Bob

1This is an updated version of my previous piece – ‘how to avoid inheritance tax’Bob is a 70-year-old with £5m of investments which he wants his children to inherit. But he’d like to avoid the £2m of inheritance tax.

He asks his tax adviser for advice on how to avoid the tax, and is expecting a long complicated memo, proposing a tax avoidance scheme involving seventeen companies, three tax havens, two trusts, and large fees.

What he actually gets is written on a postcard:

- Step 1: Sell your existing investments2Won’t there be CGT on the sale? Probably not much. £1m of the investments are in an ISA. As for the rest, like any tax-obsessed investor, you’ve been managing CGT as you go, crystallising gains to use your annual allowance, and using your wife’s annual allowance (i.e. total gain sheltered = £25k * years invested). You’ll have a bit of gain, but it’s a price worth paying. and replace them with shares listed on the Alternative Investment Market. Either assembling a diversified selection yourself, or paying someone else to do it.

- Step 2: Make sure to live at least two years.

- Step 3: Drop dead, happy in the knowledge you’ve avoided inheritance tax.

- There is no Step 4.

Jane

Jane is a 70-year-old who owns a £5bn vacuum cleaner company, which she wants her children to inherit. But she’d like to avoid the £2bn of inheritance tax.

She asks her tax adviser how to avoid the tax. The answer she gets is surprising: nothing. Her estate will have no inheritance tax liability whatsoever on the £5bn business.

Why does this work?

There is a complete exemption from inheritance tax – business property relief – where (broadly) you own a business, and have held it for at least two years. So Jane is straightforwardly exempt from inheritance tax.

Surprisingly, the exemption extends to most AIM shares, which qualify for complete exemption from inheritance tax after two years. Given AIM companies are small/mid-cap, the obvious downside is that your portfolio suddenly becomes more volatile (although not as much as you might think). But Bob probably sees that as a small price to pay for avoiding a 40% tax hit.

Does this actually happen?

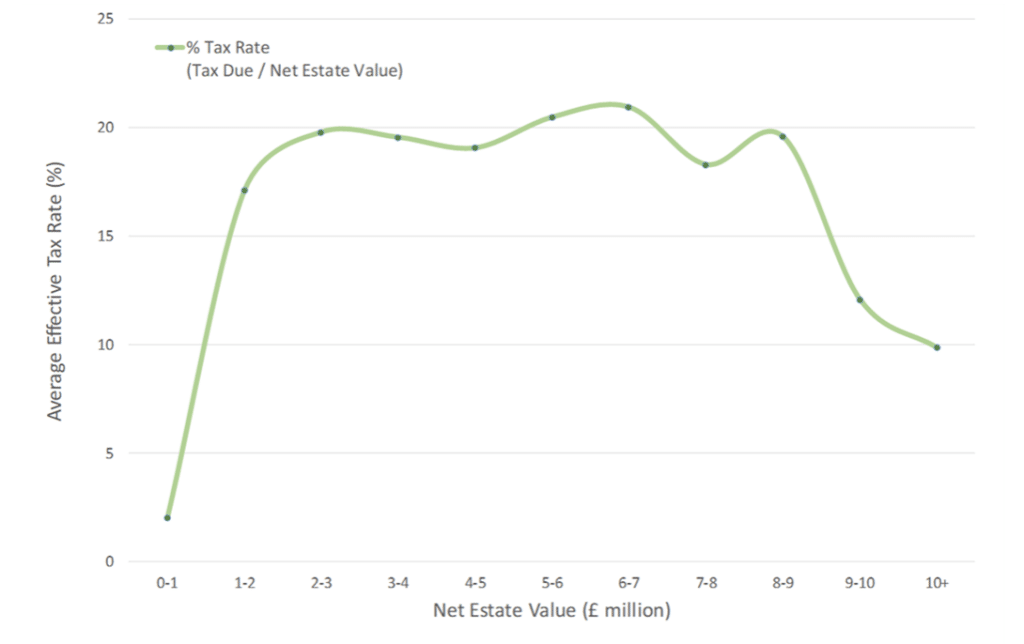

Oh yes. Here’s the HMRC analysis of the effective rate paid by different value estates. The effective rate for the wealthy is 10%:

Why are these exemptions so generous?

The road to tax hell is paved with good intentions (and also flapjack).

Inheritance tax can be unfair for small family businesses. Imagine a small shop, making a profit of £50,000/year. That business is plausibly worth £500k. So when the owners die, their children – who expect to inherit the business – have a £200k bill. A larger business could deal with this by borrowing, or bringing in outside investors – but for a small business that’s much more difficult.

So most countries with inheritance/estate taxes have exemptions for private businesses.

The UK does that with business property relief. But BPR goes much further than it needs to:

- First, the exemption has no limit. What makes sense for the cornershop doesn’t really make sense for a £1bn business – but the exemption covers it just the same.

- Second, the exemption doesn’t apply to shares in listed/quoted companies, for the very good reason that you can easily fund the tax by selling the shares in the market. But shares in alternative markets like AIM aren’t considered “quoted” for this purpose, even though you can easily fund the tax in precisely the same way.

Inheritance tax is just full of this sort of thing, which is why it’s so broken – see my previous blog.

How to fix it

That’s easy. Exemptions and reliefs should do what they’re supposed to do, and no more. If we are trying to protect small private businesses then business property relief should only cover small private businesses. Cap the relief at a generous but sensible level (£1m?). Exclude all forms of listed security.3probably with the £1m capped relief still available to the original owner of the business, before it was listed, if they continue to hold the listed shares Job done.

Given the high cost of BPR, this could raise a serious amount of money, and could fund a reduction in what is (by international standards) quite a high tax rate. The same should be done with agricultural property relief.

And by reducing both the rate of IHT, and the perception the rich don’t pay it, we might make the tax less unpopular, and therefore preserve its long term future.

Cemetary photo by John Thomas on Unsplash

-

1This is an updated version of my previous piece – ‘how to avoid inheritance tax’

-

2Won’t there be CGT on the sale? Probably not much. £1m of the investments are in an ISA. As for the rest, like any tax-obsessed investor, you’ve been managing CGT as you go, crystallising gains to use your annual allowance, and using your wife’s annual allowance (i.e. total gain sheltered = £25k * years invested). You’ll have a bit of gain, but it’s a price worth paying.

-

3probably with the £1m capped relief still available to the original owner of the business, before it was listed, if they continue to hold the listed shares