Here are six things I think Jeremy Hunt should be doing. This isn’t my dream list if-some-idiot-made-me-Chancellor. They’re things which practically and ideologically a Conservative Chancellor could and should do right now.

1. Prevent the tax system punishing the Post Office’s victims

The Post Office wrongly accused thousands of postmasters and postmistresses of theft, and covered up the bugs in the computer system that triggered the false accusations. Some went to prison. Many had their assets seized, went into bankruptcy, and saw their reputations shredded. Marriages and livelihoods were destroyed, and at least 33 have now died, never receiving an apology or recompense.

The Post Office’s victims are finally receiving compensation – but the Post Office’s incompetence means that many will see a good chunk of their compensation disappearing in tax. At this point, the only fair solution is a complete tax exemption. I’ve written more about the tax scandal within the Post Office scandal here.

Governments from 1999 to 2013 share responsibility for the Post Office scandal. The fault lies solely with the Post Office, but Government could have seen what was happening and acted. Subsequent Governments share responsibility for allowing everything to drag on for another decade, with the Post Office (through incompetence or malice) failing, again and again, to put things right.

This Government has the opportunity to do the right thing. Sadly early indications are that they’re not, and the Post Office’s victims will continue to have to fight for every inch of progress. I hope Mr Hunt proves me wrong.

2. End 60%+ marginal rates

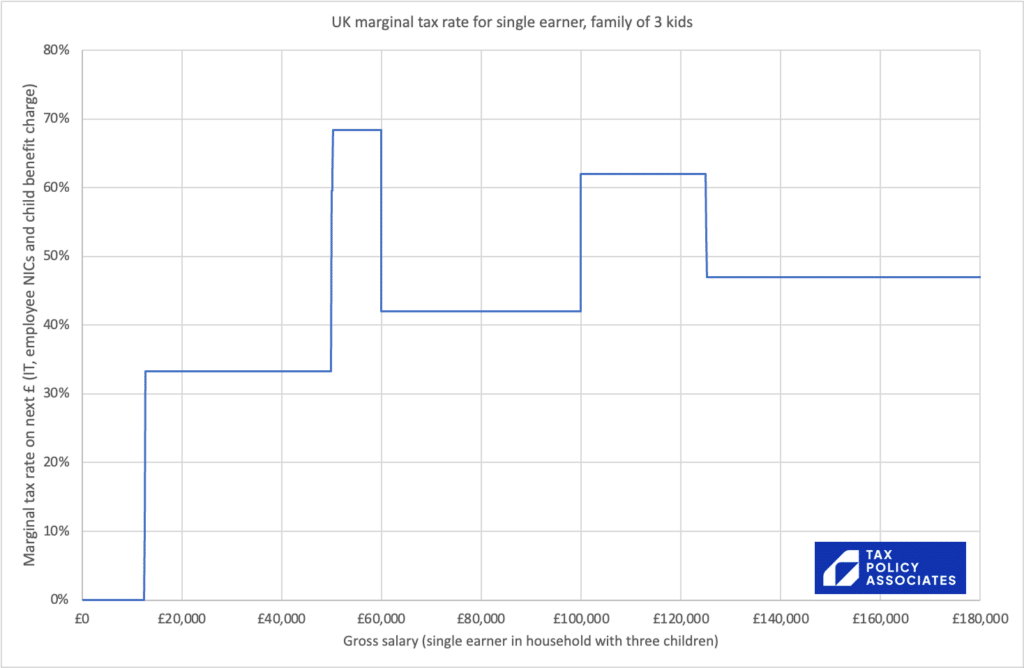

Reasonable people can disagree whether the top marginal rate of income tax should be 40%, 45% or 50%, and at what income that rate should kick in. But surely nobody thinks that there should be a marginal rate of 68% for people earning £50-60k, or 62% for people earning £100-125k. These, however, are the marginal rates you’ll pay today, if you have three children:

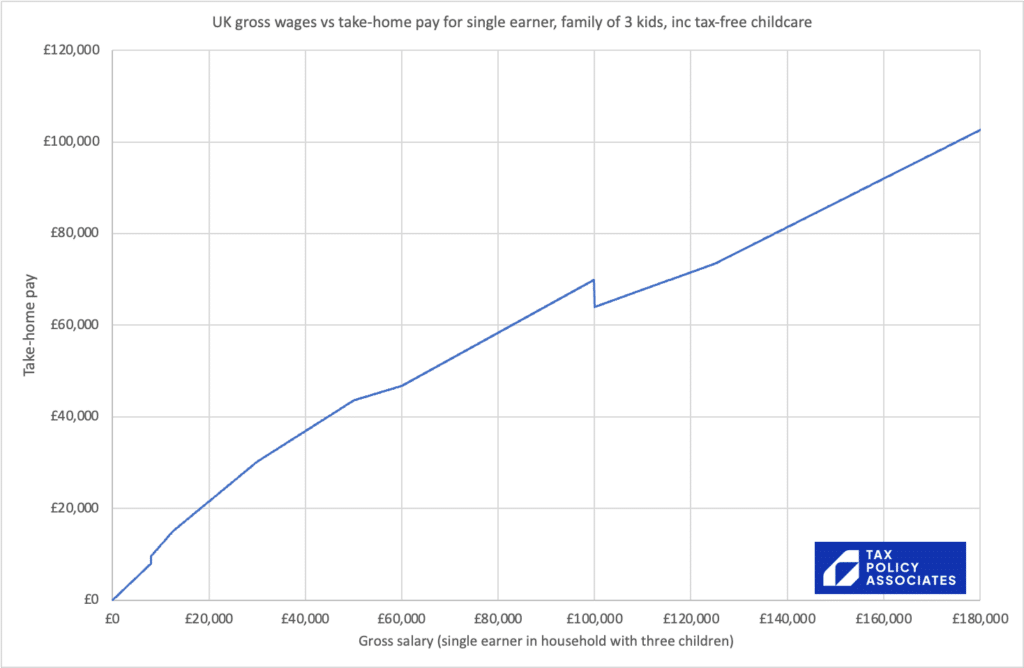

If you’re lucky/foolish enough to use the tax-free childcare scheme, your marginal rate can be so high that you lose money if your pay hits £100k:

(I’m pretty confident that the more you stare at that chart, the more insane you’ll think it is)

These are terrible features of any tax system. They discourage work, encourage evasion (not reporting income), and encourage [avoidance][sensible tax planning]1Delete according to your personal preference such as salary sacrifice schemes/additional pension contributions. They also make people miserable. An obvious question: is the benefit to the Exchequer of the higher rates greater than the cost, in lost economic growth and lost tax?

Jacob Rees-Mogg agreed with me that no Tory Chancellor should be presiding over 60%+ marginal rates. Hopefully Mr Hunt does too, and either scraps the clawback rules altogether, or at least makes the clawback gentler, reducing the marginal rates.

But please, please, if the leaks about a new free childcare policy are correct, don’t claw any new benefits back with painful marginal rates once people hit a certain level of income.

Our fully analysis of the marginal rate situation is here (although the charts above are more up-to-date, as they reflect the tweaks in the Autumn Statement).

3. End the Chart of Small Business Doom

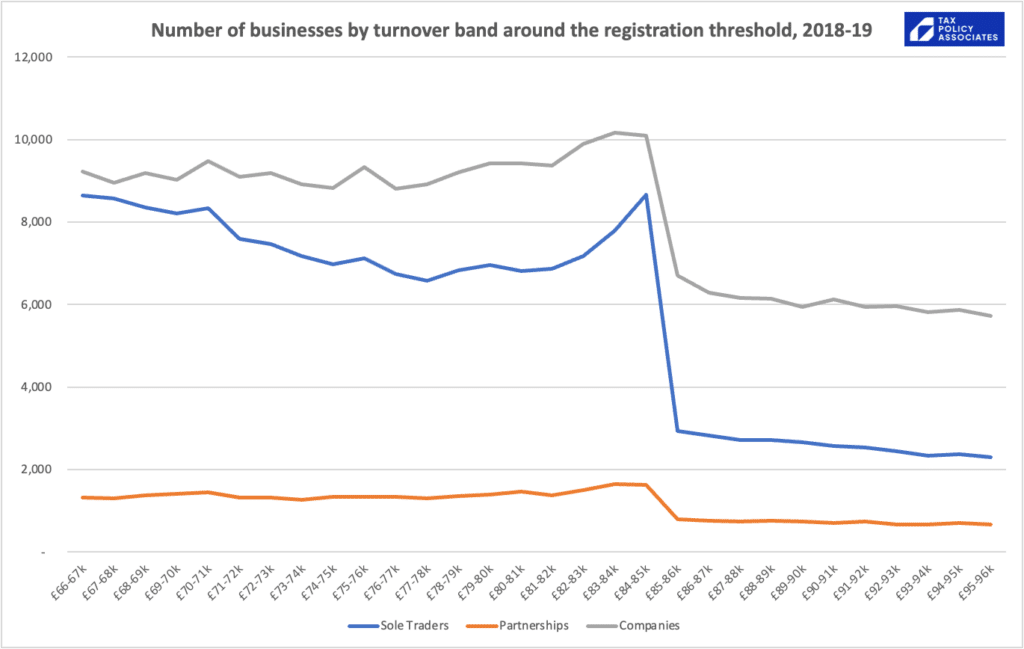

This is the chart:

It shows the number of businesses at each level of turnover.

There’s no escaping the massive cliff-edge around £85k. By an extraordinary coincidence, businesses are required to register for VAT at £85k of turnover, and start charging 20% VAT on all sales.

A cynic would say that people are hiding their income – criminal tax evasion. In this instance, there’s good evidence the cynic is wrong. Businesses are intentionally depressing their turnover – not expanding (e.g. not taking on an apprentice), turning away work, or even going on holiday for the rest of the tax year once they hit £85k.

These feel like bad things for the economy. Small businesses are staying small – and small businesses are less productive than larger businesses.

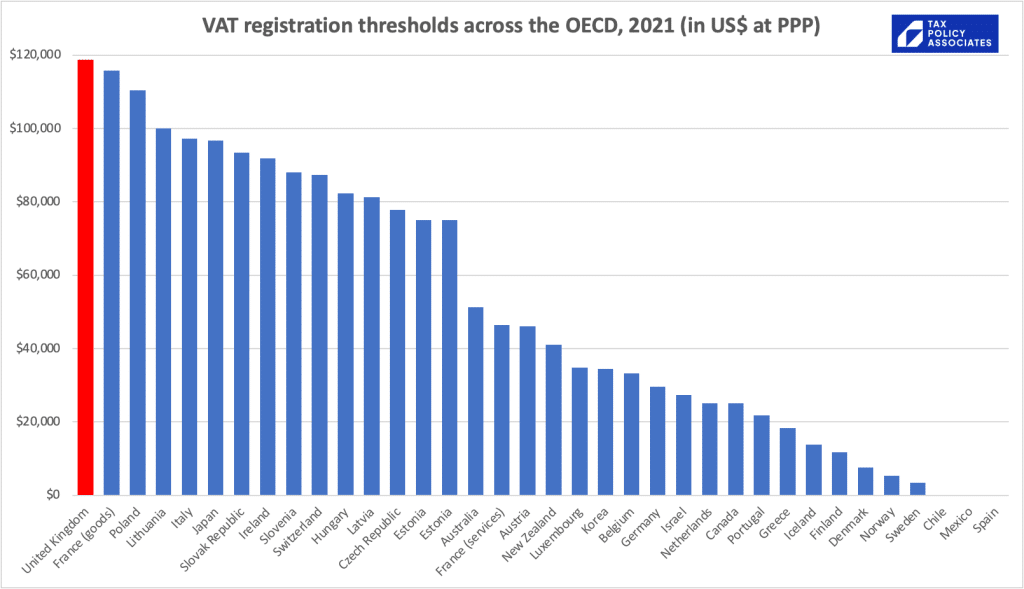

This is not a universal problem – the UK has the highest VAT threshold in the world:

A truly courageous Chancellor would solve the problem by bringing the VAT threshold down to a level where everyone except hobby businesses has to register.

A Chancellor who actually wants to keep his job probably can’t go that far. But he could announce that the VAT threshold will be gradually reduced in nominal terms (and so greatly reduced in real terms). And sweeten the pill by requiring HMRC to provide free apps to small businesses to minimise the compliance pain.

I’ve written more about this here.

4. Abolish stamp duty

Stamp duty land tax and stamp duty reserve tax, the modern taxes on land and shares, have many problems. Taxing transactions is generally a Bad Thing – not least because it distorts decisions (for example putting people off moving house to follow employment elsewhere).

That said, SDLT and SDRT are reasonable taxes from a technical standpoint. They work okay. They raise useful amounts of money, without much avoidance or evasion.

By contrast, old-style stamp duty is a joke. The word “antiquated” doesn’t quite cut it for a tax designed 250 years ago. Horribly complicated. And realistically raises zero money. I’ve written more about it here.

The Chancellor should abolish it.

5. Introduce full expensing

The UK regime for tax relief for business investment is a horrible mess – highly technical, full of arbitrary distinctions, and rife with uncertainty (for the good taxpayers) and avoidance and even evasion (for the bad). Worse still, it changes with bewildering frequency.

All this means that it’s failing in its purpose of incentivising investment. Who plans a long term investment on the basis of a tax treatment which (a) nobody understands, and (b) will probably change several times before you strike earth?

The answer is full expensing: a simple regime of giving 100% up-front tax relief for capital investment by companies. It could be expensive – £11bn/year. But some of the cost could be reduced by further restricting tax relief for interest – and if you don’t do this (as a Government consultation paper recently pointed out), you risk incentivising inefficient investment.

One large caveat: is that there are only two years left of this Parliament. For full expensing to really work to incentivise long term investment, business would need to be confident that the next Government (of any political hue) wouldn’t scrap it. So, oddly, the success of a Conservative Government policy will plausibly depend on the actions of the Labour opposition. The right Labour response, in my view, would be to applaud full expensing and promise to maintain it through the whole of a Labour term of office.

6. Tax carried interest in a fair and open way

Private equity fund managers pay only 28% tax on their income – the “carried interest loophole”. This wasn’t created by legislation, but by an impressive piece of lobbying in 1987 which resulted in an agreement between the industry and HMRC.

I recently published a peer-reviewed paper which concludes that technically the loophole shouldn’t exist, and it’s ultra vires (outside the power) of HMRC to stand by the 1987 agreement. There are increasing signs that the private equity industry recognises that the situation is unsustainable.

So the Chancellor should do one of three things:2And the Finance Bill should tidy up the consequences – it’s invidious for investors’ own tax position to be impacted by the technical tax treatment of a fund that they don’t control.

- Maintain the favoured tax status for carried interest, with new legislation in the Finance Bill that ends all uncertainty, and clearly provides the private equity industry with favoured treatment.

- Announce that the 1987 statement will be withdrawn, and HMRC will follow the law.

- Legislate to end the favoured treatment of carried interest (but perhaps preserve capital gains treatment for fund managers who properly invest in their funds, with money genuinely at stake).

Photo by Stable Diffusion: “statue of lady justice holding a (red-briefcase), photo, nikon 35mm, city street”

-

1Delete according to your personal preference

-

2And the Finance Bill should tidy up the consequences – it’s invidious for investors’ own tax position to be impacted by the technical tax treatment of a fund that they don’t control.

10 responses to “Six things the Chancellor could and should do in today’s Budget”

How about abolishing duty on imports as well? Since Brexit processing of paperwork and tiny amounts of duty collected doesn’t make sense – a real barrier to doing business (where we might previously been protectionist with things like farming industry we have thrown away those protections anyway with AUS/NZ deals). It also means that any import / export businesses end up paying duty twice if they import from RoW and re-export to EU (assuming goods do not have preferential origin and ironically even if they do coming from EU in first place and going back there).

Interesting comment on full expensing. HMRC has relied heavily on the distinction between capital and revenue expenditure to artificially collect more tax, disadvantaging thousands of taxpayers through the film tax relief saga. The only reason they can now claim victory in high profile cases is down to them completely ignoring the cost of making a film and assuming it is a non-depreciating asset akin to land or shares (whilst happily taxing all of the income) – if they really think that I have some DVDs and possibly even VHS tapes which must be worth a fortune!

Here’s one tiny silver lining I’ve noticed from the budget, it might slightly deflate the housing market with regards to the lifetime pension allowance, assuming I’m not being naive.

Before the abolishment, you’ll pay an extra tax charge on the excess amount above your lifetime allowance. For example, if your pension pot totals £1,200,000 then the excess is £126,900. This amount is then taxed at either 55 per cent (if you take it as a lump sum) or 25 per cent if you take it any other way (e.g. through drawdown, UFPLS or buying an annuity). So your additional tax bill would be either £69,795 or £31,725.

Given that, some people invested in housing as an alternative to such pensions, it may make them reconsider buying up housing. Also given that these pensions aren’t subject to inheritance tax as well, one would hope that it may well help deflate the housing market and at the same time increase capital investment elsewhere in the economy, instead of tying up such money in speculative activities.

I’ve probably overlooked something with this surface level reasoning but I’m just a layman.

I think the abolition of the lifetime allowance is only really going to help those with balances just nudging the old limit or those with final salary schemes who are being hit with unexpected bills – eg senior NHS Consultants. For everybody else, the problem is that you can only legitimately put in contributions up to your annual allowance – which is, of course, subject to abatement.

Hence as far as I can see, these annual allowance rules are still the bottleneck and there appears to be little scope to do as you say – ie cash in a property and put a lump sum into your pension scheme. Sure the increase to £60k helps (especially as the ability to utilise brought forward capacity remains) but it won’t, I think, provoke the stampede that some journalists seem to think will happen.

You mention above people being ‘lucky/ foolish’ to use the tax-free childcare scheme. I’m curious why it would be foolish to use this scheme.

I am being flippant, referring to the tax trap it creates.

Re the expensing announced today – in the press release I can’t see a cast iron confirmation that the annual investment allowance has been preserved for companies. It is referred to for unincorporated businesses, but not for companies. One would have thought it should have survived, because otherwise second hand plant would only get the standard 18% WDA – but I wouldn’t put it past HMRC to give with one hand and take away with the other…

Furthermore, the AIA can be used to “sweep up” special rate pool expenditure which only qualifies for the 50% first year allowance – worryingly the press release example doesn’t do this…

Obviously the publication of the Finance Bill will answer these questions – and I may be making too much of its absence!

Great spot!

An interesting thought. In revenue terms over the next few years, “full expensing” is the largest single item in the Red Book, and you are right to be suspicious. .

But see https://www.gov.uk/government/publications/full-expensing/spring-budget-2023-full-expensing

That guidance note at 1. says “As a result of measures announced at this Budget, businesses will now benefit from: … The Annual Investment Allowance (AIA) providing 100% first-year relief for plant and machinery investments up to £1 million, which is available for *all businesses* including unincorporated businesses and most partnerships.” [emphasis added]

And then at 4. “Expenditure on second-hand assets and those bought to lease to someone else can still qualify for the AIA.”

That implies the AIA should be available in parallel to “full expensing”.

However, the example at the end does not make this entirely clear – I’d have expected £10m of “full expensing” at 100%, then £1m of AIA at 100%, then £1m at 50%.

I don’t see anything helpful in the Budget Resolutions.

See https://publications.parliament.uk/pa/bills/cbill/58-03/FinanceDocuments/BudgetResosMarch2023.pdf

The Finance Bill should make this clear when it is published – perhaps claiming 100% “full expensing” might reduce the amount of the AIA that is available?

This seems rather important?

It certainly seems important for businesses that might be making decisions about the timing of investments.

I understand the Finance Bill should be published next week, 23 March, which gives people about a week to digest it all before the new financial year starts.

Not directly on point, but Mike Lane has noted that this is in effect narrowing the corporation tax base again somewhat after increasing the rate, but the tax take will still increase. https://www.europeantax.blog/post/102iaji/because-its-all-about-the-base-about-the-base