This is now out of date. Our more recent report is here.

Between 2018 and 2020, almost 400,000 people earning less than £13,000 received a penalty for not filing a tax return on time. Very few of them had any tax to pay (the tax-free personal allowance was around £12,000). But, by failing to submit a tax return, they were fined at least £100, and often thousands of pounds. For most of those affected, the penalty represents more than half their weekly income.

This paper illustrates the scale of the problem. We believe the law and HMRC practice should change, and we make three key recommendations.

UPDATED with some of the personal stories people sent us. You can submit your own story here.

The full report is here in PDF form. A web version follows below. The original FOIA is here and the spreadsheet with the full data is here. .The BBC’s original report is here, and the new report from The Sun is here. And the first comment below this article is extremely well-informed, written by someone who I know has huge personal experience advising in this area.

Background

Self assessment

Most people in the UK aren’t required to submit a tax return – where a person’s only income is employment income and a modest amount of bank interest, then in most cases a tax return isn’t required.

For this reason, out of the 32 million individual taxpayers[1] in the UK, around a third (12 million people) are required to submit a “self assessment” income tax return[2].

Tax returns must be filed online by 31 January, or three months earlier (31 October) for people submitting paper forms.

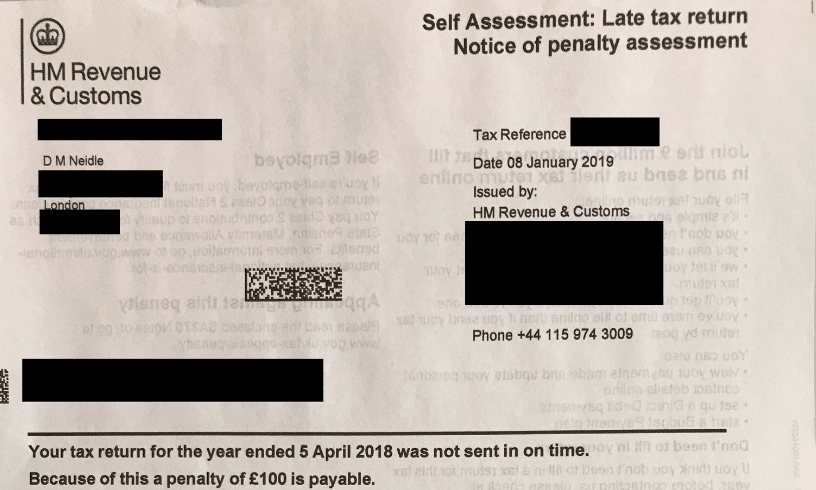

Penalties

If HMRC has required a taxpayer to submit a tax return, but he or she misses the deadline (even by one day), then a £100 automatic late filing penalty is applied.

After three months past the deadline, the penalty can start increasing by £10 each day. After six months, a flat £300 additional penalty can be applied, and after twelve months another £300. By that point, total penalties can be £1,600.[3] Those advising taxpayers on low income commonly see clients with over £1,000 of penalties (and sometimes thousands of pounds if multiple years are involved). Filing appeals for late payment penalties often makes up a significant amount of their work.

Until 2011, a late filing penalty would be cancelled if, once a tax return was filed, there was no tax to pay. However now the penalty will remain even if it turns out the “taxpayer” has no taxable income, and no tax liability.

Appeals

Anyone receiving a late payment penalty who has a “reasonable excuse” for not paying can make an administrative appeal to HMRC, either using a form or an online service.[4] If HMRC agree, then the penalty will be “cancelled”. If HMRC don’t agree, then a judicial appeal can be made to the First Tier Tribunal, but this is very rare for late filing penalties. All the “appeals” discussed in this report are administrative form-based appeals.

The data

Data provided to Tax Policy Associates by HMRC under a Freedom of Information Act request clearly demonstrates that late filing penalties are being disproportionately levied on those on low incomes, most of whom in fact have no tax to pay.

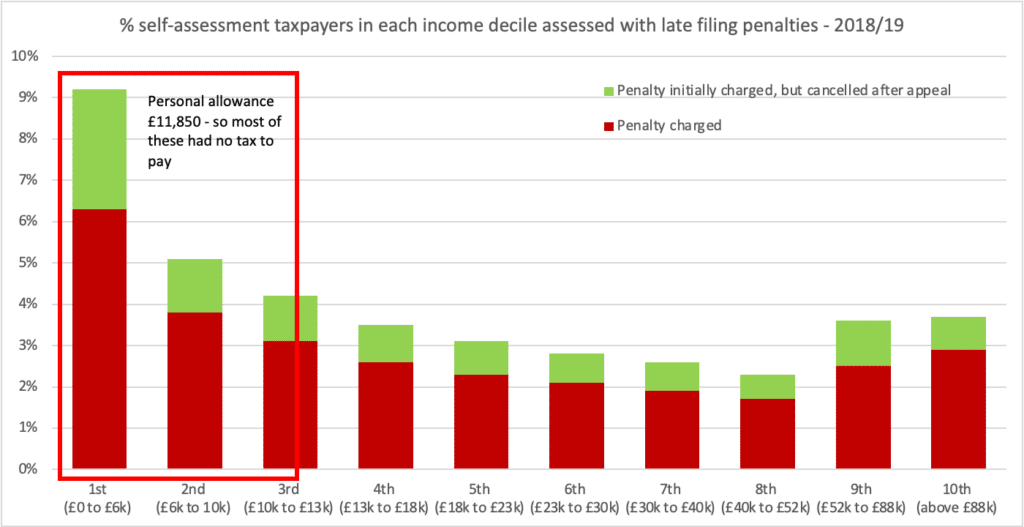

The chart below shows the percentage of taxpayers in each income decile who were charged a £100 fixed late filing penalty in 2018/19. The green bars show where penalties were assessed but successfully appealed. The red bars show where the penalty was charged.

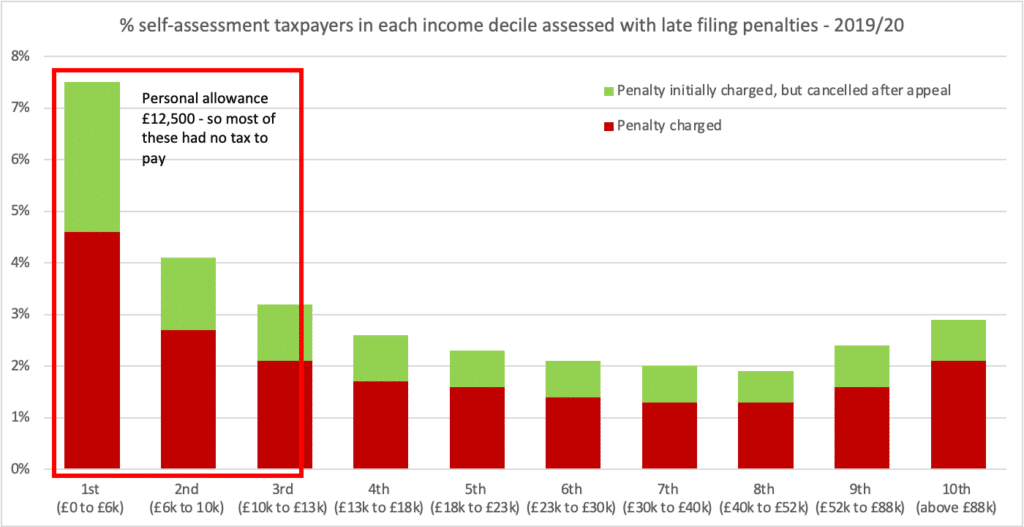

And this is the data for 2019/20, a less representative year:[5]

The charts clearly show taxpayers in the lowest three income deciles receiving a disproportionate number of penalties – 210,000 in 2018/19 and (likely less representative) 167,000 in 2019/20.

But the critical problem is that almost none of these taxpayers have any tax to pay.

We know this for two reasons.

First, the personal allowance was £11,850 in 2018/19 and £12,500 in 2019/20, and anyone earning less than that had no income tax liability. Taxpayers in the lowest three income deciles earn less than £13,000 – so very few will have tax to pay.

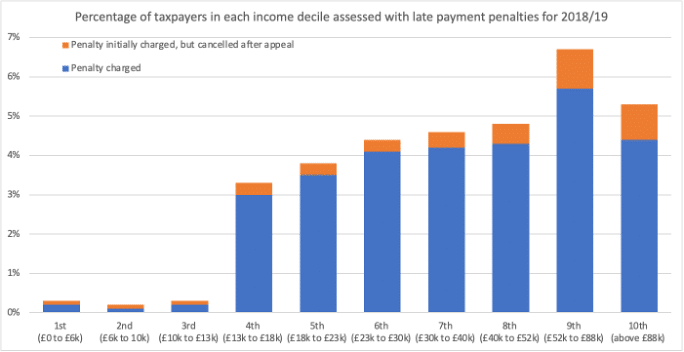

Second, this is confirmed by the data on penalties issued for late payment (as opposed to late filing). The first three deciles pay almost no late payment penalties[6]. This won’t be because they are more punctual at paying than they are at filing; it will simply be because they almost always have no tax to pay.

The impact of penalties on the poor

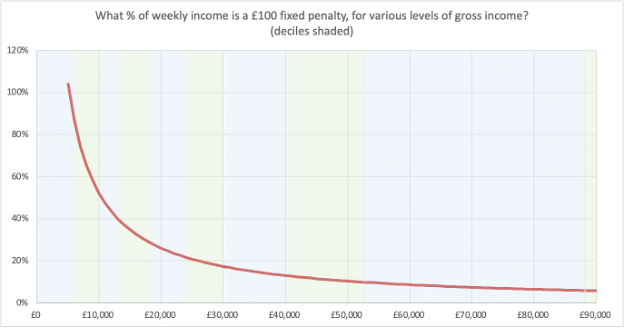

A £100 fixed penalty is a large proportion of the weekly income of someone on a low income (indeed over 100% of the weekly income for someone in the lowest income decile), but inconsequential for someone on a high income:

And, whilst the data shows the numbers of people receiving £100 fixed penalties for late filing, many of the same people will have received late filing penalties which are much higher – up to £1,600 for one year, and more than that where a taxpayer fails to file for more than one year.

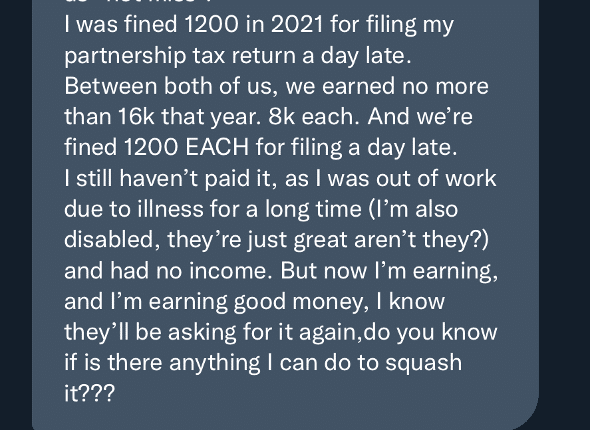

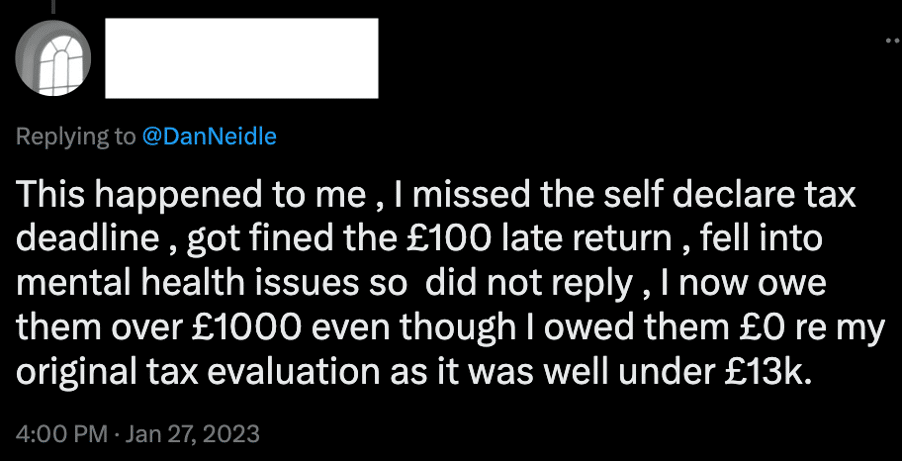

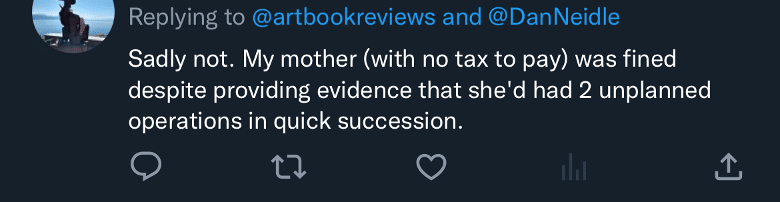

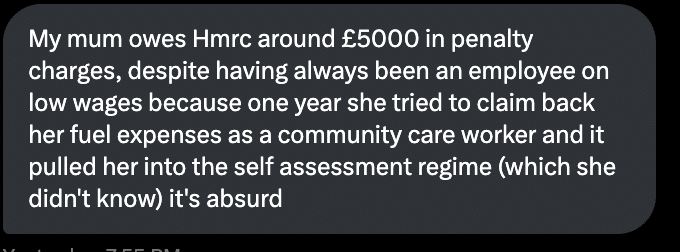

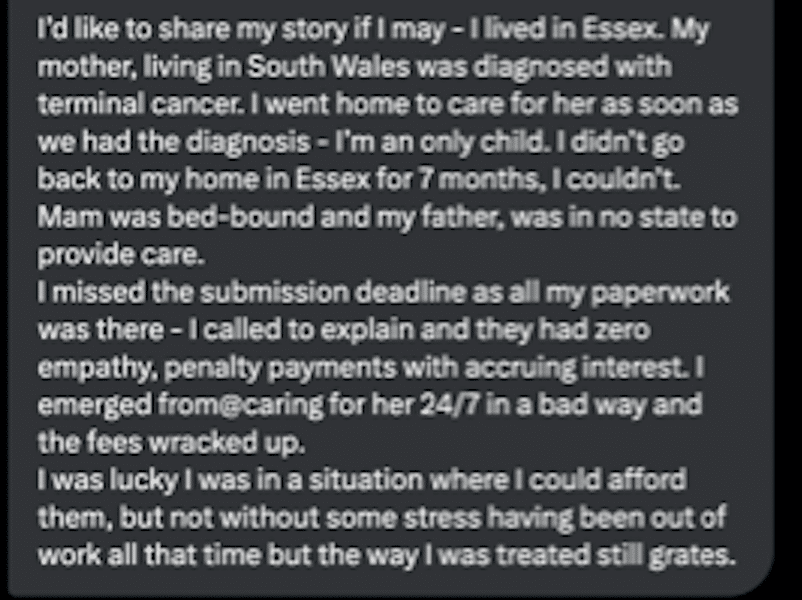

The human cost

Since publishing our initial report, we’ve been inundated with people’s stories, often very distressing.

These are vulnerable people, at a low point in their lives – and the same difficulties which meant they missed the filing deadline mean they often won’t lodge an appeal, and may take months before they pay the penalties (racking up additional penalties in the meantime).

Here are a representative sample:

Will the 2025 changes change the position?

The income tax self assessment penalty rules will likely be changing from 6 April 2025.

From that date, a one-off failure to file will not incur a penalty; rather it will result in a taxpayer incurring a “point”, and only after two points (for an annual filer) or four points (for a quarterly filer) will a penalty be issued. [7]

At the same time, the fixed penalty amount will increase to £200.

This might overall reduce the penalties imposed on low earning taxpayers (for example if they are currently missing the filing deadline by a few weeks, and then filing), but it could equally well worsen the position (if they are missing multiple deadlines, and particularly if they don’t open correspondence). At this point we have insufficient data to say. However we can say that insufficient consideration appears to have been given to the impact on the low paid when the new rules were drawn up.

Conclusions

We believe that the Government, HM Treasury and HMRC are acting in good faith, and have to date been unaware of the disproportionate impact that penalties have on the low paid.

In light of the data revealed by this report, we have three recommendations:

1. Cancellation

Fixed rate late submission penalties should be automatically cancelled (and, if paid, refunded) if HMRC later determines that a taxpayer has no taxable income. Most likely that would be after a subsequent submission of a self assessment form; but no further application or appeal should be required.

Similarly, there should be an automatic abatement of penalties (by, say, 50%) if HMRC determines that a taxpayer has a taxable income but it is low (for example less than £15,000).

In both cases, an exception could be made where HMRC can demonstrate that the failure to file was intentional (i.e. for truly exceptional cases, and not applied by an automated process).

Whilst it is possible that some cancellations could be achieved under HMRC’s existing “care and management” powers , we expect that creating a general cancellation and abatement rule falls outside those powers, and therefore may require a change of law.

This is not a radical proposal; before 2009 penalties were automatically capped at the amount of a taxpayer’s tax liability. UPDATE: It’s well worth reading the first comment below, from the respected retired tribunal judge Richard Thomas, for more background on this.

2. Monitoring

HMRC should start monitoring late submission penalties across income deciles, (using other sources of data, i.e. not limited to those provided to us) to provide a more complete picture of the impact on the low paid, including the level of penalties paid (i.e. not just the data on £100 penalties presented in this report).

And how many penalties are never paid by these deciles and get written off? We expect a fairly high proportion – in which case all that is being achieved is stress for the recipients of the penalties, and administrative cost for HMRC.

Armed with that data, HMRC should aim to reduce the disparities identified in this report, and report annually on its progress.

3. Rework processes

The data reveals that there is a significant population of self assessment “taxpayers” who are being required to complete an income tax self assessment, are charged a late submission penalty, but turn out to have no tax to pay.

HMRC should analyse this population with a view to determining:

- how many of these are taxpayers who in retrospect should not have been required to submit a self assessment return at all,

- whether that could have been determined in advance, on the basis of the information HMRC possessed at the time,

- if it could be determined in advance, what additional processes should be put in place by HMRC to prevent such taxpayers being required to submit a self assessment in the future, and

- if there are small changes which could impact this population’s tax compliance, for example changing envelope labelling (although it may be this work has already been done)

Methodology

Source of data

HMRC provided data to Tax Policy Associates following a Freedom of Information Act request.

The data shows penalty statistics by income decile of self assessment taxpayers. In the years in question there were 11.3 million self assessment taxpayers, and therefore each decile represents 1.13 million people.

Note that the income deciles are different from the usual national income deciles, as self assessment taxpayers have different (and, on average, lower) incomes than the population as a whole.

Limitations

The most important limitation is that, whilst we had asked for income level to be computed by reference to previous self assessments filed by taxpayers, HMRC’s systems were unable to do this (at least within the limited budget available for responding to FOIA requests).

The data is therefore based upon the income level revealed when a taxpayer did eventually submit his or her return. That means, if a taxpayer did not submit a return at all for the relevant year, they do not appear in this data. In fact, the majority of taxpayers fall in this category – HMRC only has income data for 44% of taxpayers receiving a late filing penalty for 2018/19, and for 30% of taxpayers receiving a late filing penalty for 2019/20.

It is plausible that the “never filing” taxpayers are more likely to be low/no income taxpayers (without the time/resources to file) than higher income taxpayers. If that is right then the data we report is under-estimating the impact of penalties on low-income taxpayers. However, this is speculation; further data is required.

Data

The complete dataset follows below.

“PF1” is the £100 fixed penalty for missing the self assessment deadline; LPP1 is the 30-day late payment penalty. “Pre” are penalties originally assessed. “Post” are penalties which are actually charged (the difference between “Pre” and “Post” being cancelled penalties, usually as the result of a successful administrative appeal).

| 2018/19 | 2019/20 | |||||||

| PF1 | LPP1 | PF1 | LPP1 | |||||

| Deciles | Pre | Post | Pre | Post | Pre | Post | Pre | Post |

| 1st (£0 to £6k) | 9.2% | 6.3% | 0.3% | 0.2% | 7.5% | 4.6% | 0.2% | 0.1% |

| 2nd (£6k to 10k) | 5.1% | 3.8% | 0.2% | 0.1% | 4.1% | 2.7% | 0.2% | 0.1% |

| 3rd (£10k to £13k) | 4.2% | 3.1% | 0.3% | 0.2% | 3.2% | 2.1% | 0.2% | 0.1% |

| 4th (£13k to £18k) | 3.5% | 2.6% | 3.3% | 3.0% | 2.6% | 1.7% | 2.8% | 2.6% |

| 5th (£18k to £23k) | 3.1% | 2.3% | 3.8% | 3.5% | 2.3% | 1.6% | 3.6% | 3.3% |

| 6th (£23k to £30k) | 2.8% | 2.1% | 4.4% | 4.1% | 2.1% | 1.4% | 4.1% | 3.8% |

| 7th (£30k to £40k) | 2.6% | 1.9% | 4.6% | 4.2% | 2.0% | 1.3% | 4.4% | 4.0% |

| 8th (£40k to £52k) | 2.3% | 1.7% | 4.8% | 4.3% | 1.9% | 1.3% | 4.8% | 4.3% |

| 9th (£52k to £88k) | 3.6% | 2.5% | 6.7% | 5.7% | 2.4% | 1.6% | 5.4% | 4.7% |

| 10th (above £88k) | 3.7% | 2.9% | 5.3% | 4.4% | 2.9% | 2.1% | 4.5% | 3.6% |

Acknowledgments

Many thanks to HMRC for their detailed response to our FOIA request on penalties and income levels, and to their openness and responsiveness to our follow-up queries.

Many thanks to all those who responded with their personal experiences of penalties, and to the tax professionals who provided technical input and insight (many of whom spend hours volunteering to help people in this position).

[1] See the projection for 2022 here: https://www.gov.uk/government/statistics/income-tax-liabilities-statistics-tax-year-2018-to-2019-to-tax-year-2021-to-2022/summary-statistics

[2] See HMRC figures at https://www.gov.uk/government/news/fascinating-facts-about-self assessment

[3] i.e., £100 + 90 x £10 + £300 + £300. The way in which penalties escalate does not seem rational, and will be improved from 2025 – see page 9 below. Technically all penalties after the first £100 are discretionary, but in practice they appear to be applied automatically in most cases.

[4] See https://www.gov.uk/government/publications/self assessment-appeal-against-penalties-for-late-filing-and-late-payment-sa370. Strictly the appeal should be made within 30 days of a penalty being notified, but in practice we believe HMRC rarely holds taxpayers to this deadline.

[5] The pandemic meant that HMRC extended the filing deadline to 28 February 2021.

[6] Another factor is that some of the late payment penalties applied to those on low income will have been held over from a previous, higher earning, year. Hence the proportion in the lowest three deciles with tax to pay will be lower than suggested by this chart.

[7] See HMRC policy paper: https://www.gov.uk/government/publications/interest-harmonisation-and-penalties-for-late-submission-and-late-payment-of-tax/interest-harmonisation-and-penalties-for-late-payment-and-late-submission

Comment policy

This website has benefited from some amazingly insightful comments, some of which have materially advanced our work. Comments are open, but we are really looking for comments which advance the debate – e.g. by specific criticisms, additions, or comments on the article (particularly technical tax comments, or comments from people with practical experience in the area). I love reading emails thanking us for our work, but I will delete those when they’re comments – just so people can clearly see the more technical comments. I will also delete comments which are political in nature.

22 responses to “Penalising the poor: HMRC charged 400,000 with penalties when they had no tax to pay”

I did mine slightly late as.I had been doing more PAYE than self employed and barely earned anything in. Self employed. I did the return in Feb and had 2.late £100 fines plus the tax they say I owe whicb I can’t afford and they’re adding daily interest. I overpaid tax on my pAYE qnd yet not heard a thing about that. I’ve had to set up a monthly payment that I can’t afford on a.low income and they want it all a

Paid by January 2024. Couple that with my council tax that I can’t afford and I think I’m going to have to go homeless or move back in with my mum as I can’t afford bills at the age of 50

Please contact TaxAid – they’re free and excellent at this sort of thing

An excellent report, whose recommendations are spot on.

The comments I have are based mainly on my experience as a member and then judge of the First-tier Tribunal. In my IR/HMRC career I was rarely involved in this area, except when I did some research and work for the Keith Committee.

In the FTT, though, I dealt with over 300 appeals against late filing penalties, nearly all involving s 8 TMA returns, so I was a little surprised by the comment on page 4 that appeals to the FTT are “very rare”. You cannot tell the rarity from the decisions published on the FTT website or Bailii as these penalty appeals are almost all dealt with by way of short or summary decisions which are not published. And appeals against such penalties still make up a decent proportion of the published cases.

The current system is scandalous, and not just because it impacts the lowest paid so harshly, for two main reasons. One is indeed its failure to keep the cap that was a feature of s 93 TMA from 1989 (and was a modified feature from the start – £5 instead of £50 if there was no income).

It seems to me that s 93 as it stood before the FA 2009 changes was a decent workable system. The reduction or cancellation of the initial or later fixed rate penalty was done automatically when the return was filed. Most people outside the lowest deciles accept that the £100 initial penalty is reasonable, about the same as a speeding fine, as one appellant put it when complaining vociferously about the daily penalties.

I once or twice had the misfortune to hear HMRC argue that because the appellant did not appeal the initial penalty, they could not have a reasonable excuse for not filing the return which would otherwise had caused the daily and later penalties to be cancelled.

I am grateful to Andrew for the research in his comment on 27th January. Paragraph 6.8 of the June 2008 Condoc is revealing. Were there really people who knew their liability well enough to pay all but £100 on the due date, but were failing to make a return. It could hardly be intentional to pay nearly all of the tax you owe if you then failed to make the return that would reveal you did indeed need to pay another £100.

“Others choose not to submit a return at all if they have no liability as they know the penalty will be reduced to zero.”

One could ask why are HMRC so anxious to know what the return says in these cases.

When I did some fairly low level research I concluded that the current UK system for failing to file and failing to pay on time is, when combined, the most punitive in the countries I looked at, and because many are based on the amount of tax only they do not disproportionately affect the poorest. It is still punitive on those who have no tax top pay, on time or not.

It’s interesting to look at the Keith Report (1983) and its recommendations in this area which are at 19.6.6. For late filing they recommended a penalty of 5% of the tax on the return after a delay of 1 month from the due date, with 5% for each month thereafter up to a maximum of 30%. This was of course in the context of the pre-SA system, with its estimated assessments and the “tax” was the excess over the estimated assessment.

What they didn’t suggest was a daily penalty. And it is the daily penalties that are the really iniquitous ones, and in particular HMRC’s duplicitousness in the Powers Review.

Section 93 TMA had always had a daily penalty rule. Section 93(1)(b) (as originally enacted) imposed a penalty of £10 a day, continuing for as long as it took to get the return filed. This was increased to £60 a day by FA 1989. However, a very substantial safeguard was that these penalties were not automatic, unlike others in s 93 after 1989 (see s 113(1D) TMA) , but required an Inspector of Taxes to start proceedings before the General or Special Commissioners and later the FTT and to demonstrate why the penalty should be imposed and the Commissioners or Tribunal decided the rate per day. Another safeguard was that making the return before the proceedings cancelled any liability to a penalty.

When the FA 2009 regime was under discussion, HMRC’s reason for continuing with daily penalties, but not requiring them to be proceeded for before the Tribunal, was that (a) the rate was reduced to a fixed amount of £10 a day and could only last for 90 days and (b) special rules would require a decision to be made by an officer and a notice to the taxpayer warning of the penalties before it would be imposed. This was reflected in paragraph 4(1) Schedule 55 FA 2009:

“P is liable to a penalty under this paragraph if (and only if)—

(a) P’s failure continues after the end of the period of 3 months beginning with the penalty date,

(b) HMRC decide that such a penalty should be payable, and

(c) HMRC give notice to P specifying the date from which the penalty is payable.”

However before the legislation even came into force, a committee of HMRC officers purportedly made a decision that the daily penalty would be imposed in every case. I know this because I was a member of the tribunal panel (with Judge Barbara Mosedale) in the case of Morgan & another v HMRC (a case appealed to the UT and Court of Appeals as Donaldson v HMRC). I am afraid that Barbara bought that “decision” (described in a witness statement by an HMRC policy officer) as complying with paragraph 4(1)(b), but I dissented (unusually for a non-legal member), and I still think I am correct.

I have no quarrel with the 6 and 12 month minimum £300 penalty (there is a tax-geared element in them where the tax unpaid exceeds £6,000 at 5% of the tax – not mentioned in the report at page 3 under “Penalties”, 2nd paragraph. It is of course irrelevant to the lowest deciles).

But for most I agree the scale is not rational and even less so if you state it as £100, then £900, then £300 then £300.

So bring on the new system. It could be introduced in 2024 as I noted in my reply to Rebecca Cave’s comment. I was slightly gobsmacked by the comment by Caroline Miskin:

“Given the delays to MTD ITSA we won’t see penalty reform in 2025, implementation is dependent on HMRC moving records from the self assessment system CESA to its ETMP platform so current system is probably with us for a while yet.”

Given that MTD ITSA was until very recently going to start from 6 April 2024, then either HMRC have known for a very long time that that would not be the case because they hadn’t started to move the records before MTD started, or they didn’t intend to impose penalties for late quarterly updates from the start.

A few more comments:

Footnote 3: Technically only the paragraph 4 daily penalties are discretionary, not the paragraph 5 (6 month) and 6 (12 month) ones. And as mentioned above HMRC have not only fettered but abolished their paragraph 4 discretion.

Conclusion 1 (page 8): If by “writing off” you mean remission because it’s not cost effective, I don’t know, but I have had 2p kept on my SA Statement for some time. HMRC do have a policy in relation to hardship, the history of which is interesting.

In relation to pre-FA 2009 penalties, s 102 TMA gave HMRC a power to mitigate:

“Mitigation of penalties

The Board may in their discretion mitigate any penalty, or stay or compound any proceedings for a penalty, and may also, after judgment, further mitigate or entirely remit the penalty.”

The policy on this is set out in the Enquiry Manual at EM5310

“The policy on its use is clear and longstanding. Given that Parliament has enacted the relevant penalty and the taxpayer has incurred it, HMRC will only mitigate in certain narrowly constrained circumstances. This is particularly true of fixed-amount penalties where Parliament has specified the amount and denied the tribunal the ability to alter it.

Mitigation will only be considered after

• the penalty has been determined and the taxpayer has exhausted (or abandoned) all appeal rights, and/or

• the failure or error that led to the penalty has been remedied or corrected.

Mitigation will then be considered in three circumstances.

1. Where some sort of HMRC maladministration, usually delay, has caused or contributed to the size of the penalty – where delay and/or lack of co-operation by the taxpayer have caused the department additional costs that will weigh against mitigation.

2. Where to enforce payment of the penalty would cause the taxpayer genuine and absolute hardship.

3. Other exceptional circumstances such as the penalty or penalties being wholly disproportionate to the offence – for example a large tax-geared failure penalty under S93(5) following upon very large S93(3) daily penalties for the same offence, or belated information revealing the type of situation set out at EM5212 (“In-built” penalty).”

Section 102 TMA does not apply to FA 2009 penalties (s 103ZA TMA) but the discretion to mitigate is now part of the special reduction that HMRC can decide to make if, in their view, there are special circumstances. This is now covered in the Compliance Handbook at CH170800. They include circumstances which are uncommon or exceptional and also:

“where the strict application of the penalty law produces a result that is contrary to the clear compliance intention of that penalty law.”

whatever that means (but see example 3).

Note also the hilarious example 2 – which is not an example at all, since it doesn’t say what Brian’s special circumstances consisted of.

But there is nothing here specifically about hardship, though it appears from Walter J. Wylie t/as Inkslingers v HMRC that it still lives on after 2011.

My purpose in mentioning this is to suggest that HMRC might also wish to look at their policy on special circumstances to see if it can be used to cancel, and better still, prevent penalties on the lowest paid.

What is the point of a nil return? What use can HMRC make of a return that says no tax is owed? I’m sure their database doesn’t include a list of everybody in the UK who might be liable to pay some tax, ticking them off as the returns come in? Don’t these returns just get in the way, clutter up the system? The HMRC penalty process only picks up those who have previously paid tax on self assessment and so encourages people not to ever engage with the tax system or to change their identity if they have done in the past. If a taxpayer gets a penalty notice, he or she should simply have to make a no tax owed declaration for the penalty to be rescinded. The penalty notice should include instructions as to how to do this. Penalties should only become payable when tax that should have been paid, hasn’t been. They should not be issued because someone who doesn’t owe any tax hasn’t joined in the HMRC paperchase.

I believe many disabled people will be in these lower income deciles, and in many cases their disabilities will make it hard or even impossible to meet filing deadlines, deal with official correspondence, and appeal resulting tax penalties. I think that by applying escalating penalties automatically, HMRC is failing to meet its obligations under the Equality Act 2010.

I agree. I wish there was a way to quantify this, and find some evidence on the scale of the problem… but I haven’t been able to…

However note that HMRC won’t be in breach of the Equality Act, because in most cases all it’s doing is following the law. The automatic and unforgiving £100 penalty is a creation of Parliament.

Have you spoken to the charity TaxAid? They do a huge amount of very good work in this area – representing people who cannot, due to illness or illiteracy, represent themselves. If someone reading this comment has a similar issue I would definitely recommend that they contact TaxAid

Absolutely – yes, anyone in this situation should 100% contact TaxAid or Tax Help for Older People

I see this from the other side. I spent 35 years as a HMRC investigator. I saw the considerable time and work these late filing penalties caused, the endless appeals and chasing up for payment. Financially there is a cost to HMRC and an even greater cost to the general public as those officers could be spending their time reducing the long waits for telephone enquiries. The problem could be resolved by timely submission. The penalties may seem excessive to the lower income taxpayers (or non taxpayers) but there has to be some system to enforce the filing deadline. Perhaps there should be greater efforts to ascertain why the deadline is not being met. I have little sympathy with the ones who simply cannot be bothered but should more be done to help and encourage the remainder. Is there a reason for non submission? Is it because help is needed which from an accountancy point of view cannot be afforded at that level of income or because taxpayers are unaware of the deadline. I am old enough to remember the “olden days” when extra staff were allocated to office enquiry counters to deal with the public trying to complete their tax return. Help is now only available over the telephone after a long wait. Has Tax Policy Associates investigated the reasons for the late submission resulting in late filing penalties and if so what is the reason and can it be overcome.

Rather than penalising late filing, how about HMRC pays people with no tax to pay £50 for the annoyance of getting an unnecessary tax return. Clear messages to people earning less than £13k that sending the form back on time will get them an easy £50 would probably sort out the problem, and enable HMRC to improve their targeting so that they send out fewer requests for unnecessary tax returns.

Developing this idea further: all taxpayers get a £100 credit for a return submitted by end of April, reducing by £10 for each month thereafter.

Even if all 6 million filed in April, £600M would surely be much less that the costs saved.

And it might encourage HMRC to root out requests for returns sent by mistake.

When SA started the penalties were capped at the tax outstanding as at the filing deadline. Those with no tax were therefore protected but it did open the floodgates for dilatory taxpayers to prevent a tax bill by paying sufficient tax (as advisers, we would obviously suggest this if it looked like the return was going to be late). It was hard to spur these people into action until HMRC issued a determination with an overstated liability. There was logic in removing this rule in the reforms, but they went further than necessary. It would have been perfectly possible to cap based on the liability for the year (after tax at source but before payments). This would have protected the low/non-taxpayers without helping people with substantial liabilities who were just disorganised.

Prevent a *late filing penalty*, I mean

The penalties forr filing slef assesemnt tax returns are unlikely to change in 2025, as suggested in this policy paper: https://www.gov.uk/government/publications/interest-harmonisation-and-penalties-for-late-submission-and-late-payment-of-tax/interest-harmonisation-and-penalties-for-late-payment-and-late-submission#detailed-proposal.

This because the new system of points leading to penalties is tied to MTD ITSA , which has been postponed again to now start in April 2026.

In fact MTD ITSA will only apply for soletrader taxpayers with total property and business turnover of £50,000 or more from 6 April 2026. The turnover threshold will drop to £30,000 from 6 April 2027 and we have no idea when MTD ITSA will be extended beyond that to partnerships or to soletraders with lower turnover.

It is VERY unlikely that the new penalty system will be introduced for self- assessment taxapyers before it has been rolled out to those reporting under MTD.

I do not understand Rebecca’s comment here, especially after reading the HMRC paper she links to, which to me sends the opposite message, as indeed does the text of Schedule 24 FA 2021.

If you look at item 1 Column A in para 2 Sch 24 there are points and penalties for people who do not have to make quarterly returns but do have to make s 8 returns, ie at present everybody. There are also points and penalties for those who have to make both returns in Column B and an up to now and for the future unpopulated Column for IT & CGT payers who have to make monthly returns.

The Commencement Order needed to bring Sch 24 into force for IT & CGT could now be made in theory for 2023-24 and it would work perfectly well for that and subsequent pre-MTD tax years and it would work perfectly well for years after MTD ITSA comes in (if it ever does).

Going back to the HMRC paper, under “Policy Objective” there is nothing there that hints that the system is dependent on MTD ITSA. The 5th and 6th paras are a bit of an add on, making it clear that in MTD ITSA you need more failures before your failures and points trigger a penalty, and the last para shows that the system is, like Sch 55 FA 2009 paras 3 & 4 which it replaces, designed to be extended to all sorts of taxes, duties and other matters, including the 60-day CGT return which is not included in the Schedule.

Bring it on now!

We perhaps need to ask why they are in SA at all? I suggest that another approach (not mutually exclusive and partial solution only) is to look at the self assessment filing criteria which are arbitrary and not aligned with the notification requirement in the legislation. Many of those required to file a return only need to do so because of limitations of HMRC’s systems (PAYE/NPS) and simple assessment powers could be used, removing the risk of late filing penalties.

Given the delays to MTD ITSA we won’t see penalty reform in 2025, implementation is dependent on HMRC moving records from the self assessment system CESA to its ETMP platform so current system is probably with us for a while yet.

One impact of the previous regime was if taxpayers got years behind with returns, because the penalties were max £200 per year HMRC debt management didn’t chase very actively. They do now with the amount being £1,600. It would be interesting to have better stats on what happens to the up to 1m cases where the filing deadline is missed, do they file and if so how late, how many of the returns are subsequently withdrawn as not required?

In Dec 2022 I received a £100 penalty for a late submission of my 2020-21 tax return as it was apparently 3 months late. I do not understand why HMRC decided in October 2022 that I needed to complete a tax return for the previous year, I was a basic rate tax payer, paid all my tax through PAYE and didn’t receive notification of the need to complete a return. I was completing a tax return for the year 2021-22 due to the high income child benefit charge which was submitted and paid on time. I have since completed the 20/21 tax return and I apparently owe £1.60!! – surely this is a rounding issue on payroll? My appeal against the fine has been rejected with HMRC stating that I should have been aware that I owed tax!

I am not happy to pay a penalty for a late submission of a tax return I was not reasonably expected to complete.

Picking up on these two comments – the first split I would have thought would be useful would be between:

a) those where something went wrong with the PAYE process (whether bad data from employers, multiple jobs etc or HMRC errors)

b) those who have “non-standard” income (foreign, trusts etc), which is not coped with by the SA system.

One can understand that these non-standard sources are sufficiently rare/heterogenous that it may involve disproportionate expense to program them.

In which case can these be priorities for simplifying the law, or adding simplified solutions to the system such as the £300 for dividends from foreign companies.

There might even be a case for education (Dan via weekend newspapers?) to discourage people having such sources of income, or facilitating conversion of them so simpler structures, E.g. offshore trusts into standard onshore products?

Apologies for the long comment, but I think the quotes below are illustrative. Hope the links below work – the archive of the HMRC website is not the easiest to navigate.

I am driven to the conclusion that the unfairness of fixed penalties for late filing of income tax returns (whatever the tax due) is deliberate – or at least consciously careless – because the previous system was perceived as too administratively burdensome, and HMRC wanted a bigger stick to beat taxpayers with.

There certainly was a case for rationalising the penalty regimes after the IR and HMCE merger, but this particular issue was raised with HMRC when it was proposed in 2008. See for example para 4.4.1 onwards here: https://www.litrg.org.uk/sites/default/files/files/080912-LITRG-response-obligations-file-pay-FINAL.pdf

And in particular para 4.4.6 “If fixed penalties are no longer to be capped by reference to the tax due, some means must be found of protecting those who are not abusing the system and who may well perceive as unfair the charging a penalty where absolutely nothing is lost to the Exchequer.”

And see the consultation document from June 2008: https://webarchive.nationalarchives.gov.uk/ukgwa/20090221094659mp_/http://customs.hmrc.gov.uk/channelsPortalWebApp/downloadFile?contentID=HMCE_PROD1_028673

Para 6.8: “However, there is evidence that capping has had a significant unintended effect on behaviour; some taxpayers make an estimated payment of tax due by the filing date and then delay filing the return until later. Others choose not to submit a return at all if they have no liability as they know the penalty will be reduced to zero. For ITSA alone, of the 1.7 million penalties issued in 2006/07, 917,000 (over half) were capped. This can lead to a lot of extra work for HMRC to encourage taxpayers to send in those returns that may be better used elsewhere. All of this means that the effectiveness of the penalty for failing to file on time is significantly reduced.”

And para 6.20: “There are weaknesses in the current regimes in terms of their cost effectiveness to administer (including enforcing payment of the penalty). Fixed late or non filing penalties charged as soon as a return is late have the benefit of simplicity and reinforce the obligation. But, they do result in many more penalty notices being issued which leads to appeal and increases the burden on the taxpayer and HMRC. For example some 150,000 (around 9%) of the 1.7 million penalties issued for failing to submit a return by the due date in 2006/07 were cancelled on appeal.

Also this summary of responses from April 2009, and in particular, para 5.14 to 5.16 here: https://webarchive.nationalarchives.gov.uk/ukgwa/20090606004353mp_/http://customs.hmrc.gov.uk/channelsPortalWebApp/downloadFile?contentID=HMCE_PROD1_029450

“5.14 … Several respondents expressed concerns at the proposal to remove the capping of late filing penalties to the amount of tax unpaid. .Concerns were raised that this could lead to penalties being imposed on vulnerable groups. … HMRC recognises these concerns, but believes that

it is better to focus resources on supporting taxpayers from vulnerable groups to meet their obligations than cap all late filing penalties to the amount of tax unpaid. …

5.15 In order to keep the filing message simple, it is important not to introduce confusion by allowing periods of grace or relating the penalty to whether tax had been paid. The proposals for improved support mentioned above and other initiatives such as rewriting guidance in

plain English and designing an enhanced service to pensioners, all give particular attention to those on low incomes.”

Well, fine, but notwithstanding any enhanced support or rewritten guidance, the upshot is that disproportionately large fixed penalties may be imposed automatically on individuals with no or little tax to pay. (At least we don’t yet have something like the ridiculously high FBAR penalties in the US, which the US Supreme Court recently declined to review for compliance with the prohibition on “excessive fines” under the 8th Amendment.)

Quick addendum. I’ve seen it suggested that the fixed automatic penalties for late filing was driven by behavioural insights. Essentially, it is a “nudge” to file on time, even if no tax is due. If so, that means the very sharp edges and disproportionate impact are the result of a deliberate policy choice.

I suspect the people responsible for making this sort of policy decision do not understand the impact that a penalty of this size can have on the precarious finances of a person whose taxable income falls below the personal allowance.

I mean, surely £100 is just like a speeding fine? Or a few rounds of drinks? Or a dinner at a nice restaurant?

Things look very different if your income is under £12,000 – particularly if you are used to everything being deducted under PAYE.

Quick further comment on FBAR – the US Supreme Court declined to hear Toth’s case earlier this year (the taxpayer was trying to argue that the swingeing tax-geared penalties for willful failure to disclose foreign bank accounts – amounting that case to half the funds, several million dollars – were excessive fines and so unconstitutional) but more recently ruled in favour of the taxpayer in Bittner, that the fixed penalty for non-willful failure is a US$10,000 fine per return, not per bank account (again, making a difference of several million dollars, when several years were included).

I’m sure I’m not the only one who received no notification at all of the £100 late penalty (one day late), nor of the consequent £300 penalty. The first notice I had that any penalty hD been imposed was when it reached £1600.

My appeal was successful (I did pay the first £100, but the following penalties were “wiped”)

However 2 years later HMRC started chasing me for the same penalties again. Someone had failed to remove them from the system!

A phone call was insufficient to resolve it, so formal letters had to be sent with copies of the appeal success letter, before the matter was finally (I hope) resolved.