June 2023, it looks very much like this has now been solved

Between 2000 and 2013, the Post Office falsely accused thousands of managers of theft. Some went to prison. Many had their assets seized and their reputations shredded. Marriages and livelihoods were destroyed, and at least 59 have now died, never receiving an apology or recompense. These prosecutions were on the basis of financial discrepancies reported by a computer accounting system called Horizon. The Post Office knew from the start that there were serious problems with the Horizon system, but covered it up, and proceeded with aggressive prosecutions based on unreliable data. It’s beyond shocking, and there should be criminal prosecutions of those responsible.

Now, finally – ten years after the Post Office almost certainly knew 1Although important people at the Post Office surely knew well before 2013, albeit that the details of “who knew what when” remain unclear that it had wronged these people, it is paying compensation. However, the way the compensation is being paid to 2,000 postmasters under the “historic shortfall scheme” (HSS) is creating serious tax problems for them.

The key issues are:

- Compensation is being paid for years of lost earnings. This is paid as a lump sum – often a very large lump sum – and so is taxed at a much higher rate than would have been applicable had the earnings been paid properly at the time. For example: a postmaster earning £30k would ordinarily have taken home about £25k after tax. But if that same postmaster receives compensation for ten years’ lost earnings in one payment, of that £300k they’ll take home not £250k, but £170k. The “compression” of many years of income into one year costs them £80k more tax. That’s an unjust result, and one that compensation would normally adjust for, by paying additional compensation so that the postmaster receives (on these figures) £250k after tax. The Post Office didn’t do that.

- As the claimants’ loss was many years ago, a large amount of interest is often due. This is fully taxable. The Post Office has correctly deducted 20% tax from its interest payments, but then failed to give a clear warning to claimants that they would have additional self assessment liability, taking the overall tax rate on the interest up to 40% or 45%. The Post Office also failed to provide any tax support to postmasters, or pay for tax advice – so postmasters would unlikely to be aware of the tax liability, and could easily fall into default with HMRC.

I suggested back in February that the solution was a statutory exemption for HSS claimants. Since then, an exemption has been created for postmasters claiming under the Overturned Historic Convictions (OHC) scheme and the Group Litigation Order (GLO) scheme. But nothing for the HSS scheme, despite a promising initial response from the responsible Minister.

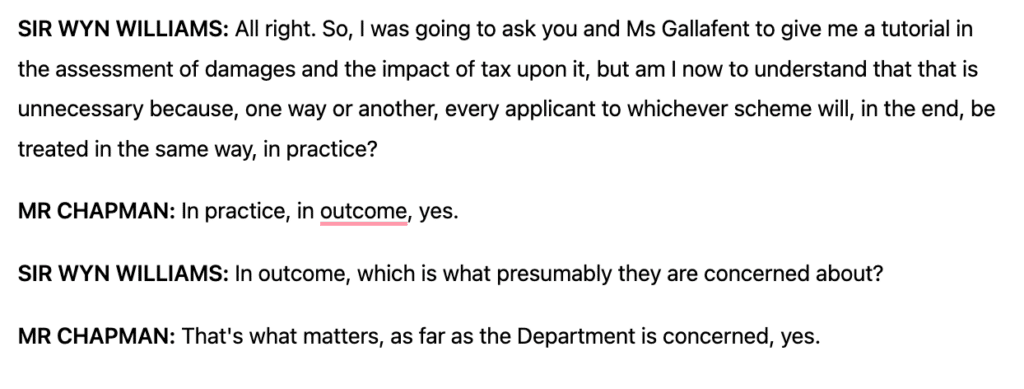

Tax on compensation payments was discussed at the Inquiry on Thursday 27 April, and we now have at least a partial explanation. The video is available in the link above, and the full transcript is available here.

On the two remaining issues:

Loss of earnings

The Post Office’s explanation last Thursday was that the GLO and OHC schemes paid compensation for lost earnings on a hypothetical net basis. In other words, a GLO claimant in the same position as in my example above would have received £250k compensation from the Government. The Government paid that amount on the expectation that a tax exemption would be created, as indeed it was. So the claimant retained the £250k, and received the correct amount.

But there’s an important caveat. Whilst that result is consistent with paragraph 4.2 of the GLO scheme, the postmasters I’ve spoken to aren’t clear that’s what happened in all cases. It would be helpful if the Inquiry requires the Government to confirm precisely how tax was treated in the GLO scheme payments.

However, let’s assume for the moment that the Post Office is right on how the GLO and OHC payments dealt with tax. How do the HSS payments compare?

- If the Post Office had treated HSS payments in the same way as GLO/OHC payments then my example postmaster would have received £250k.

- But, inexplicably, the Post Office actually paid the postmaster £300k, so that after-tax she retains £170k (and often the Post Office operated PAYE).

- That leaves the postmaster £80k out of pocket compared to their GLO equivalent.

- But if the Government enacts an exemption for HSS payments then the postmaster will retain £300k, and be £50k better off than their GLO equivalent.

So the Post Office has created a mess that is difficult to resolve. The Department for Business and Trade (DBT) reasonably want to achieve parity between claimants under the different schemes, and there is now no easy way to do that.

What’s being proposed is that the Post Office will pay “top-up” amounts so that claimants end up with the right amount, after tax. Those top-up amounts are themselves taxable, so will have to be quite large. They will also have to take account of the particular tax position of the postmasters in each of the relevant years, which will not be easy.

The alternative would be for HMRC to create a complicated special rule, which taxes claimants as if they’d received the funds in each of the years to which they relate. That is probably a worse option.

It should go without saying that the Post Office should pay for claimants to receive tax advice, both at the point of settlement and when they subsequently file their tax return. To date they’ve paid almost nothing to cover tax advice, and that has to change.

I’d conclude from this that DBT were correct to reassure the Inquiry that there is a solution for loss of earnings compensation, but proper thought does need to be given to how postmasters receive tax advice.

Interest and other compensation payments

As the harm suffered by the postmasters was some time ago, interest is due on their compensation – and for large settlements it will come to a large amount. This is fully taxable. They will also often receive other types of compensation (e.g. loss of reputation, stress, exemplary damages), and whilst that probably won’t be taxable, this won’t always be straightforward to determine.

The new tax exemption for OHC and GLO claimants mean they don’t need to worry about these issues – they are just exempt from tax on interest and everything else. The Post Office doesn’t appear to have adjusted their payments to reflect the tax exemption. It hasn’t deducted tax from interest payments (see paragraph 4.2.4 of the GLO scheme terms). This seems the right result to me. Personal injury compensation and interest is tax-exempt, and it feels entirely appropriate that this is too.

But, on the basis of DBT’s announcement at the Inquiry, HSS claimants will pay tax on interest, and potentially other compensation payments too (and will certainly have to obtain tax advice on the treatment of those other payments). Which means that this assurance from DBT to Sir Wyn was not correct…

… as things stand, HSS applicants are not being treated in the same way as GLO claimants. The obvious solution is for the Government to enact a tax exemption for HSS claimants covering interest and other compensation amounts except loss of earnings (assuming the Post Office are right in what they say about GLO compensation payments).

That exemption creates the parity between claimants that DBT are rightly seeking. It will also avoid the scenario that most concerns me – postmasters being misled by the wording in the Post Office’s settlement offer, not realising they have to self-assess tax on the interest, and falling into default with HMRC.

I have provided a copy of this article to the Inquiry.

-

1Although important people at the Post Office surely knew well before 2013, albeit that the details of “who knew what when” remain unclear

Comment policy

This website has benefited from some amazingly insightful comments, some of which have materially advanced our work. Comments are open, but we are really looking for comments which advance the debate – e.g. by specific criticisms, additions, or comments on the article (particularly technical tax comments, or comments from people with practical experience in the area). I love reading emails thanking us for our work, but I will delete those when they’re comments – it’s better if the discussion is focussed on the key technical and policy issues. I will also delete comments which are purely political in nature.