Updated: raising corporation tax to 25% will take the effective rate to the highest it’s ever been in the UK, and one the highest in the developed world. That’s bad – but the alternatives are worse.

The Johnson government increased corporation tax from 19% to 25% from April 2023. The mini-Budget reversed this. Then Jeremy Hunt’s Autumn Statement reversed the reversal, taking the rate back to 25% from April. Not a hugely stable environment for business. But how should we assess the merits of the increase to 25%? Should we reverse the reversal of the reversal?

The standard argument for the increase goes something like this:

“We’ve been cutting corporate tax for 25 years, it’s gone too far, and it’s time to go back to 25%. After all, the rate was 33% in the 80s, and is now 19%, so 25% is still a pretty good deal.”

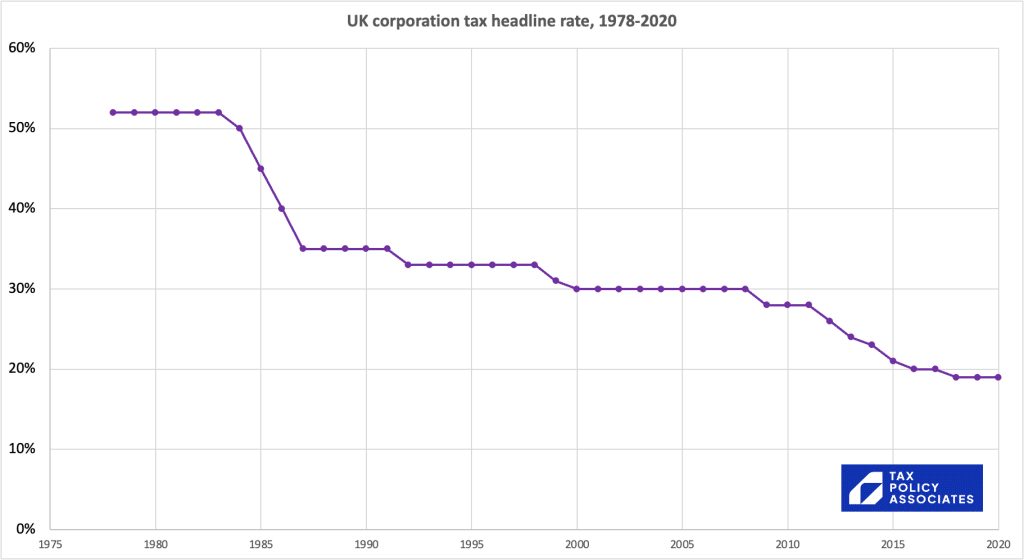

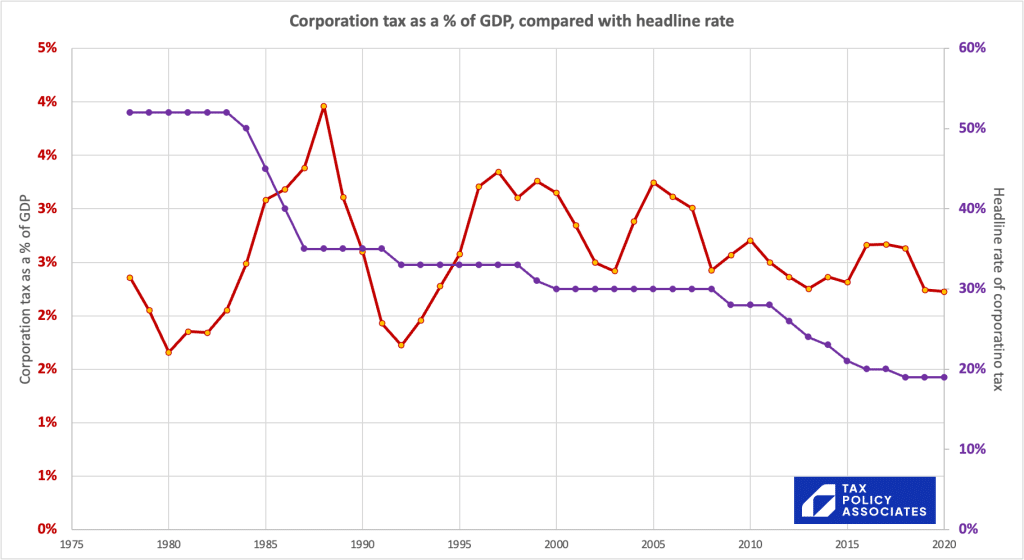

That argument is usually accompanied by this chart, showing the headline rate falling dramatically:

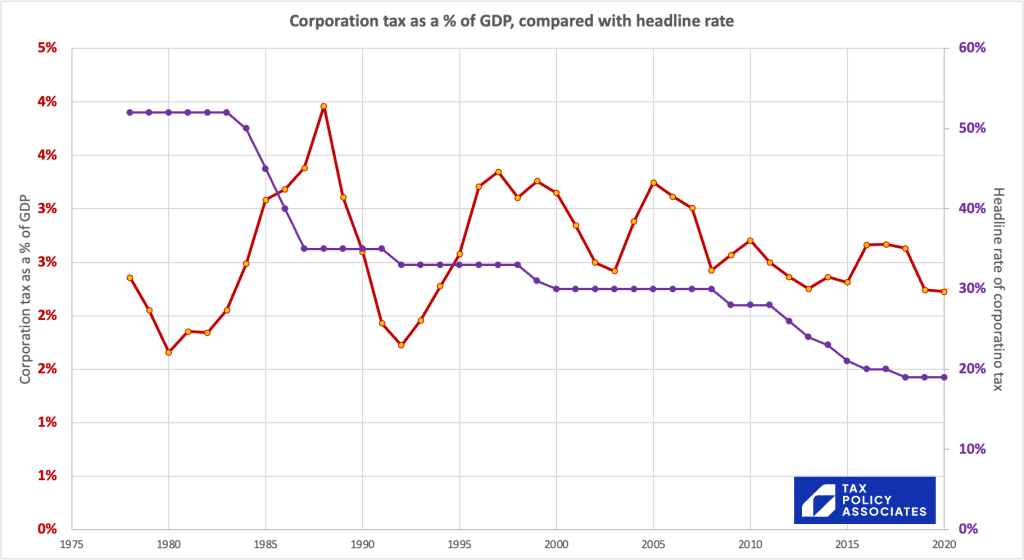

This is rather less persuasive if we look at the corporate tax actually paid – here’s an overlay showing UK corporation tax receipts (in red) as a % of GDP:

The rate fell. The revenues bounced around with the business cycle, but fundamentally didn’t change much, if at all.

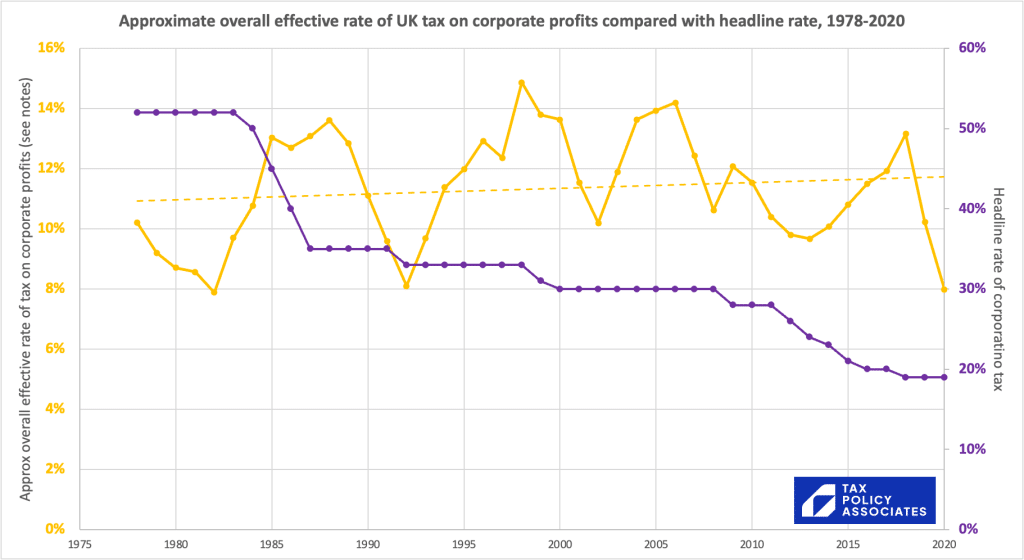

Could it just be that corporate profits rose, so the declining rate multiplied by increased profits kept revenues broadly constant? We can test that by dividing corporation tax revenues by the corporate “gross operating surplus” in the national accounts, which gives us a reasonable proxy for the overall effective tax rate.1Two big caveats: (1) GOS is not the same as accounting profit, and in particular excludes depreciation (so the chart understates ETR), (2) the tax stats are for cash collected by HMRC in a tax year, which used to lag profits by around a year, and now mainly doesn’t – neither factor should affect the overall trend, but both will create/mask considerable noise. With some work they could be corrected, and I’d love it if someone did that. Again we see that the plummeting headline rate does not lead to much, or perhaps any, reduction in the actual effective rate (particularly bearing in mind that the 2020 figures are depressed by Covid).2I’ve added a trendline which shows a slight increase over time, but I’d be hesitant to draw too many conclusions given the large fluctuations across the business cycle:

How can the tax take remain the same when the rate has fallen so dramatically? Because of a series of technical changes that meant that, at each stage when the rate went down, the tax base (the definition of “profits” to which the rate applies) expanded. Tax = rate x base. So, through accident or brilliant HM Treasury design, nothing much changed.3Another factor is that a wave of incorporation by small businesses has artificially inflated corporation tax revenues, but at the cost of (greater) reductions in income tax. This effect, however, is too small to impact the trends visible in the charts above – it’s about £1bn.

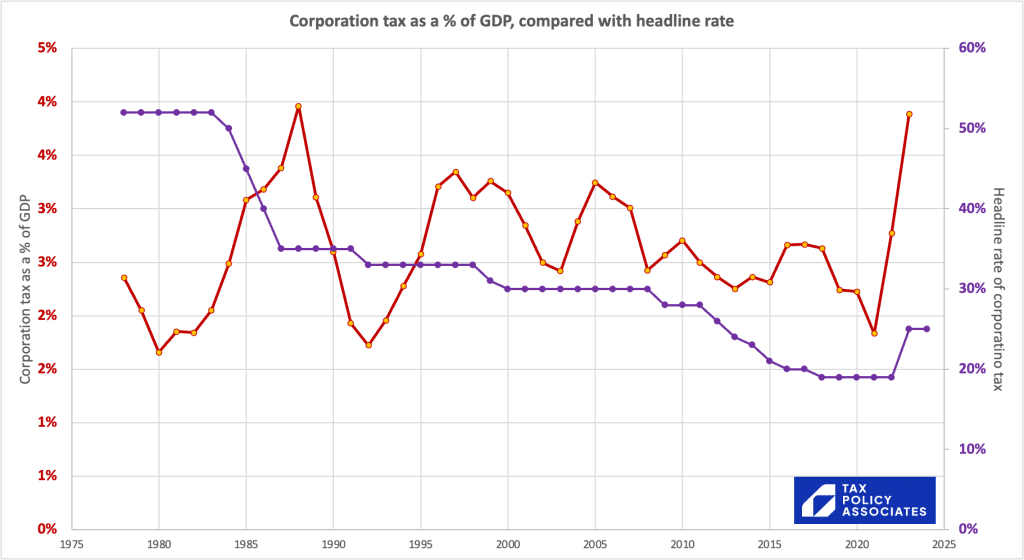

The rate increase to 25% is, by contrast, accompanied by nothing that reduces the tax base. It will therefore simply represent a 1/3 increase in the amount of tax companies pay, making our chart look like this:4It would have gone higher than this, because this chart doesn’t include the effect of the bank surcharge, which at 8% would have meant banks would have been be paying 33% on their profits. However, controversially but sensibly, the increase to 25% was accompanied by a reduction in the surcharge to 3%

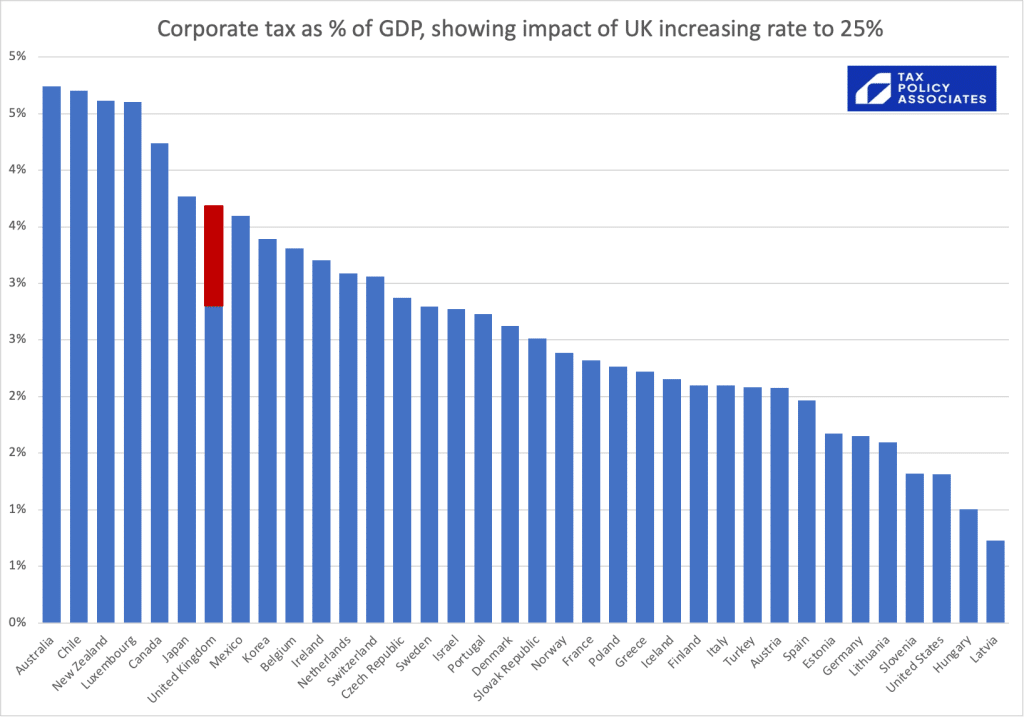

And UK corporate tax will, as a % of GDP, become one of the highest in the developed world – of large economies, only Japan and Canada’s would be higher:5And Canada, like Australia, is driven by the high tax revenues from mining/oil/gas

So I am convinced that raising corporate tax is a bad idea. The problem, however, is that the 25% increase was “banked” in government accounts, and the cancellation of the increase in the mini-Budget was unfunded. The £16bn+ it costs would therefore have been distributed opaquely throughout society through inflation and/or higher interest rates. I don’t regard that as good tax policy.

Alternatively one could keep the rate at 19% by cutting spending, or raising taxes elsewhere – that would certainly be a rational position to take (whether you agree with it or not), but it’s an argument that I don’t hear anyone making.

And, finally, you could argue that increasing the rate to 25% will actually bring in no more revenue, because profits will drop – in other words, the 25% is past the “revenue maximising point”. The problem with this is that there’s no evidence for it in the response to previous rate reductions.

So taking the rate to 25% feels like the least bad of several bad ideas. I therefore unenthusiastically support it.

10 responses to “Why the 25% corporation tax increase is a bad idea which I support”

It is extraordinary the amount of attention that corporation tax gets, despite it being a relatively small part of the overall tax take – typically below 10%, and well behind any of the “big three”, income tax, NICs and VAT. But I suppose salience is not related to overall amounts, otherwise people would not be so worried about inheritance tax or fuel duties.

Clearly the headline rate of corporate income taxes is an important signal, particularly for internationally mobile businesses that could be based in Rotterdam or anywhere, and it is one reason why multinational companies choose Dublin over London. But it is only one factor among many, and many businesses choose the UK or Luxembourg or the Netherlands over Jersey or Cayman.

Broadening the base and lowering the rate is usually a good approach (one that our antiquated inheritance tax would benefit from) but I see corporation tax largely as an anti-avoidance measure, so it is odd that the headline rate of corporation tax should be lower than the basic rate of income tax, and much lower than the higher and additional rates or even the basic rate when NICs is added (I would make a similar argument for increasing the rates of capital gains tax, perhaps to a flat 30% but ideally aligning with income tax). In my experience, few businesses or advisers were demanding a 19% rate of corporation tax, and the OECD’s Pillar 2 proposals for a minimum 15% tax show the “race to the bottom” on rates may be arrested for some time. On balance, 25% feels like a sensible place to be.

I understand why you might want to compare corporation tax revenues to GDP, but the rather odd way the latter is estimated (not just the enormous value of what is left out, but I learned today that around 10% of UK GDP is imputed rents on owner occupied properties) and the distortions caused by tax reliefs (losses, capital allowances, share options) and exemptions (dividends, branches, shareholdings) make the link rather less than direct. Is it so terrible for the UK to be in the same company as Australia, New Zealand, Luxembourg, and Canada, rather than Israel and Portugal?

Less than £250,000 Profit it remains at 19%

So I will configure my company to pay 19%

that wouldn’t make sense. It’s not like VAT – exceed the threshold and everything pays tax at 25%. The rate smoothly curves. You are always better off making an additional £1 of profit

It might be worth considering a lower rate for smaller businesses who see Corporation Tax as a big concern. They are not blessed with tax advisors and their salary/dividends are counted for Corporation Tax and then taxed as personal income.

Removal of the CT element enables investment in people and equipment.

When the rate goes up to 25%, they will be re-introducing the lower rate for small businesses. The problem with this is that you then need a series of fairly complex rules to prevent people from fragmenting a business across multiple separate companies, and claiming the small company rate for each one. That has historically led to significant uncertainty for normal companies, and avoidance by the usual suspects. Suffice to say, I am not a huge fan!

I believe they’re going back to a pre-2014 style system to “associated companies” dividing up the allowance between them. This is going to be quite entertaining with an increasingly common setup of having two Ltd companies – one for trade, and one for investment/buy-to-let (that doesn’t qualify under the tight “passive” company rules), since the £50k taper band will get divided down to £25k and folks controlling companies with a lot of trade and relatively lower investment income (or vice versa) will end up paying even more corporation tax than expected. If folks own multiple Ltd companies, it gets divided down even more.

Except as an admirative convenance to get at shareholders’ income that might not be reported, why tax busines income at all? At best (all business income is treated exactly the same except for timing of realization) we are taking shareholders with different marginal tax rate at the same rate. But more important, business tax codes are littered with special treatment for and endless variety of “good” uses of business income, especially investment is favored activities. Abolish it, impute business income to shareholders, raise personal income tax rates, and allow greater deductions for contribution to savings schemes (with the same rates being applied to withdrawals).

several reasons: (1) taxing individual shareholders is hard, particularly if they are foreign; (2) it creates wonderful avoidance opportunities for individuals to shift their income into companies and either defer tax or pay no tax.

A number of countries have a withholding tax on dividends paid to non-residents. It isn’t clear to me why the UK doesn’t. Non-residents can invest in UK companies, benefit from no UK tax on the dividends issued to them and no UK tax on any gains on sale of the shares. So the money relating to those shares ultimately vanishes offshore with no benefit to the UK exchequer.

Can we see a graph of the amount of corporate tax raised in every financial year along with the tax rate?