The hundreds of victims of the Post Office scandal are finally receiving compensation for the appalling treatment they received – including malicious prosecution, jail and asset seizures. But much of the compensation could be taken in tax, the Post Office settlement offers don’t properly explain this, and victims could end up in default to HMRC. It’s a scandal on top of a scandal, and the Government should act.

UPDATE: as of 19 June 2023, it looks very much like this has now been solved

UPDATE 14 March: the Government responds, and says they’ll fix the “compression” effect where postmasters receiving multiple years of lost income in one go get pushed into a higher tax bracket. But no sign of a general exemption. Disappointing.

UPDATE 27 Feb: the Post Office has finally responded in a letter to The Times – but much too slow, no acknowledgement of responsibility, and an inadequate compensation principle. These people have lost much more than money, and the compensation should reflect that. And it should certainly compensate for additional tax they suffer as a result of receiving multiple years’ income in one year. These practicalities are quite aside from the moral case for a complete tax exemption.

UPDATE 23 Feb: Regulations have been published creating a tax exemption for wrongly convicted postmasters, and those who claimed under the GLO settlement. But not yet anything for the people discussed in this piece, who are claiming under the Historical Shortfall Scheme or the Suspension Remuneration Review. There are hundreds.

UPDATE 22 Feb: Times column by me here. And a very fast, and promising, response from Kevin Hollinrake MP (the responsible Minister) here.

The Post Office scandal

Between 2000 and 2013, the Post Office falsely accused more than 700 branch managers of theft.1When I wrote this article I was significantly understating the number. We don’t have the full figures, but it is likely around 3,000.Some went to prison. Many had their assets seized and their reputations shredded. Marriages and livelihoods were destroyed, and at least 33 have now died, never receiving an apology or recompense. These prosecutions were on the basis of financial discrepancies reported by a computer accounting system called Horizon. The Post Office2Not to be confused with the Royal Mail – the Post Office wasn’t privatised and is owned wholly by the Government. Primary responsibility for the scandal rests with the Post Office alone, but successive governments (since the 2000s) share responsibility for not responding to early reports in Private Eye and Computer Weekly knew from the start that there were serious problems with the Horizon system, but covered it up, and proceeded with aggressive prosecutions based on unreliable data. It’s beyond shocking, and there should be criminal prosecutions of those responsible.

The tax problem

Many of the victims of the scandal are now entering into settlement agreements with the Post Office (under the “Historical Shortfall Scheme“), and receiving compensation. The Daily Mail (which previously played an important role in bringing the scandal to public attention) reported on Thursday that much of this compensation is disappearing in tax, and has kindly shared with me the terms of one settlement (with the relevant victim’s permission).3I have relied heavily upon other tax professionals who have provided input on these points – they are much more expert in these matters than I am – but, as ever, any mistakes are mine and mine alone.

My conclusion is that the Mail is right. I fear that the tax impact of the settlements on the victims has not been thought-through and, as a consequence, much of the compensation will disappear in tax. There are two big issues:

No tax advice

- The tax treatment of compensation is a complicated area, but the victims are being left to their own devices. The Post Office settlement offers suggest victims may wish to obtain tax advice, but don’t cover the cost4The cost of reasonable legal advice is covered – see paragraph 44 of this document, but tax advice is not covered, and the claimant firms involved may not have the capability to provide complex tax advice, and the settlement agreements seem to have been structured in a way that creates an unnecessarily bad tax result for the victims.

Compensation for loss of earnings is fully taxable

- Much of the payments are compensation for loss of earnings. This is taxable in the same way as normal earnings, and the Post Office will operate PAYE. The problem is that, unlike normal earnings, multiple years are being taxed at the same time, pushing the victim into a high tax bracket. For example: a postmaster earning £30k ordinarily takes home about £25k after tax. But if that same postmaster receives ten years’ worth of earnings in one payment, of that £300k they’ll take home not £250k, but £170k. The “compression” of many years of income into one year costs them £80k. That’s an unjust result.5A small compensation for this will be that many of those affected will be past retirement age, and so won’t pay national insurance – that will save them around £9,500 of tax.

- There were two ways to deal with this: (1) structure the compensation in a way that reflects the main harm suffered and also isn’t taxable (for example as damages for defamation or an economic tort)6Is that tax avoidance? In some circumstances changing a document to achieve a different tax result absolutely is. However in this case, given it is a fair way to view the compensation, and results in a more just outcome, I’d say the answer is “no”. Loss of earnings is perhaps the least significant harm the victims suffered. And structuring the compensation in this way would also be technically hard for HMRC to challenge (in the unlikely event they’d want to). , or (2) increase the compensation to make up for the additional tax. This is the approach a court would adopt when calculating damages – the ‘Gourley principle‘ – putting a claimant into the same after-tax position they would have been in had there been no breach.7In this case, using the same example figures, it would mean increasing the compensation from £300k to somewhere around £440k.. Neither of these steps appears to have been taken.

The large interest element is fully taxable

- Because the compensation is covering events from many years ago (20 years in some cases), a large amount of the compensation is interest (often a six-figure sum). This will be fully taxable for the victims. 20% of the tax will be withheld by the Post Office. The remainder (another 20%-25% of tax) will be payable by the victims on their self assessment return. They are not being warned about this and may receive a nasty surprise. I am very concerned that some of the victims won’t obtain tax advice, won’t declare the interest on their tax return, and so could fall into default with HMRC. That would be an unconscionable outcome.

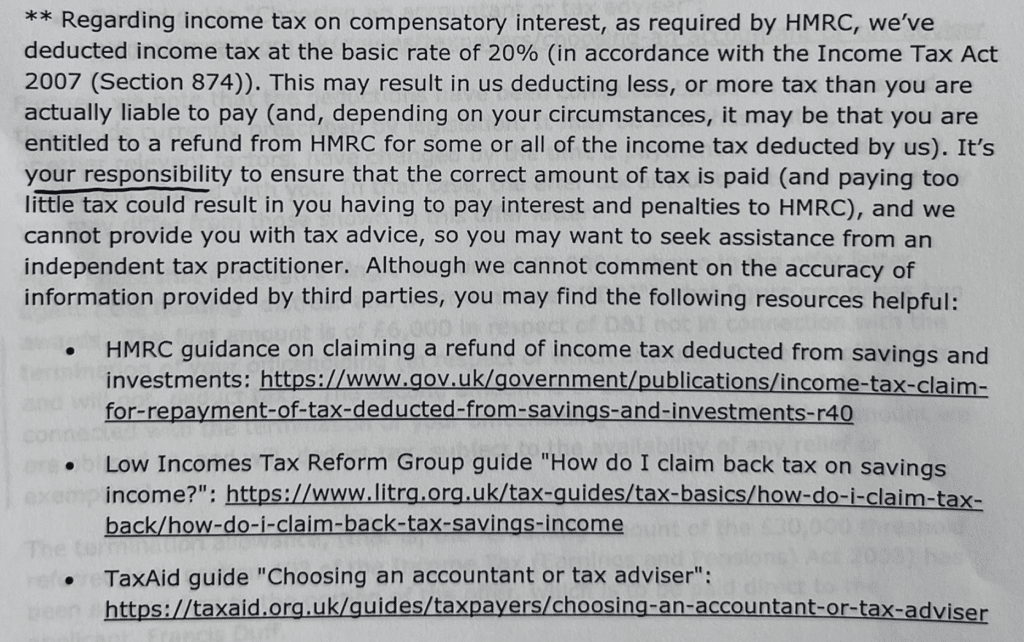

- The settlement offer mentions tax on interest, but the wording appears to be standard “boilerplate” which in the case I saw (and I expect many others) is incorrect and misleading:

- Why “incorrect”? Because, even if this individual had no other income, it is mathematically impossible that they’d be entitled to a refund of the 20% tax withheld, and mathematically certain they will have significant additional liability. I don’t understand why anyone thought this text was acceptable. It is actively misleading.

- What it should say is something like: “we’ve deducted income tax at the basic rate of 20%; given the compensation amounts you are receiving, you will have additional liability of somewhere over 20% which you will need to declare and pay in your self assessment. We will cover the reasonable costs of you obtaining tax advice from one of the following firms…”

- The more fundamental point: it’s fair for interest to be taxed when it’s a financial return; not when it reflects the time passed since an injury was suffered. For this reason, interest on personal injury damages/compensation is exempt from tax. The Post Office’s victims have suffered injuries similar in many ways to personal injury, but this exemption won’t apply. And then there’s, once more, the effect of compressing many years’ income into one year. That seems unjust.

Some of these problems could be fixed going forwards: ensure claimants receive proper tax advice (before and after the event), paid for by the Post Office, and ensure that the settlements appropriately account for tax considerations. The GLO scheme will be able to take account of these issues, and certainly should do.

But it’s too late for the hundreds of settlement agreements that have already been signed, and there’s no obvious solution to the interest on future settlements/payments being taxed. A better solution is needed.

The solution

There is a simple solution – this year’s Finance Bill should include two8My original draft said we should also consider denying the Post Office tax relief for its compensation payments. That was the approach in 2015 when the banks were making large compensation payments for their past misconduct. However, on reflection, this would be a token gesture – the Post Office cannot afford to meet the existing claims, and is having to be funded by the Government. Denying tax relief would just necessitate more Government funding – we’d be pointlessly throwing money in a circle. clauses:

- All the victims of the scandal should be exempt from tax on compensation payments they receive (whether under the original GLO, the Historical Shortfall Scheme, the Suspension Remuneration Review, the GLO scheme or otherwise). The exemption should be retrospective to the first date that settlements were made. This has already been announced for postmasters with quashed convictions, but needs to apply to all victims.

- All compensation should be calculated as if the exemption does not exist. The Post Office does not appear to have followed the Gourley principle in its settlements to date, but the creation of an exemption could enable it to reduce settlements still further in the future. So it’s important to prevent this.

If this cannot be achieved then the Post Office should, at an absolute minimum, take responsibility for what appear to be serious failings in its past settlements. It should make sure that the Gourley principle applies (to compensate for compression effects on both damages and interest), and pay for victims to receive proper tax advice (both before the settlements and when they come to file their tax returns). The Post Office should do this out of goodwill. If it does not, then it will potentially be open to past settlements being reopened, on the grounds that it made false statements in its settlement offers.

And, needless to say, future settlements (under either scheme) should give full consideration to the tax impact.

Why should the Post Office victims be treated differently from others receiving compensation?

This is a highly unusual situation. We have large numbers of people who, many years ago, suffered a grave injustice at the hands of a company wholly owned by the Government. The Government, therefore, has a special responsibility to ensure that they do not suffer more injustice. This principle was acknowledged by the Government back in December 2022, when it announced it would legislate so compensation payments were disregarded for benefits purposes, and in September when it announced that postmasters with quashed convictions would pay no tax on their compensation. The same principle should apply to all victims of the scandal – including those under the Historical Shortfall Scheme or the Suspension Remuneration Review.

And there are other precedents. Settlement payments for the Thalidomide scandal were (very belatedly), exempted from tax. Compensation payments for missold pensions were exempted from tax 9See section 148 Finance Act 1996. See also the way that “Financial Assistance Scheme” payments for members of insolvent defined benefit schemes were taxed as if the payments were made in previous years, rather than compressed into the year of payment – the quote at section 6.2 of this House of Commons Library document explains it

Many thanks to everyone who helped with this piece, particularly Ray McCann, Judith Freedman and M. And thanks, as ever, to J. Without their technical tax expertise and practical advice, I could not have written this piece. All mistakes, however, are mine.

Thanks to Tom Witherow at the Daily Mail for highlighting the issue and bringing it to my attention. And credit to Jac Roper (who I don’t know) for an article she published last year raising the point, but which I missed at the time.

Photo by Stable Diffusion, “a photo of a statue of lady justice holding a cash register”.

-

1When I wrote this article I was significantly understating the number. We don’t have the full figures, but it is likely around 3,000.

-

2Not to be confused with the Royal Mail – the Post Office wasn’t privatised and is owned wholly by the Government. Primary responsibility for the scandal rests with the Post Office alone, but successive governments (since the 2000s) share responsibility for not responding to early reports in Private Eye and Computer Weekly

-

3I have relied heavily upon other tax professionals who have provided input on these points – they are much more expert in these matters than I am – but, as ever, any mistakes are mine and mine alone.

-

4The cost of reasonable legal advice is covered – see paragraph 44 of this document, but tax advice is not covered, and the claimant firms involved may not have the capability to provide complex tax advice

-

5A small compensation for this will be that many of those affected will be past retirement age, and so won’t pay national insurance – that will save them around £9,500 of tax

-

6Is that tax avoidance? In some circumstances changing a document to achieve a different tax result absolutely is. However in this case, given it is a fair way to view the compensation, and results in a more just outcome, I’d say the answer is “no”. Loss of earnings is perhaps the least significant harm the victims suffered. And structuring the compensation in this way would also be technically hard for HMRC to challenge (in the unlikely event they’d want to).

-

7In this case, using the same example figures, it would mean increasing the compensation from £300k to somewhere around £440k.

-

8My original draft said we should also consider denying the Post Office tax relief for its compensation payments. That was the approach in 2015 when the banks were making large compensation payments for their past misconduct. However, on reflection, this would be a token gesture – the Post Office cannot afford to meet the existing claims, and is having to be funded by the Government. Denying tax relief would just necessitate more Government funding – we’d be pointlessly throwing money in a circle.

-

9See section 148 Finance Act 1996. See also the way that “Financial Assistance Scheme” payments for members of insolvent defined benefit schemes were taxed as if the payments were made in previous years, rather than compressed into the year of payment – the quote at section 6.2 of this House of Commons Library document explains it

Comment policy

This website has benefited from some amazingly insightful comments, some of which have materially advanced our work. Comments are open, but we are really looking for comments which advance the debate – e.g. by specific criticisms, additions, or comments on the article (particularly technical tax comments, or comments from people with practical experience in the area). I love reading emails thanking us for our work, but I will delete those when they’re comments – just so people can clearly see the more technical comments. I will also delete comments which are political in nature.

10 responses to “The tax scandal within the Post Office scandal, and how to fix it.”

my brother was also a victim and became very ill has been receiving in receipt of Personal Independence Payment ( PIP ) and Disability Living Allowance (DLA) and if accepts compensation will this effect his benefit. Dose any one had any idea.

he had stroke and heart attack and lost his family.

Hi I have accepted an offer by the Historical Shortfall Scheme.

Settlement figure 159,000 net

They have deducted the following 20% tax deduction.

Less income tax deducted on compensatory interest ref Shortfall losses.£20,000

Less income tax withheld £ 24,000 in respect of losses and distress.

Any advice. I am no longer self employed since 2003. Since worked for the council. Married and only my wage as wife is unable to work.

Hi Dan

Is there a reason why compensation payments don’t have similar status to lottery winnings? Would there be a downside to such a move, and would there need to be a change in the law?

(Apologies if I missed this in the piece)

Gambling is completely tax exempt – partly for historic reasons, partly because more people lose than win, so it’s in HMRC’s interest to stop people claiming loss relief (and the consequence of that is that winnings are not taxed)

I was affected in 2011 by my Pension Provider going into bankruptcy. This afterwards became a matter for the FSCS and after many years and a long drawn out dispute with the FSCS by our group (Arm Investors Group) we received compensation which was not liable for tax. Whether or not this was taken into account by the FSCS I do not know but it was certainly a concern by those who had lost considerable sums.

The FSCS is a Government Agency so it ia the Government that provides the compensation in the hope that some of their payment can be recovered. This may not be certain although I am sure that the FSCS will have a detailed knowledge of the matter.

Whether this has any relevance or helps I do not know but I do know the tax was a matter to be concerned about.

Denying the PO tax relief on the compensation payments it makes won’t achieve any benefit for the taxpayer. The PO is effectively bankrupt and the Government has already had to inject £1M or so to keep it afloat. All the compensation for Subpostmasters, which they richly deserve, is being funded by the taxpayer.

On reflection I agree, and have amended my piece. Thank you.

Congratulations on raising this scandal.

Whoever at the Post Office/ Government negotiated this settlement were either “careless” in not recognising this tax liability or were well aware of it.

Either way they need to be identified and individually held to account.

Could hmrc do a extrastatutory concession to cover this

Unfortunately not – the law is clear that the payments are taxable, and only legislation can reverse that.