Everyone is talking about the £3.7m of tax that Nadhim Zahawi “carelessly” failed to pay. Perhaps not enough people are talking about the cover-up: all the times Mr Zahawi said his taxes were in order, when he surely knew they were not.

UPDATE: this was written on 24 January. Now, on 29 January, we have Sir Laurie’s conclusions, and it appears that Zahawi must have known he was under investigation long before the “early July” timeline in his statement to the Telegraph. Hence the below is a dramatic understatement – we can add to it the many times Zahawi denied he was under investigation.

The statements

Here are ten of Zahawi’s statements, with links to original sources:

- 9 July – to the Times: “All of my business interests were properly dealt with and declared from 2000.”

- 10 July – to the Financial Times: “Zahawi said he has never had an interest in Balshore Investments and that neither he, his wife, nor their children are beneficiaries.”

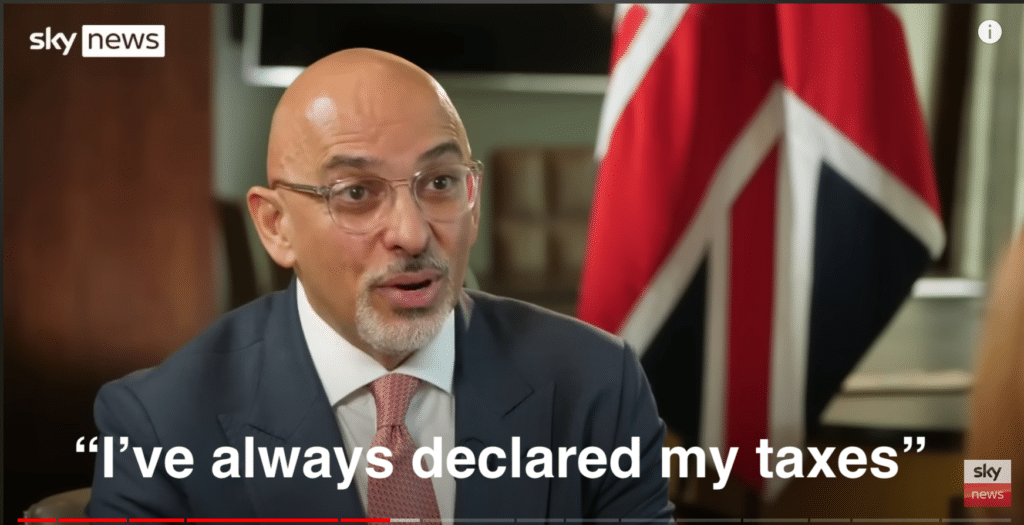

- 10 July – Kay Burley Sky interview: “I’ve always declared my taxes”.

- 10 July – in the same interview: “I don’t benefit from an offshore trust. Nor does my wife. We don’t benefit at all from that”.

- 19 July – Osborne Clarke, Mr Zahawi’s lawyers, write in a letter to me: “our client and his wife and children are not, and never have been, beneficiaries of Balshore or any entities related to it”.

- 24 August – Osborne Clarke writing to me: “Mr Zahawi’s taxes are fully declared and paid in the UK”.

- 13 September – Osborne Clarke writing to me: – “Our client’s taxes are fully declared and paid in the UK”.

- 1 December – Osborne Clarke writing to me: “Our client maintains that he is not the beneficiary of any offshore tax structure, nor has he set up an offshore tax structure for a tax benefit. His taxes are properly declared and paid in the United Kingdom”.

- 18 January – Newsnight – “Mr Zahawi’s tax affairs were and are fully up to date” [my emphasis].

- 15 January – The Sun – he “never had to instruct any lawyers to negotiate with HMRC on his behalf”.

Many, perhaps all, of these statements must have been false and/or misleading at the time Mr Zahawi made them, and he must have known that. This was the cover-up.

How can we be sure these statements were false/misleading?

There are still lots of gaps in our knowledge, but we know this for sure about the timing:

- Mr Zahawi and his advisers discovered he was in default on his taxes at some point in early July, perhaps soon after my report on 10 July (“questions were being raised”, he says in his statement).

- They then approached HMRC to discuss a contractual settlement

- The settlement was signed sometime before he stepped down as Chancellor, on 6 September 2022.

And we know this for sure about Mr Zahawi’s relationship with Balshore and the trust and his tax:

- Balshore held the YouGov shares, and we know they were eventually sold for around £27m (there were dividends on them as well; we don’t know the total amount).

- Mr Zahawi absolutely received £99,000 from Balshore in 2005 (we know this from an accidental corporate error, which led to a disclosure in the IPO documents)

- Mr Zahawi received, directly or indirectly, the proceeds from the disposal of the YouGov shares, or was entitled to those proceeds (otherwise he would surely not have been taxed on them). In plain English – he benefited from the Balshore structure. In technical tax terms, he was likely a beneficiary of the trust.

- The existence of the settlement obviously means that, prior to the settlement, Mr Zahawi had failed to pay tax that was due. The fact he admitted to “carelessness” means it was not just a technical error – there was a failure to take reasonable care.

The above facts – which nobody has contested, are simply not consistent with the ten Zahawi statements above.

The Ministerial Code requires Ministers to be honest and truthful.

Judge for yourself if Mr Zahawi was honest and truthful.

Comment policy

This website has benefited from some amazingly insightful comments, some of which have materially advanced our work. Comments are open, but we are really looking for comments which advance the debate – e.g. by specific criticisms, additions, or comments on the article (particularly technical tax comments, or comments from people with practical experience in the area). I love reading emails thanking us for our work, but I will delete those when they’re comments – just so people can clearly see the more technical comments. I will also delete comments which are political in nature.