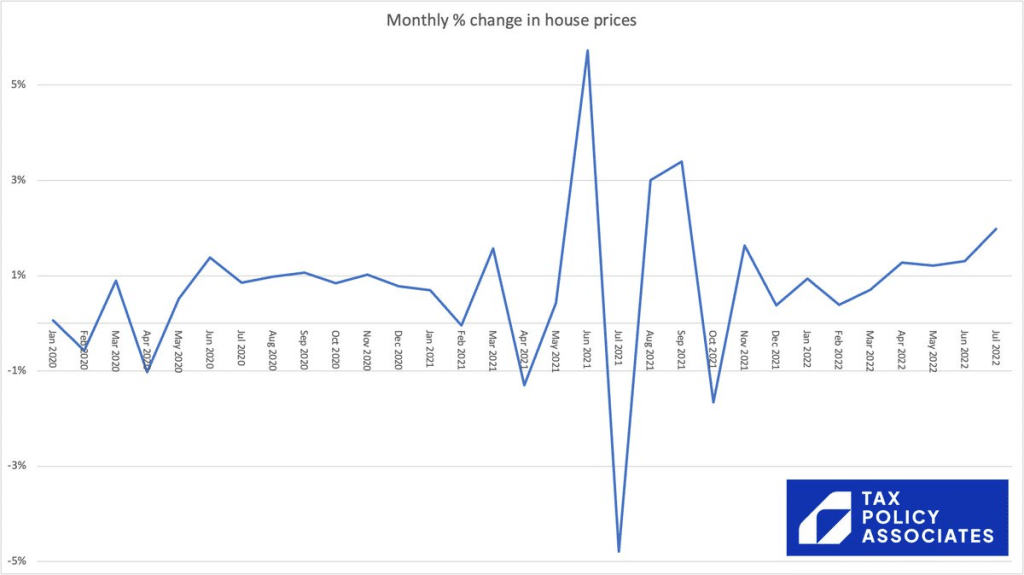

This chart shows house prices having a heart attack.

The big spike in June 2021 just happens to coincide with the last month of the £500k stamp duty “holiday”. Buy a £500k property in June 2021: £0 stamp duty. Buy in July 2021: £12,500. So a nice 2.5% saving. Shame about the 5% price hike in June 2021. Overall, buyers lost out.

Then another spike before the end of the £250k nil rate band in October. Buy a £500k property in September 2021: £12,500 stamp. Buy it in October: £15,000. A 0.5% saving – again swallowed by house price increases.

These look like irrational results: buyers would have been better off waiting til the holidays ended. But humans are irrational creatures1Or are they? A smart person suggested to me that a rational buyer might prefer to pay £525k with no stamp duty than £500k plus £12.5k stamp duty, because their mortgage lets them spread the £525k over 25 years; the stamp duty has to be funded in cash. That’s a very cool explanation, but doesn’t make this good policy!.

And these prices stick – March 2021 to December 2021, the net effect of the heart attack is a 6% increase (when looking at the chart, remember it’s a chart of house price inflation, not absolute house prices).

Previous stamp duty holidays had less dramatic effects: there’s good evidence that the 2008/9 stamp duty holiday did lead to lower net prices, but 40% of the benefit still went to sellers, not buyers. There’s also been some research on the 2021 holiday, but it was completed too soon to catch the September heart attack.

So all of this suggests stamp duty holidays are a bad policy, an inefficient way of helping buyers, and that they perhaps even trigger price rises greater than the tax saving.

A permanent stamp duty change shouldn’t, at least in theory, have as dramatic an effect – a chunk of the benefit would still be swallowed up in higher prices, but we wouldn’t see the heart attack. In the real world, however, I expect we will – partly because some people (rationally) won’t believe the stamp duty reduction is permanent, and partly because some people will (irrationally) excitedly jump on the stamp duty reduction.

The bigger point is that, from a distributional point of view, stamp duty cuts are a way to hand money to those who already have it.

And the bigger conclusion: stamp duty is a terrible tax. As the Mirrlees Review2Which if you haven’t read, you should put it:

Stamp duty land tax, as a transactions tax, is highly inefficient, discouraging mobility and meaning

that properties are not held by the people who value them most…

I’d scrap it, and replace the £12bn of revenue with increased council tax on high-value properties (not hard, when council tax raises £42bn). Fairer, more efficient, more redistributive, not a bloody transaction tax, and might even help dampen down the property market. More on this to follow.

-

1Or are they? A smart person suggested to me that a rational buyer might prefer to pay £525k with no stamp duty than £500k plus £12.5k stamp duty, because their mortgage lets them spread the £525k over 25 years; the stamp duty has to be funded in cash. That’s a very cool explanation, but doesn’t make this good policy!

-

2Which if you haven’t read, you should

2 responses to “When tax cuts cost you money – the effect of previous stamp duty reductions”

It’s not just stamp – exactly the same happened in 1986 in the run-up to the abolition of MIRAS.

Yes! And each time during the sloooow phase-out of MIRAS (I remember claiming it for my first Clifford Chance pay-check in 1998, before it vanished completely)