Well-intentioned bodges to the UK income tax system have created anomalously high marginal tax rates for people earning between £50-60k and £100-125k. The marginal rate typically hits 68% but can reach 90%. This is complicated, unfair and a disincentive to work; it could also plausibly be holding back growth. Any government serious about fixing the tax system should start here.

The marginal rate

If you want to know your take-home pay, then it’s your effective rate of tax that’s important – total tax you pay, divided by gross wage (more on that here).

The marginal rate of tax is different and more subtle – it’s the percentage of tax you’ll pay on the next £ you earn. Irrelevant to where you are now, but highly relevant to your future, because it affects your incentive to work more hours/earn more money.1For more on this, and some international context, there’s a fascinating paper by the Tax Foundation here Economists say everything happens at the margin.

The marginal rate of tax in the UK for high earners in theory caps out at 47% (45% income tax and 2% national insurance) once you get to £150k. I’m not terribly convinced this disincentivises anyone to work. But people earning much less than £150k can have a much higher rate, principally due to two effects:

- Child benefit is £1,133 per year for the first child and £751 for the rest. It starts to be phased out by a special tax – the “high income child benefit charge” – if your salary hits £50k, and you get no child benefit at all once the gross salary of the highest earner in the household hits 60k.

- The personal allowance – the amount we earn before income tax kicks in – starts to be phased out if your salary hits £100k, and is gone completely by £125k.

These phased withdrawals create very high marginal rates.

UPDATE: marginal rates are further increased by student loan repayments. See more below.

The calculations

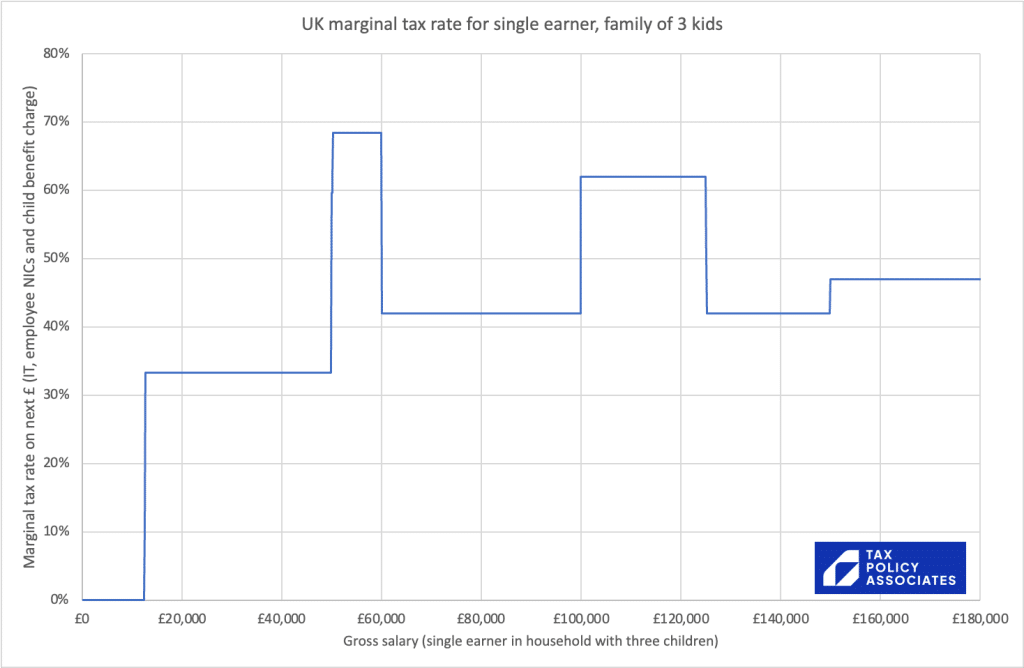

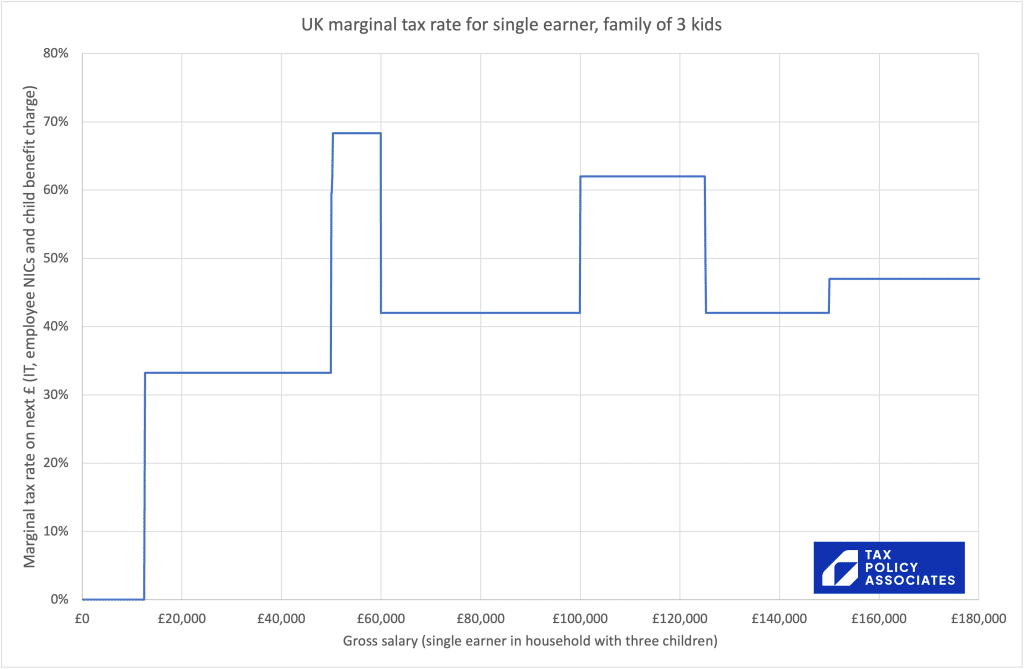

I’ve put together a quick spreadsheet. For a family with three kids, the marginal tax rate for a given salary looks like this:

That bump between £50k and £60k is a 68% marginal tax rate, meaning that, for every additional £1,000 you earn gross, you take home £320.

Looking at it another way: imagine you’re working a reasonably modest 1,500 hours a year and earning £50k gross, so about £38k take-home. That’s £33/hour before tax, £25/hour after tax.

How would you like to work another 200 hours a year for the same pay? Sounds good. But after-tax you’ll be earning £10/hour. You may well not think that’s worth your while. And, if you need childcare, the additional childcare could easily cost you more than the additional pay.

The bump between £100k and £125k is the withdrawal of the personal allowance, and results in a 62% rate between £100k and £125k. Not quite as dramatic as the 68%, but still well over the psychologically important 50% mark – and that rate lasts for a significant £25k.

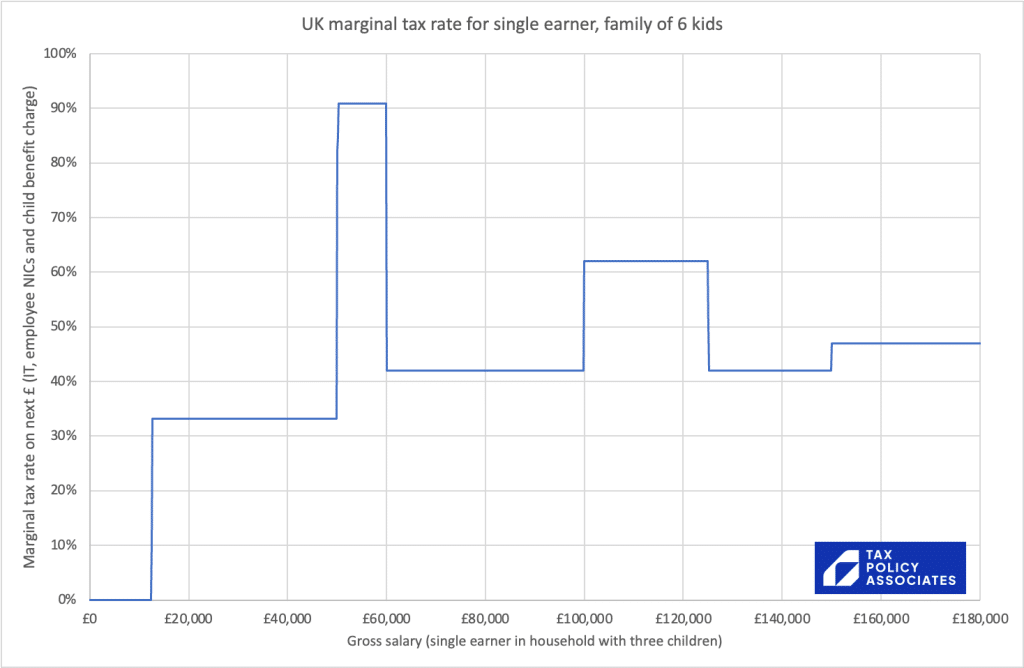

Let’s go higher

Because it’s linked to child benefits, those high marginal rates just get bigger the more children you have. I have friends with six children. Congratulations, Steve, because you can win a marginal tax rate of 91%.

Why stop there? With eight children you get a top marginal rate of 106% – so if you earn £50k gross, your after-tax pay is £38k. If you earn £60k gross, your after-tax pay is £37k. That’s insane. Hopefully, nobody is actually in that position, but a sensible tax system doesn’t create such results, even in theory.

Update: A clever anonymous coder has made an interactive version of this chart, where you can spawn as many children as you like, and see how high the marginal tax rate goes: here.

Let’s go even higher

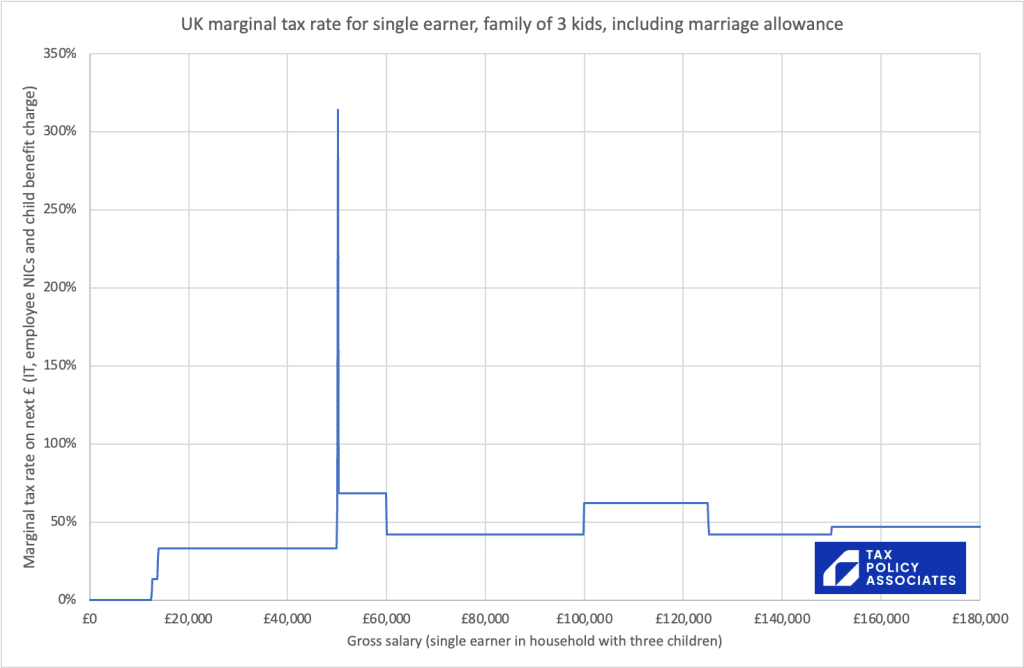

To keep the two charts above readable, I’ve omitted the marriage allowance. This lets a non-working spouse transfer £1,260 of their unused personal allowance to their partner, if they’re earning less than the £50,270 higher rate threshold. So it’s worth £252. Unlike the other allowances, it’s not withdrawn in a phased way – it disappears if the £50,270 threshold is hit. That gives us this beauty:2Strictly the marginal rate is infinite – it caps at just over 300% in my spreadsheet because the resolution of the calculations is £100. Also I didn’t have a monitor large enough to show an infinite line.

Earn £50,200 gross, your take-home is £37,887. Gross £100 more salary, your take-home pay is £214 less. You have to gross £800 more to actually make more money – take-home pay of £7 more, to be precise.

The small size of the marriage allowance means its effect vanishes pretty quickly. But it does combine with the child benefit claw-back to create a zone of extremely high marginal rates which persists for some time:

- Earn £52,200 gross, your take-home is £38,274 – that £2,000 of extra pre-tax income ends up as only £387 of additional money in your pocket.

- Earn £55,200 gross, your take-home is £39,223 – the £5,000 of extra pre-tax income has given you only £1,336 post-tax.

That is not much incentive for someone earning £50,000 to increase their earnings.

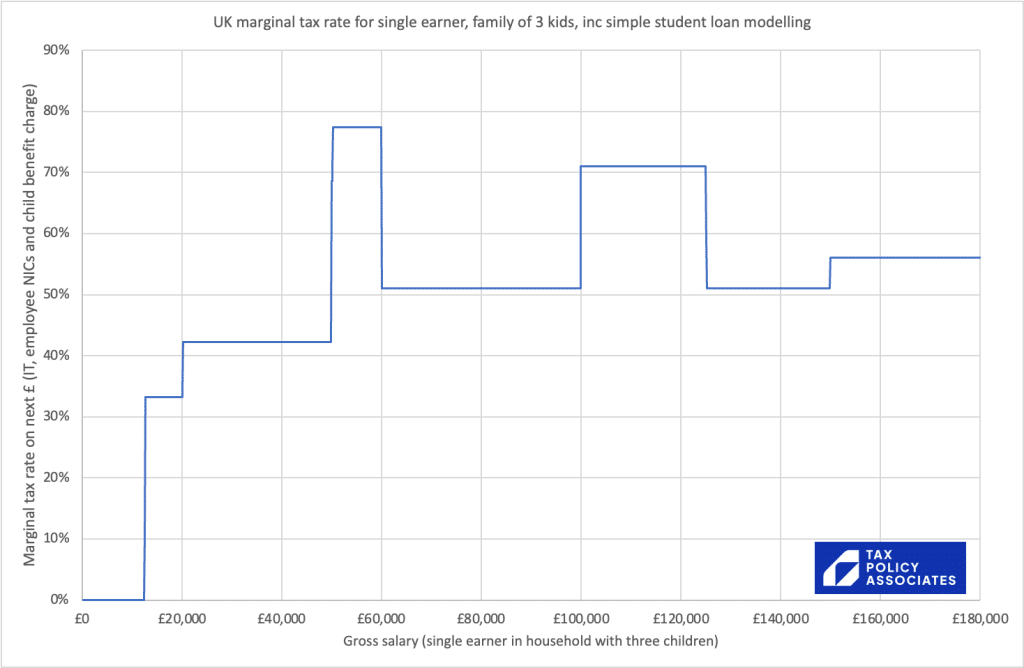

What about student loans?

Student loans are really just a complicated hidden graduate tax. For someone starting university before 2012, you pay 9% of your salary over £20,184, until the loan is repaid. Of course, the effect on individuals – even those on the same income – will vary widely, depending on how much loan they borrowed, how long they’ve been earning, and how their salary ramped up over time.

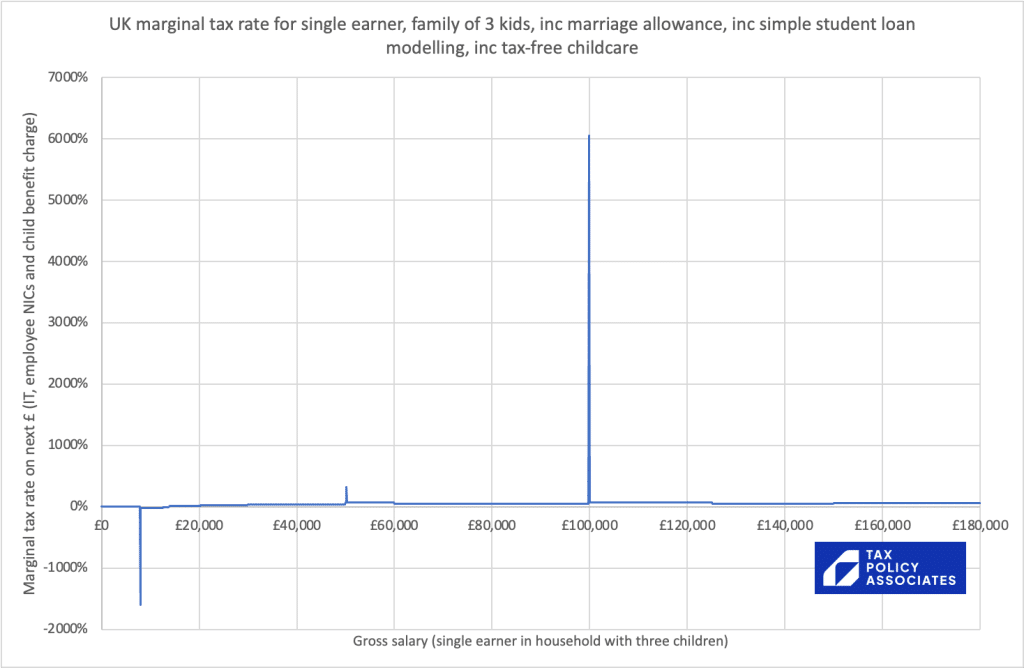

We can model it with some simplifying assumptions. Let’s say everyone on the chart is 30 years old, graduated nine years ago, and their salary ramped up in a straight line from £20k to where it is now. The marginal rates then look like this:3Corrected to fix a bad mistake/bug in the spreadsheet

I’d be cautious about citing these figures, given how dependent they are on the assumptions. However, it’s reasonably clear that graduates suffer from startling marginal rates. Please have a play with the spreadsheet if you’re interested. 4Now I’ve added the student loan calculations, I regret doing this in Excel, because it becomes unwieldy. Really needs implementation in proper code. Any volunteers?

What about [another stupid feature of the tax system]?

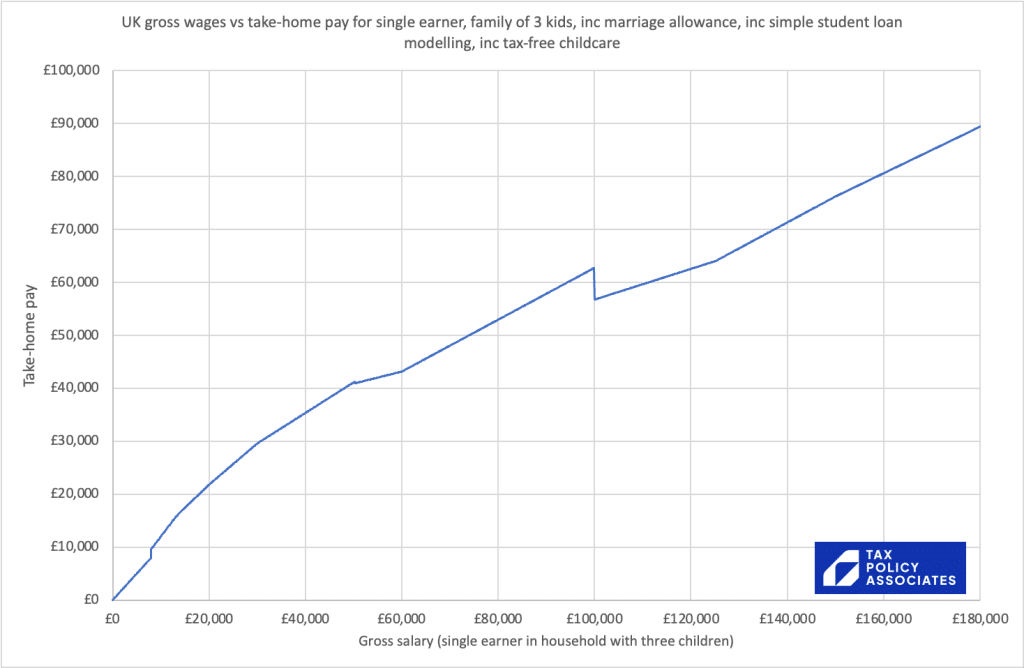

The tax-free childcare scheme creates an insane marginal rate at £100,000.

The basic scheme is that the Government will stump up for 20% of your childcare costs, up to £2,000 per child. You qualify if you and your partner’s earnings hit £7,904, and it’s completely withdrawn if one of your salaries hits £100,000. The result? An infinitely negative marginal tax rate at £7,904 and another brilliantly infinite5it’s not infinite – I forgot that you can’t divide money forever. For a couple with three kids, claiming the full £6k, the marginal rate will tend to £6k/1p = 60,000,000%positive marginal tax rate at £100,000.6For the chart, the spreadsheet assumes the higher earner in a family pays a maximum of 20% of their gross wage on childcare; if you don’t like that assumption you can change it

That £100k spike is absolutely not a joke – someone earning £99,999.99 with three children will lose an immediate £6k if they earn a penny more. They then don’t recover to their previous post-tax earnings until their gross salary hits £119k.

You can see this more clearly if we plot gross vs net income:

There are other similar effects: the thresholds around student maintenance loans for one. But I’m going to stop here for the sake of my sanity…

Why does this matter?

It’s complicated and unfair for people hitting these thresholds. The way the child benefit withdrawal applies means that it catches lots of people out.7See also this excellent OTS report here The high marginal rates act as a disincentive to work. Across the whole economy, I’m absolutely not an economist, but it seems plausible these effects act as a brake on growth.

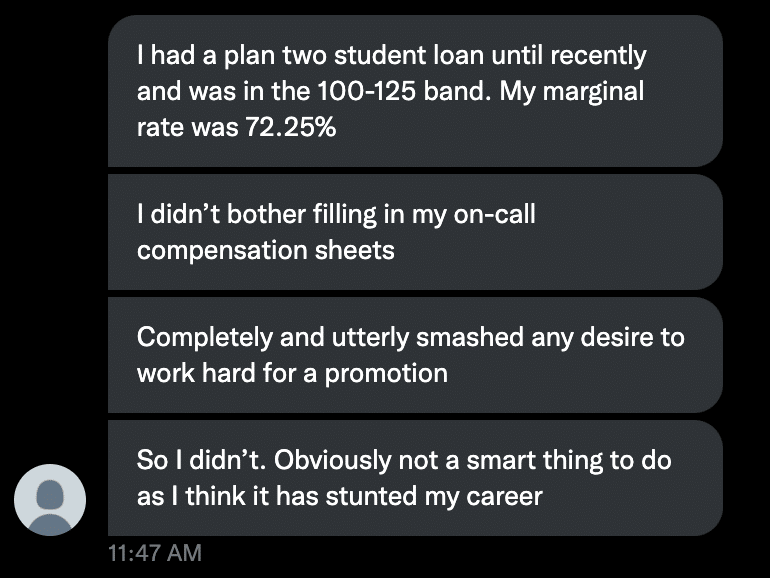

The human side looks like this, one of many similar messages sent to me today:

If we’re looking for ways to fix the tax system, then this should be right at the top of the target list. Regardless of where we sit on the political spectrum.

The solution

One solution is simply to scrap the personal allowance and child benefit tapers (and the marriage allowance to boot).8Fixing student loans is much harder, and tied into a series of policy questions where I don’t feel I have expertise to comment. Really not sure what to do about tax-free childcare. A taper would be better than a £100k hard stop. Problem is, that would be fairly expensive, on the face of it, costing somewhere around £5bn to repeal both,9 Back of a personal allowance napkin: 500,000 taxpayers earn £120k, value of personal allowance is £5k, so approx cost £2.5bn. Back of a child benefit taper envelope: the child benefit taper was expected to bring in £2.5bn of revenue when introduced in 2013. Since then, child benefit has gone up about 10%, and nominal earnings about 30%. Implying costs of around £2.5bn today. The marriage allowance should be small beer by comparison with either figure. Needless to say, these are hugely approximate estimates; I’d be grateful for anything better anyone can suggest! although the widespread awareness of these issues amongst the people affected, and use of salary sacrifice, additional pension contributions, etc, makes me wonder if the actual (dynamic) cost might be materially less.

Realistically the most likely source of funding is playing around with rate thresholds, for example reducing the point at which the additional rate kicks in. There are certainly other alternatives; but the important thing is that we really, really, shouldn’t have a tax system that can have a 68% marginal rate, let alone a 90% marginal rate.

Oh, and the other lesson: please please, politicians and HM Treasury, don’t introduce any more tapers into the tax system. Thank you.

The caveats

All the calculations are in this spreadsheet. The key assumptions/caveats are:

- Income tax/NI as for tax year 2022/23, from November 2022 (so the lower NI rate)

- One earner in a household, who is over 21 and not an apprentice, not a veteran, and under the state pension age

- Ignores benefits aside from child benefit (although benefits are notorious for creating very high marginal rates; to some extent that is unavoidable)

- Doesn’t include the thresholds around student maintenance loans.

- Doesn’t include tapering of pensions annual allowance (starting at £240k)

- Doesn’t include effects of the pension cap – that can create high marginal rates, but as it’s linked to the total size of your pension pot, the rate is very dependent on an individual’s specific position.

Any corrections, additions or comments would be much appreciated. Some kind people have offered to add in universal credit taper. It’s an incredibly important issue, but I’m reluctant to do this given that I have no understanding of the benefits system myself. I’d be delighted if others adapt the spreadsheet to do this.

Many thanks to James Wiseman on Twitter for his original calculation, and credit to William Hague for his article that sparked this train of thought.

-

1For more on this, and some international context, there’s a fascinating paper by the Tax Foundation here

-

2Strictly the marginal rate is infinite – it caps at just over 300% in my spreadsheet because the resolution of the calculations is £100. Also I didn’t have a monitor large enough to show an infinite line.

-

3Corrected to fix a bad mistake/bug in the spreadsheet

-

4Now I’ve added the student loan calculations, I regret doing this in Excel, because it becomes unwieldy. Really needs implementation in proper code. Any volunteers?

-

5it’s not infinite – I forgot that you can’t divide money forever. For a couple with three kids, claiming the full £6k, the marginal rate will tend to £6k/1p = 60,000,000%

-

6For the chart, the spreadsheet assumes the higher earner in a family pays a maximum of 20% of their gross wage on childcare; if you don’t like that assumption you can change it

-

7See also this excellent OTS report here

-

8Fixing student loans is much harder, and tied into a series of policy questions where I don’t feel I have expertise to comment. Really not sure what to do about tax-free childcare. A taper would be better than a £100k hard stop.

-

9Back of a personal allowance napkin: 500,000 taxpayers earn £120k, value of personal allowance is £5k, so approx cost £2.5bn. Back of a child benefit taper envelope: the child benefit taper was expected to bring in £2.5bn of revenue when introduced in 2013. Since then, child benefit has gone up about 10%, and nominal earnings about 30%. Implying costs of around £2.5bn today. The marriage allowance should be small beer by comparison with either figure. Needless to say, these are hugely approximate estimates; I’d be grateful for anything better anyone can suggest!

19 responses to “The UK should cut the top 90% rate of income tax”

And it continues with the tapering of pension allowances. Once your threshold income exceeds £200,000, your pension allowance reduces by £1 for every £2 your adjusted income rises above £260,000. The minimum this can taper to is £10,000.

It’s kind of ironic that taxes only really get lower as you make above £300k.

All the politicians going on about low productivity and growth and yet none of them is willing to do anything about this, which could very easily be cost neutral (and should in theory even then increase tax take with the incentive to work more or not stuff as much into pensions). The tax system is crying out for simplification but no politician seems brave enough to even try and sell it to voters; all they need to do is say, it’s too complicated, it has these silly points at 50k and 100k (and at lower earnings where benefits fade away), we’ll fix it and reduce the tax rate a tiny bit overall too (cost would be at least made up by people working more at the fringes and savings to HMRC).

Could we not propose a principle to be observed by politicians/ tax policy wonks that Marginal Tax Rate (including withdrawal of benefits. NICs, student loan repayments etc) should NEVER decrease with an increase in income. There are many ways of achieving this and the question of the overall tax take is of course a political one but there is no justice at all in taxing the (relatively) low income person at a higher overall rate than the (relatively) high income person.

The two-child benefit cap stops the ridiculous margins for lots of children through?

No, it’s not relevant to child benefit

Fantastic article – only thing missing is that 30 free hours of childcare is also lost at 100k which makes that marginal rate eye watering if you have a 3 year old!

Interesting to read, Dan, and something which causes me a fair amount of grief and dismay! As I understand it, the effective rate could be even higher over £100k in certain circumstances I think (and I think it is unlikely in your example for one person to have 3 children at nursery at any one time, under 3):

– For me, with one child under 3, I have 1 x £2k allowance (meaning, I believe an effective 80% rate for £100-125k, losing £12.5k allowance + £2k + 40% tax etc. (taking home around £5k of £25k))

– In 16 months, I will have 1 x 3 year old at nursery and 1 x 1 year old at nursery. At that time the 3 year old will qualify for 30 hours free childcare (instead of 15 hours standard) (if I earn under 100k, worth around £4k a year, I think) and the 1 year old the £2k allowance. That is a realistic circumstance, and I think would equate to around £6k of benefit. Taking off the £12.5k personal allowance as well, means of that £25k over £100k, I would take home around £3k. I think that is around a 88% rate.

In theory, with 2 x 3-4 year olds, the effective rate could even exceed 100%, couldn’t it?

Would love to hear if you agree with my maths!

Hi Dan,

Thanks for the article. Had a bit of time so wrote some quick code – I have sent a pull request to the GitHub repository.

Best,

Luca

For a couple of years I’ve managed my income to below £100k with additional pension contributions because of the double whammy of losing the 15 free hours of childcare and the loss of tax free childcare. I work part time. I always thought I’d go back to working full time when the children were at school (and I know my employer would like me to) but it would put me in the £110-120k band after pension contributions and I don’t really fancy working harder for less money.

There is zero chance of this being fixed. Not many people understand it so any political gain (ie votes) is insignificant. The winners quietly pocket their winnings while the losers scream “foul”. That assumes the whole reform is fiscally neutral. Of course the problem can be fixed by reducing the tax take. If you think that’s smart right now in a hot running (inflationary) economy with a massive deficit your name is probably Liz and the OBR and BoE want a word with you.

If you were foolish enough to study a postgraduate degree like me – that’s an additional 6% on top of the 9% undergraduate loan repayment. It is just such a painful kick in the teeth for studying and working hard to take advantage of that education.

I agree that these marginal tax rates are ridiculous.

You say in the caveats, “benefits are notorious for creating very high marginal rates”. You are right. Anyone on modest income, say £15-25k, entitled to universal credit, is faced with a universal credit taper of 55%, plus tax at 20% and NI at 12%, giving a total marginal rate of 87%, or, if they are also paying back a student loan, a total rate of 96%. Unsurprisingly, they may not feel inclined to take on an extra shift for a net payment of a few pounds.

The problem is that the tax and benefits system is like a house built of mundic block (a type of building material used in the first part of the twentieth century, predominantly in Cornwall, made from a mix of concrete and mine waste and which crumbles over time). Each year, the building owner bodges repairs, adding on bits, replacing bits; but, eventually, the only solution is to demolish the house and start again. That is where we are with the tax system. But no party has the courage to start again from scratch. Instead they add on further bits and pieces and build in even more bizarre incentives and disincentives.

2 more points 1 specific, 1 general

– If you earn more thank 100k you also lose out on 15 hours of free childcare a week for 3-4 year olds (in addition to the non-means tested 15 hours). This works out at about 4k. It isn’t even tapered. So going from 99,999 to 100k costs you about 4k if you have a 3-4 year old in childcare….

– why not include employers NIC in your calculations?

employers NICs are very relevant to the long term take-home wages, but not to marginal rate effects. Your decision whether to work an additional x hours is rightly unaffected by how much tax that would cause for your employer.

Yes, absolutely this. In addition to the tax free childcare losses as well. Two pre-school age kids so multiply everything by two.

Currently earning c. £100k. Some salary sacrifice into pension, but generally no real incentive to go and earn more until both are in school.

Not only do I have the personal pressure of actually wanting to spend time with kids rather than in the office, but also absolutely no financial incentive to stay late or work harder… infuriating!

Recent inflation figures also have me terrified re: quality of life. Can’t afford to go and get a small payrise or salary sacrifice less, due to tax penalties…

Usual caveats of yes, I’m well aware of how lucky I am with salary etc…

A basically irrelevant point, but I don’t think the withdrawal of the marriage allowance creates an infinite marginal rate. This would require income to be expressible in infinitely small fractions, whereas in reality it’s not possible to earn amounts other than in one penny increments. Sorry to ruin a good joke.

You are, disappointingly, completely right. For a couple with three kids, claiming the full £6k, the marginal rate will tend to £6k/1p = 60,000,000%

I agree – written 4 1/2 years ago, but still relevant. Only the numbers have changed

https://www.krestonreeves.com/news/simply-does-it/

Having it laid out like this is very interesting… and understanding it better compounds the disincentive to work between the margins at 50k / 100k. Sharing it with a few friends now… and thanks for the useful arguement as to why I don’t want 8 kids.