I’ve told Zahawi’s lawyers I’m going to accuse him of lying to Kay Burley in his Sky News interview back in July. Amazingly, he’s refusing to respond – no explanation, no defence, nothing. It’s the behaviour of someone with something to hide.

The backstory: Zahawi founded YouGov. But the 42.5% founder stake in the company (that you’d expect him to have) was held by a Gibraltar company – Balshore Investments – held by an offshore trust owned by his parents. More on that here.

Why would anyone do anything so weird?1And it is super-weird. I’ve spoken to dozens of QCsKCs, tax lawyers, accountants, entrepreneurs and others about this. Everyone has the same reaction: that’s really weird. Zahawi’s explanation – that his father was instrumental in the establishment of YouGov, and so it was only natural he got the shares – is bizarre on several levels. The obvious answer: he put the shares in Balshore to avoid UK tax, but has arrangements behind the scenes to get cash from Balshore.

In his Sky News interview, Zahawi denied that he benefited from Balshore:

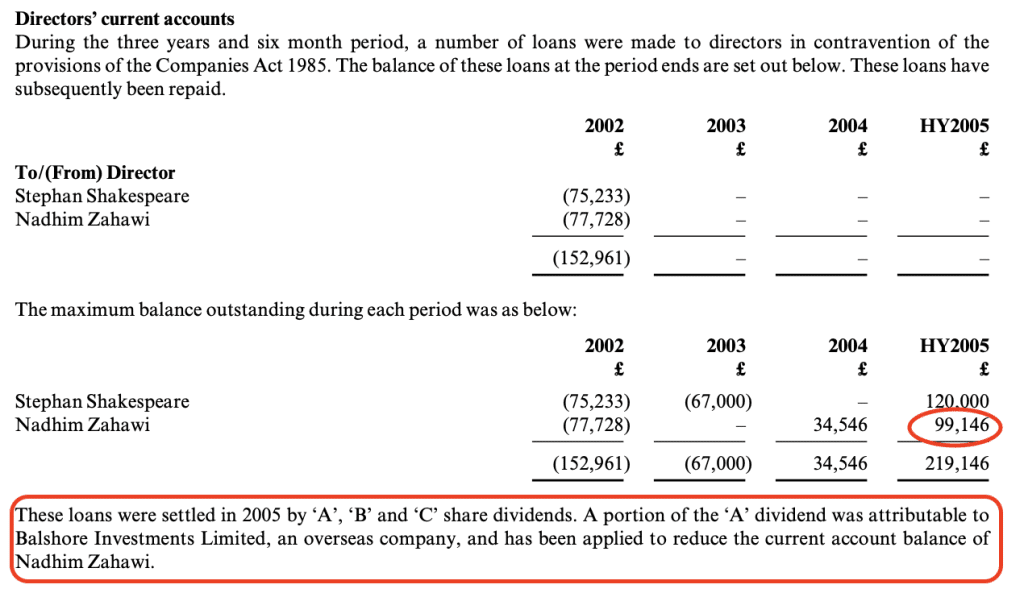

But this document shows a £99k gift from Balshore to Zahawi:2See page 36 here

My expectation is that this wasn’t a one-off – the only thing special about the £99k is that Zahawi got sloppy, and so it ended up being publicly disclosed. My bet is that there’s more out there. Possibly £26m more.3Zahawi denies that the £26m profit Balshore made from YouGov was used to fund his £26m of loans. But he also denied receiving any benefit from the trust, and we know what that denial was worth.

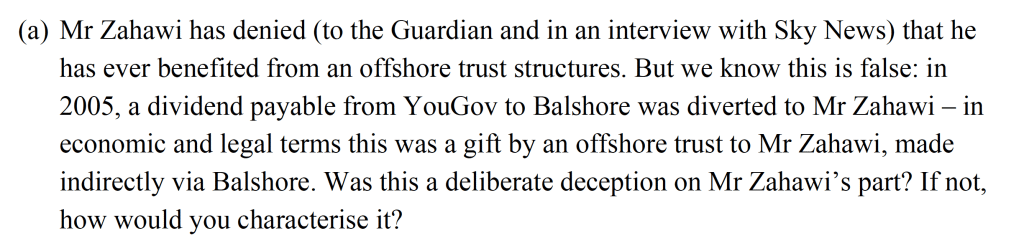

So why on earth did Zahawi deny receiving any benefit from the trust? I put this to his lawyers, Osborne Clarke:

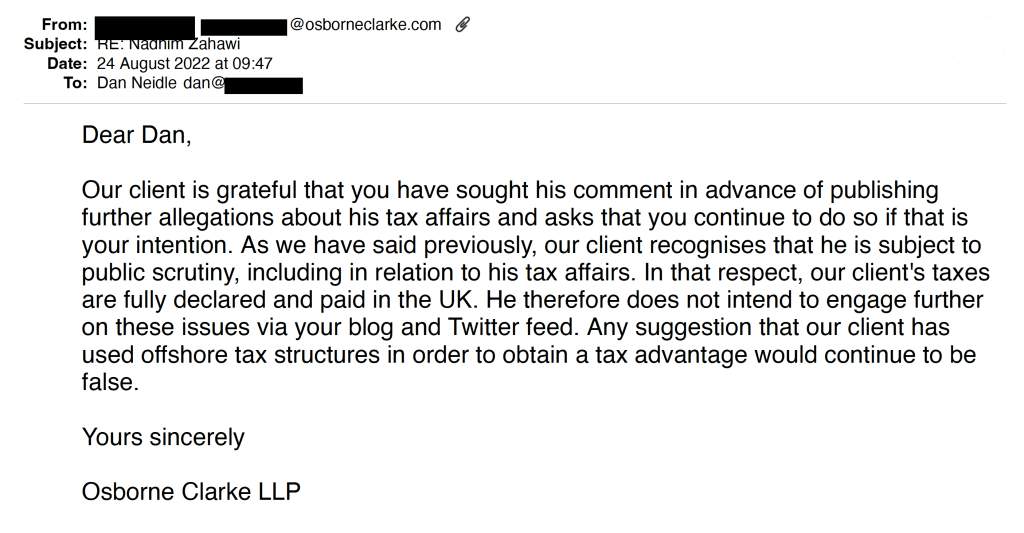

They – amazingly – refused to defend or explain Zahawi’s false denial:

Zahawi’s assertions that he’s paid all his tax, hasn’t avoided tax etc etc… they all fall flat when we know his central claim that he hasn’t benefited from the trust is false.

At this point it doesn’t look like an accidental omission – in my opinion, it looks like deliberate deception… a lie. If Zahawi told the same lie to HMRC, then this wouldn’t be tax avoidance – in my view it would be tax evasion. Astonishing for a senior cabinet minister.

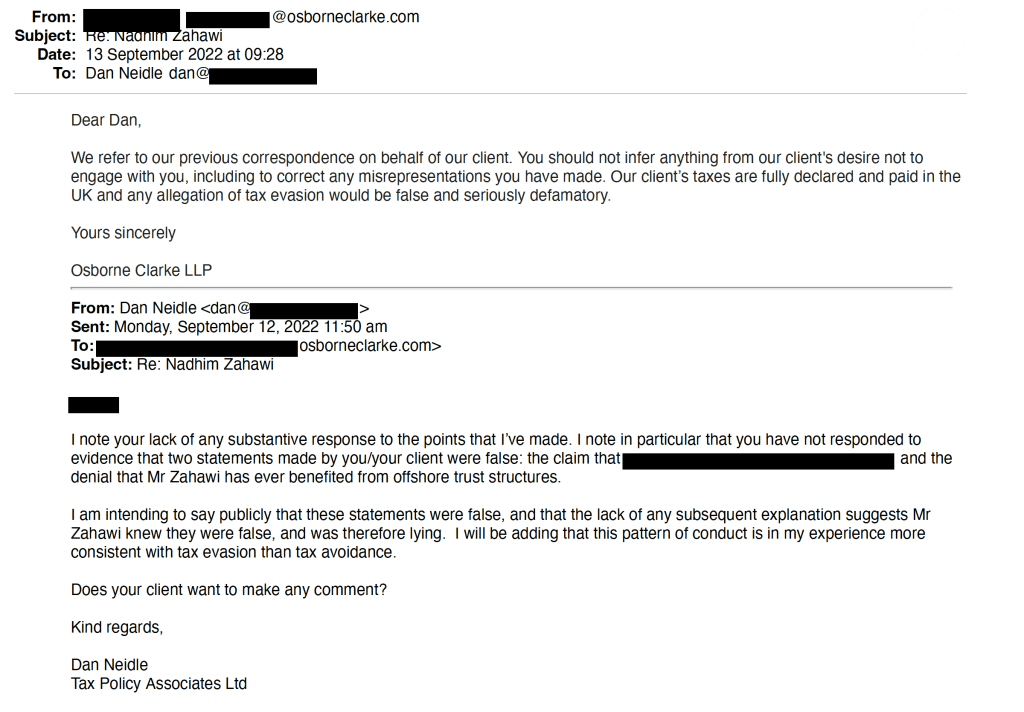

At this point, I just couldn’t believe that Zahawi and his lawyers were so not-bothered that he’d been caught out in a lie. I put the point to them again… and still they refused to comment:

If Zahawi doesn’t want me to infer things from his failure to explain what looks very much like a lie, then I’m afraid he’s going to be disappointed. Having structures that make no sense, making false statements about your tax affairs, and refusing to explain or defend those statements, is consistent with tax avoidance… but, in my experience and opinion, it’s also consistent with tax evasion.

And so is the Balshore arrangement. The more I think about the structure, the less it looks like tax avoidance. The problem is, there are lots of rules that stop you simply giving your shares to an offshore trust, and then taking money from the trust.4There are a large number of different views out there on how precisely the structure would get taxed, but literally everyone I’ve spoken to thinks that it would have been taxed; whether under the settlement rules, the usual trust rules, transfer of assets abroad, remuneration rules/loan charge, purposive disregard of Balshore entirely… take your pick HMRC aren’t that dumb. You’ll end up paying the tax. The structure only saves tax if you keep everything hidden from HMRC. But if Zahawi did that, then he wasn’t avoiding tax at all… it was simple tax evasion.

It seems incredible that someone who is now a senior cabinet minister would have acted dishonestly. But there is a longstanding allegation of criminal behaviour by Zahawi – reported in 1999 but only denied in 2020 (and never the subject of a libel claim).

Zahawi is probably hoping everyone has forgotten about his tax affairs, and it will all go away. I haven’t, and it won’t.

More to follow soon.

-

1And it is super-weird. I’ve spoken to dozens of

QCsKCs, tax lawyers, accountants, entrepreneurs and others about this. Everyone has the same reaction: that’s really weird. Zahawi’s explanation – that his father was instrumental in the establishment of YouGov, and so it was only natural he got the shares – is bizarre on several levels. -

2See page 36 here

-

3Zahawi denies that the £26m profit Balshore made from YouGov was used to fund his £26m of loans. But he also denied receiving any benefit from the trust, and we know what that denial was worth.

-

4There are a large number of different views out there on how precisely the structure would get taxed, but literally everyone I’ve spoken to thinks that it would have been taxed; whether under the settlement rules, the usual trust rules, transfer of assets abroad, remuneration rules/loan charge, purposive disregard of Balshore entirely… take your pick

4 responses to “Nadhim Zahawi – why did he say he didn’t benefit from an offshore trust, when we know he did?”

Is loan in breach of the Companies Act 1985 a criminal offence as well as a civil matter albeit one I doubt anyone in authority would follow up on now.

no, as long as it’s fixed it’s a big nothing. Pretty common for small companies, and not something I’d hold against Zahawi or YouGov.

Footnote 1 – KCs * !

Doh! The first, but not the last, time I’ll make that mistake.