Last night, Channel 4 News reported that Sunak had received payments from a tax haven. My view: Sunak did nothing wrong, and the way Channel 4 reported this was unfair and misled viewers.

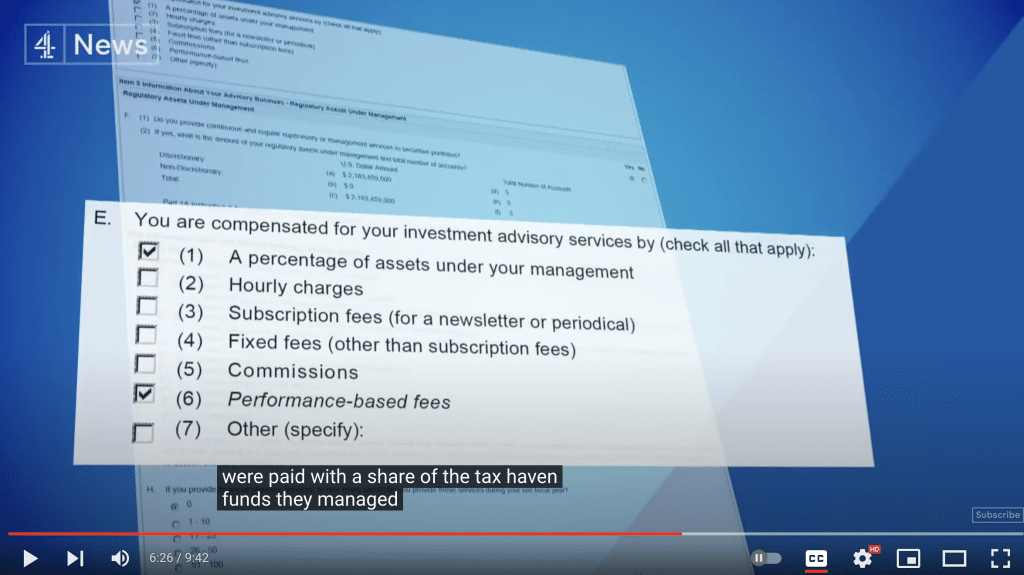

The central allegation is that Sunak, when in the US, was a partner in a hedge fund established in the Caymans, and the partners were paid with a share of the tax haven funds they managed.

This is true. But it omitted three key facts, and that made it misleading.

First, almost all hedge funds are based in tax havens. Why? Because if you’re based in country A, making the tax and regulatory rules work for investors from countries A thru Z is really hard. Tax havens make it much easier. Channel 4 fail to mention how standard it is for a hedge fund to be offshore. They imply it’s suspicious1More background – almost no funds pay tax. Why? Because if you buy shares in ten companies you pay tax on your income/gains from the companies. If you buy a fund that invests in the same ten companies then the tax result should be the same. If instead there is another level of tax, in the fund, then you wouldn’t invest through a fund. Collective investment management is a *good thing* for a bunch of reasons. So policymakers generally accept that funds should not be taxed. For onshore funds (e.g. unit trusts) it’s achieved by specific exemptions. For offshore funds, it’s achieved by rules that delineate “good” funds that don’t avoid tax, and “bad” funds that do, and imposing punitive taxes on them (the UK offshore fund rules, the US PFIC rules, and other equivalents elsewhere).

So for a hedge fund to pay no tax is the correct policy outcome, whether that’s achieved by an onshore company within a specific exemption, or a tax haven company that falls within specific rules that permit it.

There are currently a few initiatives to enable funds to come onshore; that’s a good thing for a large number of reasons, and I’ll talk more about that another time..

Second, they also present as an exciting discovery that Sunak, as a partner in the hedge fund, was entitled to a share of the fund returns. But that’s how hedge funds work – managers’ interests are “aligned” with investors by giving managers a share of the fund returns.

Third, they suggest there’s some mystery and potentially some tax dodginess here – “Did Mr Sunak earn bonuses offshore in the Cayman Islands”. But at the time, Sunak was living in the US and had a green card. So he was subject to US tax on his income, whether it came from the US, the Cayman Islands, or the moon. (They later give Sunak a quote saying this, but it’s not just his view – it’s intrinsic to the US tax system.

Then they say “There’s no suggestion Mr Sunak did anything illegal”? No – there’s no suggestion of anything remotely out-of-the-ordinary. And what triggers me is that the media use this same caveat when reporting on the most egregious of tax scams.

Connoisseurs of the genre will spot the absence of any tax experts in the report. Either:

- Channel 4 didn’t speak to any. In which case WTF?

- Channel 4 did – the experts said there was nothing to see here, and Channel 4 ignored them.

There are lots of good reasons to criticise the fund industry. And Sunak is obviously very privileged. If the focus of the report was on these issues then I’d have no argument with it.

Is it possible that there was tax avoidance going on? In principle, sure. Here’s some questions Channel 4 could have asked:

- Was this “carried interest”, taxed at the lower capital gains rate in the US and UK rather than the full income rate? (For a hedge fund it shouldn’t be)

- Did Sunak continue to be entitled to payments from funds he used to manage when he was Chancellor?

- If so, were these fully declared? And was he fully taxed on them as income (45%), at the lower capital gains rate (20%), or something else?

- What did the funds do? How were they structured? Was there avoidance going on “lower down” in the structure?

What we got instead was insinuation-heavy, context-light reporting, which damages the public understanding of tax, and undermines our ability to identify people and politicians who really have been engaged in tax avoidance. Mentioning no names.

-

1More background – almost no funds pay tax. Why? Because if you buy shares in ten companies you pay tax on your income/gains from the companies. If you buy a fund that invests in the same ten companies then the tax result should be the same. If instead there is another level of tax, in the fund, then you wouldn’t invest through a fund. Collective investment management is a *good thing* for a bunch of reasons. So policymakers generally accept that funds should not be taxed. For onshore funds (e.g. unit trusts) it’s achieved by specific exemptions. For offshore funds, it’s achieved by rules that delineate “good” funds that don’t avoid tax, and “bad” funds that do, and imposing punitive taxes on them (the UK offshore fund rules, the US PFIC rules, and other equivalents elsewhere).

So for a hedge fund to pay no tax is the correct policy outcome, whether that’s achieved by an onshore company within a specific exemption, or a tax haven company that falls within specific rules that permit it.

There are currently a few initiatives to enable funds to come onshore; that’s a good thing for a large number of reasons, and I’ll talk more about that another time.

One response to “The Channel 4 News report on Sunak’s fund management”

Excellent to see you calling out the media for not distinguishing sufficiently between things one might consider unfair (people taking advantage of bad rules) and actual cheating/deception where people break the rules.