The Chancellor of the Exchequer, Nadhim Zahawi, has been sending threatening letters, drafted by expensive lawyers, to people investigating his tax affairs. The letters are designed to intimidate, and say they are confidential and can’t be published. One was sent to me. I am publishing it.

Update: The Times has the story here. For those who prefer PDFs, I’ve uploaded the first Zahawi letter here, my response here, and the second here.

The letters

The public have a right to know if the Chancellor of the Exchequer – the person responsible for HMRC and tax – created a tax avoidance scheme to avoid £4m of his personal tax. At this moment I expect HMRC is considering whether to launch an investigation… it’s hard to imagine a worse conflict of interest than the Chancellor being investigated by tax inspectors whose conduct he can influence.

And the public definitely have a right to know if the Chancellor sends letters to prevent the media and others from writing about his tax avoidance.

I believe in transparency. I think it’s improper for lawyers acting in the shadows to curtail legitimate public debate about important public figures, particularly when there are allegations they’ve been dishonest. So I told the Chancellor’s lawyers I’d only accept open correspondence. They persisted in sending me letters that claim to be confidential. They aren’t. They contain no confidential information, and I never accepted a duty of confidence – indeed I explicitly rejected it. I don’t believe the Chancellor ever really intended to pursue a claim. The public interest is so obvious, and so strong, any libel claim would be farcical.

The letter they sent me says, rather artfully, that it’s not actually a threat to sue for libel. But it comes from a libel lawyer, and tries to prevent me publishing it. Similar letters have been sent to others in recent weeks, and I understand Zahawi has done this before – using lawyers to silence people writing about his tax affairs.

I’ve considered very carefully whether I should publish the correspondence. I’ve considered the matter with others and spoken to several legal ethics experts. All support my view that in the circumstances of this case there is no legal or ethical reason not to publish the letters, and a powerful public interest in publishing. So that is what I’m doing. And I will be writing to the Solicitors Regulatory Authority to ask them to make clear that lawyers should never assert that letters of this kind are confidential unless there is a proper and reasoned basis for such an assertion (which is is clearly absent here). More here on why I am confident this is both lawful and proper.

The background

For the last couple of weeks, I’ve been writing about how, when Nadhim Zahawi co-founded YouGov, his 42.5% founder shareholding ended up with a Gibraltar company, Balshore, owned by a secret offshore trust controlled by his parents. I said it looked like tax avoidance. I am a tax expert. And every other tax expert I’ve spoken to agrees – accountants, solicitors, QCs, and retired HMRC inspectors.

Zahawi provided an explanation for this: that his father had provided “startup capital”. But he hadn’t. He may have provided £7k for some of the 42.5% but (according to documents filed by YouGov) another investor paid £285,000 for 15% of the shares at the same time. Clearly £7k didn’t justify 42.5%. I published my conclusion – there were three possibilities: I’d made a mistake; YouGov had filed a series of wrong documents; or Zahawi was lying. I invited Zahawi to respond. He didn’t – instead he switched to a new explanation – that his father had provided so much assistance, and Zahawi was so inexperienced, that it was only fair for YouGov to give his company (Balshore) the shares.

I couldn’t understand why he provided that first explanation, and then dumped it and alighted on a new one (itself not very credible). I couldn’t think of any explanation except deliberate deception – so I called it what I thought it was: a lie. It’s this that has Zahawi so unhappy. The latest defence piles on more of what look like falsehoods. They suggest the false explanation was given only once, when I know it was given to at least three people. Zahawi’s lawyers confuse the words “capital contribution” and “startup capital” (they surely know the difference). They muddle Zahawi’s first explanation with his second. I think they know they have no real argument, and no serious libel claim. Which is why, instead, they have focused on silencing me – with bullying letters from the shadows. But I’m not going to play that game.

This is not the only false statement from Zahawi. On 11 July he told Sky News he didn’t benefit from an offshore trust and wasn’t a beneficiary of it. In fact he was – in 2005 Zahawi absolutely received a gift from Balshore. This was a benefit and he was a beneficiary – in both everyday English and technical tax law. I have not called this a “lie” because Zahawi may just have been confused. But for him not to correct his past statement is unacceptable.

And Zahawi’s tax avoidance may have triggered a raft of further taxes: value added tax in 2000; trust taxation on gifts and capital gains in subsequent years; and withholding tax on his many interest payments to Gibraltar. I’ve asked Zahawi’s lawyers if he paid these taxes. Their response – he doesn’t want to get into a debate when he has an important job to do. But a large part of that job is being in charge of the tax system. And it’s not a debate, it’s a simple question: did the Chancellor fail to pay tax that was due? The public has a right to know.

The documents

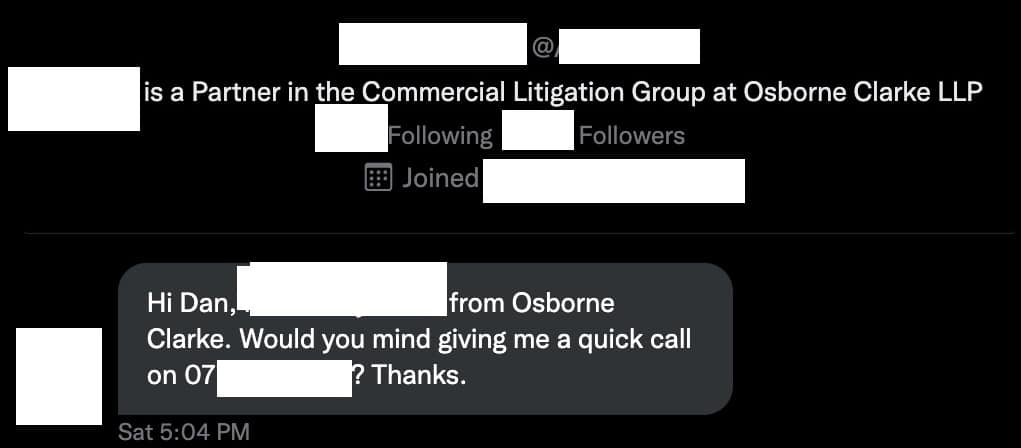

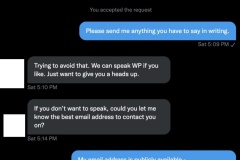

Here’s the initial Twitter DM I received from Zahawi’s lawyers, Osborne Clarke. Note my reply that I won’t accept “without prejudice” letters (a “without prejudice letter” is often sent by lawyers negotiating a settlement; it can’t subsequently be put before a court, because that would dissuade people from trying to settle disputes). The opposite is an “open” letter.

Their response was to send me a (supposedly) without prejudice letter – the very thing I’d said I wouldn’t accept:

I responded as follows:

I then received this response:

I hope it’s clear from the above why I believe publishing the letters is the right thing to do. I explain in more detail here why Osborne Clarke’s assertion that I can’t publish these letters is wrong in law.

I’m leaving comments on this post open for now, but will police them more than usual, for the predictable tedious legal reasons – sorry.

58 responses to “The Chancellor’s secret libel letters”

Hi Dan,

Great work, did anything happen to Osborne Clarke in relation to the complaint you filed with SRA? Surely operating in this model should have warranted an investigation on how the organization operates in the law industry.

Thanks,

Sav

They are under investigation; will be a few months before there’s an update. I am confident the SRA is taking this very seriously.

Sounds like Mr Neidle is more expert in tax law than the law of confidence. It is not for the confidee (i.e. the person to whom confidential information is imparted) to decide whether to “accept” or “reject” his duty of confidence.

The law (or, to be precise, equity) imposes a duty of confidence on the person to whom confidential information is imparted in circs where s/he knew, or ought reasonably to have known, it was confidential. Marking a letter ‘private & confidential’ does not necessarily imbue the information in it with the quality of confidence, but it certainly puts the confidee on notice.

Mr Neidle can seek to argue that the OC email and/or letter was not confidential, but, if they were, he cannot, as a matter of law, decide unliterally to “reject” his legal obligation of confidence.

well obviously you can’t “reject” a duty of confidence once it has arisen, but in this case I wrote *first* saying I’d only accept open correspondence. Good luck to anyone arguing it’s reasonable to imply a duty of confidence in those circumstances.

Sounds very ‘Ecclestone’ to me, mind you forward details to HMRC, their compliance unit like a trust or two.

Looks like perfectly fair, reasonable comment by DN to me. DN and I have also commented on RS’s tax affairs and possibly DN was too generous to RS. See:

https://www.accountingweb.co.uk/community/blogs/philip-fisher/a-matter-of-tax-and-morality

It has been reported in Finish media that Nadhim Zahawi has taken out a “Super Injunction” to suppress any public conversation about his tax affairs!

Pretty sure that’s false, as I haven’t received one! (And I don’t think it’s possible to get a super-injunction for such a thing). Do you have a link?

The last sentence of para 1.3 of their second letter did make me think of super-injunctions.

So if one replaces “taken out” with “tried to unilaterally declare”, that report is understandable.

I have only been threatened with a libel suit once when a prominent local firm of solicitors demanded that I retract accusations that I had made about their client (a highways company owned by the local council) and that I issue a public apology. I replied saying, “I look forward to seeing you in court”. I heard no more from them.

Sterling work Dan. Important to get the truth out about this. If you’re right NZ should not be in any public office, let alone that of Chancellor of the Exchequer.

Very courageous but essential, more power to your elbow and may many follow your example.

I’m not an expert in tax law and I’m left behind by many of the previous comments, though they’re mightily impressive. However, as a simple soul, what jumps out to me is that the Chancellor’s legal representative is making veiled threats about possible litigation, but asks that future questions are directed in the first instance to a press officer. This leads me to believe that the defence/response is less legal, more smoke and mirrors.

Keep digging on behalf of those of us that have to pay up every month without the benefit of Daddy’s offshore schemes!

Indeed so. This is a case of monumental importance, as indicated by Cyrus M in his very interesting submission earlier.

Dan, thanks for your courage and persistence

As others have perhaps already mentioned, it is interesting that OC’s open letter does not mention or purport to comply with the Pre-Action Protocols for Defamation Claims: https://www.justice.gov.uk/courts/procedure-rules/civil/protocol/prot_def

I think they’d argue they’re not going to sue me, so the PAP doesn’t apply. That is, however, fatal to the argument the first communication was “without privilege”.

Yes. Indeed, I can see the second letter is expressly stated not to be a threat to sue. Rather it seems to me to be a rather meek attempt to ask for “balance”, without giving you a full explanation of what happened in the background. As such, you can’t provide the balance they want. So it is just another way to say “please stop, pretty please”.

to be clear – does this include icing with cookies & cream or is it just a pretty please? I have a high threshold and generally won’t settle without the cookies?

Do you mean “without prejudice” there?

For me the work you are doing is vital-trust in politicians & our democracy in the UK is at an all time low. We’re facing a series of interconnected crises – climate_ societal- economic etc. Politicians holding high office must be transparently honest & respond to any issues that question this with a reply that answers questions appropriately or stand down if they can’t do this. Thank you for all your hard work & courage in taking it on.

I’m a lawyer in America and it’s quite common for third rate lawyers to send out letters saying that they are not to be shared. But that’s not how the law actually works so nothing happens if people share them. So it’s sort of not really an issue. It’s interesting that I don’t think the bar associations have addressed it. And you certainly could not just send an unsolicited offer and say that it was private as part of negotiations to settle the case. That would get you in very serious trouble. That never ever ever happens unless it is actually part of a real settlement discussion. We also have an issue here where if a letter sounds like they are about to sue you then you might be able to sue them instead for a. declaratory judgment.

Thank you for your tenacity and courage in bringing this matter to the attention of the wider world.

As a teacher who considers paying tax my civic duty I am very interested in how the former (short lived) Education Secretary’s tax affairs may not be above board. Thank you for having the courage and integrity to take this on.

I’m reasonably certain OC haven’t done much research on the facts before penning this sloppy set of letters. As a past founder of a startup (and investor in other startups) I know full well that what might start out as a ‘science experiment’ ALWAYS has the intent of making money. The only question is how much. It strikes me that if an inward investment was made by an offshore entity at a very early stage then there was every expectation that a significant financial benefit would accrue, along with the attendant tax consequences. It may of course be that Balshore makes many such investments and that this is its ‘normal’ method of operation.

It strikes me as disingenuous to cry the poor tale when discussing the origins of the business. It’s well understood in startup land that you absolutely need a backstop in case of failure and the maxim ‘don’t give up the day job’ in these situations is well made. The fact this happened implies to me that the founders well knew they were onto a winner.

Similarly, arguing that the business could NOT have been a success without the help of Zahawi’s father is interesting. What made this so? You can easily credit people with success in hindsight but again, in startup land there are always alternatives.

As an aside, I sense Zahawi’s father was much smarter than his son in how this was set up, benefitting from both a loan and a highly discounted share allocation.

One thing I’m not clear about – were the discounted shares of the same class as those issued elsewhere and definitely issued on the same day? If so and if, as OC claim they were meant to be a reward for Zahawi’s father’s efforts then surely there was a benefit by virtue of the discount unless there was a much earlier agreement that covers this point and at a time when the shares would have only had a relatively notional value?

Keep going – this is fun stuff!

Thank you!

1 I don’t believe Balshore makes other investments of this type – at least, no evidence of that in the accounts

2 the shares were absolutely at a discount. Balshore paid at most £7k for 42.5% of the company. On the same day, another investor paid £785k for 15%

3. I am guessing there is no agreement, as YouGov denied any link with Balshore or Zahawi senior (other than the share ownership.

The disparity in share price immediately looks alarming to this layman. If it looks too good to be true, it usually (always) is. If the shares were identical, then some huge benefit was granted here. Is this normal in a startup? the “other investor” must fell quite aggrieved.

In proper quoted companies the above deal would look like insider trading, but guess that will not apply to startup / offshore.

Absolutely. The other investor would be happy if Zahawi was getting founder shares, and I’m sure viewed this as those same founder shares. Where it goes wrong is when Zahawi claims that his father, despite clearly not being a founder, genuinely did something to earn the shares.

Where is the chancellor’s father resident for tax purposes? If he received equity in return for his time then the value of the shares should surely be being taxed as part of his income?

“I sense Zahawi’s father was much smarter than his son in how this was set up, benefitting from both a loan and a highly discounted share allocation.”

??? DN’s analysis suggests that the involvement of the Gibraltar company, the trust and the father was a pure sham – effectively they in aggregate were being merely a trustee for NZ in order to at least avoid, and arguably evade, tax.

Hi Dan

I am a lawyer, although not a libel lawyer I regularly use WP correspondence in my work. To start with WP is not a carte blanche. It generally means that the correspondence is aimed at reaching an out of court settlement and cannot be relied upon upon ‘in court proceedings’ as evidence. It can however later be relied upon (in most circs) in relation to questions of costs liability. That is usually at the conclusion of proceedings when costs application are made. I am not aware of any provisions that prohibit the publication of WP correspondence publicly, save that it would be inadmissible in evidence in a civil setting. The only way I can stop you publishing my letters in the press is if we had a non-disclosure agreement between us or I seek a High Court injunction. However; injunctions are not handed out easily. The court needs to be satisfied that the publication ‘should not be allowed’. That is high benchmark. There are tests applied by the courts including first that NZ has a ‘reasonable expectation of privacy’ and secondly (and this is the killer) that the claimants interests are NOT outweighed by competing interests. You would probably argue that the financial integrity of the Chancellor and public knowledge of that far outweighs any rights the post holder has to privacy.

Having written many letters of a similar nature I can confidently tell you that these letters (particularly the second) have been written extremely cautiously. They are now aware that you are minded to publish and hence the letter goads toward a litigious outcome, albeit stating that it is not a letter before action or for that matter a threat of litigation. However; it is a strength wave in the sense that it is telling you that the client is prepared to take a litigious stance if required. But – and this is where it gets complicated – for NZ to take a litigious position against you would be to open up a huge can of worms and that would elevate the debate to the front pages of the press. It would also place him and his financial dealings starkly in the public eye and his only defence would be disclosure of additional (probably confidential) material. I would think this would comprise material that NZ would ‘not’ want to air in court or publicly because as you and I both know, the more you disclose, the more questions will be asked. Only a client who has a concrete defence ‘should’ risk commencing an action for defamation. The risks are far too high otherwise as our friend Johnny Depp discovered when he sought English justice.

The second letter is taunting you. They are drawing you out in the hope that you will either retract your allegations (which is their ideal desired outcome) or that you will further defame their client and perhaps give them more ammunition with which to commence proceedings. Given that their client is currently biding his time hoping that the winner of the Tory leadership contest will appoint him to another Cabinet post, the last thing he needs is you calling him out. Even less so he needs litigation with you. Irrespective of the strengths of his case, litigation with you in the current epoch of Tory Sleaze will result in him not securing a Cabinet post from the new PM. He needs you to ‘go away’ and frankly ‘shut TF up’. Clearly that is not happening – so there are 2 ways forward. Either they empty the bath and throw the baby out the window and issue proceedings to silence you (perhaps ex-parte with a publicity freeze) or they maintain the current status quo, keep sending apparently moderate letters asking you to ‘think again’ and bide their time until the new PM appoints his/her new Cabinet and then, once the prize is secured, and assuming that you do not cease your enquiries, issue proceedings at that stage knowing that removal of a Minister by the new PM is going to result in humiliation especially given the political landscape of the past few years of Tory rule. Once the new PM appoints their Cabinet they will fast lose face if they are forced to change a Minister at short notice. It will resurge the Tory Sleaze arguments and damage the credibility of the new leader.

You don’t need me to tell you the risks of calling someone a ‘liar’. That is thin polar ice you are treading. But, if you genuinely think you have the evidence to back it up, it is your call. Personally if you called me a liar and I knew you were wrong, you would be walking through the doors of the High Court the next working day. The fact that they have not issued proceedings tells me that they are not keen on litigation for all the risks that it will entail and therefore they are using a city powerhouse lawfirm to try and leverage you into taking a more moderate approach. Defamation litigation is bankruptcy territory for most ordinary folk like you and I. The loser will literally lose their house due to the settlements and costs involved. But of course the winner will bear a very broad smile. I dare not ever predict the outcome of any litigation as I have been around long enough to know that anything can go wrong at any stage (or right for that matter).

As much as I admire you and your integrity in publishing your research, I do feel the need to give you advice to tread very cautiously. You state that you have lawyer, accountant and QC friends. Please liaise with them very carefully before publishing more. On the other hand what you claim is certainly of public interest, never moreso than when it relates to the Chancellor. Any High Court judge will need to balance this fact on the basis that a Chancellor must be beyond reproach, beyond ethical doubt and beyond question. Ministers get away with all sorts of grime but financial impropriety for the nations banker is a very hot potato. It’s Boris’ partygate fine to the power of 50. If what you allege is true, it’s a game changer for British politics. You could literally bring down the next PM.

In summary – the most recent letter tells me that their client does not have the stomach for a fight – at least not yet. For the record these are personal opinions, not legal advice, you and I do NOT have a client/lawyer relationship and I post these opinions strictly on the basis that they are not to be relied on and in a strictly social setting (given the potential ensuing Writ Storm I have to make this clear)

Safe blogging

CM

Thank you!

I unfortunately can’t comment on whether I am receiving legal advice, as if I said I was then I’d risk losing legal privilege in that advice.

…. and I wouldn’t want you to either. For the record you don’t lose privilege just by stating that you have taken legal advice but it does mean that whatever follows later will include an allegation that you knew full well what you were doing ‘cos you clearly admit having received legal advice before doing it. You can lose privilege if you disclose what advice you received (in some circs) but not just for admitting that you have received advice. In any event, the less you disclose of your own circs, the better, as I touched upon in my first post, the more that is disclosed, the more questions which can be raised. I shall be following this story very clearly in the coming weeks – sounds like this doggy has a big fat bone and won’t be letting it go anytime soon…..

😉

“they are using a city powerhouse lawfirm”

Why “they are” rather than “he is”?

I ask because I get annoyed by individuals who have something to hide (E.g. many politicians) getting journalists to use the plural to suggest that there is a (powerful) cadre of people who agree with them rather than just the individual themselves.

Trump’s “People are telling me…” were lies which no interviewers ever called him out on.

“defame their client”

Definitions of defame:

Cambridge dictionary: “the action of damaging the reputation of a person or group by saying or writing bad things about them that are not true”

Oxford dictionary: “to harm someone by saying or writing bad or false things about them”

Merriam-Webster: “to harm the reputation of by communicating false statements about”

I’m fairly sure you mean “to harm someone by writing bad things about them” (which can be true).

That falls within the Oxford definition but not the Cambridge one, nor the Merriam Webster.

Does English law recognise “defame” as doing the harm, separable from whether the statements are false?

Is US (or at least NY) law the same?

What I & many other low paid workers want to know is, did he receive any tax free Luncheon Vouchers?

Keep up the good work exposing the lies & hypocrisy of these sponging politicians.

This is excellent work and of huge public interest despite what NZs lawyers would like us to believe.

It reminds me of the campaigns by the late Paul Foot in Private Eye and it’s great to see that those who understand the finer legal points are advising

We need more of this

Thank you and keep digging

On behalf of the public, please continue your sterling work…

Thank you. I am not a lawyer either but my reading of the letters is that they are an attempt to divert attention away from your discovering the real answers. Please keep going 🙂

Peter Gay

I don’t understand the legalese involved, but I’ve lived 75 years and I’m not stupid.

Keep on keeping, please Dan.

If N Zahawi’s claim is true, what was his motivation in growing the company and making it a success? He liked being their employee? He enjoyed increasing his father’s wealth?

As I understand it he spent 10 years holding himself out as a “founder” and working for the success of the company. “Founders” have an equity interest in my experience – they want the upside.

HMRC should be looking at ITEPA 2003 – if the £27m has ended up in his hands and he wasn’t a shareholder then the employment relationship would seem to be a possible explanation. Income tax had a 50% top rate for a year or two around 2010.

Please police as you feel appropriate:

1. I know nothing about libel law but assume that OC’s client has agreed the contents of the letters (so what OC says that relates to facts is correct) and that someone from OC who knows about tax has been involved in the drafting. That may of course not be correct and I would be worried about OC asserting tax-related things without properly understanding the facts or understanding tax law.

2. I can’t decide if the letters have been (i) written very carefully and with a lot of attention to the precise words used, or (ii) written less carefully. I’m guessing a bit of both but I don’t know for sure. I’ve illustrated this below.

3. The first letter says “You have also omitted to reference that our client’s father did pay £7,000 for his second tranche of shares”. I’ve skimmed through the Companies House documents that have been filed for YouGov up until the IPO and cannot see that his father has acquired any shares (i.e. not a first tranche nor a second tranche). Similarly, he is not shown on the first post-IPO annual return. This suggests that there might have been a lack of precision with words that OC used in that:

• OC are referring to Balshore rather than their client’s father

• the reference to the £7,000 meant the second return of allotment [Form 88(2)] filed on 25 October 2002 for the shares that were acquired on 6 May 2000 in place of the contemporaneous one filed on the issue of the shares (filed on 9 May 2000) that makes clear that no money was paid by Balshore for the shares

• By £7,000 they mean £7,215 (72,150 shares at 10p per share)

It would also suggest that they did not fully read your blog posts that mention this. Of course there might be another explanation (the shares were registered in the name of a nominee and then the beneficial interest that OC’s client’s father had in those shares transferred to someone else before the IPO prospectus was prepared) and if that is the case then it would be difficult to see how you could omit something that few people would have known about.

4. Interestingly (to me) the second letter mentions £7,000 but does not give the same details. Does that mean that the details mentioned in the first letter may not be relevant (or may not have been entirely correct)?

5. The first letter also goes on to say “We acknowledge that this may have been discounted”. To me this seems to be a strange thing to say in such a letter. Now this may be a “libel” letter thing or it may be because this is something that is being discussed with HMRC?. I mentioned in a comment to one of your blog posts that this might be an issue in that employment income tax could have been due on acquisition. Perhaps this suggests that any tax has been paid or OC believes that HMRC would be out of time to raise an assessment and so it does not matter from a tax perspective? Depending on the facts, there could be other employment income tax charges (e.g. on disposal because of the notional loan created by s162 ICTA 1988 on acquisition which would then be treated as written off on disposal)) and these might be in time.

6. Para 2.3 of the second letter says that the shares were “allocated” to Hareth Zahawi “through his investment company”. This would seem to ignore the family trust. Perhaps there is not one? The lack of their trust would also make sense by the letter saying “These shares were in recognition of the £7,000 of capital which our client’s father contributed…”. If so, it would make things a lot easier if they said that there was no trust. Alternatively, it may be that the language used in the letter was not precise or that the facts had not been fully checked before the letter was sent.

7. In the second letter para 2.7 says “… our client and his wife and children are not, and never have been, beneficiaries of Balshore or any entities related to it”. That sounds fine in terms of a company like Balshore where the concept of it having beneficiaries is alien. But a typical family trust is not normally an “entity”. So is that a carefully worded reply that is designed to make it look like the trust is withing the scope of that sentence? Or is it intended to be widely written but the words didn’t quite work?

8. Similarly, in para 2.7 it says “A benefit in the form of a repayment of a loan does not necessarily amount to a tax benefit”. That is right if OC want a “tax benefit” to mean a benefit within the scope of the benefits code in Part 3 ITEPA 2003. But if they have chosen their words carefully, they could also write “Some horses have four legs” and it would have the same information content. For completeness, it might not be a “benefit” because, for example, the money used to repay the loan could amount to earnings within the meaning of s62 ITEPA 2003 (or there was no employment link or it was taxable under s415 ITTOIA 2005 because that repayment by another person would release the participator of the obligation to repay the loan from the close company). So again, is this a carefully worded non-point or a lack of precision in the words?

9. My second favourite sentence of the second letter is also in 2.7: “For the avoidance of doubt, our client has not derived any tax benefit from loans or gifts provided by offshore entities to our client”. OC’s words “tax benefit” is their own (rather than defined by tax legislation). The reason why it is my favourite is that I don’t understand exactly what it says. For example, I could read it as implying that (i) OC’s client had received loans and gifts, (ii) these were provided by offshore entities, (iii) these did amount to a benefit, but (iv) these did not amount to a “tax benefit”. If this is what is intended then it places a lot of focus on what is or is not a “tax benefit”. It might be though that OC has not been precise on the word used and, bearing in mind OC’s client appears to have borrowed money from Berkford, it might mean something else.

10. My favourite sentence causes me to invoke David Allen Green’s First Rule of Clarity (https://davidallengreen.com/2021/11/let-me-be-absolutely-clear-the-two-rules-of-clarity/) as it says “Our client has been clear on this publicly”.

Thank you – your points are well made. There is indeed a lack of clarity and specificity in the letter. Zahawi and his lawyers have used the phrase “tax benefit” a few times – responding to accusations he received a “benefit” from the trust by denying having received a “tax benefit”. Like you, I don’t know what a “tax benefit” is.

I got confused why OC were talking about a second tranche of shares and so I’ve looked through Companies House and can see that Balshore did acquire two tranches of shares. To be honest, I’m even more confused now. This is because although the 88(2) says that they were issued in May 2000, they do not appear in the accounts for the years ended 31 July 2000 or 2001. Similarly, they do not appear in the 363s annual returns (or amended returns) that YouGov sent to Companies House up to and including the one dated 11 October 2001. They do appear in the annual return signed on 19 November 2002.

1. On 6 May 2000 the Form 88(2) shows 351,590 being issued to Balshore for “know-how, expertise and effort”. At the same time Mr Shakespeare also receives the same number of shares for the same “know-how”, etc and Mr Copp pays £2.30 per share for 125,000 (i.e. £287,500). So this is the first tranche.

2. This is reflected in the statutory accounts for the year ended 31 July 2000 which show 828,200 shares (including the subscriber shares). I don’t understand how the share premium in the accounts is shown as £287,500 per the Companies House filings. That seems to be £12,500 higher than I’d expect but I’m probably missing something.

3. The 828,200 shares are also reflected in the amended annual return dated 18 October 2000. This corrects the annual return submitted signed on 14 August 2000 that forgot the subdivision of the subscription shares (they were originally £1 nominal value and each was then ten 10p nominal value shares). So I’m guessing someone realised there was something wrong and then changed it at Companies House when they were playing with the share cap table or something. That sort of thing happens. But it is interesting that the second tranche of Balshore’s shares (see below) were not included when they did the amended return.

4. The statutory accounts for the year ended 31 July 2001 show the same 828,200 shares. Strangely, they show a further £25,000 of share premium being paid in the year. No idea how that happens as no new shares were issued but I’m probably missing something. I thought that there may be a typo in the number of shares issued (i.e. it was not updated and is not part of the double entry so could be missed) but there have been no changes to Stephan Shakespeare’s shares shown in the directors’ report either and so a typo looks less likely.

5. We then move on to 25 October 2002 and a Form 88(2) is filed for 144,300 new 10p shares that are issued on 6 May 2000 (half of these are to Balshore, hald to Mr Shakespeare) and 10p per share was paid. Surprisingly, that’s nearly 30 months late. As we’ve seen, there can be errors on Companies House filings but it is strange that these were not spotted after the previous return was amended. In addition, these new shares are not shown in the accounts for the year ended 31 July 2001 (or 31 July 2000).

6. So this 144,300 includes 72,150 10p shares acquired by Balshore and so this must be the second tranche.

7. The annual return for the signed on 19 November 2002 shows that new 10p shares were issued on 6 May 2000 (and it looks a bit strange as these were shown as 10p shares when they would have then been subdivided into 1p shares by then).

8. The accounts for the year ended 31 July 2002 show that 171,800 10p shares were issued during the year (plus other 1p nominal value shares following the sub-division). This presumably includes the 144,300 shares reported on the 88(2) signed on 25 October 2002. The accounts describe these as being issued in the year (rather than issued in 2000 and adjusting the prior year. Again, that’s a surprise to me as (per the Companies House filing dated 25 October 2002) they were not issued in that year.

I agree. Not clear what happened with the late-filed 88(2). Important question is whether the £7k was paid by Balshore in 2000 or 2002.

I am not a lawyer, but my understanding is that whether or not correspondence is ‘without prejudice’ is determined by its nature, not by whether or not the issuer has said that it is. in practice usually there is no distinction; but here I think there is.

Their letters will be without prejudice if they form part of a negotiation aimed at reaching a settlement in a civil dispute without recourse to the courts.

But this does not apply here: you are not in a civil dispute with Zahawi (what ground would there be?). Rather, you are acting as a journalist trying to establish the facts in a matter of public interest.

So the letters issued by Zahawi are not in essence ‘without prejudice’ – whether Z says they are, or you ‘accept’ without prejudice correspondence, would not seem to be relevant.

In any case, they could certainly be used by HMRC in a deciding whether to launch a criminal investigation, and should be considered by them. Have you sent the corres to HMRC? As you have pointed out, they are in an invidious position; perhaps an open letter to them might be appropriate.

But the political reality is that what matters most is that this mater is brought – and kept – out in the open, and in this regard you are doing sterling work. Chapeau!

If it comes to litigation there are many of us poor sods on PAYE who are prepared to donate via one of the usual funding platforms.

Indeed so. This is a case of monumental importance, as indicated by Cyrus M in his very interesting submission earlier.

Adgilcan – first person ever to use the words ‘monumental importance’ and ‘very interesting’ in conjunction with my name – can you please speak with my wife who tends to lose interest every time I say something…..

😉

I am not a lawyer so cannot comment on the legality of these issues, but I strongly believe it is in the public interest that you continue publishing your correspondence with Mr Zahawi’s agents. It would be totally unacceptable for the Chancellor of the Exchequer to have had unethical and possibly illegal tax arrangements. All the tax affairs of MPs and Ministers – and members of the general public – should be open to scrutiny.

I am unable to view clear copies of the correspondence even with 200% magnification! This is a matter of national import and I should like to be able to see what has been said – can you attach PDF or similar please?

sorry about that – I’ve updated the post with a link to PDFs

I’m not certain NZ receiving anything from Balshore would qualify him as a beneficiary of the overlying Trust.

Speaking as a Trust Practitioner in Jersey with 25 years experience of such structures.

See https://www.gov.uk/hmrc-internal-manuals/capital-gains-manual/cg38675

Yes I agree with this. NZ may be an object of the trust (e.g may have his bills paid by the trust) without strictly speaking being a beneficiary of it.

Dear Mr Neidle. Thank you so much for pursuing this issue (and others) in such a careful, considered and forensic manner. This is of course in the public interest and you are acting on all our behalves. I only hope you are not isolated in this and have support from other areas – The Good Law Project? HMRC themselves?? I also am no lawyer, but careful reading of their letters with a layman’s eye seems to reveal nothing substantive – just careful and judicious use of deliberately ambiguous terms that don’t actually say a great deal – as several other reviewers here with more expertise than me have noted – what is commonly referred to as ‘smoke and mirrors’. I had an ex-boss who regularly used to do the same thing – he had a lawyer mate who he would get to fire-off a scary letter full of pseudo-legalese to competitors when he didn’t like what they were doing. Seeing the headed note paper from a law firm is often enough to get people hiding under their desks. And surely if anything you had said was immediately libellous you would have been issued with a writ, rather than a ‘let’s have a quiet chat about this..’ invitation. Anyway, I will thank you again for your public service and ask you to please keep us posted. Very best wishes – Tony.

After so much smoke and mirrors from current and recent past members of the cabinet, I am delighted to see genuine information published, with the hope that in this instance, someone is made accountable. The avoidance of honesty has brought shame on this country, this government and our system in general and I sincerely hope this is the beginning of the end of it. Thank you so much for the work you (Dan) are doing and I hope that you continue with success.

With best wishes

Austen

Keep going, they have something to hide.