Updated to correct my claim that there are few if any prosecutions for failure to file. There are in fact several thousand in most years. That amazed me. So there isn’t a non-prosecution scandal. There’s a scandal of hundreds of thousands of late filings, and serious policy question as to how to fix this.

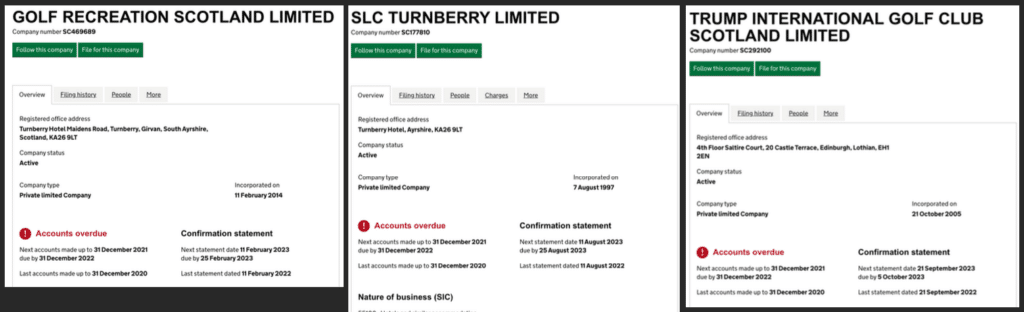

Donald Trump’s Scottish hotel and golf businesses have failed to file their accounts for 2021:

What does this mean?

There’s an automatic late filing penalty of £150. Not much, but more than Trump paid in US Federal income tax in 2020.1The ultimate sanction is for a company to be struck off. If the failure to file continues, then Companies House will send a written warning; then another warning; then they’ll begin the process of striking the company off.

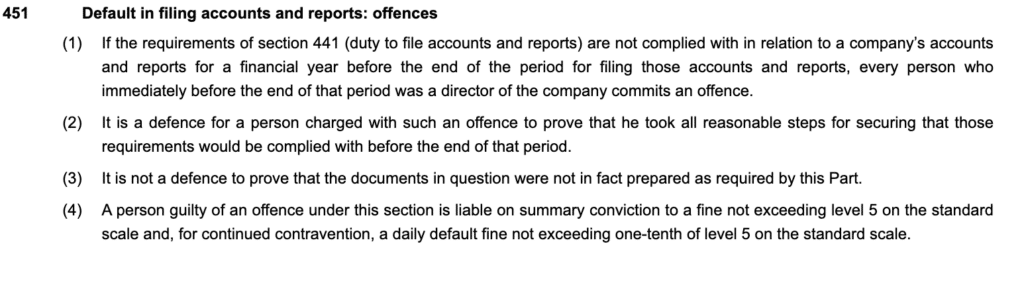

More interestingly, if a company fails to file accounts on time, it’s a criminal offence for the directors, with a potentially unlimited fine:

In this case there’s just one director, Eric Trump. Donald Trump stood down as director after he was inaugurated – although if (as must be possible) he is still directing things behind the scenes, then he will be a “shadow director” and also potentially criminally liable.

There’s a defence if the directors can show they “took all reasonable steps” to file. The most common reason – and the one I’m betting is the case here – is simple disorganisation/ineptitude. That will not qualify for the defence. What would? Most often some kind of difficulty getting the auditors to sign off on the accounts. Perhaps because a difficult technical problem has arisen (unlikely with such a relatively simple business as this one). Perhaps – more interestingly – because there is a question whether the business remains a going concern.

It’s pretty common for small companies to miss filing deadlines. Much less common for large businesses – and when I worked on big ticket corporate M&A and financings, these kind of failings were a “tell” that there were financial or governance problems.

We’ve no way of knowing what the reason is for the Trump companies’ delinquency. The tax writer Rebecca Benneyworth spotted that it looks like the Trumps had already extended the filing deadline from 30 September to 31 December. That was probably an automatic three-month Covid extension – but that’s usually a one-off, and wouldn’t explain the late filing now. That could be down to disorganisation or chaos just as much as it could be evidence of a real problem. Chaos seems the safe bet.

Update: thanks to The National for spotting that the Trumps filed their past accounts by post, not online. So it’s possible they posted the 2021 accounts right at the end of the year, but before the deadline, and Companies House just hasn’t gotten round to them yet. And also possible that the postal strikes delayed a filing that was actually posted before the deadline. I’ll withdraw/update this post if either turns out to be the case Further update – initial indications are that this is not the reason. More to follow.

There is one thing we can know for certain. The Trumps won’t be prosecuted. Over 200,000 companies file late, and pay the £150 penalty. I gather in some circles late filing is considered normal, or even tactically advantageous.

Yesterday I wrote this: “But it is almost2I am saying “almost” because it’s possible there have been some prosecutions, but I’m not personally aware of any unheard of for a director to be prosecuted. Of course it is more accurate to say: over 200,000 companies file late because it is almost unheard of for a director to be prosecuted.”

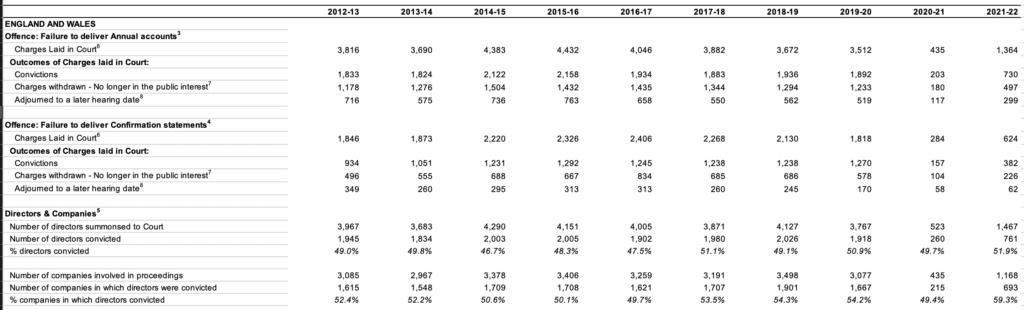

But a lawyer (an old contact of mine) with considerable experience in this area has made clear that I am completely wrong. There are in fact a large number of prosecutions. Companies House publishes the full statistics, but they are hard to find – see Table 6 here. The upshot is that there are several thousand prosecutions in a normal, non-Covid year:

On the surface, it looks like about a 50% conviction rate, but that’s not right – about half the charges are withdrawn… and I understand from my contact, that’s because the accounts have been filed. Account for that and adjournments, and (unless I’m mistaken) the conviction rate looks close to 100%.

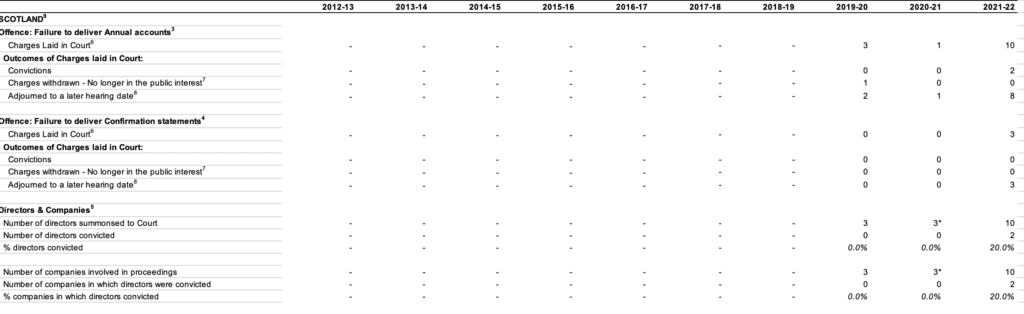

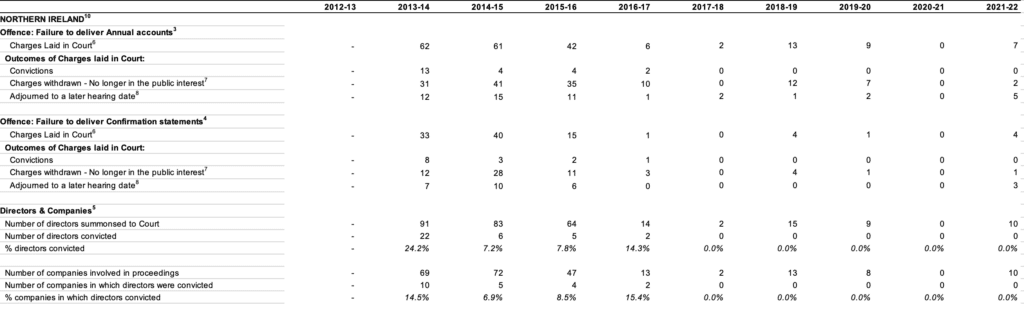

Much less going on in Scotland:

I don’t understand why this is. There are about 20x fewer Scottish companies than in England & Wales (see tab 9 of the linked spreadsheet), but about 100x fewer prosecutions. Northern Ireland has about 1/3 of the number of companies as Scotland, but around the same number of prosecutions.

So my conclusion that the Trumps are likely safe is surely correct, but my reasoning was completely wrong – and I apologise for having unfairly denigrated what looks like a busy and effective Companies House prosecution service (at least in England & Wales).

The mystery

I said there was a scandal of non-enforcement, and it looks like I was dead wrong. Instead we have a mystery – why do so many companies file late when in fact there is a non-zero prospect of prosecution?

- Are the prosecutions not well known? (Possible, given I spoke to six experienced lawyers and only one was aware of them).

- Is it a mistake to drop prosecutions if the directors belatedly file the accounts? The prosecutions are said to be dropped because they are “no longer in the public interest”. That is debatable. I would say the public interest is not just in making a particular director file their own accounts, but in deterring late filed accounts across the board. In essence, the prosecution policy has changed the offence from “failing to file by the due date” into “failing to file”. That does not seem right to me.

- Do these two factors combine so that, rationally, a director can happily file late and accept the low risk of a prosecution, knowing that the prosecution will almost certainly be discontinued once they do file?

I’m not sure what the reason is. But I am sure there’s a problem – because late filing prejudices people dealing with the companies (who often rely on filed accounts to judge creditworthiness) and facilitates financial crime.

Here’s a suggestion for a policy response:

- Does Companies House do enough to make people aware of prosecutions for failure to file accounts? (given my error on this, I would of course say “no”…)

- Investigate late filing in more detail – who is filing late, how late are they filing, and what the reasons are

- Analysis of prosecutions. Who is being prosecuted? Is it really in the public interest that prosecutions are dropped when accounts are belatedly filed?

- Is it correct that Northern Ireland and (particularly) Scotland prosecute fewer offences? If so, why?

- Does the automatic £150 penalty need to be increased for larger companies? It’s tempting to make it a percentage of turnover, but that could easily become disproportionate. 0.1% of turnover for the Trump companies would be a not-so-large £7,000, but for Sainsbury’s (a silly example to make the point) would be a ridiculous £38m

- It’s ridiculous that so many companies still file on paper. That includes giants like HSBC and Tesco. The reason is that (as a number of people have now told me) Companies House’s online submission service only works for very simple cases.3I should have known this. In my defence, I’ve only ever personally filed for very simple companies… but I should not have extrapolated that to other companies without checking. My bad. That’s inconvenient for those companies; it also means that Companies House records are much more difficult to analyse electronically (which is inconvenient for the rest of us).

It would be quite wrong for a small company missing the filing deadline by a day to face prosecution. And it would be equally wrong to selectively prosecute Trump, particularly given that Scotland appears to prosecute basically nobody.

But I remain of the view there is a problem – I’m just much less certain about the solution than I was yesterday.

Photo by Max Goldberg, licensed under the Creative Commons Attribution-Share Alike 4.0 International license

-

1The ultimate sanction is for a company to be struck off. If the failure to file continues, then Companies House will send a written warning; then another warning; then they’ll begin the process of striking the company off.

-

2I am saying “almost” because it’s possible there have been some prosecutions, but I’m not personally aware of any

-

3I should have known this. In my defence, I’ve only ever personally filed for very simple companies… but I should not have extrapolated that to other companies without checking. My bad.

14 responses to “Donald Trump’s companies failed to file their accounts – but the scandal is that this is normal”

So in Commercial Substance there are indeed no prosecutions; just chase-ups.

It would be good to see a few actual prosecutions, to change the mindset.

Of companies where it is clear that they have resources, and are multiple years behind.

All directors, not just the CFO and CEO, because the change in behaviour required is for the board to pressure the CFO.

For penalty, disqualifying from holding directorships for n years seems appropriate – is that not available in the law?

I suggest that the nine months allowed is itself too long nowadays – very few companies require audits and correspondence is by email rather than post.

Given that many (most?) accountants treat deadlines as due-dates, shortening that period would probably reduce stress for most people involved.

On the other hand, the Confirmation Statement (introduced in 2016) can only be filed in a 14-day window which I think is excessively tight for small companies/groups (one holiday or illness can cause default).

Earlier filing is permitted, but brings forward the renewal date – that’s good for allowing groups to maintain consistency as they expand, but I suggest that filing between 20 days before and 14 days after Renewal Date should leave it unchanged.

Here is a list of SPV companies set up to produce films, sharing a common director. One company is almost 28 months overdue. They often reduce the accounting period by a day to get two 3 month extensions. There is a lot more going on here than just being slack with admin! Drop me a line if you’d like to hear more.

Link + Due Date

https://find-and-update.company-information.service.gov.uk/company/08789030 Sept 2020

https://find-and-update.company-information.service.gov.uk/company/11031269 Sept 2021

https://find-and-update.company-information.service.gov.uk/company/11066313 Dec 2021

https://find-and-update.company-information.service.gov.uk/company/11066572 Aug 2021

https://find-and-update.company-information.service.gov.uk/company/11067635 Aug 2021

https://find-and-update.company-information.service.gov.uk/company/10078780 Sept 2021

https://find-and-update.company-information.service.gov.uk/company/10908828 Nov 2020

https://find-and-update.company-information.service.gov.uk/company/08398167 Dec 2020

https://find-and-update.company-information.service.gov.uk/company/10087978 Feb 2022

https://find-and-update.company-information.service.gov.uk/company/07606233 Dec 2020

https://find-and-update.company-information.service.gov.uk/company/08736464 Oct 2021

https://find-and-update.company-information.service.gov.uk/company/10087882 Sept 2022

https://find-and-update.company-information.service.gov.uk/company/10009211 Feb 2022

These two were finally struck off in April 2022, the last accounts show they together had debts of £ 10m, but they just slipped off the radar without any formal insolvency.

Link + last accounts submitted

https://find-and-update.company-information.service.gov.uk/company/08942388 Sept 2018 (so Sept 2019 accounts due around June 2020)

https://find-and-update.company-information.service.gov.uk/company/08873613 June 2017 (so June 2018 accounts due around March 2019)

I don’t think Donald Trump will have committed an offence under s. 451 Companies Act as that section doesn’t say it extends to shadow directors. The Companies Act is usually clear when it intends to apply an offence to shadow directors as well as de jure directors. For example, failure to keep a register of director (s. 162) or failure to file a confirmation statement (s. 853L) expressly refer to shadow directors.

More generally, I don’t think there is a public interest in zealous prosecution. Filed accounts are not that useful for determining current creditworthiness. They will be very out of date and in some case, such as accounts for micro-companies, not that informative. Most counterparties, such as consumers, never think to look up filed accounts. More significant and sophisticated counterparties will bargain for contractual information rights or rely on other means to obtain financial information, e.g. listing rules, credit reference checks.

Re Trump’s company accounts, there’s an acute key man problem

https://www.bloomberg.com/news/articles/2023-01-10/longtime-trump-cfo-weisselberg-to-go-right-to-jail-leave-firm#xj4y7vzkg can’t imagine there’s a long queue of eager replacenments, given the prospects, but let’s see.

I have acted for delinquent directors on occasion, and I always thought that the situation called for a fine more than a criminal sanction. I recognise the disadvantage in that (the directors would be indemnified by the company), but it does seem more in keeping with the offence. I agree wholeheartedly that the willingness to discontinue undermines the effectiveness of the threat (again, possibly a reason to switch to a fine – comparing with late filing of personal tax returns, the fine is usually levied even when the default is remedied).

Prosecution presumably depends on a case being made by Companies House. You refer to their prosecution service, which presumably does this work and then refers cases to the authorities in the various legal jurisdictions. Do we know if there are separate prosecution services operating in England & Wales, Scotland and Northern Ireland. If they are separate and I assume based in the relevant offices, it would be useful to know whether they are funded equitably.

The lack of any data prior to 2019-20 for Scotland suggests that Companies House had no staff working on this in earlier years. Two of the three years with data for Scotland would have been affected by the pandemic, which would not have helped a new prosecution service starting up in the Scottish office of Companies House.

Northern Ireland seems to have started much earlier, in 2014-15 but, after a productive two or three years, all activity seems to have tailed off.

I wouldn’t dare suggest that Scottish directors and companies are better at following Company Law, but it seems to me that the data doesn’t really support a conclusion that “Scotland” is failing in this area.

There is also a wheeze whereby if you shorten an a/p by one day, you get another 90 days to file. This is very frequently used by people wanting to hide things.

In my experience most bona fide extensions relate to some corporate deal or other which is fundamental to the ongoing business like a debt reconstruction or a major acquisition. CH doesn’t seem too fussed about this if you explain. If it goes on too long, they might look to administrative strike off.

Isn’t it the case that Companies House – and probably the one in Scotland too – is simply overwhelmed and understaffed. Presumably to prosecute would take more specialist staff. There are so many LLPs and Scottish LLPs registered who details simply aren’t scrutinised because of a lack of staff. A good number of these are used – allegedly – to assist in activities such as money laundering – according to the Dark Money podcasts.

Delays in filing can hurt so many genuine businesses. I think fines should be set proportionately to the size of the company based on turnover levels and ratchet up the longer the delay.

Also the process to move to strike off should be much faster.

Why not withdraw the protection of limited liability and automatically make the directors and shareholders personally liable for the future debts of the company when it fails to meet the appropriate deadline for filing. And to make that a reasonable sanction, ensure the filing process is as easy as possible

I generally think proportionality is an important principle, and that would have disproportionate consequences, particularly on shareholders. Indeed I’m not sure we could have publicly listed companies at all if the shareholders could become personally liable for no fault of their own.

I wonder which political party would benefit most from keeping things as they are ? I wonder if any of these late filing companies make political donations and to whom?

No, I really don’t think that’s it. We don’t need conspiracy when there’s so much evidence that it’s decision makers taking the easy path of collecting automated fines rather than spending lots of time and money on risky prosecutions.