As inews has reported, Ian Lavery MP has refused to confirm whether he paid tax on £140,000 of irregular and uncommercial payments from his former union. He says all his tax affairs are up-to-date, but refuses to comment on the specific question of these payments. That is the same answer I received from Nadhim Zahawi back in July, and it’s not good enough.

I should say up-front: credit for this story goes to David Parsley from inews and the senior tax accountant who worked with him. I stand behind the story, and provided some assistance. Please read the inews story for full background.

Normally we wouldn’t think to ask if someone paid tax on their income, and it wouldn’t be remotely fair or sensible to ask this kind of question of every MP, or everyone in a public position. However this £140,000 is different.

The background

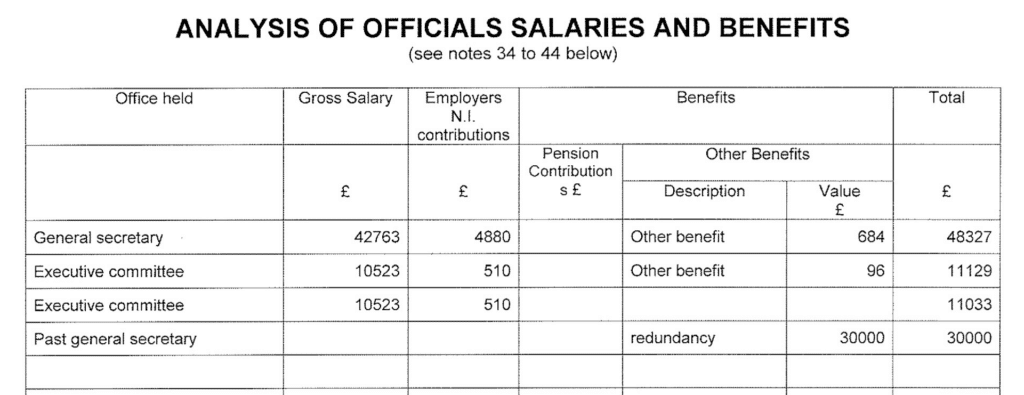

The Certification Office for Trade Unions & Employers’ Associations reported back in 2017 on financial irregularities in the Northumberland NUM, of which Mr Lavery was General Secretary. The BBC reported on it, as did the Guardian.

Here’s a short summary of what happened – but the Certification Officer report, and inews report, are well worth reading in full:

- Mr Lavery received a “redundancy payment” when as a legal matter he was not made redundant – he left the union because he became an MP.

- There was a peculiar arrangement whereby the union compensated Mr Lavery and his wife for the underperformance of an endowment policy that Mr Lavery and his wife (not the union) had invested in.

- Mr Lavery received loan write-offs of £91,5451corrected – first version said £90,454 – this is highly unusual for an employee.

- The union (in the words of the Certification Officer’s report) “in effect purchased a share in its General Secretary’s home”, again contrary to usual commercial and trade union practice.

This was all in 2005-20132corrected – first version said 2005-2012. No proper explanation or justification has ever been provided for these arrangements. The Certification Officer did not appoint an inspector to fully investigate (because he thought there would be insufficient financial records to facilitate an investigation). No prosecution was brought (or, as far as I am aware, contemplated). I will let others judge the propriety of the arrangements, and focus on the tax consequences.

The tax treatment of the payments

The experienced accountants working with inews say the loan write-offs and “redundancy payments” should have been fully taxable. I have reviewed the documentation and agree with this conclusion.

Note that there is usually an exemption for the first £30,000 of redundancy payments3Technically it’s more complicated than that, as Andrew ably explains in the comment below, but for practical purposes most people call it an “exemption” and I’ll do that here., but the point is that these were not actually redundancy payments at all – Mr Lavery left his employment to become an MP, and was succeeded as general secretary by Denis Murphy (the former MP for Wansbeck – this was an unusual “job swap”). Note the description in the filed AR21 annual returns for the union:4It seems that at some point an argument was made that Murphy was not a “general secretary” but a “secretary” – that is not consistent with the annual returns

A redundancy, by contrast, is when a job ceases to exist. Calling it a “redundancy” does not make it a redundancy, any more than calling my sister a grapefruit makes her a grapefruit. This was either a reward for his previous work as general secretary, or part of a quid-pro-quo for Mr Lavery’s job swap with Denis Murphy. In either case, the payments were general earnings, subject to income tax and national insurance in the usual way. The union, which Mr Lavery ran at the time, should have applied PAYE.

The loan write-off was more straightforward: fully taxable, no applicable exemptions, and with the income tax payable by Mr Lavery personally (not by PAYE).

In my experience, when people fail to follow correct legal procedures for payments, and/or the payments do not make commercial sense, they often also fail to follow correct tax procedures. That’s true whether the failures are accidental (for example a result of administrative chaos), or intentional. I don’t know which was the case here, and the Certification Office report doesn’t reach any conclusions as to the parties’ motivation.

There are several possibilities:

- Mr Lavery paid tax on the payments in full at the time (or the tax was collected by PAYE) and nobody did anything wrong

- Mr Lavery did not pay the correct tax at the time, and/or the union did not correctly operate PAYE, but the tax was paid subsequently, e.g. as a result of an HMRC enquiry, potentially with “carelessness” or “deliberate” penalties applying.

- Mr Lavery/the union did not pay the correct tax at the time, and still has not.

- I and the senior tax accountant are both wrong, and the payments weren’t taxable. In that case I will happily issue an apology to Mr Lavery and make a donation to charity.

It is reasonable to ask Mr Lavery which of these scenarios we are in. The question is whether the true nature of the payments was disclosed to HMRC (for example the fact that the “redundancy” payment was not a redundancy payment).

Was Mr Lavery under HMRC investigation?

Mr Lavery used the word “enquiry” when speaking to inews, and said HMRC conducted a “desktop review”, but did not explain what that involved. On the other hand, he told the BBC that he has “never been under investigation” by HMRC.

These words all have slightly different meanings:

- An “enquiry” is the process that lets HMRC challenge someone’s tax return within twelve months of it being filed. HMRC does this by giving the taxpayer notice in writing, i.e. a taxpayer should always be aware of an enquiry.

- If HMRC realises it missed something in a tax return, but has passed the twelve month deadline, then HMRC is out of luck.

- But if HMRC discovers information which was not disclosed in a tax return, and suggests the tax was incorrect, they can raise a “discovery assessment”. The deadline for this is usually four years after the end of the tax year, extended to six years where a taxpayer or their advisers have been careless, and twenty years where the taxpayer’s non-disclosure was deliberate5For completeness, the deadline can also be: twelve years for certain offshore cases, and 20 years for a failure to notify of liability (i.e. you never completed a return at all), or where the matter relates to a tax avoidance scheme

- HMRC will review someone’s affairs internally before deciding whether to commence an enquiry or discovery assessment, and that will usually involve correspondence with the taxpayer or their advisers

I think, in the usual English meaning of the word, all of the above would class as an HMRC “investigation”, and that’s how tax advisers would use the word too. So it’s not clear to me how Mr Lavery could have had dealings with HMRC well after the event (2005-2013) unless he was under investigation. Most likely because HMRC were considering whether to raise a discovery assessment – but even the six year time limit would have been challenging at that point.

Why it’s reasonable to expect an explanation

It was the unusual and uncommercial nature of the YouGov and Balshore structure which made me wonder if Mr Zahawi failed to pay all the tax that was due – and it turned out he had not. The unusual and uncommercial nature of the payments to Mr Lavery raises the same questions. The amounts are much less than Mr Zahawi’s but the principle is the same: we expect our representatives to pay the tax that’s due, in the same way millions of ordinary taxpayers do.

The other thing that’s the same is Mr Lavery’s response. inews asked him a very simple question. He should have an equally simple answer: tax was fully paid, and here are the tax returns to prove it. Giving us the same non-answers as Mr Zahawi provided is not good enough.

Mr Zahawi may agree that, in retrospect, it would have been better if he’d provided a proper explanation at the time.

I hope Mr Lavery takes the opportunity to provide us with a proper explanation now.

Thanks to the tax lawyers, tax accountants, employment lawyers and trade unionists who assisted with this report – but most of all, thanks to David Parsley for breaking the story.

-

1corrected – first version said £90,454

-

2corrected – first version said 2005-2012

-

3Technically it’s more complicated than that, as Andrew ably explains in the comment below, but for practical purposes most people call it an “exemption” and I’ll do that here.

-

4It seems that at some point an argument was made that Murphy was not a “general secretary” but a “secretary” – that is not consistent with the annual returns

-

5For completeness, the deadline can also be: twelve years for certain offshore cases, and 20 years for a failure to notify of liability (i.e. you never completed a return at all), or where the matter relates to a tax avoidance scheme

Comment policy

This website has benefited from some amazingly insightful comments, some of which have materially advanced our work. Comments are open, but we are really looking for comments which advance the debate – e.g. by specific criticisms, additions, or comments on the article (particularly technical tax comments, or comments from people with practical experience in the area). I love reading emails thanking us for our work, but I will delete those when they’re comments – just so people can clearly see the more technical comments. I will also delete comments which are political in nature.

23 responses to “Did Ian Lavery MP pay tax on the unexplained £140,000 he received from his former union?”

I am not sure that anyone has got it fully right yet in relation to the loan write-offs, except (an outside chance) Mr Lavery.

1. The iNews report quotes an expert, “a partner in a leading tax advisory firm” who:

“believes Mr Lavery should have paid around £70,000 in relation to the redundancy payments and loan-write offs, added: ‘It is highly unusual to have loan write offs of this magnitude, and not normal business practice.’

These loan write offs are taxable income and assessable on his own personal tax returns. Given the nature of these transactions, Mr Lavery should be able to confirm whether these loan write offs were put on his tax return.”

2. Dan says in his report:

“The experienced accountants working with inews say the loan write-offs and “redundancy payments” should have been fully taxable. I have reviewed the documentation and agree with this conclusion.

The loan write-off was more straightforward: fully taxable, no applicable exemptions, and with the income tax payable by Mr Lavery personally (not by PAYE).”

3. AN other view said in their comment of 10 February 2023

“I agree that if there was a loan written off by the employer, this would be considered general earnings and subject to PAYE.”

4. Thomas (not me) said in a comment of 10 February:

“Possibly asking a silly question but wouldn’t HMRC’s first course of action be to go to the union for the missing PAYE/NIC? I understand there’s a piece on what was disclosed and how in the personal tax return which puts Lavery back on hook, but wouldn’t something similar to the old IR35 rules apply and the primary responsibility go back to the employer? “

To which Dan replied:

“for the “redundancy” payment yes, but the income tax on the loan write-off is solely for the employee”

5. Justin Bryant said in his comment of 11 February:

“Just to be nerdy, this recent case [link under] shows the breadth of taxable employment income re unusual employer payments/benefits and also is it not primarily a PAYE/NIC issue for the employer?”

6. Sam Jones said in their comment of 13 February 2023:

“In my experience loan write offs are not uncommon in connection with redundancy. It is the employer’s responsibility to report and pay any tax (via form P11D).” linking to a page on the HMRC section of the http://www.gov.uk website.

The reason I say “complete” is that only Justin, Thomas and possibly Ian Lavery have mentioned the tax that is National Insurance Contributions (NICs).

Everyone, including me, is agreed that a loan write-off by an employer is charged to income tax on the person to whose employment (including an office) the write-off relates – s 188 Income Tax Earnings and Pensions Act 2003 (ITEPA), part of the benefits code and so not earnings in the ordinary tax sense but “treated as earnings” and so part of “general earnings”.

Some however seem to equate general earnings which are taxable on (generally) the recipient with income to which PAYE must be applied. That is not so.

Section 684(2) ITEPA Item 1 allows “the Commissioners” to make regulations including:

“Provision—

(a) for requiring persons making payments of, or on account of, PAYE income to make, at the relevant time, deductions or repayments of income tax calculated by reference to tax tables prepared by the Commissioners”

and to account for the amounts deducted.

The principal relevant regulation is regulation 21 of the Income Tax (Pay As You Earn) Regulations 2003 (SI 2003/2682) (PAYE Regulations):

“(1) On making a relevant payment to an employee during a tax year, an employer must deduct or repay tax in accordance with these Regulations by reference to the employee’s code, if the employer has one for the employee.”

It is not necessary, fortunately, to go through the regulations which refer you to the hideous mess that is Part 2 of ITEPA (by far the worst of the Tax Law Rewrite Acts) to find out what a “relevant payment” means, as it is clear in my and HMRC’s collective mind that when a loan is written off there is no “payment”, not even a notional one to which PAYE does apply (see s 710 ITEPA), PAYE is not deductible – there is nothing from which to deduct.

As to the employer’s obligation in relation to earnings from which PAYE is not deductible, and here I am assuming that the NUM Northumberland was the employer, even though the loans were made and written off by the National Union of Mineworkers (Northumberland Branch) Provident Fund which the Certification Officer accepts is not part of the Union’s funds* (paragraph 11 of the report), this is limited to making a return at the end of the year to HMRC and to the employee using the Form P11D (regulations 85 and 86 of the PAYE Regulations). The purpose of giving a P11D to the employee is among other things to enable those who are required to make a tax return (which includes all MPs – they, like the clergy and Lloyd’s Underwriters have their own bespoke form of return) to put the correct amount of benefits code earnings on that return.

But as to NICs, Class 1A contributions are required. It is not entirely easy to see why Class 1A and not Class 1 applies to a loan write-off but HMRC think it does, and in fact the webpage linked to by Sam Jones shows this. Class 1A NICs are required to be paid by the employer on the benefits code value of the benefit (unless some other method of calculation is required) and the amount is included on Form P11D(b).

Unlike the position with PAYE there is no way of passing the liability to pay on to the employed earner unless they are an officer of a body corporate (see s 121C Social Security Administration Act 1992). A trade union is not however a body corporate – s 10 Trade Union and Labour Relations (Consolidation) Act 1992 (TULRA)).

Thus

1. is either referring to only to income tax (IT) in which case it is correct, but not complete, or to IT and NICs in which case it is not correct for NICs.

2. ditto.

3. Wrong for IT, but right in the case of NICs.

4. Wrong for IT as Dan points out, though he does not comment on the NICs point which is correct.

5. Wrong in relation to IT, right for NICs.

6. Wrong if tax does not mean NICs only, and tax is not paid “via” a P11D.

Ian Lavery is quoted by iNews as saying:

“All taxes are and were always paid in line with HMRC requirements by myself and my previous employer.”

So that could be himself in relation IT and the employer in relation to Class 1A NICs – *could* be.

John Barnett raised an interesting point on 13 February. The general-secretaryship of a Union undoubtedly is an office – see s 119 TULRA – in the old-fashioned sense of being something which exists independently of the holder. Section 5 is of general application in ITEPA “unless the contrary intention is indicated” (to use a phrase which a Rewrite Act would not). No such intention appears indicated in s 401, so one has to read it as John does as referring to a payment in connection with the termination of a person’s office. I think that it must be read as referring to that person’s tenure, not to the office itself, although the certification officer says that in fact the general-secretaryship was abolished (or itself made redundant) on Lavery’s departure, apparently in an attempt to boost the credentials of the sham “redundancy” argument (see Certification Officer’s Report, Annex paragraph 17).

* Section 467 Income and Corporation Taxes Act 1988 (in force in 2007, but now replaced by ss 981 to 983 Corporation Tax Act 2010) operates on the opposite assumption, that a provident fund is simply a fund of the union, in the same way that the long term assurance fund or a sub-fund of an insurance company is part of the company’s assets, whatever the ring-fencing mechanisms used to surround it for the benefit of policyholders. Section 467 did not however offer any tax exemptions to income or gains used to advance large loans to union general secretaries and then write them off. Had an advance been made to enable Mr Lavery to acquire some new tools to replace those burned or stolen, the exemption would have been available!

Richard, many thanks. I plead guilty to not mentioning NICs on the loan, an act of cowardice on my part given I was not at all sure whose liability it would be! But I think this is a detail

I overlooked reg 86 Social Security Regulations 2001 which provide that a NICs Class 1 liability can be attributed to an employee in much the same way as reg 72 of the PAYE Regulations.

In my experience loan write offs are not uncommon in connection with redundancy. It is the employer’s responsibility to report and pay any tax (via form P11D).

https://www.gov.uk/expenses-and-benefits-loans-provided-to-employees/what-to-report-and-pay#:~:text=Loans%20you%20write%20off,the%20value%20of%20the%20benefit

In this case the loan write-off was four/five years earlier

A couple of small points – which may not make any difference:

– is the general secretary-ship of the union an employment…or an office? May not make any difference given s5 ITEPA, but could make a small difference when read across to the “termination of a person’s [office]” etc. in s401 ITEPA

– An endowment policy being a contract of insurance can, I think, only be taken out in the name of the insured due to insurance law rules on “insurable interest”. At a guess the arrangement related to job-related accommodation for the General Secretary, but was effected in part through an endowment policy which had to be taken out in personal name?

The £30k “exemption” applies to parents on termination of employment (whether by reason of redundancy or otherwise), so while IL was plainly not redundant (and this goes to the commercial legitimacy of the payment), I don’t see that it affects the availability of the “exemption”. It is commonly and legitimately applied in non-redundancy situations. But that’s a very minor point in the sorry story you outline above!

thanks – in this case the wider circumstances I think make clear the payment was either part of Lavery’s “general earnings”, or a quid pro quo for the job swap. so not a true termination payment and the £30k threshold doesn’t apply.

Just to be nerdy, this recent case shows the breadth of taxable employment income re unusual employer payments/benefits and also is it not primarily a PAYE/NIC issue for the employer?

https://www.bailii.org/uk/cases/UKFTT/TC/2023/TC08703.html

I agree that if there was a loan written off by the employer, this would be considered general earnings and subject to PAYE and is in connection with the employment (and would not usually be considered an ex-gratia termination payment eligible for relief under s403 even if it was a genuine termination rather than resignation). If no interest was paid on the loan, a beneficial loan benefit should have been reported on a P11D every year by the employer. It is therefore possible that the employer either reported the loan write off via a PSA with HMRC, or alternatively, failed to meet its reporting obligations and this was subsequently identified by HMRC in a PAYE audit. In either of these situations the employer is likely to settle the additional tax, potentially on a grossed up basis, and the employee may not necessarily be aware of a settlement being made on his behalf. However, there are certainly questions to be answered and the lack of response or clarification, as was the case with Zahawi, raises more suspicions that there is a case to answer here. Either way, it is reasonable to assume that an educated person might ask a suitably qualified adviser the question “do I need to report that £90k that was paid on my behalf”.

Possibly asking a silly question but wouldn’t HMRC’s first course of action be to go to the union for the missing PAYE/NIC? I understand there’s a piece on what was disclosed and how in the personal tax return which puts Lavery back on hook, but wouldn’t something simular to the old IR35 rules apply and the primary responsibility go back to the employer?

(Disclaimer – I am obviously not an employment tax expert!)

for the “redundancy” payment yes, but the income tax on the loan write-off is solely for the employee

People often talk about a £30,000 exemption, but in reality section 403 ITEPA imposes a charge to income tax on payments that are not otherwise taxable. So the first question to ask is whether any of these payments are taxable anyway, for example, as earnings from the employment.

It is only when you get through that with the answer “no” that s.403 ITEPA charges tax on payments in relation to termination (not necessarily just redundancy, although that is the sort of thing within scope), or a change in their duties, or a change in their earnings, if the payments exceed £30,000.

Here is the legislation:

* https://www.legislation.gov.uk/ukpga/2003/1/section/401

* https://www.legislation.gov.uk/ukpga/2003/1/section/403

The HMRC manuals are pretty good on this sort of thing – eg

* https://www.gov.uk/hmrc-internal-manuals/employment-income-manual/eim12810

* https://www.gov.uk/hmrc-internal-manuals/employment-income-manual/eim13000

All of this turns on the facts, so it would be interesting to understand the motivation for each of the payments when they were made. Why was a senior union official granted low or no interest loans of £90,000, and why were they waived? Why was the employer compensating the employee (and their spouse) for their failed investment?

It would, for example, be relatively easy to say “it was agreed that several amounts would be paid to me in connection with the termination of my employment; they were all disclosed to HMRC in my tax return for the year when they were paid, and income tax was paid at the time on that basis”.

If everything has been disclosed to HMRC, and they have concluded that all is well, perhaps there is nothing to see here, on the tax front at least. Union members might have legitimate concerns about how their subscriptions were used, and who was approving these generous arrangements for their former comrade.

thanks, Andrew – you are of course completely correct. Here it seems clear on the facts the payments were remuneration – there was no termination of employment… Lavery resigned when he became an MP. The reason for the payments has never been disclosed – my working assumption is that it was simple additional remuneration. The fact it was only picked up years later suggests to me that it’s unlikely tax was properly paid at the time. The question is whether it was ever properly disclosed/paid.

I’ve obviously not seen the documents and have no idea of what the true facts are. But as a matter of principle, if someone chooses to resign then payments made to them can still fall within the £30,000 exemption if they are not otherwise taxable.

The availablity of that exemption does not depend on the termination being driven by the employer. This is mentioned here (“You may get a termination payment if you: …choose to leave your job): https://www.gov.uk/termination-payments-and-tax-when-you-leave-a-job However, if what you say is right (i.e. that it really is remuneration) then as Andrew explained it would never have fallen within this exemption anyway.

The other thing I’m not clear on from the reporting is whose obligation it is to pay the tax. So if the £30,000 exemption was available but he had received more then the employer (or former employer) would have had to account for the PAYE due:

1. If the payment was paid by his employer then the employer would have to pay the full PAYE and the individual would have no further tax to pay.

2. If it was paid by the ex-employer would have had to account for basic rate tax on the payment (since it was quite a while ago**) and the individual would have been responsible.

** I say quite a while ago as I think the 0T tax code came in around 2011 or 2012 (it was 2012 for shares but I thought cash may have a year changed earlier but I’m getting old now).

There is normally no PAYE when a loan is formally waived and so the tax is paid by the individual (this is not necessarily true with dodgy loan schemes).

Hi and thanks – I’ve updated my piece to reflect these points

Why do the accountants not think the other two items mentioned above (compensation for endowment policy and share of home) are not also taxable?

I think the compensation ended up taking the form of the loan (i.e. already included). The precise legal form of the “share of home” is not clear to me, so I’m hesitant to express a view on the tax – have left it out for now.

Dear Mr Neidle

In the absence of a witchfinder general ( I’m from Lancs so this is welcome), and judging from your phrase ‘on occasion’, with reference to the regularity of your glancing at MPs’ tax forms, do you feel there should be a more rigorous system in place to aid MPs with their tax declarations, as so many of them seem to find these challenging?

I’m not sure – my feeling is that Zahawi and Lavery are, in their very different ways, both exceptional, and that there is not a wider problem.

There seems two layers to this: has Ian Lavery avoided tax? The evidence suggests yes. But also, has the union properly used members funds? I’m not a trade union expert but I have been involved in setting up employee benefit trusts and employee ownership trusts. The trust deeds are generally worded to give a boundary to what the trust funds can be used for. Paying sums towards the head honcho’s mortgage or making pseudo redundancy payments where no legal redundancy is in point, would not tend to be allowed. Presumably the union’s funds are from members’ subs or returns on investments made with members’ subs, and that fund should also be controlled by constitutional documents?

I feel a Companies House rabbit hole may be in my near future, if the union was an incorporated body…

I am certain he didn’t avoid tax. Tax was due; he either paid it or didn’t. But it was definitely due.

Whether the payments were improper/ultra vires is a whole separate question I won’t go into – and I don’t have expertise, so if you don’t mind I won’t approve further comments on the point on this post. The Certification Officer report didn’t refer the matter further because of lack of contemporaneous documentation.

With regard to the legitimacy of the redundancy payment(s), the Job swap with Dennis Murphy is even more dubious when you consider that both The NUM & Wansbeck MP operated out of the same office (7 Ester Court Ashington) both before and after the swap took place.

All they did was swap chairs in the same office which hardly counts as a redundancy.

Strikes me as odd that the “redundancy” was paid as 3 separate payments each £30000 or less, this couldn’t be an attempt to stay under the HMRC radar surely?