It’s increasingly likely that Nadhim Zahawi should have paid £3.7m in tax at some point after 2005, but didn’t. What are the legal consequences? Did he evade tax? As lawyers always say: it depends.

UPDATE at 1pm: the Guardian is reporting that Zahawi paid 30% penalties. I’ve updated the below to reflect that

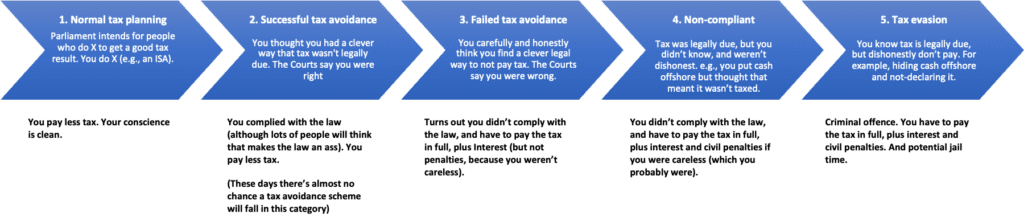

Here’s my handy tax avoidance/evasion infographic:1It’s inevitably an oversimplification. Any comments on how to improve the content or design would be gratefully received… the Tax Policy Associates infographics department has stopped returning my phone calls

Where does Zahawi sit on this chart? Going through each one:

- 1. Normal tax planning. This isn’t that. It doesn’t look normal, and a contractual settlement isn’t normal. But I guess in principle the Sun’s report could be wrong, and all my instincts and expertise (and that of the many other experts I collaborated with) could be dead wrong. Consequence: I apologise to Zahawi, make a donation to a charity of his choice, and then eat my hat.

- 2. Successful tax avoidance scheme. I always discarded this possibility – the structure just doesn’t work. The fact Zahawi appears to have approached HMRC to settle suggests that both Zahawi’s advisers and HMRC agree with me. But it’s just about still possible that I could be completely wrong. Consequence: I apologise to Zahawi, and make a donation to a charity of his choice.

- 3. Failed tax avoidance scheme. Zahawi was fully advised on the structure by a reputable law/accounting firm, and honestly believed it worked. The advisers were idiots, but he couldn’t know that. You might think Zahawi acted immorally, but that’s a value judgment – legally he’s squeaky clean. This feels somewhat unlikely to me, as the structure is so amateur. But it’s possible. Consequence: the tax is due, with interest. Very possibly no penalties. Zahawi should sue his advisers.

- 4. Non-compliant. Zahawi winged it, took no advice (except perhaps from his father or friends), and blundered into a situation where a pile of tax was legally payable, but he didn’t know that. This is very plausible, and forgivable, when a startup is founded – i.e. YouGov back in 2000. In my view it’s much less plausible once Zahawi started receiving serious sums of money from the structure – perhaps £25m or more. Surely at that point you’d obtain advice? Consequence: tax, plus interest, plus penalties of 10% to 100% (and possibly 200%) – depending on the precise facts

- 5. Tax evasion. Zahawi knew the YouGov proceeds were taxable, but dishonestly failed to pay or report the arrangements to HMRC. Or he was so reckless about it that it amounts to dishonesty. Consequence: tax, plus interest, plus penalties at the top end of that 10% to 100% range (maybe even 200%). Prosecution for tax evasion and potential jail time.

So I don’t think it will be scenarios 1 or 2.

I expect we will find out pretty soon if it’s scenario 3 – failed tax avoidance scheme. If advisers are at fault, then Zahawi will surely say so. That doesn’t let Zahawi off the hook for his behaviour after I revealed the avoidance. If Zahawi indeed paid a 30% penalty then we can probably discard this scenario.

Otherwise, it’s scenario 4 or 5. And here’s the key point: the only difference between the two scenarios is Zahawi’s state of mind twenty years ago. If/when the facts are clearer, and if/when we get an explanation from Zahawi, we may be able to assess the plausibility of Zahawi blundering vs Zahawi being dishonest. But it’s very unlikely we will ever know for sure… and very unlikely HMRC would be able to establish dishonesty beyond “reasonable doubt”.

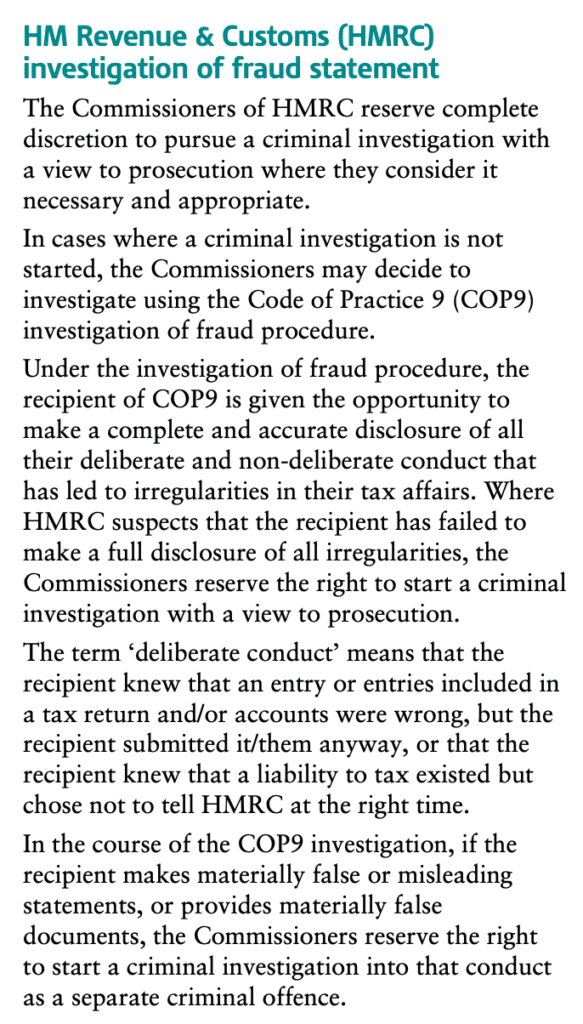

Journalists should put this question to Zahawi: “did HMRC apply their investigation of fraud procedure, COP9?” If they did, then HMRC thought tax evasion was absolutely a possibility, but didn’t proceed with a prosecution. I’ll talk more about that below.

Another important point: it’s my opinion that Zahawi has been dishonest in his response to my original report. If he knew for a fact his tax affairs weren’t in order, but put out statements saying they were, then that was dishonest. But it does not necessarily follow from this that he was dishonest in not paying his tax – he could have been hiding out of embarrassment that he had blundered so badly.

So how should this be reported?

I would say:

“If the Sun report is correct, and Nadhim Zahawi reached a contractual settlement with HMRC over his YouGov arrangements, then that means that he originally failed to pay tax that was due. At this point we don’t know why.”

It’s misleading to say he avoided or evaded tax, and misleading to say definitively that he didn’t. We just don’t know enough. There is no need to use the words “avoidance” or “evasion” at all. If Zahawi doesn’t like the implication, then Zahawi can provide an explanation.

Why is there one rule for the rich, and one for the rest of us?

There isn’t. Except there kind of is.

The frustrating thing is that it’s much easier to prove dishonesty/tax evasion in simple cases. A shopowner fails to declare a chunk of their sales to HMRC, and does so regularly, keeping two sets of books. What explanation is there, other than dishonesty? Ditto some benefit fraud.

But a wealthy individual fails to declare cash in an offshore bank account, opened in the name of their dog? They can argue they forgot and got confused, and a jury might believe them. Without the dog detail, it’s even easier.

And another thing that’s frustrating to many of us: when HMRC finds tax evasion, standard policy is not to prosecute unless there are very aggravating factors. HMRC will often charge penalties, and reach a contractual settlement agreement, backed by a promise from the taxpayer that they have fully disclosed everything. This is what HMRC’s Code of Practice on fraud investigation, COP9, says:

And that’s what happened with Lester Piggott – he confessed to undeclared cash in offshore bank accounts, paid the tax and penalties, and then it later turned out he had other offshore bank accounts he hadn’t disclosed. At which point the Inland Revenue prosecuted.2Legend has it that the Revenue found out because, when he wrote them a cheque for the tax due on the three offshore accounts he’d ‘fessed up to, it was drawn on a fourth, completely undisclosed, bank account.

Current HMRC practice has the considerable advantage that lots of tax, and penalties, is swiftly collected without the time, cost and uncertainty of a long trial. And in the worst cases, there clearly are prosecutions. But many of us think there should be more visible prosecutions of wealthy tax evaders – it would strengthen the rule of law, and everyone’s faith in the integrity of the tax system.

But right now there is no reason to think Nadhim Zahawi has been treated any differently from anyone else. We can reassess that if/when we know the details of the settlement.

But Nadhim Zahawi committed tax evasion! Jail him!

Please think about the company you are keeping.

Comment policy

This website has benefited from some amazingly insightful comments, some of which have materially advanced our work. Comments are open, but we are really looking for comments which advance the debate – e.g. by specific criticisms, additions, or comments on the article (particularly technical tax comments, or comments from people with practical experience in the area). I love reading emails thanking us for our work, but I will delete those when they’re comments – just so people can clearly see the more technical comments. I will also delete comments which are political in nature.

-

1It’s inevitably an oversimplification. Any comments on how to improve the content or design would be gratefully received… the Tax Policy Associates infographics department has stopped returning my phone calls

-

2Legend has it that the Revenue found out because, when he wrote them a cheque for the tax due on the three offshore accounts he’d ‘fessed up to, it was drawn on a fourth, completely undisclosed, bank account.

11 responses to “It’s wrong to say Nadhim Zahawi evaded tax. It’s also wrong to say he didn’t. Here’s why.”

Scenario 4 seems an unduly generous assessment of Zahawi. Even if he made an innocent mistake 20 years ago,:

1. He has had 20 years of experience, knowledge & time to fix it.

2. It appears that he received a large number of payments over a many year’s, none of which were declared.

3. He continued to lie about his situation and try to threaten anyone who challenged him, so he was fully aware of the seriousness.

4. He only chose to resolve the matter when he was in such a position of power that a prosecution for tax fraud was unlikely.

“Any comments on how to improve the content or design would be gratefully received…”

I’d consider adding a further category to the left, along the lines of “normal operation of the tax system”, i.e. things that automatically “reduce” your tax liability without you having to do anything (cf transferring cash into an ISA). An obvious example would be the personal allowance (although, of course, this is academic for someone in Zaharwi’s earnings bracket!).

The reason I suggest it is there are people – mainly apologists for tax avoidance – who try to conflate things like the personal allowance with avoidance in support of their “perfectly legal” narrative.

Another example in this box might be electing to benefit from something that just requires ticking a box/entering a number in a return, but without actually doing something in real life, like transfer of personal allowance between spouses.

Dan, well done for an your excellent work on this.

https://www.bbc.co.uk/news/uk-politics-64360260

This BBC story says that “Following discussions with HMRC, they agreed that my father was entitled to founder shares in YouGov, though they disagreed about the exact allocation. They concluded that this was a ‘careless and not deliberate’ error.” and “Additionally, HMRC agreed with my accountants that I have never set up an offshore structure, including Balshore Investments, and that I am not the beneficiary of Balshore Investments.

Does this imply that the settlement was on the basis that Zahawi should have been taxed on some of the value of the shares as employment income rather than a capital gain?

I’m a constituent of Mr Z and will no doubt be attending some of his hustings meetings in the future. What would you like me to ask him from the floor?

I’ll post a list of questions tomorrow!

Presumably his advisors approached HMRC and said something along the lines of ‘Our client would like to discuss his tax affairs as he might inadvertently have made errors in previous tax returns specifically year endings………. what happens then depends on how credible HMRC think he is, unless he had previous form they would seek a civil outcome. Howver, where does that fit into him being a high profile individual who at face value should have been aware of the importance of accurate reporting? Furthermore what were his advisors saying to him everytime he came to submit a tax return.? A 30% penalty suggests significant mitigation what exactly would that be?

Well, quite! Perhaps he’d say it’s unprompted. It may have been unprompted by HMRC, but if I were them I would have said it was certainly “prompted” in any real meaning of the word.

On the question of Zahawi’s state of mind 20 years ago:

1) Presumably YouGuv wouldn’t be worth then so the tax charge may not have been an issue

2) But Zahawi has been an MP since 2010 and the shares were sold in 2018

3) So isn’t it Zahawi’s state of mind when he started to take an income from the trust and/or when the trust sold the stake?

Wouldn’t any income from the trust be declarable in the register of members’ financial interests?

I would say both- but probably the actual taxable event was when he received the funds – most of which was within last 3-5 years. And absolutely big question re declarations.

There is a typo at the end of points 4 and 5. They should also say “and then I eat my hat”.

In unrelated news, the Guardian suggests that the penalties were 30% – https://www.theguardian.com/uk-news/2023/jan/20/nadhim-zahawi-agreed-on-penalty-to-settle-tax-bill-worth-millions

thank you!