9 June 2023 update: the Companies House entries still fail to disclose Douglas Barrowman as the ultimate beneficial owner. PPE Medro was updated on 11 May to show Arthur John Lancaster as the owner of the company. Lancaster is a trust accountant/tax adviser for Barrowman’s group – it is unlikely he actually controls the companies himself. 1It is relevant to note that Lancaster was heavily criticised by a tax tribunal, in the context of one of Barrowman’s avoidance schemes, for providing evidence that was “seriously misleading”. The PSC entry for LFI Diagnostics Limited is unchanged.

Given the failure to correct the entries, it is now hard to see how this can be an innocent mistake. Companies House should be seriously considering a prosecution of the directors.

UPDATE 13 August 2023: this has been overtaken by new evidence. See our new report here.

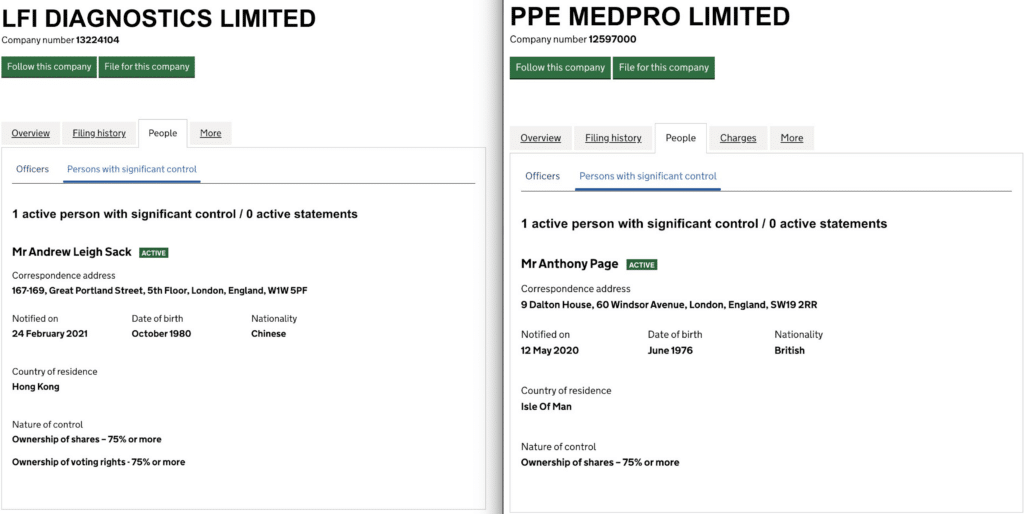

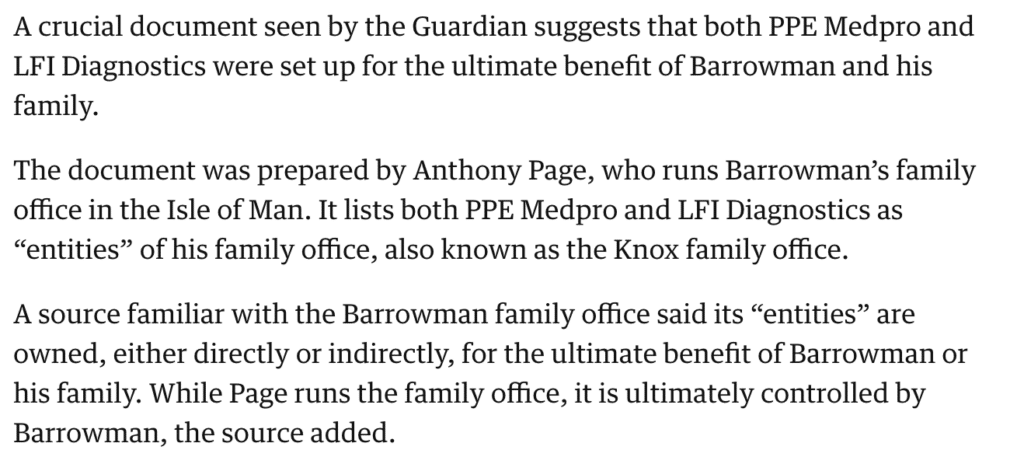

The Guardian recently reported that two UK companies ultimately controlled by businessman Douglas Barrowman were the subject of PPE contract lobbying by his wife. I’ve no expertise or interest in the PPE lobbying issue. But I am interested2Disclosure: I am an experienced commercial lawyer, but I am not a company law expert. However, I know many people who are; this article reflects my reading of the legislation, informed by their experience and expertise. Any errors, however, are solely mine in the fact that, while the Guardian says Barrowman controls the companies, their Companies House entries3See here and here say no such thing:

I’m fairly sure these are the right companies4PPE Medpro is easy; Anthony Page is definitely the right person. LFI Diagnostics is slightly more difficult; I’ve no idea who Andrew Sack and the other director, Chan Chen, are, but Companies House shows it as majority owned by “PPE Medpo Limited”, and the incorporation date lines up with the Guardian article. So, absent an amazing coincidence, this is the right company too. So my immediate view is that either the Guardian was wrong, or the Companies Act rules requiring registration of “persons with significant control” were broken. I haven’t seen the document on which the Guardian relies, and I can’t know for sure if their story is correct but, given the stupidity of English libel law, and the willingness of Barrowman to use it, I expect the Guardian was very careful.

What are the “persons with significant control” rules?

Back in the day, Companies House showed who the shareholders of a company were, but stopped there. So if, for example, a company was owned by a tax haven holding company, you wouldn’t be able to ever find out who the ultimate shareholder was.

This all changed in 2016 – rules were put in place requiring companies to identify their “persons with significant control” – meaning the actual humans who were able to tell the company what to do.5The legislation starts here, and is fairly easy to read – there’s also useful (statutory) guidance Normally this would be the ultimate shareholder – but sometimes there would be someone who wasn’t a shareholder, but who nevertheless could ensure that the company always adopted the activities they desired. They too would be a “person with significant control”.

So, let’s say I’m a secretive oligarch. I set up a UK company with some local directors. The shares in the company are held by a Panamanian company, and that in turn is held by my personal chef, who I throw money at and therefore always does what I ask. Pre-2016, your Companies House search stopped dead in Panama. But today, the company should register me (not the Panamanian company, and not my chef) as the “person with significant control”.

And that’s the whole point of the rules – to enhance corporate transparency and help stop the abuse of companies for nefarious purposes.

If the Guardian report is accurate, who is the “person with significant control” of the two companies?

The definition of a “person with significant control” is set out in Schedule 1A of the Companies Act. In our case, the relevant section is paragraph 5: where a person (not necessarily a shareholder) has a right to exercise, or actually exercises, significant influence or control over a company.

This passage in the Guardian article is key:

If indeed the companies are “ultimately controlled” by Barrowman then he has “significant influence or control” and is therefore the “person with significant control”, regardless of whether he holds any shares.6Although LFI Diagnostics Limited may be majority held by PPE Medpro Limited (its name is shown as “PPE Medpo Limited” in the LFI confirmation statement; that could be a different company but I’m guessing is a simple typo). If that’s correct, then the correct approach should be for LFI Diagnostics Limited to report that it’s held by PPE Medpro Limited, as the “relevant legal entity”. The reason is that we can then look at the disclosure for PPE Medpro Limited and see who the ultimate owner is – but of course we can’t, because that is wrongly reported7There can be more than one “person with significant control” – so, for example, it could be that Page and Barrowman both fall in this category.

What should have happened?

A company is required to identify and then register its “persons with significant control”.

Section 790D of the Companies Act requires a company to take reasonable steps to find out who controls it.

For a small part of a big international corporate group that might be hard on the poor UK directors, and so there are procedures for the directors to essentially send out begging letters to its immediate shareholders to find out who controls them. But in the PPE Medpro case there are no such complexities – the sole director is Anthony Page, who helps run Barrowman’s private office.

So if Barrowman really controls PPE Medpro, it would be surprising (but I suppose not impossible) if Page didn’t know that.

Since we know nothing about the LFI Diagnostics directors, Andrew Sack and Chan Chen, we can’t say anything about the likelihood they knew about Barrowman’s involvement – but surely they knew that they were not the actual controllers? Andrew Sack wasn’t even the majority shareholder:

There are similar problems with other Barrowman UK companies. Just looking up companies where Page is a director we see Neo Space (Douglas) Limited, PPE Medical Protection Limited, Neo Space Aberdeen Limited, and a few more. All of them list Page (and sometimes other directors) as the “persons with significant control”. It seems most unlikely this is correct.

There’s just one exception I can find, Knox House Trustees Limited, which correctly discloses Barrowman as the “person with significant control”:

Why are they getting this wrong?

I don’t know. It could be incompetence. It could be obsessive secrecy. It could be related to some kind of tax planning, perhaps linked to arguments that the groups are not in fact under common control (Barrowman’s group has a history of shady tax behaviour).

Does it matter?

The ownership disclosure rules are there for a reason: so that it’s easy to see who really controls a company. In this case the failure to comply could have had serious consequences, if it meant that civil servants assessing a PPE bid were unaware of the connection between the bidding companies and Barrowman, and hence the link to Mone. I’ve no idea if that happened – but it’s the potential for this to happen (whether in this scenario or a different one) which is why the rules are there.

What are the criminal offences applicable to directors?

There’s a specific offence for breach of section 790D, committed by the company itself, and every director responsible. On conviction, the director faces up to two years in jail and an unlimited fine.

And there’s a general Companies Act offence of knowingly or recklessly delivering a false statement or document to Companies House. Again, up to two years in jail and an unlimited fine.

So if Barrowman controls the companies, and Page knew (but didn’t register) then in principle he should be very worried.

And Sack and Chen clearly got this wrong – how could Sack, a minority shareholder, have thought he controlled the company? But perhaps the prospect of a prosecution doesn’t bother them, given they’re based in Hong Kong.

What are the criminal offences applicable to Barrowman?

There’s a specific requirement that, where someone knows they control a company, but they haven’t received a notice from the company requiring them to provide information, then they have to tell the company that they do in fact control it. And if they don’t do this, then they commit an offence – again, with up to two years’ imprisonment, and an unlimited fine.

What does this mean for Barrowman?

It all means that, in my opinion, Barrowman may have committed a criminal offence if:

- The Guardian summary of the internal “crucial” document is correct, and the Guardian’s source is correct that Barrowman “ultimately controls” the private office.8It would be a very strange private office if he didn’t ultimately control it

- The correct legal analysis is that Barrowman actually exercised “significant influence or control” over either or both companies (which, if the Guardian summary and source are correct, will likely be the case).

- Barrowman knew, or ought reasonably to have known, that he should have been registered as a “person with significant control”.

- The companies never sent him a formal notice asking for him to confirm control.

- He never notified the companies of his status as a “registrable person”.

Points 1, 4 and 5 are straightforwardly factual. 2 is legal, but doesn’t seem too challenging.

The most difficult point for a prosecution, and the most obvious “out” for Barrowman, is 3. Barrowman could say he had no idea the company was incorporated. Or that he didn’t know the rules worked this way, and it’s not reasonable to say he ought to have known.

Pleading ignorance as to the existence of the company may be challenging given the significance of the contracts the companies were reportedly involved with – but whether such a defence could be sustained turns on the facts and, in particular, what kind of paper-trail would emerge, and how credible people are on the witness stand.

The “I couldn’t be expected to know the rules worked this way” defence would be successful in many cases, and is one of the reasons why prosecutions of these offences are so hard. The difficulty Barrowman has is that he’s a highly sophisticated businessman, who runs a group of companies that provide technical tax and legal services to private offices – in fact he is, in my view, exactly the sort of person who ought reasonably to know that the rules work this way. So this would plausibly be a harder defence for him than for the average businessman.

If breaching these rules is a criminal offence, why do people do it?

Because they think they won’t be prosecuted, and historically that’s been a very safe bet. So there is widespread failure to comply with the law.

Part of the answer is a high profile prosecution or two.

But another important part is to have effective civil penalties, which don’t require the expense and uncertainty of a criminal trial, and which deter shareholders, directors, corporate services providers, and advisers from participating in filing false information. I’ll be writing more about that soon.

-

1It is relevant to note that Lancaster was heavily criticised by a tax tribunal, in the context of one of Barrowman’s avoidance schemes, for providing evidence that was “seriously misleading”.

-

2Disclosure: I am an experienced commercial lawyer, but I am not a company law expert. However, I know many people who are; this article reflects my reading of the legislation, informed by their experience and expertise. Any errors, however, are solely mine

- 3

-

4PPE Medpro is easy; Anthony Page is definitely the right person. LFI Diagnostics is slightly more difficult; I’ve no idea who Andrew Sack and the other director, Chan Chen, are, but Companies House shows it as majority owned by “PPE Medpo Limited”, and the incorporation date lines up with the Guardian article. So, absent an amazing coincidence, this is the right company too

- 5

-

6Although LFI Diagnostics Limited may be majority held by PPE Medpro Limited (its name is shown as “PPE Medpo Limited” in the LFI confirmation statement; that could be a different company but I’m guessing is a simple typo). If that’s correct, then the correct approach should be for LFI Diagnostics Limited to report that it’s held by PPE Medpro Limited, as the “relevant legal entity”. The reason is that we can then look at the disclosure for PPE Medpro Limited and see who the ultimate owner is – but of course we can’t, because that is wrongly reported

-

7There can be more than one “person with significant control” – so, for example, it could be that Page and Barrowman both fall in this category.

-

8It would be a very strange private office if he didn’t ultimately control it

12 responses to “A legal analysis: did Douglas Barrowman commit a criminal offence?”

Thanks for this fascinating piece of investigative work. Have you looked into the businesses that Barrowman holds in his second registered identity (https://find-and-update.company-information.service.gov.uk/search?q=Douglas+Alan+Barrowman)? He’s used the other identity to register THE CSJ FOUNDATION (13382551), from which he resigned a few days ago, and COMMUNITY SOCIAL INVESTMENT LIMITED (08223448), which is dissolved. Are there conflict of interests being concealed in this second identity (https://find-and-update.company-information.service.gov.uk/officers/rURP8zmjbkrNo1tE-N77sG00c-E/appointments)?

Isn’t the purpose of the PSC requirements to identify all PSCs?

AP is clearly identified as the sole PSC (for both entities) as they hold all shares and, provided there is no outside influence or nominee shareholders. With all the allegations made by the Guardian, currently, isn’t it appearing that there is a nominee shareholding by Barrowman? The Guardian alleges they’ve seen bank statements that indicate funds moved towards accounts held or controlled by Barrowman.

@Dan – What UK legislation covers this type of conflict of interest, if the allegations are proven?

If Mr Barrowman actually exercised “significant influence or control” over either or both companies and he did not know that he should have been registered as a “person with significant control” you could be providing a great service to him by writing to tell him of his compliance obligations. In so doing you would be providing him with the information required to promptly correct any inadvertent errors which may exist in current declarations and helping him to avoid making such an error in future. You may wish to consider doing so on a pro bono basis and route the correspondence via agents who are known to act for him.

You’re seriously saying Dan should consider trying to dig Barrowman out of the deliberate deception he/his representative’s have manufactured?

I think Mr Bear is cheekily suggesting that I help put Barrowman in a position where he can’t deny being ignorance of his obligations.

Mr Bear may also be thinking of the way you admirably put Osborne Clarke in a position where they cannot deny ignorance of their professional duty to cease acting for Nadhim Zahawi if their situation is as you speculated it might be.

Total layman here but the first “out” for Barrowman, that he had no idea the company was incorporated seems to be be utterly implausible given the fact that he knowingly received £65 million from PPE Medpro. Knowingly, because he actively transferred £29 million of the funds to a trust for the benefit of his wife.

Whichever way you spin it, it seems highly unlikely Donald Barrowman is an innocent man!

[Dan edit: important to note that there are number of assumptions and factual hurdles this comment doesn’t mention. I don’t think fair to put it so bluntly]

More than one person can have “significant control” of a company. It starts as a 25% test.

So Andrew Sack may have “significant control” of LFI Diagnostics because he owns more than 25% of the shares (see paragraph 2 in Schedule 1A). That assumes he actually controls the shares himself, and he is not a nominee (paragraph 19) and there is no other arrangement that means he only acts according to someone else’s directions or instructions or only with another person’s consent or concurrence. (paragraph 20).

And even if that is right, it does not mean that someone else could not also have “significant control” of LFI Diagnostics through the other 70% of the shares. If there is a “PPE Medpo” (I also think it is a typo) who control that company? But as you say, I suspect it is just a typo and we need to look at who controls PPE Medpro.

For PPE Medpro, I expect the simplistic analysis is that Anthony Page has “significant control” because he is the sole shareholder (paragraph 2 again). Given his job I’d be surprised if he actually controls those shares in his own right. But it does not stop someone else having “significant control” too, such as a person who has “the right to exercise, or actually exercises, significant influence or control” within paragraph 5. Or perhaps through paragraph 19 or 20 again.

In any event, as PPE Medpro has 70% of the shares in LFI Diagnostics. I would expect an individual who has “significant control” of PPE Medpro by holding all of its shares (or if he is a nominee, or only acts according to someone else’s directions or with their consent, the person who pulls the strings behind him) to also have “significant control” of LFI Diagnostics. That might be Anthony Page, or perhaps more likely someone else.

On another tack, the filed (unaudited abridged) accounts for PPE Medpro to April 2021 – a period when it was awarded multi-million government supply contracts – are interesting both for what they say (e.g. just three employees, just £3.89m of retained profit, after £0.9m of tax to pay) and what they don’t say (turnover? cost of sales? salaries? distributions?). But apparently is only a “small” company,.

Thank you! You are of course right – Page could also be a person with significant control.

Great work. I do hope you are writing for a publication with a wider readership – private eye perhaps?

And your expertise would be a great asset to an incoming government.

I’m not sure the cops would touch this given the sensitivity. Which would be the right Avenue? The SFO?

That’s very kind, but I’m happy writing here. The audience is small, but it’s the *right* audience!

It is in all our interests that individuals and companies follow the rules. So it is right that we, the taxpayers, should know key aspects of the company, individuals and their track records. Keep up the good work.